444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Japan IVD market represents one of the most sophisticated and technologically advanced diagnostic landscapes in the Asia-Pacific region. In vitro diagnostics in Japan encompasses a comprehensive range of medical testing solutions that analyze biological samples outside the human body to provide critical healthcare insights. The market demonstrates remarkable resilience and innovation, driven by Japan’s aging population, advanced healthcare infrastructure, and strong emphasis on preventive medicine.

Market dynamics indicate sustained growth with the sector experiencing a compound annual growth rate of 4.2% over recent years. This expansion reflects Japan’s commitment to precision medicine and early disease detection. The country’s unique demographic profile, with over 28% of the population aged 65 and above, creates substantial demand for diagnostic testing across multiple therapeutic areas including oncology, cardiology, infectious diseases, and diabetes management.

Technological advancement remains a cornerstone of Japan’s IVD market evolution. The integration of artificial intelligence, molecular diagnostics, and point-of-care testing solutions has transformed traditional laboratory workflows. Japanese healthcare providers increasingly adopt automated systems and digital pathology platforms to enhance diagnostic accuracy and operational efficiency. The market benefits from strong government support for healthcare innovation and substantial investment in research and development activities.

The Japan IVD market refers to the comprehensive ecosystem of medical diagnostic products, technologies, and services used to analyze biological specimens such as blood, urine, tissue, and other bodily fluids to diagnose diseases, monitor health conditions, and guide treatment decisions within Japan’s healthcare system.

In vitro diagnostics encompasses various testing methodologies including clinical chemistry, immunoassays, molecular diagnostics, hematology, microbiology, and histopathology. These diagnostic solutions enable healthcare professionals to make informed clinical decisions, monitor therapeutic responses, and implement preventive healthcare strategies. The Japanese market specifically emphasizes high-quality standards, regulatory compliance, and integration with advanced healthcare information systems.

Market participants include multinational diagnostic companies, domestic manufacturers, healthcare institutions, clinical laboratories, and research organizations. The ecosystem supports Japan’s healthcare objectives of improving patient outcomes, reducing healthcare costs, and advancing personalized medicine approaches. The market’s significance extends beyond commercial considerations to encompass public health initiatives, disease surveillance, and healthcare policy implementation.

Japan’s IVD market demonstrates exceptional stability and growth potential, positioning itself as a regional leader in diagnostic innovation and healthcare excellence. The market benefits from favorable demographic trends, robust healthcare infrastructure, and strong regulatory frameworks that ensure product quality and patient safety. Key growth drivers include the expanding elderly population, increasing prevalence of chronic diseases, and growing adoption of personalized medicine approaches.

Market segmentation reveals diverse opportunities across multiple product categories and application areas. Clinical chemistry maintains the largest market share at approximately 35% of total market volume, followed by immunoassays and molecular diagnostics. Point-of-care testing segments show particularly strong growth momentum, driven by healthcare decentralization trends and patient convenience requirements.

Competitive dynamics feature both international and domestic players competing across technology platforms, distribution channels, and customer segments. The market rewards innovation, quality, and regulatory compliance while presenting opportunities for strategic partnerships and collaborative development initiatives. Future prospects remain positive with anticipated growth in digital health integration, artificial intelligence applications, and companion diagnostics for targeted therapies.

Strategic insights reveal several critical factors shaping Japan’s IVD market trajectory and competitive landscape:

Primary market drivers propelling Japan’s IVD market growth encompass demographic, technological, and healthcare policy factors that create sustained demand for diagnostic solutions.

Aging population dynamics represent the most significant growth driver, with Japan experiencing one of the world’s most rapid demographic transitions. The increasing prevalence of age-related conditions including cardiovascular disease, diabetes, cancer, and neurodegenerative disorders drives substantial demand for diagnostic testing. Healthcare utilization rates among elderly populations exceed younger demographics by approximately 300%, creating sustained market expansion opportunities.

