444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Poland Courier, Express, and Parcel (CEP) market represents one of the most dynamic and rapidly evolving logistics sectors in Central Europe. This comprehensive market encompasses the transportation and delivery of packages, documents, and parcels through various service levels including same-day, next-day, and standard delivery options. Market dynamics indicate substantial growth driven by the explosive expansion of e-commerce, changing consumer expectations, and digital transformation initiatives across the country.

Poland’s strategic location within Europe positions it as a crucial logistics hub, connecting Western European markets with Eastern European economies. The market has experienced remarkable transformation over the past decade, with e-commerce penetration rates reaching approximately 78% of the adult population, significantly driving demand for reliable and efficient parcel delivery services. Urban areas particularly Warsaw, Krakow, and Gdansk have emerged as key growth centers, accounting for a substantial portion of total parcel volumes.

Technology integration has become a defining characteristic of the modern Polish CEP landscape. Companies are increasingly adopting advanced tracking systems, automated sorting facilities, and last-mile delivery innovations to meet growing consumer demands for transparency and speed. The market demonstrates strong resilience and adaptability, with delivery volumes showing consistent year-over-year growth of approximately 12-15% annually across various service categories.

The Poland Courier, Express, and Parcel (CEP) market refers to the comprehensive ecosystem of companies, services, and infrastructure dedicated to the collection, transportation, and delivery of packages, documents, and parcels throughout Poland and internationally. This market encompasses three distinct service categories: courier services for urgent, time-sensitive deliveries typically completed within hours; express services for guaranteed next-day or two-day delivery; and parcel services for standard delivery timeframes ranging from two to five business days.

Service providers within this market range from international logistics giants to local and regional carriers, each offering specialized solutions tailored to different customer segments and delivery requirements. The market includes both business-to-business (B2B) and business-to-consumer (B2C) delivery services, with increasing emphasis on consumer-focused solutions driven by e-commerce growth.

Operational infrastructure supporting the CEP market includes sorting facilities, distribution centers, transportation networks, and last-mile delivery capabilities. Modern CEP operations integrate advanced technology solutions including route optimization software, real-time tracking systems, and automated processing equipment to enhance efficiency and customer satisfaction.

Poland’s CEP market stands as a cornerstone of the country’s modern economy, facilitating commerce and connecting businesses with consumers across urban and rural areas. The market has undergone significant transformation, evolving from traditional postal services to a sophisticated network of specialized logistics providers offering diverse delivery solutions.

E-commerce expansion serves as the primary growth catalyst, with online retail sales contributing approximately 65% of total parcel volumes in the consumer segment. This digital commerce boom has fundamentally reshaped delivery expectations, with consumers increasingly demanding faster, more flexible, and cost-effective shipping options. Same-day delivery services have gained particular traction in major metropolitan areas, representing a growing segment of premium service offerings.

Market consolidation trends indicate increasing competition among established players while creating opportunities for innovative startups and technology-focused logistics companies. International carriers maintain strong market positions, while domestic players leverage local knowledge and specialized service offerings to compete effectively. Sustainability initiatives are becoming increasingly important, with companies investing in electric delivery vehicles, carbon-neutral shipping options, and environmentally conscious packaging solutions.

Future growth prospects remain robust, supported by continued e-commerce expansion, cross-border trade growth, and ongoing digital transformation across various industry sectors. The market demonstrates strong fundamentals with consistent demand growth and ongoing infrastructure investments supporting long-term expansion.

Consumer behavior patterns reveal significant shifts in delivery preferences and expectations. Modern Polish consumers prioritize convenience, speed, and transparency in their shipping experiences, driving demand for innovative delivery solutions and enhanced tracking capabilities.

E-commerce proliferation stands as the most significant driver of CEP market expansion in Poland. The rapid adoption of online shopping across all demographic segments has created unprecedented demand for reliable, efficient parcel delivery services. Digital marketplace growth including platforms like Allegro, Amazon, and various international retailers has fundamentally transformed consumer purchasing behavior and delivery expectations.

