444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The US solar market represents one of the most dynamic and rapidly expanding renewable energy sectors in North America, demonstrating unprecedented growth across residential, commercial, and utility-scale applications. Solar energy adoption has accelerated significantly over the past decade, driven by technological advancements, declining installation costs, and supportive federal and state policies. The market encompasses photovoltaic systems, solar thermal technologies, and energy storage solutions that collectively contribute to America’s clean energy transition.

Market dynamics indicate robust expansion with the sector experiencing 23% annual growth in new installations across multiple segments. Residential solar adoption has particularly gained momentum, with homeowners increasingly recognizing the long-term financial benefits and environmental impact of solar energy systems. The commercial and industrial segments continue to drive substantial capacity additions, while utility-scale projects represent the largest portion of new solar installations nationwide.

Geographic distribution shows concentrated growth in sun-rich states including California, Texas, Florida, and Arizona, though emerging markets in the Northeast and Midwest are demonstrating accelerating adoption rates. Technology innovation continues to enhance system efficiency, with modern solar panels achieving 22% efficiency rates compared to earlier generations, while installation costs have decreased substantially over the past five years.

The US solar market refers to the comprehensive ecosystem of solar energy technologies, installation services, financing solutions, and supporting infrastructure that enables the conversion of sunlight into electricity across residential, commercial, and utility applications throughout the United States. This market encompasses photovoltaic panel manufacturing, system design and installation, energy storage integration, and ongoing maintenance services that collectively support America’s renewable energy objectives.

Solar market participants include equipment manufacturers, installation contractors, financing companies, utility providers, and technology developers who collaborate to deliver comprehensive solar solutions. The market spans the entire value chain from silicon production and panel manufacturing to project development, system installation, and long-term performance monitoring. Energy storage integration has become increasingly important, with battery systems enhancing solar installations’ reliability and grid independence capabilities.

Market leadership in the US solar sector reflects a mature industry experiencing sustained growth across all major segments, with residential installations showing 18% year-over-year growth while utility-scale projects continue expanding capacity nationwide. Policy support through federal tax credits, state renewable portfolio standards, and net metering programs provides favorable conditions for continued market expansion through the remainder of the decade.

Technology advancement drives market competitiveness, with next-generation solar panels, smart inverters, and integrated energy storage solutions enhancing system performance and customer value propositions. Cost reduction trends have made solar energy increasingly competitive with traditional electricity sources, achieving grid parity in most US markets and creating compelling economic incentives for adoption across customer segments.

Supply chain resilience has become a critical focus area, with domestic manufacturing initiatives and diversified sourcing strategies addressing previous vulnerabilities. The market demonstrates strong fundamentals with established financing mechanisms, experienced installation networks, and proven technology platforms supporting sustained growth trajectories.

Strategic insights reveal several key trends shaping the US solar market landscape:

Economic incentives represent the primary driver for US solar market growth, with federal investment tax credits providing 30% cost reduction for residential and commercial installations through 2032. State-level policies including renewable portfolio standards, net metering programs, and additional rebates create compelling financial incentives that accelerate adoption across diverse geographic markets.

Technology advancement continues driving market expansion through improved panel efficiency, enhanced inverter capabilities, and integrated energy storage solutions that increase system value propositions. Installation cost reductions have made solar energy increasingly competitive with traditional electricity sources, creating favorable economics for customers across residential, commercial, and utility segments.

Environmental consciousness motivates growing numbers of consumers and businesses to adopt solar energy as part of sustainability initiatives and carbon reduction strategies. Energy independence concerns, particularly following recent grid reliability challenges, drive interest in distributed solar generation combined with battery storage systems that provide backup power capabilities.

Corporate sustainability commitments from major businesses create substantial demand for commercial and utility-scale solar projects as companies work to achieve renewable energy targets and reduce operational carbon footprints.

Regulatory challenges including complex permitting processes, varying local codes, and interconnection requirements create barriers that can delay project development and increase installation costs. Grid integration limitations in certain regions restrict the ability to accommodate high levels of distributed solar generation, particularly during peak production periods.

Supply chain constraints occasionally impact equipment availability and pricing, with global manufacturing dependencies creating potential vulnerabilities during periods of high demand or geopolitical tensions. Skilled labor shortages in installation and maintenance services can limit market growth rates in rapidly expanding regions.

Financing accessibility remains challenging for certain customer segments, particularly those with limited credit history or lower incomes, despite the availability of various financing options. Technology complexity and customer education requirements can slow adoption rates among less technically sophisticated market segments.

Intermittency concerns related to solar energy production patterns require careful system design and potentially additional investments in energy storage or grid services to ensure reliable electricity supply.

