444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The Middle East and Africa armored vehicle market represents one of the most dynamic and strategically important defense sectors globally, driven by complex geopolitical landscapes and evolving security requirements. This region has witnessed substantial growth in armored vehicle procurement and modernization programs, with countries investing heavily in advanced protective technologies and tactical mobility solutions. The market encompasses a comprehensive range of platforms including main battle tanks, armored personnel carriers, infantry fighting vehicles, mine-resistant ambush protected vehicles, and specialized reconnaissance platforms.

Regional dynamics indicate that the market is experiencing robust expansion, with growth rates reaching 8.2% CAGR across key segments. The increasing focus on border security, counter-terrorism operations, and peacekeeping missions has created substantial demand for versatile armored platforms. Countries such as Saudi Arabia, UAE, Turkey, Egypt, and South Africa are leading procurement initiatives, while emerging markets in sub-Saharan Africa are gradually expanding their armored capabilities.

Technological advancement remains a critical driver, with manufacturers integrating cutting-edge protection systems, advanced fire control technologies, and enhanced situational awareness capabilities. The market demonstrates strong preference for modular designs that allow for mission-specific configurations and future upgrade pathways. Additionally, the growing emphasis on indigenous production capabilities has led to increased collaboration between international manufacturers and regional defense companies.

The Middle East and Africa armored vehicle market refers to the comprehensive ecosystem encompassing the development, manufacturing, procurement, and deployment of protected military and security vehicles across the MEA region. This market includes all categories of armored platforms designed to provide crew protection, tactical mobility, and combat effectiveness in diverse operational environments ranging from urban warfare to desert operations.

Market scope extends beyond traditional military applications to include law enforcement, border patrol, peacekeeping, and critical infrastructure protection roles. The definition encompasses both wheeled and tracked platforms, from light armored reconnaissance vehicles to heavy main battle tanks, each designed to meet specific operational requirements and threat profiles prevalent in the region.

Strategic significance of this market lies in its role as a cornerstone of regional defense capabilities, supporting national security objectives, alliance commitments, and stability operations. The market represents the intersection of advanced defense technology, regional manufacturing capabilities, and evolving security doctrines that shape military modernization programs across the Middle East and Africa.

Market performance in the Middle East and Africa armored vehicle sector demonstrates exceptional resilience and growth potential, driven by sustained defense spending and modernization initiatives. The region accounts for approximately 23% of global armored vehicle procurement, reflecting the strategic importance of land-based defense capabilities in addressing diverse security challenges.

Key growth drivers include escalating regional tensions, counter-terrorism requirements, and the need for border security enhancement. The market benefits from substantial government defense budgets, with several countries allocating over 15% of their defense spending to ground vehicle programs. Technology transfer agreements and local production partnerships have become increasingly important, with 65% of new contracts including some form of indigenous manufacturing component.

Competitive landscape features a mix of established international manufacturers and emerging regional players, creating a dynamic environment for innovation and cost-effective solutions. The market shows strong preference for proven platforms with upgrade potential, while simultaneously embracing next-generation technologies such as active protection systems, hybrid propulsion, and advanced command and control integration.

Future trajectory indicates continued expansion with emphasis on multi-role capabilities, enhanced survivability, and reduced lifecycle costs. The integration of artificial intelligence, autonomous systems, and network-centric warfare capabilities is expected to drive the next wave of market evolution.

Strategic insights reveal several critical trends shaping the Middle East and Africa armored vehicle market landscape:

Market maturation is evident in the sophisticated procurement processes and detailed technical specifications being developed by regional defense ministries. The emphasis on total cost of ownership and through-life support has transformed vendor selection criteria, favoring companies that can provide comprehensive capability packages rather than standalone platforms.

Geopolitical tensions serve as the primary catalyst for armored vehicle market growth across the Middle East and Africa. Regional conflicts, border disputes, and security challenges have created sustained demand for advanced protective platforms capable of operating in diverse threat environments. The ongoing need for territorial defense and power projection capabilities drives continuous modernization of armored fleets.

