444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Spain IVD market represents a dynamic and rapidly evolving segment of the country’s healthcare infrastructure, characterized by significant technological advancement and increasing demand for diagnostic solutions. In vitro diagnostics have become fundamental to modern healthcare delivery across Spanish medical facilities, from major metropolitan hospitals to regional healthcare centers. The market demonstrates robust growth potential driven by an aging population, rising prevalence of chronic diseases, and continuous innovation in diagnostic technologies.

Market dynamics indicate sustained expansion with the sector experiencing growth rates of approximately 6.2% annually, reflecting strong demand across multiple diagnostic categories. Spanish healthcare providers are increasingly adopting advanced IVD solutions to enhance patient care quality and operational efficiency. The integration of digital health technologies and point-of-care testing solutions has particularly accelerated market development, with molecular diagnostics and immunoassays leading technological adoption.

Regional distribution shows concentrated market activity in major urban centers including Madrid, Barcelona, Valencia, and Seville, where approximately 68% of diagnostic testing volume occurs. The market encompasses diverse stakeholder groups including public hospitals, private healthcare facilities, independent laboratories, and specialized diagnostic centers, each contributing to the overall market ecosystem through distinct service offerings and technological capabilities.

The Spain IVD market refers to the comprehensive ecosystem of in vitro diagnostic products, services, and technologies utilized within Spanish healthcare facilities for medical testing and disease diagnosis. In vitro diagnostics encompass laboratory tests performed on biological samples such as blood, urine, tissue, and other bodily fluids to detect diseases, monitor health conditions, and guide treatment decisions.

This market segment includes various diagnostic categories such as clinical chemistry, immunoassays, hematology, microbiology, molecular diagnostics, and point-of-care testing solutions. Spanish IVD providers deliver essential diagnostic capabilities that support clinical decision-making across primary care, specialized medicine, emergency services, and preventive healthcare programs throughout the country’s healthcare system.

Market participants include international diagnostic companies, domestic manufacturers, healthcare institutions, independent laboratories, and technology providers who collectively contribute to advancing diagnostic capabilities and improving patient outcomes across Spain’s diverse healthcare landscape.

Spain’s IVD market demonstrates exceptional growth momentum driven by demographic shifts, technological innovation, and evolving healthcare delivery models. The market benefits from strong government healthcare investment, with public healthcare spending representing approximately 71% of total healthcare expenditure, creating stable demand for diagnostic services and advanced testing technologies.

Key market drivers include the increasing prevalence of chronic diseases affecting approximately 42% of the Spanish adult population, rising demand for personalized medicine approaches, and growing adoption of molecular diagnostic technologies. Point-of-care testing has emerged as a particularly dynamic segment, with adoption rates increasing by 15% annually as healthcare providers seek to improve patient care efficiency and reduce turnaround times.

Technological advancement remains central to market evolution, with artificial intelligence integration, automation solutions, and digital connectivity transforming traditional diagnostic workflows. Spanish healthcare institutions are increasingly investing in comprehensive diagnostic platforms that offer integrated testing capabilities, enhanced data management, and improved clinical decision support functionality.

Market challenges include regulatory compliance requirements, cost containment pressures, and the need for continuous workforce development to support advanced diagnostic technologies. However, these challenges are balanced by significant opportunities in emerging diagnostic areas, expanded testing accessibility, and enhanced healthcare outcomes through improved diagnostic capabilities.

Strategic market analysis reveals several critical insights that define the current landscape and future trajectory of Spain’s IVD sector. Market segmentation shows distinct growth patterns across different diagnostic categories, with molecular diagnostics and immunoassays leading expansion efforts.

Market penetration varies significantly across different healthcare settings, with large hospitals achieving higher adoption rates of advanced diagnostic technologies compared to smaller healthcare facilities. Regional variations also influence market dynamics, with urban areas typically demonstrating faster technology adoption and higher testing volumes.

Demographic transformation serves as a primary catalyst for IVD market expansion in Spain, with the country experiencing significant population aging that increases demand for diagnostic services. Chronic disease prevalence continues rising, particularly diabetes, cardiovascular conditions, and cancer, requiring comprehensive diagnostic monitoring and management solutions.