Chronic disease prevalence continues rising across multiple therapeutic areas, necessitating regular monitoring and diagnostic testing. Diabetes affects over 7.4% of Japan’s adult population, while cardiovascular disease remains a leading cause of mortality. These conditions require continuous monitoring through various diagnostic modalities, creating recurring revenue streams for market participants.

Technological advancement enables new diagnostic capabilities and improved testing accuracy. Artificial intelligence integration, molecular diagnostics expansion, and automation technologies enhance laboratory productivity while reducing costs. Government initiatives supporting healthcare innovation provide additional momentum for technology adoption and market development.

Market constraints present challenges that may limit growth potential and market expansion within Japan’s IVD sector.

Regulatory complexity creates significant barriers for new market entrants and product launches. Japan’s pharmaceutical and medical device approval processes require extensive documentation, clinical validation, and compliance with specific quality standards. These requirements increase development costs and time-to-market for innovative diagnostic solutions, potentially limiting market dynamism.

Healthcare cost pressures influence purchasing decisions and reimbursement policies. Japan’s national healthcare system faces mounting financial pressures due to demographic changes and increasing medical expenses. Cost containment initiatives may limit adoption of premium diagnostic technologies and constrain market growth in certain segments.

Technical workforce challenges affect laboratory operations and diagnostic service delivery. Skilled technicians and laboratory professionals face increasing demand while supply remains constrained. This situation may limit expansion of diagnostic services and impact operational efficiency across healthcare institutions.

Market saturation in certain segments limits growth opportunities for established diagnostic categories. Mature markets for routine clinical chemistry and basic immunoassays experience slower growth rates compared to emerging diagnostic technologies, requiring companies to focus on innovation and differentiation strategies.

Emerging opportunities within Japan’s IVD market present significant potential for growth and market expansion across multiple dimensions.

Digital health integration offers substantial opportunities for diagnostic companies to develop connected solutions that integrate with electronic health records, telemedicine platforms, and mobile health applications. The convergence of diagnostics and digital health creates new value propositions and revenue models while improving patient care coordination.

Point-of-care testing expansion presents opportunities to extend diagnostic capabilities beyond traditional laboratory settings. Primary care clinics, pharmacies, and home healthcare environments represent underserved markets with growing demand for rapid, accurate diagnostic solutions. Market penetration rates for point-of-care testing remain below 15% of total diagnostic volume, indicating substantial growth potential.

Companion diagnostics development aligns with Japan’s growing focus on personalized medicine and targeted therapies. Pharmaceutical companies increasingly require diagnostic tests to identify appropriate patient populations for specific treatments, creating collaborative opportunities and new market segments.

Artificial intelligence applications enable advanced diagnostic capabilities including image analysis, pattern recognition, and predictive analytics. These technologies can improve diagnostic accuracy, reduce interpretation time, and support clinical decision-making processes across multiple medical specialties.

Market dynamics within Japan’s IVD sector reflect complex interactions between demographic trends, technological innovation, regulatory frameworks, and competitive forces that shape industry evolution.

Supply chain dynamics demonstrate increasing consolidation and strategic partnerships among market participants. Diagnostic companies pursue vertical integration strategies to control manufacturing costs and ensure product quality while distributors expand service capabilities to provide comprehensive solutions to healthcare customers. Market concentration shows the top five companies controlling approximately 60% of market share across all diagnostic segments.

Innovation cycles accelerate as companies invest heavily in research and development to maintain competitive advantages. Product lifecycles shorten while customer expectations for advanced features and improved performance increase. This dynamic creates both opportunities for differentiation and pressures for continuous investment in technology development.

Customer behavior patterns evolve toward integrated solutions and value-based purchasing decisions. Healthcare institutions increasingly evaluate diagnostic solutions based on total cost of ownership, clinical outcomes, and operational efficiency rather than initial purchase price alone. This shift favors companies offering comprehensive service packages and proven clinical value.

Research methodology employed for analyzing Japan’s IVD market incorporates comprehensive data collection, analysis, and validation processes to ensure accuracy and reliability of market insights.

