444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The  represents a critical component of the nation’s energy infrastructure, encompassing refining, petrochemicals, marketing, and distribution activities. Colombia’s downstream sector has experienced significant transformation over the past decade, driven by modernization initiatives, regulatory reforms, and increasing domestic energy demand. The market demonstrates robust growth potential with expanding refining capacity and enhanced distribution networks across urban and rural regions.

represents a critical component of the nation’s energy infrastructure, encompassing refining, petrochemicals, marketing, and distribution activities. Colombia’s downstream sector has experienced significant transformation over the past decade, driven by modernization initiatives, regulatory reforms, and increasing domestic energy demand. The market demonstrates robust growth potential with expanding refining capacity and enhanced distribution networks across urban and rural regions.

Market dynamics indicate that Colombia’s downstream operations are becoming increasingly sophisticated, with major investments in refinery upgrades and petrochemical facilities. The sector benefits from the country’s strategic geographic position, serving as a gateway between North and South American markets. Refining capacity has expanded significantly, with the Cartagena refinery modernization project representing one of the largest infrastructure investments in Latin America’s energy sector.

Growth projections suggest the market will expand at a compound annual growth rate of 6.2% through the forecast period, driven by rising fuel consumption, industrial development, and improved infrastructure connectivity. The downstream sector’s contribution to Colombia’s GDP continues to strengthen, supported by government policies promoting energy security and regional integration initiatives.

The Colombia oil and gas downstream market refers to the comprehensive network of activities involved in refining crude oil and processing natural gas into finished petroleum products, petrochemicals, and other value-added derivatives for domestic consumption and export. This market encompasses refining operations, petrochemical production, fuel distribution networks, retail marketing, and storage infrastructure throughout Colombia’s territory.

Downstream operations in Colombia include major refining complexes, petrochemical plants, fuel distribution terminals, service station networks, and specialized industrial facilities. The sector transforms raw hydrocarbons into essential products including gasoline, diesel, jet fuel, liquefied petroleum gas, lubricants, asphalt, and various petrochemical feedstocks that support multiple industries across the Colombian economy.

Market participants range from integrated oil companies and independent refiners to specialized distributors, retailers, and petrochemical manufacturers. The downstream value chain creates significant economic value through job creation, tax revenue generation, and support for related industries including transportation, construction, manufacturing, and agriculture.

Colombia’s downstream market has emerged as a cornerstone of the nation’s energy security strategy, with substantial investments in refining capacity expansion and infrastructure modernization. The market demonstrates strong fundamentals supported by growing domestic demand, strategic geographic advantages, and favorable regulatory frameworks that encourage private sector participation and foreign investment.

Key market drivers include urbanization trends, industrial growth, transportation sector expansion, and increasing petrochemical demand from manufacturing industries. The sector has achieved significant operational improvements with refinery utilization rates reaching 87% capacity and enhanced product quality standards meeting international specifications for both domestic consumption and export markets.

Strategic developments focus on sustainability initiatives, digital transformation, and regional market integration. Colombian downstream companies are investing heavily in cleaner technologies, renewable energy integration, and circular economy principles while maintaining competitive positioning in traditional petroleum products. The market outlook remains positive with continued infrastructure investments and expanding regional trade opportunities.

Market analysis reveals several critical insights shaping Colombia’s downstream sector development and competitive landscape:

Economic growth serves as the primary driver for Colombia’s downstream market expansion, with increasing industrial activity, urban development, and consumer spending supporting higher fuel and petrochemical demand. The country’s GDP growth trajectory directly correlates with energy consumption patterns, creating sustained demand for refined petroleum products across multiple sectors.

Transportation sector expansion significantly influences downstream market dynamics, with growing vehicle ownership, commercial transportation, and aviation activities driving gasoline, diesel, and jet fuel consumption. Colombia’s strategic position as a regional transportation hub enhances demand for high-quality fuels meeting international standards for both domestic use and transit operations.

