444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Australia & New Zealand industrial flooring market represents a dynamic and rapidly evolving sector within the broader construction and manufacturing industries. This specialized market encompasses a comprehensive range of flooring solutions designed to withstand the demanding conditions of industrial environments, including manufacturing facilities, warehouses, distribution centers, automotive plants, and heavy machinery operations across both nations.

Market growth in this region has been particularly robust, driven by increasing industrialization, infrastructure development, and the growing emphasis on workplace safety and operational efficiency. The market is experiencing a compound annual growth rate (CAGR) of 6.2%, reflecting strong demand across various industrial sectors. Manufacturing expansion and the rise of e-commerce fulfillment centers have created substantial opportunities for industrial flooring contractors and material suppliers.

Australia dominates the regional market with approximately 75% market share, while New Zealand accounts for the remaining 25%. This distribution reflects the relative sizes of the industrial sectors in both countries, with Australia’s larger manufacturing base and more extensive mining operations driving higher demand for specialized flooring solutions. The market encompasses various flooring types, including epoxy coatings, polyurethane systems, concrete polishing, and specialized chemical-resistant surfaces.

The Australia & New Zealand industrial flooring market refers to the comprehensive ecosystem of specialized flooring solutions, installation services, and maintenance systems designed specifically for industrial and commercial applications across both countries. This market encompasses the design, manufacture, supply, installation, and ongoing maintenance of durable flooring systems that can withstand heavy machinery, chemical exposure, high traffic, and extreme operational conditions.

Industrial flooring systems in this context include epoxy resin floors, polyurethane coatings, concrete polishing and sealing, anti-static flooring, chemical-resistant surfaces, and specialized safety flooring solutions. These systems are engineered to provide long-term durability, safety compliance, aesthetic appeal, and operational efficiency in demanding industrial environments ranging from food processing facilities to automotive manufacturing plants.

The Australia & New Zealand industrial flooring market is experiencing unprecedented growth driven by robust industrial expansion, infrastructure development, and increasing focus on workplace safety standards. The market has demonstrated remarkable resilience and adaptability, with technological innovations and sustainable flooring solutions gaining significant traction among end-users.

Key market drivers include the expansion of manufacturing sectors, growth in e-commerce and logistics facilities, stringent safety regulations, and increasing awareness of the long-term cost benefits of high-quality industrial flooring systems. The market is characterized by a diverse range of applications, from heavy manufacturing to food processing, each requiring specialized flooring solutions tailored to specific operational requirements.

Regional dynamics show strong performance across both countries, with Australia leading in absolute terms while New Zealand demonstrates higher growth rates in specific sectors such as dairy processing and renewable energy infrastructure. The market is supported by a robust network of local contractors, international suppliers, and specialized service providers offering comprehensive flooring solutions.

Market segmentation analysis reveals several critical insights that define the current landscape of industrial flooring in Australia and New Zealand. The following key insights provide a comprehensive understanding of market dynamics:

Industrial expansion across Australia and New Zealand serves as the primary catalyst for market growth, with both countries experiencing significant increases in manufacturing capacity and infrastructure development. The ongoing diversification of industrial sectors, including advanced manufacturing, renewable energy, and technology production, creates sustained demand for specialized flooring solutions tailored to specific operational requirements.

E-commerce growth has fundamentally transformed the logistics and warehousing landscape, driving unprecedented demand for high-performance flooring systems capable of supporting automated storage and retrieval systems, heavy machinery, and high-traffic operations. The expansion of fulfillment centers and distribution hubs requires flooring solutions that can withstand constant use while maintaining safety and operational efficiency standards.

Regulatory compliance requirements continue to strengthen across both countries, with workplace safety standards, environmental regulations, and industry-specific guidelines driving demand for compliant flooring solutions. Food safety regulations, pharmaceutical manufacturing standards, and chemical handling requirements necessitate specialized flooring systems that meet stringent performance and safety criteria.

