444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The United Kingdom sustainable home furniture market represents a transformative sector within the broader furniture industry, characterized by increasing consumer awareness of environmental impact and sustainable living practices. Market dynamics indicate robust growth driven by evolving consumer preferences toward eco-friendly materials, circular economy principles, and responsible manufacturing processes. The market encompasses furniture products manufactured using sustainable materials such as reclaimed wood, bamboo, recycled metals, and low-emission finishes.

Consumer behavior patterns demonstrate a significant shift toward environmentally conscious purchasing decisions, with 73% of UK consumers expressing willingness to pay premium prices for sustainable furniture options. Retail channels have adapted to accommodate this demand through expanded sustainable product lines, enhanced transparency in sourcing practices, and comprehensive sustainability certifications. The market benefits from supportive government policies promoting circular economy initiatives and environmental sustainability across manufacturing sectors.

Manufacturing innovation continues to drive market expansion through advanced sustainable production techniques, waste reduction strategies, and renewable energy adoption. Supply chain optimization focuses on local sourcing, reduced transportation emissions, and ethical labor practices throughout the production process.

The United Kingdom sustainable home furniture market refers to the commercial sector encompassing furniture products designed, manufactured, and distributed using environmentally responsible practices and materials. This market segment prioritizes ecological sustainability through renewable resource utilization, waste minimization, energy-efficient production processes, and end-of-life recyclability considerations.

Sustainable furniture characteristics include the use of certified sustainable wood sources, non-toxic finishes, recyclable materials, and manufacturing processes that minimize environmental impact. Market participants include manufacturers specializing in eco-friendly production, retailers promoting sustainable product lines, and consumers actively seeking environmentally responsible furniture solutions for residential applications.

Sustainability criteria encompass material sourcing transparency, carbon footprint reduction, durability enhancement for extended product lifecycles, and compliance with recognized environmental certification standards such as FSC, GREENGUARD, and Cradle to Cradle certifications.

Market performance demonstrates exceptional growth momentum driven by heightened environmental consciousness among UK consumers and supportive regulatory frameworks promoting sustainable manufacturing practices. Key growth drivers include increasing awareness of climate change impacts, rising disposable income allocation toward sustainable products, and expanding availability of eco-friendly furniture options across multiple price segments.

Competitive landscape features established furniture manufacturers transitioning toward sustainable practices alongside emerging companies specializing exclusively in eco-friendly furniture production. Market penetration shows 42% of UK households have purchased at least one piece of sustainable furniture within the past two years, indicating substantial market adoption rates.

Technology integration enhances market growth through innovative sustainable materials development, advanced manufacturing processes reducing waste generation, and digital platforms facilitating transparent supply chain communication. Regional distribution shows concentrated demand in urban areas with higher environmental awareness levels and disposable income capacity for premium sustainable products.

Future projections indicate continued market expansion supported by evolving consumer preferences, technological advancement in sustainable materials, and increasing corporate sustainability commitments across the furniture industry.

Consumer preference analysis reveals significant insights driving market evolution and growth patterns across the United Kingdom sustainable furniture sector:

Environmental consciousness serves as the primary catalyst driving sustained growth within the UK sustainable home furniture market. Climate change awareness motivates consumers to make environmentally responsible purchasing decisions across all household categories, with furniture representing a significant opportunity for environmental impact reduction through sustainable material selection and manufacturing processes.

Government policy support accelerates market development through initiatives promoting circular economy principles, sustainable manufacturing incentives, and environmental regulation enforcement. Regulatory frameworks encourage furniture manufacturers to adopt sustainable practices through tax incentives, grants for sustainable technology adoption, and preferential treatment for environmentally responsible businesses.

Millennial and Gen Z purchasing power significantly influences market dynamics as these demographic segments prioritize sustainability considerations in purchasing decisions. Generational preferences demonstrate strong correlation between age demographics and sustainable furniture adoption rates, with younger consumers showing 85% higher likelihood of choosing sustainable options compared to traditional alternatives.

Corporate sustainability commitments drive demand through office furniture procurement policies emphasizing environmental responsibility. Business sector adoption creates substantial market opportunities as companies integrate sustainability criteria into furniture purchasing decisions for workplace environments.

Innovation in sustainable materials expands market possibilities through development of new eco-friendly alternatives to traditional furniture materials, enhancing both environmental performance and aesthetic appeal of sustainable furniture products.

