444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Turkey Courier Express and Parcel (CEP) market represents one of the most dynamic and rapidly evolving logistics sectors in the Middle East and Europe region. This comprehensive market encompasses the collection, transportation, and delivery of packages, documents, and parcels across Turkey’s diverse geographical landscape. Market dynamics indicate substantial growth driven by e-commerce expansion, urbanization trends, and increasing consumer demand for fast, reliable delivery services.

Digital transformation has fundamentally reshaped the Turkish CEP landscape, with companies investing heavily in technology infrastructure, automated sorting facilities, and last-mile delivery optimization. The market demonstrates remarkable resilience and adaptability, particularly following the acceleration of online shopping behaviors during recent global events. Growth projections suggest the sector will continue expanding at a compound annual growth rate (CAGR) of 12.5% through the forecast period.

Geographic advantages position Turkey as a strategic logistics hub connecting Europe, Asia, and the Middle East. This unique positioning has attracted significant international investment and partnerships, fostering innovation in delivery technologies and service offerings. The market encompasses various service categories including same-day delivery, next-day delivery, international express services, and specialized logistics solutions for different industry verticals.

The Turkey Courier Express and Parcel (CEP) market refers to the comprehensive ecosystem of logistics service providers specializing in the time-sensitive collection, transportation, sorting, and delivery of packages, documents, and parcels throughout Turkey and internationally. This market encompasses both domestic and international shipping services, ranging from same-day local deliveries to express international shipments.

Service categories within the CEP market include express delivery services, standard parcel delivery, document courier services, e-commerce fulfillment, reverse logistics, and specialized transportation for sensitive or high-value items. The market serves diverse customer segments including individual consumers, small and medium enterprises, large corporations, government institutions, and healthcare organizations requiring reliable logistics solutions.

Technological integration defines modern CEP operations, incorporating advanced tracking systems, route optimization algorithms, automated sorting facilities, and digital customer interfaces. These technological capabilities enable real-time shipment visibility, predictive delivery scheduling, and enhanced customer experience through multiple touchpoints and communication channels.

Market leadership in Turkey’s CEP sector is characterized by intense competition among domestic and international players, each striving to capture market share through service innovation, geographic expansion, and technological advancement. The market demonstrates strong fundamentals supported by robust e-commerce growth, increasing urbanization rates, and evolving consumer expectations for convenient, fast delivery services.

E-commerce integration represents the primary growth driver, with online retail sales accounting for 65% of total CEP volume growth in recent years. This trend has prompted CEP providers to develop specialized e-commerce solutions including fulfillment center services, returns management, and integrated payment systems. Consumer behavior shifts toward online shopping have created sustained demand for reliable, cost-effective delivery services across all market segments.

Infrastructure development continues to enhance market capabilities, with significant investments in sorting facilities, transportation networks, and last-mile delivery solutions. The market benefits from Turkey’s strategic geographic position, well-developed transportation infrastructure, and growing digital economy. Regulatory support from government initiatives promoting digitalization and logistics sector development further strengthens market prospects.

Market segmentation reveals distinct growth patterns across different service categories and customer segments. The following key insights highlight the most significant market developments and trends:

E-commerce expansion serves as the fundamental driver propelling Turkey’s CEP market growth. The rapid digitalization of retail operations, accelerated by changing consumer preferences and technological advancement, has created unprecedented demand for reliable delivery services. Online marketplace growth has particularly benefited CEP providers, as platforms require sophisticated logistics networks to fulfill customer orders efficiently.

Urbanization trends contribute significantly to market expansion, with increasing population density in major cities creating optimal conditions for last-mile delivery optimization. Urban consumers demonstrate higher propensity for online shopping and express delivery services, driving volume growth and service innovation. Demographic shifts toward younger, tech-savvy consumers further accelerate adoption of digital commerce and delivery services.