Counter-terrorism operations represent a significant market driver, with specialized vehicles required for urban warfare, convoy protection, and special operations support. The evolving nature of asymmetric threats has increased demand for mine-resistant ambush protected vehicles and platforms with enhanced situational awareness capabilities.

Economic diversification initiatives in several Gulf countries have led to substantial investments in defense manufacturing capabilities, creating demand for technology transfer programs and local production partnerships. These initiatives aim to develop indigenous defense industrial bases while reducing dependence on foreign suppliers.

Alliance commitments and peacekeeping responsibilities require standardized equipment platforms that can operate effectively in multinational environments. This driver has increased demand for NATO-compatible systems and platforms that meet international operational standards.

Border security enhancement programs across the region have created substantial demand for patrol vehicles, surveillance platforms, and rapid response capabilities. The need to secure extensive land borders against smuggling, infiltration, and other transnational threats drives continuous procurement activity.

Budget constraints represent a significant challenge for many countries in the region, particularly those affected by economic volatility or reduced oil revenues. The high acquisition costs of modern armored vehicles, combined with substantial through-life support expenses, can strain defense budgets and delay procurement programs.

Technology transfer restrictions imposed by supplier countries can limit access to advanced systems and create barriers to indigenous production capabilities. Export control regulations and political considerations sometimes prevent the transfer of cutting-edge technologies, forcing buyers to accept less capable alternatives.

Infrastructure limitations in some regions can constrain the deployment and effectiveness of heavy armored platforms. Poor road networks, limited maintenance facilities, and inadequate logistics support can reduce the operational utility of sophisticated systems.

Training requirements for advanced armored systems can be extensive and costly, requiring significant investment in personnel development and support infrastructure. The complexity of modern platforms demands highly skilled operators and maintainers, which may not be readily available in all markets.

Political instability in certain regions can disrupt procurement programs and create uncertainty about long-term requirements. Changing governments may alter defense priorities or cancel existing programs, creating risks for both buyers and suppliers.

Modernization programs across the region present substantial opportunities for armored vehicle manufacturers and system integrators. Many countries operate aging fleets that require replacement or significant upgrades, creating demand for both new platforms and retrofit solutions that can extend service life while improving capabilities.

Technology partnerships offer opportunities for international companies to establish long-term relationships with regional manufacturers and defense organizations. These partnerships can provide access to growing markets while supporting local industrial development objectives and technology transfer requirements.

Specialized applications such as border patrol, law enforcement, and critical infrastructure protection represent emerging market segments with distinct requirements. The development of purpose-built platforms for these applications can create new revenue streams and market differentiation opportunities.

Maintenance and support services represent a growing opportunity as fleets expand and age. The complexity of modern armored vehicles requires sophisticated support capabilities, creating demand for comprehensive through-life support contracts and local service capabilities.

Export potential from regional manufacturing centers could transform some countries from importers to exporters of armored vehicles. The development of indigenous capabilities, combined with competitive cost structures, could enable regional manufacturers to compete in global markets.

Supply chain evolution in the Middle East and Africa armored vehicle market reflects increasing emphasis on regional production capabilities and reduced dependence on traditional supplier countries. The establishment of local manufacturing facilities has created new dynamics in vendor relationships and technology transfer arrangements.

Competitive intensity has increased significantly as more manufacturers seek to establish presence in high-growth regional markets. This competition has driven innovation in both technical capabilities and commercial terms, benefiting end users through improved value propositions and more flexible procurement arrangements.

Customer sophistication has evolved substantially, with defense organizations developing detailed technical specifications and comprehensive evaluation criteria. The emphasis on total cost of ownership, operational effectiveness, and industrial participation has transformed procurement processes and vendor selection methodologies.

Technology convergence between military and commercial sectors has accelerated, with civilian automotive technologies being adapted for defense applications. This convergence has reduced development costs and accelerated innovation cycles while improving reliability and maintainability of military platforms.

Regulatory environment continues to evolve, with new standards for vehicle safety, environmental impact, and export controls affecting market dynamics. Compliance with international standards and regulations has become increasingly important for market access and competitive positioning.

