444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

The identity analytics and intelligence market represents a rapidly evolving cybersecurity segment that focuses on analyzing user behavior patterns, access privileges, and identity-related risks across enterprise environments. This sophisticated market encompasses advanced technologies that monitor, analyze, and provide actionable insights about user identities, their access patterns, and potential security threats. Organizations worldwide are increasingly recognizing the critical importance of identity-centric security approaches as traditional perimeter-based security models prove insufficient against modern cyber threats.

Market dynamics indicate substantial growth driven by escalating cybersecurity concerns, regulatory compliance requirements, and the widespread adoption of cloud-based services. The market experiences significant momentum from enterprises seeking to implement zero-trust security architectures and enhance their overall security posture. Digital transformation initiatives across industries have accelerated the demand for comprehensive identity analytics solutions that can provide real-time visibility into user activities and identify anomalous behaviors that may indicate security breaches or insider threats.

Regional adoption patterns show strong market penetration in North America and Europe, with Asia-Pacific emerging as a high-growth region. The market demonstrates robust expansion potential, with industry analysts projecting growth rates of approximately 15.2% CAGR over the forecast period. Enterprise adoption continues to accelerate as organizations face increasing pressure to protect sensitive data while maintaining operational efficiency and user productivity.

The identity analytics and intelligence market refers to the comprehensive ecosystem of technologies, solutions, and services designed to analyze, monitor, and provide actionable insights about user identities, their behaviors, and associated security risks within enterprise environments. This market encompasses advanced analytical tools that leverage machine learning, artificial intelligence, and behavioral analytics to identify patterns, anomalies, and potential threats related to user access and activities across organizational systems and applications.

Core functionalities include user behavior analytics, privilege access management, identity governance, risk assessment, and automated response capabilities. These solutions continuously monitor user activities, analyze access patterns, and provide security teams with detailed insights about potential risks, compliance violations, and suspicious behaviors that may indicate compromised accounts or insider threats.

Market leadership in the identity analytics and intelligence sector is characterized by rapid technological advancement and increasing enterprise adoption across multiple industries. The market demonstrates strong growth momentum driven by escalating cybersecurity threats, regulatory compliance requirements, and the widespread shift toward remote work environments that have expanded attack surfaces and increased identity-related risks.

Key market drivers include the growing sophistication of cyber attacks, increasing regulatory pressures, and the need for organizations to implement comprehensive identity-centric security strategies. Enterprise adoption rates have accelerated significantly, with approximately 68% of organizations planning to increase their investment in identity analytics solutions over the next two years. The market benefits from strong technological innovation, with vendors continuously enhancing their offerings through advanced machine learning algorithms and artificial intelligence capabilities.

Competitive dynamics reveal a market with established security vendors, specialized identity management companies, and emerging technology providers competing to deliver comprehensive solutions. The market shows strong potential for continued expansion as organizations recognize the critical importance of identity-centric security approaches in protecting against modern cyber threats and maintaining regulatory compliance.

Strategic market insights reveal several critical factors driving the identity analytics and intelligence market forward:

Primary market drivers propelling the identity analytics and intelligence market include the exponential increase in cybersecurity threats targeting user identities and credentials. Organizations face sophisticated attacks that specifically target user accounts, privileged access, and identity infrastructure, creating urgent demand for advanced analytics solutions that can detect and respond to these threats effectively.

Regulatory compliance requirements serve as a significant driver, with regulations such as GDPR, HIPAA, SOX, and industry-specific standards mandating strict identity governance and access controls. Organizations must demonstrate comprehensive visibility into user access patterns, privilege usage, and identity-related risks to maintain compliance and avoid substantial penalties.

Digital transformation initiatives accelerate market growth as organizations migrate to cloud environments, adopt hybrid work models, and implement modern applications that require sophisticated identity management capabilities. The shift toward remote work has expanded attack surfaces and created new identity-related risks that traditional security approaches cannot adequately address.

Zero-trust security adoption drives demand for identity analytics solutions that can provide continuous user verification and risk assessment. Organizations implementing zero-trust architectures require comprehensive identity intelligence to make informed access decisions and maintain security while enabling productivity.

Implementation complexity represents a significant market restraint, as identity analytics solutions often require extensive integration with existing security infrastructure, identity management systems, and enterprise applications. Organizations may face challenges in deploying comprehensive solutions that can effectively analyze user behaviors across diverse IT environments without disrupting operational efficiency.

