444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The US Real Estate and Hospitality Market represents a dynamic and interconnected ecosystem that drives significant economic activity across the nation. This comprehensive sector encompasses residential and commercial real estate development, property management, hotel operations, vacation rentals, and hospitality services. Market dynamics indicate robust growth potential, with the sector experiencing a 6.2% annual growth rate in recent years, driven by demographic shifts, technological innovation, and evolving consumer preferences.

Digital transformation has fundamentally reshaped both real estate transactions and hospitality experiences, with online platforms facilitating property searches, virtual tours, and seamless booking processes. The integration of smart building technologies, sustainable development practices, and data-driven decision making has enhanced operational efficiency by approximately 35% across leading market participants.

Regional variations characterize market performance, with metropolitan areas experiencing different growth trajectories based on employment opportunities, population migration patterns, and infrastructure development. The hospitality segment has demonstrated remarkable resilience, adapting to changing travel behaviors and implementing innovative service delivery models that prioritize safety, convenience, and personalized experiences.

The US Real Estate and Hospitality Market refers to the comprehensive economic sector encompassing property development, sales, leasing, management, and hospitality services including hotels, resorts, vacation rentals, and related accommodation facilities. This integrated market facilitates property transactions, provides temporary lodging solutions, and supports the broader tourism and business travel ecosystem through interconnected real estate and hospitality operations.

Real estate components include residential properties, commercial buildings, industrial facilities, and mixed-use developments, while hospitality elements encompass traditional hotels, boutique accommodations, extended-stay facilities, and alternative lodging options. The market operates through complex networks of developers, investors, property managers, hospitality operators, and service providers who collectively create value through strategic asset development and customer experience delivery.

Technology integration has expanded the market definition to include proptech innovations, hospitality management systems, and digital platforms that enhance property discovery, transaction processing, and guest services. This evolution reflects the sector’s adaptation to modern consumer expectations and operational efficiency requirements.

Market performance across the US real estate and hospitality sector demonstrates sustained growth momentum, supported by favorable demographic trends, urbanization patterns, and recovering travel demand. The sector benefits from diverse revenue streams, including property appreciation, rental income, hospitality services, and ancillary business operations that create multiple value creation opportunities.

Key growth drivers include population growth in target markets, increased business travel activity, leisure tourism expansion, and the rise of remote work arrangements that influence both residential preferences and hospitality demand patterns. Technology adoption has accelerated, with 78% of market participants implementing digital solutions to enhance operational efficiency and customer engagement.

Investment activity remains robust, with institutional investors, private equity firms, and real estate investment trusts actively pursuing acquisition and development opportunities. The hospitality segment has shown particular resilience, with occupancy rates recovering to pre-pandemic levels and revenue per available room demonstrating consistent improvement across key markets.

Strategic positioning focuses on sustainable development practices, energy efficiency improvements, and enhanced guest experiences through technology integration and personalized service delivery models that differentiate market leaders from competitors.

Market intelligence reveals several critical trends shaping the US real estate and hospitality landscape:

Investment patterns show increased focus on secondary and tertiary markets, where development costs remain favorable while growth potential remains significant. The integration of real estate and hospitality operations creates synergistic opportunities for portfolio diversification and risk mitigation.

Population growth serves as a fundamental driver, with target metropolitan areas experiencing steady demographic expansion that creates sustained demand for both residential properties and hospitality services. Migration patterns toward job-rich markets support property value appreciation and occupancy rate stability across both sectors.

Economic expansion in key regions generates employment opportunities, increases disposable income, and stimulates business travel activity that benefits hospitality operators. Corporate relocations and business expansion initiatives create demand for temporary accommodations and long-term housing solutions.

Infrastructure development enhances market accessibility and attractiveness, with transportation improvements, utility upgrades, and connectivity enhancements supporting property values and tourism growth. Public-private partnerships facilitate large-scale development projects that transform entire districts.

Technology advancement enables operational efficiency improvements, cost reduction, and enhanced customer experiences that drive competitive advantage. Digital platforms facilitate property discovery, streamline transaction processes, and enable dynamic pricing strategies that optimize revenue generation.

Lifestyle preferences increasingly favor urban living, walkable communities, and experiential travel that align with sustainable development practices and authentic local experiences. These trends support premium positioning and pricing power for well-positioned assets.

