444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Japan patient monitoring equipment market represents a critical component of the nation’s healthcare infrastructure, experiencing robust growth driven by an aging population and advancing medical technology. Japan’s healthcare sector has embraced sophisticated monitoring solutions to address the increasing demand for continuous patient care and early disease detection. The market encompasses a comprehensive range of devices including cardiac monitors, respiratory monitoring systems, neurological monitoring equipment, and multi-parameter monitoring solutions.

Market dynamics indicate substantial expansion opportunities as healthcare facilities nationwide modernize their monitoring capabilities. The integration of artificial intelligence and IoT technologies has revolutionized patient monitoring, enabling real-time data analysis and predictive healthcare interventions. Japan’s commitment to healthcare innovation, combined with government initiatives supporting digital health transformation, has created a favorable environment for market growth at a CAGR of 6.2% over the forecast period.

Healthcare digitization trends have accelerated the adoption of advanced monitoring systems across hospitals, clinics, and home care settings. The market benefits from Japan’s technologically advanced healthcare infrastructure and the increasing prevalence of chronic diseases requiring continuous monitoring. Remote patient monitoring solutions have gained significant traction, particularly following the healthcare digitization initiatives that emerged during recent global health challenges.

The Japan patient monitoring equipment market refers to the comprehensive ecosystem of medical devices and systems designed to continuously observe, measure, and record vital signs and physiological parameters of patients within Japanese healthcare facilities and home care environments. This market encompasses various monitoring technologies including cardiac monitors, pulse oximeters, blood pressure monitors, temperature monitoring devices, respiratory monitors, and integrated multi-parameter monitoring systems.

Patient monitoring equipment serves as the foundation for modern healthcare delivery, enabling healthcare professionals to track patient conditions in real-time, detect early warning signs of deterioration, and make informed clinical decisions. These sophisticated systems integrate advanced sensors, data analytics capabilities, and connectivity features to provide comprehensive patient surveillance across diverse healthcare settings.

Market scope extends beyond traditional hospital environments to include ambulatory care centers, home healthcare applications, and emergency medical services. The equipment ranges from basic vital sign monitors to complex multi-parameter systems capable of simultaneous monitoring of multiple physiological functions with integrated alarm systems and data management capabilities.

Japan’s patient monitoring equipment market demonstrates exceptional growth potential driven by demographic shifts, technological advancement, and healthcare system modernization. The market has evolved from basic monitoring devices to sophisticated integrated systems incorporating artificial intelligence, machine learning, and predictive analytics capabilities. Healthcare providers increasingly prioritize continuous monitoring solutions to improve patient outcomes and optimize resource utilization.

Key market drivers include Japan’s rapidly aging population, with 28.7% of citizens aged 65 and above, creating unprecedented demand for continuous health monitoring solutions. The prevalence of chronic diseases such as cardiovascular disorders, diabetes, and respiratory conditions has intensified the need for advanced monitoring equipment. Government healthcare initiatives supporting digital transformation and telemedicine adoption have further accelerated market expansion.

Technological innovation remains a cornerstone of market development, with manufacturers introducing wireless monitoring systems, wearable devices, and cloud-based data management platforms. The integration of IoT technologies has enabled seamless connectivity between monitoring devices and healthcare information systems, facilitating real-time data sharing and remote patient management capabilities.

Market analysis reveals several critical insights shaping the Japan patient monitoring equipment landscape:

Demographic transformation serves as the primary catalyst for Japan’s patient monitoring equipment market expansion. The nation’s aging population creates unprecedented healthcare demands, with elderly patients requiring continuous monitoring for multiple chronic conditions. Healthcare facilities must adapt to increased patient volumes while maintaining high-quality care standards, driving investment in advanced monitoring technologies.

Chronic disease prevalence continues escalating across Japan, with cardiovascular diseases, diabetes, and respiratory disorders affecting significant portions of the population. These conditions necessitate continuous monitoring to prevent complications and optimize treatment outcomes. Healthcare providers recognize that early detection through advanced monitoring systems reduces long-term treatment costs and improves patient quality of life.

