444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The MEA fruits and vegetable juice market represents a dynamic and rapidly expanding sector within the broader beverage industry across the Middle East and Africa region. This market encompasses a diverse range of products including fresh fruit juices, vegetable juices, blended combinations, and fortified nutritional beverages that cater to the evolving health consciousness of consumers throughout the region. Market dynamics indicate significant growth potential driven by increasing urbanization, rising disposable incomes, and a growing awareness of the health benefits associated with natural fruit and vegetable consumption.

Regional characteristics play a crucial role in shaping market preferences, with countries like the United Arab Emirates, Saudi Arabia, South Africa, and Egypt emerging as key consumption centers. The market demonstrates remarkable diversity in product offerings, ranging from traditional citrus juices popular in North African markets to exotic tropical fruit blends favored in Gulf Cooperation Council countries. Consumer preferences are increasingly shifting toward premium, organic, and cold-pressed juice varieties, reflecting a broader global trend toward healthier lifestyle choices.

Growth trajectories across the MEA region show promising expansion at a compound annual growth rate of 8.2%, with particularly strong performance in the premium juice segment. The market benefits from favorable climatic conditions in many regions that support local fruit and vegetable production, creating opportunities for both domestic processing and export activities. Innovation trends include the introduction of functional beverages, probiotic-enhanced juices, and sustainable packaging solutions that appeal to environmentally conscious consumers.

The MEA fruits and vegetable juice market refers to the comprehensive commercial ecosystem encompassing the production, processing, distribution, and retail sale of liquid beverages derived from fruits and vegetables across Middle Eastern and African countries. This market includes both single-ingredient juices and complex blended formulations that combine multiple fruits, vegetables, or both to create unique flavor profiles and nutritional benefits.

Market scope extends beyond traditional juice products to include smoothies, juice concentrates, frozen juice products, and innovative functional beverages that incorporate additional nutrients, vitamins, or health-promoting compounds. The definition encompasses both domestically produced products utilizing local agricultural resources and imported premium brands that cater to sophisticated consumer preferences in urban markets throughout the region.

Commercial activities within this market span from small-scale local producers serving neighborhood markets to large multinational corporations operating sophisticated processing facilities and extensive distribution networks. The market includes both retail channels such as supermarkets, convenience stores, and specialty health food outlets, as well as food service applications in restaurants, hotels, and institutional catering operations across the MEA region.

Strategic positioning of the MEA fruits and vegetable juice market reveals a sector experiencing robust expansion driven by demographic shifts, health consciousness trends, and economic development across the region. The market demonstrates exceptional resilience and adaptability, with manufacturers successfully navigating diverse regulatory environments, cultural preferences, and economic conditions while maintaining consistent growth momentum.

Key performance indicators highlight the market’s strength, with premium juice segments showing growth rates exceeding 12% annually in major urban centers. The market benefits from increasing penetration of modern retail formats, improved cold chain infrastructure, and growing consumer sophistication regarding product quality and nutritional value. Innovation drivers include the introduction of organic certification programs, sustainable packaging initiatives, and the development of region-specific flavor profiles that resonate with local taste preferences.

Competitive dynamics reveal a market structure that accommodates both international brands and emerging local producers, creating a diverse ecosystem that serves multiple consumer segments effectively. The market’s future trajectory appears highly favorable, supported by demographic trends including population growth, urbanization, and rising middle-class prosperity across key MEA markets.

Consumer behavior analysis reveals several critical insights that shape market development across the MEA region. The following key insights demonstrate the market’s complexity and growth potential:

Health and wellness trends represent the primary driving force behind market expansion, with consumers increasingly recognizing the nutritional benefits of natural fruit and vegetable juices. This trend is particularly pronounced among younger demographics who actively seek alternatives to carbonated soft drinks and artificial beverages. Nutritional awareness campaigns by health organizations and government initiatives promoting healthy eating habits have significantly contributed to market growth across the region.