Emerging market segments present significant growth opportunities, particularly in community solar programs that enable renters and businesses without suitable rooftops to access solar energy benefits. Agricultural applications including agrivoltaics and solar-powered irrigation systems represent expanding market niches with substantial potential.

Energy storage integration creates opportunities for enhanced system value through grid services, demand charge management, and backup power capabilities that appeal to diverse customer segments. Electric vehicle integration with solar charging systems represents a growing market opportunity as EV adoption accelerates nationwide.

Grid modernization initiatives create opportunities for advanced solar technologies including smart inverters, virtual power plants, and demand response capabilities that provide additional revenue streams. Corporate procurement programs continue expanding as businesses seek large-scale renewable energy solutions to meet sustainability commitments.

Technology innovation in areas such as floating solar, building-integrated photovoltaics, and advanced energy storage systems opens new market applications and customer segments previously underserved by traditional solar solutions.

Competitive dynamics in the US solar market reflect a mature industry with established leaders and emerging innovators competing across technology, installation services, and financing solutions. Market consolidation trends have created larger, more capable companies while specialized providers continue serving niche applications and regional markets.

Technology evolution drives continuous improvement in system performance, with panel efficiency gains and cost reductions creating ongoing competitive advantages for early adopters of advanced technologies. Customer expectations have evolved to demand comprehensive solutions including design, installation, monitoring, and maintenance services from single providers.

Regulatory environment changes at federal and state levels significantly impact market dynamics, with policy stability supporting long-term investment while regulatory uncertainty can slow market development. Grid integration requirements continue evolving as utilities adapt to higher levels of distributed solar generation and implement advanced grid management systems.

Supply chain dynamics influence pricing and availability of key components, with domestic manufacturing initiatives aimed at reducing dependence on international suppliers while maintaining cost competitiveness.

Comprehensive analysis of the US solar market incorporates multiple research methodologies including primary data collection from industry participants, secondary research from government agencies and industry associations, and quantitative analysis of installation data and market trends. Data sources include the Solar Energy Industries Association, Energy Information Administration, and state public utility commissions that provide detailed market statistics and regulatory information.

Primary research involves interviews with solar installers, equipment manufacturers, financing providers, and customers across residential, commercial, and utility market segments. Market surveys capture customer preferences, adoption barriers, and satisfaction levels with existing solar installations and service providers.

Secondary research analyzes government databases, industry reports, and academic studies to understand technology trends, policy impacts, and long-term market projections. Quantitative analysis examines installation data, pricing trends, and performance metrics to identify market patterns and growth drivers.

Regional analysis incorporates state-level data on solar policies, installation rates, and market conditions to understand geographic variations in market development and identify emerging growth opportunities.

California leadership continues with the state maintaining 40% of total US solar capacity, driven by aggressive renewable energy policies, favorable solar resources, and mature market infrastructure. Residential adoption remains strong despite recent policy changes, while utility-scale development continues expanding in desert regions with excellent solar irradiance levels.

Texas emergence as a major solar market reflects the state’s abundant land resources, competitive electricity markets, and growing corporate demand for renewable energy. Utility-scale projects dominate Texas installations, with the state representing 15% of new capacity additions annually and continuing to attract major project developers.

Florida expansion demonstrates rapid growth across all market segments, with utility companies investing heavily in solar generation while residential adoption accelerates due to favorable economics and increasing environmental awareness. Commercial installations show particular strength in the hospitality and retail sectors.

Northeast markets including New York, Massachusetts, and New Jersey show strong growth despite less favorable solar resources, driven by supportive policies, high electricity rates, and environmental commitments. Community solar programs have gained significant traction in these markets, enabling broader customer participation.

Emerging markets in the Midwest and Southeast show accelerating adoption rates as costs decline and policies become more supportive, with states like Illinois, Virginia, and North Carolina demonstrating substantial growth potential.

