444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The UK surgical devices market represents a dynamic and rapidly evolving sector within the broader healthcare technology landscape. Market dynamics indicate sustained growth driven by technological innovations, aging demographics, and increasing demand for minimally invasive procedures. The market encompasses a comprehensive range of surgical instruments, implants, and advanced medical technologies designed to support various surgical specialties including cardiovascular, orthopedic, neurological, and general surgery applications.

Growth trajectories within the UK surgical devices sector demonstrate robust expansion, with the market experiencing a compound annual growth rate (CAGR) of 6.2% over recent years. This growth reflects the nation’s commitment to healthcare modernization and the adoption of cutting-edge surgical technologies. Key market segments include surgical instruments, cardiovascular devices, orthopedic implants, neurosurgical equipment, and minimally invasive surgical systems, each contributing significantly to the overall market expansion.

Healthcare infrastructure improvements across the UK have created favorable conditions for surgical device adoption. The National Health Service (NHS) continues to invest in advanced surgical technologies, while private healthcare facilities expand their capabilities to meet growing patient demands. Regional distribution shows that England accounts for approximately 84% of market activity, followed by Scotland, Wales, and Northern Ireland, reflecting population density and healthcare facility concentration patterns.

The UK surgical devices market refers to the comprehensive ecosystem of medical instruments, equipment, and implantable devices specifically designed for surgical procedures within the United Kingdom healthcare system. This market encompasses both disposable and reusable surgical tools, advanced robotic surgical systems, implants, and supporting technologies that enable healthcare professionals to perform complex surgical interventions with enhanced precision and improved patient outcomes.

Market scope includes traditional surgical instruments such as scalpels, forceps, and scissors, as well as sophisticated technologies including robotic surgical systems, computer-assisted navigation tools, and smart surgical devices integrated with artificial intelligence capabilities. The market serves various healthcare settings including NHS hospitals, private medical facilities, ambulatory surgical centers, and specialized surgical clinics throughout the UK.

Regulatory framework governing this market involves compliance with UK medical device regulations, CE marking requirements, and post-Brexit regulatory adaptations. The Medicines and Healthcare products Regulatory Agency (MHRA) oversees device approval processes, ensuring safety and efficacy standards are maintained across all surgical device categories.

Strategic analysis of the UK surgical devices market reveals a sector characterized by innovation-driven growth, increasing adoption of minimally invasive technologies, and expanding applications across diverse surgical specialties. The market benefits from strong healthcare infrastructure, skilled medical professionals, and supportive regulatory environments that facilitate the introduction of advanced surgical technologies.

Key growth drivers include the aging UK population, rising prevalence of chronic diseases requiring surgical intervention, and increasing patient preference for minimally invasive procedures that offer reduced recovery times and improved outcomes. Technological advancement in areas such as robotic surgery, smart implants, and AI-assisted surgical planning contributes to market expansion and enhanced surgical capabilities.

Market segmentation analysis indicates that cardiovascular surgical devices represent the largest segment, accounting for approximately 28% of total market share, followed by orthopedic devices at 24% and general surgical instruments at 22%. The minimally invasive surgery segment demonstrates the highest growth potential, driven by increasing adoption rates and technological improvements.

Competitive landscape features a mix of established multinational corporations and innovative UK-based companies developing specialized surgical technologies. Market consolidation trends continue as larger companies acquire innovative startups and smaller specialized manufacturers to expand their product portfolios and technological capabilities.

Market intelligence reveals several critical insights shaping the UK surgical devices landscape. The following key insights provide strategic understanding of market dynamics and growth opportunities:

Primary market drivers propelling growth in the UK surgical devices sector stem from demographic, technological, and healthcare system factors. The aging UK population represents a fundamental driver, as older adults typically require more surgical interventions for age-related conditions including joint replacements, cardiovascular procedures, and cancer treatments.

Technological innovation serves as a critical growth catalyst, with advances in robotic surgery, minimally invasive techniques, and smart surgical devices creating new treatment possibilities and improving surgical outcomes. Healthcare digitization initiatives across the NHS promote adoption of connected surgical devices and digital surgical planning tools that enhance operational efficiency and patient care quality.

