444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The Asia-Pacific SSD caching market represents one of the most dynamic and rapidly evolving segments in the global storage technology landscape. This region has emerged as a critical hub for technological innovation and digital transformation, driving unprecedented demand for high-performance storage solutions. SSD caching technology has become increasingly vital as organizations across the Asia-Pacific region seek to optimize their data storage infrastructure while managing costs effectively.

Market dynamics in the Asia-Pacific region are characterized by robust economic growth, increasing digitalization initiatives, and expanding cloud infrastructure investments. The region’s diverse economies, ranging from established technology leaders like Japan and South Korea to rapidly growing markets such as India and Southeast Asian nations, create a complex but lucrative landscape for SSD caching solutions. Current growth trajectories indicate the market is expanding at a compound annual growth rate of 12.8%, driven by enterprise modernization efforts and increasing data-intensive applications.

Regional adoption patterns vary significantly across different countries, with developed markets focusing on performance optimization and emerging economies prioritizing cost-effective storage solutions. The integration of artificial intelligence and machine learning workloads has further accelerated demand for SSD caching technologies, as organizations require faster data access speeds to support real-time analytics and decision-making processes.

The Asia-Pacific SSD caching market refers to the regional ecosystem encompassing the development, deployment, and utilization of solid-state drive caching technologies across countries in the Asia-Pacific region. This market includes hardware components, software solutions, and integrated systems that leverage SSD technology to accelerate data access and improve overall storage performance.

SSD caching technology fundamentally operates by using high-speed solid-state drives as an intermediate storage layer between primary storage systems and end-users or applications. This approach significantly reduces data retrieval times while maintaining cost-effectiveness by combining the speed advantages of SSDs with the capacity benefits of traditional storage media. The technology has become particularly relevant in the Asia-Pacific context due to the region’s diverse infrastructure requirements and varying economic conditions.

Market participants include hardware manufacturers, software developers, system integrators, and end-users across various industries. The ecosystem encompasses everything from small-scale enterprise implementations to large-scale data center deployments, reflecting the broad applicability of SSD caching solutions across different organizational sizes and requirements.

Strategic market positioning in the Asia-Pacific SSD caching sector reveals a landscape characterized by intense competition, rapid technological advancement, and diverse customer requirements. The market has demonstrated remarkable resilience and growth potential, with adoption rates increasing by 18.5% annually across key industry verticals. This growth trajectory reflects the region’s commitment to digital transformation and infrastructure modernization initiatives.

Key market drivers include the exponential growth of data generation, increasing demand for real-time analytics, and the need for cost-effective storage solutions that can handle diverse workloads. Organizations across the region are recognizing the strategic value of implementing SSD caching technologies to improve application performance while managing total cost of ownership. The integration of cloud computing and edge computing architectures has further amplified demand for flexible and scalable storage solutions.

Competitive dynamics are shaped by both global technology leaders and regional players who understand local market nuances. The market structure includes established multinational corporations alongside innovative startups that are developing specialized solutions for specific industry requirements. This diversity creates opportunities for both large-scale deployments and niche applications, contributing to overall market expansion and technological innovation.

Market intelligence reveals several critical insights that define the current state and future direction of the Asia-Pacific SSD caching market:

Digital transformation initiatives across the Asia-Pacific region serve as the primary catalyst for SSD caching market growth. Organizations are modernizing their IT infrastructure to support increasingly complex business requirements, driving demand for storage solutions that can deliver both performance and cost-effectiveness. The rapid adoption of cloud computing, big data analytics, and artificial intelligence applications has created unprecedented requirements for high-performance storage systems.

Data explosion trends continue to fuel market expansion as organizations generate and process ever-increasing volumes of information. The proliferation of Internet of Things devices, mobile applications, and digital content creation has created a need for storage solutions that can handle diverse data types and access patterns efficiently. SSD caching technology addresses these challenges by providing intelligent data placement and retrieval mechanisms.

Economic growth patterns across emerging Asia-Pacific markets are creating new opportunities for technology adoption. Countries experiencing rapid economic development are investing heavily in digital infrastructure, creating demand for advanced storage solutions. Additionally, the region’s focus on becoming a global technology hub has led to increased investments in data centers, cloud infrastructure, and enterprise technology solutions.

Performance requirements for modern applications continue to escalate, driving organizations to seek solutions that can deliver consistent, high-speed data access. The growing importance of real-time analytics, machine learning workloads, and interactive applications has made traditional storage architectures insufficient for meeting contemporary performance expectations.