Technological advancement in flooring materials and installation techniques has expanded the range of available solutions while improving performance characteristics and reducing long-term maintenance costs. Innovations in epoxy formulations, polyurethane chemistry, and surface preparation techniques enable flooring systems to deliver enhanced durability, chemical resistance, and aesthetic appeal.

High initial investment requirements represent a significant barrier for many potential customers, particularly smaller industrial operations and startups. The comprehensive nature of industrial flooring projects, including surface preparation, material costs, and specialized installation requirements, can create substantial upfront expenses that may deter cost-sensitive customers from pursuing optimal flooring solutions.

Installation complexity and the need for specialized expertise limit market accessibility and can create project delays. The technical requirements for proper surface preparation, environmental controls during installation, and curing processes require experienced contractors and favorable weather conditions, potentially constraining project scheduling and market growth in certain regions.

Economic volatility and cyclical industrial demand patterns can impact market stability, with construction and manufacturing sectors experiencing periodic downturns that affect flooring investment decisions. Economic uncertainty may lead to project deferrals or reduced specification requirements as customers seek to minimize capital expenditures during challenging periods.

Material cost fluctuations in raw materials, particularly petroleum-based chemicals used in epoxy and polyurethane systems, can create pricing pressures and margin challenges for suppliers and contractors. Supply chain disruptions and commodity price volatility may impact project economics and customer decision-making processes.

Sustainable flooring solutions present substantial growth opportunities as both countries strengthen their commitment to environmental sustainability and carbon reduction targets. The development and adoption of bio-based flooring materials, low-VOC formulations, and recyclable flooring systems align with corporate sustainability initiatives and regulatory trends, creating new market segments and premium pricing opportunities.

Smart building integration offers emerging opportunities for flooring systems that incorporate sensors, monitoring capabilities, and data collection features. The integration of IoT technologies, predictive maintenance systems, and performance monitoring capabilities can create value-added services and differentiation opportunities for forward-thinking suppliers and contractors.

Infrastructure modernization programs across both countries create substantial opportunities for flooring upgrades and replacements in existing industrial facilities. Aging infrastructure, changing operational requirements, and evolving safety standards drive demand for flooring system upgrades and modernization projects that can provide significant market opportunities.

Specialized sector growth in areas such as data centers, pharmaceutical manufacturing, renewable energy production, and advanced manufacturing creates demand for highly specialized flooring solutions with unique performance requirements. These niche markets often command premium pricing and offer opportunities for specialized contractors and suppliers to develop expertise and market leadership.

Supply chain evolution continues to reshape the industrial flooring market, with increasing emphasis on local sourcing, supply chain resilience, and just-in-time delivery capabilities. The integration of digital technologies in supply chain management enables better inventory management, project scheduling, and customer service while reducing costs and improving efficiency across the value chain.

Competitive intensity has increased significantly as the market attracts both established construction companies and specialized flooring contractors seeking to capitalize on growth opportunities. This competition drives innovation, service improvement, and competitive pricing while creating challenges for market participants to maintain margins and differentiate their offerings.

Customer sophistication has evolved substantially, with industrial customers becoming more knowledgeable about flooring options, performance characteristics, and long-term cost implications. This trend toward informed decision-making creates opportunities for suppliers who can provide comprehensive technical support, performance data, and value-based selling approaches.

Technology integration across the entire value chain, from design and specification through installation and maintenance, is transforming traditional business models and creating new service opportunities. Digital tools for project management, quality control, and customer communication enhance service delivery while creating operational efficiencies and competitive advantages.

Comprehensive market analysis for this report employed a multi-faceted research approach combining primary and secondary research methodologies to ensure accuracy and completeness of market insights. The research framework incorporated quantitative data collection, qualitative analysis, and industry expert consultations to provide a holistic view of the Australia & New Zealand industrial flooring market.

Primary research activities included structured interviews with key industry stakeholders, including flooring contractors, material suppliers, end-user customers, and industry associations. Survey methodologies captured quantitative data on market size, growth rates, customer preferences, and competitive dynamics while ensuring representative sampling across both geographic markets and industry segments.

