444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The United States washing machines market represents a cornerstone of the American home appliance industry, demonstrating remarkable resilience and continuous innovation. This dynamic sector encompasses traditional top-loading and front-loading washing machines, high-efficiency models, smart connected appliances, and commercial-grade units serving diverse consumer segments across the nation.

Market dynamics indicate robust growth driven by technological advancement, energy efficiency mandates, and evolving consumer preferences toward smart home integration. The market experiences steady demand replacement cycles, with American households typically replacing washing machines every 10-12 years, creating consistent market opportunities for manufacturers and retailers.

Consumer behavior patterns reveal increasing preference for energy-efficient models, with Energy Star certified units capturing significant market share. The integration of Internet of Things (IoT) technology has transformed traditional washing machines into connected appliances, enabling remote monitoring, predictive maintenance, and customized washing cycles through smartphone applications.

Regional distribution shows concentrated demand in suburban and urban areas, with the South and West regions accounting for approximately 55% of total market demand. New construction activities, housing market recovery, and demographic shifts toward millennials entering homeownership contribute to sustained market expansion.

The United States washing machines market refers to the comprehensive ecosystem encompassing the manufacturing, distribution, sales, and servicing of residential and commercial washing appliances within American borders. This market includes various washing machine types, from basic top-loading models to sophisticated front-loading units with advanced features.

Market scope extends beyond simple appliance sales to include related services such as installation, maintenance, extended warranties, and recycling programs. The market serves diverse consumer segments including individual households, multi-family residential complexes, laundromats, hospitality establishments, and healthcare facilities requiring specialized washing solutions.

Technology integration has expanded the market definition to include smart washing machines equipped with Wi-Fi connectivity, mobile app controls, artificial intelligence for load optimization, and integration with home automation systems. These innovations represent the evolution from traditional mechanical appliances to sophisticated home management tools.

Market performance demonstrates consistent growth trajectory supported by replacement demand, new household formation, and technological innovation. The American washing machine industry benefits from strong domestic manufacturing capabilities, established distribution networks, and consumer preference for reliable, feature-rich appliances.

Key growth drivers include increasing focus on energy efficiency, with high-efficiency models experiencing 8.2% annual growth as consumers seek to reduce utility costs and environmental impact. Smart washing machine adoption accelerates rapidly, driven by younger demographics embracing connected home technologies and convenience features.

Competitive landscape features established American brands competing alongside international manufacturers, creating diverse product offerings across price segments. Premium segment growth outpaces basic models, indicating consumer willingness to invest in advanced features, durability, and brand reputation.

Market challenges include supply chain disruptions, raw material cost fluctuations, and increasing regulatory requirements for energy efficiency and environmental compliance. However, these challenges drive innovation and market differentiation opportunities for forward-thinking manufacturers.

Consumer preferences reveal significant shifts toward larger capacity machines, with 4.5+ cubic feet models representing the fastest-growing segment. American households increasingly value time-saving features, leading to demand for shorter wash cycles without compromising cleaning performance.

Regional variations show distinct preferences, with Western states favoring water-efficient models due to drought concerns, while Southern markets emphasize large capacity units for family households. Urban areas demonstrate higher adoption rates for compact, stackable units suitable for apartment living.

Technological advancement serves as the primary market driver, with manufacturers continuously introducing innovative features such as steam cleaning, allergen removal cycles, and smartphone connectivity. These technological improvements enhance user experience while addressing specific consumer needs for convenience and performance.

Energy efficiency regulations mandate higher performance standards, driving replacement of older, less efficient models. Federal and state energy efficiency programs provide rebates and incentives for consumers purchasing Energy Star certified appliances, accelerating market adoption of advanced models.

Housing market recovery generates substantial demand through new construction and home renovation projects. Millennials entering peak homebuying years represent a significant demographic driving market growth, with preferences for modern, efficient appliances integrated into smart home ecosystems.

Environmental consciousness influences purchasing decisions, with consumers increasingly selecting washing machines that reduce water consumption, energy usage, and environmental impact. Manufacturers respond with eco-friendly features including cold-water washing capabilities and biodegradable detergent compatibility.

Lifestyle changes accelerated by remote work trends increase home appliance usage, driving demand for durable, high-performance washing machines capable of handling increased laundry loads. Consumers invest in premium models offering reliability and advanced features for enhanced home management.

Economic uncertainty impacts consumer spending on major appliances, with households delaying replacement purchases during economic downturns. Price sensitivity increases during challenging economic periods, affecting premium segment sales and overall market growth rates.

