444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Malaysia payment market represents a dynamic and rapidly evolving ecosystem that encompasses traditional banking services, digital payment solutions, mobile wallets, and emerging fintech innovations. Malaysia’s payment landscape has undergone significant transformation over the past decade, driven by government initiatives, technological advancement, and changing consumer preferences toward cashless transactions.

Digital payment adoption in Malaysia has accelerated dramatically, with mobile payment penetration reaching 78% among urban consumers as of 2024. The market encompasses various payment methods including credit and debit cards, online banking, mobile wallets, QR code payments, and contactless solutions. Bank Negara Malaysia has played a pivotal role in modernizing the payment infrastructure through initiatives like the Real-time Retail Payments Platform (RPP) and the promotion of interoperable payment systems.

E-commerce growth and smartphone proliferation have been fundamental drivers of payment market expansion. The COVID-19 pandemic further accelerated digital payment adoption, with contactless transactions experiencing 65% growth during 2020-2022. Financial inclusion initiatives have also contributed to market development, bringing previously unbanked populations into the formal payment ecosystem through mobile-first solutions.

Regulatory support from Malaysian authorities has created a conducive environment for payment innovation while maintaining security standards. The introduction of comprehensive digital banking licenses and sandbox programs has encouraged both local and international players to develop innovative payment solutions tailored to Malaysian consumers and businesses.

The Malaysia payment market refers to the comprehensive ecosystem of financial services, technologies, and platforms that facilitate monetary transactions between individuals, businesses, and institutions within Malaysia. This market encompasses both traditional payment methods such as cash, checks, and bank transfers, as well as modern digital solutions including mobile wallets, contactless payments, cryptocurrency platforms, and peer-to-peer transfer systems.

Payment market dynamics in Malaysia involve multiple stakeholders including commercial banks, fintech companies, payment processors, merchants, consumers, and regulatory bodies. The market facilitates various transaction types ranging from retail purchases and bill payments to business-to-business transfers and cross-border remittances. Digital transformation has fundamentally reshaped how Malaysians conduct financial transactions, moving from cash-dependent behaviors toward integrated digital payment experiences.

Market infrastructure includes payment gateways, point-of-sale systems, mobile applications, banking networks, and security protocols that ensure safe and efficient transaction processing. The Malaysian payment market also encompasses emerging technologies such as blockchain-based solutions, artificial intelligence-driven fraud detection, and biometric authentication systems that enhance user experience and transaction security.

Malaysia’s payment market has emerged as one of Southeast Asia’s most progressive and technologically advanced payment ecosystems. The market demonstrates robust growth momentum driven by strong government support, increasing smartphone penetration, and evolving consumer preferences toward digital-first financial services. Mobile wallet adoption has reached unprecedented levels, with major platforms capturing significant market share across diverse demographic segments.

Key market characteristics include high interoperability between payment systems, comprehensive regulatory frameworks that balance innovation with consumer protection, and strong collaboration between traditional financial institutions and fintech disruptors. The market benefits from Malaysia’s strategic position as a regional financial hub and its well-developed telecommunications infrastructure that supports advanced payment technologies.

Growth drivers encompass government digitalization initiatives, rising e-commerce penetration which accounts for 42% of retail transactions, and increasing consumer comfort with contactless payment methods. The market has also benefited from significant foreign investment in fintech companies and payment infrastructure development. Cross-border payment capabilities have strengthened Malaysia’s position as a regional payment hub, facilitating trade and remittances across Southeast Asia.

Future prospects remain highly positive, with continued innovation in areas such as central bank digital currencies, embedded finance solutions, and AI-powered payment personalization expected to drive sustained market expansion and enhanced user experiences.

Digital payment transformation in Malaysia has reached a tipping point where digital transactions now represent the majority of non-cash payments. Several critical insights define the current market landscape:

Market maturation is evidenced by the seamless integration of payment solutions into daily life, from transportation and dining to healthcare and government services. Consumer behavior has shifted toward expecting instant, secure, and convenient payment options across all transaction types.