Urbanization trends contribute substantially to market growth, with increasing numbers of Polish consumers living in cities and adopting urban lifestyles that favor online shopping and home delivery services. Metropolitan areas demonstrate particularly strong growth in premium delivery services, including same-day and evening delivery options that cater to busy professional lifestyles.

Cross-border e-commerce expansion drives international shipping demand, as Polish consumers increasingly purchase from foreign retailers and Polish businesses expand their reach to international markets. EU market integration facilitates seamless cross-border commerce, creating opportunities for specialized international delivery services and customs handling capabilities.

Technology advancement enables new service offerings and operational efficiencies that drive market growth. Mobile commerce growth, improved payment systems, and enhanced logistics technology create conditions for continued market expansion and service innovation.

Consumer lifestyle changes including increased time constraints, dual-income households, and preference for convenience drive demand for flexible delivery options and value-added services. Demographic shifts toward younger, tech-savvy consumers who view online shopping as a primary retail channel support long-term market growth prospects.

Infrastructure limitations in certain regions of Poland create challenges for comprehensive market coverage and service quality consistency. Rural areas particularly face delivery challenges due to dispersed populations, limited transportation infrastructure, and higher per-delivery costs that impact service economics.

Labor shortages in the logistics sector present ongoing challenges for market expansion and service quality maintenance. Driver availability particularly affects last-mile delivery capabilities, with competition from other sectors and changing work preferences impacting recruitment and retention efforts.

Regulatory complexity surrounding cross-border deliveries, customs procedures, and varying local regulations can create operational challenges and compliance costs for CEP providers. International shipping faces particular complexity with changing trade regulations and customs requirements affecting service efficiency and costs.

Price competition intensity pressures profit margins and limits investment capacity for infrastructure improvements and service innovations. Consumer price sensitivity particularly in the standard delivery segment creates challenges for providers seeking to maintain profitability while meeting competitive pricing expectations.

Seasonal demand fluctuations create operational challenges and capacity planning difficulties, particularly during peak shopping periods like Christmas and Black Friday when demand can exceed normal capacity by significant margins. Peak season management requires substantial temporary capacity investments that impact overall operational efficiency.

Last-mile innovation presents substantial opportunities for companies willing to invest in new delivery technologies and service models. Autonomous delivery vehicles, drone delivery systems, and smart locker networks represent emerging technologies that could revolutionize urban delivery efficiency and customer convenience.

Sustainability services offer differentiation opportunities as environmentally conscious consumers seek carbon-neutral and eco-friendly delivery options. Green logistics initiatives including electric vehicle fleets, renewable energy-powered facilities, and sustainable packaging solutions can create competitive advantages and premium pricing opportunities.

B2B market expansion provides growth opportunities beyond traditional consumer-focused services. Small and medium enterprises increasingly require sophisticated logistics solutions, creating demand for integrated services combining warehousing, fulfillment, and delivery capabilities.

Technology integration opportunities include artificial intelligence for route optimization, predictive analytics for demand forecasting, and Internet of Things (IoT) solutions for enhanced package tracking and security. Digital transformation initiatives can drive operational efficiency improvements and enable new service offerings.

Rural market development represents an underserved opportunity for companies willing to invest in expanding coverage to smaller towns and rural areas. Alternative delivery models including partnerships with local businesses and community pickup points can make rural delivery economically viable while serving previously underserved markets.

Competitive intensity continues to reshape the Polish CEP landscape, with established international players competing alongside innovative domestic companies and emerging technology-focused startups. Market positioning strategies increasingly focus on service differentiation rather than price competition alone, with companies investing in premium services, technology capabilities, and customer experience enhancements.

Consumer expectations evolution drives continuous service innovation and operational improvements across the industry. Delivery speed expectations have accelerated significantly, with same-day delivery becoming standard in major cities and next-day delivery expected as a baseline service level for most shipments.

Technology disruption creates both challenges and opportunities for traditional CEP providers. Digital platforms enable new business models and service offerings while requiring substantial technology investments to remain competitive. Data analytics capabilities become increasingly important for operational optimization and customer service enhancement.

