444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Germany e-brokerage market represents a dynamic and rapidly evolving segment of the European financial services landscape, characterized by technological innovation and increasing digital adoption among retail investors. Digital transformation has fundamentally reshaped how German investors access financial markets, with online brokerage platforms experiencing unprecedented growth in user engagement and trading volumes. The market demonstrates robust expansion driven by demographic shifts, regulatory modernization, and the proliferation of mobile trading applications that cater to both seasoned investors and newcomers to financial markets.

Market dynamics indicate that Germany’s e-brokerage sector is experiencing significant momentum, with trading activity growing at a compound annual growth rate of 12.3% over recent years. This growth trajectory reflects the increasing confidence of German retail investors in digital platforms, supported by enhanced security measures, improved user interfaces, and comprehensive educational resources. The market encompasses traditional online brokers, neo-brokers, and hybrid platforms that combine digital convenience with personalized advisory services.

Technological advancement continues to drive market evolution, with artificial intelligence, algorithmic trading tools, and real-time analytics becoming standard features across leading platforms. German investors increasingly demand sophisticated trading capabilities, multi-asset access, and competitive fee structures that traditional brick-and-mortar brokerages struggle to match. The integration of robo-advisory services and automated portfolio management tools has further expanded the market’s appeal to younger demographics and tech-savvy investors seeking efficient wealth management solutions.

The Germany e-brokerage market refers to the comprehensive ecosystem of digital platforms and online services that enable German retail and institutional investors to execute securities transactions, manage portfolios, and access financial markets through internet-based interfaces and mobile applications, encompassing traditional online brokers, commission-free platforms, and technology-driven investment services.

E-brokerage platforms in Germany facilitate trading across multiple asset classes including equities, bonds, exchange-traded funds, derivatives, cryptocurrencies, and international securities. These platforms provide investors with direct market access, real-time pricing information, research tools, and portfolio management capabilities without requiring physical branch visits or telephone-based transactions. The market includes established financial institutions that have digitized their brokerage operations alongside innovative fintech companies that operate exclusively in the digital realm.

Modern e-brokerage services extend beyond simple trade execution to encompass comprehensive wealth management solutions, educational resources, social trading features, and automated investment strategies. German platforms increasingly offer multi-language support, regulatory compliance tools, tax optimization features, and integration with banking services to provide holistic financial management experiences for diverse investor segments.

Germany’s e-brokerage market has emerged as one of Europe’s most sophisticated and competitive digital investment landscapes, driven by strong regulatory frameworks, technological innovation, and evolving investor preferences toward self-directed trading. The market demonstrates remarkable resilience and growth potential, with digital adoption rates among German investors reaching 78% penetration across various demographic segments. This transformation reflects broader trends in financial digitalization and the increasing democratization of investment access.

Key market characteristics include intense competition among established players and emerging fintech disruptors, leading to compressed fee structures and enhanced service offerings. German investors benefit from a diverse ecosystem of platforms ranging from full-service online brokers to commission-free neo-brokers that have revolutionized cost structures. The market’s maturity is evidenced by sophisticated regulatory compliance, robust investor protection measures, and comprehensive market access spanning domestic and international securities.

Strategic developments within the market focus on mobile-first experiences, artificial intelligence integration, and personalized investment solutions that cater to individual risk profiles and investment objectives. The emergence of social trading platforms and copy-trading features has attracted younger investors, while traditional platforms have enhanced their digital capabilities to retain existing client bases and attract new segments.

Market intelligence reveals several critical insights that define Germany’s e-brokerage landscape and its future trajectory:

Technological advancement serves as the primary catalyst driving Germany’s e-brokerage market expansion, with cloud computing, mobile applications, and real-time data processing capabilities enabling sophisticated trading experiences previously available only to institutional investors. The proliferation of high-speed internet infrastructure and smartphone penetration has created an environment where retail investors can access professional-grade trading tools and market information instantaneously.

Demographic shifts significantly influence market growth, as millennials and Generation Z investors demonstrate strong preferences for digital-first financial services. These younger demographics value transparency, low costs, and user-friendly interfaces over traditional relationship-based brokerage models. Their comfort with technology and expectation of immediate access to information and services drives continuous innovation in platform design and functionality.

Regulatory modernization has created a more competitive and transparent market environment, with European regulations promoting investor protection while enabling innovative service delivery models. The implementation of open banking initiatives and PSD2 regulations has facilitated seamless integration between brokerage platforms and banking services, enhancing user convenience and operational efficiency.