Industrial development creates substantial demand for petrochemical feedstocks, specialty chemicals, and industrial fuels. Manufacturing sector growth, particularly in textiles, plastics, pharmaceuticals, and construction materials, requires reliable supplies of petrochemical products and industrial-grade petroleum derivatives. The downstream sector’s ability to supply these materials supports broader economic development objectives.

Infrastructure investments in refining capacity, distribution networks, and storage facilities enable market expansion and improved service delivery. Government and private sector commitments to modernizing energy infrastructure create opportunities for enhanced operational efficiency, product quality improvements, and expanded market reach throughout Colombia’s diverse geographic regions.

Regulatory complexity presents ongoing challenges for downstream market participants, with evolving environmental standards, safety requirements, and operational compliance creating additional costs and administrative burdens. Companies must navigate multiple regulatory frameworks while maintaining competitive operations and meeting market demands for reliable product supplies.

Infrastructure limitations in certain regions constrain market development, particularly in remote areas where transportation costs and logistical challenges impact product availability and pricing. Limited pipeline connectivity, inadequate storage capacity, and transportation bottlenecks create operational inefficiencies that affect overall market performance and competitiveness.

Environmental concerns increasingly influence downstream operations, with stricter emissions standards, waste management requirements, and sustainability mandates requiring substantial investments in cleaner technologies and operational modifications. These environmental compliance costs can impact profitability and require careful balance between regulatory adherence and market competitiveness.

Price volatility in crude oil markets creates uncertainty for downstream planning and investment decisions. Fluctuating feedstock costs, currency exchange variations, and international market dynamics affect refining margins and operational profitability, requiring sophisticated risk management strategies and flexible operational approaches.

Regional market integration presents significant opportunities for Colombian downstream companies to expand their market reach and leverage economies of scale. Enhanced connectivity with neighboring countries through pipeline infrastructure, trade agreements, and regional energy cooperation creates potential for increased product exports and market diversification.

Petrochemical sector development offers substantial growth potential, with increasing demand for plastics, synthetic materials, and specialty chemicals across Latin American markets. Colombia’s strategic location and existing infrastructure provide competitive advantages for petrochemical production and distribution to regional customers seeking reliable supply sources.

Sustainability initiatives create opportunities for innovation and market differentiation through cleaner production technologies, renewable energy integration, and circular economy approaches. Companies investing in sustainable downstream operations can capture growing demand for environmentally responsible products while meeting evolving regulatory requirements and consumer preferences.

Digital transformation enables operational optimization, cost reduction, and enhanced customer service through advanced analytics, automation, and digital platforms. Downstream companies can leverage technology to improve refinery efficiency, optimize distribution networks, and develop new business models that create additional value for customers and stakeholders.

Supply chain optimization drives continuous improvement in Colombia’s downstream operations, with companies implementing advanced logistics management, inventory optimization, and distribution network enhancements. These improvements result in 15% reduction in operational costs and improved product availability across diverse market segments and geographic regions.

Competitive dynamics intensify as market participants pursue differentiation strategies through product quality, service excellence, and technological innovation. The market structure evolves with new entrants, strategic partnerships, and consolidation activities that reshape competitive positioning and market share distribution among major players.

Technology adoption accelerates across downstream operations, with artificial intelligence, Internet of Things, and advanced process control systems enhancing operational efficiency and safety performance. According to MarkWide Research analysis, technology investments have improved refinery productivity by 12% while reducing environmental impact and operational risks.

Market integration deepens through vertical and horizontal consolidation, strategic alliances, and joint ventures that create synergies and operational efficiencies. These collaborative approaches enable companies to share risks, access new technologies, and expand market presence while maintaining competitive advantages in core business areas.

Comprehensive market analysis employs multiple research methodologies to ensure accurate and reliable insights into Colombia’s downstream market dynamics, competitive landscape, and growth prospects. The research approach combines quantitative data analysis with qualitative assessments from industry experts, market participants, and regulatory authorities.

Primary research activities include structured interviews with downstream industry executives, government officials, and market analysts to gather firsthand insights into market trends, challenges, and opportunities. Survey methodologies capture operational data, investment plans, and strategic priorities from major market participants across different segments and geographic regions.