Partnership strategies emerge as critical success factors, with CEP providers forming alliances with e-commerce platforms, retailers, and technology companies to create integrated service offerings. Ecosystem collaboration enables companies to leverage complementary capabilities and expand service reach without proportional infrastructure investments.

Regulatory evolution influences market dynamics through changing requirements for data protection, environmental standards, and cross-border commerce facilitation. Policy changes can create new opportunities while requiring operational adaptations and compliance investments.

Comprehensive market analysis employs multiple research methodologies to ensure accurate and reliable insights into the Poland CEP market landscape. Primary research includes extensive interviews with industry executives, logistics managers, and key stakeholders across various market segments to gather firsthand insights into market trends, challenges, and opportunities.

Secondary research incorporates analysis of industry reports, government statistics, company financial statements, and regulatory documents to establish market context and validate primary research findings. Data triangulation methods ensure consistency and accuracy across multiple information sources and research approaches.

Market segmentation analysis examines various market dimensions including service types, customer segments, geographic regions, and technology adoption patterns. Quantitative analysis incorporates statistical modeling and trend analysis to identify growth patterns and market dynamics.

Competitive intelligence gathering includes analysis of major market participants, their service offerings, pricing strategies, and market positioning approaches. SWOT analysis framework evaluates strengths, weaknesses, opportunities, and threats facing the overall market and individual market segments.

Expert consultation with industry specialists, academic researchers, and technology providers provides additional validation and insights into emerging trends and future market developments. Continuous monitoring of market developments ensures research findings remain current and relevant to market participants and stakeholders.

Warsaw metropolitan area dominates the Polish CEP market, accounting for approximately 28% of total parcel volumes and serving as the primary hub for both domestic and international logistics operations. Capital city advantages include concentrated business activity, high e-commerce adoption rates, and sophisticated infrastructure supporting advanced delivery services including same-day and premium express options.

Krakow region represents the second-largest market segment, driven by strong economic growth, significant student population, and thriving technology sector. Southern Poland demonstrates robust growth potential with expanding industrial activity and increasing consumer spending supporting CEP market development.

Gdansk and the Tri-City area serve as crucial logistics gateways for international trade and cross-border e-commerce. Baltic coast region benefits from port infrastructure and strategic location for Northern European trade connections, creating opportunities for specialized international shipping services.

Wroclaw and Lower Silesia show strong growth momentum driven by foreign investment, manufacturing expansion, and increasing urbanization. Western Poland benefits from proximity to German markets and established transportation infrastructure supporting efficient cross-border logistics operations.

Rural and smaller urban areas represent emerging opportunities for market expansion, though service economics remain challenging. Regional development initiatives and improving infrastructure gradually expand viable service coverage to previously underserved areas, creating new growth opportunities for innovative delivery solutions.

Market leadership remains distributed among several major players, each leveraging distinct competitive advantages and market positioning strategies. International carriers maintain strong positions through extensive networks, advanced technology capabilities, and comprehensive service offerings.

Competitive differentiation strategies increasingly focus on technology innovation, customer experience enhancement, and specialized service offerings rather than price competition alone. Market consolidation trends continue as larger players acquire smaller regional operators to expand coverage and capabilities.

Service type segmentation divides the market into distinct categories based on delivery speed, service level, and pricing structure. Express services command premium pricing for guaranteed next-day delivery, while standard parcel services serve price-sensitive customers with longer delivery timeframes.

By Service Type:

By Customer Segment:

By Geographic Coverage:

Express delivery services demonstrate the strongest growth momentum, driven by increasing consumer expectations for speed and reliability. Same-day delivery particularly shows exceptional growth in major metropolitan areas, with adoption rates increasing approximately 35% annually as consumers embrace ultra-fast delivery options for urgent purchases.

E-commerce fulfillment represents the largest and fastest-growing category, with online retail shipments accounting for the majority of parcel volumes. Marketplace integration becomes increasingly important as platforms like Allegro and Amazon expand their logistics capabilities and service requirements.

International shipping shows strong growth potential driven by cross-border e-commerce expansion and increasing trade connections with other EU markets. Cross-border services require specialized capabilities including customs clearance, international tracking, and regulatory compliance management.

