444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

The Internet of Things (IoT) managed services market represents a rapidly expanding segment within the broader technology services landscape, driven by organizations’ increasing need to efficiently manage complex IoT ecosystems. IoT managed services encompass comprehensive solutions that help businesses deploy, monitor, maintain, and optimize their connected device networks without requiring extensive in-house expertise. The market is experiencing robust growth as enterprises across various industries recognize the strategic value of outsourcing IoT infrastructure management to specialized service providers.

Market dynamics indicate that the sector is witnessing accelerated adoption, with growth rates reaching 22.5% CAGR as organizations seek to leverage IoT technologies while minimizing operational complexity. Digital transformation initiatives across manufacturing, healthcare, retail, and smart city projects are driving substantial demand for managed IoT services. The market encompasses various service categories including device management, connectivity management, data analytics, security services, and application development support.

Regional distribution shows North America maintaining approximately 35% market share, followed by Europe and Asia-Pacific regions experiencing rapid growth. Enterprise adoption is particularly strong in sectors requiring large-scale IoT deployments, where managed services provide critical expertise in handling device provisioning, network optimization, and data processing at scale.

The Internet of Things (IoT) managed services market refers to the comprehensive ecosystem of outsourced services that enable organizations to effectively deploy, manage, and optimize their IoT infrastructure without maintaining extensive internal technical capabilities. These services encompass end-to-end IoT lifecycle management including device provisioning, connectivity management, data analytics, security monitoring, and ongoing maintenance support.

Managed IoT services provide businesses with access to specialized expertise, advanced platforms, and scalable infrastructure necessary to successfully implement IoT solutions. Service providers offer various engagement models ranging from fully managed services where providers handle all aspects of IoT operations, to hybrid models where organizations retain control over specific components while outsourcing others. Core service categories include device lifecycle management, network connectivity services, data processing and analytics, security and compliance management, and application development support.

Value proposition centers on enabling organizations to focus on their core business objectives while leveraging IoT technologies to drive operational efficiency, enhance customer experiences, and create new revenue streams. These services eliminate the complexity associated with managing diverse device ecosystems, ensuring reliable connectivity, and extracting actionable insights from IoT-generated data.

Market momentum in the IoT managed services sector reflects the growing recognition that successful IoT implementations require specialized expertise and dedicated resources that many organizations prefer to outsource rather than develop internally. Service providers are responding to this demand by developing comprehensive service portfolios that address the full spectrum of IoT management requirements, from initial deployment through ongoing optimization and scaling.

Key growth drivers include the increasing complexity of IoT ecosystems, rising demand for real-time data analytics, and the need for robust security frameworks to protect connected devices and data. Organizations are particularly drawn to managed services that offer predictable cost structures and access to cutting-edge technologies without significant capital investments. Industry adoption is accelerating across manufacturing, healthcare, transportation, and smart infrastructure sectors, with managed services enabling faster time-to-market and reduced implementation risks.

Competitive landscape features established technology service providers, telecommunications companies, and specialized IoT service firms competing to deliver comprehensive managed service offerings. Service differentiation increasingly focuses on industry-specific expertise, advanced analytics capabilities, and integrated security solutions that address the unique requirements of different vertical markets.

Strategic insights reveal several critical trends shaping the IoT managed services market landscape:

Market maturation is evident in the evolution from basic device management services to comprehensive platforms that integrate multiple IoT technologies and provide strategic business insights. Customer expectations continue to rise, with organizations seeking managed services that not only reduce operational burden but also drive measurable business value through improved efficiency and innovation capabilities.

Primary market drivers propelling the IoT managed services market include the increasing complexity of IoT ecosystems and the growing recognition that successful IoT implementations require specialized expertise. Digital transformation initiatives across industries are creating substantial demand for managed services that can accelerate IoT adoption while minimizing implementation risks and operational overhead.

Cost optimization pressures drive organizations to seek managed service alternatives that provide access to advanced IoT technologies without requiring significant capital investments in infrastructure and specialized personnel. Skill shortage challenges in IoT technologies, cybersecurity, and data analytics make managed services an attractive option for organizations lacking internal expertise. The ability to leverage provider expertise and established best practices enables faster deployment and more reliable operations.