Implementation complexity represents a significant challenge for organizations considering SSD caching solutions. Many enterprises lack the technical expertise required to properly design, deploy, and manage sophisticated caching architectures. This complexity barrier is particularly pronounced in smaller organizations and emerging markets where IT resources may be limited. The need for specialized knowledge in storage architecture design and performance optimization can delay adoption decisions.

Initial investment requirements continue to present obstacles for cost-sensitive organizations, particularly in developing economies within the Asia-Pacific region. While SSD caching can deliver long-term cost benefits, the upfront capital expenditure required for implementation can be substantial. Organizations must carefully evaluate return on investment calculations and justify expenditures against competing business priorities.

Integration challenges with existing infrastructure can complicate deployment processes and extend implementation timelines. Many organizations operate legacy systems that may not be fully compatible with modern SSD caching solutions, requiring additional investment in infrastructure upgrades or middleware solutions. These compatibility issues can increase project complexity and associated costs.

Skills shortage in the region affects the ability of organizations to effectively implement and manage SSD caching solutions. The rapid pace of technological advancement has created a gap between available expertise and market requirements, leading to increased implementation costs and potential performance optimization challenges.

Emerging technology convergence creates substantial opportunities for SSD caching market expansion. The integration of artificial intelligence, edge computing, and 5G networks is generating new use cases that require high-performance storage solutions. Organizations implementing these technologies need caching solutions that can support low-latency applications and real-time data processing requirements.

Industry-specific solutions present significant growth opportunities as different sectors develop unique requirements for storage performance and functionality. The financial services sector requires solutions that can support high-frequency trading and real-time risk analysis, while healthcare organizations need systems that can handle large medical imaging files and patient data efficiently. These specialized requirements create opportunities for targeted product development and market segmentation.

Small and medium enterprise adoption represents an underserved market segment with substantial growth potential. As SSD caching technologies become more accessible and cost-effective, smaller organizations are increasingly able to implement these solutions. The development of simplified deployment models and cloud-based caching services is making advanced storage technologies available to a broader range of organizations.

Regional expansion opportunities exist in developing Asia-Pacific markets where digital infrastructure investment is accelerating. Countries such as Vietnam, Indonesia, and Philippines are experiencing rapid economic growth and technology adoption, creating new markets for SSD caching solutions. These emerging markets often have fewer legacy infrastructure constraints, enabling more straightforward implementation of modern storage architectures.

Competitive forces within the Asia-Pacific SSD caching market are creating a dynamic environment characterized by rapid innovation and evolving customer expectations. Market participants are continuously developing new features and capabilities to differentiate their offerings and capture market share. This competitive pressure is driving improvements in performance metrics, cost-effectiveness, and ease of implementation.

Technology evolution continues to reshape market dynamics as new storage technologies and architectures emerge. The development of NVMe protocols, persistent memory technologies, and software-defined storage solutions is influencing how organizations approach caching implementations. These technological advances are creating opportunities for performance improvements while potentially disrupting existing market relationships.

Customer behavior patterns are shifting toward more sophisticated evaluation criteria that consider total cost of ownership, performance consistency, and integration capabilities. Organizations are increasingly conducting comprehensive proof-of-concept evaluations and requiring detailed performance benchmarking before making purchasing decisions. This trend is driving vendors to provide more comprehensive pre-sales support and demonstration capabilities.

Supply chain considerations have become increasingly important as organizations seek reliable access to storage technologies. Recent global supply chain disruptions have highlighted the importance of vendor diversification and regional sourcing strategies. Market participants are adapting by developing more resilient supply chains and local manufacturing capabilities.

Comprehensive market analysis for the Asia-Pacific SSD caching market employs multiple research methodologies to ensure accuracy and completeness of findings. Primary research activities include extensive interviews with industry executives, technology leaders, and end-users across different market segments and geographic regions. These interviews provide insights into market trends, adoption patterns, and future requirements that quantitative data alone cannot capture.

Secondary research components involve analysis of industry reports, financial statements, technology specifications, and market intelligence from various sources. This approach ensures comprehensive coverage of market dynamics and validates primary research findings through multiple data sources. The research methodology incorporates both qualitative insights and quantitative analysis to provide a balanced perspective on market conditions.

Data validation processes include cross-referencing information from multiple sources and conducting follow-up interviews to verify key findings. Market sizing and growth projections are developed using multiple analytical approaches to ensure reliability and accuracy. The methodology also incorporates feedback from industry experts and market participants to validate assumptions and conclusions.

Geographic coverage encompasses all major Asia-Pacific markets, with particular focus on countries with significant technology adoption and economic development. The research methodology accounts for regional variations in market conditions, regulatory environments, and customer requirements to provide accurate market characterization across different geographic segments.