Premium pricing challenges represent the most significant barrier to widespread sustainable furniture adoption across all consumer segments. Cost considerations limit market penetration among price-sensitive consumers, despite growing environmental awareness and preference for sustainable products. Manufacturing costs associated with sustainable materials and processes typically result in 25-40% higher retail prices compared to conventional furniture alternatives.

Limited product availability constrains market growth in certain furniture categories and regional markets. Supply chain limitations affect consistent product availability, particularly for specialized sustainable materials and custom furniture solutions requiring extended lead times for production and delivery.

Consumer education gaps hinder market expansion as many potential customers lack comprehensive understanding of sustainability benefits, certification meanings, and long-term value propositions associated with sustainable furniture investments. Information asymmetry between manufacturers and consumers creates barriers to informed purchasing decisions.

Durability perception concerns affect consumer confidence in sustainable furniture products, with some consumers questioning whether eco-friendly materials can match the durability and performance characteristics of traditional furniture materials. Quality assurance becomes critical for market credibility and continued growth.

Competition from conventional furniture remains intense, with traditional manufacturers offering competitive pricing and established distribution networks that sustainable furniture companies must overcome to gain market share.

Digital marketplace expansion creates unprecedented opportunities for sustainable furniture companies to reach environmentally conscious consumers through e-commerce platforms, social media marketing, and direct-to-consumer sales channels. Online retail growth enables smaller sustainable furniture manufacturers to compete effectively with established traditional furniture companies through targeted marketing and specialized product offerings.

Corporate procurement programs represent substantial growth opportunities as businesses increasingly integrate sustainability criteria into furniture purchasing decisions for office environments, hospitality facilities, and retail spaces. B2B market potential shows significant expansion possibilities through corporate sustainability initiatives and green building certification requirements.

Circular economy initiatives open new market segments through furniture refurbishment, upcycling services, and take-back programs that extend product lifecycles and create additional revenue streams. Service-based models complement traditional furniture sales through maintenance, restoration, and end-of-life recycling services.

International expansion opportunities emerge as UK sustainable furniture manufacturers develop expertise and reputation that can be leveraged in global markets with similar environmental consciousness trends. Export potential grows as international demand for UK-designed sustainable furniture increases across European and North American markets.

Technology integration enables innovative sustainable furniture solutions through smart home integration, IoT connectivity, and advanced materials development that enhance both environmental performance and functional capabilities of furniture products.

Supply and demand equilibrium within the UK sustainable home furniture market demonstrates complex interactions between consumer preferences, manufacturing capabilities, and regulatory influences. Demand patterns show seasonal variations with peak purchasing periods during spring home renovation seasons and year-end holiday periods when consumers invest in home improvement projects.

Manufacturing capacity expansion responds to growing market demand through facility upgrades, sustainable technology adoption, and workforce development programs focused on eco-friendly production techniques. Production efficiency improvements of 18% annually demonstrate industry commitment to sustainable manufacturing optimization while maintaining competitive pricing structures.

Raw material sourcing dynamics influence market stability through sustainable supply chain development, certified material availability, and pricing fluctuations affecting production costs. Material innovation cycles introduce new sustainable alternatives that enhance product performance while reducing environmental impact throughout product lifecycles.

Consumer education initiatives by manufacturers, retailers, and industry associations improve market understanding of sustainable furniture benefits, certification standards, and long-term value propositions. Knowledge transfer accelerates market adoption through improved consumer confidence in sustainable furniture investments.

Competitive dynamics evolve as traditional furniture manufacturers integrate sustainable practices while specialized eco-friendly companies expand market presence through innovation and targeted marketing strategies.

Comprehensive market analysis employs multiple research methodologies to ensure accurate representation of UK sustainable home furniture market conditions, trends, and growth projections. Primary research components include structured interviews with industry executives, consumer surveys across diverse demographic segments, and retailer feedback sessions to understand market dynamics from multiple perspectives.

Secondary research integration incorporates industry reports, government statistics, trade association data, and academic research to provide comprehensive market context and validation of primary research findings. Data triangulation ensures research accuracy through cross-verification of information sources and methodological approaches.

Consumer behavior analysis utilizes both quantitative surveys and qualitative focus groups to understand purchasing motivations, preference patterns, and decision-making processes related to sustainable furniture investments. Demographic segmentation provides insights into market variations across age groups, income levels, and geographic regions within the United Kingdom.