Infrastructure development across Turkey’s transportation network enhances CEP market capabilities and geographic reach. Government investments in highway systems, airport facilities, and digital infrastructure create favorable conditions for logistics operations. Strategic location advantages position Turkey as a natural logistics hub for regional and international trade, attracting investment from global CEP providers seeking to establish regional operations.

Technology advancement enables new service offerings and operational efficiencies that drive market growth. Implementation of artificial intelligence, machine learning, and IoT technologies allows CEP providers to optimize routes, predict demand patterns, and enhance customer experience. Mobile technology adoption facilitates seamless integration between consumers and delivery services through user-friendly applications and real-time tracking capabilities.

Infrastructure limitations in certain regions pose challenges for comprehensive market coverage and service quality consistency. Rural and remote areas often lack adequate transportation infrastructure, making delivery operations costly and time-consuming. Geographic complexity of Turkey’s terrain, including mountainous regions and dispersed rural communities, creates logistical challenges that impact service efficiency and cost structures.

Regulatory compliance requirements across different jurisdictions and service categories create operational complexity and compliance costs for CEP providers. International shipping regulations, customs procedures, and documentation requirements can slow delivery times and increase operational overhead. Taxation policies and import/export regulations affecting cross-border shipments may impact international express service growth.

Labor market challenges including driver shortages, seasonal workforce fluctuations, and increasing labor costs affect operational efficiency and service reliability. The demanding nature of delivery work, combined with competitive employment markets in urban areas, creates ongoing recruitment and retention challenges. Training requirements for technology adoption and customer service standards add to operational costs.

Competition intensity among established players and new market entrants creates pricing pressure and margin compression. The market’s attractiveness has led to increased competition, forcing providers to invest heavily in service differentiation and cost optimization. Price sensitivity among certain customer segments limits pricing flexibility and profitability potential.

Cross-border e-commerce presents significant expansion opportunities as Turkish consumers increasingly purchase from international online retailers. The growing demand for international express delivery services creates opportunities for CEP providers to develop specialized cross-border logistics solutions. Regional hub development leveraging Turkey’s strategic location can attract international businesses seeking efficient distribution networks for European, Asian, and Middle Eastern markets.

Technology integration opportunities include implementation of advanced automation, artificial intelligence, and predictive analytics to enhance operational efficiency and customer experience. Drone delivery pilot programs and autonomous vehicle testing represent emerging opportunities for service innovation and cost reduction in specific market segments.

Sustainability initiatives create opportunities for market differentiation through eco-friendly delivery options, carbon-neutral shipping programs, and green logistics solutions. Growing environmental consciousness among consumers and businesses drives demand for sustainable delivery alternatives. Electric vehicle adoption for last-mile delivery operations can reduce operational costs while appealing to environmentally conscious customers.

Specialized service development for healthcare, pharmaceuticals, automotive, and other industry verticals offers opportunities for premium pricing and customer loyalty. Cold chain logistics and temperature-controlled delivery services address growing demand from food delivery, pharmaceutical, and biotechnology sectors requiring specialized handling capabilities.

Competitive landscape dynamics reflect intense rivalry among domestic and international CEP providers, each pursuing market share through service innovation, geographic expansion, and strategic partnerships. Market consolidation trends indicate potential merger and acquisition activity as companies seek to achieve economies of scale and enhance service capabilities.

Customer expectations continue evolving toward faster delivery times, greater flexibility, and enhanced visibility throughout the shipping process. This evolution drives continuous investment in technology infrastructure and service innovation. Omnichannel integration becomes increasingly important as retailers seek seamless logistics solutions across multiple sales channels.

Pricing dynamics reflect balance between competitive pressure and operational cost increases. CEP providers must optimize pricing strategies to maintain profitability while remaining competitive in price-sensitive market segments. Value-added services including packaging, assembly, and returns management provide opportunities for revenue diversification and margin improvement.

Seasonal fluctuations create both challenges and opportunities, with peak shopping periods requiring significant capacity scaling and workforce management. Demand forecasting and capacity planning become critical capabilities for managing seasonal variations effectively while maintaining service quality standards.