China dominates the Asia-Pacific SSD caching market with approximately 35% market share, driven by massive investments in digital infrastructure and cloud computing platforms. The country’s focus on becoming a global technology leader has resulted in substantial demand for high-performance storage solutions across various industries. Chinese enterprises are increasingly implementing SSD caching to support artificial intelligence initiatives and big data analytics projects.

Japan represents a mature market characterized by sophisticated technology adoption and emphasis on performance optimization. Japanese organizations prioritize solutions that can deliver consistent performance and integrate seamlessly with existing infrastructure. The country’s focus on manufacturing excellence and financial services innovation drives demand for specialized caching solutions that can support mission-critical applications.

South Korea demonstrates strong growth potential with increasing adoption of SSD caching technologies across the gaming industry, entertainment sector, and telecommunications companies. The country’s advanced digital infrastructure and high-speed internet connectivity create ideal conditions for implementing high-performance storage solutions. Korean organizations are particularly interested in solutions that can support content delivery and streaming applications.

India exhibits rapid market expansion with growth rates exceeding 22% annually, driven by digital transformation initiatives across both public and private sectors. The country’s large and growing IT services industry creates substantial demand for cost-effective storage solutions that can scale efficiently. Indian organizations are particularly focused on solutions that can support cloud migration projects and data center modernization efforts.

Southeast Asian markets including Singapore, Malaysia, and Thailand are experiencing increasing adoption of SSD caching technologies as organizations modernize their IT infrastructure. These markets are characterized by growing demand for financial technology solutions and e-commerce platforms that require high-performance storage capabilities.

Market leadership in the Asia-Pacific SSD caching sector is characterized by a diverse mix of global technology companies and regional specialists. The competitive environment includes both established storage vendors and innovative startups that are developing next-generation caching solutions.

Competitive strategies focus on differentiation through performance optimization, cost-effectiveness, and integration capabilities. Market participants are investing heavily in research and development to create solutions that can address specific regional requirements and industry use cases.

By Technology:

By Application:

By End-User Industry:

Enterprise segment represents the largest market category, accounting for approximately 58% of total adoption across the Asia-Pacific region. Large enterprises are implementing SSD caching solutions to support digital transformation initiatives and improve application performance. These organizations typically require comprehensive solutions that can integrate with existing infrastructure while providing scalability for future growth.

Small and medium enterprises demonstrate the fastest growth rate at 16.3% annually, driven by increasing accessibility of cloud-based caching solutions and simplified deployment models. SME adoption is particularly strong in countries with developing economies where organizations are building modern IT infrastructure without legacy constraints.

Cloud service providers represent a rapidly expanding category as organizations increasingly rely on cloud-based infrastructure. These providers require highly scalable caching solutions that can support diverse customer workloads while maintaining cost-effectiveness. The integration of edge computing capabilities is creating additional opportunities within this segment.

Government and public sector adoption is accelerating as agencies modernize their IT infrastructure to support digital government initiatives. These organizations require solutions that can meet strict security requirements and compliance standards while delivering improved citizen services.

Performance optimization represents the primary benefit for organizations implementing SSD caching solutions. Users experience significantly improved application response times, with many implementations achieving performance improvements of 300-500% for database applications and analytical workloads. This performance enhancement directly translates to improved user productivity and customer satisfaction.

Cost reduction opportunities emerge through more efficient utilization of existing storage infrastructure. Organizations can extend the life of traditional storage systems while achieving performance levels that would otherwise require complete infrastructure replacement. The ability to implement tiered storage architectures enables organizations to optimize costs while maintaining performance requirements.

Scalability advantages allow organizations to grow their storage capabilities incrementally rather than requiring large upfront investments. SSD caching solutions can be implemented in phases, enabling organizations to align infrastructure investments with business growth and changing requirements.

Competitive differentiation becomes possible through improved application performance and customer experience. Organizations can deliver faster response times and more reliable services, creating competitive advantages in their respective markets. This benefit is particularly important for customer-facing applications and revenue-generating systems.

Strengths:

Weaknesses:

Opportunities:

Threats:

Artificial intelligence integration is transforming SSD caching solutions through the implementation of machine learning algorithms that can predict data access patterns and optimize cache placement automatically. These intelligent systems can adapt to changing workload characteristics and improve performance over time without manual intervention. AI-driven optimization is becoming a key differentiator for vendors seeking to provide superior performance and reduced management overhead.

Edge computing adoption is creating new requirements for distributed caching solutions that can operate effectively in resource-constrained environments. Organizations are implementing edge caching architectures to support IoT applications, content delivery networks, and real-time analytics at the network edge. This trend is driving development of more compact and energy-efficient caching solutions.

