444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

Chad’s oil and gas upstream market represents a pivotal sector in Central Africa’s energy landscape, characterized by substantial reserves and growing international investment. The country’s upstream activities encompass exploration, drilling, and production operations across multiple sedimentary basins, with the Doba Basin serving as the primary production hub. Chad’s strategic position in the Sahel region, combined with its proven hydrocarbon reserves, positions the nation as an emerging player in Africa’s energy sector.

Recent developments indicate significant momentum in Chad’s upstream market, with production capacity expanding at approximately 8.5% annually over the past three years. The market benefits from favorable geological conditions, including extensive sedimentary formations that extend across 65% of the country’s territory. International oil companies continue to demonstrate strong interest in Chad’s upstream potential, particularly in unexplored northern and eastern regions where seismic surveys suggest substantial untapped reserves.

Infrastructure development has accelerated considerably, with the Chad-Cameroon pipeline system facilitating efficient crude oil transportation to international markets. The upstream sector’s contribution to Chad’s economy remains substantial, accounting for approximately 40% of government revenues and supporting thousands of direct and indirect employment opportunities across the value chain.

The Chad oil and gas upstream market refers to the comprehensive sector encompassing all activities related to the exploration, development, and production of hydrocarbon resources within Chad’s territorial boundaries. This market includes seismic surveys, exploratory drilling, field development, crude oil extraction, natural gas production, and associated infrastructure development necessary for bringing hydrocarbons from underground reservoirs to the surface.

Upstream operations in Chad involve multiple phases, beginning with geological assessments and seismic data acquisition to identify potential hydrocarbon-bearing formations. The sector encompasses both conventional and unconventional resource development, though conventional reserves currently dominate production activities. Key stakeholders include international oil companies, national oil companies, service providers, and government regulatory bodies that collectively manage exploration licenses, production sharing agreements, and operational oversight.

The market’s scope extends beyond mere extraction activities to include supporting services such as drilling contractors, oilfield services companies, logistics providers, and environmental management specialists. This comprehensive ecosystem ensures sustainable development of Chad’s hydrocarbon resources while maintaining operational efficiency and environmental compliance standards.

Chad’s upstream oil and gas market demonstrates robust growth potential driven by expanding exploration activities, increasing production capacity, and growing international investment. The sector has experienced steady development since the early 2000s, with production levels reaching significant milestones and contributing substantially to national economic development. Current market dynamics reflect a balanced approach between maximizing resource extraction and ensuring sustainable development practices.

Key performance indicators highlight the market’s resilience and growth trajectory. Production efficiency has improved by approximately 15% over the past five years, while exploration success rates have increased due to advanced geological mapping and improved drilling technologies. The upstream sector’s operational footprint continues expanding, with new concessions awarded to qualified operators and existing fields undergoing capacity enhancement programs.

Strategic partnerships between international operators and local entities have strengthened market foundations, facilitating technology transfer and capacity building initiatives. According to MarkWide Research analysis, Chad’s upstream market positioning within the broader Central African energy landscape has improved significantly, attracting increased attention from global energy companies seeking new growth opportunities in emerging markets.

Critical market insights reveal several fundamental trends shaping Chad’s upstream oil and gas sector:

Primary market drivers propelling Chad’s upstream oil and gas sector include substantial proven reserves, favorable geological conditions, and increasing global energy demand. The country’s strategic location provides advantageous access to both regional and international markets, while government policies supporting foreign investment have created an attractive business environment for upstream operators.

Technological advancement serves as a crucial driver, with modern exploration techniques revealing previously unknown hydrocarbon accumulations. Enhanced seismic imaging, horizontal drilling capabilities, and improved reservoir management technologies are maximizing recovery rates and extending field productivity. These technological improvements have contributed to production optimization rates of approximately 12% annually across major producing fields.

Economic diversification initiatives by the Chadian government emphasize hydrocarbon sector development as a cornerstone of national economic strategy. Supportive fiscal policies, streamlined licensing procedures, and infrastructure investment programs are attracting international operators and service companies. Regional energy demand growth, particularly from neighboring countries, provides additional market expansion opportunities and revenue streams for Chad’s upstream sector.

Investment climate improvements have enhanced market attractiveness, with transparent bidding processes and stable regulatory frameworks encouraging long-term capital commitments. The establishment of local content requirements has created additional value-added opportunities while building domestic capacity in the energy services sector.