Supply chain disruptions create manufacturing challenges, component shortages, and delivery delays that impact market availability and pricing. Global semiconductor shortages particularly affect smart washing machine production, limiting growth in the connected appliance segment.

Raw material costs fluctuate significantly, affecting manufacturing expenses and retail pricing. Steel, plastic, and electronic component price volatility creates margin pressure for manufacturers and potential price increases for consumers.

Regulatory compliance costs increase as energy efficiency standards become more stringent. Manufacturers invest substantially in research and development to meet evolving regulations, potentially impacting product pricing and market accessibility for budget-conscious consumers.

Market saturation in certain segments limits growth opportunities, particularly in mature markets with high appliance penetration rates. Extended product lifecycles mean consumers replace washing machines less frequently, creating longer replacement cycles and reduced market velocity.

Smart home integration presents significant growth opportunities as consumers embrace connected living solutions. Washing machines equipped with artificial intelligence, predictive maintenance capabilities, and integration with home automation systems appeal to tech-savvy consumers seeking convenience and efficiency.

Sustainability focus creates opportunities for manufacturers developing ultra-efficient models that exceed current standards. Water-saving technologies, renewable energy compatibility, and recyclable materials appeal to environmentally conscious consumers willing to pay premium prices for sustainable solutions.

Commercial market expansion offers growth potential in hospitality, healthcare, and multi-family residential sectors. Specialized washing machines designed for commercial applications, including larger capacities and enhanced durability, address specific industry requirements.

Service market development provides revenue opportunities beyond initial appliance sales. Extended warranties, maintenance services, smart diagnostics, and subscription-based service models create recurring revenue streams and strengthen customer relationships.

Demographic shifts toward urbanization create demand for compact, space-efficient washing machines suitable for apartment living. Stackable units, combination washer-dryers, and portable models address urban housing constraints while maintaining performance standards.

Competitive intensity drives continuous innovation and product differentiation strategies among major manufacturers. Companies invest heavily in research and development to introduce unique features, improve energy efficiency, and enhance user experience through advanced technology integration.

Consumer behavior evolution influences market dynamics as buyers become more informed and selective. Online research, product reviews, and energy efficiency ratings significantly impact purchasing decisions, requiring manufacturers to maintain strong digital presence and reputation management.

Distribution channel transformation reflects changing retail landscapes, with e-commerce gaining market share alongside traditional appliance retailers. Omnichannel strategies become essential for manufacturers and retailers to reach diverse consumer segments effectively.

Price competition intensifies across all market segments, with manufacturers balancing feature innovation against cost considerations. Value engineering and manufacturing efficiency improvements help maintain competitive pricing while preserving profit margins.

Regulatory environment continues evolving with stricter energy efficiency standards and environmental regulations. Manufacturers must anticipate regulatory changes and invest in compliant technologies to maintain market access and competitive positioning.

Primary research encompasses comprehensive surveys of consumers, retailers, and industry professionals to gather firsthand insights into market trends, preferences, and challenges. In-depth interviews with key stakeholders provide qualitative understanding of market dynamics and future outlook.

Secondary research involves analysis of industry reports, government statistics, trade publications, and company financial statements to establish market baselines and identify growth patterns. Historical data analysis reveals cyclical trends and seasonal variations affecting market performance.

Market modeling utilizes statistical analysis and forecasting techniques to project future market scenarios based on current trends and driving factors. Econometric models incorporate macroeconomic indicators, demographic changes, and technology adoption rates to predict market evolution.

Data validation ensures research accuracy through triangulation of multiple data sources and expert verification. Industry specialists review findings to confirm market insights and validate projections against real-world observations and experience.

Continuous monitoring tracks market developments, competitive activities, and regulatory changes to maintain current and relevant market intelligence. Regular updates incorporate new data and emerging trends to provide accurate market representation.

Northeast region demonstrates strong preference for energy-efficient models driven by high utility costs and environmental awareness. Urban markets in New York, Boston, and Philadelphia favor compact, stackable units suitable for apartment living, while suburban areas prefer larger capacity models.

Southeast markets show robust growth driven by population migration, new construction, and economic development. Florida, Texas, and North Carolina lead regional demand with approximately 28% of national market share, reflecting demographic trends and housing market strength.

Midwest region maintains steady demand with emphasis on durability and value. Traditional preferences for top-loading machines gradually shift toward front-loading models as consumers recognize efficiency benefits and performance advantages.