Economic development across MEA countries has resulted in rising disposable incomes and improved living standards, enabling consumers to invest in premium juice products. The expansion of middle-class populations in countries like Saudi Arabia, UAE, and South Africa has created substantial market opportunities for both domestic and international juice manufacturers. Urbanization trends have facilitated the development of modern retail infrastructure that supports the distribution of refrigerated juice products.

Demographic factors including population growth and increasing youth representation create favorable market conditions. The region’s young population demonstrates higher propensity for trying new products and embracing health-conscious lifestyle choices. Cultural shifts toward Western-influenced consumption patterns, particularly in Gulf countries, have expanded acceptance of diverse juice varieties and premium product categories.

Infrastructure improvements in cold chain logistics and retail distribution have enabled market expansion into previously underserved areas. Enhanced transportation networks and refrigeration capabilities have improved product quality maintenance and extended shelf life, making juice products more accessible to consumers across diverse geographic locations throughout the MEA region.

Economic volatility across several MEA countries presents significant challenges for market growth, with currency fluctuations and political instability affecting consumer purchasing power and business operations. Economic uncertainties in countries experiencing political transitions or commodity price dependencies create unpredictable market conditions that impact both producers and consumers.

Infrastructure limitations in certain regions continue to constrain market development, particularly regarding cold chain logistics and reliable electricity supply for refrigeration. Rural areas often lack adequate retail infrastructure to support the distribution of perishable juice products, limiting market penetration and growth opportunities in these segments.

Regulatory challenges vary significantly across different MEA countries, creating complexity for manufacturers operating in multiple markets. Varying food safety standards, import regulations, and labeling requirements increase operational costs and complicate product development strategies. Certification processes for organic and premium products can be lengthy and expensive, particularly for smaller local producers.

Cultural and religious considerations require careful product formulation and marketing approaches, with certain ingredients or processing methods potentially limiting market acceptance. Seasonal agricultural production patterns can create supply chain challenges and price volatility for raw materials, affecting product availability and pricing strategies throughout the year.

Organic and premium segments present exceptional growth opportunities as consumer sophistication increases across the region. The growing awareness of organic farming benefits and premium product quality creates substantial market potential for manufacturers willing to invest in high-quality production processes and certification programs. Premium positioning strategies can command higher margins while serving the expanding affluent consumer base.

Functional beverage development offers significant opportunities for innovation and market differentiation. Products incorporating probiotics, vitamins, minerals, and other health-enhancing ingredients appeal to health-conscious consumers seeking specific nutritional benefits. Customization opportunities exist for developing region-specific formulations that address local nutritional deficiencies or health concerns.

E-commerce expansion creates new distribution channels and market reach opportunities, particularly important in countries with developing retail infrastructure. Online platforms enable direct-to-consumer sales and provide access to premium products in areas lacking specialized retail outlets. Digital marketing strategies can effectively reach younger demographics who increasingly make purchasing decisions based on online research and social media influence.

Export potential exists for countries with strong agricultural production capabilities to serve regional markets. Cross-border trade opportunities within economic cooperation frameworks can facilitate market expansion and economies of scale for efficient producers. Private label development for major retailers presents opportunities for manufacturers to establish stable, long-term business relationships.

Supply chain evolution demonstrates increasing sophistication as market participants invest in advanced processing technologies and quality control systems. The integration of modern agricultural practices with state-of-the-art processing facilities has improved product quality and consistency while reducing production costs. Vertical integration strategies adopted by major players have enhanced supply chain control and profitability.

Consumer preferences continue evolving toward more diverse and sophisticated product offerings, driving innovation in flavor combinations, packaging formats, and nutritional enhancement. The market responds dynamically to changing consumer demands, with manufacturers introducing new products at an accelerated pace to capture emerging opportunities. Seasonal adaptation strategies help companies manage demand fluctuations effectively.

Competitive intensity has increased as both local and international players recognize the market’s growth potential. This competition drives innovation, improves product quality, and enhances distribution efficiency while maintaining reasonable pricing for consumers. Market consolidation trends are emerging as larger companies acquire successful local brands to expand their regional presence.