Government digitalization initiatives serve as the primary catalyst for Malaysia’s payment market expansion. The Malaysian Digital Economy Blueprint and various smart city projects have created substantial demand for integrated digital payment solutions. Bank Negara Malaysia’s progressive regulatory approach has encouraged innovation while maintaining financial stability and consumer protection.

Smartphone penetration exceeding 91% of the adult population has created an ideal foundation for mobile payment adoption. The widespread availability of affordable smartphones and reliable internet connectivity has democratized access to digital payment services across urban and rural areas. 5G network deployment is further enhancing payment processing speeds and enabling more sophisticated payment applications.

E-commerce growth has been instrumental in driving payment market expansion. The rise of online shopping platforms, food delivery services, and digital marketplaces has created substantial demand for secure and convenient online payment methods. COVID-19 pandemic effects accelerated this trend, with many consumers permanently shifting toward digital payment preferences.

Financial inclusion objectives have motivated both government and private sector initiatives to develop accessible payment solutions for underserved populations. Mobile-first payment platforms have successfully reached previously unbanked individuals, particularly in rural areas where traditional banking infrastructure is limited. Micro-lending integration with payment platforms has further enhanced financial inclusion outcomes.

Merchant adoption incentives including reduced transaction fees, improved cash flow management, and enhanced customer insights have encouraged widespread acceptance of digital payment methods. Government subsidies and tax incentives for digital payment adoption have accelerated merchant onboarding across various business sectors.

Digital literacy gaps continue to pose challenges for universal payment market adoption, particularly among older demographics and rural populations with limited technology exposure. While smartphone penetration is high, effective utilization of advanced payment features requires ongoing education and support initiatives. Language barriers and complex user interfaces can further limit adoption among certain demographic segments.

Cybersecurity concerns remain a significant restraint, with consumers expressing hesitation about digital payment security despite advanced protection measures. High-profile data breaches in other markets have created lingering consumer anxiety about sharing financial information through digital channels. Fraud incidents and scam activities targeting digital payment users have necessitated continuous security enhancement and consumer education efforts.

Infrastructure limitations in certain rural areas continue to restrict payment market expansion. Inconsistent internet connectivity and limited point-of-sale infrastructure can impede seamless digital payment experiences. Power supply reliability issues in remote areas also affect the consistent availability of digital payment services.

Regulatory compliance costs can be substantial for payment service providers, particularly smaller fintech companies seeking to enter the market. Complex licensing requirements and ongoing compliance obligations may limit market entry for innovative payment solutions. Cross-border regulatory coordination challenges can also restrict the development of regional payment services.

Cash dependency in certain sectors and demographic groups continues to limit digital payment adoption. Traditional markets, street vendors, and informal economy participants may resist transitioning to digital payment acceptance due to cost concerns or operational complexity.

Central Bank Digital Currency (CBDC) development presents significant opportunities for payment market evolution. Malaysia’s exploration of digital ringgit could revolutionize payment infrastructure and create new business models for payment service providers. CBDC implementation would enable more efficient cross-border transactions and enhanced monetary policy transmission mechanisms.

Embedded finance solutions represent a substantial growth opportunity as non-financial companies integrate payment capabilities into their core services. E-commerce platforms, ride-sharing applications, and social media platforms can leverage embedded payment solutions to enhance user experiences and create new revenue streams. API-driven integration enables seamless payment embedding across diverse digital platforms.

Islamic finance integration offers unique opportunities given Malaysia’s position as a global Islamic finance hub. Sharia-compliant payment solutions and Islamic fintech innovations can serve both domestic and international Muslim markets. Sukuk-backed payment systems and Islamic crowdfunding platforms represent emerging opportunities within this segment.

