444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

The safety in automotive market represents a critical sector focused on developing, manufacturing, and implementing advanced safety technologies and systems designed to protect vehicle occupants and pedestrians. This comprehensive market encompasses a wide range of safety solutions including active safety systems, passive safety components, advanced driver assistance systems (ADAS), and emerging autonomous safety technologies. The market has experienced unprecedented growth driven by stringent regulatory requirements, increasing consumer awareness about vehicle safety, and rapid technological advancements in automotive engineering.

Market dynamics indicate robust expansion across all major automotive segments, with passenger vehicles, commercial vehicles, and electric vehicles all incorporating increasingly sophisticated safety features. The integration of artificial intelligence, machine learning, and sensor technologies has revolutionized automotive safety, enabling vehicles to predict, prevent, and mitigate potential accidents. Current market trends show that 65% of new vehicles now come equipped with at least five advanced safety features as standard equipment, reflecting the industry’s commitment to enhanced protection standards.

Regional markets demonstrate varying adoption rates, with North America and Europe leading in regulatory compliance and consumer demand for advanced safety features. The Asia-Pacific region shows the highest growth potential, driven by expanding automotive production, rising disposable incomes, and increasing safety consciousness among consumers. Emerging markets are experiencing accelerated adoption of safety technologies as manufacturers prioritize global safety standards across all vehicle platforms.

The safety in automotive market refers to the comprehensive ecosystem of technologies, systems, components, and services designed to prevent accidents, protect occupants during collisions, and minimize the severity of injuries in automotive applications. This market encompasses both active safety systems that work to prevent accidents from occurring and passive safety systems that protect occupants when accidents are unavoidable.

Active safety technologies include advanced driver assistance systems such as automatic emergency braking, lane departure warning, blind spot monitoring, adaptive cruise control, and collision avoidance systems. These systems utilize sophisticated sensors, cameras, radar, and artificial intelligence to monitor the vehicle’s environment and intervene when potential hazards are detected. Passive safety components encompass airbags, seatbelts, crumple zones, reinforced vehicle structures, and energy-absorbing materials that protect occupants during impact events.

Modern automotive safety extends beyond traditional crash protection to include cybersecurity measures, pedestrian protection systems, and vehicle-to-everything (V2X) communication technologies that enable vehicles to share safety-critical information with other vehicles, infrastructure, and traffic management systems.

The automotive safety market stands at the forefront of technological innovation, driven by regulatory mandates, consumer demand, and the automotive industry’s commitment to achieving zero fatalities on roadways. The market encompasses a diverse portfolio of safety solutions ranging from traditional passive safety components to cutting-edge autonomous safety systems powered by artificial intelligence and machine learning algorithms.

Key market drivers include increasingly stringent safety regulations worldwide, growing consumer awareness of vehicle safety ratings, rising insurance costs for unsafe vehicles, and the automotive industry’s transition toward autonomous driving technologies. The market benefits from continuous technological advancement, with 78% of automotive manufacturers investing heavily in next-generation safety research and development programs.

Market segmentation reveals strong growth across multiple categories including advanced driver assistance systems, occupant protection systems, pedestrian safety technologies, and vehicle security systems. The integration of Internet of Things (IoT) technologies and cloud-based safety analytics platforms is creating new opportunities for predictive safety solutions and real-time hazard detection capabilities.

Competitive dynamics show established automotive suppliers competing alongside technology companies and startups to develop innovative safety solutions. The market is characterized by strategic partnerships, mergers and acquisitions, and collaborative research initiatives aimed at accelerating safety technology development and deployment across global automotive markets.

Critical market insights reveal several transformative trends shaping the automotive safety landscape:

Regulatory compliance serves as the primary driver for automotive safety market expansion, with government agencies worldwide implementing increasingly stringent safety requirements. The National Highway Traffic Safety Administration (NHTSA), European New Car Assessment Programme (Euro NCAP), and similar organizations continuously raise safety standards, mandating advanced safety features that were previously optional. These regulatory frameworks drive consistent demand for safety technologies across all vehicle segments.