Comprehensive market analysis employs multiple research methodologies to ensure accuracy and completeness of market insights. Primary research includes extensive interviews with industry executives, logistics managers, and key stakeholders across the CEP value chain. Secondary research incorporates analysis of industry reports, government statistics, trade publications, and company financial statements.

Data collection methods include structured surveys of CEP service providers, customer satisfaction studies, and analysis of shipping volume trends across different market segments. Quantitative analysis focuses on market size estimation, growth rate calculations, and competitive market share assessment using multiple data sources and validation techniques.

Market segmentation analysis examines service categories, customer segments, geographic regions, and technology adoption patterns to identify growth opportunities and market trends. Competitive intelligence gathering includes analysis of service offerings, pricing strategies, geographic coverage, and technology investments among major market participants.

Validation processes ensure data accuracy through cross-referencing multiple sources, expert interviews, and statistical analysis techniques. MarkWide Research methodology emphasizes comprehensive market coverage and objective analysis to provide reliable insights for strategic decision-making.

Istanbul metropolitan region dominates the Turkish CEP market, accounting for approximately 35% of total market volume due to high population density, economic activity concentration, and advanced logistics infrastructure. The region benefits from proximity to major airports, seaports, and highway networks, making it the primary hub for both domestic and international CEP operations.

Ankara and surrounding areas represent the second-largest market segment, driven by government institutions, corporate headquarters, and growing e-commerce adoption. The capital region demonstrates strong demand for business-to-business delivery services and document courier solutions. Infrastructure development in the region supports efficient distribution networks and same-day delivery capabilities.

Izmir and Aegean region show robust growth potential, supported by industrial activity, port operations, and tourism-related logistics needs. The region’s manufacturing base creates demand for specialized logistics solutions and international shipping services. Export-oriented businesses in the region drive demand for reliable international express services.

Mediterranean coastal regions including Antalya and Mersin demonstrate seasonal demand patterns influenced by tourism and agricultural exports. These regions require flexible service capacity to accommodate seasonal fluctuations while maintaining year-round coverage for local businesses and residents. Agricultural logistics create opportunities for specialized handling and time-sensitive delivery services.

Central and Eastern Anatolia regions present expansion opportunities despite infrastructure challenges and lower population density. Growing internet penetration and e-commerce adoption in these regions create demand for reliable delivery services. Network optimization strategies focus on cost-effective coverage while maintaining acceptable service levels.

Market leadership is distributed among several major players, each with distinct competitive advantages and market positioning strategies. The competitive landscape includes both domestic Turkish companies and international logistics giants establishing strong local presence.

Competitive strategies focus on service differentiation, technology investment, geographic expansion, and strategic partnerships with e-commerce platforms. Market share distribution remains relatively fragmented, with the top five providers collectively holding approximately 60% of market share, leaving significant opportunities for growth and consolidation.

Service-based segmentation reveals distinct market categories with varying growth rates and customer requirements:

By Service Type:

By End-User Segment:

By Geographic Coverage:

Express delivery services demonstrate the highest growth potential, driven by increasing customer expectations for fast, reliable shipping. This category benefits from premium pricing and strong customer loyalty, particularly among business customers requiring guaranteed delivery times. Technology integration in express services includes real-time tracking, predictive delivery notifications, and flexible delivery options.

E-commerce fulfillment represents the fastest-growing category, with specialized services including warehouse management, order processing, and returns handling. This segment requires significant infrastructure investment but offers opportunities for long-term customer relationships and volume-based pricing. Integration capabilities with e-commerce platforms become critical competitive differentiators.

International express services provide opportunities for premium pricing and market differentiation through specialized expertise in customs clearance, documentation, and global logistics coordination. This category serves both import and export markets, benefiting from Turkey’s strategic geographic position. Compliance expertise and regulatory knowledge create barriers to entry and competitive advantages.

