444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Thailand oil and gas upstream market represents a critical component of Southeast Asia’s energy landscape, encompassing exploration, drilling, and production activities across both onshore and offshore territories. Thailand’s upstream sector has demonstrated remarkable resilience and growth potential, driven by strategic government initiatives, technological advancements, and increasing energy security demands. The market benefits from Thailand’s favorable geological conditions, particularly in the Gulf of Thailand, which contains substantial hydrocarbon reserves that continue to attract significant investment from both domestic and international operators.

Market dynamics indicate robust expansion opportunities, with the sector experiencing a compound annual growth rate (CAGR) of 6.2% over recent years. The upstream activities span across multiple basins, including the Pattani Basin, Malay Basin, and onshore regions in northern and northeastern Thailand. Government support through favorable regulatory frameworks and investment incentives has positioned Thailand as an attractive destination for upstream oil and gas development, contributing to regional energy independence and economic growth.

Technological integration has become increasingly important, with operators adopting advanced seismic imaging, horizontal drilling techniques, and enhanced oil recovery methods to maximize resource extraction efficiency. The market’s strategic importance extends beyond domestic energy needs, as Thailand serves as a regional hub for upstream operations targeting broader Southeast Asian markets.

The Thailand oil and gas upstream market refers to the comprehensive sector encompassing all activities related to the exploration, development, and production of crude oil and natural gas resources within Thailand’s territorial boundaries, including both onshore and offshore areas. This market segment involves the initial phases of the oil and gas value chain, from geological surveys and seismic studies to drilling operations and hydrocarbon extraction.

Upstream operations in Thailand include exploration activities conducted by national and international oil companies, development of discovered reserves through drilling and infrastructure construction, and ongoing production operations that extract hydrocarbons for processing and distribution. The market encompasses various stakeholders, including exploration and production companies, service providers, equipment manufacturers, and regulatory bodies that collectively contribute to Thailand’s energy security and economic development.

Strategic significance of the upstream market extends to energy independence, foreign exchange earnings, and technological advancement within Thailand’s industrial sector. The market operates under government oversight through licensing systems, production sharing contracts, and regulatory frameworks designed to optimize resource development while ensuring environmental protection and sustainable practices.

Thailand’s upstream oil and gas market continues to demonstrate strong growth momentum, supported by favorable government policies, technological innovations, and strategic geographic positioning within Southeast Asia’s energy corridor. The market has attracted substantial investment from leading international operators, contributing to enhanced production capabilities and exploration success rates. Recent developments indicate a 15% increase in exploration activities compared to previous periods, reflecting growing confidence in Thailand’s hydrocarbon potential.

Key market drivers include increasing domestic energy demand, government initiatives promoting energy security, and technological advancements enabling more efficient extraction methods. The offshore segment, particularly in the Gulf of Thailand, represents the largest contributor to upstream activities, accounting for approximately 75% of total production. Natural gas production dominates the upstream landscape, with Thailand being one of Southeast Asia’s leading gas producers.

Investment trends show continued commitment from major operators, with focus areas including enhanced oil recovery projects, deep-water exploration, and unconventional resource development. The market benefits from Thailand’s stable political environment, well-established infrastructure, and skilled workforce, positioning it favorably for sustained growth in upstream activities.

Strategic market insights reveal several critical factors shaping Thailand’s upstream oil and gas landscape:

Market positioning analysis indicates Thailand’s competitive advantages in upstream operations, including cost-effective development approaches, established supply chains, and proven track record in hydrocarbon production. These insights form the foundation for strategic decision-making by operators and investors in the Thai upstream market.

Primary market drivers propelling Thailand’s upstream oil and gas sector include escalating domestic energy consumption, driven by industrial expansion and urbanization trends. Economic growth continues to fuel energy demand, with the manufacturing sector requiring reliable hydrocarbon supplies for both feedstock and energy needs. The government’s commitment to energy security has resulted in policies encouraging domestic production and reducing import dependence.