B2B logistics evolution toward integrated supply chain solutions creates opportunities for comprehensive service offerings combining warehousing, fulfillment, and delivery capabilities. Small business segment particularly seeks simplified logistics solutions that enable e-commerce participation without substantial infrastructure investments.

Return logistics emerges as a critical service category driven by e-commerce growth and consumer return expectations. Reverse logistics capabilities become competitive differentiators for companies serving online retailers and consumer-direct businesses.

E-commerce retailers benefit from expanded market reach and improved customer satisfaction through reliable delivery services. Logistics partnerships enable online businesses to focus on core competencies while leveraging specialized delivery expertise and infrastructure.

Consumers enjoy increased convenience, delivery options, and service transparency through advanced tracking and communication capabilities. Flexible delivery options including evening deliveries, weekend services, and alternative pickup locations accommodate diverse lifestyle preferences and scheduling requirements.

Traditional retailers can compete more effectively with online-only competitors by offering omnichannel fulfillment options including buy-online-pickup-in-store and home delivery services. Retail integration enables seamless customer experiences across multiple shopping channels.

Small and medium enterprises gain access to sophisticated logistics capabilities previously available only to large corporations. Scalable solutions enable business growth without proportional logistics infrastructure investments, supporting entrepreneurship and economic development.

Technology companies find opportunities to develop innovative solutions for route optimization, package tracking, and customer communication. Digital transformation initiatives create demand for advanced software solutions and automation technologies.

Real estate developers benefit from increased demand for logistics facilities, distribution centers, and last-mile delivery infrastructure. Urban planning considerations increasingly incorporate logistics requirements and delivery infrastructure needs.

Strengths:

Weaknesses:

Opportunities:

Threats:

Automation integration transforms CEP operations through advanced sorting systems, robotic fulfillment centers, and autonomous delivery vehicles. Operational efficiency improvements from automation enable faster processing times and reduced labor dependency while maintaining service quality standards.

Sustainable logistics initiatives gain momentum as companies invest in electric delivery vehicles, renewable energy systems, and carbon-neutral shipping options. Environmental responsibility becomes a competitive differentiator with approximately 52% of consumers considering environmental impact in their delivery choices.

Real-time visibility expectations drive investments in advanced tracking systems, predictive delivery notifications, and customer communication platforms. Transparency requirements extend beyond basic tracking to include detailed delivery windows, driver locations, and proactive exception management.

Flexible delivery models expand beyond traditional home delivery to include pickup points, automated lockers, and workplace delivery services. Alternative delivery options accommodate diverse consumer preferences while improving delivery efficiency and reducing failed delivery attempts.

Data analytics utilization enables predictive demand forecasting, route optimization, and personalized customer service. Big data applications support operational decision-making and strategic planning while enabling new service offerings based on customer behavior insights.

Omnichannel integration connects online and offline retail experiences through unified fulfillment and delivery services. Seamless customer experiences across multiple touchpoints become essential for competitive positioning in the evolving retail landscape.

Infrastructure investments by major CEP providers include new sorting facilities, distribution centers, and last-mile delivery hubs designed to support growing parcel volumes and service requirements. Capacity expansion initiatives focus on automation integration and scalable operations to handle peak demand periods effectively.

Technology partnerships between CEP providers and software companies create innovative solutions for route optimization, customer communication, and operational management. Digital transformation initiatives enable new service capabilities while improving operational efficiency and customer satisfaction.

Sustainability commitments from major market participants include carbon neutrality goals, electric vehicle fleet transitions, and renewable energy adoption. Green logistics investments demonstrate industry recognition of environmental responsibilities and consumer preferences for sustainable services.

Market consolidation activities include acquisitions of regional players by international carriers seeking to expand market coverage and service capabilities. Strategic partnerships enable companies to leverage complementary strengths while expanding service reach without proportional infrastructure investments.

Regulatory compliance initiatives address evolving requirements for data protection, environmental standards, and cross-border commerce facilitation. Industry collaboration with government agencies supports regulatory development that balances market growth with consumer protection and environmental responsibility.