Comprehensive analysis of the Middle East and Africa armored vehicle market employs multiple research methodologies to ensure accuracy and completeness of findings. Primary research includes extensive interviews with defense officials, procurement specialists, industry executives, and technical experts across the region to gather firsthand insights into market trends and requirements.

Secondary research encompasses analysis of government defense budgets, procurement announcements, industry reports, and technical publications to establish market size, growth trends, and competitive dynamics. This approach provides quantitative foundation for market assessments and trend analysis.

Market modeling techniques incorporate historical data, current market conditions, and forward-looking indicators to develop accurate projections and scenario analyses. The methodology accounts for regional variations, program timelines, and external factors that influence market development.

Validation processes include cross-referencing multiple data sources, expert review panels, and sensitivity analysis to ensure reliability of findings and recommendations. The research methodology emphasizes transparency and reproducibility to support strategic decision-making by market participants.

Continuous monitoring of market developments, policy changes, and technological advances ensures that analysis remains current and relevant. The methodology incorporates feedback mechanisms to refine analytical approaches and improve accuracy of future assessments.

Gulf Cooperation Council countries represent the largest segment of the Middle East and Africa armored vehicle market, accounting for approximately 42% of regional procurement activity. Saudi Arabia leads with extensive modernization programs covering main battle tanks, infantry fighting vehicles, and specialized platforms. The UAE focuses on advanced technologies and multi-role capabilities, while Kuwait, Qatar, and Oman pursue targeted capability enhancements.

North African markets demonstrate strong growth potential, with Egypt maintaining significant armored vehicle production capabilities and Morocco expanding its indigenous manufacturing base. Algeria continues substantial procurement programs while Tunisia and Libya represent emerging opportunities despite political challenges.

Sub-Saharan Africa shows increasing activity in armored vehicle procurement, with South Africa maintaining its position as a regional manufacturing hub. Nigeria, Kenya, and Ghana are expanding their armored capabilities while countries like Botswana and Namibia pursue targeted acquisitions for specific security requirements.

Levant region markets are influenced by ongoing security challenges, with Jordan and Lebanon maintaining active procurement programs despite budget constraints. The region emphasizes proven, cost-effective platforms with strong support infrastructure and rapid deployment capabilities.

East African markets are experiencing growth driven by peacekeeping commitments and border security requirements. Ethiopia, Tanzania, and Uganda are expanding their armored capabilities while regional cooperation initiatives create opportunities for standardized procurement approaches.

Market leadership in the Middle East and Africa armored vehicle sector is distributed among several major international manufacturers and emerging regional players:

Competitive strategies increasingly focus on technology transfer, local production partnerships, and comprehensive support packages. Companies that can demonstrate long-term commitment to regional markets through industrial participation and capability development are gaining competitive advantages.

Innovation leadership is driving differentiation through advanced protection systems, improved mobility, and enhanced situational awareness capabilities. The integration of artificial intelligence and autonomous systems represents the next frontier of competitive advantage.

By Platform Type:

By Application:

By Technology:

Main Battle Tanks continue to represent the cornerstone of armored capabilities across the region, with countries prioritizing platforms that combine firepower, protection, and mobility. Modern MBTs feature advanced fire control systems, modular armor packages, and network connectivity that enables integration with broader command and control systems.

Infantry Fighting Vehicles are experiencing strong demand growth as military doctrines emphasize combined arms operations and mechanized infantry capabilities. The market shows preference for platforms that can adapt to multiple roles while providing superior crew protection and situational awareness.

Mine-Resistant Vehicles represent one of the fastest-growing segments, driven by the persistent threat of improvised explosive devices and the need for force protection in asymmetric conflict environments. Advanced blast-resistant designs and crew survivability features are key differentiators in this category.

Wheeled Armored Vehicles are gaining popularity due to their strategic mobility, reduced logistics footprint, and cost-effectiveness compared to tracked alternatives. The versatility of wheeled platforms makes them suitable for diverse applications from peacekeeping to border patrol missions.

Upgrade and Retrofit Programs constitute a significant market segment as countries seek to extend the service life of existing platforms while incorporating modern technologies. These programs offer cost-effective capability enhancement and represent substantial opportunities for system integrators.