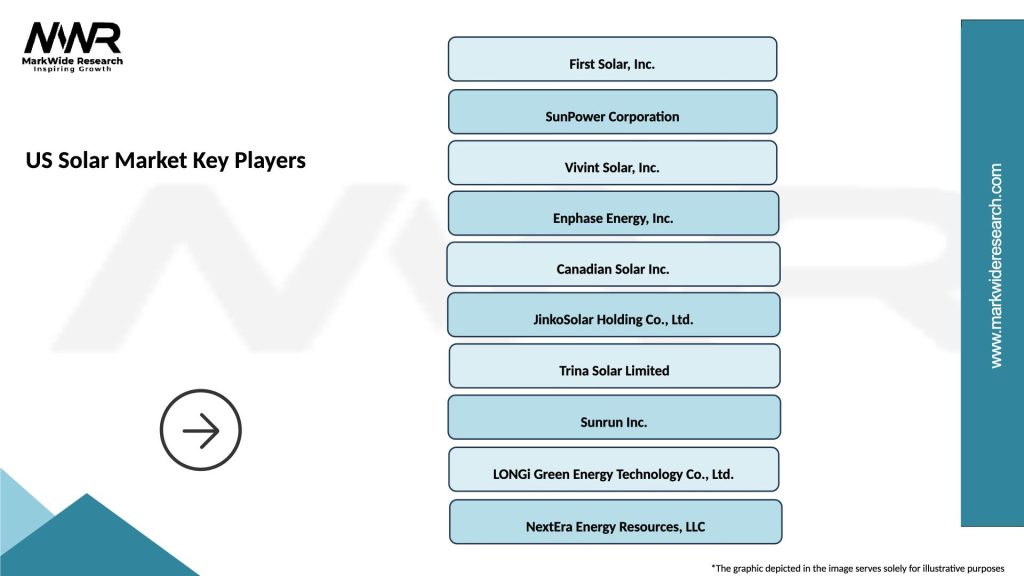

Market leaders in the US solar industry include established companies with comprehensive capabilities across manufacturing, development, and installation services:

Competitive differentiation focuses on technology innovation, installation quality, customer service, and financing options that address diverse customer needs across market segments. Regional specialists continue playing important roles in local markets through established relationships and specialized expertise.

By Application:

By Technology:

By Installation Type:

Residential segment analysis reveals strong growth momentum with homeowners increasingly viewing solar installations as long-term investments that enhance property values while reducing electricity costs. Energy storage adoption in residential applications has reached 45% attachment rates for new installations, driven by backup power needs and time-of-use rate optimization.

Commercial sector dynamics show businesses adopting solar primarily for cost reduction and sustainability goals, with installation sizes averaging larger than residential systems and offering attractive return on investment profiles. Power purchase agreements remain popular financing mechanisms for commercial customers seeking to avoid upfront capital investments.

Utility-scale developments continue driving the majority of new capacity additions, with projects increasingly incorporating energy storage systems to provide grid services and enhance project economics. Competitive procurement processes have driven significant cost reductions while improving project quality and performance standards.

Community solar programs address market segments unable to install on-site solar systems, with subscription models enabling broader customer participation and supporting grid-scale renewable energy development in diverse geographic locations.

Customer benefits include substantial electricity cost savings, increased energy independence, enhanced property values, and reduced environmental impact through clean energy adoption. Financial advantages encompass federal and state tax incentives, net metering credits, and long-term price stability that protect against utility rate increases.

Industry participants benefit from expanding market opportunities, technology advancement driving improved margins, and established supply chains supporting scalable business growth. Installation contractors enjoy recurring revenue opportunities through maintenance services and system monitoring while building long-term customer relationships.

Utility companies gain access to distributed generation resources that support grid stability, reduce transmission losses, and help meet renewable energy requirements while potentially deferring infrastructure investments. Grid benefits include peak demand reduction, voltage support, and enhanced system resilience through distributed generation.

Environmental stakeholders benefit from reduced greenhouse gas emissions, improved air quality, and decreased dependence on fossil fuel generation sources that contribute to climate change and environmental degradation.

Strengths:

Weaknesses:

Opportunities:

Threats:

Energy storage integration represents the most significant trend reshaping the US solar market, with battery systems becoming standard components in new installations to address intermittency concerns and provide additional grid services. Smart technology adoption including advanced inverters, monitoring systems, and automated maintenance capabilities enhances system performance and customer experience.

Community solar expansion addresses market segments previously unable to access solar benefits, with virtual net metering programs enabling apartment dwellers, renters, and businesses without suitable rooftops to participate in solar energy programs. Corporate procurement continues growing as businesses seek large-scale renewable energy solutions to meet sustainability commitments.

Agrivoltaics development combines solar generation with agricultural activities, creating dual land use opportunities that benefit farmers while expanding solar deployment options. Floating solar installations on reservoirs and other water bodies provide land conservation benefits while potentially improving panel performance through cooling effects.

Grid modernization initiatives enable higher levels of solar penetration through advanced grid management systems, demand response programs, and virtual power plant capabilities that optimize distributed energy resources.

Manufacturing expansion initiatives aim to establish domestic solar panel production capabilities, reducing supply chain dependencies while supporting job creation and energy security objectives. Technology breakthroughs in perovskite solar cells and other next-generation technologies promise further efficiency improvements and cost reductions.

Policy developments including the Inflation Reduction Act provide long-term incentive certainty while introducing new programs supporting domestic manufacturing and disadvantaged community access to solar energy. Utility partnerships with solar developers create new business models for distributed generation integration and grid services.