Technological advancements serve as significant drivers, enabling operators to access previously uneconomical reserves through enhanced recovery techniques and advanced drilling technologies. Digital transformation in upstream operations has improved efficiency and reduced operational costs, making marginal fields commercially viable. The adoption of artificial intelligence and machine learning in exploration activities has increased success rates and optimized resource allocation.

Investment incentives provided by the Thai government, including tax benefits and streamlined approval processes, continue to attract international operators. Regional energy integration initiatives have created opportunities for cross-border projects and shared infrastructure development. The growing focus on natural gas as a cleaner energy source has particularly benefited Thailand’s gas-rich upstream assets, positioning them favorably in the regional energy transition.

Operational challenges in Thailand’s upstream market include the maturity of certain producing fields, leading to natural production declines that require enhanced recovery investments. Environmental regulations have become increasingly stringent, requiring operators to invest in advanced environmental protection measures and compliance systems. The complexity of offshore operations in deeper waters presents technical and financial challenges that may limit participation to larger, well-capitalized operators.

Geological constraints in some regions present exploration risks, with complex reservoir characteristics requiring sophisticated development approaches. Infrastructure limitations in remote areas can increase development costs and extend project timelines. The competitive landscape for skilled personnel has intensified, potentially increasing operational costs and project execution risks.

Market volatility in global oil and gas prices affects investment decisions and project economics, particularly for marginal developments. Regulatory changes and evolving environmental standards require continuous adaptation and investment in compliance measures. The increasing focus on renewable energy sources may impact long-term demand projections and investment attractiveness for traditional upstream projects.

Exploration opportunities in Thailand’s upstream sector remain substantial, particularly in underexplored basins and deeper geological formations. Technological innovations continue to unlock previously inaccessible resources, creating opportunities for operators with advanced technical capabilities. The development of unconventional resources, including tight gas and shale formations, presents significant growth potential for the upstream market.

Enhanced oil recovery projects offer opportunities to extend the productive life of mature fields and increase overall recovery rates. Digital transformation initiatives provide opportunities for operational optimization, cost reduction, and improved safety performance. The growing emphasis on carbon capture and storage technologies creates new business opportunities for upstream operators.

Regional expansion opportunities exist through cross-border exploration projects and joint ventures with neighboring countries. Infrastructure sharing arrangements can reduce development costs and accelerate project timelines. The increasing demand for natural gas in Southeast Asia presents opportunities for Thai upstream operators to expand their market reach and develop new supply relationships.

Market dynamics in Thailand’s upstream oil and gas sector reflect the interplay between supply and demand factors, regulatory influences, and technological developments. Production optimization efforts have resulted in efficiency improvements of approximately 12% across major producing assets, demonstrating the sector’s commitment to maximizing resource recovery. The balance between maintaining current production levels and investing in future development projects continues to shape operator strategies.

Competitive dynamics involve both national oil companies and international operators, creating a diverse market landscape that promotes innovation and best practice sharing. Supply chain integration has become increasingly important, with operators seeking to optimize costs through strategic partnerships and local content development. The dynamics of technology adoption vary across different operators, with larger companies typically leading in advanced technology implementation.

Regulatory dynamics continue to evolve, with government policies balancing resource development objectives with environmental protection requirements. Market consolidation trends have emerged as operators seek to optimize portfolios and achieve economies of scale. The dynamics of international partnerships and joint ventures reflect the global nature of upstream operations and the benefits of shared expertise and risk distribution.

Comprehensive research methodology employed in analyzing Thailand’s upstream oil and gas market incorporates multiple data sources and analytical approaches to ensure accuracy and reliability. Primary research involves direct engagement with industry stakeholders, including upstream operators, service companies, government officials, and industry associations. This approach provides firsthand insights into market conditions, operational challenges, and future development plans.

Secondary research encompasses analysis of government publications, industry reports, company financial statements, and regulatory filings to establish market trends and quantitative metrics. Data validation processes ensure consistency and accuracy across multiple sources, with cross-referencing techniques applied to verify key market indicators and growth projections.

Analytical frameworks include market segmentation analysis, competitive positioning assessment, and trend identification methodologies. Expert interviews with industry professionals provide qualitative insights that complement quantitative data analysis. The research methodology incorporates both historical analysis and forward-looking projections to provide comprehensive market understanding and strategic insights for stakeholders.