Industry expert consultations with furniture manufacturers, sustainability consultants, and retail executives provide professional insights into market trends, challenges, and future development opportunities. Stakeholder perspectives enhance research comprehensiveness through diverse viewpoints across the sustainable furniture value chain.

Market modeling techniques apply statistical analysis and forecasting methodologies to project market growth trends, identify emerging opportunities, and assess potential market risks affecting sustainable furniture sector development.

London and Southeast England dominate the UK sustainable home furniture market with 45% market share driven by higher disposable incomes, environmental consciousness levels, and access to specialized sustainable furniture retailers. Urban concentration in metropolitan areas creates favorable conditions for sustainable furniture adoption through lifestyle preferences aligned with environmental responsibility and contemporary design aesthetics.

Northern England regions demonstrate growing market penetration as sustainable furniture awareness increases and product availability expands through regional retailers and online distribution channels. Manchester, Leeds, and Newcastle emerge as significant secondary markets with 22% combined regional market share supported by young professional demographics and urban regeneration initiatives promoting sustainable living practices.

Scotland market development shows strong growth momentum driven by government sustainability initiatives, environmental awareness campaigns, and increasing availability of locally manufactured sustainable furniture options. Edinburgh and Glasgow lead Scottish market adoption with premium sustainable furniture segments experiencing particularly robust demand growth.

Wales and Southwest England markets benefit from rural lifestyle preferences that align with sustainable furniture values, including natural materials, local craftsmanship, and environmental stewardship. Regional manufacturing supports local sustainable furniture production through artisan workshops and small-scale manufacturers specializing in eco-friendly furniture solutions.

Midlands region represents emerging market opportunity with growing consumer awareness and expanding retail presence of sustainable furniture options across Birmingham, Nottingham, and surrounding urban centers.

Market leadership within the UK sustainable home furniture sector encompasses both established furniture manufacturers transitioning toward sustainable practices and specialized companies focusing exclusively on eco-friendly furniture production. Competitive positioning varies across product categories, price segments, and distribution channels, creating diverse market opportunities for different business models.

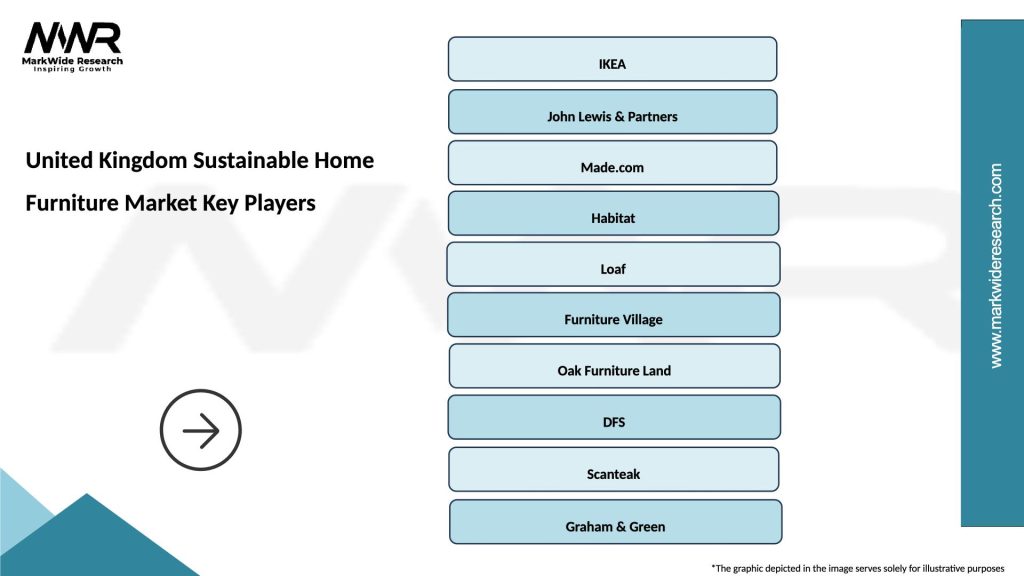

Key market participants include:

Competitive strategies focus on sustainability certification, transparent supply chain communication, innovative material development, and customer education initiatives to differentiate products and build brand loyalty within the growing sustainable furniture market segment.