Technological advancement in monitoring equipment has revolutionized patient care capabilities. Modern systems offer enhanced accuracy, wireless connectivity, and integrated data analytics that enable predictive healthcare interventions. Artificial intelligence integration allows monitoring systems to identify patterns and alert healthcare professionals to potential complications before they become critical.

Government healthcare initiatives supporting digital transformation have created favorable market conditions. Policy frameworks encouraging telemedicine adoption and remote patient monitoring have accelerated equipment deployment across healthcare facilities. Regulatory support for innovative medical technologies facilitates faster market entry for advanced monitoring solutions.

High implementation costs represent a significant barrier to market expansion, particularly for smaller healthcare facilities with limited capital budgets. Advanced monitoring systems require substantial initial investments in equipment, installation, and staff training. Budget constraints within Japan’s healthcare system may limit the pace of technology adoption across all facility types.

Technical complexity associated with modern monitoring systems can create implementation challenges for healthcare facilities. Integration with existing IT infrastructure, staff training requirements, and ongoing technical support needs may overwhelm facilities with limited technical resources. System interoperability issues between different manufacturers’ equipment can complicate deployment and data management processes.

Regulatory compliance requirements in Japan’s healthcare sector impose strict standards for medical device approval and deployment. Lengthy approval processes for new monitoring technologies may delay market entry and limit innovation adoption. Quality assurance standards while ensuring patient safety, can extend product development timelines and increase costs for manufacturers.

Data privacy concerns surrounding patient monitoring systems create additional compliance requirements. Healthcare facilities must ensure robust cybersecurity measures and data protection protocols, adding complexity and cost to monitoring system implementations. Privacy regulations may limit certain data sharing and remote monitoring capabilities.

Home healthcare expansion presents substantial growth opportunities as Japan’s healthcare system shifts toward patient-centered care models. Remote monitoring solutions enable patients to receive continuous care while remaining in familiar environments, reducing hospital readmissions and improving quality of life. Aging population preferences for aging in place create significant demand for home-based monitoring technologies.

Artificial intelligence integration offers transformative opportunities for monitoring equipment manufacturers. AI-powered systems can provide predictive analytics, automated alert systems, and personalized monitoring protocols that enhance patient outcomes while reducing healthcare provider workload. Machine learning capabilities enable continuous improvement in monitoring accuracy and clinical decision support.

Wearable technology convergence creates new market segments as consumer health devices evolve into clinical-grade monitoring solutions. The integration of wearable sensors with professional monitoring systems enables continuous patient surveillance across multiple environments. Consumer acceptance of wearable health technology facilitates adoption of professional monitoring solutions.

Telemedicine integration opportunities expand as healthcare providers embrace remote care delivery models. Monitoring equipment that seamlessly integrates with telemedicine platforms enables comprehensive remote patient management. Digital health initiatives supported by government policies create favorable conditions for integrated monitoring and telemedicine solutions.

Supply chain dynamics within Japan’s patient monitoring equipment market reflect the interplay between domestic manufacturing capabilities and international technology partnerships. Japanese medical device manufacturers leverage advanced engineering expertise while collaborating with global technology leaders to develop innovative monitoring solutions. Manufacturing excellence standards ensure high-quality products that meet stringent healthcare requirements.

Competitive dynamics intensify as established medical device companies compete with emerging technology firms entering the monitoring equipment space. Traditional manufacturers focus on reliability and clinical proven performance, while technology startups emphasize innovation and connectivity features. Market consolidation trends may emerge as companies seek to combine complementary capabilities and expand market reach.

Healthcare delivery transformation influences market dynamics as providers adopt value-based care models emphasizing patient outcomes over service volume. Monitoring equipment that demonstrates clear clinical benefits and cost-effectiveness gains competitive advantage. Outcome measurement capabilities become increasingly important for equipment selection and procurement decisions.