Primary research activities include structured interviews with key industry stakeholders, healthcare professionals, laboratory managers, and regulatory experts. Survey methodologies capture quantitative data on market trends, purchasing behaviors, and technology adoption patterns across different customer segments and geographic regions within Japan.

Secondary research sources encompass government publications, industry reports, company financial statements, patent databases, and academic literature. MarkWide Research analysts utilize proprietary databases and analytical frameworks to synthesize information from multiple sources and identify market patterns and trends.

Data validation processes include triangulation of information from multiple sources, expert review panels, and statistical analysis to ensure data accuracy and consistency. Market sizing methodologies employ bottom-up and top-down approaches to validate market estimates and growth projections.

Analytical frameworks incorporate quantitative modeling techniques, competitive analysis methodologies, and scenario planning approaches to develop comprehensive market insights and strategic recommendations for industry participants.

Regional distribution within Japan’s IVD market reveals distinct patterns based on healthcare infrastructure, population density, and economic development levels across different prefectures and metropolitan areas.

Tokyo metropolitan area dominates market activity, accounting for approximately 25% of total diagnostic testing volume and serving as the primary hub for market participants, research institutions, and regulatory agencies. The region benefits from concentrated healthcare facilities, advanced medical centers, and strong research and development capabilities that drive innovation and market development.

Osaka and Kansai region represents the second-largest market concentration with significant pharmaceutical and biotechnology industry presence. The region’s manufacturing capabilities and proximity to major healthcare institutions create favorable conditions for diagnostic companies and support market growth initiatives.

Regional healthcare networks demonstrate varying adoption patterns for advanced diagnostic technologies. Urban areas typically show higher penetration rates for sophisticated testing solutions while rural regions focus on basic diagnostic capabilities and point-of-care testing options. Geographic distribution shows urban areas accounting for approximately 70% of total market activity despite representing only 50% of the population.

Healthcare infrastructure development varies significantly between regions, influencing market opportunities and competitive dynamics. Government initiatives to improve rural healthcare access create opportunities for telemedicine integration and remote diagnostic solutions.

Competitive dynamics within Japan’s IVD market feature a diverse mix of multinational corporations, domestic companies, and specialized technology providers competing across multiple market segments and customer channels.

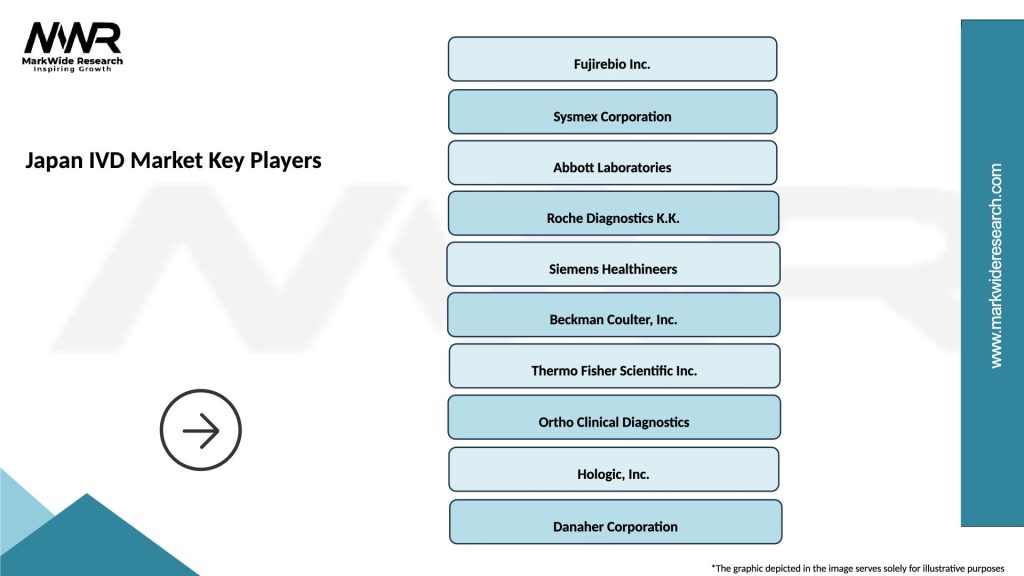

Market leaders include established diagnostic companies with comprehensive product portfolios and strong distribution networks:

Competitive strategies focus on innovation, strategic partnerships, and customer service excellence. Companies invest heavily in research and development while pursuing acquisitions and collaborations to expand technology capabilities and market reach.