Western states prioritize water efficiency due to drought concerns and environmental regulations. California leads innovation adoption with smart washing machines and ultra-efficient models gaining 18% market share compared to 12% nationally.

Mountain states experience rapid growth driven by population influx and new home construction. Energy efficiency becomes increasingly important as utility costs rise and environmental consciousness grows among residents.

Market leadership remains concentrated among established manufacturers with strong brand recognition, extensive distribution networks, and comprehensive product portfolios spanning multiple price segments and feature categories.

Competitive strategies emphasize product differentiation through advanced features, energy efficiency improvements, and smart technology integration. Manufacturers invest in marketing campaigns highlighting unique selling propositions and building brand loyalty among target demographics.

Market consolidation continues as larger manufacturers acquire smaller brands and technologies to expand capabilities and market reach. Strategic partnerships with technology companies enable rapid development of smart appliance features and connectivity solutions.

By Product Type:

By Technology Level:

By Capacity Range:

Energy Efficiency Category dominates market growth with Energy Star certified models representing the fastest-expanding segment. Consumers increasingly prioritize long-term operating cost savings over initial purchase price, driving demand for high-efficiency units that reduce water and energy consumption.

Smart Technology Integration transforms traditional appliances into connected home management tools. Features including remote monitoring, predictive maintenance alerts, and customized wash cycles through smartphone applications appeal to tech-savvy consumers seeking convenience and control.

Capacity Expansion reflects changing household needs and lifestyle preferences. Larger capacity machines accommodate bulky items, reduce wash frequency, and provide convenience for busy families. The trend toward 4.5+ cubic feet models continues accelerating across all price segments.

Premium Features gain traction as consumers invest in appliances offering superior performance and durability. Steam cleaning, allergen removal cycles, and advanced fabric care technologies justify higher prices for quality-conscious buyers seeking long-term value.

Commercial Applications maintain steady growth driven by hospitality industry recovery, healthcare facility expansion, and multi-family residential development. Specialized features including larger capacities, enhanced durability, and commercial-grade components address specific industry requirements.

Manufacturers benefit from consistent replacement demand cycles, technological innovation opportunities, and expanding market segments. Smart appliance development creates new revenue streams through connected services and data analytics capabilities.

Retailers enjoy stable product categories with predictable demand patterns and opportunities for value-added services including installation, extended warranties, and maintenance programs. E-commerce growth expands market reach beyond traditional geographic limitations.

Consumers gain access to increasingly efficient, feature-rich appliances that reduce operating costs while improving convenience and performance. Smart technology integration enables better home management and predictive maintenance capabilities.

Service providers benefit from growing complexity of modern washing machines requiring specialized maintenance and repair expertise. Smart diagnostics and remote monitoring create new service delivery models and revenue opportunities.

Technology companies find partnership opportunities with appliance manufacturers seeking to integrate connectivity, artificial intelligence, and smart home compatibility into traditional products.

Strengths:

Weaknesses:

Opportunities:

Threats:

Smart Connectivity emerges as the dominant trend transforming traditional washing machines into intelligent appliances capable of remote monitoring, predictive maintenance, and integration with home automation systems. Wi-Fi enabled models allow users to start, monitor, and receive notifications about wash cycles through smartphone applications.

Sustainability Integration drives development of ultra-efficient models that exceed current Energy Star standards. Manufacturers focus on reducing water consumption, energy usage, and environmental impact through innovative technologies including cold-water washing capabilities and eco-friendly materials.

Capacity Optimization reflects consumer preference for larger machines that accommodate bulky items and reduce wash frequency. The trend toward 5.0+ cubic feet models continues across price segments as households prioritize convenience and time savings.

Premium Feature Adoption accelerates as consumers invest in advanced capabilities including steam cleaning, allergen removal, and specialized fabric care cycles. These features justify higher prices while providing superior cleaning performance and fabric protection.

Voice Control Integration gains momentum with compatibility for Amazon Alexa and Google Assistant, enabling hands-free operation and integration with smart home ecosystems. Voice commands for starting cycles, checking status, and receiving maintenance alerts enhance user convenience.

Technology Partnerships between appliance manufacturers and technology companies accelerate smart feature development. Collaborations focus on artificial intelligence integration, predictive analytics, and enhanced connectivity capabilities that differentiate products in competitive markets.

Manufacturing Investments in domestic production facilities demonstrate commitment to American manufacturing while reducing supply chain dependencies. Companies invest in automation and advanced manufacturing technologies to improve efficiency and quality control.