Technology evolution cycles accelerate market dynamics as rapid innovation creates opportunities for market disruption. Companies must balance investment in current product lines with development of next-generation technologies. Innovation partnerships between healthcare providers and technology companies drive collaborative development of advanced monitoring solutions.

Comprehensive market analysis employs multiple research methodologies to ensure accurate and reliable insights into Japan’s patient monitoring equipment market. Primary research involves extensive interviews with healthcare professionals, hospital administrators, and medical device manufacturers to gather firsthand market intelligence. Healthcare facility surveys provide detailed information about current monitoring equipment usage, procurement preferences, and future technology adoption plans.

Secondary research encompasses analysis of government healthcare statistics, medical device registration data, and industry publications to establish market baselines and trend identification. MarkWide Research utilizes proprietary databases and analytical frameworks to synthesize diverse data sources into coherent market insights. Healthcare policy analysis provides context for regulatory influences on market development.

Market segmentation analysis employs statistical modeling techniques to identify distinct market segments based on product types, end-user categories, and geographic regions. Competitive intelligence gathering involves systematic analysis of major market participants, their product portfolios, market positioning strategies, and recent developments.

Trend analysis incorporates longitudinal data examination to identify emerging patterns and forecast future market directions. Technology assessment methodologies evaluate the potential impact of emerging innovations on market dynamics. Validation processes ensure research findings accuracy through cross-referencing multiple data sources and expert review procedures.

Tokyo metropolitan area dominates Japan’s patient monitoring equipment market, accounting for approximately 32% market concentration due to the presence of major medical centers, research institutions, and corporate headquarters. The region’s advanced healthcare infrastructure and high patient volumes drive significant demand for sophisticated monitoring solutions. Technology adoption rates in Tokyo exceed national averages, with leading hospitals implementing cutting-edge monitoring systems.

Osaka and Kansai region represents the second-largest market segment, with 18% market share driven by major healthcare facilities and medical device manufacturing presence. The region’s industrial base supports local production of monitoring equipment components while serving as a testing ground for new technologies. Healthcare collaboration between universities and medical centers accelerates innovation adoption.

Nagoya and central Japan contribute 14% market share, benefiting from automotive industry precision manufacturing expertise that translates to medical device production capabilities. The region’s healthcare facilities prioritize reliable, high-quality monitoring equipment that meets stringent performance standards. Manufacturing synergies between automotive and medical device sectors drive technological advancement.

Rural and regional markets collectively represent 36% market share, with unique requirements for cost-effective, easy-to-maintain monitoring solutions. These areas face healthcare provider shortages, making remote monitoring and automated alert systems particularly valuable. Government initiatives supporting rural healthcare infrastructure development create growth opportunities for monitoring equipment providers.

Market leadership in Japan’s patient monitoring equipment sector involves both international medical device giants and domestic technology innovators. The competitive environment emphasizes product reliability, clinical efficacy, and seamless integration with existing healthcare systems.

Competitive strategies focus on technological innovation, clinical partnerships, and comprehensive service offerings. Companies invest heavily in research and development to maintain technological leadership while building strong relationships with healthcare providers. Market differentiation occurs through specialized applications, integration capabilities, and clinical outcome improvements.

Product-based segmentation reveals distinct market categories with varying growth trajectories and application requirements:

End-user segmentation identifies distinct market requirements and purchasing patterns:

Cardiac monitoring equipment maintains market leadership due to high prevalence of cardiovascular diseases in Japan’s aging population. Advanced ECG systems with AI-powered analysis capabilities demonstrate 15% annual growth as healthcare providers seek early detection of cardiac abnormalities. Wearable cardiac monitors gain traction for long-term patient monitoring and remote care applications.

Respiratory monitoring systems experience accelerated adoption following increased awareness of respiratory health importance. Pulse oximeters and capnography devices see expanded use beyond critical care settings into general patient monitoring applications. Non-invasive monitoring technologies reduce patient discomfort while providing accurate respiratory assessment capabilities.