Cost consciousness among German investors has intensified demand for low-cost trading solutions, particularly following the introduction of commission-free trading models by neo-brokers. This trend has forced traditional brokers to reevaluate their fee structures and value propositions, leading to increased competition and improved services across the market.

Regulatory complexity presents ongoing challenges for e-brokerage platforms operating in Germany, with stringent compliance requirements, reporting obligations, and investor protection measures creating significant operational overhead. The need to navigate multiple regulatory frameworks, particularly for platforms offering international market access, requires substantial investment in legal expertise and compliance infrastructure.

Cybersecurity concerns remain a persistent restraint, as the increasing sophistication of cyber threats poses risks to platform security and investor confidence. German investors demonstrate heightened sensitivity to data protection and financial security, requiring platforms to invest heavily in cybersecurity measures, insurance coverage, and incident response capabilities.

Market volatility and economic uncertainty can negatively impact trading volumes and investor confidence, particularly during periods of financial stress or geopolitical tension. While volatility can increase trading activity in the short term, sustained market downturns may lead to reduced investor participation and platform revenue compression.

Traditional banking relationships continue to influence investor behavior, with some German investors preferring established financial institutions over newer fintech platforms. This preference for traditional providers can limit market share growth for innovative platforms, particularly among older demographic segments who value personal relationships and established brand recognition.

Artificial intelligence integration presents substantial opportunities for e-brokerage platforms to differentiate their offerings through personalized investment recommendations, automated portfolio optimization, and predictive analytics. German investors show increasing interest in AI-powered tools that can enhance decision-making processes and improve investment outcomes while maintaining transparency and user control.

Sustainable investing represents a rapidly growing opportunity, with German investors demonstrating strong interest in ESG-focused investment products and platforms that provide comprehensive sustainability metrics. The integration of environmental, social, and governance factors into investment decision-making tools can attract environmentally conscious investors and align with broader societal trends.

International market expansion offers significant growth potential, as German investors seek access to global markets and alternative investment opportunities. Platforms that can provide seamless access to international exchanges, foreign currencies, and emerging market securities can capture market share from investors seeking portfolio diversification.

Financial education initiatives create opportunities for platforms to build long-term relationships with investors while contributing to financial literacy improvement. Comprehensive educational programs, webinars, and interactive learning tools can enhance user engagement and platform loyalty while attracting novice investors to the market.

Competitive intensity within Germany’s e-brokerage market has reached unprecedented levels, with traditional banks, established online brokers, and innovative fintech companies competing for market share through aggressive pricing strategies and feature differentiation. This competition has resulted in significant benefits for German investors, including reduced trading costs, enhanced platform functionality, and improved customer service standards.

Technology evolution continues to reshape market dynamics, with platforms investing heavily in mobile optimization, user experience design, and advanced trading tools. The integration of social trading features, copy-trading capabilities, and community-driven investment insights has created new engagement models that appeal to younger investors while challenging traditional brokerage approaches.

Regulatory adaptation influences market dynamics through ongoing changes in compliance requirements, investor protection measures, and cross-border trading regulations. Platforms must continuously adapt their operations to meet evolving regulatory standards while maintaining competitive positioning and operational efficiency.

Market consolidation trends are emerging as smaller platforms face pressure from regulatory compliance costs and competitive pricing pressures. Strategic partnerships, acquisitions, and technology sharing agreements are becoming more common as companies seek to achieve scale economies and enhance their competitive positions.

Comprehensive market analysis was conducted through multi-source data collection and validation processes, incorporating primary research through industry expert interviews, platform user surveys, and regulatory authority consultations. The research methodology employed both quantitative and qualitative approaches to ensure accurate representation of market conditions and future trends.

Primary research activities included structured interviews with e-brokerage platform executives, technology providers, regulatory experts, and active retail investors across different demographic segments. Survey data was collected from over 2,500 German investors to understand usage patterns, platform preferences, and investment behavior trends.

Secondary research encompassed analysis of regulatory filings, industry reports, financial statements, and market data from leading platforms and industry associations. Competitive analysis was conducted through platform feature comparison, pricing analysis, and user experience evaluation across major market participants.

Data validation processes included cross-referencing multiple sources, expert review panels, and statistical verification of key findings. Market projections were developed using econometric modeling techniques that incorporate historical trends, regulatory changes, and demographic shifts to provide reliable forecasting insights.

Geographic distribution within Germany’s e-brokerage market reveals significant concentration in major metropolitan areas, with Berlin, Munich, and Frankfurt accounting for approximately 45% of total platform users. These urban centers demonstrate higher adoption rates due to younger demographics, higher income levels, and greater technology penetration. The concentration reflects broader patterns of financial services adoption and digital literacy across German regions.