Sustainability Initiatives include development of washing machines using recycled materials, renewable energy compatibility, and end-of-life recycling programs. MarkWide Research indicates that environmental considerations increasingly influence consumer purchasing decisions across all demographic segments.

Retail Channel Evolution reflects changing consumer shopping preferences with expanded e-commerce capabilities, virtual showrooms, and augmented reality tools for product visualization. Omnichannel strategies become essential for reaching diverse consumer segments effectively.

Service Innovation introduces subscription-based maintenance programs, predictive repair services, and extended warranty options that create recurring revenue streams while enhancing customer satisfaction and loyalty.

Innovation Investment remains critical for manufacturers seeking to maintain competitive positioning in rapidly evolving markets. Companies should prioritize smart technology development, energy efficiency improvements, and unique feature differentiation to capture premium market segments.

Supply Chain Diversification becomes essential for reducing vulnerability to global disruptions and component shortages. Manufacturers should develop multiple supplier relationships and consider nearshoring strategies to improve supply chain resilience.

Consumer Education programs help buyers understand advanced features and efficiency benefits of modern washing machines. Educational initiatives can drive adoption of premium models while building brand loyalty and customer satisfaction.

Service Expansion opportunities include development of comprehensive maintenance programs, smart diagnostics, and subscription-based services that create recurring revenue streams beyond initial appliance sales.

Sustainability Leadership positions companies favorably with environmentally conscious consumers willing to pay premium prices for eco-friendly appliances. Investment in sustainable technologies and materials creates competitive advantages in growing market segments.

Market evolution toward smart, connected appliances accelerates as consumers embrace home automation and Internet of Things technologies. MarkWide Research projects that connected washing machines will achieve 35% market penetration within the next five years, driven by younger demographics and technology adoption trends.

Energy efficiency standards continue advancing, requiring manufacturers to develop increasingly efficient models that exceed current regulations. Future washing machines will likely achieve 40% greater efficiency compared to current models through advanced technologies and innovative design approaches.

Artificial intelligence integration enables washing machines to learn user preferences, optimize wash cycles automatically, and provide predictive maintenance alerts. These capabilities enhance user experience while reducing energy consumption and extending appliance lifespan.

Sustainability focus drives development of washing machines using renewable materials, offering carbon-neutral operation, and providing end-of-life recycling programs. Environmental considerations become primary purchase drivers for growing consumer segments.

Market consolidation may continue as larger manufacturers acquire innovative technologies and smaller brands to expand capabilities and market reach. Strategic partnerships with technology companies enable rapid development of advanced features and connectivity solutions.

The United States washing machines market demonstrates remarkable resilience and continuous evolution driven by technological innovation, changing consumer preferences, and sustainability requirements. Smart connectivity, energy efficiency, and premium features define the market trajectory as manufacturers compete to meet diverse consumer needs across multiple segments.

Growth opportunities abound in smart appliance development, commercial applications, and service expansion as the market transitions from traditional mechanical appliances to intelligent home management tools. Manufacturers investing in innovation, sustainability, and consumer education position themselves favorably for long-term success.

Market challenges including supply chain disruptions, regulatory compliance, and economic uncertainty require strategic planning and operational flexibility. However, these challenges also create opportunities for differentiation and competitive advantage for forward-thinking companies.

Future success depends on balancing innovation with affordability, sustainability with performance, and technology advancement with reliability. The American washing machine market continues evolving to meet changing household needs while maintaining the quality and durability expectations that define this essential appliance category.

What is Washing Machines?

Washing machines are household appliances designed to wash laundry, including clothes, linens, and other textiles. They come in various types, such as front-loading and top-loading, and are essential for modern laundry practices.

