444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The UK minimally-invasive surgery devices market represents a transformative segment within the nation’s healthcare technology landscape, characterized by rapid technological advancement and increasing adoption across medical specialties. Minimally-invasive surgical procedures have revolutionized patient care by offering reduced recovery times, minimal scarring, and improved surgical outcomes compared to traditional open surgery methods.

Market dynamics indicate robust growth driven by an aging population, rising prevalence of chronic diseases, and continuous technological innovations in surgical instrumentation. The market encompasses a comprehensive range of devices including laparoscopic instruments, robotic surgical systems, endoscopic equipment, and catheter-based devices that enable surgeons to perform complex procedures through small incisions.

Healthcare providers across the UK are increasingly investing in advanced minimally-invasive technologies to enhance patient outcomes and operational efficiency. The market is experiencing significant expansion at a CAGR of 8.2%, reflecting strong demand from both public and private healthcare sectors. Technological convergence between artificial intelligence, robotics, and surgical instrumentation is creating new opportunities for innovation and market growth.

Regional distribution shows concentrated adoption in major metropolitan areas, with London and Southeast England accounting for approximately 35% of market activity. The integration of minimally-invasive devices into NHS facilities and private hospitals continues to drive market penetration across diverse surgical specialties.

The UK minimally-invasive surgery devices market refers to the comprehensive ecosystem of medical instruments, equipment, and technologies designed to enable surgical procedures through small incisions or natural body openings, minimizing tissue damage and patient trauma while maintaining surgical precision and effectiveness.

Minimally-invasive surgery devices encompass a broad spectrum of specialized instruments including laparoscopes, arthroscopes, endoscopes, robotic surgical systems, energy-based devices, and imaging technologies that allow surgeons to visualize, access, and treat internal structures with minimal disruption to surrounding tissues. These devices represent a paradigm shift from traditional open surgical approaches toward precision-guided, patient-centric treatment methodologies.

Core components of this market include visualization systems with high-definition cameras and monitors, specialized surgical instruments designed for confined spaces, energy delivery systems for cutting and coagulation, and robotic platforms that enhance surgical dexterity and control. The market also encompasses supporting technologies such as insufflation systems, trocars, and advanced imaging modalities that facilitate successful minimally-invasive procedures.

Clinical applications span multiple medical specialties including general surgery, orthopedics, gynecology, urology, cardiology, and neurosurgery, with each specialty requiring specialized device configurations and surgical approaches tailored to specific anatomical and procedural requirements.

Strategic market analysis reveals the UK minimally-invasive surgery devices market as a dynamic and rapidly evolving sector driven by technological innovation, demographic trends, and changing healthcare delivery models. The market demonstrates strong growth momentum supported by increasing surgical volumes, expanding clinical applications, and continuous device improvements.

Key growth drivers include the aging UK population requiring more surgical interventions, rising prevalence of chronic conditions such as cardiovascular disease and cancer, and healthcare system emphasis on cost-effective treatment solutions. Patient preference for less invasive procedures with shorter recovery times is accelerating adoption rates across both public and private healthcare settings.

Technology advancement remains a critical market catalyst, with robotic surgery adoption increasing by approximately 15% annually across major UK hospitals. Integration of artificial intelligence, machine learning, and advanced imaging technologies is enhancing surgical precision and expanding the scope of minimally-invasive procedures.

Market challenges include high initial capital investments, training requirements for healthcare professionals, and regulatory compliance complexities. However, long-term cost benefits through reduced hospital stays, lower complication rates, and improved patient outcomes continue to drive market expansion.

Competitive landscape features established global medical device manufacturers alongside emerging technology companies developing innovative surgical solutions. Strategic partnerships between device manufacturers and healthcare providers are facilitating technology adoption and clinical integration across the UK healthcare system.

Market intelligence reveals several critical insights shaping the UK minimally-invasive surgery devices landscape. Surgical volume trends indicate consistent growth across key specialties, with laparoscopic procedures representing the largest segment by procedure volume and device utilization.