Product category segmentation reveals distinct market dynamics across different furniture types within the UK sustainable home furniture market:

By Product Type:

By Material Type:

By Price Segment:

Living room furniture dominates sustainable furniture sales with 52% category market share driven by high visibility, frequent use, and consumer willingness to invest in centerpiece furniture items. Sofa and seating solutions lead category growth through innovative sustainable upholstery materials, natural latex cushioning, and certified wood frame construction that appeals to health-conscious consumers.

Bedroom furniture experiences robust growth as consumers prioritize healthy sleep environments free from toxic chemicals and off-gassing materials. Organic mattresses and bed frames using sustainable materials show particularly strong demand growth among families with young children and environmentally conscious adults seeking chemical-free sleeping spaces.

Home office furniture represents the fastest-growing category segment driven by remote work trends and increased home office setup investments. Ergonomic sustainable desk chairs and adjustable standing desks manufactured using eco-friendly materials experience exceptional demand growth as professionals create dedicated workspace environments.

Dining room furniture benefits from durability expectations and family gathering importance, with consumers viewing sustainable dining sets as long-term investments worthy of premium pricing. Solid wood dining tables from certified sustainable sources demonstrate strong market performance through combination of environmental responsibility and traditional craftsmanship appeal.

Storage solutions gain market traction through space optimization needs in urban environments and organizational trends promoting minimalist living aligned with sustainability values. Modular storage systems using sustainable materials offer flexibility and longevity that resonates with environmentally conscious consumers.

Manufacturers benefit from sustainable furniture market participation through differentiated product positioning, premium pricing opportunities, and alignment with evolving consumer preferences toward environmental responsibility. Brand reputation enhancement through sustainability commitments creates competitive advantages and customer loyalty that support long-term business growth and market share expansion.

Retailers gain advantages through sustainable furniture offerings that attract environmentally conscious consumers, justify premium pricing, and create marketing differentiation from competitors focusing solely on conventional furniture products. Customer acquisition improves through sustainability positioning that resonates with target demographic segments prioritizing environmental values.

Consumers receive multiple benefits including reduced environmental impact, improved indoor air quality, enhanced durability and longevity, and alignment of purchasing decisions with personal environmental values. Health benefits from non-toxic materials and finishes provide additional value beyond environmental considerations, particularly for families with children and individuals with chemical sensitivities.

Environmental stakeholders benefit through reduced deforestation pressure, decreased manufacturing waste, lower carbon emissions from sustainable production processes, and promotion of circular economy principles within the furniture industry. Ecosystem preservation results from responsible sourcing practices and sustainable material utilization.

Government and policy makers achieve environmental policy objectives through market-driven adoption of sustainable practices, reduced regulatory enforcement needs, and demonstration of successful private sector environmental initiatives that can be replicated across other industries.

Strengths:

Weaknesses:

Opportunities:

Threats:

Circular economy integration emerges as a dominant trend reshaping the UK sustainable home furniture market through take-back programs, refurbishment services, and end-of-life recycling initiatives. MarkWide Research analysis indicates that 34% of sustainable furniture companies now offer product lifecycle services extending beyond initial sales to include maintenance, restoration, and recycling programs.

Biophilic design principles gain prominence as consumers seek furniture that connects indoor living spaces with natural environments through organic shapes, natural materials, and earth-tone color palettes. Natural material integration extends beyond wood to include stone, rattan, and other renewable resources that enhance both aesthetic appeal and environmental credentials.

Customization and personalization trends drive demand for bespoke sustainable furniture solutions that meet specific consumer requirements while maintaining environmental responsibility standards. Made-to-order manufacturing reduces waste while providing unique products that align with individual style preferences and space requirements.

Technology-enabled transparency allows consumers to trace furniture production from raw material sourcing through manufacturing and delivery, building trust and confidence in sustainability claims. Blockchain integration and QR code tracking systems provide unprecedented supply chain visibility for environmentally conscious consumers.

Multi-functional design responds to urban living space constraints through furniture pieces serving multiple purposes while maintaining sustainable material standards. Space optimization becomes increasingly important as housing costs drive demand for efficient, versatile furniture solutions.

Local manufacturing renaissance supports regional economic development while reducing transportation emissions and enabling closer customer relationships through direct manufacturer-consumer interactions.