Secondary research incorporates analysis of government statistics, industry reports, financial statements, and regulatory documents to establish comprehensive market baselines and validate primary research findings. Data triangulation ensures accuracy and reliability of market assessments and growth projections.

Market modeling utilizes advanced analytical techniques to project future market scenarios, assess competitive dynamics, and evaluate the impact of various factors on market development. Scenario analysis considers multiple variables including economic conditions, regulatory changes, and technological developments to provide robust market forecasts.

Caribbean Coast region dominates Colombia’s downstream market with 45% market share, centered around the Cartagena refinery complex and major petrochemical facilities. This region benefits from strategic port access, established infrastructure, and proximity to international markets, making it the primary hub for refining operations and product exports.

Andean region represents 28% of market activity, encompassing major urban centers including Bogotá, Medellín, and surrounding industrial areas. This region demonstrates strong fuel demand growth driven by urbanization, industrial development, and transportation sector expansion, requiring enhanced distribution infrastructure and storage capacity.

Eastern Plains region accounts for 18% of downstream operations, primarily focused on crude oil production support services and regional fuel distribution. The area’s growing agricultural and mining activities create increasing demand for diesel fuel, lubricants, and specialty petroleum products.

Pacific Coast region holds 9% market share with developing infrastructure and growing industrial activities. This region presents significant growth opportunities through port development, industrial expansion, and enhanced connectivity with Pacific markets, particularly for petrochemical exports and specialized product distribution.

Market leadership is characterized by a mix of integrated oil companies, independent refiners, and specialized downstream operators competing across different market segments and geographic regions. The competitive environment emphasizes operational efficiency, product quality, and customer service excellence.

By Product Type:

By Application:

By Distribution Channel:

Transportation fuels category dominates the downstream market with gasoline and diesel representing the highest volume products. Fuel quality improvements have enhanced market competitiveness, with Colombian refineries now producing Euro V standard fuels that meet international specifications and support export opportunities to regional markets.

Petrochemical segment demonstrates the fastest growth potential, with new facilities targeting regional demand for plastics, synthetic materials, and specialty chemicals. The category benefits from Colombia’s strategic location and competitive feedstock costs, enabling cost-effective production for both domestic consumption and export markets.

Industrial products category serves diverse manufacturing, mining, and construction sectors with specialized petroleum derivatives. This segment requires technical expertise, customized solutions, and reliable supply chains to meet specific customer requirements and support Colombia’s industrial development objectives.

LPG and natural gas category expands rapidly driven by residential adoption, industrial switching, and government policies promoting cleaner energy sources. Market penetration reaches 78% in urban areas with continued expansion into rural regions through infrastructure development and distribution network enhancement.

Operational efficiency gains result from modernized refining facilities, advanced process technologies, and optimized supply chain management. Downstream companies achieve significant cost reductions while improving product quality, environmental performance, and safety standards across their operations.

Market access expansion enables companies to reach new customer segments, geographic regions, and export markets through enhanced distribution networks and strategic partnerships. Improved infrastructure connectivity creates opportunities for market share growth and revenue diversification across multiple product categories.

Technology advantages provide competitive differentiation through advanced refining processes, digital operations management, and innovative product development. Companies investing in technology achieve superior operational performance, reduced environmental impact, and enhanced customer service capabilities.

Strategic positioning benefits emerge from Colombia’s geographic advantages, regulatory improvements, and regional market integration opportunities. Stakeholders can leverage these factors to build sustainable competitive advantages and capture growth opportunities in expanding Latin American energy markets.

Strengths:

Weaknesses:

Opportunities:

Threats:

Digital transformation accelerates across downstream operations with artificial intelligence, machine learning, and advanced analytics optimizing refinery performance, supply chain management, and customer service delivery. Companies implementing digital solutions achieve operational efficiency improvements of 18% while reducing maintenance costs and environmental impact.

Sustainability focus intensifies with investments in cleaner production technologies, renewable energy integration, and circular economy principles. Downstream companies are developing low-carbon fuels, implementing carbon capture technologies, and pursuing sustainability certifications to meet evolving market demands and regulatory requirements.