Cross-border payment expansion leverages Malaysia’s strategic position within ASEAN to develop regional payment corridors. Enhanced remittance services, trade finance solutions, and tourist payment systems can capture growing cross-border transaction volumes. Regional payment interoperability initiatives create opportunities for Malaysian payment providers to expand internationally.

Artificial intelligence applications in payment processing offer opportunities for enhanced fraud detection, personalized payment experiences, and predictive analytics. Machine learning algorithms can optimize payment routing, reduce transaction costs, and improve success rates for complex payment scenarios.

Competitive intensity in Malaysia’s payment market has increased significantly as traditional banks, global fintech companies, and local startups compete for market share. This competition has driven rapid innovation, reduced transaction costs, and improved user experiences across all payment platforms. Market consolidation trends are emerging as larger players acquire smaller fintech companies to enhance their technological capabilities and market reach.

Technology convergence is reshaping payment market dynamics through the integration of artificial intelligence, blockchain technology, and biometric authentication. These technological advances are enabling more secure, efficient, and user-friendly payment experiences while reducing operational costs for service providers. Cloud-based infrastructure adoption has enhanced scalability and reduced barriers to entry for new market participants.

Consumer behavior evolution continues to drive market dynamics, with users demanding seamless, instant, and contextual payment experiences. The expectation for 24/7 payment availability and real-time transaction processing has become standard across all payment channels. Generational differences in payment preferences are creating opportunities for targeted payment solutions.

Regulatory evolution maintains pace with technological advancement, with authorities continuously updating frameworks to accommodate new payment innovations while ensuring consumer protection. Sandbox programs enable controlled testing of innovative payment solutions, accelerating time-to-market for new technologies. International regulatory coordination is improving cross-border payment efficiency and compliance.

Partnership ecosystems are becoming increasingly important as payment providers collaborate with merchants, technology companies, and financial institutions to create comprehensive payment solutions. These partnerships enable rapid market expansion and enhanced service offerings while sharing development costs and risks.

Comprehensive market analysis for the Malaysia payment market employs multiple research methodologies to ensure accurate and actionable insights. Primary research involves extensive surveys and interviews with key stakeholders including payment service providers, merchants, consumers, and regulatory officials. Quantitative surveys capture statistical data on payment usage patterns, preferences, and market trends across diverse demographic segments.

Secondary research incorporates analysis of government publications, central bank reports, industry studies, and financial statements from major market participants. Regulatory filings and licensing data provide insights into market structure and competitive dynamics. Academic research and technology reports contribute to understanding emerging trends and innovation trajectories.

Market modeling utilizes advanced statistical techniques to project future market developments and identify growth opportunities. Scenario analysis evaluates potential market outcomes under different economic and regulatory conditions. Time-series analysis of transaction data reveals seasonal patterns and long-term growth trends.

Stakeholder interviews with industry executives, technology leaders, and policy makers provide qualitative insights into market dynamics and strategic directions. Focus group discussions with consumers reveal preferences, pain points, and adoption barriers that quantitative data may not capture.

Technology assessment involves evaluation of emerging payment technologies, security protocols, and infrastructure developments that may impact market evolution. Competitive intelligence gathering tracks product launches, partnership announcements, and strategic initiatives across the payment ecosystem.

Kuala Lumpur and Selangor dominate Malaysia’s payment market landscape, accounting for approximately 45% of total digital payment transactions. These urban centers benefit from high smartphone penetration, extensive merchant acceptance networks, and concentrated fintech company presence. Financial district concentration in Kuala Lumpur has created a hub for payment innovation and cross-border financial services.

Penang and Johor represent significant secondary markets with strong payment adoption driven by manufacturing industries and proximity to Singapore. Penang’s technology sector has embraced advanced payment solutions for both B2B and B2C transactions. Johor’s border economy has created unique opportunities for cross-border payment solutions serving Malaysian and Singaporean consumers.

East Malaysia states including Sabah and Sarawak present both challenges and opportunities for payment market expansion. While infrastructure limitations exist, government digitalization initiatives and natural resource industries are driving payment modernization. Rural payment solutions specifically designed for these markets are gaining traction among agricultural and tourism sectors.