Scalability requirements represent another significant driver, as organizations need solutions that can grow from small pilot projects to enterprise-wide deployments. Managed service providers offer the infrastructure and expertise necessary to support rapid scaling without the complexity of managing internal resources. Regulatory compliance demands, particularly in healthcare, financial services, and manufacturing sectors, drive adoption of managed services that include specialized compliance and security capabilities.

Innovation acceleration through managed services enables organizations to focus on core business activities while leveraging cutting-edge IoT technologies. Time-to-market pressures make managed services attractive for organizations seeking to quickly implement IoT solutions and realize business benefits without lengthy internal development cycles.

Market restraints affecting IoT managed services adoption include concerns about data security and privacy, particularly for organizations handling sensitive information or operating in highly regulated industries. Data sovereignty issues create challenges for managed service providers operating across multiple jurisdictions with varying regulatory requirements. Organizations may hesitate to outsource critical IoT operations due to concerns about losing control over sensitive data and business processes.

Integration complexity with existing enterprise systems can create implementation challenges and increase project timelines. Legacy system compatibility issues may require additional customization and integration work, potentially reducing the cost advantages of managed services. Vendor lock-in concerns make some organizations reluctant to commit to comprehensive managed service arrangements, preferring to maintain flexibility in their technology choices.

Cost considerations for long-term managed service contracts may appear higher than internal development options, particularly for organizations with existing IoT expertise. Service level agreement negotiations can be complex, with organizations requiring specific performance guarantees and customization options that may not align with standardized service offerings.

Cultural resistance within organizations accustomed to maintaining direct control over technology operations can slow managed services adoption. Change management challenges associated with transitioning from internal to external service delivery models require careful planning and stakeholder engagement to ensure successful implementation.

Significant opportunities exist for IoT managed service providers to expand their offerings and capture growing market demand. Edge computing integration presents substantial opportunities as organizations seek to process IoT data closer to its source for improved performance and reduced latency. Artificial intelligence and machine learning integration within managed services create opportunities to deliver advanced analytics and predictive capabilities that drive greater business value.

Industry-specific solutions represent a major opportunity area, with providers developing specialized expertise in healthcare, manufacturing, retail, and smart city applications. Vertical market focus enables providers to develop deep domain knowledge and create tailored solutions that address specific industry challenges and regulatory requirements. Small and medium enterprise markets present significant growth opportunities as these organizations seek cost-effective ways to implement IoT technologies without substantial internal investments.

Emerging technologies such as 5G networks, blockchain integration, and advanced security frameworks create opportunities for managed service providers to differentiate their offerings and capture premium pricing. Sustainability initiatives drive demand for IoT solutions that optimize energy consumption and environmental impact, creating opportunities for specialized managed services focused on green technology implementations.

Global expansion opportunities exist in emerging markets where organizations are rapidly adopting IoT technologies but lack internal expertise. Partnership strategies with technology vendors, system integrators, and industry consultants create opportunities to expand market reach and enhance service capabilities through collaborative offerings.

Market dynamics in the IoT managed services sector reflect the interplay between rapidly evolving technology capabilities and growing enterprise demand for simplified IoT management solutions. Technology advancement continues to drive market evolution, with providers incorporating emerging technologies such as artificial intelligence, edge computing, and advanced analytics into their service portfolios to deliver enhanced value propositions.

Competitive intensity is increasing as traditional IT service providers, telecommunications companies, and specialized IoT firms compete for market share. Service differentiation strategies focus on industry expertise, technology innovation, and comprehensive service portfolios that address the full spectrum of IoT management requirements. Pricing pressure from competitive dynamics is driving providers to optimize their service delivery models and demonstrate clear return on investment for their offerings.

Customer expectations continue to evolve, with organizations seeking managed services that not only reduce operational complexity but also drive strategic business outcomes. Service level demands are increasing, with customers expecting 99.9% uptime guarantees and rapid response times for critical issues. Customization requirements vary significantly across industries and organization sizes, creating challenges for providers seeking to balance standardization with flexibility.

Technology convergence trends are reshaping service offerings, with providers integrating IoT management with broader digital transformation services including cloud computing, cybersecurity, and data analytics. Ecosystem partnerships are becoming increasingly important as providers seek to offer comprehensive solutions that leverage best-of-breed technologies from multiple vendors.

Comprehensive research methodology employed in analyzing the IoT managed services market incorporates multiple data collection and analysis techniques to ensure accurate and reliable market insights. Primary research includes extensive interviews with industry executives, service providers, technology vendors, and end-user organizations across various sectors to gather firsthand perspectives on market trends, challenges, and opportunities.