Clinical adoption patterns show varying penetration rates across different surgical specialties, with some areas achieving over 70% minimally-invasive procedure rates while others remain in early adoption phases. This variation presents significant growth opportunities for device manufacturers and healthcare providers.

Demographic transformation represents the primary driver of UK minimally-invasive surgery devices market growth. The aging population requires increasing surgical interventions, with individuals over 65 accounting for a growing proportion of surgical procedures. Life expectancy increases and improved healthcare access are expanding the patient population requiring surgical treatment.

Clinical advantages of minimally-invasive procedures continue to drive adoption across medical specialties. Reduced post-operative pain, shorter hospital stays, faster recovery times, and improved cosmetic outcomes create compelling value propositions for both patients and healthcare providers. Patient satisfaction scores consistently favor minimally-invasive approaches over traditional open surgery methods.

Healthcare cost pressures are accelerating adoption of technologies that reduce overall treatment costs. Despite higher initial device costs, minimally-invasive procedures typically result in lower total healthcare expenditure through reduced complications, shorter hospital stays, and faster patient recovery. NHS efficiency initiatives increasingly favor treatment modalities that optimize resource utilization.

Technological innovation continues to expand the scope and effectiveness of minimally-invasive procedures. Advances in imaging technology, surgical instrumentation, and robotic systems are enabling surgeons to perform increasingly complex procedures through minimally-invasive approaches. Artificial intelligence integration is enhancing surgical planning and intraoperative decision-making.

Surgeon training and expertise improvements are reducing barriers to adoption. Enhanced training programs, simulation technologies, and mentorship initiatives are building surgeon confidence and competency in minimally-invasive techniques. Medical education evolution increasingly emphasizes minimally-invasive approaches as standard practice rather than specialized techniques.

Capital investment requirements represent a significant barrier to market expansion, particularly for smaller healthcare facilities and specialized surgical centers. Advanced minimally-invasive surgery systems require substantial upfront investments that may strain healthcare budgets and limit adoption rates in cost-sensitive environments.

Training and learning curve challenges continue to impact adoption rates across surgical specialties. Minimally-invasive techniques require specialized skills and extensive training periods, creating temporary productivity reductions and increased training costs for healthcare institutions. Surgeon resistance to changing established surgical practices can slow technology adoption.

Regulatory complexity and approval processes can delay market entry for innovative devices and technologies. Stringent safety requirements and clinical validation demands, while necessary for patient safety, can extend development timelines and increase costs for device manufacturers. Post-market surveillance requirements add ongoing compliance burdens.

Technical limitations of current minimally-invasive technologies restrict their application in certain complex procedures. Some surgical cases still require open approaches due to anatomical constraints, tumor characteristics, or procedural complexity. Haptic feedback limitations in robotic systems can impact surgeon tactile sensation and procedural confidence.

Reimbursement challenges in certain procedure categories can limit adoption rates. While many minimally-invasive procedures receive appropriate reimbursement, some newer technologies and techniques may face coverage limitations or reduced reimbursement rates that impact economic viability for healthcare providers.

Emerging surgical specialties present significant expansion opportunities for minimally-invasive device manufacturers. Specialties such as neurosurgery, cardiac surgery, and complex oncological procedures are increasingly adopting minimally-invasive approaches, creating demand for specialized instrumentation and technologies.

Artificial intelligence integration offers transformative opportunities for surgical enhancement and automation. AI-powered surgical planning, real-time guidance systems, and predictive analytics can improve surgical outcomes while reducing procedure complexity and training requirements. Machine learning algorithms can optimize surgical workflows and enhance decision-making capabilities.

Outpatient surgery expansion creates opportunities for portable and cost-effective minimally-invasive devices. As healthcare systems shift toward ambulatory care models, demand increases for devices that enable complex procedures in outpatient settings while maintaining safety and efficacy standards.