Northern states including Kedah, Perlis, and Perak show growing payment adoption supported by agricultural modernization and tourism development. Cross-border trade with Thailand has created demand for international payment capabilities in these regions.

Central states demonstrate steady payment market growth driven by manufacturing industries and government administrative centers. Industrial payment solutions for supply chain finance and B2B transactions are particularly relevant in these manufacturing-focused regions.

Market leadership in Malaysia’s payment sector is contested among several key players representing different market segments and technological approaches. The competitive landscape encompasses traditional banks, global technology companies, and innovative fintech startups.

Strategic partnerships between traditional financial institutions and fintech companies are reshaping competitive dynamics. Technology integration and customer acquisition strategies differentiate market leaders from emerging players. International expansion capabilities increasingly influence competitive positioning as Malaysian payment companies seek regional growth opportunities.

By Payment Method: The Malaysia payment market segments into multiple payment categories, each serving distinct consumer and business needs. Mobile wallets represent the fastest-growing segment, capturing significant market share through user-friendly interfaces and comprehensive merchant acceptance. Card payments including credit and debit cards maintain substantial market presence, particularly for higher-value transactions and international purchases.

Online banking transfers continue to serve business-to-business payments and large consumer transactions requiring enhanced security measures. QR code payments have emerged as a preferred contactless method, offering interoperability across different payment platforms and merchant systems.

By End User: Consumer payments dominate transaction volumes, driven by retail purchases, dining, transportation, and entertainment spending. Business payments encompass supply chain finance, vendor payments, and payroll processing, representing higher average transaction values. Government payments including tax collection, license fees, and public service charges contribute to market stability and digital adoption.

By Transaction Type: Peer-to-peer transfers show strong growth as consumers embrace digital money sharing and splitting capabilities. Merchant payments represent the largest segment by volume, covering retail, hospitality, and service industry transactions. Bill payments for utilities, telecommunications, and financial services demonstrate steady growth and high user retention rates.

By Technology: Near Field Communication (NFC) payments are gaining adoption through contactless cards and mobile devices. Biometric authentication enhances security while improving user experience across various payment methods.

Mobile Wallet Category: This segment demonstrates the highest growth momentum with 82% user satisfaction rates driven by convenience, security features, and integrated loyalty programs. Super app strategies combining payments with lifestyle services have proven particularly successful in capturing and retaining users. Cross-platform interoperability has become a key differentiator as consumers expect seamless payment experiences across different service providers.

Banking Payment Category: Traditional banks have successfully modernized their payment offerings while maintaining customer trust and regulatory compliance advantages. Digital banking platforms now offer payment experiences comparable to fintech solutions while leveraging existing customer relationships and financial product integration. Corporate banking payments remain a stronghold for traditional institutions due to complex compliance requirements and relationship-based service models.

Contactless Payment Category: The COVID-19 pandemic accelerated contactless payment adoption, with usage rates increasing 73% during 2020-2022. Tap-and-pay functionality has become standard across retail environments, supported by widespread NFC-enabled point-of-sale infrastructure. Wearable payment devices represent an emerging subcategory with growing consumer interest.

Cross-border Payment Category: This segment benefits from Malaysia’s strategic position as a regional hub and growing international trade volumes. Remittance services serve Malaysia’s significant migrant worker population, while trade finance payments support the country’s export-oriented economy. Tourist payment services cater to Malaysia’s substantial tourism industry, though this segment experienced temporary disruption during pandemic travel restrictions.

Payment Service Providers benefit from Malaysia’s supportive regulatory environment, growing digital adoption, and strategic regional position. Market entry opportunities exist across various payment segments, with government initiatives providing clear pathways for licensing and operation. Technology infrastructure investments by telecommunications companies and financial institutions create favorable conditions for payment innovation and scaling.