Secondary research encompasses analysis of industry reports, company financial statements, technology publications, and regulatory documents to establish market context and validate primary research findings. Quantitative analysis utilizes statistical modeling techniques to project market growth trends and assess the impact of various market drivers and restraints on sector development.

Market segmentation analysis examines the IoT managed services market across multiple dimensions including service type, industry vertical, organization size, and geographic region. Competitive landscape assessment evaluates service provider capabilities, market positioning, and strategic initiatives to understand competitive dynamics and identify market leaders.

Technology trend analysis focuses on emerging technologies and their potential impact on managed service offerings, including edge computing, artificial intelligence, 5G networks, and advanced security frameworks. Regulatory impact assessment examines how evolving data privacy and security regulations affect managed service delivery models and market opportunities.

North America maintains its position as the largest regional market for IoT managed services, accounting for approximately 35% of global market share. United States leads regional adoption driven by advanced technology infrastructure, substantial enterprise IoT investments, and the presence of major service providers. Canadian market shows strong growth in manufacturing and natural resources sectors, with organizations seeking managed services to optimize operational efficiency and regulatory compliance.

Europe represents the second-largest regional market with approximately 28% market share, characterized by strong regulatory frameworks and emphasis on data privacy and security. Germany leads European adoption through Industry 4.0 initiatives and manufacturing sector digitalization. United Kingdom shows significant growth in smart city and healthcare IoT applications, while Nordic countries demonstrate leadership in sustainable IoT implementations.

Asia-Pacific exhibits the highest growth rates with CAGR exceeding 25%, driven by rapid industrialization and smart city development initiatives. China represents the largest individual market within the region, with substantial government investments in IoT infrastructure and manufacturing modernization. Japan shows strong adoption in automotive and electronics sectors, while India demonstrates growing demand for managed services in telecommunications and healthcare applications.

Latin America and Middle East & Africa represent emerging markets with significant growth potential, particularly in sectors such as agriculture, energy, and smart infrastructure. Brazil and Mexico lead Latin American adoption, while UAE and Saudi Arabia drive Middle Eastern market development through smart city initiatives and economic diversification programs.

Competitive landscape in the IoT managed services market features a diverse mix of established technology service providers, telecommunications companies, and specialized IoT service firms competing across various market segments. Market leaders differentiate themselves through comprehensive service portfolios, industry expertise, and global delivery capabilities.

Competitive strategies focus on developing industry-specific expertise, expanding service portfolios, and creating strategic partnerships to enhance market position. Service innovation remains a key differentiator, with providers investing in advanced analytics, artificial intelligence, and edge computing capabilities to deliver enhanced value propositions.

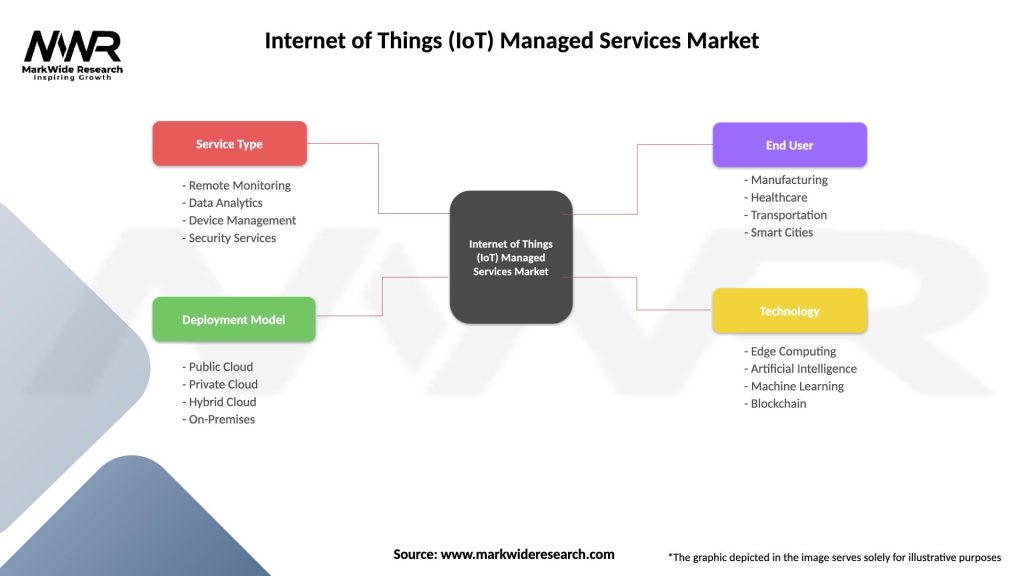

Market segmentation analysis reveals distinct categories within the IoT managed services market, each addressing specific customer requirements and use cases. Service type segmentation represents the primary classification method, encompassing various managed service categories that organizations can select based on their specific needs and internal capabilities.