Regulatory complexity creates operational challenges through zoning restrictions, building codes, environmental regulations, and licensing requirements that increase development costs and project timelines. Compliance obligations require specialized expertise and ongoing monitoring to avoid penalties and delays.

Capital intensity demands significant upfront investments for property acquisition, development, and renovation projects that may strain financial resources and limit growth opportunities for smaller market participants. Access to financing can be challenging during economic uncertainty periods.

Economic sensitivity exposes the sector to cyclical downturns, interest rate fluctuations, and consumer spending variations that impact both property values and hospitality demand. Market volatility can affect investment returns and operational performance.

Labor shortages in construction, property management, and hospitality services create operational constraints and increase wage pressures that affect profitability. Skills gaps in specialized areas require ongoing training investments and retention strategies.

Environmental concerns regarding sustainability, energy consumption, and climate change adaptation require substantial investments in green technologies and building improvements that may not generate immediate returns on investment.

Emerging markets in secondary cities offer attractive development opportunities with lower entry costs, growing populations, and improving infrastructure that support long-term value creation. These markets often provide superior risk-adjusted returns compared to saturated primary markets.

Technology integration creates opportunities for operational efficiency improvements, enhanced customer experiences, and new revenue streams through smart building systems, mobile applications, and data analytics platforms. Proptech innovations enable competitive differentiation and cost optimization.

Sustainable development initiatives align with environmental regulations, investor preferences, and consumer values while potentially reducing operating costs through energy efficiency improvements. Green building certifications command premium pricing and attract quality tenants.

Alternative accommodations including extended-stay facilities, serviced apartments, and hybrid living concepts address evolving consumer preferences for flexibility and convenience. These formats often generate higher returns than traditional hospitality models.

Public-private partnerships enable access to large-scale development opportunities, infrastructure improvements, and risk sharing arrangements that facilitate complex projects. Government incentives and tax benefits can enhance project economics significantly.

Supply and demand dynamics vary significantly across geographic markets, with some regions experiencing inventory shortages while others face oversupply conditions. Market timing and location selection become critical success factors for development and investment decisions.

Interest rate sensitivity affects both property values and hospitality demand through financing costs, consumer spending patterns, and investment return requirements. Rate fluctuations create opportunities for strategic acquisitions and refinancing activities.

Competitive intensity drives innovation, service quality improvements, and pricing optimization strategies. Market leaders differentiate through brand strength, operational excellence, and customer loyalty programs that create sustainable competitive advantages.

Seasonal variations impact hospitality performance and real estate transaction activity, requiring sophisticated revenue management and inventory optimization strategies. Diversification across markets and property types helps mitigate seasonal risks.

Consumer behavior evolution influences property design, amenity preferences, and service delivery models. Understanding demographic preferences and lifestyle trends enables market participants to anticipate demand shifts and adapt accordingly.

Comprehensive analysis employs multiple research approaches including primary data collection, secondary source analysis, and industry expert interviews to develop accurate market insights. Data validation through triangulation ensures reliability and accuracy of findings.

Market segmentation analysis examines performance across property types, geographic regions, customer segments, and price points to identify growth opportunities and competitive dynamics. Statistical modeling techniques support trend analysis and forecasting accuracy.

Competitive intelligence gathering involves systematic monitoring of market participants, pricing strategies, development pipelines, and operational performance metrics. This information supports strategic decision-making and competitive positioning analysis.

Economic modeling incorporates macroeconomic indicators, demographic trends, and industry-specific factors to project market performance and identify potential risks and opportunities. Scenario analysis examines various economic conditions and their market impacts.

Technology assessment evaluates emerging innovations, adoption rates, and implementation costs to understand their potential market impact. This analysis helps identify technology-driven opportunities and competitive threats.

Northeast region maintains market leadership with established financial centers, tourism destinations, and high-value real estate markets. The region benefits from dense population centers, strong transportation infrastructure, and diverse economic bases that support both residential and hospitality demand.

Southeast markets demonstrate the strongest growth momentum, with 42% of new development activity concentrated in states like Florida, Georgia, and North Carolina. Population migration, business relocations, and tourism growth drive sustained demand across property types.

Western states command premium pricing due to technology industry concentration, lifestyle attractions, and supply constraints in key markets. California and Washington lead in innovation adoption and sustainable development practices.

Midwest region offers value opportunities with affordable property prices, stable employment markets, and growing tourism sectors. Cities like Chicago, Minneapolis, and Columbus attract investment due to strong fundamentals and development potential.