Cost considerations pose barriers for smaller organizations and budget-constrained enterprises that may find advanced identity analytics solutions financially challenging to implement and maintain. The total cost of ownership includes not only software licensing but also professional services, training, and ongoing management requirements that can strain organizational budgets.

Skills shortage in cybersecurity and identity management creates implementation and operational challenges. Organizations struggle to find qualified professionals who can effectively deploy, configure, and manage sophisticated identity analytics platforms, potentially limiting market adoption rates.

Privacy concerns and data protection requirements may restrict the implementation of comprehensive user monitoring and behavioral analytics capabilities. Organizations must balance security needs with employee privacy rights and regulatory requirements, potentially limiting the scope of identity analytics implementations.

Emerging technologies present substantial opportunities for market expansion, particularly in artificial intelligence, machine learning, and advanced behavioral analytics. Vendors can differentiate their solutions by incorporating cutting-edge technologies that improve threat detection accuracy, reduce false positives, and provide more actionable security insights.

Industry-specific solutions offer significant growth potential as different sectors face unique identity-related challenges and compliance requirements. Healthcare, financial services, government, and critical infrastructure sectors present opportunities for specialized identity analytics solutions tailored to specific regulatory and operational needs.

Small and medium enterprise adoption represents an underserved market segment with substantial growth potential. As cybersecurity threats increasingly target smaller organizations, there is growing demand for cost-effective, easy-to-deploy identity analytics solutions designed for resource-constrained environments.

International expansion opportunities exist in emerging markets where organizations are rapidly adopting digital technologies and facing increasing cybersecurity challenges. Asia-Pacific, Latin America, and Middle East regions show strong potential for market growth as regulatory frameworks evolve and cybersecurity awareness increases.

Technological evolution drives continuous market dynamics as vendors enhance their solutions with advanced capabilities such as artificial intelligence, machine learning, and predictive analytics. These technological improvements enable more sophisticated threat detection, improved accuracy in identifying anomalous behaviors, and enhanced automation capabilities that reduce manual security operations.

Competitive pressures intensify as established cybersecurity vendors, specialized identity management companies, and emerging technology providers compete for market share. This competition drives innovation, improves solution capabilities, and often results in more competitive pricing structures that benefit end-user organizations.

Customer expectations continue to evolve, with organizations demanding more comprehensive, integrated solutions that can provide holistic identity security coverage. Users expect solutions that can seamlessly integrate with existing infrastructure while providing intuitive interfaces and actionable insights that enable effective security decision-making.

Regulatory landscape changes create ongoing market dynamics as new compliance requirements emerge and existing regulations evolve. Organizations must adapt their identity analytics strategies to meet changing regulatory demands, creating opportunities for vendors who can provide compliant, auditable solutions.

Comprehensive market analysis employs multiple research methodologies to provide accurate and reliable insights into the identity analytics and intelligence market. Primary research includes extensive interviews with industry executives, security professionals, and technology vendors to gather firsthand insights about market trends, challenges, and opportunities.

Secondary research encompasses analysis of industry reports, vendor documentation, regulatory filings, and academic studies to validate primary findings and provide comprehensive market context. This approach ensures thorough coverage of market dynamics, competitive landscapes, and technological developments.

Quantitative analysis utilizes statistical modeling and data analysis techniques to identify market patterns, growth trends, and adoption rates across different industry segments and geographic regions. This methodology provides reliable projections and helps identify key market drivers and restraints.

Expert validation involves consultation with industry experts, technology analysts, and cybersecurity professionals to verify research findings and ensure accuracy of market insights. This validation process helps maintain research quality and provides additional perspectives on market developments.

North America maintains market leadership with approximately 42% market share, driven by strong cybersecurity awareness, regulatory requirements, and significant technology adoption across enterprises. The region benefits from the presence of major technology vendors, substantial cybersecurity investments, and mature IT infrastructure that supports advanced identity analytics implementations.

Europe represents a significant market segment with strong growth potential, particularly driven by GDPR compliance requirements and increasing cybersecurity regulations. The region shows approximately 28% market share with notable growth in countries such as Germany, United Kingdom, and France, where organizations prioritize data protection and identity governance.