Innovation labs and pilot programs test emerging technologies including drone delivery, autonomous vehicles, and artificial intelligence applications. Future technology development focuses on solutions that can scale effectively while maintaining service quality and cost competitiveness.

MarkWide Research analysis indicates that CEP providers should prioritize technology investments and customer experience enhancements to maintain competitive positioning in the evolving market landscape. Digital capabilities become essential for operational efficiency and customer satisfaction as market expectations continue to rise.

Market expansion strategies should focus on underserved segments including rural areas, cross-border services, and specialized industry verticals. Service differentiation through innovative delivery options and value-added services can command premium pricing while building customer loyalty.

Partnership development with e-commerce platforms, retailers, and technology providers creates opportunities for integrated service offerings and expanded market reach. Ecosystem collaboration enables companies to leverage complementary capabilities while sharing infrastructure investments and market development costs.

Sustainability initiatives should be integrated into core business strategies rather than treated as separate programs. Environmental leadership can create competitive advantages while addressing regulatory requirements and consumer preferences for responsible business practices.

Operational flexibility investments enable companies to adapt quickly to changing market conditions and customer requirements. Scalable infrastructure and adaptable service models support growth while maintaining operational efficiency during demand fluctuations.

Data utilization capabilities should be developed to support predictive analytics, personalized services, and operational optimization. Information assets become increasingly valuable for competitive differentiation and strategic decision-making in the data-driven logistics environment.

Long-term growth prospects for the Poland CEP market remain highly positive, supported by continued e-commerce expansion, digital transformation, and evolving consumer expectations. Market evolution will likely accelerate as technology adoption enables new service models and operational efficiencies that reshape competitive dynamics.

E-commerce penetration is expected to continue growing, with MWR projecting online retail adoption rates reaching approximately 85% of the adult population within the next five years. Digital commerce growth will drive sustained demand for delivery services while creating opportunities for specialized fulfillment solutions.

Technology integration will transform CEP operations through artificial intelligence, Internet of Things applications, and advanced automation systems. Innovation adoption will separate market leaders from followers as companies that successfully integrate new technologies gain significant competitive advantages.

Sustainability requirements will become increasingly important for market participation, with environmental regulations and consumer preferences driving adoption of green logistics practices. Carbon neutrality goals will influence operational decisions and infrastructure investments across the industry.

International expansion opportunities will grow as cross-border e-commerce continues developing and trade relationships strengthen within the European Union and globally. Global connectivity will become increasingly important for Polish CEP providers seeking growth beyond domestic markets.

Service innovation will focus on ultra-fast delivery options, flexible customer solutions, and integrated logistics services that combine multiple supply chain functions. Customer experience will remain the primary differentiator as service commoditization increases competitive pressure on traditional delivery offerings.

The Poland Courier, Express, and Parcel market represents a dynamic and rapidly evolving sector that plays a crucial role in the country’s modern economy. Market fundamentals remain strong, supported by robust e-commerce growth, increasing consumer expectations, and ongoing digital transformation across various industry sectors.

Competitive dynamics continue to intensify as established international players compete with innovative domestic companies and emerging technology-focused startups. Success factors increasingly center on technology capabilities, customer experience excellence, and operational efficiency rather than traditional cost-based competition alone.

Future opportunities abound for companies willing to invest in innovation, sustainability, and customer-centric service development. Market leaders will be those organizations that successfully balance operational excellence with strategic vision, leveraging technology and partnerships to create sustainable competitive advantages in the evolving logistics landscape.

The Poland CEP market outlook remains highly positive, with continued growth expected across all major segments and service categories. Strategic positioning for long-term success requires focus on technology integration, sustainability initiatives, and customer experience enhancement while maintaining operational efficiency and financial performance in an increasingly competitive marketplace.

What is Courier, Express, and Parcel (CEP)?

Courier, Express, and Parcel (CEP) refers to services that facilitate the fast and reliable delivery of packages and documents. This includes various delivery options such as same-day, next-day, and scheduled deliveries across different sectors including e-commerce, retail, and logistics.