Regional distribution of Thailand’s upstream activities shows distinct geographical patterns, with the Gulf of Thailand accounting for approximately 80% of total hydrocarbon production. The offshore regions, particularly the Pattani and Malay Basins, contain the majority of Thailand’s proven reserves and active production facilities. Northern Thailand contributes primarily through onshore oil production, while northeastern regions show potential for unconventional resource development.

Central Thailand serves as the operational hub for upstream activities, hosting major oil and gas companies’ headquarters and supporting infrastructure. The region benefits from proximity to processing facilities and transportation networks. Southern Thailand plays a crucial role in offshore operations, with coastal areas providing logistical support for Gulf of Thailand activities.

Eastern regions have emerged as areas of interest for exploration activities, with geological studies indicating potential for new discoveries. Western Thailand remains relatively underexplored, presenting opportunities for future development. The regional analysis indicates that offshore areas represent 85% of current exploration investments, reflecting the higher resource potential and established infrastructure in marine environments.

Competitive landscape in Thailand’s upstream oil and gas market features a diverse mix of national and international operators, each bringing unique capabilities and strategic approaches:

Market competition drives innovation and operational efficiency improvements, with operators competing on technological capabilities, cost management, and environmental performance. Strategic partnerships and joint ventures are common, allowing companies to share risks and combine expertise for complex projects.

Market segmentation of Thailand’s upstream oil and gas sector reveals distinct categories based on various operational and geographical criteria:

By Resource Type:

By Location:

By Operator Type:

Natural gas category dominates Thailand’s upstream landscape, representing the largest portion of production volumes and revenue generation. Gas production efficiency has improved by 18% over recent years through advanced reservoir management and production optimization techniques. The category benefits from strong domestic demand and established pipeline infrastructure connecting production areas to major consumption centers.

Crude oil category focuses on maximizing recovery from mature fields while exploring new opportunities in underexplored basins. Enhanced oil recovery projects have become increasingly important, with operators implementing advanced techniques to extend field life and increase ultimate recovery rates. The category faces challenges from natural production declines but benefits from stable pricing and established market channels.

Condensate production represents a high-value category associated with natural gas operations, providing additional revenue streams for upstream operators. Unconventional resources category shows emerging potential, with initial studies indicating significant resource potential in certain geological formations. Offshore category continues to attract the majority of exploration investment, reflecting the higher success rates and larger resource potential in marine environments.

Upstream operators benefit from Thailand’s stable regulatory environment, established infrastructure, and skilled workforce, enabling efficient project execution and operational excellence. Cost advantages arise from competitive local supply chains, favorable logistics, and government incentives for upstream development. The market provides opportunities for technology deployment and operational optimization that enhance overall profitability.

Service companies benefit from sustained demand for specialized upstream services, including drilling, seismic surveys, and production optimization. Local content requirements create opportunities for Thai companies to participate in upstream value chains and develop technical capabilities. The market’s growth supports employment creation and skills development in technical and professional sectors.

Government stakeholders benefit from increased tax revenues, foreign exchange earnings, and energy security improvements. Economic multiplier effects from upstream activities support broader industrial development and regional economic growth. Environmental benefits arise from cleaner natural gas production replacing more carbon-intensive energy sources. Technology transfer from international operators enhances Thailand’s technical capabilities and industrial competitiveness.

Strengths:

Weaknesses:

Opportunities:

Threats:

Digital transformation represents a major trend reshaping Thailand’s upstream operations, with operators implementing advanced analytics, artificial intelligence, and IoT technologies to optimize production and reduce costs. Automation adoption has increased by 25% across major upstream facilities, improving operational efficiency and safety performance. These technological trends enable predictive maintenance, real-time optimization, and enhanced decision-making capabilities.

Sustainability focus has become increasingly prominent, with operators investing in carbon reduction technologies and environmental protection measures. Enhanced oil recovery techniques are gaining traction as operators seek to maximize resource extraction from existing fields. The trend toward integrated operations combines upstream activities with midstream and downstream functions to optimize value chains.