Asia-Pacific emerges as the fastest-growing region with projected growth rates exceeding 18% CAGR, driven by rapid digital transformation, increasing cyber threats, and growing cybersecurity awareness. Countries such as China, Japan, India, and Australia lead regional adoption as organizations modernize their security infrastructure and implement comprehensive identity management strategies.

Latin America and Middle East & Africa show promising growth potential as organizations in these regions face increasing cybersecurity challenges and regulatory pressures. These markets demonstrate growing awareness of identity-related risks and increasing investment in advanced security technologies to protect against evolving threats.

Market leadership includes established cybersecurity vendors and specialized identity management companies that offer comprehensive identity analytics and intelligence solutions:

Competitive strategies focus on technological innovation, strategic partnerships, and comprehensive solution portfolios that address diverse customer requirements across different industry segments and organizational sizes.

By Component:

By Deployment Model:

By Organization Size:

By Industry Vertical:

User Behavior Analytics represents the largest market category, focusing on analyzing user activities, access patterns, and behavioral anomalies to identify potential security threats. This category demonstrates strong growth as organizations seek to detect insider threats and compromised accounts through advanced behavioral monitoring capabilities.

Identity Governance and Administration shows significant market traction as organizations require comprehensive visibility into user access rights, privilege escalation, and compliance status. According to MarkWide Research, this category experiences approximately 14.8% growth rate driven by regulatory compliance requirements and risk management needs.

Privileged Access Management Analytics gains importance as organizations recognize the critical need to monitor high-risk accounts and privileged user activities. This category focuses on analyzing administrative access patterns, detecting privilege abuse, and ensuring appropriate controls over sensitive system access.

Risk Assessment and Scoring emerges as a crucial category providing quantitative risk metrics and automated risk scoring capabilities. Organizations utilize these solutions to prioritize security responses, allocate resources effectively, and make informed decisions about user access and privileges.

Enhanced Security Posture represents the primary benefit for organizations implementing identity analytics solutions. These platforms provide comprehensive visibility into user activities, enable rapid threat detection, and support proactive security measures that significantly reduce the risk of data breaches and cyber attacks.

Regulatory Compliance benefits include automated compliance reporting, audit trail generation, and governance capabilities that help organizations meet regulatory requirements efficiently. Solutions provide detailed documentation of user access patterns, privilege usage, and security controls that support compliance audits and regulatory assessments.

Operational Efficiency improvements result from automated identity management processes, reduced manual security operations, and streamlined access governance. Organizations experience significant productivity gains through automated user provisioning, access reviews, and risk assessment processes that reduce administrative overhead.

Cost Reduction benefits emerge from preventing security incidents, reducing compliance costs, and optimizing identity management operations. Organizations avoid substantial costs associated with data breaches while reducing the resources required for manual identity governance and security monitoring activities.

Strategic Decision Making capabilities enable organizations to make informed security investments, optimize access policies, and align identity management strategies with business objectives. Advanced analytics provide actionable insights that support strategic planning and risk management decisions.

Strengths:

Weaknesses:

Opportunities:

Threats:

Artificial Intelligence Integration represents a dominant trend as vendors incorporate advanced AI and machine learning capabilities to improve threat detection accuracy and reduce false positives. Organizations increasingly demand intelligent solutions that can adapt to evolving threat patterns and provide predictive security insights.

Zero-Trust Architecture Alignment drives market evolution as organizations implement comprehensive zero-trust security models requiring continuous identity verification and risk assessment. Identity analytics solutions increasingly focus on supporting zero-trust principles through real-time user verification and dynamic access controls.

Cloud-Native Development accelerates as organizations migrate to cloud environments and demand scalable, flexible identity analytics solutions. Vendors prioritize cloud-native architectures that can integrate seamlessly with modern IT infrastructure and provide elastic scaling capabilities.

Behavioral Analytics Enhancement continues advancing with more sophisticated user behavior modeling, anomaly detection, and risk scoring capabilities. Solutions increasingly focus on understanding normal user patterns and identifying subtle deviations that may indicate security threats or policy violations.

Automation and Orchestration trends emphasize automated response capabilities, workflow integration, and orchestrated security operations. Organizations seek solutions that can automatically respond to identified threats, trigger security workflows, and integrate with broader security orchestration platforms.