Consumer safety consciousness has reached unprecedented levels, with vehicle buyers prioritizing safety ratings and advanced safety features in their purchasing decisions. Modern consumers actively research safety technologies and expect comprehensive protection systems as standard equipment rather than premium options. This shift in consumer behavior creates sustained market demand for innovative safety solutions.

Insurance industry influence significantly impacts safety technology adoption, with insurance companies offering reduced premiums for vehicles equipped with advanced safety features. The correlation between safety technology and reduced claim costs incentivizes both manufacturers and consumers to invest in comprehensive safety systems. Insurance data analysis demonstrates that vehicles with advanced safety features experience 35% fewer accidents compared to vehicles without such technologies.

Technological advancement in sensors, processors, and artificial intelligence enables the development of increasingly sophisticated safety systems at reduced costs. The convergence of multiple technologies creates opportunities for integrated safety platforms that provide comprehensive protection while maintaining cost-effectiveness for mass market adoption.

High implementation costs represent a significant barrier to widespread safety technology adoption, particularly in emerging markets where price sensitivity remains high. Advanced safety systems require substantial research and development investments, sophisticated manufacturing processes, and ongoing software updates that increase overall vehicle costs. These cost factors can limit market penetration in price-sensitive segments.

Technical complexity associated with modern safety systems creates challenges for automotive manufacturers, suppliers, and service providers. The integration of multiple sensors, processors, and software systems requires specialized expertise and can lead to compatibility issues, system failures, and increased maintenance requirements. System complexity also raises concerns about reliability and long-term durability in diverse operating conditions.

Consumer skepticism regarding autonomous and semi-autonomous safety systems poses adoption challenges, with some consumers preferring traditional manual control over automated safety interventions. Concerns about system reliability, false alarms, and loss of driving control can slow market acceptance of advanced safety technologies, particularly among experienced drivers who may resist technological assistance.

Infrastructure limitations in many regions constrain the effectiveness of advanced safety systems that rely on vehicle-to-infrastructure communication, high-definition mapping, and reliable connectivity. The lack of supporting infrastructure can reduce the benefits of advanced safety technologies and limit their market appeal in areas with inadequate technological infrastructure.

Emerging market expansion presents substantial growth opportunities as developing economies experience rapid automotive market growth and increasing safety awareness. Countries in Asia-Pacific, Latin America, and Africa are implementing new safety regulations while consumers in these regions demonstrate growing willingness to invest in safety technologies. Market penetration rates in emerging economies currently stand at less than 25% for advanced safety features, indicating significant growth potential.

Electric vehicle integration creates new opportunities for safety technology providers as electric and hybrid vehicles require specialized safety solutions addressing unique risks associated with high-voltage systems, battery technologies, and different vehicle architectures. The rapid growth of electric vehicle adoption worldwide drives demand for innovative safety solutions tailored to electrified powertrains.

Autonomous driving development accelerates demand for advanced safety technologies as self-driving vehicles require comprehensive sensor systems, artificial intelligence platforms, and fail-safe mechanisms to ensure passenger and pedestrian safety. The progression toward higher levels of vehicle autonomy creates opportunities for safety technology providers to develop next-generation solutions.

Aftermarket opportunities emerge as vehicle owners seek to upgrade existing vehicles with advanced safety features through retrofit solutions and aftermarket installations. The large population of older vehicles without modern safety features represents a substantial market for safety technology upgrades and enhancements.

Market dynamics in the automotive safety sector reflect the complex interplay between regulatory requirements, technological innovation, consumer preferences, and competitive pressures. The market exhibits strong growth momentum driven by mandatory safety regulations, increasing consumer safety awareness, and continuous technological advancement that makes sophisticated safety systems more accessible and affordable.