Multi-parameter monitoring systems represent the fastest-growing category as healthcare facilities seek integrated solutions that reduce equipment complexity and improve workflow efficiency. These systems combine multiple monitoring functions into single platforms with centralized data management. Integration capabilities with electronic health records systems drive adoption among technology-forward healthcare providers.

Remote monitoring solutions emerge as a transformative category enabling continuous patient surveillance outside traditional healthcare settings. Home monitoring devices and wearable sensors provide real-time health data transmission to healthcare providers. Patient engagement improves through user-friendly interfaces and mobile connectivity features.

Healthcare providers benefit from enhanced patient care capabilities through continuous monitoring and early warning systems that prevent medical complications. Advanced monitoring equipment enables more efficient resource allocation and improved patient throughput while maintaining high care quality standards. Clinical decision support features integrated into modern monitoring systems assist healthcare professionals in making informed treatment decisions.

Patients experience improved health outcomes through continuous monitoring that enables early intervention and personalized care approaches. Remote monitoring capabilities allow patients to receive care in comfortable home environments while maintaining connection with healthcare providers. Quality of life improvements result from reduced hospital stays and more proactive health management.

Equipment manufacturers gain access to a sophisticated market with high-quality standards and appreciation for technological innovation. Japan’s healthcare system values reliable, clinically proven solutions, creating opportunities for companies that invest in research and development. Long-term partnerships with healthcare providers provide stable revenue streams and collaborative innovation opportunities.

Government healthcare systems achieve cost optimization through improved patient outcomes and reduced emergency interventions enabled by continuous monitoring. Early detection capabilities prevent costly complications while supporting population health management initiatives. Healthcare efficiency improvements contribute to sustainable healthcare delivery models.

Strengths:

Weaknesses:

Opportunities:

Threats:

Artificial intelligence integration represents the most significant trend transforming patient monitoring equipment capabilities. AI-powered systems provide predictive analytics, automated pattern recognition, and intelligent alert systems that enhance clinical decision-making. Machine learning algorithms continuously improve monitoring accuracy and reduce false alarms, increasing healthcare provider confidence in automated systems.

Wireless connectivity expansion enables seamless data transmission between monitoring devices and healthcare information systems. Bluetooth, Wi-Fi, and cellular connectivity options provide flexibility in device placement and patient mobility. Cloud-based data management platforms facilitate remote monitoring and multi-location data access for healthcare providers.

Miniaturization and wearability trends drive development of compact, patient-friendly monitoring devices that reduce discomfort while maintaining clinical accuracy. Wearable sensors and patch-based monitors enable continuous monitoring without restricting patient movement. Battery life improvements extend monitoring duration and reduce maintenance requirements.

Interoperability standardization efforts focus on ensuring seamless communication between different manufacturers’ monitoring equipment and healthcare IT systems. Industry standards development facilitates data sharing and system integration across diverse healthcare environments. Open architecture designs enable flexible system configurations and future upgrade capabilities.

Recent technological breakthroughs in patient monitoring equipment include advanced sensor technologies that provide more accurate and comprehensive physiological measurements. Non-invasive monitoring capabilities have expanded to include previously invasive measurement parameters, improving patient comfort and reducing infection risks.

Strategic partnerships between traditional medical device manufacturers and technology companies accelerate innovation development and market deployment. These collaborations combine clinical expertise with cutting-edge technology capabilities to create next-generation monitoring solutions. MWR analysis indicates that such partnerships drive 40% faster product development cycles.

Regulatory approvals for innovative monitoring technologies have accelerated as Japanese health authorities recognize the importance of advanced patient monitoring in improving healthcare outcomes. Streamlined approval processes for certain device categories facilitate faster market entry for beneficial technologies. Digital health regulations evolve to accommodate emerging monitoring and telemedicine applications.