Northern German states including Hamburg, Bremen, and Schleswig-Holstein show strong growth in e-brokerage adoption, driven by maritime industry wealth and progressive attitudes toward financial technology. The region’s proximity to Scandinavian markets and international trade connections contribute to investor interest in global market access and currency diversification strategies.

Southern Germany demonstrates robust market development, particularly in Bavaria and Baden-Württemberg, where strong industrial economies and high disposable incomes support active retail investment participation. The presence of major corporations and technology companies in these regions creates investor populations with sophisticated financial knowledge and higher risk tolerance.

Eastern German regions represent emerging opportunities for e-brokerage platforms, with growing middle-class populations and increasing financial market participation. While adoption rates remain below national averages, the potential for growth is substantial as economic development continues and digital infrastructure improves across these areas.

Market leadership in Germany’s e-brokerage sector is distributed among several categories of providers, each with distinct competitive advantages and target market segments:

Competitive differentiation strategies focus on pricing innovation, technology advancement, and specialized service offerings. Neo-brokers emphasize simplicity and cost efficiency, while established players leverage comprehensive service portfolios and regulatory expertise to maintain market positions.

By Platform Type:

By Investor Type:

By Asset Class:

Equity trading platforms dominate the German e-brokerage market, with domestic and international stock trading representing the largest segment by transaction volume and user engagement. German investors demonstrate strong preference for DAX-listed securities while increasingly seeking access to U.S. and Asian markets for portfolio diversification. Platform providers focus on reducing latency, improving execution quality, and offering comprehensive market data to serve this segment effectively.

ETF trading has experienced remarkable growth, with passive investment strategies gaining 32% adoption rate among German retail investors over recent years. The popularity of low-cost index investing has driven platform providers to offer extensive ETF selections, automated savings plans, and portfolio construction tools that simplify passive investment implementation.

Cryptocurrency trading represents an emerging category with significant growth potential, as German regulatory clarity improves and investor interest in digital assets increases. Platforms integrating cryptocurrency trading capabilities alongside traditional securities access can capture market share from investors seeking comprehensive asset class exposure within single platforms.

Robo-advisory services appeal to investors seeking professional portfolio management without traditional advisory fees, with automated rebalancing and tax-loss harvesting features providing additional value propositions. The integration of ESG investing criteria and personalized risk assessment tools enhances the appeal of these services among younger investors.

For Retail Investors:

For Platform Providers:

For Regulatory Authorities:

Strengths:

Weaknesses:

Opportunities:

Threats:

Mobile-first platform design has become the dominant trend in Germany’s e-brokerage market, with platforms prioritizing smartphone and tablet optimization to meet evolving user expectations. Mobile trading activity now represents 68% of total transactions across leading platforms, driving continuous investment in app development and user experience enhancement. This trend reflects broader consumer behavior shifts toward mobile-centric financial services consumption.

Social trading integration represents an emerging trend that combines investment execution with social networking features, allowing investors to follow successful traders, share investment strategies, and participate in community-driven investment discussions. German platforms increasingly incorporate these features to attract younger investors and enhance user engagement through gamification and social interaction elements.

Artificial intelligence adoption continues accelerating across the market, with platforms implementing AI-powered features for personalized investment recommendations, risk assessment, and automated portfolio optimization. Machine learning algorithms analyze user behavior patterns, market conditions, and investment outcomes to provide increasingly sophisticated advisory services without human intervention.

Sustainable investing focus has gained significant momentum, with platforms developing comprehensive ESG screening tools, sustainability scoring systems, and specialized green investment products. German investors demonstrate strong interest in aligning investment decisions with environmental and social values, driving platform providers to integrate sustainability metrics into their core offerings.

Regulatory evolution continues shaping the German e-brokerage landscape, with recent implementations of enhanced investor protection measures and transparency requirements affecting platform operations. The introduction of MiFID II regulations has improved market transparency while creating compliance challenges that favor larger, well-resourced platforms over smaller competitors.

Technology partnerships between traditional financial institutions and fintech companies are becoming increasingly common, with established banks leveraging innovative technology solutions while fintech firms gain access to regulatory expertise and customer bases. These collaborations enable rapid innovation while maintaining regulatory compliance and operational stability.

International market access expansion has accelerated, with German platforms increasingly offering direct access to U.S., Asian, and emerging market securities. This development responds to investor demand for global diversification opportunities while creating competitive differentiation through comprehensive market coverage.

Cryptocurrency integration represents a significant industry development, with traditional e-brokerage platforms beginning to offer digital asset trading capabilities alongside conventional securities. This integration reflects growing mainstream acceptance of cryptocurrencies and investor demand for comprehensive asset class access within unified platforms.