Significant market restraints affecting Chad’s upstream oil and gas sector include infrastructure limitations, security challenges, and regulatory complexities. Remote geographical locations of many potential hydrocarbon resources require substantial infrastructure investments, creating barriers to entry for smaller operators and increasing overall development costs.

Security concerns in certain regions have impacted exploration activities and operational continuity. Political instability and regional conflicts occasionally disrupt operations, requiring enhanced security measures and risk management protocols. These challenges have led to increased operational costs and extended project timelines in some areas.

Technical challenges associated with harsh operating environments, including extreme temperatures and challenging terrain, require specialized equipment and expertise. Limited local technical capacity necessitates reliance on international service providers, increasing operational costs and creating potential supply chain vulnerabilities.

Environmental regulations and community relations requirements add complexity to project development and execution. Compliance with international environmental standards and local community expectations requires comprehensive management systems and ongoing stakeholder engagement programs. Financial constraints related to project financing and currency fluctuations can impact investment decisions and project viability, particularly for smaller-scale developments.

Substantial market opportunities exist across Chad’s upstream oil and gas sector, driven by unexplored acreage, technological innovations, and growing regional energy demand. The country’s vast unexplored territories offer significant potential for new discoveries, with geological studies suggesting favorable conditions across multiple sedimentary basins beyond current producing areas.

Natural gas development presents particularly attractive opportunities, with associated gas from oil production and dedicated gas fields offering potential for domestic power generation and regional export markets. The development of gas-to-power projects could address local energy needs while creating additional revenue streams for upstream operators.

Enhanced oil recovery techniques provide opportunities to maximize production from existing fields, potentially increasing recovery rates by 20-25% through advanced reservoir management and secondary recovery methods. These techniques offer attractive returns on investment while extending field life cycles and optimizing existing infrastructure utilization.

Regional integration initiatives create opportunities for cross-border pipeline development and shared infrastructure projects. Collaboration with neighboring countries on energy infrastructure could reduce individual project costs while improving market access for Chad’s hydrocarbon resources. Technology partnerships with international companies offer opportunities for knowledge transfer and capacity building, strengthening the domestic energy services sector.

Market dynamics in Chad’s upstream oil and gas sector reflect the interplay between global energy trends, regional development priorities, and local operational conditions. The sector operates within a complex environment where international oil price fluctuations directly impact investment decisions and project economics, while government policies and regulatory changes influence operational frameworks.

Supply and demand dynamics are shaped by production capacity constraints, infrastructure limitations, and market access considerations. Current production levels operate at approximately 75% of installed capacity, indicating potential for near-term expansion without major capital investments. Demand patterns reflect both domestic energy needs and export market requirements, with pipeline capacity serving as a key constraint on market growth.

Competitive dynamics involve multiple international operators competing for exploration acreage and development opportunities. Market consolidation trends have emerged as larger operators acquire smaller concessions to achieve operational synergies and economies of scale. Technology adoption rates vary across operators, with leading companies implementing advanced digital technologies to optimize production and reduce operational costs.

Regulatory dynamics continue evolving as the government balances revenue maximization with sustainable development objectives. Recent policy changes have emphasized local content development and environmental protection, influencing operational strategies and investment priorities across the upstream sector.

Comprehensive research methodology employed for analyzing Chad’s upstream oil and gas market incorporates multiple data sources and analytical approaches to ensure accuracy and reliability. Primary research activities include direct engagement with industry stakeholders, government officials, and operational personnel across the upstream value chain.

Data collection methods encompass structured interviews with key industry participants, field visits to operational sites, and analysis of regulatory filings and government publications. Secondary research involves examination of industry reports, academic studies, and international energy databases to provide broader market context and comparative analysis.

Analytical frameworks utilize both quantitative and qualitative assessment methodologies, including statistical analysis of production data, financial performance metrics, and market trend identification. Geographic information systems and geological data analysis support spatial market assessment and resource potential evaluation.

Validation processes ensure data accuracy through cross-referencing multiple sources and expert review procedures. Market projections and trend analysis incorporate scenario modeling and sensitivity analysis to account for various market conditions and potential developments. Quality assurance protocols maintain research standards and ensure findings reflect current market realities and future potential accurately.

Regional analysis of Chad’s upstream oil and gas market reveals distinct geographical patterns in resource distribution, operational activity, and development potential. The Doba Basin in southern Chad represents the most mature producing region, accounting for approximately 80% of current production and hosting the majority of established infrastructure and operational facilities.