Secondary research encompassed comprehensive analysis of industry publications, government statistics, trade association reports, and company financial disclosures. This research component provided historical context, market trend analysis, and competitive landscape insights while validating primary research findings through triangulation of multiple data sources.

Data validation processes included cross-referencing multiple sources, expert review panels, and statistical analysis to ensure data accuracy and reliability. The research methodology incorporated both bottom-up and top-down market sizing approaches to provide robust market estimates and growth projections for the industrial flooring sector.

Australia’s market leadership reflects the country’s larger industrial base, extensive mining operations, and diverse manufacturing sectors. New South Wales leads regional demand with strong manufacturing and logistics sectors, while Victoria contributes significantly through automotive and food processing industries. Queensland’s mining and agricultural processing sectors create substantial demand for specialized chemical-resistant and heavy-duty flooring systems.

Western Australia presents unique opportunities driven by mining infrastructure, oil and gas facilities, and port operations requiring specialized flooring solutions capable of withstanding extreme conditions and heavy equipment loads. The region’s focus on resource extraction and processing creates demand for flooring systems with exceptional durability and chemical resistance characteristics.

New Zealand’s market dynamics are characterized by strong growth in dairy processing, renewable energy infrastructure, and advanced manufacturing sectors. Auckland dominates demand with 45% of national market share, driven by manufacturing diversity and port operations, while Canterbury’s agricultural processing and Otago’s renewable energy projects contribute to regional growth patterns.

Cross-border collaboration between Australian and New Zealand suppliers, contractors, and customers creates synergies and knowledge sharing opportunities that benefit both markets. Shared regulatory frameworks, similar industrial standards, and cultural similarities facilitate market development and technology transfer between the two countries, enhancing overall market sophistication and growth potential.

Market leadership in the Australia & New Zealand industrial flooring sector is characterized by a mix of international suppliers, regional contractors, and specialized service providers. The competitive landscape features both large multinational companies with comprehensive product portfolios and smaller specialized firms focusing on niche applications or geographic markets.

Key market participants include established players who have built strong reputations through consistent quality delivery and comprehensive service offerings:

Competitive strategies focus on technical innovation, service quality, geographic coverage, and customer relationship management. Leading companies invest heavily in research and development, technical training, and customer support capabilities to maintain competitive advantages and market leadership positions.

Technology-based segmentation reveals distinct market segments with varying growth patterns and customer requirements. Each technology segment serves specific applications and offers unique performance characteristics that appeal to different customer needs and operational requirements.

By Technology:

By Application:

By End-User Industry:

Epoxy flooring systems maintain market leadership through superior chemical resistance, durability, and versatility across diverse industrial applications. These systems excel in manufacturing environments where chemical spills, heavy machinery, and high-traffic conditions demand exceptional performance. Recent innovations in epoxy formulations have enhanced UV resistance, reduced curing times, and improved aesthetic options while maintaining core performance characteristics.

Polyurethane flooring solutions are gaining market share through superior flexibility, impact resistance, and thermal cycling performance. These systems particularly excel in food processing, cold storage, and applications requiring frequent temperature variations. The segment benefits from ongoing innovations in fast-cure formulations and enhanced chemical resistance properties.

Concrete polishing represents a cost-effective solution for warehouse and distribution applications where durability and low maintenance are primary considerations. This category has evolved significantly with advanced diamond grinding techniques, densification treatments, and decorative options that enhance both performance and aesthetic appeal while maintaining competitive pricing.

Specialty flooring systems address niche applications with specific performance requirements such as anti-static properties for electronics manufacturing, antimicrobial surfaces for healthcare facilities, and decorative options for retail and commercial applications. These specialized solutions often command premium pricing while serving critical functional requirements.

Manufacturers and suppliers benefit from robust market growth, technological advancement opportunities, and expanding application diversity that creates multiple revenue streams and market development possibilities. The market’s evolution toward high-performance, specialized solutions enables premium pricing strategies and enhanced profit margins for companies investing in innovation and technical capabilities.