Product quality enhancement continues with refineries upgrading to produce higher-grade fuels meeting international specifications. The transition to Euro V standards and specialty product development creates opportunities for premium pricing and export market expansion while supporting Colombia’s reputation for quality petroleum products.

Regional market integration deepens through infrastructure development, trade agreements, and strategic partnerships that enhance connectivity with neighboring countries. Cross-border pipeline projects, joint ventures, and regional supply arrangements create synergies and expand market opportunities for Colombian downstream companies.

Refinery modernization projects represent the most significant industry developments, with major capacity expansions and technology upgrades enhancing Colombia’s refining capabilities. The Cartagena refinery expansion project exemplifies these investments, incorporating advanced process technologies and environmental controls that position Colombia as a regional refining hub.

Petrochemical facility development accelerates with new plants targeting regional markets for plastics, synthetic materials, and specialty chemicals. These investments leverage Colombia’s competitive advantages in feedstock costs, strategic location, and market access to create integrated downstream value chains serving multiple industries.

Distribution network expansion continues with new terminals, pipelines, and retail facilities improving market coverage and service quality. Infrastructure investments focus on underserved regions, urban growth areas, and strategic corridors that support economic development and enhance energy security across Colombia.

Technology partnerships emerge between Colombian companies and international technology providers to implement advanced refining processes, digital operations systems, and environmental technologies. These collaborations accelerate innovation adoption and enhance competitive positioning in regional markets.

Strategic focus should emphasize operational excellence, technology adoption, and market differentiation to maintain competitive advantages in Colombia’s evolving downstream market. Companies must balance traditional petroleum product operations with emerging opportunities in petrochemicals, sustainable fuels, and digital services to ensure long-term success.

Investment priorities should target infrastructure modernization, technology upgrades, and market expansion initiatives that enhance operational efficiency and customer service capabilities. MWR analysis suggests that companies investing in digital transformation and sustainability initiatives achieve superior financial performance and market positioning.

Market expansion strategies should leverage Colombia’s geographic advantages and regional integration opportunities to access new markets and customer segments. Companies should pursue strategic partnerships, joint ventures, and export development initiatives that capitalize on growing regional demand for quality petroleum products and petrochemicals.

Risk management approaches must address price volatility, regulatory changes, and competitive pressures through diversification strategies, operational flexibility, and financial hedging mechanisms. Successful companies maintain balanced portfolios across product categories, market segments, and geographic regions to mitigate various market risks.

Market growth prospects remain positive with continued expansion expected across all major downstream segments. The market is projected to grow at a compound annual growth rate of 6.2% through the next decade, driven by economic development, industrial growth, and regional market integration initiatives that enhance demand for petroleum products and petrochemicals.

Technology evolution will reshape downstream operations through advanced process control, artificial intelligence, and sustainable production technologies. Companies embracing digital transformation and clean technology adoption will achieve competitive advantages while meeting evolving customer expectations and regulatory requirements for environmental performance.

Regional integration will accelerate through infrastructure development, trade facilitation, and strategic partnerships that enhance Colombia’s position as a regional energy hub. Enhanced connectivity with neighboring markets creates opportunities for export growth, supply chain optimization, and collaborative development initiatives that benefit all market participants.

Sustainability transformation will drive fundamental changes in downstream operations, with increasing focus on low-carbon fuels, circular economy principles, and environmental stewardship. According to MarkWide Research projections, sustainable product categories will represent 35% of market demand by the end of the forecast period, requiring substantial investments in clean technologies and operational modifications.

Colombia’s oil and gas downstream market demonstrates strong fundamentals and promising growth prospects supported by strategic investments, regulatory improvements, and favorable market dynamics. The sector has successfully modernized its operations, enhanced product quality, and expanded market reach while maintaining competitive positioning in regional markets.

Key success factors include operational excellence, technology adoption, sustainability initiatives, and strategic market positioning that leverage Colombia’s geographic advantages and growing regional integration opportunities. Companies that effectively balance traditional petroleum operations with emerging market segments will achieve superior performance and long-term success.