Personalized surgery approaches leveraging patient-specific imaging and planning technologies represent emerging opportunities. 3D printing applications for surgical planning and custom instrumentation can enhance procedure precision while reducing operative times and improving outcomes.

International market expansion opportunities exist for UK-based device manufacturers and healthcare providers. Expertise in minimally-invasive surgery developed within the UK healthcare system can be leveraged for global market penetration and technology transfer initiatives.

Supply chain evolution is reshaping the UK minimally-invasive surgery devices market through improved distribution networks, inventory management systems, and just-in-time delivery models. Digital supply chain integration is enhancing efficiency while reducing costs and improving device availability across healthcare facilities.

Competitive intensity continues to drive innovation and price optimization across device categories. Established manufacturers face increasing competition from emerging technology companies and international suppliers, creating pressure for continuous product improvement and cost competitiveness. Market consolidation trends are reshaping competitive dynamics through strategic acquisitions and partnerships.

Technology convergence is creating new market dynamics as traditionally separate device categories integrate into comprehensive surgical platforms. Ecosystem approaches combining multiple technologies and services are becoming increasingly important for market success and customer retention.

Regulatory evolution is adapting to rapid technological advancement while maintaining patient safety standards. Digital health integration and software-based medical devices are creating new regulatory pathways and market opportunities for innovative companies.

Healthcare delivery transformation toward value-based care models is influencing purchasing decisions and technology adoption patterns. Providers increasingly evaluate devices based on total cost of ownership and patient outcome improvements rather than initial acquisition costs alone.

Comprehensive market analysis employed multiple research methodologies to ensure accuracy and reliability of findings. Primary research included structured interviews with healthcare professionals, device manufacturers, and industry experts across the UK minimally-invasive surgery ecosystem.

Secondary research encompassed analysis of published clinical studies, regulatory filings, company financial reports, and industry publications to validate market trends and growth projections. Database analysis of surgical procedure volumes and device utilization patterns provided quantitative foundation for market sizing and segmentation.

Expert consultation with leading surgeons, hospital administrators, and medical device executives provided qualitative insights into market dynamics, adoption barriers, and future opportunities. Focus group discussions with healthcare procurement professionals revealed purchasing decision factors and vendor evaluation criteria.

Market modeling techniques incorporated historical data analysis, trend extrapolation, and scenario planning to develop robust growth projections and market forecasts. Statistical validation ensured data accuracy and reliability across all research components.

Regulatory analysis examined current and proposed regulations affecting minimally-invasive surgery devices, including safety requirements, approval processes, and reimbursement policies that impact market development and technology adoption patterns.

London and Southeast England dominate the UK minimally-invasive surgery devices market, accounting for approximately 40% of total market activity. This concentration reflects the region’s high density of major teaching hospitals, private healthcare facilities, and medical device companies. Research and development activities are particularly concentrated in this region, driving innovation and early technology adoption.

Northern England represents a growing market segment with increasing adoption rates across major metropolitan areas including Manchester, Leeds, and Liverpool. NHS foundation trusts in this region are actively investing in minimally-invasive technologies to improve patient outcomes and operational efficiency. Regional medical device clusters are emerging to support local innovation and manufacturing.

Scotland demonstrates strong market growth driven by centralized healthcare planning and strategic technology investments. NHS Scotland initiatives promoting minimally-invasive surgery adoption are creating consistent demand across the region. Edinburgh and Glasgow serve as primary market centers with expanding capabilities in robotic surgery and advanced laparoscopy.

Wales and Northern Ireland represent emerging markets with significant growth potential. Healthcare system modernization initiatives and EU funding programs are supporting technology adoption and infrastructure development. Rural healthcare challenges are driving demand for portable and versatile minimally-invasive devices.

Regional specialization is emerging with certain areas developing expertise in specific surgical specialties and device categories. This specialization creates opportunities for targeted technology development and clinical collaboration between regions.