Contractors and installers gain from increasing project complexity, service integration opportunities, and growing demand for specialized expertise that commands premium pricing. The market trend toward comprehensive service offerings, including design consultation, installation, and maintenance services, creates opportunities for business model expansion and customer relationship deepening.

End-user customers realize significant benefits through improved operational efficiency, reduced maintenance costs, enhanced safety performance, and regulatory compliance support. High-quality industrial flooring systems provide long-term value through extended service life, reduced downtime, and improved workplace conditions that enhance productivity and employee satisfaction.

Industry stakeholders including distributors, consultants, and service providers benefit from market expansion, technological advancement, and increasing customer sophistication that creates opportunities for value-added services and specialized expertise development. The market’s growth trajectory supports investment in capabilities, technology, and market development initiatives.

Strengths:

Weaknesses:

Opportunities:

Threats:

Sustainability integration has emerged as a dominant trend driving product development, customer selection criteria, and regulatory compliance across the industrial flooring market. Customers increasingly prioritize eco-friendly materials, low-VOC formulations, and recyclable flooring systems that support corporate sustainability goals while maintaining performance standards.

Digital transformation is revolutionizing project management, quality control, and customer service delivery throughout the industrial flooring value chain. Advanced project management software, digital documentation systems, and remote monitoring capabilities enhance service delivery while improving efficiency and customer satisfaction levels.

Performance enhancement continues through ongoing innovations in material science, application techniques, and system design that deliver superior durability, faster installation, and enhanced aesthetic options. These improvements enable flooring systems to meet increasingly demanding operational requirements while providing better long-term value propositions.

Service integration toward comprehensive solutions encompassing design consultation, installation, and ongoing maintenance services creates competitive differentiation and customer value. This trend enables suppliers and contractors to develop deeper customer relationships while capturing additional revenue opportunities throughout the flooring system lifecycle.

Recent technological advances have introduced next-generation flooring formulations with enhanced performance characteristics, including improved chemical resistance, faster curing times, and superior aesthetic options. These developments enable flooring systems to meet increasingly demanding operational requirements while reducing installation time and project costs.

Market consolidation activities have reshaped the competitive landscape as larger companies acquire specialized contractors and regional suppliers to expand geographic coverage and technical capabilities. This consolidation trend creates opportunities for enhanced service delivery while potentially reducing competitive intensity in some market segments.

Regulatory developments continue to influence product specifications, installation practices, and performance requirements across various industrial sectors. New safety standards, environmental regulations, and industry-specific guidelines drive innovation while creating compliance requirements that favor established suppliers with comprehensive technical capabilities.

Infrastructure investment programs announced by both Australian and New Zealand governments create substantial opportunities for industrial flooring contractors and suppliers. These programs encompass manufacturing facility upgrades, logistics infrastructure development, and renewable energy projects that require specialized flooring solutions.

MarkWide Research analysis indicates that market participants should prioritize sustainability initiatives, technological innovation, and service integration to capitalize on emerging growth opportunities. Companies investing in eco-friendly product development, digital capabilities, and comprehensive service offerings are positioned to capture disproportionate market share growth.

Strategic recommendations emphasize the importance of developing specialized expertise in high-growth sectors such as e-commerce logistics, renewable energy, and advanced manufacturing. These sectors offer premium pricing opportunities and long-term growth potential that justify focused investment in technical capabilities and market development activities.

Geographic expansion strategies should consider the unique characteristics and growth patterns of different regional markets within Australia and New Zealand. Successful market development requires understanding local industrial dynamics, regulatory requirements, and customer preferences that influence product selection and service delivery approaches.

Partnership development with complementary service providers, technology companies, and industry specialists can enhance competitive positioning while expanding service capabilities and market reach. Strategic alliances enable companies to offer comprehensive solutions while leveraging partner expertise and resources.