Southwest markets benefit from population growth, business-friendly environments, and expanding tourism infrastructure. Texas, Arizona, and Nevada lead regional growth with diverse economic bases supporting multiple property types.

Market leadership is distributed among several categories of participants, each with distinct competitive advantages and strategic focus areas:

Competitive strategies emphasize brand differentiation, operational excellence, technology integration, and strategic market positioning. Market leaders invest heavily in customer experience enhancement, sustainability initiatives, and portfolio optimization to maintain competitive advantages.

By Property Type:

By Market Segment:

By Geographic Focus:

Residential real estate demonstrates steady demand growth driven by household formation, demographic shifts, and lifestyle preferences favoring urban and suburban living. The segment benefits from low inventory levels in many markets, supporting price appreciation and development opportunities.

Commercial properties adapt to changing work patterns through flexible space designs, technology integration, and amenity enhancements that attract quality tenants. Mixed-use developments gain popularity by combining office, retail, and residential components.

Hospitality sector recovery continues with occupancy rates reaching 73% of pre-pandemic levels and revenue per available room showing consistent improvement. Business travel normalization and leisure tourism growth support performance recovery across market segments.

Industrial real estate experiences exceptional demand due to e-commerce growth, supply chain optimization, and nearshoring trends. Warehouse and distribution facilities command premium pricing in strategic locations near population centers.

Alternative accommodations including extended-stay and serviced apartments gain market share by addressing evolving consumer preferences for flexibility, convenience, and home-like amenities during extended travel periods.

Investors benefit from diversified revenue streams, inflation hedging characteristics, and long-term appreciation potential across real estate and hospitality assets. Portfolio diversification reduces risk while providing steady cash flow generation and capital appreciation opportunities.

Developers gain from strong demand fundamentals, favorable financing conditions, and opportunities to create value through strategic land acquisition, entitlement processes, and construction management. Mixed-use projects offer enhanced returns through diversified revenue sources.

Operators achieve operational efficiency improvements through technology integration, data analytics, and process optimization that reduce costs while enhancing customer experiences. Brand strength and loyalty programs create competitive moats and pricing power.

Service providers including property managers, hospitality operators, and professional services firms benefit from steady demand for specialized expertise, technology solutions, and operational support services across the sector.

Communities experience economic development benefits through job creation, tax revenue generation, and infrastructure improvements that enhance quality of life and attract additional investment and residents.

Strengths:

Weaknesses:

Opportunities:

Threats:

Sustainability integration becomes a competitive necessity rather than optional enhancement, with 68% of new developments incorporating green building features and energy-efficient systems. Environmental certifications command premium pricing and attract environmentally conscious tenants and guests.

Technology convergence creates smart building ecosystems that optimize energy usage, enhance security, and improve user experiences through IoT devices, artificial intelligence, and mobile applications. These systems generate operational data that supports predictive maintenance and space optimization.

Experience-focused hospitality emphasizes unique, locally-inspired offerings that create memorable experiences and drive customer loyalty. Properties differentiate through authentic design, curated amenities, and personalized services that reflect local culture and preferences.

Flexible living arrangements gain popularity as remote work arrangements and lifestyle preferences drive demand for adaptable spaces, short-term rentals, and hybrid residential-hospitality concepts that provide convenience and flexibility.

Data-driven decision making enables sophisticated market analysis, pricing optimization, and operational efficiency improvements through advanced analytics, machine learning, and predictive modeling capabilities that enhance competitive positioning.

Strategic acquisitions continue reshaping the competitive landscape as market leaders pursue portfolio expansion, geographic diversification, and operational synergies. Consolidation activities create larger, more efficient operators with enhanced market power.

Technology partnerships between traditional real estate and hospitality companies and proptech innovators accelerate digital transformation initiatives. These collaborations enable rapid deployment of advanced systems and capabilities.

Sustainability commitments drive significant capital investments in energy-efficient systems, renewable energy sources, and green building certifications. MarkWide Research analysis indicates that sustainability initiatives improve operational efficiency by approximately 25% while enhancing brand reputation.

Alternative investment structures including opportunity zones, real estate crowdfunding, and tokenization platforms democratize access to real estate investments while providing developers with additional capital sources.

Regulatory adaptations address changing market conditions through zoning modifications, short-term rental regulations, and building code updates that reflect evolving safety, environmental, and operational requirements.