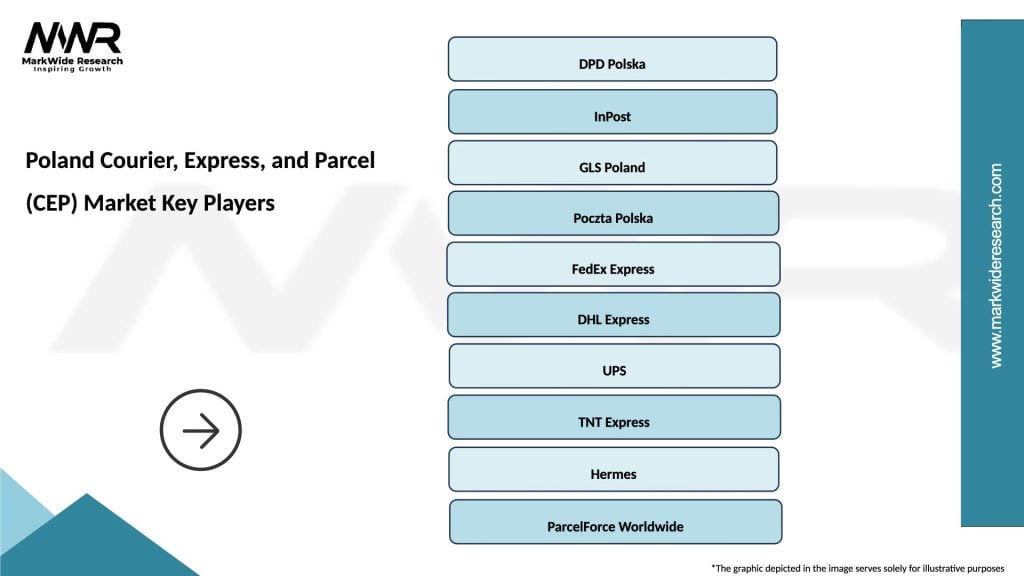

What are the key players in the Poland Courier, Express, and Parcel (CEP) Market?

Key players in the Poland Courier, Express, and Parcel (CEP) Market include companies like DPD, GLS, and InPost. These companies provide a range of services from standard parcel delivery to express shipping solutions, catering to both businesses and individual consumers.

What are the growth factors driving the Poland Courier, Express, and Parcel (CEP) Market?

The growth of the Poland Courier, Express, and Parcel (CEP) Market is driven by the increasing demand for e-commerce, the rise in online shopping, and the need for faster delivery services. Additionally, advancements in logistics technology and consumer expectations for quick shipping are significant contributors.

What challenges does the Poland Courier, Express, and Parcel (CEP) Market face?

The Poland Courier, Express, and Parcel (CEP) Market faces challenges such as rising operational costs, regulatory compliance issues, and competition from alternative delivery methods. Additionally, managing logistics in urban areas with traffic congestion can hinder efficiency.

What opportunities exist in the Poland Courier, Express, and Parcel (CEP) Market?

Opportunities in the Poland Courier, Express, and Parcel (CEP) Market include the expansion of last-mile delivery services, the integration of technology for improved tracking and customer service, and the growth of green logistics solutions. These trends can enhance service offerings and customer satisfaction.

What trends are shaping the Poland Courier, Express, and Parcel (CEP) Market?

Trends shaping the Poland Courier, Express, and Parcel (CEP) Market include the increasing use of automation and robotics in sorting and delivery processes, the rise of sustainable delivery options, and the growing importance of real-time tracking for consumers. These innovations are transforming how logistics companies operate.

Poland Courier, Express, and Parcel (CEP) Market

| Segmentation Details | Description |

|---|---|

| Service Type | Same-Day Delivery, Next-Day Delivery, Standard Delivery, International Shipping |

| Customer Type | Retailers, E-commerce Platforms, Corporates, Individual Consumers |

| Delivery Mode | Ground, Air, Sea, Drone |

| Packaging Type | Boxes, Envelopes, Pallets, Crates |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Poland Courier, Express, and Parcel (CEP) Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at