Technology adoption in processing, packaging, and distribution continues advancing, with companies implementing automated systems, quality monitoring technologies, and efficient logistics solutions. Sustainability initiatives are becoming increasingly important, with companies investing in environmentally friendly packaging and production processes to meet growing consumer environmental consciousness.

Comprehensive market analysis employs multiple research methodologies to ensure accurate and reliable insights into the MEA fruits and vegetable juice market. Primary research activities include extensive surveys of consumers, retailers, distributors, and industry participants across key markets in the region. Data collection processes utilize both quantitative and qualitative research techniques to capture market dynamics, consumer preferences, and industry trends.

Secondary research incorporates analysis of industry reports, government statistics, trade publications, and company financial statements to provide comprehensive market context. Market sizing methodologies employ bottom-up and top-down approaches to validate market estimates and growth projections. Cross-referencing multiple data sources ensures accuracy and reliability of market insights.

Regional analysis considers the unique characteristics of different MEA markets, including economic conditions, cultural factors, regulatory environments, and competitive landscapes. Segmentation analysis examines market performance across product categories, distribution channels, and consumer demographics to identify specific growth opportunities and market trends.

Industry expert interviews provide valuable insights into market dynamics, competitive strategies, and future development prospects. Trend analysis incorporates both historical performance data and forward-looking indicators to develop accurate market projections and identify emerging opportunities for market participants.

Gulf Cooperation Council countries represent the most developed and sophisticated segment of the MEA fruits and vegetable juice market, with the United Arab Emirates and Saudi Arabia leading consumption and innovation trends. These markets demonstrate strong preference for premium products, with organic juice adoption rates reaching 28% in major urban centers. Consumer sophistication in GCC markets drives demand for diverse flavor profiles, functional beverages, and premium packaging solutions.

North African markets including Egypt, Morocco, and Tunisia show substantial growth potential driven by large populations and improving economic conditions. Traditional citrus juice preferences dominate these markets, though growing urbanization is expanding acceptance of diverse product categories. Local production capabilities in these countries provide competitive advantages for domestic manufacturers while creating export opportunities to other regional markets.

South Africa maintains its position as the most mature market in the region, with well-established distribution networks and sophisticated consumer preferences. The market demonstrates strong performance in premium segments and innovative product categories. Market penetration rates for packaged juices exceed 65% in urban areas, indicating mature market characteristics with opportunities for value-added products.

Sub-Saharan African markets present significant long-term growth opportunities despite current infrastructure challenges. Countries like Nigeria, Kenya, and Ghana show promising demographic trends and economic development that support future market expansion. Infrastructure development initiatives in these markets are gradually improving distribution capabilities and market accessibility.

Market leadership in the MEA fruits and vegetable juice sector is characterized by a diverse mix of international corporations, regional players, and emerging local brands. The competitive environment demonstrates healthy dynamics that promote innovation, quality improvement, and market expansion across different consumer segments.

Competitive strategies focus on product innovation, distribution network expansion, and brand building activities that resonate with local consumer preferences while maintaining international quality standards.

Product category segmentation reveals distinct market characteristics and growth patterns across different juice types and formulations. The market demonstrates clear differentiation between traditional single-fruit juices and innovative blended products that combine multiple ingredients for enhanced nutritional value and unique flavor profiles.

By Product Type:

By Packaging Format:

Fresh juice categories demonstrate the strongest growth momentum, with consumers increasingly valuing products that maintain natural flavor profiles and nutritional integrity. Cold-pressed juices represent the fastest-growing subcategory, appealing to health-conscious consumers willing to pay premium prices for superior quality and nutritional benefits. This segment shows annual growth rates exceeding 15% in major urban markets across the region.

Organic juice products have gained significant traction among affluent consumers, particularly in GCC countries where disposable incomes support premium purchasing decisions. Certification requirements and supply chain complexities create barriers to entry but also provide competitive advantages for established organic producers. The organic segment commands price premiums of 40-60% above conventional products while maintaining strong demand growth.

Functional beverage categories represent the most innovative segment, with manufacturers developing products that address specific health concerns or nutritional needs. Probiotic-enhanced juices have shown particular success in markets where digestive health awareness is high. Vitamin-fortified products appeal to consumers seeking convenient ways to supplement their nutritional intake through regular beverage consumption.