Healthcare modernization initiatives supported by government investment programs are driving adoption of advanced diagnostic technologies across public healthcare facilities. Digital health transformation efforts emphasize integrated diagnostic solutions that enhance care coordination and improve patient outcomes through better clinical decision support.

Regulatory support through favorable reimbursement policies and quality improvement initiatives encourages healthcare providers to invest in advanced diagnostic capabilities. Clinical evidence demonstrating the value of early diagnosis and precision medicine approaches further drives market demand across multiple therapeutic areas.

Economic constraints within Spain’s healthcare system create challenges for IVD market expansion, particularly regarding high-cost advanced diagnostic technologies. Budget limitations in public healthcare facilities may restrict adoption of premium diagnostic solutions, requiring careful cost-benefit analysis for technology investments.

Regulatory complexity associated with the European IVD Regulation implementation creates compliance challenges for market participants, requiring significant investment in quality systems and documentation. Skilled workforce shortages in specialized diagnostic areas limit the ability to fully utilize advanced testing technologies and may slow market growth in certain segments.

Market fragmentation across different healthcare settings creates complexity in standardizing diagnostic approaches and may limit economies of scale. Reimbursement uncertainties for newer diagnostic technologies can slow adoption rates and create market access barriers for innovative solutions.

Emerging diagnostic technologies present substantial growth opportunities within Spain’s IVD market, particularly in areas such as liquid biopsies, companion diagnostics, and artificial intelligence-enhanced testing platforms. Personalized medicine approaches are creating demand for specialized diagnostic solutions that support targeted therapy selection and treatment monitoring.

Digital health integration offers significant potential for market expansion through enhanced connectivity, data analytics, and clinical decision support capabilities. Point-of-care testing expansion into primary care settings and community healthcare facilities represents a major growth opportunity, with potential market penetration rates reaching 35% over the next five years.

Public-private partnerships create opportunities for innovative diagnostic service delivery models that combine public healthcare objectives with private sector efficiency and innovation. International collaboration in diagnostic research and development can accelerate technology transfer and market access for advanced solutions.

Market dynamics within Spain’s IVD sector reflect complex interactions between technological innovation, regulatory requirements, healthcare policy, and economic factors. Competitive intensity continues increasing as international diagnostic companies expand their Spanish operations while domestic players strengthen their market positions through strategic partnerships and technology investments.

Supply chain evolution has become increasingly important, with market participants focusing on resilient distribution networks and local service capabilities. MarkWide Research analysis indicates that supply chain optimization efforts have improved diagnostic test availability by approximately 23% across Spanish healthcare facilities over recent years.

Technology convergence is reshaping market dynamics through integration of diagnostic testing with digital health platforms, electronic health records, and clinical decision support systems. Value-based healthcare initiatives are driving demand for diagnostic solutions that demonstrate clear clinical and economic benefits, influencing purchasing decisions across healthcare institutions.

Pricing dynamics reflect competitive pressures and healthcare cost containment efforts, with market participants developing value-based pricing models that align diagnostic costs with clinical outcomes and healthcare savings.

Comprehensive market research methodology employed for analyzing Spain’s IVD market incorporates multiple data collection approaches and analytical frameworks to ensure accuracy and reliability of market insights. Primary research activities include structured interviews with healthcare professionals, laboratory managers, diagnostic company executives, and healthcare policy experts across Spain’s major metropolitan areas and regional centers.

Secondary research encompasses analysis of healthcare statistics, regulatory documents, industry publications, and financial reports from key market participants. Market sizing methodologies utilize bottom-up and top-down approaches, incorporating healthcare facility surveys, diagnostic testing volume analysis, and technology adoption tracking across different healthcare settings.

Data validation processes include cross-referencing multiple sources, statistical analysis of survey responses, and expert review of preliminary findings. Market forecasting models incorporate demographic trends, healthcare policy developments, and technology adoption curves to project future market evolution.

Regional market distribution across Spain reveals significant variations in IVD adoption, testing volumes, and technology penetration rates. Madrid region leads market activity with approximately 28% of national diagnostic testing volume, benefiting from concentrated healthcare infrastructure, research institutions, and major hospital systems.