Market leadership is distributed among several global medical device manufacturers with strong UK presence and local market expertise. The competitive environment is characterized by continuous innovation, strategic partnerships, and expanding product portfolios across minimally-invasive surgery categories.

Emerging competitors include technology startups developing AI-powered surgical systems, advanced imaging solutions, and novel minimally-invasive devices. Strategic partnerships between established manufacturers and innovative technology companies are creating new competitive dynamics and accelerating product development cycles.

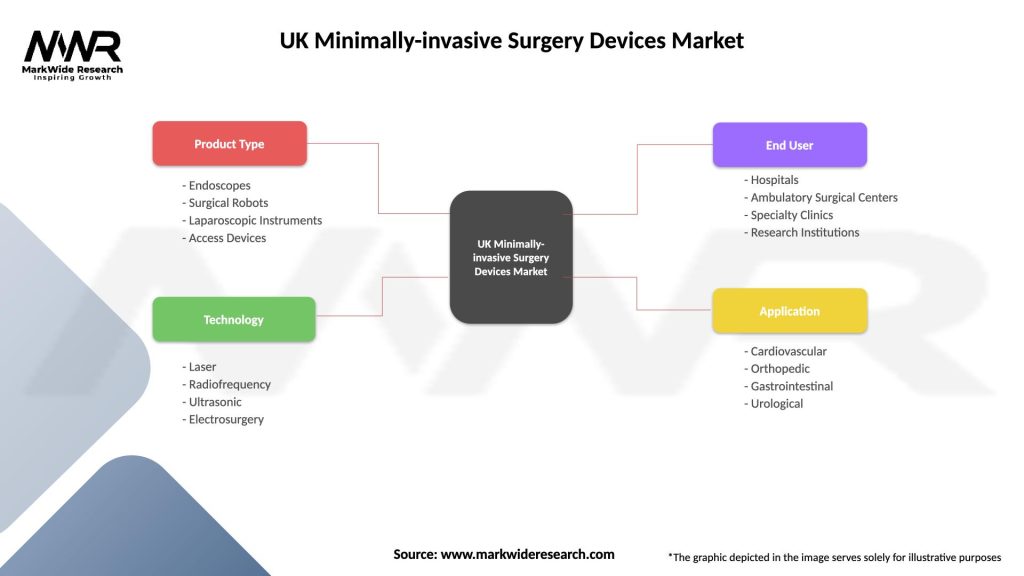

By Product Type:

By Application:

By End User:

Laparoscopic devices maintain market leadership through established clinical acceptance and broad application across surgical specialties. Technology evolution toward single-port surgery and advanced visualization systems is driving segment growth. Integration of AI-powered image enhancement and surgical guidance systems is creating new opportunities for innovation and market expansion.

Robotic surgery systems represent the fastest-growing segment with adoption rates increasing 18% annually across major UK hospitals. Expanding clinical applications beyond traditional urology and gynecology into general surgery, cardiothoracic surgery, and orthopedics are driving market growth. Training programs and simulation technologies are reducing adoption barriers and accelerating market penetration.

Endoscopic equipment demonstrates steady growth driven by increasing diagnostic and therapeutic applications. Advanced imaging technologies including narrow-band imaging and confocal endomicroscopy are enhancing diagnostic capabilities and expanding clinical applications. Integration with AI-powered diagnostic assistance is creating new market opportunities.

Energy-based devices continue evolving toward multifunctional platforms combining multiple energy modalities in single systems. Advanced energy management and tissue sensing technologies are improving surgical outcomes while reducing complications. Market growth is driven by expanding applications and improved cost-effectiveness.

Visualization systems are experiencing rapid advancement through 4K and 8K imaging technologies, 3D visualization, and augmented reality integration. Image enhancement algorithms and real-time surgical guidance systems are creating new value propositions for healthcare providers and improving surgical outcomes.