Software-defined storage approaches are gaining traction as organizations seek more flexible and manageable storage architectures. These solutions separate storage software from underlying hardware, enabling organizations to implement caching capabilities across diverse infrastructure environments. The trend toward software-defined architectures is creating opportunities for more agile and cost-effective implementations.

Sustainability considerations are increasingly influencing purchasing decisions as organizations focus on reducing energy consumption and environmental impact. SSD caching solutions that can demonstrate energy efficiency improvements and reduced cooling requirements are gaining preference among environmentally conscious organizations.

Technology partnerships between storage vendors and cloud providers are creating new opportunities for integrated caching solutions. Recent collaborations have resulted in native cloud caching services that can seamlessly integrate with existing cloud infrastructure while providing high-performance storage capabilities. These partnerships are accelerating adoption by reducing implementation complexity and improving integration capabilities.

Product innovations continue to drive market evolution with the introduction of persistent memory technologies and advanced NVMe protocols. Recent product launches have demonstrated significant improvements in performance density and cost-effectiveness, making SSD caching solutions accessible to a broader range of organizations. According to MarkWide Research analysis, these innovations are contributing to accelerated market adoption across multiple industry segments.

Acquisition activities within the storage industry are consolidating capabilities and creating more comprehensive solution portfolios. Recent acquisitions have combined complementary technologies and expertise, resulting in more integrated offerings that can address diverse customer requirements. These consolidation activities are reshaping competitive dynamics and creating new market opportunities.

Standards development efforts are improving interoperability and reducing implementation complexity. Industry organizations are working to establish common protocols and interfaces that can simplify integration and reduce vendor lock-in concerns. These standardization efforts are expected to accelerate adoption by reducing implementation risks and costs.

Strategic planning for organizations considering SSD caching implementations should focus on comprehensive performance assessment and total cost of ownership analysis. MWR recommends conducting thorough workload analysis to identify applications that can benefit most from caching acceleration. Organizations should also evaluate their existing infrastructure capabilities and integration requirements before selecting specific solutions.

Vendor selection should prioritize suppliers that can demonstrate proven performance in similar environments and provide comprehensive support throughout the implementation process. Organizations should evaluate vendors based on technical capabilities, support quality, financial stability, and long-term product roadmaps. The ability to provide ongoing optimization and support services should be a key evaluation criterion.

Implementation approach should emphasize phased deployment strategies that allow organizations to validate performance benefits and optimize configurations before full-scale rollout. Starting with pilot implementations in non-critical environments can help organizations develop expertise and refine deployment processes. This approach reduces implementation risks while building internal capabilities.

Performance monitoring and optimization should be integral components of any SSD caching implementation. Organizations should establish baseline performance metrics and implement ongoing monitoring to ensure optimal system performance. Regular performance reviews and optimization activities can help organizations maximize their investment returns and identify opportunities for further improvements.

Market evolution over the next five years will be characterized by continued technological advancement and expanding adoption across diverse industry segments. Growth projections indicate the Asia-Pacific SSD caching market will maintain robust expansion with compound annual growth rates exceeding 11% through 2028. This growth will be driven by increasing data generation, expanding cloud adoption, and growing requirements for real-time analytics capabilities.

Technology development will focus on improving performance density, reducing costs, and enhancing integration capabilities. Emerging technologies such as computational storage and persistent memory will create new opportunities for performance optimization and application acceleration. The integration of artificial intelligence and machine learning capabilities will enable more sophisticated optimization and predictive performance management.

Market expansion will be particularly strong in emerging Asia-Pacific economies where digital infrastructure investment is accelerating. Countries such as Vietnam, Indonesia, and Bangladesh represent significant growth opportunities as their economies develop and technology adoption increases. These markets will likely adopt more modern storage architectures without the constraints of legacy infrastructure.

Industry transformation will continue as organizations increasingly recognize the strategic value of high-performance storage capabilities. The growing importance of data-driven decision making and real-time analytics will drive continued investment in storage optimization technologies. Organizations that can effectively leverage SSD caching capabilities will gain competitive advantages through improved application performance and enhanced customer experiences.

The Asia-Pacific SSD caching market represents a dynamic and rapidly evolving sector with substantial growth potential across diverse industry segments and geographic regions. Market analysis reveals strong fundamentals driven by digital transformation initiatives, increasing data generation, and growing requirements for high-performance storage solutions. The region’s diverse economic landscape creates opportunities for both established technology leaders and innovative new entrants.