Northern regions demonstrate significant exploration potential, with geological surveys indicating favorable hydrocarbon prospects across extensive sedimentary formations. Recent seismic campaigns have identified multiple structural targets, though infrastructure limitations and security considerations have slowed development activities in some areas.

Eastern Chad presents emerging opportunities with several exploration licenses awarded to international operators. The region’s proximity to Sudan’s producing fields suggests geological continuity and potential for significant discoveries. However, limited infrastructure and challenging logistics require substantial investment for commercial development.

Central regions remain largely unexplored but show geological promise based on regional structural analysis. The area’s potential for both oil and gas resources could support future exploration campaigns as infrastructure development progresses. Western Chad has received limited exploration attention but geological studies suggest potential hydrocarbon accumulations that warrant further investigation.

Infrastructure distribution remains concentrated in southern producing regions, with pipeline networks, processing facilities, and support services clustered around established fields. Regional development strategies emphasize infrastructure expansion to support exploration activities in frontier areas while optimizing existing facility utilization.

Chad’s upstream competitive landscape features a diverse mix of international oil companies, regional operators, and service providers competing across exploration, development, and production activities. The market structure reflects a combination of established operators with significant acreage positions and newer entrants seeking growth opportunities in frontier areas.

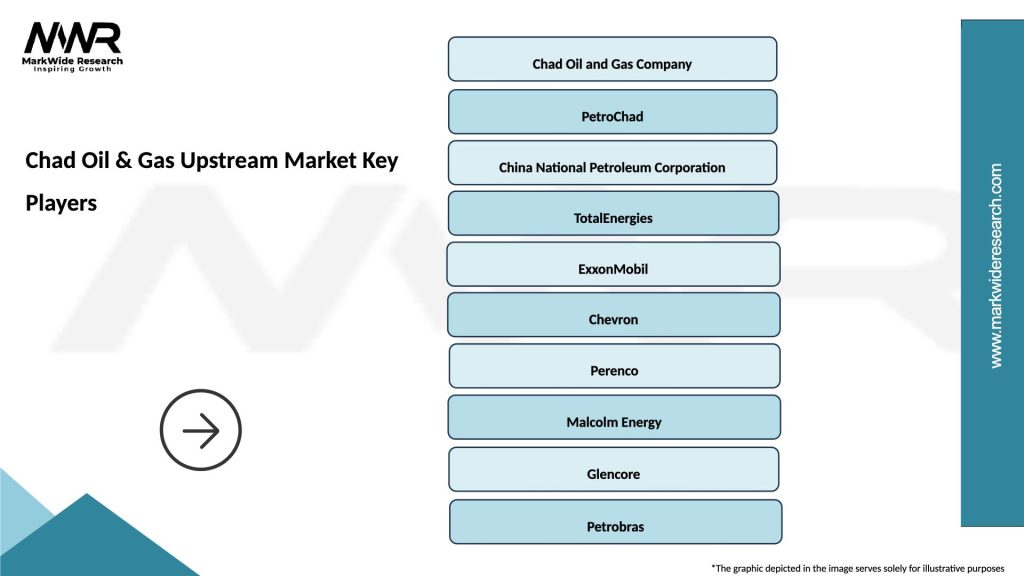

Major market participants include:

Competitive strategies vary among operators, with larger companies focusing on maximizing production from established fields while smaller operators pursue exploration opportunities in frontier areas. Technology differentiation, operational efficiency, and local partnership development serve as key competitive advantages.

Market consolidation trends have emerged as operators seek to optimize portfolio management and achieve operational synergies. Strategic partnerships and joint ventures are increasingly common, particularly for exploration activities in challenging or remote areas where risk sharing and expertise combination provide competitive benefits.

Market segmentation of Chad’s upstream oil and gas sector encompasses multiple classification criteria including resource type, operational phase, geographical location, and operator category. This comprehensive segmentation provides detailed insights into market structure and development patterns.

By Resource Type:

By Operational Phase:

By Operator Type:

Exploration category demonstrates robust activity levels with multiple operators conducting seismic surveys and exploratory drilling programs. Success rates have improved to approximately 35% for exploratory wells due to enhanced geological understanding and advanced exploration technologies. New exploration licenses continue attracting international interest, particularly in frontier basins with limited previous exploration activity.

Development category focuses on optimizing field development strategies and infrastructure expansion. Recent developments emphasize modular facility design and phased development approaches to manage capital requirements and operational risks. Enhanced oil recovery techniques are increasingly incorporated into development planning, potentially increasing ultimate recovery factors by 18-22% compared to primary recovery methods.