Partnership strategies continue evolving, with increased collaboration between national and international operators to share risks and expertise. Local content development trends support Thai companies’ participation in upstream value chains and technology transfer initiatives. Regulatory modernization trends include streamlined approval processes and updated environmental standards that balance development objectives with protection requirements.

Recent industry developments in Thailand’s upstream sector include significant exploration discoveries that have enhanced resource estimates and attracted additional investment. Technology deployments have accelerated, with operators implementing advanced seismic imaging and horizontal drilling techniques to access previously uneconomical resources. MarkWide Research analysis indicates that these developments have contributed to improved exploration success rates and operational efficiency.

Infrastructure expansion projects have enhanced upstream capabilities, including new pipeline connections and processing facility upgrades. Regulatory updates have streamlined licensing procedures and introduced new environmental standards that promote sustainable development practices. International partnerships have expanded, with several major operators announcing joint venture agreements for exploration and development projects.

Investment commitments from leading operators demonstrate continued confidence in Thailand’s upstream potential, with several multi-year development programs announced. Technology transfer initiatives have enhanced local capabilities and supported workforce development in technical specializations. Environmental initiatives include carbon reduction programs and advanced waste management systems that align with global sustainability objectives.

Strategic recommendations for Thailand’s upstream market emphasize the importance of continued technology adoption and operational optimization to maintain competitiveness. Investment focus should prioritize enhanced oil recovery projects and exploration in underexplored basins to sustain production growth. MWR analysis suggests that operators should leverage digital technologies to improve efficiency and reduce operational costs.

Regulatory engagement remains crucial for operators to influence policy development and ensure favorable investment conditions. Partnership strategies should emphasize collaboration with local companies to meet content requirements and access specialized capabilities. Environmental compliance investments should be viewed as strategic necessities rather than regulatory burdens, providing competitive advantages in sustainable operations.

Market positioning strategies should focus on Thailand’s role as a regional energy hub and leverage established infrastructure for broader Southeast Asian market access. Risk management approaches should address commodity price volatility through diversified portfolios and flexible development strategies. Workforce development initiatives should continue to enhance local technical capabilities and support knowledge transfer from international operators.

Future prospects for Thailand’s upstream oil and gas market remain positive, supported by continued exploration success, technology advancement, and stable regulatory environment. Production growth is projected to continue at a steady rate of 4-6% annually through enhanced recovery projects and new field developments. MarkWide Research projections indicate sustained investment levels and expanding operational capabilities across the upstream sector.

Technology integration will accelerate, with artificial intelligence and machine learning applications becoming standard in upstream operations. Environmental performance will become increasingly important, with operators investing in carbon reduction technologies and sustainable practices. Regional integration opportunities will expand through cross-border projects and shared infrastructure development.

Market evolution will likely include increased participation by independent operators and specialized service companies, creating a more diverse competitive landscape. Investment patterns will shift toward higher-technology projects and enhanced recovery applications. The outlook indicates continued growth potential of 5-7% annually for upstream activities, supported by favorable market conditions and strategic government support for energy sector development.

Thailand’s upstream oil and gas market demonstrates robust fundamentals and strong growth potential, positioned favorably within Southeast Asia’s evolving energy landscape. The market benefits from substantial hydrocarbon resources, established infrastructure, and supportive regulatory environment that continues to attract significant investment from both domestic and international operators. Technological advancement and operational optimization have enhanced efficiency and competitiveness, while strategic partnerships have strengthened capabilities and market positioning.

Key success factors include continued focus on enhanced oil recovery, exploration in underexplored basins, and adoption of advanced technologies that improve operational performance. The market’s strategic importance extends beyond domestic energy security to regional energy integration and economic development objectives. Sustainable development practices and environmental compliance will remain critical for long-term success and social license to operate.

Future growth prospects remain positive, supported by favorable market dynamics, continued investment commitments, and Thailand’s strategic position as a regional energy hub. The upstream sector’s evolution toward more technology-intensive and environmentally conscious operations positions it well for sustained development and contribution to Thailand’s energy independence and economic prosperity.