Financing innovation includes new loan products, lease structures, and power purchase agreement terms that improve solar accessibility across diverse customer segments. MarkWide Research analysis indicates that innovative financing mechanisms have contributed to 25% growth in customer adoption rates over the past two years.

Grid integration standards continue evolving to accommodate higher levels of distributed solar generation while maintaining system reliability and power quality standards.

Strategic recommendations for industry participants include focusing on energy storage integration capabilities to enhance system value propositions and address customer concerns about grid reliability. Technology investment in advanced monitoring and maintenance systems can differentiate service offerings while improving long-term system performance and customer satisfaction.

Market expansion strategies should target emerging segments including community solar, agrivoltaics, and commercial energy storage applications that offer growth opportunities beyond traditional rooftop installations. Partnership development with utilities, energy storage providers, and electric vehicle companies can create integrated solutions addressing evolving customer needs.

Operational excellence in installation quality, customer service, and project management becomes increasingly important as market competition intensifies and customer expectations rise. Supply chain diversification strategies should reduce dependencies on single suppliers while maintaining cost competitiveness and quality standards.

Policy engagement at federal, state, and local levels helps shape favorable regulatory environments while addressing potential barriers to market growth and technology deployment.

Long-term projections indicate continued robust growth for the US solar market, with MWR forecasting sustained expansion across all major segments through 2030 and beyond. Technology advancement will continue driving cost reductions and performance improvements, making solar energy increasingly competitive with traditional generation sources.

Market maturation trends suggest evolution toward more sophisticated solutions including integrated energy storage, grid services, and smart home integration that enhance customer value beyond simple electricity generation. Geographic expansion into previously underserved markets will be supported by declining costs and improving policy environments.

Grid integration capabilities will expand through continued investment in transmission infrastructure, energy storage systems, and advanced grid management technologies that accommodate higher levels of renewable energy penetration. Corporate adoption will accelerate as businesses increasingly prioritize sustainability goals and seek cost-effective renewable energy solutions.

Innovation pipeline includes emerging technologies such as perovskite solar cells, advanced energy storage systems, and artificial intelligence applications that promise to further enhance solar market growth and customer adoption rates reaching 12% annually through the decade.

Market fundamentals for the US solar industry remain exceptionally strong, with technological advancement, supportive policies, and compelling economics driving sustained growth across residential, commercial, and utility market segments. Energy storage integration and smart technology adoption are transforming solar from a simple electricity generation technology into comprehensive energy solutions that address diverse customer needs and grid requirements.

Competitive dynamics continue evolving as established leaders and innovative newcomers compete to capture market share in an expanding industry characterized by improving technology, declining costs, and growing customer acceptance. Regional diversification beyond traditional solar markets creates new growth opportunities while reducing geographic concentration risks.

Future prospects indicate the US solar market will continue its trajectory as a cornerstone of America’s clean energy transition, supported by favorable economics, technology innovation, and policy stability that create attractive conditions for continued investment and growth across all market segments.

What is Solar?

Solar refers to the technology and processes that harness sunlight to generate electricity or heat. It encompasses various methods, including photovoltaic systems, solar thermal energy, and concentrated solar power, which are increasingly utilized in residential, commercial, and utility-scale applications.

What are the key players in the US Solar Market?

Key players in the US Solar Market include companies like First Solar, SunPower, and Tesla, which are involved in manufacturing solar panels, providing installation services, and developing solar energy projects, among others.

What are the main drivers of growth in the US Solar Market?

The main drivers of growth in the US Solar Market include the decreasing cost of solar technology, government incentives for renewable energy adoption, and increasing consumer demand for sustainable energy solutions. Additionally, advancements in energy storage technologies are enhancing solar energy’s viability.

What challenges does the US Solar Market face?

The US Solar Market faces challenges such as regulatory hurdles, competition from traditional energy sources, and supply chain disruptions. These factors can impact the pace of solar adoption and project development across various regions.

What opportunities exist in the US Solar Market?

Opportunities in the US Solar Market include the expansion of community solar projects, increased investment in solar technology innovation, and the potential for integrating solar with electric vehicle charging infrastructure. These developments can enhance energy access and sustainability.

What trends are shaping the US Solar Market?

Trends shaping the US Solar Market include the rise of solar-plus-storage solutions, the growth of residential solar installations, and the increasing focus on sustainability and corporate renewable energy commitments. These trends are driving innovation and investment in the sector.

US Solar Market

| Segmentation Details | Description |

|---|---|

| Product Type | Photovoltaic Panels, Inverters, Mounting Systems, Batteries |

| Technology | Monocrystalline, Polycrystalline, Thin-Film, Bifacial |

| End User | Residential, Commercial, Industrial, Utilities |

| Installation | Rooftop, Ground-Mounted, Carport, Floating |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the US Solar Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at