Merchants and Retailers gain access to expanded customer bases through digital payment acceptance, improved cash flow management, and reduced handling costs compared to cash transactions. Data analytics capabilities from digital payments enable better inventory management, customer insights, and targeted marketing strategies. Integration opportunities with loyalty programs and customer relationship management systems enhance business value beyond basic payment processing.

Consumers enjoy enhanced convenience, security, and choice in payment methods while benefiting from competitive pricing and innovative features. Financial inclusion benefits extend banking services to previously underserved populations through mobile-first payment solutions. Reward programs and cashback incentives provide additional value for digital payment adoption.

Financial Institutions can leverage payment services to strengthen customer relationships, generate fee income, and gather valuable transaction data for product development. Partnership opportunities with fintech companies enable rapid innovation without extensive internal development costs. Regulatory compliance expertise provides competitive advantages in serving business customers with complex payment needs.

Government and Regulators achieve policy objectives including financial inclusion, economic digitalization, and improved tax collection through enhanced payment system transparency. Economic development benefits include job creation in the fintech sector and improved business efficiency across industries.

Strengths:

Weaknesses:

Opportunities:

Threats:

Super App Evolution continues to reshape Malaysia’s payment landscape as platforms integrate multiple services including transportation, food delivery, e-commerce, and financial services within single applications. This trend enables payment providers to increase user engagement and transaction frequency while creating comprehensive digital ecosystems. Platform monetization strategies extend beyond transaction fees to include advertising, data analytics, and premium service subscriptions.

Biometric Authentication adoption is accelerating across payment platforms as consumers prioritize security and convenience. Fingerprint recognition, facial recognition, and voice authentication technologies are becoming standard features in mobile payment applications. Multi-factor authentication combining biometrics with traditional security measures enhances protection against fraud while maintaining user-friendly experiences.

Artificial Intelligence Integration is transforming payment processing through advanced fraud detection, personalized user experiences, and predictive analytics. Machine learning algorithms analyze transaction patterns to identify suspicious activities in real-time while minimizing false positives that could disrupt legitimate transactions. AI-powered chatbots provide instant customer support and transaction assistance across payment platforms.

Embedded Finance represents a significant trend as non-financial companies integrate payment capabilities directly into their core services. E-commerce platforms, social media applications, and service marketplaces are incorporating payment processing to create seamless user experiences and capture additional revenue streams. API-driven integration enables rapid deployment of embedded payment solutions across diverse digital platforms.

Sustainability Focus is emerging as payment companies develop environmentally conscious solutions and carbon-neutral transaction processing. Digital receipt systems reduce paper consumption while green payment initiatives appeal to environmentally conscious consumers and businesses.

Central Bank Digital Currency Research by Bank Negara Malaysia represents a pivotal development that could fundamentally transform the payment landscape. Digital ringgit exploration involves comprehensive studies on technical infrastructure, monetary policy implications, and consumer adoption strategies. This development positions Malaysia among global leaders in CBDC innovation and could create new opportunities for payment service providers.

Real-time Payment Infrastructure enhancements have improved transaction processing speeds and reliability across the Malaysian payment ecosystem. DuitNow expansion has increased interbank transfer capabilities while reducing transaction costs for consumers and businesses. 24/7 payment processing availability has become standard across major payment platforms, meeting consumer expectations for instant transaction completion.

Cross-border Payment Initiatives including participation in regional payment connectivity projects have strengthened Malaysia’s position as a payment hub. ASEAN payment integration efforts enable seamless transactions across member countries, supporting trade and tourism growth. Remittance corridor improvements have reduced costs and increased efficiency for international money transfers.

Fintech Licensing Framework updates have created clearer pathways for payment innovation while maintaining regulatory oversight. Digital bank licenses have introduced new competition and innovation in payment services. Regulatory sandbox expansions enable testing of emerging payment technologies including blockchain-based solutions and AI-powered fraud detection systems.