Platform differentiation should focus on specialized services and unique value propositions rather than competing solely on price, as commission compression limits profitability and sustainability. MarkWide Research analysis suggests that platforms emphasizing educational content, advanced analytics, and personalized user experiences demonstrate higher customer retention and lifetime value metrics.

Technology investment priorities should emphasize mobile optimization, artificial intelligence integration, and cybersecurity enhancement to meet evolving user expectations and regulatory requirements. Platforms that successfully balance innovation with reliability and security will capture market share from competitors struggling with technology implementation challenges.

Regulatory compliance capabilities should be viewed as competitive advantages rather than operational burdens, with platforms that excel in compliance management able to expand internationally and serve institutional clients more effectively. Investment in compliance technology and expertise creates long-term strategic value beyond immediate regulatory requirements.

Customer acquisition strategies should target younger demographics through digital marketing, social media engagement, and educational content that builds financial literacy while promoting platform adoption. Traditional advertising approaches show declining effectiveness compared to content marketing and influencer partnerships that resonate with target audiences.

Market evolution over the next five years will be characterized by continued consolidation, technology advancement, and regulatory adaptation as the German e-brokerage sector matures. Growth projections indicate sustained expansion at annual rates of 8-10%, driven primarily by demographic transitions and increasing digital adoption among traditional investor segments.

Technology integration will deepen significantly, with artificial intelligence, blockchain technology, and advanced analytics becoming standard features across leading platforms. The emergence of quantum computing applications and enhanced cybersecurity measures will further differentiate technologically advanced platforms from traditional competitors.

International expansion opportunities will increase as European regulatory harmonization progresses and German platforms leverage their domestic success to enter adjacent markets. Cross-border investment flows and pan-European platform consolidation will create larger, more competitive market participants with enhanced service capabilities.

Sustainable investing will transition from niche offering to mainstream requirement, with ESG integration becoming essential for platform competitiveness. MWR projections suggest that sustainability-focused features will influence over 60% of platform selection decisions among younger investors by 2028, fundamentally reshaping product development priorities across the industry.

Germany’s e-brokerage market stands at a pivotal juncture, characterized by intense competition, rapid technological advancement, and evolving investor expectations that continue reshaping the financial services landscape. The market’s transformation from traditional brokerage models to sophisticated digital platforms reflects broader trends in financial technology adoption and consumer behavior evolution across European markets.

Strategic success factors for market participants increasingly center on technology excellence, regulatory compliance capabilities, and customer experience optimization rather than traditional competitive advantages. Platforms that successfully integrate artificial intelligence, maintain robust cybersecurity measures, and provide comprehensive educational resources demonstrate superior performance metrics and market positioning.

Future market development will be driven by demographic transitions, regulatory evolution, and continued technology innovation that expands investment accessibility while maintaining investor protection standards. The emergence of sustainable investing requirements, international market integration, and advanced analytical capabilities will create new opportunities for platforms that adapt quickly to changing market conditions and investor preferences, positioning Germany’s e-brokerage market for continued growth and innovation leadership within the European financial services sector.

What is E-Brokerage?

E-Brokerage refers to the online platforms that facilitate the buying and selling of financial securities, such as stocks and bonds, through electronic means. These platforms provide investors with tools for trading, research, and portfolio management.