By Service Type:

By Deployment Model:

By Organization Size:

Device Management Services represent the largest segment within IoT managed services, driven by the complexity of managing diverse device ecosystems across different manufacturers and technologies. Service providers in this category focus on automating device provisioning, monitoring device health, managing firmware updates, and ensuring optimal device performance throughout the lifecycle. Growth drivers include the increasing number of connected devices per deployment and the need for centralized management capabilities.

Connectivity Management Services address the critical requirement for reliable, secure communication between IoT devices and backend systems. Service offerings include network optimization, bandwidth management, failover capabilities, and multi-carrier connectivity options. Market demand is particularly strong in applications requiring high availability and low latency, such as industrial automation and healthcare monitoring systems.

Data Management and Analytics Services represent the fastest-growing segment, with organizations seeking to extract maximum value from IoT-generated data. Advanced analytics capabilities including machine learning, predictive analytics, and real-time processing are becoming standard components of managed service offerings. Business intelligence integration enables organizations to incorporate IoT insights into broader decision-making processes.

Security Management Services have become increasingly critical as IoT deployments expand and cyber threats evolve. Comprehensive security frameworks address device authentication, data encryption, network security, and threat response capabilities. Compliance support for industry-specific regulations adds significant value for organizations in healthcare, financial services, and manufacturing sectors.

Enterprise organizations benefit from IoT managed services through reduced operational complexity, access to specialized expertise, and predictable cost structures that enable better budget planning and resource allocation. Faster time-to-market for IoT initiatives allows organizations to realize business benefits more quickly while minimizing implementation risks associated with internal development approaches.

Cost optimization represents a significant benefit, with managed services eliminating the need for substantial capital investments in IoT infrastructure and specialized personnel. Scalability advantages enable organizations to grow their IoT deployments without proportional increases in internal resources or complexity. Access to innovation through managed service providers ensures organizations can leverage cutting-edge technologies without internal research and development investments.

Service providers benefit from recurring revenue models and opportunities to develop long-term customer relationships through comprehensive service delivery. Market expansion opportunities exist across various industry verticals and geographic regions, with providers able to leverage their expertise across multiple customer deployments.

Technology vendors benefit from increased demand for their solutions through managed service provider partnerships and integrated offerings. Market reach expansion through service provider channels enables vendors to access customers who prefer managed service delivery models over direct technology purchases.

End users benefit from improved system reliability, enhanced security, and better user experiences delivered through professional managed service operations. Business outcome focus ensures that IoT implementations deliver measurable value rather than simply deploying technology for its own sake.

Strengths:

Weaknesses:

Opportunities:

Threats:

Edge computing integration represents a transformative trend in IoT managed services, with providers incorporating edge processing capabilities to enable real-time data analysis and reduced latency for critical applications. Service offerings increasingly include edge infrastructure management, distributed computing capabilities, and hybrid cloud-edge architectures that optimize performance and cost-effectiveness.

Artificial intelligence and machine learning integration are becoming standard components of managed service platforms, enabling predictive analytics, automated decision-making, and intelligent system optimization. AI-powered services provide enhanced value through predictive maintenance, anomaly detection, and automated response capabilities that improve system reliability and efficiency.

Industry-specific solutions are gaining prominence as service providers develop deep vertical expertise to address unique sector requirements. Healthcare IoT managed services focus on regulatory compliance and patient data security, while manufacturing solutions emphasize operational efficiency and predictive maintenance capabilities.

Security-first approaches are becoming fundamental to managed service design, with providers implementing comprehensive security frameworks that address device authentication, data encryption, network protection, and threat response. Zero-trust security models are increasingly adopted to ensure robust protection across distributed IoT environments.

Sustainability focus is driving demand for managed services that optimize energy consumption and environmental impact. Green IoT initiatives include energy-efficient device management, carbon footprint monitoring, and sustainable technology implementation strategies.