Traditional juice categories maintain stable market positions while adapting to changing consumer preferences through improved packaging, quality enhancement, and value-added formulations. Citrus juices remain fundamental to market structure, providing reliable volume and serving as entry points for new market participants.

Manufacturers benefit from expanding market opportunities that support sustainable business growth and profitability improvement. The market’s diverse consumer base enables companies to develop multiple product lines targeting different segments, reducing dependence on single product categories and improving overall business resilience. Innovation opportunities in product development, packaging, and marketing create competitive advantages and market differentiation possibilities.

Retailers gain from the juice market’s ability to drive foot traffic and increase basket values through complementary product sales. Premium juice categories offer attractive margins while building customer loyalty through quality and health positioning. The market’s growth trajectory provides retailers with reliable revenue streams and opportunities for private label development.

Consumers receive significant health and lifestyle benefits from increased access to nutritious, convenient, and diverse juice products. Nutritional advantages include improved vitamin and mineral intake, enhanced hydration, and support for healthy dietary habits. Product innovation provides consumers with expanding choices that meet specific taste preferences and health objectives.

Agricultural producers benefit from increased demand for high-quality fruits and vegetables, creating stable income opportunities and incentives for production expansion. Contract farming arrangements with juice manufacturers provide price stability and technical support that improve agricultural productivity and farmer livelihoods throughout the region.

Economic development benefits include job creation across the value chain, from agricultural production through processing, distribution, and retail activities. Export opportunities for successful regional producers contribute to foreign exchange earnings and economic diversification efforts in MEA countries.

Strengths:

Weaknesses:

Opportunities:

Threats:

Health and wellness positioning has emerged as the dominant trend shaping product development and marketing strategies across the MEA fruits and vegetable juice market. Manufacturers increasingly emphasize nutritional benefits, natural ingredients, and functional health properties in their product communications. Clean label trends drive demand for products with minimal processing and recognizable ingredients that appeal to health-conscious consumers.

Premium product proliferation reflects growing consumer willingness to pay higher prices for superior quality, organic certification, and unique flavor experiences. Artisanal and craft juice producers have gained market share by offering distinctive products that differentiate from mass-market alternatives. This trend particularly resonates in affluent urban markets where consumers seek authentic and high-quality beverage experiences.

Sustainable packaging innovation addresses growing environmental consciousness among consumers and regulatory pressure for reduced plastic waste. Biodegradable materials, recyclable packaging, and reduced packaging waste initiatives have become important competitive differentiators. Companies investing in sustainable packaging solutions often achieve positive brand perception and customer loyalty benefits.

Digital marketing integration has transformed how juice brands connect with consumers, particularly younger demographics who rely heavily on social media for product discovery and purchase decisions. Influencer partnerships and social media campaigns effectively build brand awareness and drive trial among target consumer segments. E-commerce platforms provide direct-to-consumer sales channels that complement traditional retail distribution.

Functional beverage development continues expanding as manufacturers incorporate probiotics, vitamins, minerals, and other health-enhancing ingredients into juice formulations. Immunity-boosting products have gained particular popularity, reflecting consumer interest in products that support overall health and wellness objectives.

Manufacturing capacity expansion across the region demonstrates industry confidence in long-term market growth prospects. Major producers have announced significant investments in new production facilities and equipment upgrades that enhance processing capabilities and product quality. Technology adoption in processing and packaging has improved efficiency while reducing production costs and environmental impact.

Strategic partnerships between international brands and local distributors have accelerated market penetration and brand building activities. These collaborations combine global expertise with local market knowledge to develop products and marketing strategies that resonate with regional consumer preferences. Joint ventures have enabled technology transfer and capacity building that benefits the overall industry ecosystem.

Regulatory harmonization efforts across MEA countries are gradually reducing trade barriers and compliance complexities for regional producers. Food safety standards alignment facilitates cross-border trade while ensuring consistent product quality and consumer protection. These developments support market integration and economies of scale for efficient producers.