Healthcare Providers benefit from improved patient outcomes, reduced complication rates, and enhanced operational efficiency through minimally-invasive surgery adoption. Shorter hospital stays and faster patient turnover improve resource utilization and financial performance. Enhanced reputation and patient satisfaction scores create competitive advantages in healthcare markets.

Surgeons gain access to advanced technologies that enhance surgical precision, reduce physical strain, and expand treatment capabilities. Career development opportunities through advanced training and specialization in minimally-invasive techniques create professional advancement pathways. Improved patient outcomes and reduced complications enhance professional satisfaction and clinical reputation.

Patients experience reduced pain, faster recovery times, minimal scarring, and improved quality of life through minimally-invasive procedures. Shorter hospital stays reduce disruption to personal and professional activities while lowering overall treatment costs. Enhanced safety profiles and reduced complication rates improve treatment confidence and satisfaction.

Device Manufacturers access expanding market opportunities through technological innovation and clinical application development. Strategic partnerships with healthcare providers create sustainable competitive advantages and market penetration opportunities. Continuous innovation requirements drive research and development investments with long-term growth potential.

Healthcare Systems achieve cost savings through reduced complications, shorter hospital stays, and improved resource utilization. Quality metrics improvement enhances system reputation and regulatory compliance while supporting value-based care initiatives. Population health benefits through improved access to advanced surgical treatments create long-term healthcare system value.

Strengths:

Weaknesses:

Opportunities:

Threats:

Artificial Intelligence Integration is transforming minimally-invasive surgery through intelligent surgical guidance systems, predictive analytics, and automated decision support. Machine learning algorithms are enhancing surgical planning, intraoperative navigation, and post-operative monitoring to improve outcomes and reduce complications.

Robotic Surgery Democratization is expanding beyond premium healthcare facilities to mainstream hospitals and surgical centers. Cost-effective robotic platforms and flexible financing models are making advanced surgical robotics accessible to broader healthcare provider networks across the UK.

Single-Port Surgery Evolution continues advancing toward scarless surgery through innovative instrument designs and surgical techniques. Natural orifice transluminal endoscopic surgery represents the next frontier in minimally-invasive approaches, eliminating external incisions entirely for selected procedures.

Augmented Reality Surgical Guidance is emerging as a transformative technology for surgical planning and intraoperative navigation. Mixed reality systems overlay digital information onto surgical fields, enhancing precision and reducing procedural complexity for complex minimally-invasive procedures.

Personalized Surgical Approaches leveraging patient-specific imaging and 3D modeling are enabling customized surgical planning and instrument selection. Digital twin technology allows surgeons to practice procedures and optimize approaches before actual surgery, improving outcomes and reducing operative times.

Regulatory Milestone Achievements include streamlined approval processes for innovative minimally-invasive devices and expanded reimbursement coverage for robotic surgery procedures. MHRA initiatives supporting medical device innovation are accelerating market entry for breakthrough technologies while maintaining safety standards.

Strategic Partnership Formations between device manufacturers and healthcare providers are creating integrated solutions and comprehensive service offerings. NHS foundation trusts are establishing long-term partnerships with technology companies to ensure sustainable access to advanced surgical capabilities.

Technology Breakthrough Announcements include next-generation robotic surgery platforms with enhanced haptic feedback, AI-powered surgical assistance systems, and advanced energy devices with improved tissue interaction capabilities. Innovation investments continue driving technological advancement across all device categories.

Clinical Evidence Publications demonstrating superior outcomes for minimally-invasive procedures are expanding adoption across previously conservative surgical specialties. Large-scale clinical studies provide compelling evidence for healthcare providers considering technology investments and clinical protocol changes.

Training Program Expansions include comprehensive simulation centers, virtual reality training systems, and structured fellowship programs for minimally-invasive surgery specialization. Educational initiatives are addressing skill gaps and accelerating surgeon proficiency development across the UK healthcare system.