Same-day delivery emerges as a high-growth niche, particularly in urban markets where consumer demand for immediate gratification drives adoption. This category requires dense network coverage and sophisticated routing optimization but commands premium pricing. Technology dependence makes this segment particularly suitable for companies with advanced logistics technology capabilities.

CEP service providers benefit from expanding market opportunities driven by e-commerce growth, urbanization trends, and increasing consumer demand for convenient delivery services. The market offers potential for revenue diversification through value-added services, geographic expansion, and technology-enabled service innovation. Operational efficiency gains through technology adoption can improve profitability while enhancing customer satisfaction.

E-commerce businesses gain access to sophisticated logistics networks that enable market expansion, improved customer experience, and operational cost optimization. Reliable CEP services allow online retailers to compete effectively with traditional retail channels by offering convenient, fast delivery options. Integration capabilities with CEP providers streamline operations and reduce complexity.

Consumers benefit from increased service options, competitive pricing, and enhanced convenience through flexible delivery alternatives. The expanding CEP market provides greater choice in delivery speed, cost, and service features, allowing consumers to select options that best meet their specific needs. Technology advancement improves transparency and control over the delivery process.

Economic stakeholders including suppliers, technology providers, and infrastructure developers benefit from increased investment and business opportunities within the growing CEP ecosystem. The market’s expansion creates employment opportunities, stimulates related industries, and contributes to overall economic development. Innovation drivers within the CEP market encourage technological advancement and entrepreneurship.

Strengths:

Weaknesses:

Opportunities:

Threats:

Digital transformation accelerates across the CEP industry, with companies investing heavily in mobile applications, artificial intelligence, and automated sorting systems. These technologies enable better customer experience, operational efficiency, and competitive differentiation. Customer interface evolution focuses on seamless digital interactions and real-time communication throughout the delivery process.

Sustainability initiatives gain prominence as environmental consciousness increases among consumers and businesses. CEP providers implement electric vehicle fleets, carbon-neutral shipping options, and eco-friendly packaging solutions. Green logistics becomes a competitive differentiator and regulatory compliance requirement in many markets.

Last-mile innovation drives development of alternative delivery methods including locker networks, pickup points, and flexible delivery windows. These solutions address urbanization challenges while reducing delivery costs and improving customer convenience. Micro-fulfillment centers in urban areas enable faster delivery times and reduced transportation costs.

Data analytics utilization enhances route optimization, demand forecasting, and customer service personalization. Advanced analytics enable predictive maintenance, capacity planning, and operational efficiency improvements. Machine learning applications continuously improve delivery accuracy and customer satisfaction through pattern recognition and optimization algorithms.

Partnership strategies evolve toward deeper integration with e-commerce platforms, retailers, and technology providers. These collaborations create comprehensive logistics ecosystems that benefit all participants through shared resources and expertise. Strategic alliances enable market expansion and service enhancement without requiring significant capital investment.

Infrastructure investments by major CEP providers include construction of automated sorting facilities, expansion of distribution networks, and implementation of advanced technology systems. These developments enhance service capabilities and operational efficiency while supporting future growth plans. Capacity expansion focuses on high-growth urban markets and underserved rural regions.

Technology partnerships between CEP providers and software companies accelerate innovation in tracking systems, route optimization, and customer interface development. These collaborations bring specialized expertise and reduce development costs while accelerating time-to-market for new services. Integration platforms enable seamless connectivity between different systems and stakeholders.

Regulatory developments include new standards for data privacy, environmental compliance, and service quality requirements. These regulations shape industry practices and create opportunities for companies that proactively address compliance requirements. Government initiatives supporting digitalization and logistics sector development provide favorable conditions for market growth.

Market consolidation activities include mergers, acquisitions, and strategic partnerships aimed at achieving economies of scale and enhancing competitive positioning. These developments reshape the competitive landscape and create opportunities for improved service offerings. International expansion by domestic providers and local market entry by global companies intensify competition while expanding service options.