Sustainability initiatives have gained momentum as companies respond to environmental concerns and regulatory requirements. Water conservation programs, renewable energy adoption, and waste reduction initiatives demonstrate industry commitment to environmental responsibility. These efforts often result in operational cost savings while improving brand reputation and stakeholder relationships.

Innovation accelerators and startup incubation programs have emerged to support new product development and entrepreneurship in the juice industry. These initiatives foster creativity and innovation while providing access to funding and market development resources for promising new companies and products.

Market entry strategies should prioritize understanding local consumer preferences and cultural considerations that influence purchasing decisions across different MEA markets. MarkWide Research analysis indicates that successful companies invest significantly in market research and product adaptation to meet specific regional requirements. Companies should develop flexible product portfolios that can be customized for different markets while maintaining operational efficiency.

Distribution network development requires careful consideration of infrastructure capabilities and retail landscape characteristics in target markets. Partnership strategies with established local distributors often provide more effective market entry than attempting to build distribution networks independently. Companies should evaluate both traditional and modern retail channels to maximize market coverage and consumer accessibility.

Innovation focus should emphasize health and wellness benefits, premium quality positioning, and sustainable packaging solutions that align with evolving consumer preferences. Product development investments in functional beverages and organic formulations offer significant differentiation opportunities in competitive markets. Companies should balance innovation with proven consumer acceptance to minimize market risks.

Brand building activities should leverage digital marketing channels while maintaining presence in traditional media that reaches diverse consumer demographics. Social media strategies particularly important for engaging younger consumers who influence household purchasing decisions. Brand messaging should emphasize health benefits, quality, and local relevance to build strong consumer connections.

Supply chain optimization should focus on ensuring consistent product quality and availability while managing costs effectively. Vertical integration opportunities in agricultural production or processing may provide competitive advantages and supply security. Companies should invest in cold chain capabilities and quality control systems that support premium product positioning.

Long-term growth prospects for the MEA fruits and vegetable juice market remain highly favorable, supported by demographic trends, economic development, and evolving consumer preferences toward healthier beverage choices. Market expansion is expected to continue at robust rates, with premium segments leading growth as consumer sophistication increases across the region. MWR projections indicate sustained market momentum driven by urbanization and rising disposable incomes.

Technology advancement will continue transforming production processes, product quality, and distribution efficiency throughout the forecast period. Automation adoption in manufacturing and packaging will improve consistency while reducing labor costs and operational complexity. Digital technologies will enhance supply chain visibility and enable more responsive demand planning and inventory management.

Product innovation will accelerate as manufacturers develop increasingly sophisticated formulations that address specific consumer health and wellness objectives. Personalized nutrition trends may drive development of customized juice products tailored to individual dietary needs and preferences. Functional beverage categories are projected to achieve growth rates exceeding 18% annually as health consciousness continues expanding.

Market consolidation trends are likely to continue as larger companies acquire successful local brands and smaller players to expand their regional presence and product portfolios. Strategic partnerships will become increasingly important for accessing new markets, technologies, and distribution channels. Export development opportunities will expand as regional trade integration progresses and quality standards harmonize across MEA countries.

Sustainability requirements will become increasingly important competitive factors, with companies investing in environmentally friendly packaging, production processes, and supply chain practices. Circular economy principles will influence business model development and operational strategies throughout the industry.

The MEA fruits and vegetable juice market represents a dynamic and rapidly evolving sector with exceptional growth potential driven by favorable demographic trends, increasing health consciousness, and economic development across the region. Market fundamentals remain strong, with diverse consumer preferences creating opportunities for both traditional and innovative product categories that serve different market segments effectively.

Strategic success factors include deep understanding of local market characteristics, investment in quality and innovation, development of efficient distribution networks, and building strong brand relationships with consumers. Companies that successfully navigate the region’s complexity while maintaining operational excellence are well-positioned to capitalize on substantial growth opportunities in this expanding market.

Future market development will be characterized by continued premiumization, functional product innovation, sustainability focus, and digital transformation of marketing and distribution strategies. The market’s long-term outlook remains highly positive, supported by demographic trends and economic development that favor continued expansion of the fruits and vegetable juice sector throughout the MEA region.