Strategic positioning should emphasize technology integration, sustainability initiatives, and customer experience enhancement to maintain competitive advantages in evolving market conditions. Market participants must balance growth investments with operational efficiency improvements.

Geographic diversification across primary and secondary markets reduces concentration risk while capturing growth opportunities in emerging regions. Portfolio optimization should consider demographic trends, economic fundamentals, and infrastructure development patterns.

Technology adoption requires systematic evaluation of proptech solutions, implementation planning, and staff training to maximize return on investment. Focus areas include revenue management systems, customer relationship platforms, and operational automation tools.

Sustainability integration should encompass both new development and existing property improvement initiatives. Energy efficiency improvements, water conservation systems, and waste reduction programs create operational savings while meeting stakeholder expectations.

Partnership strategies with technology providers, service companies, and financial institutions can accelerate capability development while sharing implementation risks and costs. Strategic alliances enable access to specialized expertise and resources.

Market expansion is projected to continue with steady growth rates of 5.8% annually over the next five years, supported by favorable demographic trends, economic growth, and continued urbanization patterns. Secondary markets are expected to outperform primary markets in terms of growth rates and investment returns.

Technology transformation will accelerate with artificial intelligence, machine learning, and IoT integration becoming standard operational components rather than competitive differentiators. MWR projections suggest that technology adoption rates will reach 85% market penetration within three years.

Sustainability requirements will intensify through regulatory mandates, investor preferences, and consumer expectations that drive green building adoption and operational efficiency improvements. Carbon neutrality commitments will become competitive necessities.

Alternative accommodations are expected to capture increasing market share as consumer preferences shift toward flexibility, authenticity, and personalized experiences. Extended-stay and serviced apartment formats show particular growth potential.

Investment patterns will favor mixed-use developments, technology-enabled properties, and sustainable assets that provide diversified revenue streams and operational resilience. Institutional investment in the sector is projected to increase significantly.

The US Real Estate and Hospitality Market demonstrates remarkable resilience and adaptation capability while maintaining strong growth fundamentals supported by demographic trends, economic expansion, and technological innovation. Market participants who embrace digital transformation, sustainability initiatives, and customer-centric strategies are well-positioned to capture emerging opportunities and maintain competitive advantages.

Strategic success requires balancing growth investments with operational efficiency improvements while adapting to evolving consumer preferences and regulatory requirements. The integration of real estate and hospitality operations creates synergistic opportunities for portfolio diversification and risk mitigation that enhance long-term value creation potential.

Future market leadership will belong to organizations that successfully navigate technological disruption, environmental sustainability requirements, and changing demographic preferences while maintaining operational excellence and financial discipline. The sector’s continued evolution presents significant opportunities for innovative market participants who can anticipate and respond to emerging trends effectively.

What is US Real Estate and Hospitality?

US Real Estate and Hospitality refers to the sectors involved in the buying, selling, and leasing of properties, as well as the services related to lodging, dining, and entertainment. This includes residential, commercial, and industrial real estate, along with hotels, restaurants, and other hospitality services.