Investment Prioritization should focus on technologies demonstrating clear clinical advantages and cost-effectiveness profiles. MarkWide Research analysis indicates that healthcare providers achieving the greatest success prioritize comprehensive technology platforms over individual device acquisitions, enabling integrated surgical workflows and improved efficiency.

Training Infrastructure Development represents a critical success factor for minimally-invasive surgery adoption. Healthcare organizations should invest in simulation centers, structured training programs, and ongoing education initiatives to maximize technology utilization and clinical outcomes. Surgeon proficiency directly correlates with patient outcomes and technology return on investment.

Strategic Partnership Development with device manufacturers can provide access to latest technologies, comprehensive training programs, and favorable financing arrangements. Long-term partnerships enable healthcare providers to maintain technology currency while managing capital investment requirements and operational complexity.

Quality Metrics Implementation should focus on patient outcomes, procedural efficiency, and cost-effectiveness measures to demonstrate technology value and support continued investment. Data-driven decision making enables healthcare providers to optimize technology utilization and identify areas for improvement.

Market Expansion Strategies for device manufacturers should emphasize clinical evidence generation, comprehensive training support, and flexible commercial models that address diverse healthcare provider needs. Customer success programs ensuring optimal technology utilization create sustainable competitive advantages and market penetration opportunities.

Technology Evolution will continue driving market expansion through AI integration, robotic surgery advancement, and novel minimally-invasive approaches. Next-generation platforms combining multiple technologies into comprehensive surgical ecosystems will reshape competitive dynamics and clinical workflows over the next decade.

Market Growth Projections indicate sustained expansion at a CAGR of 8.5% through 2030, driven by demographic trends, technology advancement, and expanding clinical applications. MWR forecasts suggest that robotic surgery adoption will accelerate significantly, potentially reaching 25% of eligible procedures by 2028.

Clinical Application Expansion will extend minimally-invasive approaches into increasingly complex surgical procedures across all medical specialties. Breakthrough technologies in areas such as neurosurgery, cardiac surgery, and oncology will create new market segments and growth opportunities for innovative device manufacturers.

Healthcare System Integration will evolve toward comprehensive minimally-invasive surgery programs encompassing technology, training, and clinical protocols. Centers of excellence specializing in advanced minimally-invasive procedures will emerge as regional referral centers and innovation hubs.

Global Market Leadership opportunities exist for UK-based companies and healthcare institutions to export expertise and technology solutions to international markets. Innovation ecosystem development combining clinical excellence, technology development, and commercial expertise will position the UK as a global leader in minimally-invasive surgery advancement.

The UK minimally-invasive surgery devices market represents a dynamic and rapidly evolving healthcare technology sector characterized by strong growth momentum, continuous innovation, and expanding clinical applications. Market fundamentals remain robust, supported by demographic trends, healthcare system priorities, and technological advancement that collectively drive sustained demand for minimally-invasive surgical solutions.

Technology convergence between artificial intelligence, robotics, and advanced surgical instrumentation is creating transformative opportunities for improved patient outcomes, enhanced surgical precision, and expanded treatment capabilities. The integration of these technologies into comprehensive surgical platforms will continue reshaping clinical practice and market dynamics throughout the forecast period.

Strategic success factors for market participants include investment in advanced technologies, comprehensive training programs, strategic partnerships, and evidence-based clinical validation. Healthcare providers and device manufacturers that prioritize these elements will achieve sustainable competitive advantages and optimal patient outcomes in the evolving UK minimally-invasive surgery devices market.

What is Minimally-invasive Surgery Devices?

Minimally-invasive surgery devices refer to tools and technologies used in surgical procedures that require smaller incisions, leading to reduced recovery times and less postoperative pain. These devices include laparoscopes, robotic surgical systems, and endoscopes, among others.