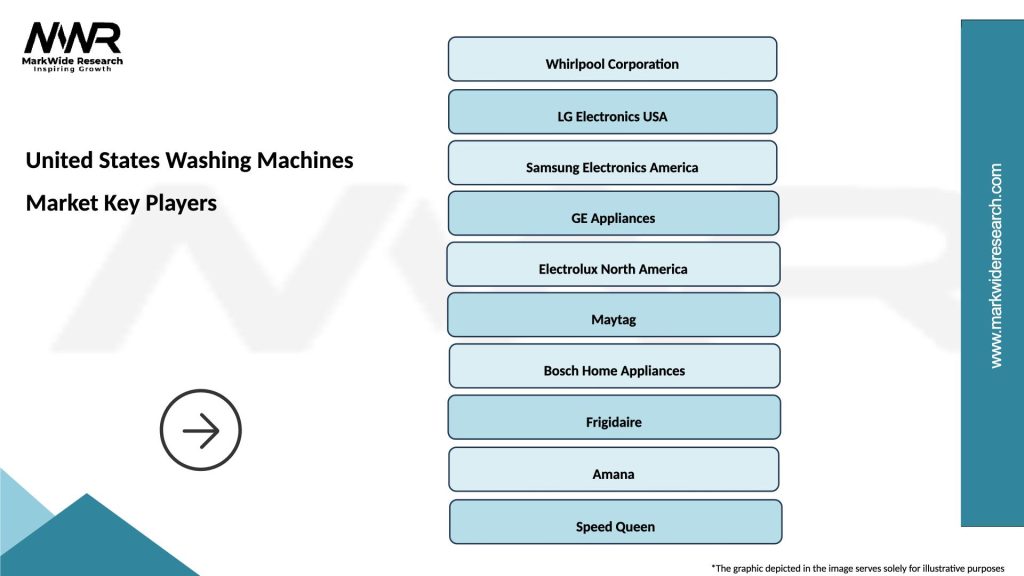

What are the key players in the United States Washing Machines Market?

Key players in the United States Washing Machines Market include Whirlpool Corporation, LG Electronics, Samsung Electronics, and Electrolux, among others. These companies are known for their innovative designs and energy-efficient models.

What are the main drivers of growth in the United States Washing Machines Market?

The main drivers of growth in the United States Washing Machines Market include increasing consumer demand for energy-efficient appliances, advancements in washing technology, and a growing trend towards smart home integration.

What challenges does the United States Washing Machines Market face?

The United States Washing Machines Market faces challenges such as intense competition among manufacturers, fluctuating raw material prices, and changing consumer preferences towards more sustainable products.

What opportunities exist in the United States Washing Machines Market?

Opportunities in the United States Washing Machines Market include the rising demand for smart washing machines, the potential for eco-friendly models, and the expansion of online retail channels for better consumer access.

What trends are shaping the United States Washing Machines Market?

Trends shaping the United States Washing Machines Market include the increasing popularity of smart appliances, the integration of IoT technology for remote operation, and a focus on sustainability with water and energy-saving features.

United States Washing Machines Market

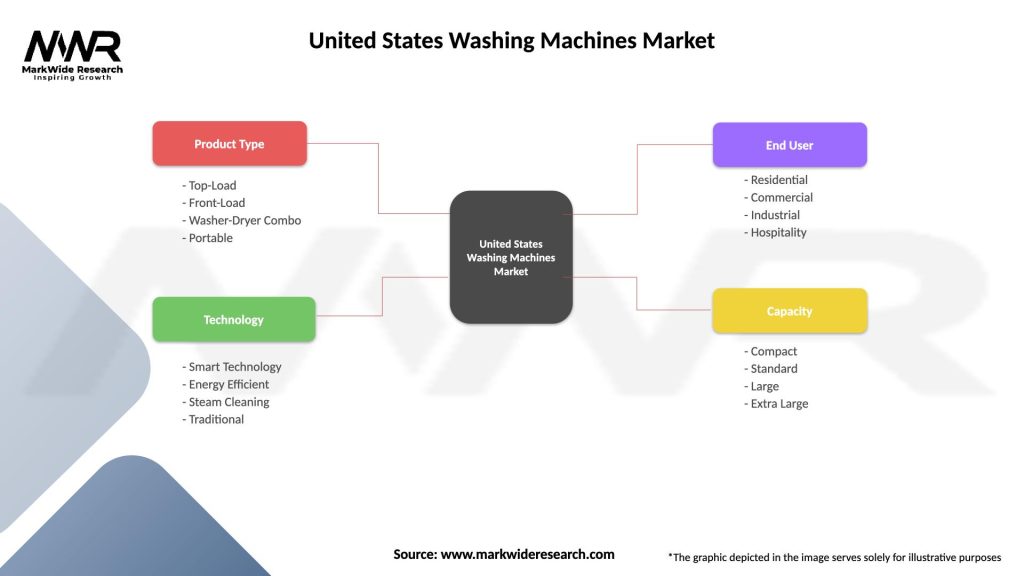

| Segmentation Details | Description |

|---|---|

| Product Type | Top-Load, Front-Load, Washer-Dryer Combo, Portable |

| Technology | Smart Technology, Energy Efficient, Steam Cleaning, Traditional |

| End User | Residential, Commercial, Industrial, Hospitality |

| Capacity | Compact, Standard, Large, Extra Large |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the United States Washing Machines Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at