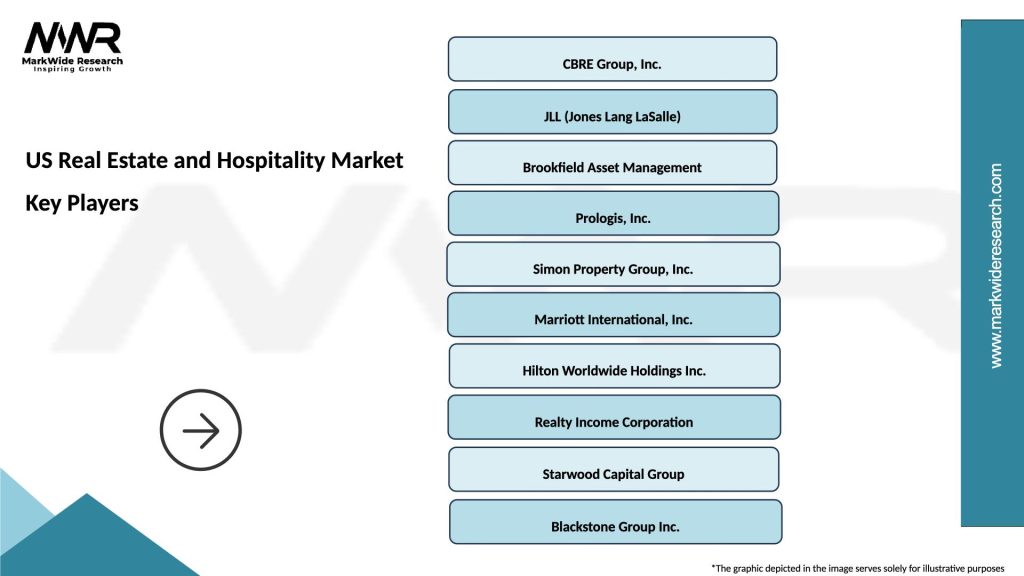

What are the key players in the US Real Estate and Hospitality Market?

Key players in the US Real Estate and Hospitality Market include companies like Marriott International, Hilton Worldwide, and CBRE Group. These companies are involved in various aspects of real estate management, hotel operations, and property development, among others.

What are the growth factors driving the US Real Estate and Hospitality Market?

The US Real Estate and Hospitality Market is driven by factors such as increasing urbanization, rising disposable incomes, and a growing demand for travel and tourism. Additionally, the expansion of e-commerce has boosted the need for commercial real estate.

What challenges does the US Real Estate and Hospitality Market face?

Challenges in the US Real Estate and Hospitality Market include fluctuating interest rates, regulatory hurdles, and the impact of economic downturns on consumer spending. These factors can affect property values and occupancy rates in the hospitality sector.

What opportunities exist in the US Real Estate and Hospitality Market?

Opportunities in the US Real Estate and Hospitality Market include the growth of sustainable building practices, the rise of short-term rental platforms, and the increasing popularity of experiential travel. These trends can lead to innovative business models and investment strategies.

What trends are shaping the US Real Estate and Hospitality Market?

Trends shaping the US Real Estate and Hospitality Market include the integration of technology in property management, the focus on sustainability, and the shift towards remote work influencing residential preferences. These trends are redefining how properties are developed and utilized.

US Real Estate and Hospitality Market

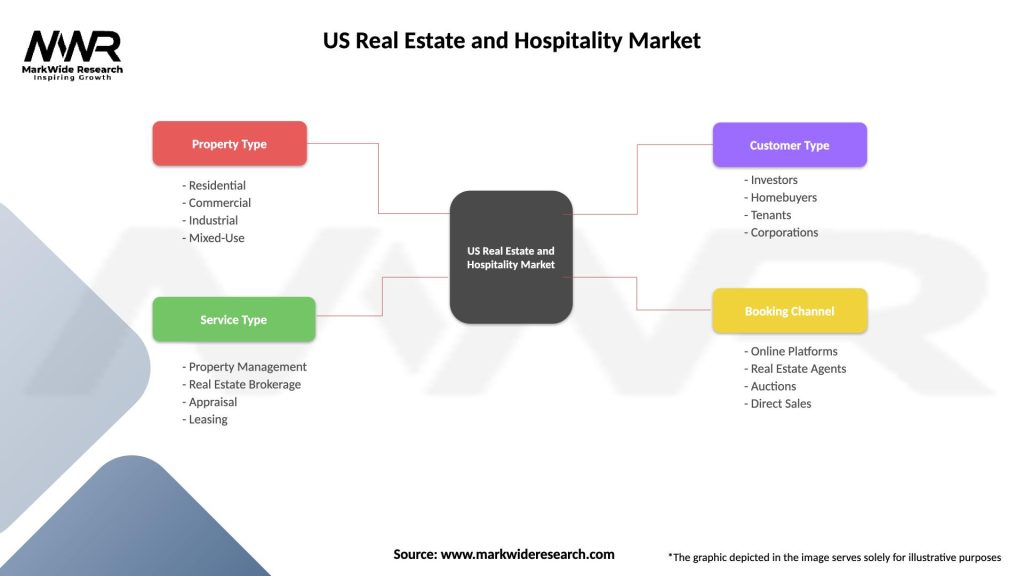

| Segmentation Details | Description |

|---|---|

| Property Type | Residential, Commercial, Industrial, Mixed-Use |

| Service Type | Property Management, Real Estate Brokerage, Appraisal, Leasing |

| Customer Type | Investors, Homebuyers, Tenants, Corporations |

| Booking Channel | Online Platforms, Real Estate Agents, Auctions, Direct Sales |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the US Real Estate and Hospitality Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at