Investment increases in research and development reflect industry commitment to continuous innovation in patient monitoring technologies. Companies allocate significant resources to developing AI-powered systems, improved sensor technologies, and enhanced connectivity features. Venture capital funding supports startup companies developing disruptive monitoring technologies.

Market participants should prioritize development of integrated monitoring solutions that combine multiple physiological parameters into comprehensive patient assessment platforms. Healthcare providers increasingly prefer systems that reduce equipment complexity while providing enhanced monitoring capabilities. System integration expertise becomes a key competitive differentiator in equipment selection processes.

Investment focus should emphasize artificial intelligence and machine learning capabilities that provide predictive analytics and clinical decision support features. Healthcare facilities value monitoring systems that not only collect data but also provide actionable insights for patient care optimization. Clinical validation of AI algorithms through rigorous testing and peer-reviewed research strengthens market acceptance.

Partnership strategies with healthcare providers enable collaborative development of monitoring solutions that address specific clinical needs and workflow requirements. Long-term relationships with key healthcare institutions provide valuable feedback for product development and create stable market channels. Clinical partnerships facilitate real-world testing and validation of innovative monitoring technologies.

Geographic expansion strategies should consider regional healthcare infrastructure differences and specific market requirements across Japan. Rural and urban markets have distinct needs for monitoring equipment capabilities, service support, and cost structures. Localized approaches to product development and marketing improve market penetration success rates.

Market trajectory indicates sustained growth driven by demographic trends, technological advancement, and healthcare system evolution toward value-based care models. The convergence of monitoring equipment with digital health platforms creates comprehensive patient management ecosystems. Growth projections suggest continued expansion at 6.8% CAGR through the next decade.

Technology evolution will focus on enhanced AI capabilities, improved sensor accuracy, and seamless connectivity across healthcare environments. Next-generation monitoring systems will provide predictive health insights and automated intervention recommendations. Precision medicine integration enables personalized monitoring protocols based on individual patient characteristics and risk factors.

Market consolidation trends may emerge as companies seek to combine complementary technologies and expand market reach through strategic acquisitions. Successful companies will balance innovation investment with operational efficiency to maintain competitive positioning. MarkWide Research projects that market leaders will increasingly focus on comprehensive solution portfolios rather than individual device offerings.

Healthcare delivery transformation toward patient-centered care models will drive demand for monitoring solutions that support home healthcare and remote patient management. The integration of consumer health technologies with professional monitoring equipment creates new market opportunities. Regulatory evolution will accommodate emerging monitoring applications while maintaining patient safety standards.

Japan’s patient monitoring equipment market stands at a transformative juncture, driven by demographic imperatives, technological innovation, and evolving healthcare delivery models. The convergence of aging population dynamics with advanced monitoring technologies creates unprecedented opportunities for market growth and clinical improvement. Healthcare providers increasingly recognize that sophisticated monitoring capabilities are essential for delivering high-quality, efficient patient care in an evolving healthcare landscape.

Market success will depend on companies’ ability to develop integrated solutions that address complex healthcare challenges while providing clear clinical and economic value. The emphasis on AI-powered analytics, seamless connectivity, and patient-centered design will define competitive advantage in this dynamic market. Strategic partnerships between technology innovators and healthcare providers will accelerate the development and deployment of next-generation monitoring solutions.

Future market leadership will belong to organizations that successfully balance technological innovation with practical healthcare application, ensuring that advanced monitoring capabilities translate into improved patient outcomes and operational efficiency. As Japan continues its healthcare digital transformation journey, patient monitoring equipment will remain central to achieving the vision of predictive, personalized, and preventive healthcare delivery that meets the needs of an aging society while maintaining the highest standards of clinical excellence.

What is Patient Monitoring Equipment?

Patient Monitoring Equipment refers to devices used to monitor patients’ vital signs and health parameters in real-time. These devices are essential in various healthcare settings, including hospitals, clinics, and home care, to ensure timely medical intervention and improve patient outcomes.

What are the key players in the Japan Patient Monitoring Equipment Market?