Market growth trajectory remains strongly positive with continued expansion expected across all major segments and geographic regions. The combination of industrial growth, infrastructure investment, and technological advancement creates a favorable environment for sustained market development over the next five to ten years.

Technology evolution will continue driving product innovation, installation efficiency, and performance enhancement that expands market opportunities while improving customer value propositions. Emerging technologies including smart sensors, predictive maintenance systems, and advanced material formulations will create new market segments and service opportunities.

Sustainability requirements will increasingly influence product development, customer selection criteria, and regulatory compliance across the industrial flooring market. Companies developing comprehensive sustainability strategies and eco-friendly product portfolios are positioned to capture growing market segments focused on environmental performance.

MWR projections indicate that the market will continue expanding at robust growth rates, with particular strength in specialized applications, high-performance systems, and integrated service offerings. The outlook remains positive despite potential economic volatility, supported by fundamental industrial growth trends and infrastructure development requirements.

The Australia & New Zealand industrial flooring market represents a dynamic and rapidly evolving sector with substantial growth opportunities driven by industrial expansion, technological advancement, and increasing focus on operational efficiency and sustainability. The market’s strong fundamentals, including robust industrial sectors, high-quality standards, and technological sophistication, support continued growth and development across all major segments.

Key success factors for market participants include technological innovation, service integration, sustainability focus, and specialized expertise development that enables differentiation and premium positioning. Companies investing in these capabilities while maintaining operational excellence and customer focus are positioned to capture disproportionate growth opportunities in this expanding market.

Future market development will be characterized by continued technological advancement, sustainability integration, and service evolution that creates new opportunities while enhancing customer value propositions. The combination of strong industrial growth, infrastructure investment, and regulatory support creates a favorable environment for sustained market expansion and profitability across the Australia & New Zealand industrial flooring sector.

What is Industrial Flooring?

Industrial flooring refers to specialized flooring solutions designed for heavy-duty applications in various industries, including manufacturing, warehousing, and logistics. These floors are engineered to withstand high traffic, chemical exposure, and heavy loads, ensuring durability and safety in industrial environments.

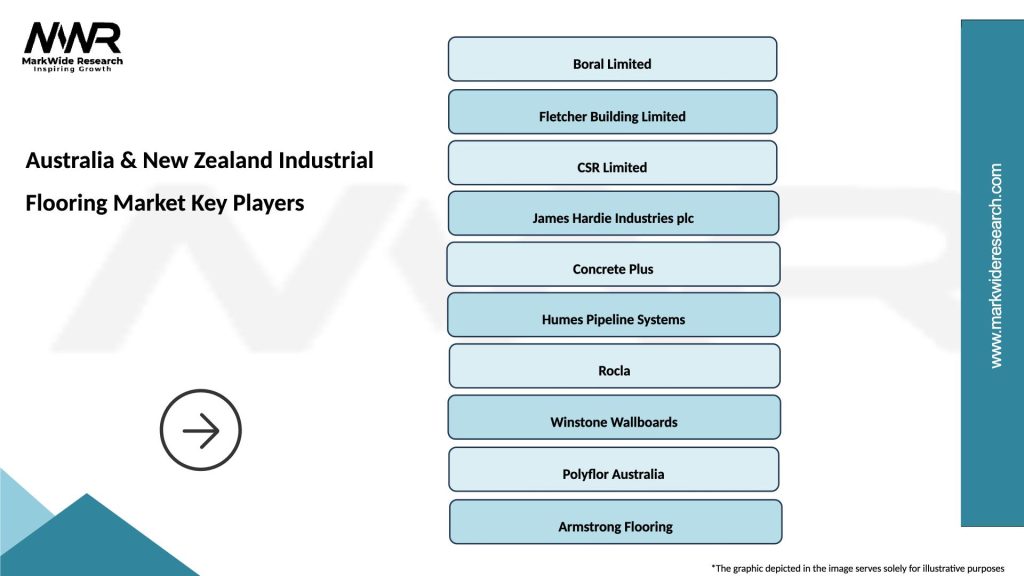

What are the key players in the Australia & New Zealand Industrial Flooring Market?