Rising healthcare expenditure in both public and private sectors supports investment in advanced surgical technologies. The UK government’s commitment to NHS modernization includes significant funding for medical equipment upgrades and technology infrastructure improvements. Private healthcare growth also contributes to market expansion as private facilities invest in cutting-edge surgical capabilities to attract patients seeking premium healthcare services.

Clinical outcome improvements associated with advanced surgical devices drive adoption among healthcare providers. Reduced complication rates, shorter hospital stays, and faster patient recovery times create compelling value propositions for surgical device investments. Surgeon training programs and medical education initiatives further support market growth by ensuring healthcare professionals possess the skills necessary to utilize advanced surgical technologies effectively.

Market constraints affecting the UK surgical devices sector include budget limitations within the NHS, complex regulatory requirements, and high implementation costs associated with advanced surgical technologies. Healthcare budget pressures create challenges for device procurement, particularly for expensive robotic surgical systems and specialized implants that require significant capital investments.

Regulatory complexity following Brexit has introduced additional compliance requirements and potential delays in device approvals. Manufacturers must navigate evolving regulatory frameworks while ensuring continued market access and product compliance. Post-Brexit trade considerations may impact supply chains and increase costs for imported surgical devices and components.

Skills shortages in specialized surgical areas limit the adoption of advanced surgical technologies. Training requirements for complex surgical devices can be extensive and costly, creating barriers to implementation. Infrastructure limitations in some healthcare facilities may restrict the deployment of advanced surgical systems that require specialized operating room configurations and support systems.

Economic uncertainties and healthcare funding constraints can delay capital equipment purchases and technology upgrades. Competition from alternative treatments including pharmaceutical therapies and non-surgical interventions may limit growth in certain surgical device categories.

Emerging opportunities within the UK surgical devices market present significant potential for growth and innovation. Digital health integration offers opportunities to develop connected surgical devices that provide real-time data analytics, remote monitoring capabilities, and enhanced surgical planning tools that improve patient outcomes and operational efficiency.

Artificial intelligence applications in surgical devices create opportunities for predictive analytics, automated surgical assistance, and intelligent decision support systems. Machine learning algorithms can enhance surgical precision, reduce complications, and optimize surgical workflows through data-driven insights and automated processes.

Personalized surgical solutions represent a growing opportunity as 3D printing technologies enable custom implants, patient-specific surgical guides, and personalized surgical instruments. Biocompatible materials and advanced manufacturing techniques support the development of next-generation implants with improved integration and longevity.

Ambulatory surgery expansion creates demand for portable surgical devices and equipment designed for outpatient procedures. Home healthcare trends may drive development of surgical devices suitable for post-operative care and monitoring in home settings. Telemedicine integration offers opportunities for remote surgical consultation and guidance systems that extend surgical expertise to underserved areas.

Market dynamics within the UK surgical devices sector reflect complex interactions between technological advancement, regulatory evolution, and healthcare system transformation. Innovation cycles continue to accelerate as manufacturers invest heavily in research and development to create next-generation surgical technologies that address evolving clinical needs and market demands.

Competitive pressures drive continuous product improvement and cost optimization efforts among surgical device manufacturers. Market consolidation trends result in strategic acquisitions and partnerships that combine complementary technologies and expand market reach. Startup ecosystem growth introduces disruptive technologies and innovative approaches to surgical device design and functionality.

Healthcare system evolution toward value-based care models influences purchasing decisions and device selection criteria. Clinical evidence requirements become increasingly important as healthcare providers seek surgical devices with proven outcomes and cost-effectiveness data. Patient safety initiatives drive demand for surgical devices with enhanced safety features and reduced complication risks.

Supply chain optimization efforts focus on improving device availability, reducing costs, and ensuring quality consistency. Sustainability considerations influence product development and procurement decisions as healthcare organizations prioritize environmentally responsible surgical device options.