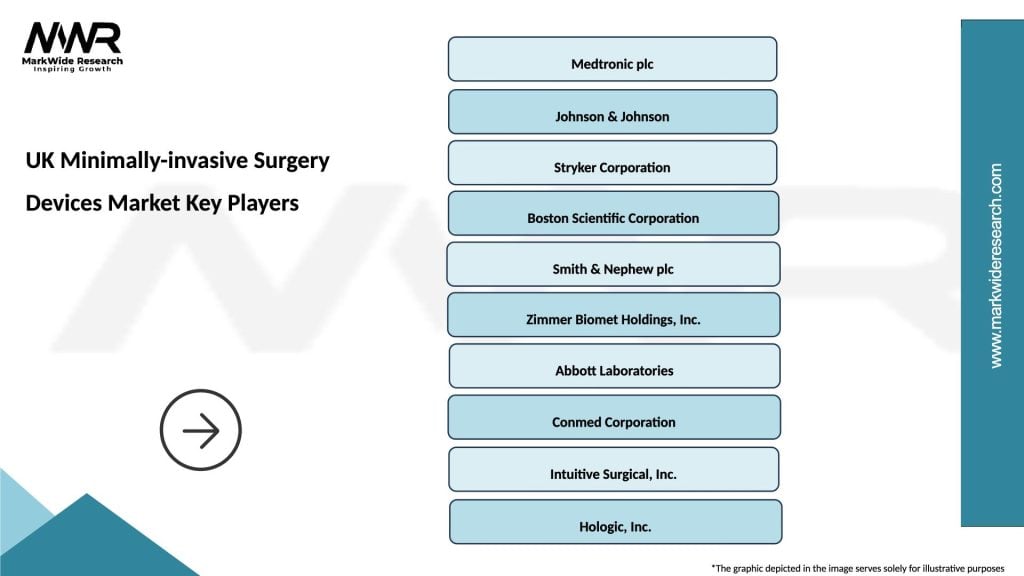

What are the key players in the UK Minimally-invasive Surgery Devices Market?

Key players in the UK Minimally-invasive Surgery Devices Market include Medtronic, Johnson & Johnson, and Stryker. These companies are known for their innovative surgical technologies and extensive product portfolios, among others.

What are the growth factors driving the UK Minimally-invasive Surgery Devices Market?

The growth of the UK Minimally-invasive Surgery Devices Market is driven by factors such as the increasing prevalence of chronic diseases, advancements in surgical technologies, and a growing preference for outpatient procedures. Additionally, the rising demand for minimally-invasive techniques among patients contributes to market expansion.

What challenges does the UK Minimally-invasive Surgery Devices Market face?

The UK Minimally-invasive Surgery Devices Market faces challenges such as high costs associated with advanced surgical technologies and the need for specialized training for healthcare professionals. Furthermore, regulatory hurdles can also impact the speed of innovation and market entry for new devices.

What opportunities exist in the UK Minimally-invasive Surgery Devices Market?

Opportunities in the UK Minimally-invasive Surgery Devices Market include the development of new technologies such as robotic-assisted surgery and enhanced imaging systems. Additionally, increasing investments in healthcare infrastructure and rising awareness about the benefits of minimally-invasive procedures present significant growth potential.

What trends are shaping the UK Minimally-invasive Surgery Devices Market?

Trends shaping the UK Minimally-invasive Surgery Devices Market include the integration of artificial intelligence in surgical procedures, the rise of telemedicine, and the growing emphasis on patient-centered care. These trends are leading to more efficient surgical outcomes and improved patient experiences.

UK Minimally-invasive Surgery Devices Market

| Segmentation Details | Description |

|---|---|

| Product Type | Endoscopes, Surgical Robots, Laparoscopic Instruments, Access Devices |

| Technology | Laser, Radiofrequency, Ultrasonic, Electrosurgery |

| End User | Hospitals, Ambulatory Surgical Centers, Specialty Clinics, Research Institutions |

| Application | Cardiovascular, Orthopedic, Gastrointestinal, Urological |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the UK Minimally-invasive Surgery Devices Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at