Supply chain dynamics show increasing collaboration between traditional automotive suppliers and technology companies to develop integrated safety solutions. This collaboration enables the combination of automotive expertise with cutting-edge technologies such as artificial intelligence, machine learning, and advanced sensor systems. Partnership agreements between automotive manufacturers and technology providers have increased by 42% annually over recent years.

Innovation cycles in automotive safety are accelerating, with new safety technologies moving from concept to market implementation in shorter timeframes. The competitive pressure to introduce advanced safety features drives rapid innovation and creates opportunities for companies that can quickly develop and deploy effective safety solutions.

Market consolidation trends show larger companies acquiring specialized safety technology providers to expand their capabilities and market reach. This consolidation enables the development of comprehensive safety platforms while providing smaller companies with resources needed for large-scale market deployment.

Comprehensive market analysis employs multiple research methodologies to ensure accurate and reliable insights into the automotive safety market. Primary research includes extensive interviews with industry executives, safety engineers, regulatory officials, and automotive manufacturers to gather firsthand insights into market trends, challenges, and opportunities.

Secondary research encompasses analysis of industry reports, regulatory documents, patent filings, and academic research to understand technological developments, market trends, and competitive dynamics. This research methodology provides comprehensive coverage of market segments, geographic regions, and technology categories within the automotive safety ecosystem.

Data validation processes include cross-referencing multiple sources, conducting expert interviews, and analyzing historical market data to ensure accuracy and reliability of market insights. MarkWide Research employs rigorous validation procedures to verify market data and projections through multiple independent sources and expert consultations.

Market modeling utilizes advanced analytical techniques to project market trends, identify growth opportunities, and assess competitive dynamics. The research methodology incorporates quantitative analysis, qualitative insights, and scenario planning to provide comprehensive market intelligence for industry stakeholders.

North America maintains a leadership position in automotive safety technology adoption, driven by stringent regulatory requirements, high consumer safety awareness, and the presence of major automotive manufacturers and technology companies. The region benefits from advanced infrastructure, strong research and development capabilities, and consumer willingness to invest in safety technologies. Market penetration of advanced safety features reaches 85% in premium vehicles and 60% in mainstream vehicles across North American markets.

Europe demonstrates strong commitment to automotive safety through comprehensive regulatory frameworks and consumer demand for advanced safety features. The European market is characterized by strict safety standards, mandatory safety testing programs, and strong government support for safety technology development. European consumers show high acceptance of advanced safety technologies, with safety ratings significantly influencing vehicle purchasing decisions.

Asia-Pacific represents the fastest-growing regional market for automotive safety technologies, driven by rapid automotive industry expansion, increasing disposable incomes, and growing safety consciousness among consumers. Countries such as China, Japan, and South Korea are implementing advanced safety regulations while investing heavily in safety technology research and development.

Emerging markets in Latin America, Middle East, and Africa show increasing adoption of automotive safety technologies as economic development drives automotive market growth and safety awareness. These regions present significant growth opportunities as safety regulations become more stringent and consumers prioritize vehicle safety features.

The competitive landscape in automotive safety markets features a diverse ecosystem of established automotive suppliers, technology companies, and innovative startups competing to develop and deploy advanced safety solutions. Market leaders combine automotive expertise with cutting-edge technologies to create comprehensive safety platforms.

Competitive strategies include strategic partnerships, technology acquisitions, research and development investments, and expansion into emerging markets. Companies are increasingly collaborating with technology providers to integrate artificial intelligence, machine learning, and advanced sensor technologies into their safety solutions.

By Technology Type:

By Vehicle Type:

By Application:

Advanced Driver Assistance Systems (ADAS) represent the fastest-growing category within automotive safety markets, driven by regulatory mandates and consumer demand for collision avoidance technologies. These systems utilize sophisticated sensor arrays, artificial intelligence, and real-time processing to monitor vehicle surroundings and intervene when potential hazards are detected. ADAS adoption rates have increased by 28% annually across all vehicle segments, with automatic emergency braking becoming standard equipment in most new vehicles.