Manufacturing innovation accelerates through advanced sustainable material development, including bio-based composites, recycled plastic lumber, and innovative wood alternatives that maintain aesthetic appeal while improving environmental performance. Production technology advancement enables more efficient sustainable manufacturing processes with reduced energy consumption and waste generation.

Certification program expansion provides consumers with clearer sustainability standards and verification processes through enhanced third-party certification systems covering material sourcing, manufacturing processes, and end-of-life considerations. Industry standardization improves market transparency and consumer confidence in sustainable furniture claims.

Retail channel evolution includes specialized sustainable furniture showrooms, enhanced online presentation of sustainability credentials, and educational initiatives helping consumers understand environmental benefits and long-term value propositions. Omnichannel integration combines physical and digital retail experiences optimized for sustainable furniture marketing and sales.

Supply chain collaboration strengthens through partnerships between furniture manufacturers, sustainable material suppliers, and logistics providers focused on reducing environmental impact throughout the value chain. Vertical integration strategies enable greater control over sustainability standards and cost optimization.

Investment activity increases as venture capital and private equity firms recognize growth potential within the sustainable furniture sector, providing capital for expansion, innovation, and market development initiatives. Financial support accelerates company growth and market penetration across the UK sustainable furniture landscape.

Market entry strategies should prioritize clear sustainability positioning, transparent communication of environmental benefits, and competitive pricing strategies that justify premium costs through superior value propositions. Brand development requires consistent messaging across all customer touchpoints emphasizing both environmental responsibility and product quality excellence.

Product development focus should emphasize durability, functionality, and aesthetic appeal while maintaining strict sustainability standards throughout design and manufacturing processes. Innovation investment in sustainable materials and production techniques will create competitive advantages and support premium positioning strategies.

Distribution channel optimization should include both online and physical retail presence with emphasis on customer education, product demonstration, and sustainability credential communication. Partnership development with established retailers can accelerate market penetration while specialized sustainable furniture showrooms provide focused customer experiences.

Customer education initiatives remain critical for market development through content marketing, sustainability workshops, and transparent communication of environmental benefits and long-term value propositions. Digital marketing strategies should leverage social media platforms and influencer partnerships to reach environmentally conscious consumer segments effectively.

Supply chain investment in sustainable material sourcing, certification compliance, and logistics optimization will support scalable growth while maintaining environmental standards. Technology adoption for supply chain transparency and customer communication enhances brand credibility and market positioning.

Market growth trajectory indicates sustained expansion driven by increasing environmental awareness, supportive government policies, and continuous innovation in sustainable materials and manufacturing processes. Long-term projections suggest the sustainable furniture segment will capture 65% of total UK furniture market share within the next decade as sustainability becomes the standard rather than a premium option.

Technology integration will accelerate through smart home connectivity, IoT-enabled furniture monitoring, and advanced materials that enhance both functionality and environmental performance. Digital transformation of retail channels will improve customer education, product customization, and supply chain transparency supporting continued market growth.

Regulatory evolution toward stricter environmental standards and mandatory sustainability reporting will create competitive advantages for companies already committed to sustainable practices while pressuring conventional furniture manufacturers to adopt eco-friendly alternatives. Policy support will continue favoring sustainable furniture through tax incentives and green building requirements.

Consumer behavior evolution suggests sustainability will become a baseline expectation rather than a differentiating factor, requiring companies to compete on design, quality, and value while maintaining environmental responsibility standards. Generational change will accelerate adoption as environmentally conscious younger consumers gain purchasing power and influence market dynamics.

International expansion opportunities will emerge as UK sustainable furniture expertise and reputation create demand in global markets seeking environmentally responsible furniture solutions. Export potential supports domestic industry growth while spreading UK sustainability innovations internationally.

The United Kingdom sustainable home furniture market represents a dynamic and rapidly evolving sector positioned for continued growth driven by environmental consciousness, technological innovation, and supportive policy frameworks. Market fundamentals demonstrate strong consumer demand, increasing manufacturer commitment to sustainability, and expanding retail channel support for eco-friendly furniture options across all price segments and product categories.

Growth drivers including climate change awareness, generational preference shifts, and corporate sustainability initiatives create favorable conditions for sustained market expansion. Competitive advantages emerge for companies successfully balancing environmental responsibility with design excellence, quality craftsmanship, and competitive pricing strategies that justify premium positioning.