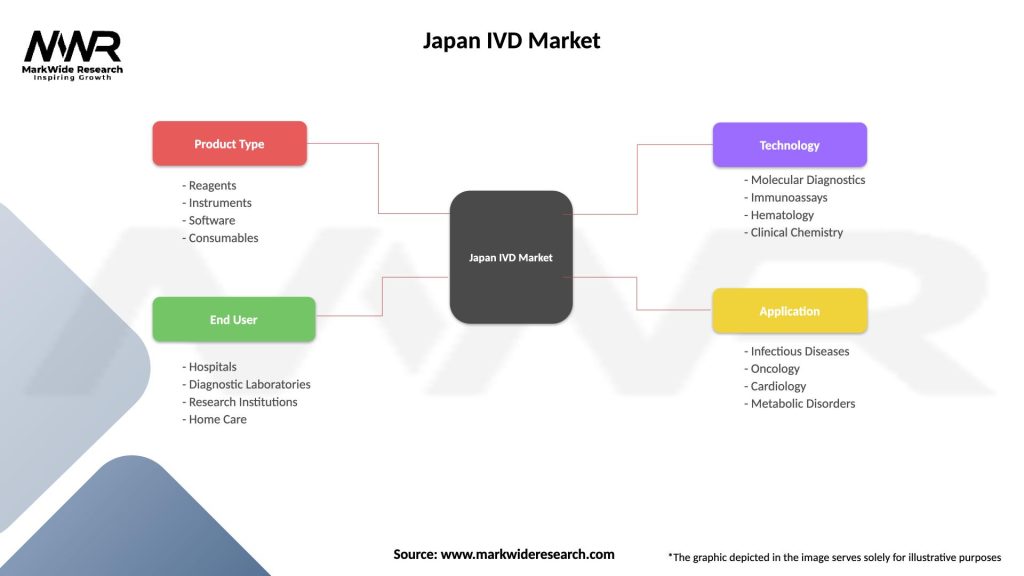

Market segmentation analysis reveals diverse opportunities across multiple dimensions including product type, technology platform, end-user category, and application area.

By Product Type:

By Technology Platform:

By End User:

Clinical chemistry diagnostics maintain market leadership through established testing protocols and widespread adoption across healthcare institutions. This category benefits from standardized procedures, reliable automation, and cost-effective testing solutions that support routine patient care. Growth rates remain steady at approximately 3.5% annually, driven by increasing test volumes and aging population demographics.

Immunoassay technologies demonstrate strong performance across multiple therapeutic areas including cardiology, endocrinology, and infectious diseases. Advanced chemiluminescent and electrochemiluminescent platforms provide superior sensitivity and specificity compared to traditional methods. Market expansion reflects growing demand for biomarker testing and therapeutic drug monitoring applications.

Molecular diagnostics represent the fastest-growing category with applications spanning infectious disease detection, oncology, pharmacogenomics, and genetic testing. Segment growth rates exceed 8% annually as healthcare providers adopt precision medicine approaches and patients seek personalized treatment options. Technology advancement in next-generation sequencing and polymerase chain reaction platforms drives market expansion.

Point-of-care testing gains momentum through improved technology miniaturization and connectivity capabilities. Rapid diagnostic tests for infectious diseases, cardiac markers, and blood glucose monitoring provide immediate results that support clinical decision-making. Market penetration increases as healthcare delivery models emphasize patient convenience and care coordination.