Future market development will be shaped by continued infrastructure investments, technology advancement, and sustainability transformation that create new opportunities while addressing evolving customer needs and regulatory requirements. The downstream sector’s contribution to Colombia’s economic development will continue strengthening through job creation, tax revenue generation, and support for related industries across the value chain.

What is Oil & Gas Downstream?

Oil & Gas Downstream refers to the processes involved in refining crude oil and distributing petroleum products. This includes the production of fuels, lubricants, and other petrochemicals, as well as their transportation and marketing to end-users.

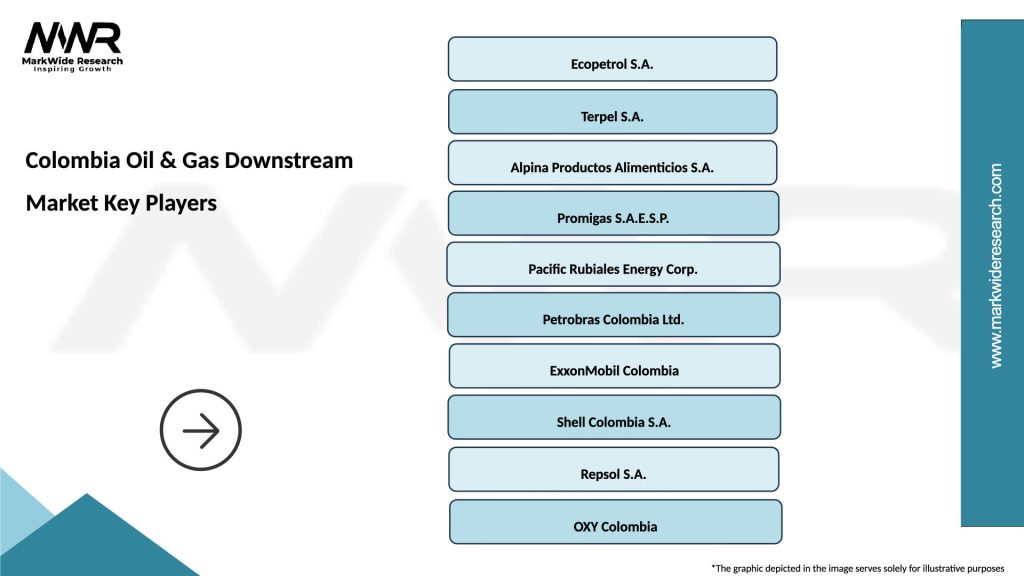

What are the key players in the Colombia Oil & Gas Downstream Market?

Key players in the Colombia Oil & Gas Downstream Market include Ecopetrol, Terpel, and Promigas, which are involved in refining, distribution, and marketing of petroleum products, among others.

What are the growth factors driving the Colombia Oil & Gas Downstream Market?

The growth of the Colombia Oil & Gas Downstream Market is driven by increasing domestic energy demand, investments in refining capacity, and the expansion of distribution networks to enhance accessibility.

What challenges does the Colombia Oil & Gas Downstream Market face?

Challenges in the Colombia Oil & Gas Downstream Market include regulatory hurdles, fluctuating crude oil prices, and environmental concerns related to refining processes and emissions.

What opportunities exist in the Colombia Oil & Gas Downstream Market?

Opportunities in the Colombia Oil & Gas Downstream Market include the potential for renewable energy integration, advancements in refining technologies, and the growing demand for cleaner fuels.

What trends are shaping the Colombia Oil & Gas Downstream Market?

Trends in the Colombia Oil & Gas Downstream Market include a shift towards sustainable practices, increased investment in digital technologies for operational efficiency, and a focus on reducing carbon emissions in refining operations.

Colombia Oil & Gas Downstream Market

| Segmentation Details | Description |

|---|---|

| Service Type | Refining, Distribution, Retailing, Transportation |

| End User | Industrial, Commercial, Residential, Government |

| Product Type | Gasoline, Diesel, Jet Fuel, Lubricants |

| Technology | Hydrocracking, Catalytic Reforming, Distillation, Gas-to-Liquids |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Colombia Oil & Gas Downstream Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at