Technology investment priorities should focus on customer-facing applications, automated sorting systems, and data analytics capabilities that directly impact service quality and operational efficiency. Companies should evaluate emerging technologies carefully to identify those with the greatest potential for competitive advantage and return on investment. Digital transformation requires comprehensive planning and phased implementation to minimize disruption while maximizing benefits.

Geographic expansion strategies should balance market opportunity with infrastructure requirements and competitive intensity. Companies should prioritize markets with favorable demographics, growing e-commerce adoption, and adequate infrastructure support. Rural market penetration requires innovative service models and cost optimization to achieve profitability while maintaining service quality.

Partnership development with e-commerce platforms, retailers, and technology providers can accelerate growth while reducing capital requirements and operational risks. Strategic alliances should focus on complementary capabilities and shared value creation. MarkWide Research analysis suggests that successful partnerships require clear governance structures and aligned incentives.

Sustainability initiatives should be integrated into core business strategies rather than treated as separate programs. Companies should evaluate the full lifecycle impact of sustainability investments and communicate benefits effectively to customers and stakeholders. Environmental compliance preparation positions companies advantageously for future regulatory requirements.

Customer experience enhancement through technology and service innovation creates opportunities for differentiation and premium pricing. Companies should invest in understanding customer needs and developing solutions that address specific pain points. Service personalization and flexibility become increasingly important competitive factors.

Market growth trajectory indicates continued expansion driven by e-commerce proliferation, urbanization trends, and evolving consumer expectations for convenient delivery services. The market is projected to maintain robust growth rates, with annual expansion exceeding 10% in key segments through the forecast period. Technology advancement will continue reshaping service offerings and operational capabilities.

Competitive landscape evolution suggests increasing consolidation as companies seek economies of scale and enhanced service capabilities. Market leaders will likely emerge through strategic acquisitions, technology investments, and geographic expansion. International competition will intensify as global logistics companies establish stronger local presence and capabilities.

Service innovation will focus on speed, convenience, and sustainability as key differentiators. Same-day and instant delivery services will expand beyond urban centers, while eco-friendly options become standard offerings rather than premium services. Automation adoption will accelerate across all aspects of CEP operations, from sorting facilities to last-mile delivery.

Regulatory environment development will likely emphasize environmental compliance, data privacy, and service quality standards. Companies that proactively address these requirements will gain competitive advantages and avoid compliance-related disruptions. Government support for digitalization and logistics infrastructure will continue creating favorable market conditions.

MarkWide Research projections indicate that successful CEP providers will be those that effectively balance growth investments with operational efficiency, customer service excellence with cost competitiveness, and innovation with reliability. The market’s future success depends on continued adaptation to changing customer needs and technological possibilities.

Turkey’s Courier Express and Parcel market represents a dynamic and rapidly evolving sector with substantial growth potential driven by e-commerce expansion, technological advancement, and changing consumer behaviors. The market demonstrates strong fundamentals supported by strategic geographic advantages, growing digital economy, and increasing demand for convenient, reliable delivery services across all customer segments.

Competitive dynamics reflect healthy rivalry among domestic and international players, each pursuing market share through service innovation, technology investment, and strategic partnerships. The market’s fragmented structure provides opportunities for both consolidation and new entrant success, particularly in specialized service categories and underserved geographic regions.

Future success factors will include effective technology utilization, sustainable operational practices, customer experience excellence, and strategic geographic expansion. Companies that successfully balance growth investments with operational efficiency while maintaining service quality standards will be best positioned to capitalize on market opportunities and achieve sustainable competitive advantages in Turkey’s evolving CEP landscape.

What is Courier Express and Parcel (CEP)?

Courier Express and Parcel (CEP) refers to the services that facilitate the rapid delivery of packages and documents. This includes various delivery options such as same-day, next-day, and scheduled deliveries, catering to both businesses and individual consumers.

Who are the key players in the Turkey Courier Express and Parcel (CEP) Market?