Healthcare providers benefit from advanced diagnostic capabilities that improve patient care quality, reduce treatment costs, and enhance operational efficiency. Automated systems reduce manual labor requirements while digital integration streamlines workflow processes and data management. Diagnostic accuracy improvements of up to 15% through advanced technologies reduce misdiagnosis rates and improve patient outcomes.

Patients receive faster, more accurate diagnostic results that enable earlier intervention and better treatment outcomes. Point-of-care testing reduces wait times and improves convenience while molecular diagnostics enable personalized treatment approaches. Preventive screening programs supported by advanced diagnostics help identify health issues before symptoms develop.

Diagnostic companies access growing market opportunities driven by demographic trends and technology advancement. Innovation in artificial intelligence, automation, and molecular diagnostics creates competitive advantages and premium pricing opportunities. Strategic partnerships with healthcare institutions and pharmaceutical companies expand market reach and revenue potential.

Healthcare systems achieve cost savings through improved diagnostic efficiency, reduced hospital readmissions, and better resource utilization. Early disease detection through advanced screening programs reduces long-term treatment costs while population health management benefits from comprehensive diagnostic data.

Strengths:

Weaknesses:

Opportunities:

Threats:

Automation and digitalization transform laboratory operations through advanced robotics, artificial intelligence, and data analytics capabilities. Healthcare institutions invest in integrated laboratory systems that reduce manual processes, improve accuracy, and enhance productivity. Automation adoption rates increase by approximately 12% annually as laboratories seek operational efficiency improvements.

Molecular diagnostics expansion accelerates across multiple applications including infectious disease detection, oncology testing, and pharmacogenomics. Next-generation sequencing technologies become more accessible while polymerase chain reaction platforms offer improved speed and accuracy. This trend supports Japan’s precision medicine initiatives and personalized treatment approaches.

Point-of-care testing growth reflects healthcare delivery model changes that emphasize patient convenience and immediate results. Rapid diagnostic tests expand beyond traditional applications to include complex biomarker analysis and molecular testing. MWR analysis indicates point-of-care segments growing at twice the rate of traditional laboratory testing.

Digital health integration creates connected diagnostic ecosystems that link testing devices, laboratory information systems, and electronic health records. Cloud-based platforms enable remote monitoring, data sharing, and predictive analytics capabilities that enhance patient care coordination and population health management.

Strategic partnerships between diagnostic companies and healthcare institutions accelerate technology adoption and market expansion. Collaborative agreements focus on innovation development, clinical validation, and market access strategies that benefit all participants. These partnerships often include long-term service contracts and exclusive distribution arrangements.

Regulatory approvals for advanced diagnostic technologies enable market entry for innovative solutions including artificial intelligence-powered analysis systems, next-generation sequencing platforms, and novel biomarker tests. Japanese regulatory authorities demonstrate increasing openness to breakthrough technologies while maintaining rigorous safety standards.

Technology acquisitions reshape competitive dynamics as established companies acquire specialized technology providers to expand capabilities and market reach. These transactions often focus on artificial intelligence, molecular diagnostics, and digital health solutions that complement existing product portfolios.

Research collaborations between industry and academic institutions advance diagnostic science and support innovation development. Government funding programs encourage public-private partnerships that accelerate technology transfer and commercial development of breakthrough diagnostic solutions.

Market participants should prioritize innovation investment and strategic partnerships to maintain competitive advantages in Japan’s evolving IVD market. MarkWide Research recommends focusing on digital health integration, artificial intelligence applications, and point-of-care testing expansion to capture emerging growth opportunities.

Technology development strategies should emphasize automation, connectivity, and user-friendly interfaces that address healthcare workforce challenges and operational efficiency requirements. Companies investing in comprehensive solutions that integrate hardware, software, and services will achieve stronger market positions and customer loyalty.

Market entry approaches for new participants should consider strategic partnerships with established distributors or healthcare institutions to navigate regulatory requirements and build market presence. Understanding local market dynamics, customer preferences, and competitive landscapes remains critical for success.