Strategic considerations for market participants include the need to address varying customer requirements across different countries and industry sectors. Success in this market requires comprehensive understanding of local business conditions, regulatory environments, and technology adoption patterns. Organizations that can effectively balance performance capabilities with cost-effectiveness will be best positioned to capture market opportunities.

Future success in the Asia-Pacific SSD caching market will depend on continued innovation, strategic partnerships, and the ability to deliver solutions that address evolving customer requirements. The integration of emerging technologies such as artificial intelligence and edge computing will create new opportunities for differentiation and market expansion. Organizations that can effectively leverage these technological advances while maintaining focus on customer value creation will achieve sustainable competitive advantages in this dynamic market environment.

What is SSD Caching?

SSD caching refers to the use of solid-state drives to temporarily store frequently accessed data, improving the speed and efficiency of data retrieval in computing systems. This technology is commonly used in data centers, enterprise storage solutions, and personal computing to enhance performance.

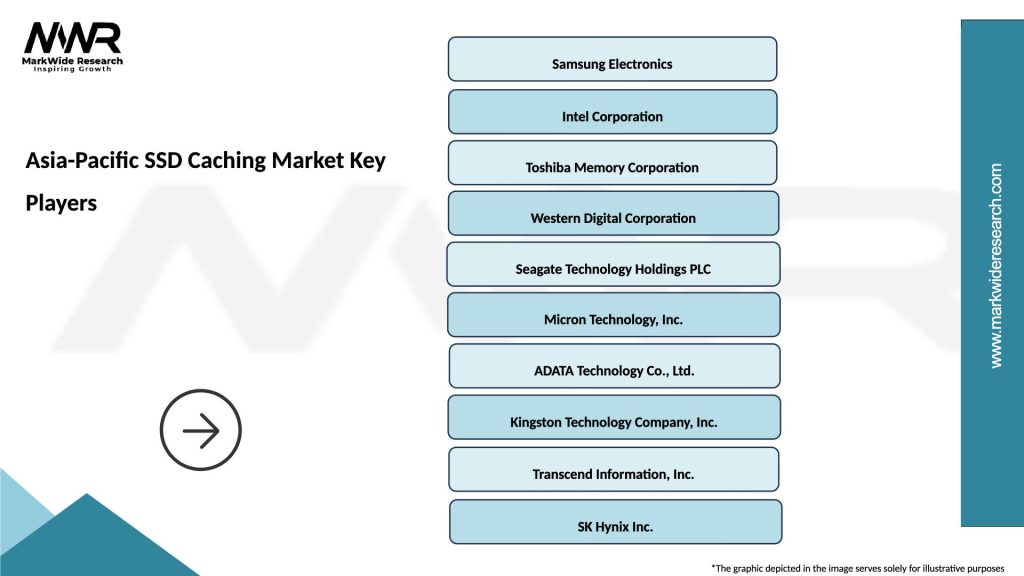

What are the key players in the Asia-Pacific SSD Caching Market?

Key players in the Asia-Pacific SSD Caching Market include Samsung Electronics, Intel Corporation, and Western Digital, among others. These companies are known for their innovative SSD solutions and play a significant role in shaping market trends.

What are the growth factors driving the Asia-Pacific SSD Caching Market?

The Asia-Pacific SSD Caching Market is driven by the increasing demand for high-speed data processing, the growth of cloud computing, and the rising adoption of big data analytics. These factors contribute to the need for efficient data storage solutions.

What challenges does the Asia-Pacific SSD Caching Market face?

Challenges in the Asia-Pacific SSD Caching Market include the high cost of SSD technology compared to traditional storage solutions and concerns regarding data security. Additionally, the rapid pace of technological advancements can lead to obsolescence.

What opportunities exist in the Asia-Pacific SSD Caching Market?

Opportunities in the Asia-Pacific SSD Caching Market include the growing trend of digital transformation across various industries and the increasing investment in data center infrastructure. These trends are expected to drive demand for advanced caching solutions.

What trends are shaping the Asia-Pacific SSD Caching Market?

Trends in the Asia-Pacific SSD Caching Market include the integration of artificial intelligence for optimized caching strategies and the development of NVMe SSDs for faster data access. These innovations are enhancing the overall performance of storage systems.

Asia-Pacific SSD Caching Market

| Segmentation Details | Description |

|---|---|

| Product Type | Enterprise SSD, Consumer SSD, Hybrid SSD, NVMe SSD |

| Technology | Flash Memory, DRAM Cache, 3D NAND, SLC |

| End User | Data Centers, Cloud Service Providers, Enterprises, SMBs |

| Deployment | On-Premises, Cloud-Based, Hybrid, Edge Computing |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Asia-Pacific SSD Caching Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at