Key players in the Australia & New Zealand Industrial Flooring Market include companies like Boral Limited, Sika Australia, and Polyflor Australia. These companies offer a range of industrial flooring solutions tailored to meet the needs of various sectors, including commercial and industrial applications, among others.

What are the main drivers of the Australia & New Zealand Industrial Flooring Market?

The main drivers of the Australia & New Zealand Industrial Flooring Market include the growth of the construction industry, increasing demand for durable flooring solutions, and the rise in industrial activities. Additionally, advancements in flooring technology and materials are contributing to market expansion.

What challenges does the Australia & New Zealand Industrial Flooring Market face?

Challenges in the Australia & New Zealand Industrial Flooring Market include fluctuating raw material prices, stringent regulations regarding environmental impact, and competition from alternative flooring solutions. These factors can affect pricing and availability in the market.

What opportunities exist in the Australia & New Zealand Industrial Flooring Market?

Opportunities in the Australia & New Zealand Industrial Flooring Market include the increasing focus on sustainable flooring options and the growing demand for customized flooring solutions. Additionally, the expansion of e-commerce and logistics sectors presents new avenues for growth.

What trends are shaping the Australia & New Zealand Industrial Flooring Market?

Trends shaping the Australia & New Zealand Industrial Flooring Market include the adoption of eco-friendly materials, the integration of smart technology in flooring systems, and the growing popularity of polished concrete and resin flooring. These trends reflect a shift towards sustainability and innovation in industrial environments.

Australia & New Zealand Industrial Flooring Market

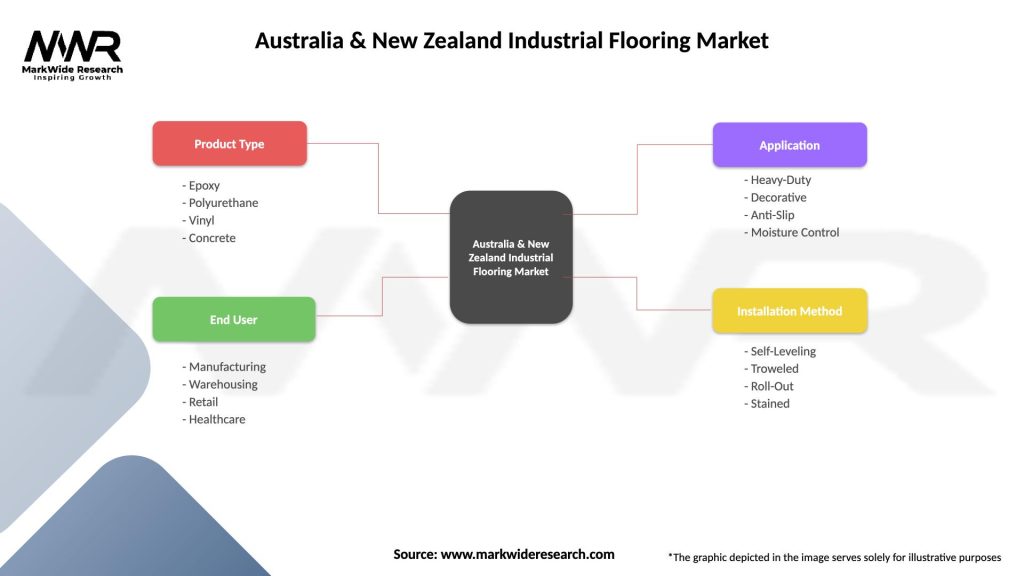

| Segmentation Details | Description |

|---|---|

| Product Type | Epoxy, Polyurethane, Vinyl, Concrete |

| End User | Manufacturing, Warehousing, Retail, Healthcare |

| Application | Heavy-Duty, Decorative, Anti-Slip, Moisture Control |

| Installation Method | Self-Leveling, Troweled, Roll-Out, Stained |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Australia & New Zealand Industrial Flooring Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at