Future success within this market will require continued investment in sustainable material innovation, manufacturing process optimization, customer education, and supply chain transparency. Market participants who effectively communicate sustainability benefits while delivering superior product quality and customer experiences will capture disproportionate market share as the sector matures and expands. The United Kingdom sustainable home furniture market stands poised to transform from a niche segment into the dominant force shaping the future of the broader furniture industry.

What is Sustainable Home Furniture?

Sustainable Home Furniture refers to furniture products that are designed and manufactured with environmentally friendly practices, using materials that are renewable, recyclable, or sourced sustainably. This includes items made from reclaimed wood, bamboo, or non-toxic finishes.

What are the key players in the United Kingdom Sustainable Home Furniture Market?

Key players in the United Kingdom Sustainable Home Furniture Market include IKEA, Made.com, and Habitat, which focus on eco-friendly designs and sustainable sourcing practices, among others.

What are the growth factors driving the United Kingdom Sustainable Home Furniture Market?

The growth of the United Kingdom Sustainable Home Furniture Market is driven by increasing consumer awareness of environmental issues, a rising demand for eco-friendly products, and government initiatives promoting sustainability in home furnishings.

What challenges does the United Kingdom Sustainable Home Furniture Market face?

Challenges in the United Kingdom Sustainable Home Furniture Market include higher production costs associated with sustainable materials, limited consumer knowledge about sustainability, and competition from cheaper, non-sustainable alternatives.

What opportunities exist in the United Kingdom Sustainable Home Furniture Market?

Opportunities in the United Kingdom Sustainable Home Furniture Market include the potential for innovation in sustainable materials, the growth of online retail channels, and increasing collaborations between designers and eco-conscious brands.

What trends are shaping the United Kingdom Sustainable Home Furniture Market?

Trends in the United Kingdom Sustainable Home Furniture Market include a shift towards minimalistic designs, the use of biodegradable materials, and an emphasis on circular economy practices, where furniture is designed for longevity and recyclability.

United Kingdom Sustainable Home Furniture Market

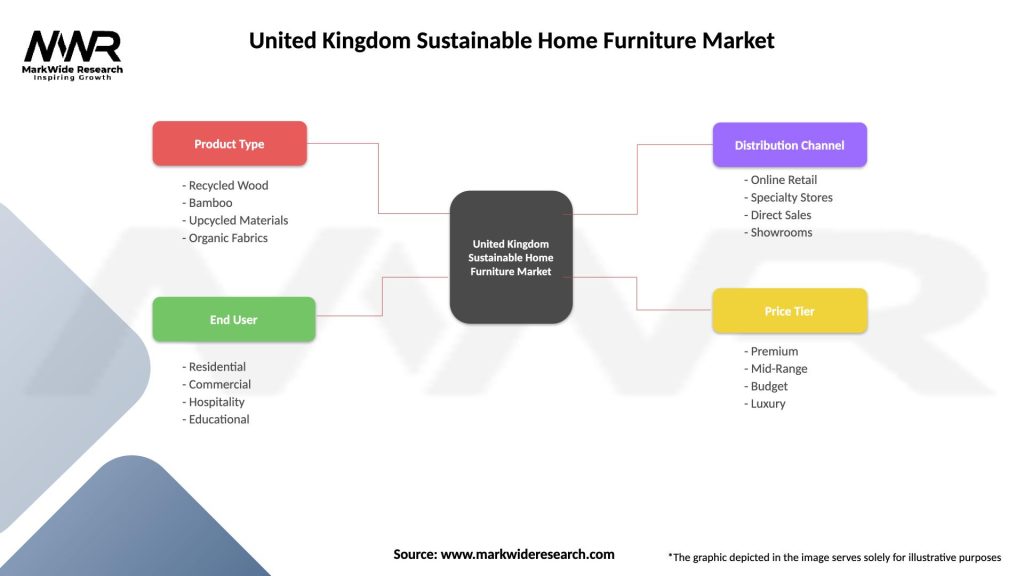

| Segmentation Details | Description |

|---|---|

| Product Type | Recycled Wood, Bamboo, Upcycled Materials, Organic Fabrics |

| End User | Residential, Commercial, Hospitality, Educational |

| Distribution Channel | Online Retail, Specialty Stores, Direct Sales, Showrooms |

| Price Tier | Premium, Mid-Range, Budget, Luxury |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the United Kingdom Sustainable Home Furniture Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at