Passive Safety Systems continue to evolve with advanced materials, improved designs, and intelligent deployment algorithms that optimize protection based on crash severity and occupant characteristics. Modern airbag systems include multiple deployment stages, side-impact protection, and pedestrian protection features that extend safety beyond vehicle occupants.

Occupant Monitoring Systems emerge as critical safety technologies that use cameras, sensors, and artificial intelligence to monitor driver alertness, detect drowsiness, and ensure proper seatbelt usage. These systems can prevent accidents caused by driver inattention and optimize safety system deployment based on occupant positioning and characteristics.

Vehicle Cybersecurity becomes increasingly important as connected vehicles face potential cyber threats that could compromise safety systems. Advanced cybersecurity solutions protect against unauthorized access, malicious attacks, and system manipulation that could endanger vehicle occupants and other road users.

Automotive Manufacturers benefit from enhanced brand reputation, improved safety ratings, reduced liability exposure, and competitive differentiation through advanced safety features. Comprehensive safety systems help manufacturers meet regulatory requirements while appealing to safety-conscious consumers who prioritize protection in their vehicle purchasing decisions.

Safety Technology Suppliers gain access to expanding markets, opportunities for innovation, and long-term partnerships with automotive manufacturers. The growing demand for safety technologies creates sustainable revenue streams and opportunities for companies to develop specialized expertise in emerging safety technologies.

Consumers receive enhanced protection, reduced accident risk, lower insurance premiums, and improved peace of mind through advanced safety technologies. Modern safety systems provide multiple layers of protection that significantly reduce the likelihood and severity of accidents while enabling safer and more confident driving experiences.

Insurance Companies benefit from reduced claim costs, improved risk assessment capabilities, and opportunities to offer usage-based insurance products that reward safe driving behaviors. Advanced safety technologies provide detailed data about driving patterns and accident circumstances that enable more accurate risk pricing and claims processing.

Government Agencies achieve improved road safety statistics, reduced healthcare costs associated with traffic accidents, and enhanced public safety through widespread adoption of advanced safety technologies. Regulatory agencies can leverage safety technology data to identify hazardous road conditions and implement targeted safety improvements.

Strengths:

Weaknesses:

Opportunities:

Threats:

Artificial Intelligence Integration transforms automotive safety through machine learning algorithms that can predict potential accidents, optimize safety system responses, and continuously improve performance based on real-world driving data. AI-powered safety systems demonstrate superior performance compared to traditional rule-based systems, with 45% better hazard detection accuracy in complex driving scenarios.

Vehicle-to-Everything (V2X) Communication enables vehicles to share safety-critical information with other vehicles, infrastructure, and traffic management systems. This connectivity allows for coordinated safety responses and early warning systems that extend beyond individual vehicle sensor capabilities.

Predictive Safety Analytics utilize big data analysis and machine learning to identify potential safety risks before they result in accidents. These systems analyze driving patterns, environmental conditions, and vehicle performance data to provide proactive safety interventions and maintenance recommendations.

Integrated Safety Platforms combine multiple safety systems into cohesive platforms that provide comprehensive protection through coordinated responses. Modern vehicles integrate active and passive safety systems with occupant monitoring and emergency response capabilities to create holistic safety solutions.

Personalized Safety Systems adapt to individual driver characteristics, preferences, and behaviors to provide customized protection. These systems learn from driver patterns and adjust safety interventions to match personal driving styles while maintaining optimal protection levels.

Regulatory Evolution continues with government agencies worldwide implementing more comprehensive safety standards and mandatory requirements for advanced safety features. Recent developments include expanded ADAS requirements, pedestrian protection standards, and cybersecurity regulations for connected vehicles.

Technology Partnerships between automotive manufacturers and technology companies accelerate safety innovation through combined expertise in automotive engineering and cutting-edge technologies. These collaborations enable rapid development and deployment of advanced safety solutions across multiple vehicle platforms.

Investment in Research and development reaches unprecedented levels as companies recognize the critical importance of safety technology leadership. MWR analysis indicates that major automotive suppliers are investing 15-20% of annual revenue in safety technology research and development programs.