Strategic partnerships between managed service providers and technology vendors are reshaping the competitive landscape, with collaborations focused on delivering integrated solutions that combine best-of-breed technologies with professional service expertise. Ecosystem development initiatives create comprehensive platforms that address the full spectrum of IoT management requirements.

Acquisition activity continues as established technology service providers acquire specialized IoT companies to enhance their capabilities and market position. Market consolidation trends are creating larger, more comprehensive service providers capable of delivering end-to-end IoT solutions across multiple industry verticals.

Technology investments by service providers focus on developing proprietary platforms and capabilities that differentiate their offerings and create competitive advantages. Research and development initiatives emphasize emerging technologies such as 5G integration, blockchain applications, and advanced analytics capabilities.

Regulatory compliance initiatives are driving service providers to develop specialized capabilities for highly regulated industries such as healthcare, financial services, and manufacturing. Compliance frameworks address data privacy, security standards, and industry-specific regulatory requirements.

Global expansion strategies by major service providers include establishing local presence in emerging markets and developing partnerships with regional technology companies to enhance market reach and service delivery capabilities.

MarkWide Research analysis suggests that organizations evaluating IoT managed services should prioritize providers with demonstrated industry expertise and comprehensive security capabilities. Due diligence processes should include thorough assessment of provider technology platforms, service level agreements, and data protection frameworks to ensure alignment with organizational requirements and regulatory obligations.

Service provider selection should consider long-term strategic alignment rather than solely focusing on initial cost considerations. Scalability assessment is critical to ensure that chosen providers can support organizational growth and evolving IoT requirements without service disruption or significant cost increases.

Hybrid service models may offer optimal balance between control and efficiency for many organizations, allowing retention of critical capabilities while outsourcing routine management tasks. Pilot project approaches enable organizations to evaluate provider capabilities and service quality before committing to comprehensive managed service arrangements.

Contract negotiations should include specific performance metrics, service level guarantees, and exit clauses to protect organizational interests and ensure service quality. Data governance requirements should be clearly defined to address privacy, security, and compliance obligations throughout the service relationship.

Technology roadmap alignment between organizations and service providers ensures that managed service investments support long-term strategic objectives and technology evolution plans. Regular service reviews and performance assessments help optimize service delivery and identify opportunities for enhanced value creation.

Market projections indicate continued robust growth in the IoT managed services sector, with MWR forecasting sustained expansion driven by increasing IoT adoption across industries and growing recognition of managed services value propositions. Technology evolution will continue to create new opportunities for service providers to deliver enhanced capabilities and address emerging customer requirements.

Edge computing integration is expected to become a standard component of managed service offerings, enabling real-time processing capabilities and supporting latency-sensitive applications. 5G network deployment will create new opportunities for managed services that leverage enhanced connectivity capabilities and support advanced IoT applications.

Artificial intelligence and machine learning capabilities will become increasingly sophisticated, enabling predictive analytics, automated optimization, and intelligent decision-making that drive greater business value for customers. Industry specialization trends will continue, with service providers developing deeper vertical expertise and tailored solutions for specific sector requirements.

Sustainability initiatives will drive demand for managed services that optimize energy consumption and environmental impact, creating opportunities for providers with green technology expertise. Regulatory evolution will require continuous adaptation of service offerings to address changing compliance requirements and data protection standards.

Global market expansion will continue as emerging economies increase IoT adoption and seek managed service solutions to accelerate implementation while minimizing risks. Competitive dynamics will favor providers with comprehensive capabilities, industry expertise, and strong technology partnerships that enable differentiated service delivery.

IoT managed services market represents a dynamic and rapidly expanding sector that addresses the growing complexity of IoT implementations across various industries. Market growth is driven by organizations’ need to leverage IoT technologies while minimizing operational complexity and accessing specialized expertise without substantial internal investments.

Service evolution continues to incorporate emerging technologies such as edge computing, artificial intelligence, and advanced analytics that enhance value propositions and enable new use cases. Industry specialization trends create opportunities for providers to develop deep vertical expertise and deliver tailored solutions that address specific sector requirements and regulatory obligations.

Competitive landscape features diverse participants ranging from established technology service providers to specialized IoT companies, with success factors including comprehensive service portfolios, industry expertise, and strong technology partnerships. Market opportunities remain substantial across various geographic regions and industry verticals, with emerging markets showing particularly strong growth potential.