Defense manufacturers benefit from sustained demand growth and opportunities to establish long-term partnerships with regional customers. The emphasis on technology transfer and local production creates opportunities for expanded market presence and revenue diversification beyond traditional export models.

Regional governments gain access to advanced military capabilities while developing indigenous defense industrial bases that support economic diversification objectives. Local production partnerships create employment opportunities and technology transfer that benefits broader industrial development.

Technology providers can leverage the region’s growing demand for advanced systems to establish market presence and develop specialized solutions for unique operational requirements. The market’s emphasis on proven technologies with upgrade potential creates opportunities for sustained engagement.

Service providers benefit from the growing complexity of modern armored vehicles, which creates demand for comprehensive support services, training programs, and maintenance capabilities. The establishment of regional service centers provides opportunities for long-term revenue streams.

Financial institutions can participate in the market through defense financing solutions, export credit arrangements, and project financing for large-scale procurement programs. The stable demand profile and government backing make armored vehicle programs attractive financing opportunities.

Strengths:

Weaknesses:

Opportunities:

Threats:

Digital transformation is revolutionizing armored vehicle capabilities through integration of artificial intelligence, advanced sensors, and network-centric warfare systems. Modern platforms increasingly feature digital cockpits, automated systems, and enhanced situational awareness capabilities that improve operational effectiveness.

Modular design approaches are becoming standard practice, allowing platforms to be configured for specific missions while maintaining commonality in core systems. This trend reduces lifecycle costs and improves logistics efficiency while providing operational flexibility.

Active protection systems are transitioning from optional to standard equipment as threats evolve and countermeasure technologies mature. The integration of hard-kill and soft-kill systems provides comprehensive protection against diverse threat types.

Hybrid propulsion systems are gaining attention as military organizations seek to reduce fuel consumption, improve stealth characteristics, and enhance operational range. Electric drive systems also enable silent operation capabilities for reconnaissance and special operations.

Autonomous capabilities are being integrated into armored vehicles for logistics support, reconnaissance missions, and force protection applications. While fully autonomous combat vehicles remain in development, semi-autonomous systems are already enhancing operational capabilities.

Cybersecurity integration has become critical as vehicles become more connected and dependent on digital systems. Robust cybersecurity measures are now essential requirements for modern armored platforms operating in network-centric environments.

Strategic partnerships between international manufacturers and regional companies have accelerated, with several major agreements announced for technology transfer and local production capabilities. These partnerships are reshaping the competitive landscape and creating new market dynamics.

Indigenous development programs have gained momentum, with countries like Turkey, South Africa, and UAE demonstrating significant progress in developing domestically-produced armored vehicles. These programs are reducing import dependence while building export capabilities.

Next-generation technologies are being integrated into production platforms, including advanced materials, artificial intelligence, and autonomous systems. According to MarkWide Research analysis, technology integration rates have increased by 35% over the past three years.

Upgrade program expansion has accelerated as countries seek to modernize existing fleets cost-effectively. Major retrofit programs are incorporating advanced protection systems, improved fire control, and enhanced communication capabilities.

Regional cooperation initiatives are creating opportunities for standardized procurement and joint development programs. These initiatives aim to achieve economies of scale while building regional defense industrial capabilities.

Sustainability focus is emerging as a key consideration, with manufacturers developing more fuel-efficient platforms and exploring alternative propulsion systems. Environmental considerations are increasingly influencing procurement decisions and design requirements.

Market participants should prioritize development of comprehensive capability packages that combine platforms, training, and support services. The market increasingly values total solutions rather than standalone products, creating opportunities for companies that can provide integrated offerings.

Technology investment should focus on areas that address specific regional requirements such as desert operations, urban warfare, and counter-IED capabilities. Companies that can demonstrate superior performance in these challenging environments will gain competitive advantages.

Partnership strategies should emphasize long-term relationships with regional manufacturers and defense organizations. The market rewards companies that demonstrate commitment to local industrial development and technology transfer.

Service capabilities should be developed to support the growing installed base of complex armored vehicles. Companies that can provide comprehensive through-life support will benefit from recurring revenue streams and customer loyalty.