Market Consolidation through mergers and acquisitions enables companies to expand their safety technology capabilities and market reach. Strategic acquisitions of specialized safety technology companies provide established automotive suppliers with access to innovative technologies and expertise.

Standardization Efforts focus on developing common protocols and interfaces for safety systems to ensure compatibility and interoperability across different vehicle platforms and manufacturers. Industry-wide standardization initiatives reduce development costs and accelerate technology deployment.

Investment Prioritization should focus on artificial intelligence and machine learning capabilities that enable predictive safety interventions and adaptive system responses. Companies that develop superior AI-powered safety solutions will gain significant competitive advantages in the evolving automotive safety market.

Partnership Strategies should emphasize collaboration with technology companies, research institutions, and other automotive suppliers to access complementary capabilities and accelerate innovation. Strategic partnerships enable companies to develop comprehensive safety solutions while sharing development costs and risks.

Market Expansion opportunities exist in emerging markets where safety technology adoption remains low but regulatory requirements and consumer awareness are increasing. Companies should develop cost-effective safety solutions tailored to price-sensitive markets while maintaining high safety performance standards.

Technology Integration efforts should focus on developing platforms that seamlessly combine multiple safety technologies into cohesive systems. Integrated approaches provide superior performance while reducing system complexity and costs compared to standalone safety solutions.

Cybersecurity Investment becomes critical as connected safety systems face increasing cyber threats. Companies must invest in robust cybersecurity capabilities to protect safety systems from malicious attacks and maintain consumer confidence in connected vehicle technologies.

The automotive safety market is positioned for sustained growth driven by regulatory evolution, technological advancement, and increasing consumer safety consciousness. MarkWide Research projects continued expansion across all market segments, with particularly strong growth in artificial intelligence-powered safety systems and integrated safety platforms.

Technological convergence will create opportunities for comprehensive safety solutions that combine active and passive safety systems with predictive analytics and autonomous driving capabilities. The integration of multiple technologies into cohesive platforms will provide superior protection while reducing system complexity and costs.

Market expansion into emerging economies will drive significant growth as these regions implement safety regulations and consumers prioritize vehicle safety features. The development of cost-effective safety solutions tailored to price-sensitive markets will enable widespread adoption of advanced safety technologies.

Autonomous vehicle development will accelerate demand for advanced safety technologies as self-driving vehicles require comprehensive sensor systems, redundant safety mechanisms, and fail-safe capabilities. The progression toward higher levels of vehicle autonomy creates substantial opportunities for safety technology providers.

Industry transformation toward electric and connected vehicles will require specialized safety solutions addressing unique risks and opportunities associated with new vehicle architectures and technologies. Companies that successfully adapt their safety solutions to emerging vehicle technologies will capture significant market opportunities.

The safety in automotive market represents a dynamic and rapidly evolving sector that plays a crucial role in protecting vehicle occupants and pedestrians while enabling the automotive industry’s transformation toward autonomous and connected mobility. The market benefits from strong regulatory support, increasing consumer safety consciousness, and continuous technological advancement that makes sophisticated safety systems more accessible and effective.

Market growth prospects remain robust across all segments, driven by mandatory safety regulations, expanding automotive markets in emerging economies, and the industry’s transition toward electric and autonomous vehicles. The integration of artificial intelligence, machine learning, and advanced sensor technologies creates opportunities for predictive safety solutions that can prevent accidents before they occur.

Success in this market requires companies to invest in cutting-edge technologies, develop strategic partnerships, and maintain focus on cost-effective solutions that can achieve widespread adoption. The companies that successfully combine automotive expertise with advanced technologies while addressing diverse market needs will capture the greatest opportunities in this essential and growing market sector.

What is Safety in Automotive?

Safety in Automotive refers to the measures and technologies implemented to protect vehicle occupants and pedestrians from accidents and injuries. This includes features like airbags, anti-lock braking systems, and advanced driver-assistance systems (ADAS).