Key players in the Japan Patient Monitoring Equipment Market include Philips Healthcare, GE Healthcare, and Siemens Healthineers. These companies are known for their innovative technologies and comprehensive product offerings in patient monitoring solutions, among others.

What are the main drivers of the Japan Patient Monitoring Equipment Market?

The main drivers of the Japan Patient Monitoring Equipment Market include the increasing prevalence of chronic diseases, the growing aging population, and advancements in telemedicine technologies. These factors contribute to the rising demand for efficient patient monitoring solutions across healthcare facilities.

What challenges does the Japan Patient Monitoring Equipment Market face?

The Japan Patient Monitoring Equipment Market faces challenges such as high costs of advanced monitoring systems and regulatory hurdles in device approval. Additionally, the need for continuous training of healthcare professionals to effectively use these technologies can be a barrier to widespread adoption.

What opportunities exist in the Japan Patient Monitoring Equipment Market?

Opportunities in the Japan Patient Monitoring Equipment Market include the integration of artificial intelligence and machine learning in monitoring devices, which can enhance predictive analytics. Furthermore, the expansion of home healthcare services presents a significant growth avenue for patient monitoring solutions.

What trends are shaping the Japan Patient Monitoring Equipment Market?

Trends shaping the Japan Patient Monitoring Equipment Market include the increasing use of wearable monitoring devices and the shift towards remote patient monitoring solutions. These trends are driven by technological advancements and the need for more patient-centric care models.

Japan Patient Monitoring Equipment Market

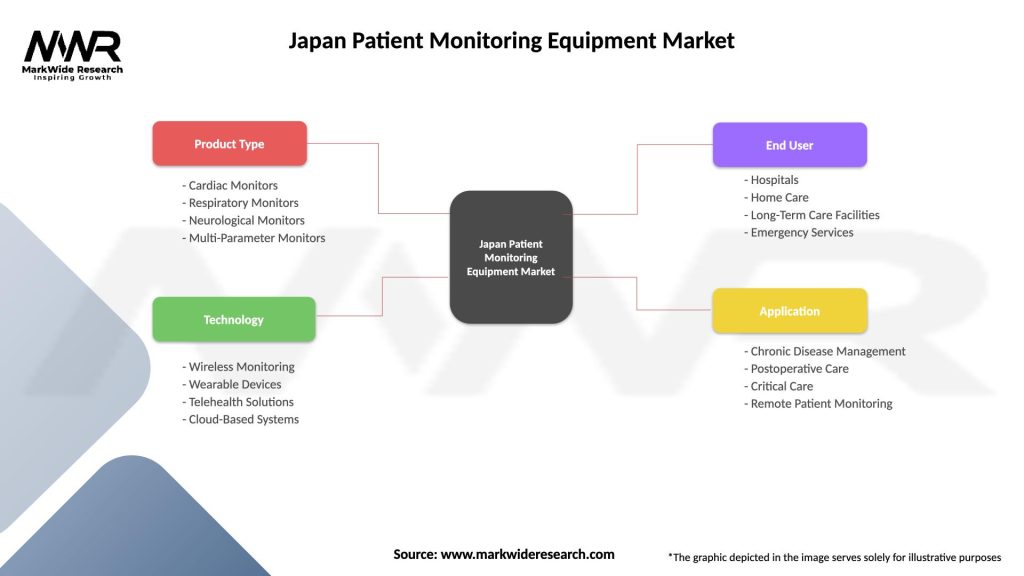

| Segmentation Details | Description |

|---|---|

| Product Type | Cardiac Monitors, Respiratory Monitors, Neurological Monitors, Multi-Parameter Monitors |

| Technology | Wireless Monitoring, Wearable Devices, Telehealth Solutions, Cloud-Based Systems |

| End User | Hospitals, Home Care, Long-Term Care Facilities, Emergency Services |

| Application | Chronic Disease Management, Postoperative Care, Critical Care, Remote Patient Monitoring |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Japan Patient Monitoring Equipment Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at