Innovation focus should address emerging requirements such as network integration, autonomous systems, and advanced protection technologies. Early investment in these areas will position companies for future market opportunities.

Risk management strategies should account for political and economic volatility in the region. Diversified market approaches and flexible business models can help mitigate risks while capturing growth opportunities.

Market trajectory for the Middle East and Africa armored vehicle sector remains strongly positive, with sustained growth expected across all major segments. MWR projections indicate continued expansion driven by modernization requirements, emerging threats, and regional industrial development initiatives.

Technology evolution will accelerate the integration of artificial intelligence, autonomous systems, and advanced materials into production platforms. The next generation of armored vehicles will feature unprecedented levels of connectivity, situational awareness, and operational effectiveness.

Regional manufacturing capabilities will continue expanding, with several countries expected to achieve significant indigenous production capacity within the next decade. This trend will reshape supply chains and create new competitive dynamics in the global market.

Market consolidation may occur as smaller players struggle to compete with the substantial investment requirements for advanced technologies and regional presence. Strategic partnerships and acquisitions are likely to reshape the competitive landscape.

Emerging applications such as border security, critical infrastructure protection, and peacekeeping operations will create new market segments with distinct requirements. These applications offer opportunities for specialized platforms and innovative solutions.

Sustainability considerations will become increasingly important, driving development of more efficient platforms and alternative propulsion systems. Environmental regulations and operational cost pressures will influence future design requirements and procurement decisions.

The Middle East and Africa armored vehicle market represents a dynamic and strategically important sector characterized by robust growth, technological advancement, and evolving customer requirements. The market’s strong fundamentals, driven by persistent security challenges and substantial defense investments, position it as a key growth area for manufacturers and service providers.

Strategic opportunities abound for companies that can navigate the complex regional dynamics while delivering innovative solutions that address specific operational requirements. The emphasis on technology transfer, local production, and comprehensive support services creates multiple pathways for market participation and long-term success.

Future success in this market will depend on the ability to adapt to changing customer needs, integrate advanced technologies, and build sustainable partnerships with regional stakeholders. Companies that can demonstrate long-term commitment to the region while delivering superior value propositions will be best positioned to capitalize on the substantial growth opportunities ahead.

What is Armored Vehicle?

Armored vehicles are specialized military and tactical vehicles designed to provide protection against various threats, including ballistic attacks and explosive devices. They are used in combat, peacekeeping missions, and law enforcement operations.

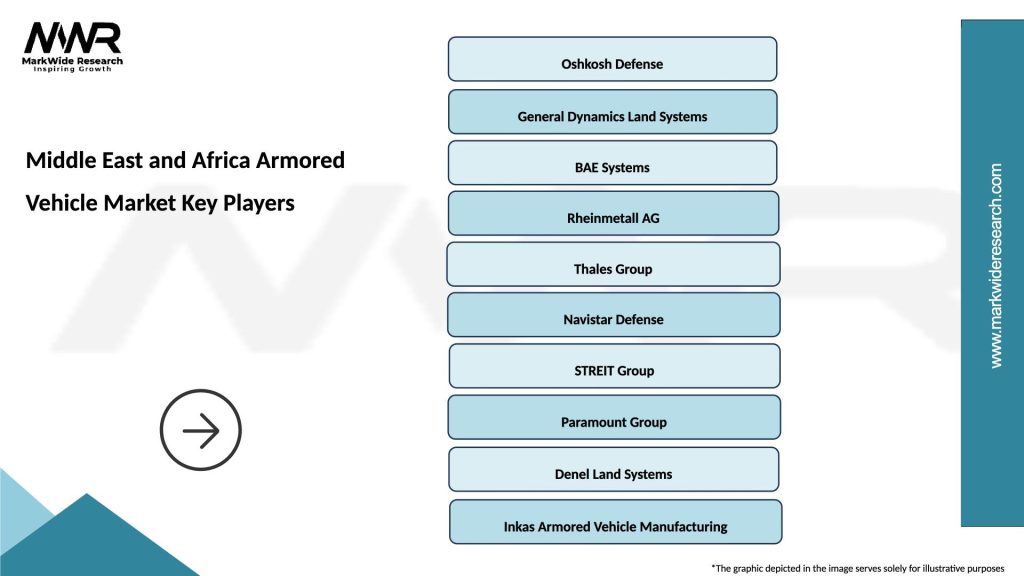

What are the key players in the Middle East and Africa Armored Vehicle Market?