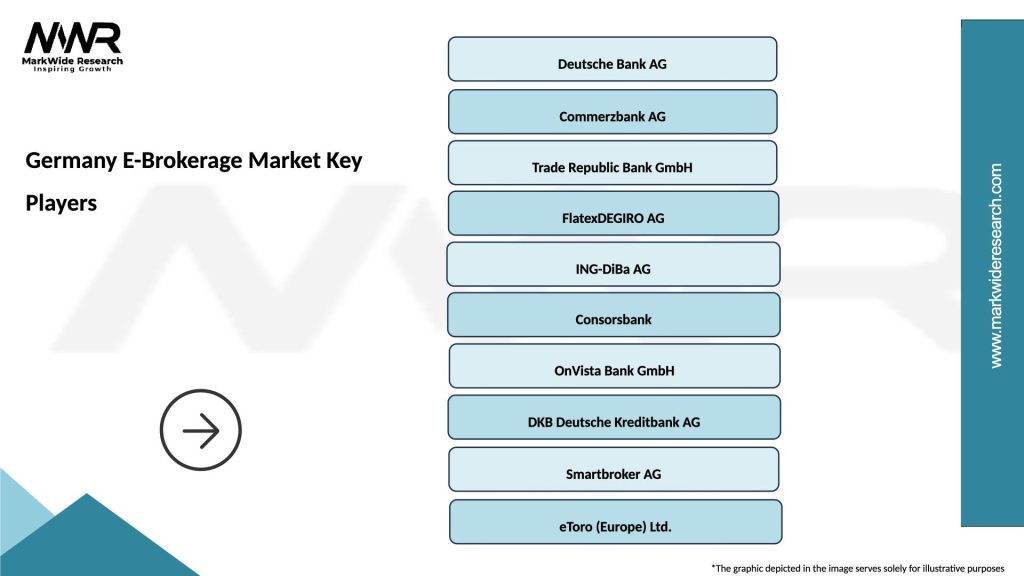

What are the key players in the Germany E-Brokerage Market?

Key players in the Germany E-Brokerage Market include companies like Deutsche Bank, Comdirect, and Flatex, which offer a range of online trading services. These firms compete on factors such as fees, user experience, and the variety of investment products available, among others.

What are the growth factors driving the Germany E-Brokerage Market?

The growth of the Germany E-Brokerage Market is driven by increasing digitalization, a rise in retail investor participation, and the demand for low-cost trading options. Additionally, advancements in technology and mobile trading applications are enhancing accessibility for users.

What challenges does the Germany E-Brokerage Market face?

The Germany E-Brokerage Market faces challenges such as regulatory compliance, cybersecurity threats, and intense competition among service providers. These factors can impact operational costs and customer trust in online trading platforms.

What opportunities exist in the Germany E-Brokerage Market?

Opportunities in the Germany E-Brokerage Market include the expansion of services to include cryptocurrencies and ESG investments, as well as the potential for partnerships with fintech companies. These trends can attract a broader range of investors seeking diverse portfolios.

What trends are shaping the Germany E-Brokerage Market?

Trends shaping the Germany E-Brokerage Market include the rise of robo-advisors, increased focus on user-friendly interfaces, and the integration of artificial intelligence for personalized trading experiences. These innovations are transforming how investors engage with financial markets.

Germany E-Brokerage Market

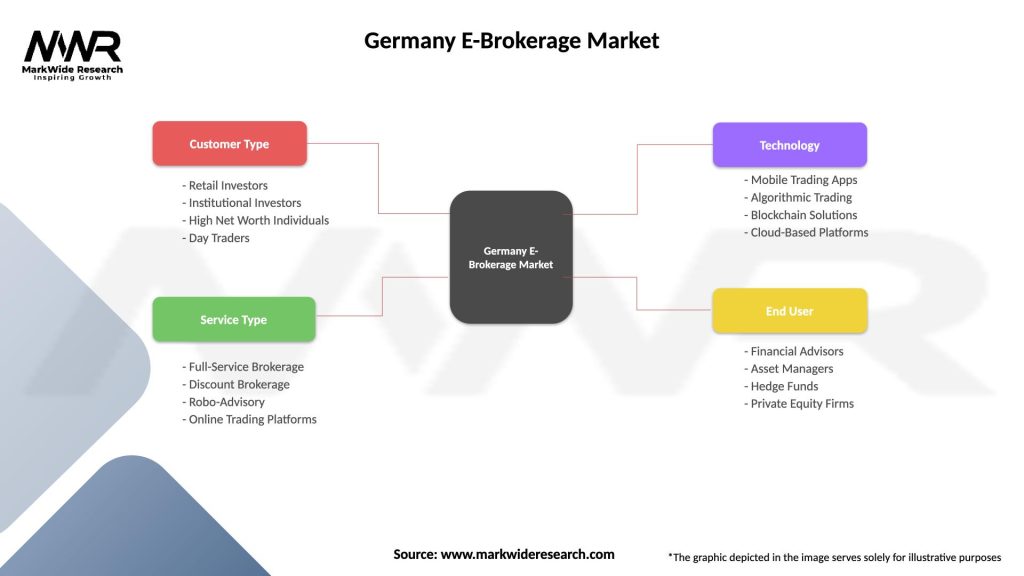

| Segmentation Details | Description |

|---|---|

| Customer Type | Retail Investors, Institutional Investors, High Net Worth Individuals, Day Traders |

| Service Type | Full-Service Brokerage, Discount Brokerage, Robo-Advisory, Online Trading Platforms |

| Technology | Mobile Trading Apps, Algorithmic Trading, Blockchain Solutions, Cloud-Based Platforms |

| End User | Financial Advisors, Asset Managers, Hedge Funds, Private Equity Firms |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Germany E-Brokerage Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at