Research approach for analyzing the UK surgical devices market employs comprehensive methodologies combining primary and secondary research techniques. Primary research involves direct engagement with key market participants including surgical device manufacturers, healthcare providers, regulatory authorities, and medical professionals to gather firsthand insights and market intelligence.

Secondary research encompasses analysis of industry reports, regulatory filings, clinical studies, and market databases to establish baseline market understanding and identify trends. Data triangulation methods ensure accuracy and reliability by cross-referencing information from multiple sources and validating findings through independent verification processes.

Market sizing methodologies utilize bottom-up and top-down approaches to establish comprehensive market assessments. Segmentation analysis examines market categories by product type, application, end-user, and geographic distribution to provide detailed market insights. Competitive intelligence gathering involves systematic analysis of market participants, product portfolios, and strategic initiatives.

Expert interviews with industry leaders, clinical specialists, and regulatory experts provide qualitative insights that complement quantitative data analysis. Market validation processes ensure research findings accurately reflect current market conditions and future growth prospects through multiple verification stages and expert review procedures.

Regional distribution across the UK surgical devices market demonstrates significant geographic variations in market activity and growth patterns. England dominates the market landscape, accounting for approximately 84% of total market activity, driven by high population density, extensive healthcare infrastructure, and concentration of major medical centers and teaching hospitals.

London and Southeast England represent the largest regional market segment, benefiting from numerous private healthcare facilities, research institutions, and proximity to European markets. Northern England shows strong growth potential driven by healthcare infrastructure investments and regional medical center expansions. Midlands region demonstrates steady market development supported by manufacturing capabilities and healthcare facility modernization initiatives.

Scotland accounts for approximately 8% of market share, with Edinburgh and Glasgow serving as primary market centers. Scottish healthcare initiatives focus on advanced surgical technologies and medical device innovation programs. Wales represents roughly 5% of market activity, with Cardiff leading regional market development and healthcare technology adoption.

Northern Ireland comprises approximately 3% of the market, with Belfast serving as the primary healthcare hub. Cross-border healthcare collaborations with the Republic of Ireland create unique market dynamics and opportunities for surgical device manufacturers. Regional specialization patterns emerge as different areas develop expertise in specific surgical device categories and clinical applications.

Competitive environment within the UK surgical devices market features a diverse ecosystem of multinational corporations, specialized manufacturers, and innovative startups. Market leadership positions are held by established companies with comprehensive product portfolios and strong distribution networks throughout the UK healthcare system.

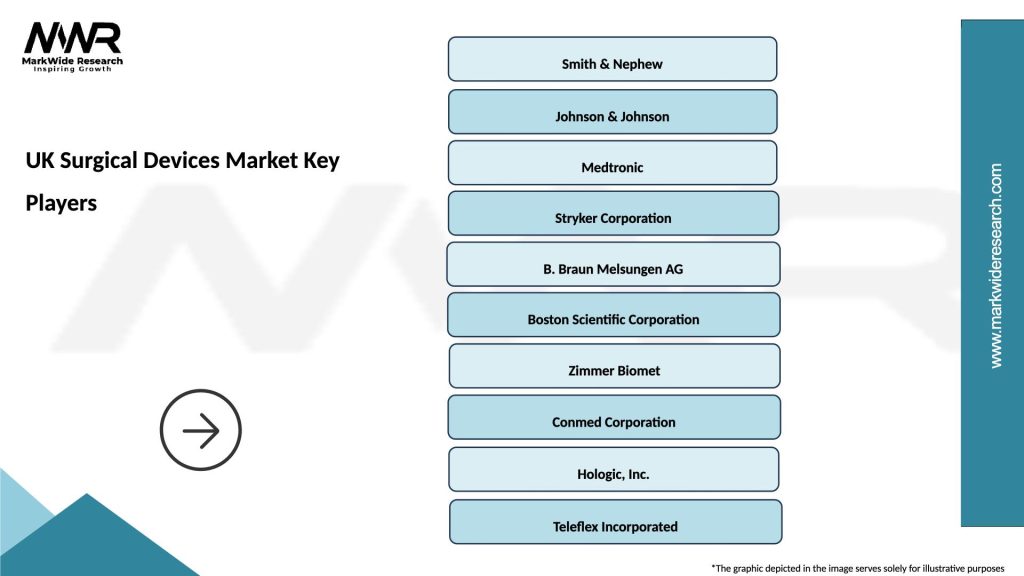

Key market participants include:

Innovation strategies focus on developing AI-enhanced surgical devices, minimally invasive technologies, and connected healthcare solutions. Partnership approaches involve collaborations with NHS trusts, academic medical centers, and technology companies to accelerate product development and market adoption.

Market segmentation analysis reveals distinct categories within the UK surgical devices market, each with unique characteristics and growth dynamics. Product-based segmentation provides comprehensive understanding of market composition and opportunities across different device categories.

By Product Type:

By Application:

Cardiovascular surgical devices maintain market leadership with approximately 28% market share, driven by aging population demographics and increasing prevalence of heart disease. Advanced cardiac technologies including transcatheter heart valves, coronary stents, and cardiac rhythm management devices demonstrate strong growth trajectories supported by clinical evidence and improved patient outcomes.

Orthopedic devices represent the second-largest category at 24% market share, benefiting from active aging trends and sports-related injury treatments. Joint replacement technologies continue evolving with personalized implants, advanced materials, and minimally invasive surgical approaches that reduce recovery times and improve long-term outcomes.

General surgical instruments account for 22% of market activity, encompassing traditional surgical tools and advanced energy-based devices. Smart surgical instruments with integrated sensors and connectivity features gain adoption as hospitals seek to improve surgical efficiency and patient safety through real-time monitoring and data collection.

Minimally invasive surgery devices show the highest growth potential with annual growth rates exceeding 8%, driven by patient preference for less invasive procedures and surgeon adoption of advanced laparoscopic and robotic technologies. Robotic surgical systems expand beyond traditional applications into new surgical specialties and procedures.

Neurosurgical devices represent a specialized but growing segment, with innovation focus on precision instruments, navigation systems, and neurostimulation technologies. Brain surgery advancement through AI-assisted planning and real-time imaging integration creates new opportunities for surgical device development and clinical applications.

Healthcare providers benefit from advanced surgical devices through improved patient outcomes, reduced complication rates, and enhanced operational efficiency. Clinical advantages include shorter procedure times, minimally invasive approaches, and better surgical precision that translate into improved patient satisfaction and reduced healthcare costs.

Patients experience significant benefits including reduced recovery times, less post-operative pain, smaller incisions, and improved long-term outcomes. Quality of life improvements result from advanced implant technologies, personalized surgical approaches, and enhanced surgical safety measures that reduce risks and complications.

Surgical device manufacturers gain access to a sophisticated healthcare market with strong demand for innovative technologies. Market opportunities include partnerships with NHS trusts, private healthcare facilities, and academic medical centers that support product development and clinical validation processes.

Healthcare systems benefit from cost-effective surgical solutions that reduce overall treatment costs through improved efficiency and better patient outcomes. Economic advantages include reduced hospital stays, lower complication rates, and improved resource utilization that support healthcare sustainability goals.

Medical professionals gain access to advanced training opportunities, cutting-edge surgical technologies, and professional development programs that enhance their clinical capabilities and career prospects. Skill development in advanced surgical techniques creates competitive advantages and improved patient care capabilities.

Strengths:

Weaknesses:

Opportunities:

Threats:

Robotic surgery adoption accelerates across UK hospitals as healthcare providers recognize the benefits of enhanced precision, reduced invasiveness, and improved patient outcomes. Surgical robotics expand beyond traditional applications into new specialties including urology, gynecology, and general surgery, creating broader market opportunities for robotic surgical systems and instruments.

Artificial intelligence integration transforms surgical device capabilities through predictive analytics, automated surgical assistance, and intelligent decision support systems. AI-powered surgical planning tools enable personalized surgical approaches and improved outcome predictions, while machine learning algorithms enhance device performance and safety features.