What is Oil & Gas Upstream?

Oil & Gas Upstream refers to the exploration and production segment of the oil and gas industry, focusing on locating and extracting crude oil and natural gas from the earth. This includes activities such as drilling, well completion, and production operations.

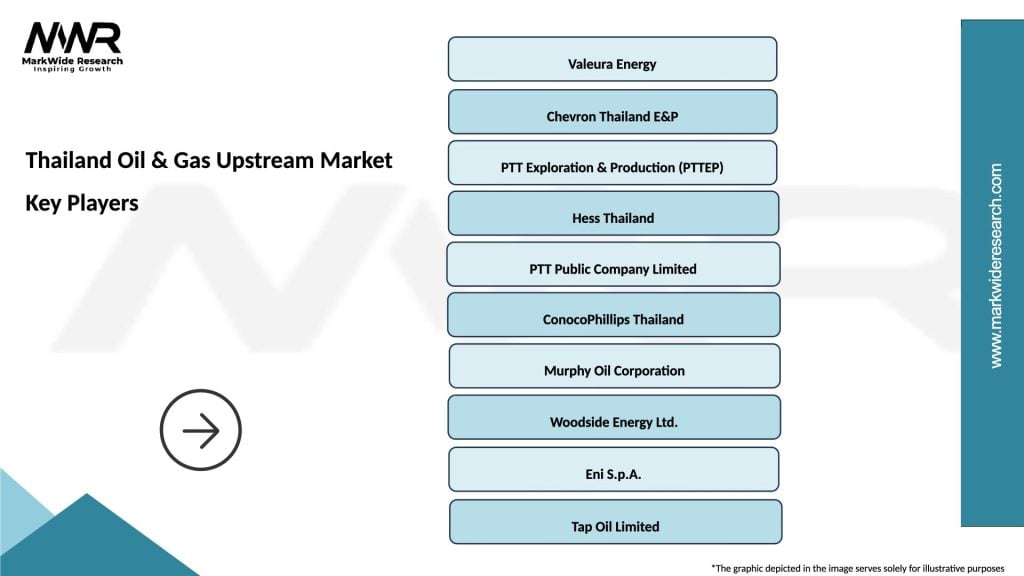

What are the key players in the Thailand Oil & Gas Upstream Market?

Key players in the Thailand Oil & Gas Upstream Market include PTTEP, Chevron Thailand Exploration and Production, and Mubadala Petroleum, among others. These companies are involved in various activities from exploration to production in the region.

What are the growth factors driving the Thailand Oil & Gas Upstream Market?

The growth of the Thailand Oil & Gas Upstream Market is driven by increasing energy demand, advancements in extraction technologies, and the discovery of new oil and gas reserves. Additionally, government policies supporting energy independence play a significant role.

What challenges does the Thailand Oil & Gas Upstream Market face?

The Thailand Oil & Gas Upstream Market faces challenges such as fluctuating oil prices, environmental regulations, and the need for significant capital investment. These factors can impact the profitability and sustainability of upstream operations.

What opportunities exist in the Thailand Oil & Gas Upstream Market?

Opportunities in the Thailand Oil & Gas Upstream Market include the potential for offshore exploration, partnerships with international firms, and the adoption of innovative technologies to enhance production efficiency. These factors can lead to increased investment and growth.

What trends are shaping the Thailand Oil & Gas Upstream Market?

Trends in the Thailand Oil & Gas Upstream Market include a shift towards renewable energy integration, increased focus on sustainability practices, and the use of digital technologies for operational efficiency. These trends are influencing how companies approach exploration and production.

Thailand Oil & Gas Upstream Market

| Segmentation Details | Description |

|---|---|

| Type | Exploration, Production, Drilling, Extraction |

| Technology | Seismic Imaging, Horizontal Drilling, Hydraulic Fracturing, Enhanced Oil Recovery |

| End User | Energy Companies, Government Agencies, Contractors, Service Providers |

| Installation | Onshore, Offshore, Coastal, Deepwater |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Thailand Oil & Gas Upstream Market

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at