What is Fruits and Vegetable Juice?

Fruits and Vegetable Juice refers to beverages made from the extraction or pressing of the natural liquid contained in fruits and vegetables. These juices are popular for their nutritional benefits and are consumed for hydration, health, and flavor.

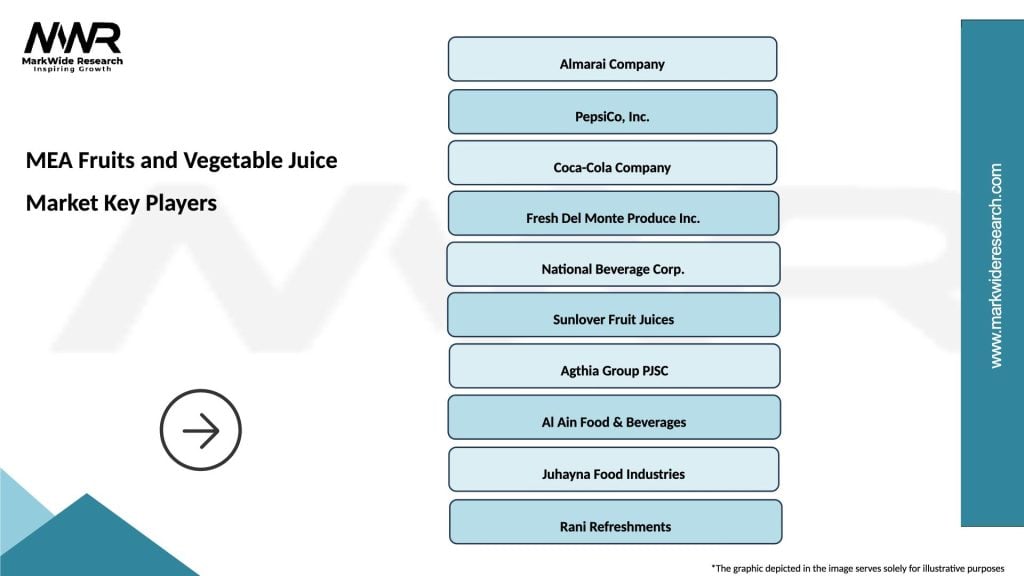

What are the key players in the MEA Fruits and Vegetable Juice Market?

Key players in the MEA Fruits and Vegetable Juice Market include companies like Almarai, Tropicana, and Del Monte, which offer a variety of fruit and vegetable juice products. These companies compete on quality, flavor variety, and health benefits, among others.

What are the growth factors driving the MEA Fruits and Vegetable Juice Market?

The MEA Fruits and Vegetable Juice Market is driven by increasing health consciousness among consumers, a growing demand for natural and organic beverages, and the rising popularity of functional drinks that offer added health benefits.

What challenges does the MEA Fruits and Vegetable Juice Market face?

Challenges in the MEA Fruits and Vegetable Juice Market include high production costs, competition from alternative beverages, and issues related to the shelf life and preservation of natural juices.

What opportunities exist in the MEA Fruits and Vegetable Juice Market?

Opportunities in the MEA Fruits and Vegetable Juice Market include the expansion of distribution channels, the introduction of innovative flavors and blends, and the increasing trend towards health and wellness products among consumers.

What trends are shaping the MEA Fruits and Vegetable Juice Market?

Trends in the MEA Fruits and Vegetable Juice Market include a rise in cold-pressed juices, the incorporation of superfoods into juice blends, and a growing emphasis on sustainable packaging solutions to appeal to environmentally conscious consumers.

MEA Fruits and Vegetable Juice Market

| Segmentation Details | Description |

|---|---|

| Product Type | 100% Juice, Juice Blend, Nectar, Concentrate |

| Packaging Type | Bottles, Tetra Packs, Cans, Pouches |

| Distribution Channel | Supermarkets, Online Retail, Convenience Stores, Health Food Stores |

| End User | Households, Restaurants, Cafés, Hotels |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the MEA Fruits and Vegetable Juice Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at