Catalonia region, centered around Barcelona, represents the second-largest market segment with 22% market share, driven by advanced healthcare facilities, biotechnology clusters, and strong private healthcare presence. Andalusia region demonstrates growing market importance with expanding healthcare infrastructure and increasing diagnostic service accessibility across urban and rural areas.

Rural market segments present unique challenges and opportunities, with approximately 18% of the population residing in areas with limited diagnostic access. Telemedicine integration and mobile diagnostic solutions are increasingly important for serving these underserved regions and ensuring equitable healthcare access.

Regional healthcare policies influence market dynamics through varying investment priorities, technology adoption incentives, and service delivery models. Cross-regional collaboration in diagnostic services and shared laboratory networks is emerging as a strategy to optimize resource utilization and improve service accessibility.

Competitive dynamics within Spain’s IVD market feature a diverse mix of international corporations, regional players, and specialized diagnostic companies competing across multiple market segments. Market leadership positions are established through comprehensive product portfolios, strong distribution networks, and robust customer service capabilities.

Competitive strategies emphasize innovation, customer service excellence, and comprehensive solution offerings that address evolving healthcare needs. Market differentiation occurs through technology leadership, clinical evidence generation, and value-based service models that demonstrate clear healthcare benefits.

Strategic partnerships between diagnostic companies and Spanish healthcare institutions are increasingly common, facilitating technology transfer, clinical validation, and market access for innovative diagnostic solutions.

Market segmentation analysis reveals distinct growth patterns and opportunities across different diagnostic categories, testing methodologies, and end-user segments. Technology-based segmentation shows molecular diagnostics and immunoassays leading market expansion, while traditional clinical chemistry maintains stable market presence.

By Technology:

By End User:

Application-based segmentation shows strong growth in chronic disease management, infectious disease testing, and cancer diagnostics, reflecting Spain’s healthcare priorities and demographic trends.

Clinical chemistry represents the foundational segment of Spain’s IVD market, encompassing routine blood chemistry panels, cardiac markers, and metabolic testing. Market maturity in this category drives focus toward automation, efficiency improvements, and integrated testing platforms that reduce manual intervention and improve turnaround times.

Immunoassay testing demonstrates robust growth driven by expanding biomarker applications, therapeutic drug monitoring, and hormone testing requirements. Technology advancement in this category includes enhanced sensitivity, multiplexing capabilities, and automated sample handling systems that improve laboratory productivity.

Molecular diagnostics emerges as the highest-growth category, with adoption rates increasing by approximately 19% annually across Spanish healthcare facilities. Applications expansion includes infectious disease testing, oncology diagnostics, pharmacogenomics, and genetic screening programs that support personalized medicine initiatives.

Emerging categories include liquid biopsy applications, companion diagnostics for targeted therapies, and digital pathology solutions that integrate with traditional IVD testing workflows.

Healthcare providers benefit significantly from advanced IVD solutions through improved diagnostic accuracy, faster turnaround times, and enhanced clinical decision-making capabilities. Operational efficiency gains include reduced manual processes, automated result reporting, and integrated laboratory workflows that optimize resource utilization.

Patient outcomes improve through earlier disease detection, more accurate diagnoses, and personalized treatment approaches enabled by advanced diagnostic technologies. Cost benefits for healthcare systems include reduced unnecessary procedures, optimized treatment selection, and improved resource allocation through evidence-based diagnostic insights.

Diagnostic companies benefit from market expansion opportunities, technology advancement partnerships, and sustainable revenue growth through comprehensive service offerings. Research institutions gain access to advanced diagnostic tools that support clinical research and biomarker discovery initiatives.

Healthcare policy makers achieve improved population health outcomes, enhanced healthcare system efficiency, and better resource allocation through evidence-based diagnostic strategies supported by comprehensive IVD capabilities.

Strengths:

Weaknesses:

Opportunities:

Threats:

Artificial intelligence integration represents a transformative trend reshaping Spain’s IVD market through enhanced diagnostic interpretation, pattern recognition, and clinical decision support capabilities. Machine learning algorithms are increasingly incorporated into diagnostic platforms to improve accuracy, reduce interpretation time, and support complex diagnostic challenges.