Customer engagement strategies should focus on value-based selling approaches that demonstrate clinical outcomes, operational benefits, and total cost of ownership advantages. Healthcare customers increasingly evaluate diagnostic solutions based on comprehensive value propositions rather than initial purchase price considerations.

Long-term prospects for Japan’s IVD market remain highly positive, supported by favorable demographic trends, technology advancement, and healthcare system evolution. The market will continue benefiting from aging population dynamics, chronic disease prevalence, and growing emphasis on preventive medicine and early detection strategies.

Technology convergence will create new diagnostic capabilities through integration of artificial intelligence, molecular diagnostics, and digital health platforms. These advances will enable more accurate, faster, and cost-effective testing solutions that improve patient care while reducing healthcare system costs. Innovation investment is expected to increase by approximately 8% annually as companies pursue competitive differentiation.

Market expansion will occur through point-of-care testing growth, companion diagnostics development, and digital health integration. These segments offer substantial growth potential as healthcare delivery models evolve toward decentralized, personalized, and connected care approaches. Emerging segments may account for up to 40% of market growth over the next five years.

Regulatory evolution will likely support innovation adoption while maintaining high quality and safety standards. Government initiatives promoting healthcare digitization and precision medicine will create favorable conditions for advanced diagnostic technologies and market development.

Japan’s IVD market represents a dynamic and sophisticated healthcare sector that combines advanced technology, rigorous quality standards, and strong growth potential. The market benefits from unique demographic advantages, robust healthcare infrastructure, and continuous innovation that position it as a regional leader in diagnostic excellence.

Key success factors for market participants include technology innovation, strategic partnerships, regulatory compliance, and customer-focused value propositions. Companies that effectively navigate Japan’s complex market dynamics while delivering superior diagnostic solutions will achieve sustainable competitive advantages and growth opportunities.

Future market evolution will be shaped by digital health integration, artificial intelligence advancement, and personalized medicine adoption. These trends create substantial opportunities for innovative companies while challenging traditional market participants to adapt their strategies and capabilities. The market’s continued growth trajectory reflects Japan’s commitment to healthcare excellence and technological leadership in diagnostic medicine.

What is IVD?

IVD stands for In Vitro Diagnostics, which refers to tests performed on samples such as blood or tissue to diagnose diseases or conditions. These tests are crucial in various medical fields, including oncology, infectious diseases, and genetic disorders.

What are the key players in the Japan IVD Market?

Key players in the Japan IVD Market include Sysmex Corporation, Fujirebio, and Roche Diagnostics, among others. These companies are known for their innovative diagnostic solutions and extensive product portfolios.

What are the growth factors driving the Japan IVD Market?

The Japan IVD Market is driven by factors such as the increasing prevalence of chronic diseases, advancements in diagnostic technologies, and a growing emphasis on personalized medicine. Additionally, the aging population in Japan contributes to the demand for effective diagnostic tools.

What challenges does the Japan IVD Market face?

The Japan IVD Market faces challenges such as stringent regulatory requirements, high costs of advanced diagnostic equipment, and competition from alternative diagnostic methods. These factors can hinder market growth and innovation.

What opportunities exist in the Japan IVD Market?

Opportunities in the Japan IVD Market include the development of point-of-care testing solutions, integration of artificial intelligence in diagnostics, and expansion into emerging markets. These trends can enhance accessibility and efficiency in healthcare.

What trends are shaping the Japan IVD Market?

Trends in the Japan IVD Market include the rise of molecular diagnostics, increased automation in laboratories, and a focus on rapid testing methods. These innovations are transforming how diagnostics are conducted and improving patient outcomes.

Japan IVD Market

| Segmentation Details | Description |

|---|---|

| Product Type | Reagents, Instruments, Software, Consumables |

| End User | Hospitals, Diagnostic Laboratories, Research Institutions, Home Care |

| Technology | Molecular Diagnostics, Immunoassays, Hematology, Clinical Chemistry |

| Application | Infectious Diseases, Oncology, Cardiology, Metabolic Disorders |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Japan IVD Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at