Key players in the Middle East and Africa Armored Vehicle Market include companies like BAE Systems, Oshkosh Defense, and Rheinmetall, which are known for their advanced armored vehicle technologies and solutions, among others.

What are the growth factors driving the Middle East and Africa Armored Vehicle Market?

The growth of the Middle East and Africa Armored Vehicle Market is driven by increasing defense budgets, rising geopolitical tensions, and the need for enhanced security measures in conflict-prone regions. Additionally, modernization of military fleets is contributing to market expansion.

What challenges does the Middle East and Africa Armored Vehicle Market face?

The Middle East and Africa Armored Vehicle Market faces challenges such as high procurement costs, maintenance issues, and the complexity of integrating advanced technologies. Additionally, political instability in certain regions can hinder market growth.

What opportunities exist in the Middle East and Africa Armored Vehicle Market?

Opportunities in the Middle East and Africa Armored Vehicle Market include the development of next-generation armored vehicles, increased demand for unmanned systems, and potential collaborations between defense contractors and local manufacturers to enhance production capabilities.

What trends are shaping the Middle East and Africa Armored Vehicle Market?

Trends in the Middle East and Africa Armored Vehicle Market include the integration of advanced technologies such as artificial intelligence and autonomous systems, a focus on lightweight materials for improved mobility, and the growing emphasis on multi-role capabilities for versatile operational use.

Middle East and Africa Armored Vehicle Market

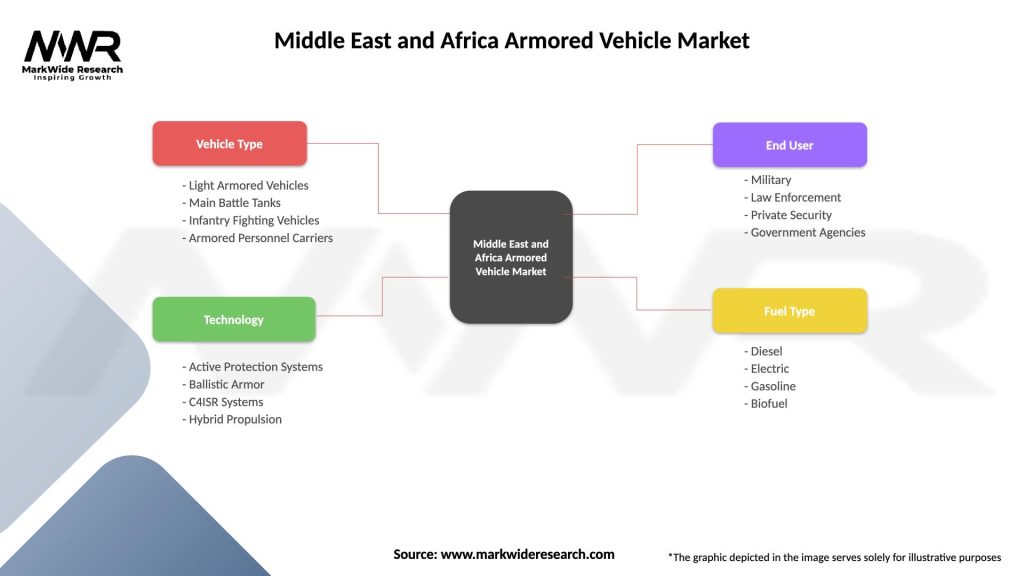

| Segmentation Details | Description |

|---|---|

| Vehicle Type | Light Armored Vehicles, Main Battle Tanks, Infantry Fighting Vehicles, Armored Personnel Carriers |

| Technology | Active Protection Systems, Ballistic Armor, C4ISR Systems, Hybrid Propulsion |

| End User | Military, Law Enforcement, Private Security, Government Agencies |

| Fuel Type | Diesel, Electric, Gasoline, Biofuel |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Middle East and Africa Armored Vehicle Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at