Minimally invasive surgery continues gaining preference among patients and surgeons, driving demand for specialized laparoscopic instruments, endoscopic equipment, and single-port surgical systems. Patient recovery benefits including reduced pain, shorter hospital stays, and faster return to normal activities support continued growth in minimally invasive surgical device adoption.

Personalized surgical solutions emerge through 3D printing technologies that enable custom implants, patient-specific surgical guides, and personalized surgical instruments. Precision medicine approaches in surgery create opportunities for tailored surgical devices that optimize outcomes for individual patients based on their unique anatomy and medical conditions.

Connected surgical devices with IoT capabilities provide real-time monitoring, data collection, and remote management features that enhance surgical workflow efficiency and patient safety. Digital surgery platforms integrate multiple technologies to create comprehensive surgical ecosystems that support planning, execution, and post-operative care management.

Recent industry developments demonstrate the dynamic nature of the UK surgical devices market and ongoing innovation efforts. Regulatory approvals for next-generation surgical robots and AI-enhanced surgical systems indicate growing acceptance of advanced technologies within the UK healthcare system.

Strategic partnerships between surgical device manufacturers and NHS trusts create collaborative frameworks for technology evaluation, clinical validation, and implementation support. Innovation hubs established at major medical centers facilitate the development and testing of new surgical technologies in real-world clinical environments.

Investment activities in UK-based surgical device companies reflect investor confidence in the market’s growth potential and innovation capabilities. Venture capital funding supports startup companies developing breakthrough surgical technologies including smart implants, robotic surgical systems, and AI-powered surgical planning tools.

Clinical trial expansions for advanced surgical devices demonstrate the UK’s role as a leading center for medical device research and development. Research collaborations between industry, academia, and healthcare providers accelerate the translation of innovative surgical technologies from laboratory concepts to clinical applications.

Manufacturing investments by international surgical device companies in UK facilities indicate long-term commitment to the market and confidence in the country’s manufacturing capabilities and skilled workforce. Supply chain optimization efforts focus on improving device availability and reducing costs while maintaining quality standards.

Strategic recommendations for market participants focus on leveraging emerging opportunities while addressing key challenges in the UK surgical devices market. MarkWide Research analysis suggests that companies should prioritize digital health integration and AI-enhanced surgical technologies to remain competitive in the evolving market landscape.

Innovation investment should focus on developing surgical devices that address specific UK healthcare needs including NHS efficiency requirements, patient safety priorities, and cost-effectiveness considerations. Partnership strategies with healthcare providers, academic institutions, and technology companies can accelerate product development and market adoption processes.

Regulatory compliance preparation for evolving post-Brexit requirements ensures continued market access and reduces approval delays. Quality management systems should align with UK regulatory expectations while maintaining international standards for global market opportunities.

Market entry strategies for new participants should consider regional variations in healthcare infrastructure and procurement processes. Distribution partnerships with established UK medical device distributors can provide market access and customer relationship advantages for international companies.

Training and education programs for healthcare professionals support successful technology adoption and maximize the clinical benefits of advanced surgical devices. Customer support services including technical assistance, maintenance programs, and clinical education enhance customer satisfaction and long-term market success.

Future market prospects for the UK surgical devices sector remain highly positive, with continued growth expected across all major device categories. Technological advancement will drive market expansion as AI, robotics, and digital health technologies become increasingly integrated into surgical practice and device functionality.

Market growth projections indicate sustained expansion at a CAGR of approximately 6.5% over the next five years, driven by demographic trends, healthcare system modernization, and increasing adoption of advanced surgical technologies. Innovation cycles will accelerate as manufacturers invest in research and development to create next-generation surgical devices with enhanced capabilities and improved patient outcomes.

Healthcare system evolution toward value-based care models will influence device selection criteria and purchasing decisions, favoring surgical devices with proven clinical outcomes and cost-effectiveness data. Digital transformation of healthcare delivery will create new opportunities for connected surgical devices and integrated surgical platforms.