What are the key players in the Safety in Automotive Market?

Key players in the Safety in Automotive Market include companies like Bosch, Continental, and Denso, which are known for their innovative safety technologies. These companies focus on developing systems such as collision avoidance and electronic stability control, among others.

What are the main drivers of growth in the Safety in Automotive Market?

The main drivers of growth in the Safety in Automotive Market include increasing consumer demand for advanced safety features, stringent government regulations on vehicle safety, and the rising incidence of road accidents. Additionally, technological advancements in safety systems are also contributing to market expansion.

What challenges does the Safety in Automotive Market face?

The Safety in Automotive Market faces challenges such as high costs associated with advanced safety technologies and the complexity of integrating these systems into existing vehicle designs. Furthermore, varying regulations across different regions can complicate compliance for manufacturers.

What opportunities exist in the Safety in Automotive Market?

Opportunities in the Safety in Automotive Market include the growing trend towards electric and autonomous vehicles, which require enhanced safety features. Additionally, the increasing focus on sustainability and reducing carbon footprints presents avenues for innovation in safety technologies.

What trends are shaping the Safety in Automotive Market?

Trends shaping the Safety in Automotive Market include the integration of artificial intelligence in safety systems, the development of vehicle-to-everything (V2X) communication technologies, and the rise of smart cities that promote safer transportation solutions. These innovations aim to enhance overall road safety and reduce accidents.

Safety in Automotive Market

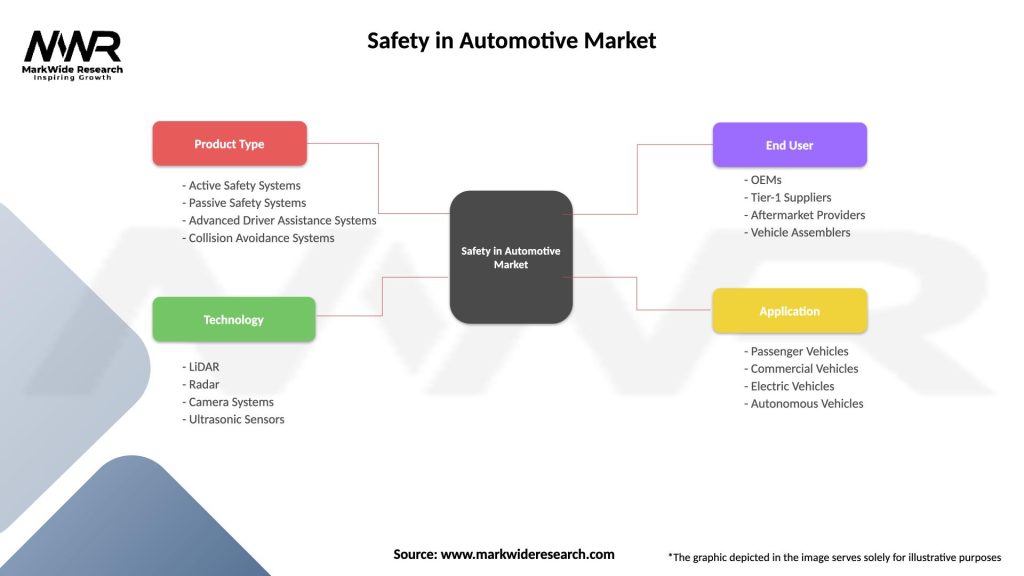

| Segmentation Details | Description |

|---|---|

| Product Type | Active Safety Systems, Passive Safety Systems, Advanced Driver Assistance Systems, Collision Avoidance Systems |

| Technology | LiDAR, Radar, Camera Systems, Ultrasonic Sensors |

| End User | OEMs, Tier-1 Suppliers, Aftermarket Providers, Vehicle Assemblers |

| Application | Passenger Vehicles, Commercial Vehicles, Electric Vehicles, Autonomous Vehicles |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Safety in Automotive Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at