Point-of-care testing expansion continues accelerating with adoption rates growing by 16% annually, driven by demand for immediate diagnostic results and decentralized healthcare delivery models. Molecular point-of-care solutions are particularly gaining traction in emergency departments, intensive care units, and primary care settings.

Sustainability initiatives are influencing diagnostic technology development, with focus on environmentally friendly testing solutions, reduced waste generation, and energy-efficient laboratory operations. MarkWide Research indicates that sustainability considerations now influence approximately 34% of diagnostic purchasing decisions across Spanish healthcare facilities.

Telemedicine integration creates new opportunities for remote diagnostic consultation, result interpretation, and clinical decision support, particularly important for serving rural and underserved populations across Spain’s diverse geographic regions.

Recent industry developments highlight significant advancement in diagnostic capabilities, regulatory compliance, and market access strategies across Spain’s IVD sector. Technology partnerships between international diagnostic companies and Spanish healthcare institutions have accelerated innovation transfer and clinical validation of advanced diagnostic solutions.

Regulatory milestone achievements include successful implementation of European IVD Regulation requirements across major diagnostic laboratories, enhancing quality standards and patient safety protocols. Investment announcements from leading diagnostic companies indicate continued confidence in Spain’s market potential and commitment to expanding local operations.

Market consolidation activities include strategic acquisitions and partnership formations aimed at strengthening market positions and expanding service capabilities. Innovation centers established by major diagnostic companies in Spain support local research and development activities while facilitating technology transfer to clinical applications.

Quality improvement initiatives across Spanish laboratories demonstrate commitment to excellence and compliance with international standards, enhancing the country’s reputation as a reliable diagnostic services provider.

Strategic recommendations for market participants emphasize the importance of technology innovation, customer service excellence, and value-based solution development. Diagnostic companies should prioritize artificial intelligence integration, automation enhancement, and point-of-care testing expansion to capture emerging market opportunities.

Healthcare providers are advised to develop comprehensive diagnostic strategies that balance cost optimization with quality improvement objectives. Investment priorities should focus on technologies that demonstrate clear clinical benefits, operational efficiency gains, and long-term sustainability advantages.

Regulatory compliance should remain a top priority, with organizations investing in quality systems, documentation processes, and staff training to meet evolving requirements. Sustainability initiatives should be integrated into strategic planning to address environmental concerns and operational efficiency objectives.

Digital transformation strategies should encompass data analytics, connectivity solutions, and clinical decision support capabilities that enhance diagnostic value and improve patient outcomes across Spain’s healthcare system.

Future market prospects for Spain’s IVD sector remain highly positive, with sustained growth expected across multiple diagnostic categories and technology segments. Market expansion will be driven by demographic trends, technology innovation, and evolving healthcare delivery models that emphasize precision medicine and personalized care approaches.

Technology evolution will continue reshaping the diagnostic landscape through artificial intelligence advancement, automation enhancement, and digital health integration. Molecular diagnostics are projected to maintain the highest growth rates, with market penetration expected to reach 45% of total diagnostic testing volume within the next five years.

Point-of-care testing expansion will accelerate, particularly in primary care settings and emergency departments where rapid diagnostic results directly impact clinical decision-making. MWR projections indicate that point-of-care testing adoption could achieve 38% market penetration across Spanish healthcare facilities by 2029.

Investment opportunities will emerge in emerging diagnostic categories, underserved market segments, and technology integration projects that enhance healthcare system efficiency and patient outcomes.

Spain’s IVD market represents a dynamic and rapidly evolving sector characterized by strong growth potential, technological innovation, and significant opportunities for market participants. Market fundamentals remain robust, supported by demographic trends, healthcare modernization initiatives, and continuous advancement in diagnostic technologies.

Key success factors for market participants include technology leadership, customer service excellence, regulatory compliance, and value-based solution development that addresses evolving healthcare needs. Strategic positioning in high-growth segments such as molecular diagnostics, point-of-care testing, and artificial intelligence-enhanced solutions will be critical for long-term market success.