Production category maintains steady output levels while implementing efficiency improvement programs. Digital technologies and automated systems are reducing operational costs and improving safety performance. Production optimization initiatives have achieved efficiency gains of approximately 10% annually through better reservoir management and facility optimization.

Service sector category supports upstream operations through drilling services, oilfield services, and logistics support. Local service provider development has accelerated, with domestic companies increasing their market share to approximately 25% of total service spending. Technology transfer programs and capacity building initiatives continue strengthening local service capabilities.

Industry participants in Chad’s upstream oil and gas market benefit from substantial resource potential, favorable geological conditions, and supportive government policies. International operators gain access to significant hydrocarbon reserves with attractive commercial terms and stable regulatory frameworks that support long-term investment planning.

Economic benefits for stakeholders include substantial revenue generation opportunities, employment creation, and technology transfer. The upstream sector provides direct employment for thousands of workers while supporting extensive supply chains and service industries. Local communities benefit from infrastructure development, social investment programs, and economic opportunities created by upstream operations.

Government stakeholders receive significant fiscal revenues through production sharing agreements, royalties, and taxation. These revenues support national development programs and economic diversification initiatives. Regional benefits include improved energy security, cross-border cooperation opportunities, and enhanced regional integration through shared infrastructure projects.

Environmental stakeholders benefit from enhanced environmental management practices and conservation programs implemented by upstream operators. Modern operational standards and environmental monitoring systems ensure responsible resource development while protecting local ecosystems and communities.

Technology stakeholders gain opportunities for innovation and technology deployment in challenging operational environments. The sector serves as a testing ground for advanced technologies and operational practices that can be applied in other markets and regions.

Strengths:

Weaknesses:

Opportunities:

Threats:

Digital transformation represents a fundamental trend reshaping Chad’s upstream oil and gas operations. Advanced data analytics, artificial intelligence, and automated systems are improving operational efficiency and reducing costs. Digital oilfield technologies have contributed to productivity improvements of approximately 12% across major producing fields.

Environmental sustainability has become increasingly important, with operators implementing enhanced environmental management systems and carbon reduction initiatives. Gas flaring reduction programs and renewable energy integration are becoming standard practices across upstream operations.

Local content development continues gaining momentum as operators increase procurement from local suppliers and invest in workforce development programs. Local participation rates have increased to approximately 30% of total project spending through targeted capacity building and supplier development initiatives.

Technology partnerships between international operators and technology providers are accelerating innovation adoption and operational optimization. These partnerships focus on developing solutions specifically adapted to Chad’s operational conditions and challenges.

Regional cooperation trends include cross-border infrastructure projects and shared facility development. These initiatives reduce individual project costs while improving market access and operational efficiency. Investment diversification patterns show increasing interest from Asian and Middle Eastern investors alongside traditional Western operators.

Recent industry developments in Chad’s upstream oil and gas sector include significant exploration discoveries, infrastructure expansion projects, and regulatory framework enhancements. New exploration licenses have been awarded to qualified operators, expanding the active exploration footprint across previously unexplored basins.

Infrastructure developments include pipeline capacity expansions, processing facility upgrades, and transportation system improvements. These investments enhance operational capabilities and support increased production levels from existing and new fields. Technology deployments have accelerated with implementation of advanced drilling techniques, enhanced oil recovery systems, and digital monitoring technologies.

Regulatory developments include updated petroleum laws, environmental regulations, and local content requirements. These changes create more attractive investment conditions while ensuring sustainable development practices and community benefit sharing.

Partnership agreements between international operators and local entities have strengthened market foundations and facilitated technology transfer. According to MWR analysis, these partnerships have contributed to improved operational efficiency and enhanced local capacity development.

Investment commitments from major operators demonstrate continued confidence in Chad’s upstream potential, with substantial capital allocated for exploration, development, and infrastructure projects. These investments support long-term market growth and development objectives.

Strategic recommendations for Chad’s upstream oil and gas market emphasize the importance of continued infrastructure development, technology adoption, and regulatory framework optimization. Analysts suggest prioritizing pipeline capacity expansion and processing facility development to support increased production levels and market access.

Investment strategies should focus on balanced portfolio development combining established producing assets with high-potential exploration opportunities. Risk management through diversified geographical exposure and phased development approaches can optimize returns while managing operational challenges.

Technology adoption recommendations emphasize implementing digital technologies and advanced operational systems to improve efficiency and reduce costs. Enhanced oil recovery techniques should be prioritized to maximize production from existing fields while extending asset life cycles.