Future success in the IoT managed services market will depend on providers’ ability to continuously innovate, develop industry-specific expertise, and deliver measurable business value through comprehensive service offerings. Organizations seeking to leverage IoT technologies will increasingly turn to managed services as the preferred approach for achieving their digital transformation objectives while managing complexity and risk effectively.

What is Internet of Things (IoT) Managed Services?

Internet of Things (IoT) Managed Services refer to the comprehensive management and support of IoT devices and applications. This includes monitoring, data analysis, and maintenance to ensure optimal performance and security of connected devices across various industries.

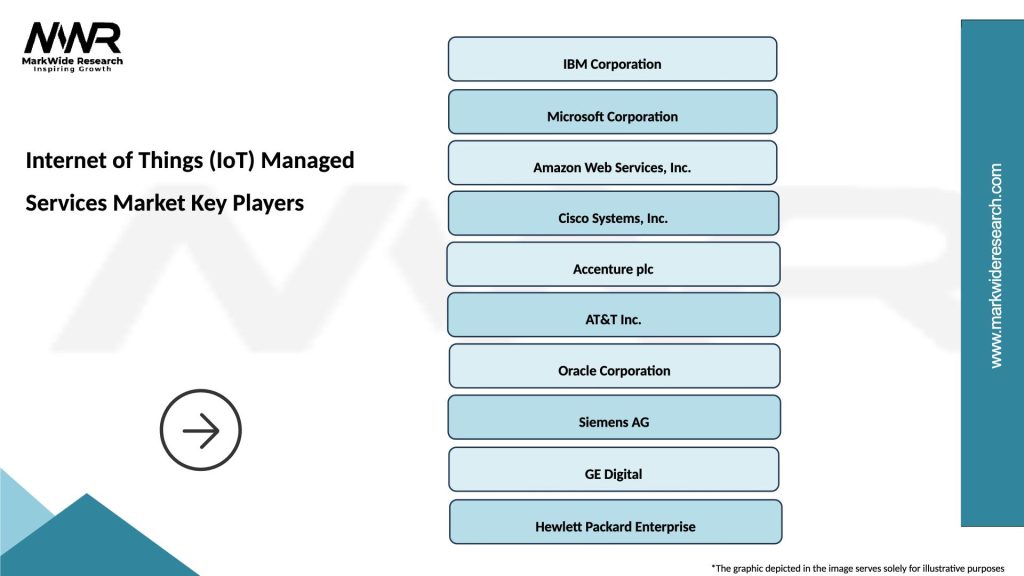

What are the key players in the Internet of Things (IoT) Managed Services Market?

Key players in the Internet of Things (IoT) Managed Services Market include IBM, Cisco, and Accenture, which provide a range of solutions from device management to data analytics, among others.

What are the main drivers of growth in the Internet of Things (IoT) Managed Services Market?

The main drivers of growth in the Internet of Things (IoT) Managed Services Market include the increasing adoption of smart devices, the need for enhanced data security, and the demand for real-time analytics in sectors like healthcare and manufacturing.

What challenges does the Internet of Things (IoT) Managed Services Market face?

Challenges in the Internet of Things (IoT) Managed Services Market include concerns over data privacy, the complexity of integrating various devices, and the need for skilled professionals to manage IoT ecosystems effectively.

What opportunities exist in the Internet of Things (IoT) Managed Services Market?

Opportunities in the Internet of Things (IoT) Managed Services Market include the expansion of smart cities, advancements in AI and machine learning for predictive maintenance, and the growing demand for IoT solutions in agriculture and logistics.

What trends are shaping the Internet of Things (IoT) Managed Services Market?

Trends shaping the Internet of Things (IoT) Managed Services Market include the rise of edge computing, increased focus on cybersecurity measures, and the integration of IoT with blockchain technology for enhanced security and transparency.

Internet of Things (IoT) Managed Services Market

| Segmentation Details | Description |

|---|---|

| Service Type | Remote Monitoring, Data Analytics, Device Management, Security Services |

| Deployment Model | Public Cloud, Private Cloud, Hybrid Cloud, On-Premises |

| End User | Manufacturing, Healthcare, Transportation, Smart Cities |

| Technology | Edge Computing, Artificial Intelligence, Machine Learning, Blockchain |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Internet of Things (IoT) Managed Services Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at