Strategic acquisitions continue shaping the market landscape as established cybersecurity vendors acquire specialized identity analytics companies to enhance their solution portfolios. These acquisitions enable comprehensive identity security offerings and accelerate technology development through combined expertise and resources.

Partnership agreements between identity analytics vendors and cloud service providers expand market reach and improve solution integration capabilities. These partnerships enable seamless deployment in cloud environments and provide customers with integrated security solutions that span multiple technology platforms.

Product innovations focus on advanced artificial intelligence capabilities, improved user interfaces, and enhanced integration options. Vendors continuously enhance their solutions with new features such as predictive analytics, automated risk scoring, and comprehensive compliance reporting capabilities.

Regulatory compliance enhancements drive solution development as vendors adapt their platforms to meet evolving regulatory requirements across different industries and geographic regions. These enhancements ensure solutions can support compliance with GDPR, CCPA, HIPAA, and other relevant regulations.

Industry certifications and security validations increase as vendors seek to demonstrate solution security and reliability through third-party assessments and compliance certifications. These validations provide customers with confidence in solution security and regulatory compliance capabilities.

Investment prioritization should focus on solutions that provide comprehensive identity analytics capabilities while offering seamless integration with existing security infrastructure. Organizations should evaluate solutions based on their ability to support current security requirements and adapt to future needs as threat landscapes evolve.

Vendor selection criteria should emphasize proven track records, strong customer support, and continuous innovation capabilities. MWR analysis suggests that organizations prioritize vendors who demonstrate commitment to ongoing product development and can provide comprehensive professional services support.

Implementation strategies should include phased deployment approaches that allow organizations to gradually expand identity analytics capabilities while minimizing operational disruption. Starting with high-risk user populations and critical systems can provide immediate security benefits while building organizational expertise.

Skills development investments are crucial for successful identity analytics implementations. Organizations should prioritize training programs for security teams and consider managed services options to supplement internal capabilities during initial deployment phases.

Integration planning should address existing security tools, identity management systems, and enterprise applications to ensure comprehensive coverage and avoid security gaps. Proper integration planning can maximize solution effectiveness while minimizing implementation complexity.

Market expansion projections indicate continued strong growth driven by increasing cybersecurity threats, regulatory requirements, and digital transformation initiatives. The market is expected to maintain robust growth rates exceeding 15% CAGR as organizations prioritize identity-centric security approaches and invest in advanced analytics capabilities.

Technology evolution will continue advancing artificial intelligence, machine learning, and behavioral analytics capabilities. Future solutions will provide more accurate threat detection, improved automation, and enhanced integration with broader security ecosystems to support comprehensive cybersecurity strategies.

Industry adoption patterns suggest expanding market penetration across diverse sectors as organizations recognize the critical importance of identity analytics for protecting against modern cyber threats. Healthcare, financial services, and government sectors are expected to drive significant market growth through specialized solution requirements.

Geographic expansion opportunities in emerging markets will contribute to overall market growth as cybersecurity awareness increases and regulatory frameworks evolve. Asia-Pacific regions particularly show strong potential with projected adoption rates reaching 75% of enterprises implementing some form of identity analytics by 2028.

Solution convergence trends indicate increasing integration between identity analytics, security information and event management (SIEM), and security orchestration platforms. This convergence will create more comprehensive security solutions that provide holistic threat detection and response capabilities across enterprise environments.

The identity analytics and intelligence market represents a critical component of modern cybersecurity strategies, offering organizations essential capabilities for detecting, analyzing, and responding to identity-related threats. Market growth continues accelerating driven by increasing cyber threats, regulatory compliance requirements, and the widespread adoption of digital transformation initiatives that expand organizational attack surfaces.

Technological advancement in artificial intelligence, machine learning, and behavioral analytics creates substantial opportunities for enhanced threat detection accuracy and automated security operations. Organizations increasingly recognize that traditional security approaches are insufficient for protecting against sophisticated attacks targeting user identities and credentials, driving demand for comprehensive identity analytics solutions.

Future market development will be characterized by continued innovation, expanding geographic adoption, and increasing integration with broader security ecosystems. The market offers significant opportunities for vendors who can deliver comprehensive, scalable solutions that address diverse organizational requirements while providing measurable security improvements and regulatory compliance support. As cybersecurity threats continue evolving, identity analytics and intelligence solutions will remain essential for protecting organizational assets and maintaining operational security in an increasingly complex threat landscape.