Future market development will be shaped by continued innovation, regulatory evolution, and changing healthcare delivery models that emphasize precision medicine and personalized care approaches. Market participants who successfully navigate these trends while maintaining focus on quality, efficiency, and clinical value will be well-positioned to capitalize on Spain’s expanding IVD market opportunities.

What is IVD?

IVD stands for In Vitro Diagnostics, which refers to tests performed on samples such as blood or tissue that have been taken from the human body. These tests are crucial for diagnosing diseases, monitoring health conditions, and guiding treatment decisions.

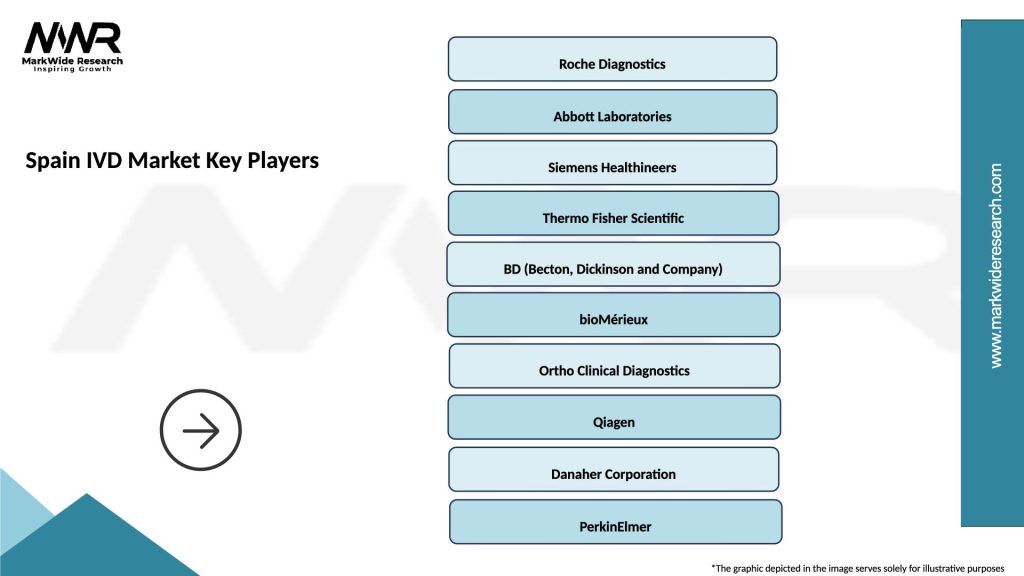

What are the key players in the Spain IVD Market?

Key players in the Spain IVD Market include companies like Roche Diagnostics, Abbott Laboratories, and Siemens Healthineers, which are known for their innovative diagnostic solutions and extensive product portfolios, among others.

What are the growth factors driving the Spain IVD Market?

The Spain IVD Market is driven by factors such as the increasing prevalence of chronic diseases, advancements in diagnostic technologies, and a growing emphasis on personalized medicine. Additionally, the rising demand for point-of-care testing is contributing to market growth.

What challenges does the Spain IVD Market face?

The Spain IVD Market faces challenges such as stringent regulatory requirements, high costs associated with advanced diagnostic technologies, and the need for continuous innovation to keep pace with rapid technological advancements.

What opportunities exist in the Spain IVD Market?

Opportunities in the Spain IVD Market include the expansion of telemedicine, the integration of artificial intelligence in diagnostics, and the increasing focus on preventive healthcare. These trends are expected to enhance the efficiency and accuracy of diagnostic processes.

What trends are shaping the Spain IVD Market?

Trends shaping the Spain IVD Market include the rise of home-based testing solutions, the development of rapid diagnostic tests, and the growing use of molecular diagnostics. These innovations are transforming how healthcare providers approach disease detection and management.

Spain IVD Market

| Segmentation Details | Description |

|---|---|

| Product Type | Reagents, Instruments, Software, Consumables |

| End User | Hospitals, Diagnostic Laboratories, Research Institutions, Home Care |

| Technology | Molecular Diagnostics, Immunoassays, Microbiology, Hematology |

| Application | Infectious Diseases, Oncology, Cardiology, Metabolic Disorders |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Spain IVD Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at