Key players in the Turkey Courier Express and Parcel (CEP) Market include Aras Kargo, MNG Kargo, and Yurtiçi Kargo, among others. These companies offer a range of services from standard parcel delivery to express shipping solutions.

What are the main drivers of growth in the Turkey Courier Express and Parcel (CEP) Market?

The growth of the Turkey Courier Express and Parcel (CEP) Market is driven by the rise of e-commerce, increasing consumer demand for fast delivery services, and advancements in logistics technology. Additionally, the expansion of retail businesses and the need for efficient supply chain solutions contribute to this growth.

What challenges does the Turkey Courier Express and Parcel (CEP) Market face?

The Turkey Courier Express and Parcel (CEP) Market faces challenges such as high operational costs, regulatory compliance issues, and competition from alternative delivery methods. Additionally, fluctuating fuel prices and infrastructure limitations can impact service efficiency.

What opportunities exist in the Turkey Courier Express and Parcel (CEP) Market?

Opportunities in the Turkey Courier Express and Parcel (CEP) Market include the potential for expanding last-mile delivery services, leveraging technology for improved tracking and customer experience, and tapping into underserved regions. The growth of online shopping also presents new avenues for service providers.

What trends are shaping the Turkey Courier Express and Parcel (CEP) Market?

Trends shaping the Turkey Courier Express and Parcel (CEP) Market include the increasing use of automation and robotics in logistics, the rise of green delivery options, and the integration of artificial intelligence for route optimization. Additionally, consumer preferences for contactless delivery methods are influencing service offerings.

Turkey Courier Express and Parcel (CEP) Market

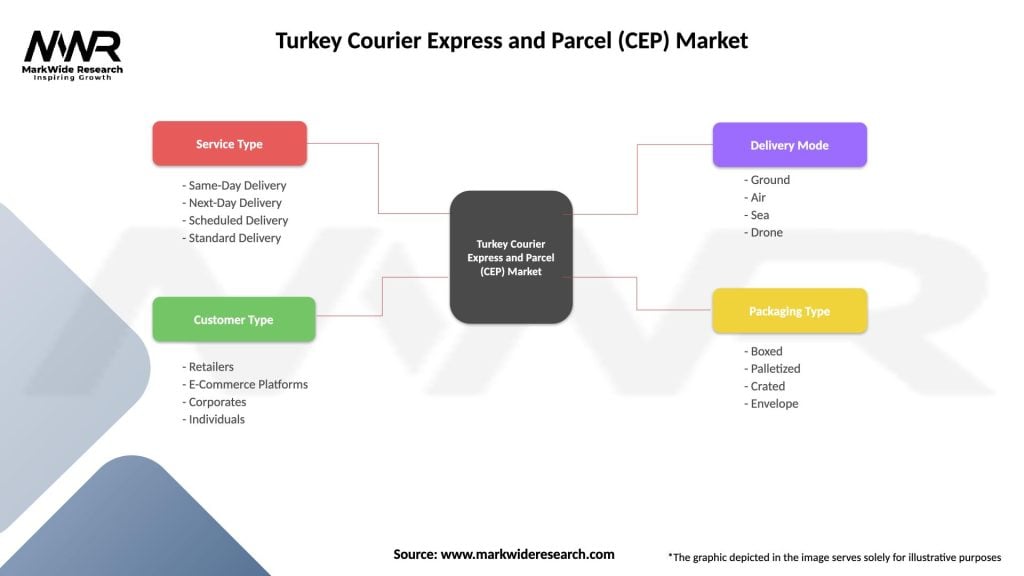

| Segmentation Details | Description |

|---|---|

| Service Type | Same-Day Delivery, Next-Day Delivery, Scheduled Delivery, Standard Delivery |

| Customer Type | Retailers, E-Commerce Platforms, Corporates, Individuals |

| Delivery Mode | Ground, Air, Sea, Drone |

| Packaging Type | Boxed, Palletized, Crated, Envelope |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Turkey Courier Express and Parcel (CEP) Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at