Regulatory landscape stabilization following Brexit transition will provide clarity for market participants and support continued investment in UK surgical device development and manufacturing capabilities. International trade relationships will influence market access and competitive dynamics as the UK establishes new trading partnerships and regulatory frameworks.

Sustainability initiatives will become increasingly important as healthcare organizations prioritize environmentally responsible surgical device options and circular economy principles. MWR projections suggest that sustainable surgical devices and reusable instrument systems will gain market share of approximately 15% by 2028, reflecting growing environmental consciousness in healthcare procurement decisions.

The UK surgical devices market represents a dynamic and rapidly evolving sector with substantial growth potential driven by technological innovation, demographic trends, and healthcare system modernization. Market fundamentals remain strong, supported by advanced healthcare infrastructure, skilled medical professionals, and robust regulatory frameworks that ensure patient safety and device quality.

Growth opportunities abound in areas including robotic surgery, AI-enhanced surgical devices, minimally invasive technologies, and personalized surgical solutions. Digital health integration and connected surgical devices will transform surgical practice and create new value propositions for healthcare providers and patients alike.

Market participants who successfully navigate regulatory requirements, invest in innovation, and develop strategic partnerships with healthcare providers will be well-positioned to capitalize on the significant opportunities within the UK surgical devices market. Future success will depend on the ability to deliver advanced surgical technologies that improve patient outcomes while addressing healthcare system efficiency and cost-effectiveness requirements.

Long-term market outlook remains highly favorable, with sustained growth expected across all major surgical device categories as the UK continues to lead in healthcare innovation and surgical technology adoption. The combination of strong market fundamentals, technological advancement, and supportive healthcare policies creates an attractive environment for continued investment and growth in the UK surgical devices market.

What is Surgical Devices?

Surgical devices refer to a range of instruments and tools used during surgical procedures to assist in operations, including cutting, suturing, and monitoring. These devices are essential for various medical specialties, including orthopedics, cardiology, and general surgery.

What are the key players in the UK Surgical Devices Market?

Key players in the UK Surgical Devices Market include Medtronic, Johnson & Johnson, and Stryker Corporation, which are known for their innovative surgical solutions and extensive product portfolios. These companies focus on developing advanced technologies to improve surgical outcomes, among others.

What are the growth factors driving the UK Surgical Devices Market?

The UK Surgical Devices Market is driven by factors such as the increasing prevalence of chronic diseases, advancements in minimally invasive surgical techniques, and a growing aging population requiring surgical interventions. Additionally, technological innovations in surgical devices enhance their effectiveness and safety.

What challenges does the UK Surgical Devices Market face?

Challenges in the UK Surgical Devices Market include stringent regulatory requirements, high costs associated with advanced surgical technologies, and the need for continuous innovation to meet evolving healthcare demands. These factors can hinder market growth and product adoption.

What opportunities exist in the UK Surgical Devices Market?

Opportunities in the UK Surgical Devices Market include the rising demand for robotic-assisted surgeries, the expansion of outpatient surgical procedures, and the integration of digital technologies in surgical devices. These trends are expected to enhance surgical precision and patient outcomes.

What trends are shaping the UK Surgical Devices Market?

Trends in the UK Surgical Devices Market include the increasing adoption of minimally invasive techniques, the development of smart surgical instruments, and a focus on sustainability in device manufacturing. These trends aim to improve patient recovery times and reduce hospital stays.

UK Surgical Devices Market

| Segmentation Details | Description |

|---|---|

| Product Type | Surgical Instruments, Sutures, Electrosurgical Devices, Surgical Implants |

| Technology | Robotic Surgery, Minimally Invasive Surgery, Laser Surgery, Traditional Surgery |

| End User | Hospitals, Ambulatory Surgical Centers, Clinics, Research Institutions |

| Application | Orthopedic Surgery, Cardiovascular Surgery, Neurological Surgery, General Surgery |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the UK Surgical Devices Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at