Strategic Partnerships between traditional banks and fintech companies have accelerated payment innovation and market expansion. Technology integration initiatives combine banking expertise with fintech agility to create comprehensive payment solutions. International collaborations with global payment networks have enhanced Malaysia’s connectivity to worldwide payment systems.

MarkWide Research analysis indicates that payment service providers should prioritize interoperability and user experience optimization to succeed in Malaysia’s competitive market environment. Platform integration strategies that enable seamless connectivity across different payment systems will become increasingly important as consumers expect unified payment experiences regardless of their chosen platform or merchant.

Investment in cybersecurity infrastructure should be a top priority for all market participants as digital payment adoption increases exposure to cyber threats. Advanced fraud detection systems utilizing artificial intelligence and machine learning can provide competitive advantages while building consumer trust. Security certification and compliance with international standards will become key differentiators in the market.

Rural market penetration strategies should focus on simplified user interfaces, offline payment capabilities, and partnerships with local businesses and community organizations. Financial literacy programs combined with payment solution deployment can accelerate adoption among underserved populations while contributing to national financial inclusion objectives.

Cross-border payment capabilities should be developed to capitalize on Malaysia’s strategic position within ASEAN and growing international trade volumes. Multi-currency support and competitive exchange rates can attract both business and consumer users seeking international payment solutions. Regulatory compliance across multiple jurisdictions will be essential for successful cross-border expansion.

Data analytics capabilities should be enhanced to provide value-added services beyond basic payment processing. Merchant analytics, consumer insights, and predictive modeling can create additional revenue streams while strengthening customer relationships. Privacy protection and transparent data usage policies will be crucial for maintaining user trust.

Malaysia’s payment market is positioned for continued robust growth driven by ongoing digitalization initiatives, technological advancement, and evolving consumer preferences. Market maturation will likely result in consolidation among smaller players while creating opportunities for specialized payment solutions serving niche markets or specific industry verticals.

Central Bank Digital Currency implementation could revolutionize payment infrastructure within the next five years, creating new business models and competitive dynamics. CBDC adoption may accelerate financial inclusion while enabling more efficient monetary policy transmission and reduced payment system costs. MWR projections suggest that CBDC integration could increase overall payment system efficiency by 35% over the medium term.

Artificial intelligence integration will become increasingly sophisticated, enabling personalized payment experiences, predictive fraud prevention, and automated financial management services. Machine learning algorithms will optimize payment routing, reduce transaction failures, and enhance user experience through intelligent payment recommendations and automated bill management.

Regional payment integration through ASEAN initiatives will create opportunities for Malaysian payment providers to expand internationally while attracting foreign investment in domestic payment infrastructure. Cross-border interoperability improvements will support trade growth and tourism recovery while positioning Malaysia as a regional payment hub.

Sustainability considerations will increasingly influence payment system design and operation, with carbon-neutral payment processing and environmentally conscious business practices becoming competitive differentiators. Green finance integration with payment platforms may create new market segments focused on sustainable consumption and investment.

Malaysia’s payment market represents one of Southeast Asia’s most dynamic and promising financial technology ecosystems, characterized by strong government support, progressive regulation, and rapid consumer adoption of digital payment solutions. The market has successfully balanced innovation with security, creating an environment where traditional financial institutions and fintech disruptors can collaborate to serve diverse consumer and business needs.

Key success factors include Malaysia’s strategic position as a regional financial hub, comprehensive telecommunications infrastructure, and supportive regulatory framework that encourages innovation while maintaining consumer protection. The market benefits from high smartphone penetration, growing e-commerce adoption, and government digitalization initiatives that create substantial demand for advanced payment solutions.

Future growth prospects remain highly positive, with emerging technologies such as central bank digital currencies, artificial intelligence, and blockchain solutions expected to drive continued market evolution. Cross-border payment opportunities through regional integration initiatives will further enhance Malaysia’s position as a payment hub serving both domestic and international markets.