Partnership development strategies should emphasize collaboration between international operators and local entities to build capacity and ensure sustainable development. These partnerships can facilitate technology transfer while creating value-added opportunities for local stakeholders.

Market positioning recommendations suggest focusing on operational excellence, environmental compliance, and community engagement to maintain competitive advantages and ensure long-term operational sustainability. Regulatory engagement should emphasize transparent communication and collaborative policy development to support market growth objectives.

Future prospects for Chad’s upstream oil and gas market appear promising, with substantial growth potential driven by continued exploration success, infrastructure development, and increasing international investment. Market projections indicate sustained production growth at approximately 6-8% annually over the next decade, supported by new field developments and enhanced recovery from existing assets.

Exploration activities are expected to intensify across frontier basins, with advanced geological studies and seismic surveys revealing additional hydrocarbon potential. Natural gas development opportunities are likely to gain prominence as domestic energy demand increases and regional export markets develop.

Technology integration will continue accelerating, with digital oilfield technologies, automated systems, and advanced analytics becoming standard across upstream operations. These technological advances are projected to improve operational efficiency by 15-20% while reducing environmental impact and operational costs.

Infrastructure expansion will support market growth through enhanced pipeline capacity, improved processing capabilities, and expanded transportation networks. Regional integration initiatives are expected to create additional market opportunities and improve competitive positioning.

Investment climate improvements and regulatory framework enhancements will continue attracting international operators and capital investment. According to MarkWide Research projections, Chad’s upstream market is positioned for sustained growth and development over the long term, supported by favorable resource endowments and improving operational conditions.

Chad’s upstream oil and gas market represents a dynamic and growing sector with substantial potential for continued development and expansion. The combination of significant hydrocarbon resources, improving infrastructure, and supportive government policies creates an attractive environment for international investment and operational development.

Market fundamentals remain strong, with proven reserves, favorable geological conditions, and established operational capabilities providing a solid foundation for future growth. The sector’s contribution to national economic development and regional energy security continues expanding through increased production, infrastructure development, and technology adoption.

Strategic opportunities in exploration, development, and production optimization offer attractive returns for qualified operators and investors. The market’s evolution toward enhanced sustainability, local content development, and technological innovation positions Chad’s upstream sector for long-term success and competitiveness within the broader African energy landscape.

Future success will depend on continued collaboration between government, industry, and local stakeholders to address challenges while maximizing opportunities. With proper planning, investment, and execution, Chad’s upstream oil and gas market is well-positioned to achieve its substantial potential and contribute significantly to national and regional energy development objectives.

What is Chad Oil & Gas?

Chad Oil & Gas refers to the exploration, extraction, and production of oil and natural gas resources in Chad. This sector plays a crucial role in the country’s economy and energy supply.

What are the key players in the Chad Oil & Gas Upstream Market?

Key players in the Chad Oil & Gas Upstream Market include companies like ExxonMobil, Petronas, and China National Petroleum Corporation, among others. These companies are involved in various stages of oil and gas exploration and production.

What are the main drivers of the Chad Oil & Gas Upstream Market?

The main drivers of the Chad Oil & Gas Upstream Market include the increasing global demand for energy, the discovery of new oil reserves, and investments in infrastructure development. These factors contribute to the growth of the sector.

What challenges does the Chad Oil & Gas Upstream Market face?

The Chad Oil & Gas Upstream Market faces challenges such as political instability, regulatory hurdles, and environmental concerns. These issues can impact investment and operational efficiency in the sector.

What opportunities exist in the Chad Oil & Gas Upstream Market?

Opportunities in the Chad Oil & Gas Upstream Market include the potential for new exploration projects, partnerships with international firms, and advancements in extraction technologies. These can enhance production capabilities and attract investment.

What trends are shaping the Chad Oil & Gas Upstream Market?

Trends shaping the Chad Oil & Gas Upstream Market include a shift towards sustainable practices, the adoption of digital technologies for exploration, and increased focus on local content in oil production. These trends aim to improve efficiency and community engagement.

Chad Oil & Gas Upstream Market

| Segmentation Details | Description |

|---|---|

| Service Type | Drilling, Exploration, Production, Well Services |

| Technology | Seismic Imaging, Horizontal Drilling, Hydraulic Fracturing, Enhanced Oil Recovery |

| End User | Independent Producers, National Oil Companies, Service Providers, Contractors |

| Installation | Onshore, Offshore, Coastal, Remote |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Chad Oil & Gas Upstream Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at