What is Identity Analytics and Intelligence?

Identity Analytics and Intelligence refers to the processes and technologies used to analyze identity-related data to enhance security, improve user experience, and ensure compliance. It encompasses various applications such as fraud detection, identity verification, and risk management.

What are the key players in the Identity Analytics and Intelligence Market?

Key players in the Identity Analytics and Intelligence Market include IBM, Oracle, and SAS Institute, which provide advanced analytics solutions for identity management and security. Other notable companies include Microsoft and RSA Security, among others.

What are the main drivers of growth in the Identity Analytics and Intelligence Market?

The growth of the Identity Analytics and Intelligence Market is driven by increasing cyber threats, the need for regulatory compliance, and the rising demand for enhanced customer experiences. Organizations are increasingly adopting these solutions to protect sensitive data and streamline identity verification processes.

What challenges does the Identity Analytics and Intelligence Market face?

Challenges in the Identity Analytics and Intelligence Market include data privacy concerns, the complexity of integrating analytics into existing systems, and the evolving nature of cyber threats. These factors can hinder the adoption and effectiveness of identity analytics solutions.

What opportunities exist in the Identity Analytics and Intelligence Market?

Opportunities in the Identity Analytics and Intelligence Market include the growing adoption of artificial intelligence and machine learning for identity verification, the expansion of cloud-based solutions, and the increasing focus on identity governance. These trends are expected to drive innovation and growth in the sector.

What trends are shaping the Identity Analytics and Intelligence Market?

Trends shaping the Identity Analytics and Intelligence Market include the rise of biometric authentication, the integration of identity analytics with other security solutions, and the emphasis on user-centric identity management. These trends are influencing how organizations approach identity security and analytics.

Identity Analytics and Intelligence Market

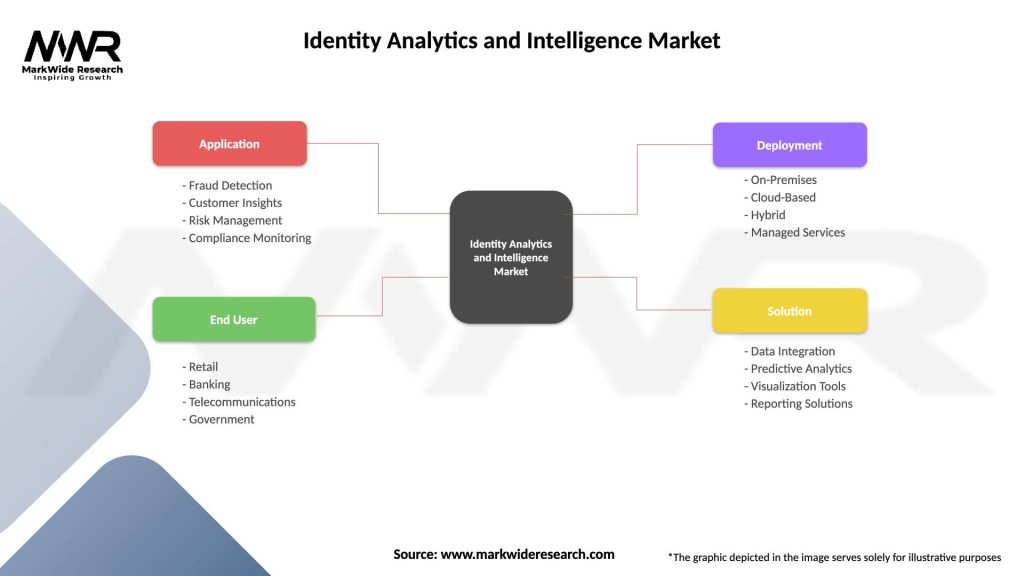

| Segmentation Details | Description |

|---|---|

| Application | Fraud Detection, Customer Insights, Risk Management, Compliance Monitoring |

| End User | Retail, Banking, Telecommunications, Government |

| Deployment | On-Premises, Cloud-Based, Hybrid, Managed Services |

| Solution | Data Integration, Predictive Analytics, Visualization Tools, Reporting Solutions |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Identity Analytics and Intelligence Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at