Market participants who prioritize user experience, security, interoperability, and financial inclusion will be best positioned to capture growth opportunities in this rapidly evolving landscape. The Malaysia payment market continues to demonstrate that thoughtful regulation, technological innovation, and consumer-centric design can create thriving digital payment ecosystems that serve as models for regional development.

What is Malaysia Payment?

Malaysia Payment refers to the various methods and systems used for financial transactions in Malaysia, including digital wallets, credit cards, and bank transfers.

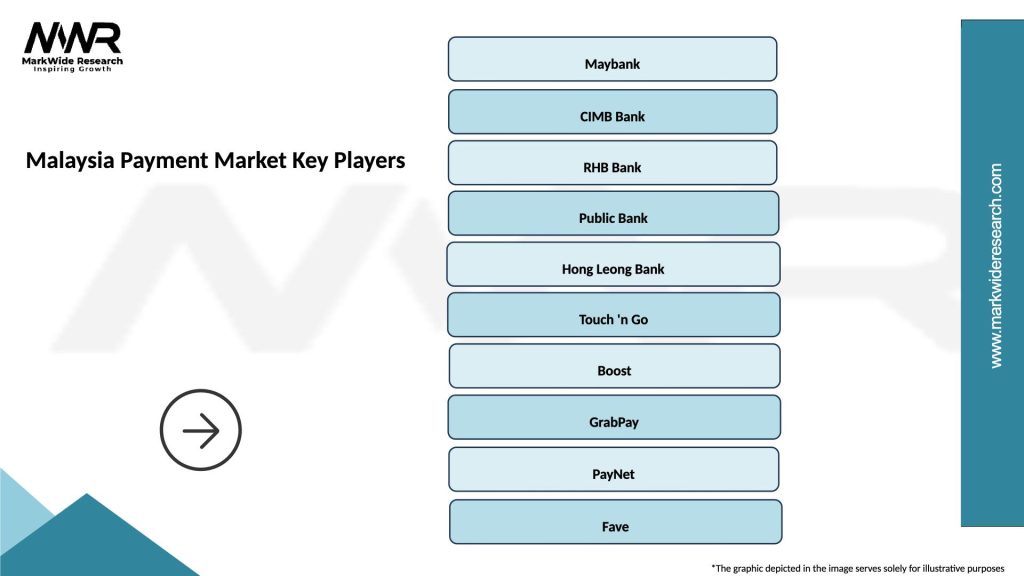

What are the key players in the Malaysia Payment Market?

Key players in the Malaysia Payment Market include companies like Touch ‘n Go, GrabPay, and Maybank, which offer a range of payment solutions and services to consumers and businesses, among others.

What are the growth factors driving the Malaysia Payment Market?

The Malaysia Payment Market is driven by factors such as the increasing adoption of digital payment methods, the rise of e-commerce, and government initiatives promoting cashless transactions.

What challenges does the Malaysia Payment Market face?

Challenges in the Malaysia Payment Market include cybersecurity threats, regulatory compliance issues, and the need for consumer education on digital payment security.

What opportunities exist in the Malaysia Payment Market?

Opportunities in the Malaysia Payment Market include the expansion of mobile payment solutions, the integration of blockchain technology, and the growing demand for contactless payment options.

What trends are shaping the Malaysia Payment Market?

Trends in the Malaysia Payment Market include the increasing use of QR code payments, the rise of fintech startups, and the growing popularity of loyalty programs linked to payment methods.

Malaysia Payment Market

| Segmentation Details | Description |

|---|---|

| Payment Method | Credit Card, Debit Card, E-Wallet, Bank Transfer |

| Customer Type | Retail Consumers, Small Businesses, Corporates, E-Commerce |

| Transaction Type | Online Payments, In-Store Payments, Recurring Payments, Peer-to-Peer Transfers |

| Technology | Contactless, QR Code, Mobile Payment, Blockchain |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Malaysia Payment Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at