444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The UK wound care management market represents a critical segment of the healthcare industry, encompassing advanced medical solutions designed to promote healing and prevent complications in various types of wounds. This comprehensive market includes traditional wound dressings, advanced therapeutic products, and innovative technologies that address both acute and chronic wound conditions across diverse healthcare settings.

Market dynamics indicate robust growth driven by an aging population, increasing prevalence of chronic diseases, and rising awareness of advanced wound care solutions. The market experiences significant expansion with healthcare providers increasingly adopting evidence-based wound management protocols that emphasize patient outcomes and cost-effectiveness.

Healthcare transformation across the UK has accelerated the adoption of sophisticated wound care technologies, with hospitals, community care centers, and home healthcare services integrating advanced treatment modalities. The market demonstrates strong growth potential, with projections indicating a compound annual growth rate of 6.2% over the forecast period, reflecting the increasing demand for specialized wound care solutions.

Regional distribution shows concentrated activity in major metropolitan areas, with London, Manchester, and Birmingham leading in market adoption. The integration of digital health technologies and telemedicine platforms has further enhanced market accessibility, enabling remote monitoring and consultation services that improve patient care delivery across urban and rural communities.

The UK wound care management market refers to the comprehensive ecosystem of medical products, technologies, and services designed to facilitate optimal healing outcomes for patients with various wound types. This market encompasses traditional and advanced wound dressings, therapeutic devices, antimicrobial solutions, and specialized treatment protocols used across healthcare facilities and home care settings.

Wound care management involves systematic approaches to wound assessment, treatment selection, and healing monitoring, utilizing evidence-based practices to achieve optimal patient outcomes. The market includes products ranging from basic adhesive bandages to sophisticated negative pressure wound therapy systems, bioactive dressings, and advanced wound monitoring technologies.

Healthcare integration within this market extends beyond product supply to include comprehensive care pathways, clinical education, and outcome measurement systems. Modern wound care management emphasizes multidisciplinary approaches that combine medical expertise, advanced materials science, and patient-centered care delivery models to address the complex needs of wound healing across diverse patient populations.

Market expansion in the UK wound care management sector reflects significant healthcare evolution driven by demographic changes, technological advancement, and enhanced clinical understanding of wound healing processes. The market demonstrates substantial growth potential across multiple segments, with advanced wound care products experiencing particularly strong adoption rates.

Key growth drivers include the increasing prevalence of diabetes and cardiovascular diseases, which contribute to higher incidences of chronic wounds requiring specialized management. Healthcare system reforms emphasizing value-based care have accelerated the adoption of cost-effective wound care solutions that demonstrate measurable improvements in healing outcomes and reduced treatment duration.

Technology integration has transformed traditional wound care practices, with digital health solutions, smart dressings, and remote monitoring capabilities becoming increasingly prevalent. The market benefits from strong research and development activities, with UK-based companies and international organizations investing significantly in innovative wound care technologies.

Competitive landscape features established medical device manufacturers alongside emerging biotechnology companies developing next-generation wound care solutions. Market consolidation through strategic partnerships and acquisitions has strengthened product portfolios and expanded market reach, creating comprehensive wound care ecosystems that serve diverse healthcare needs.

Market segmentation reveals distinct growth patterns across different wound care categories, with advanced wound dressings commanding significant market share due to their superior healing properties and cost-effectiveness. The following insights highlight critical market dynamics:

Demographic transformation serves as the primary catalyst for UK wound care management market expansion, with an aging population experiencing higher rates of chronic conditions that predispose individuals to wound complications. The increasing prevalence of diabetes affects approximately 3.9 million people in the UK, creating substantial demand for specialized diabetic wound care solutions.

Healthcare system evolution toward value-based care models emphasizes patient outcomes and cost-effectiveness, driving adoption of advanced wound care technologies that demonstrate measurable improvements in healing rates and reduced treatment costs. This shift encourages healthcare providers to invest in innovative solutions that deliver superior clinical and economic outcomes.

Technological advancement in wound care materials and treatment modalities creates opportunities for enhanced healing outcomes through sophisticated product offerings. Developments in bioactive materials, nanotechnology applications, and smart monitoring systems provide healthcare professionals with powerful tools for optimizing wound management strategies.

Clinical awareness regarding the importance of evidence-based wound care practices has increased significantly, with healthcare professionals seeking advanced training and certification in specialized wound management techniques. This growing expertise drives demand for sophisticated products that support optimal clinical decision-making and patient care delivery.

Home healthcare expansion creates substantial market opportunities as healthcare systems seek to reduce costs while maintaining quality care delivery. The shift toward community-based and home care settings requires user-friendly wound care products that patients and caregivers can safely and effectively utilize outside traditional healthcare facilities.

Cost considerations present significant challenges for widespread adoption of advanced wound care technologies, particularly in resource-constrained healthcare environments. Budget limitations within NHS trusts and private healthcare facilities may restrict access to premium wound care products despite their potential for improved outcomes.

Regulatory complexity surrounding medical device approval and market authorization creates barriers for innovative product introduction. Lengthy approval processes and stringent compliance requirements may delay market entry for breakthrough technologies, limiting patient access to potentially beneficial treatments.

Clinical inertia among healthcare professionals accustomed to traditional wound care approaches may slow adoption of advanced technologies. Resistance to change, combined with limited training opportunities, can impede the integration of innovative wound care solutions into established clinical practices.

Reimbursement challenges affect product accessibility, particularly for advanced wound care technologies that may not receive adequate coverage under existing healthcare funding mechanisms. Limited reimbursement policies can restrict patient access to optimal treatment options and influence healthcare provider decision-making.

Supply chain disruptions experienced during recent global events have highlighted vulnerabilities in wound care product availability. Manufacturing delays, raw material shortages, and logistics challenges can impact product supply and pricing, affecting market stability and growth potential.

Digital health integration presents substantial opportunities for market expansion through the development of connected wound care solutions that enable remote monitoring, data collection, and personalized treatment optimization. Smart dressings and mobile health applications create new revenue streams while improving patient outcomes and care efficiency.

Personalized medicine approaches in wound care management offer significant growth potential through the development of customized treatment protocols based on individual patient characteristics, wound types, and healing patterns. Precision medicine applications can enhance treatment effectiveness while reducing costs and complications.

Preventive care emphasis creates opportunities for products and services focused on wound prevention rather than treatment alone. Educational programs, risk assessment tools, and preventive interventions can address market needs while reducing overall healthcare costs associated with wound complications.

International expansion opportunities exist for UK-based wound care companies to leverage their expertise and product innovations in global markets. Export potential and international partnerships can drive revenue growth while establishing UK leadership in advanced wound care technologies.

Research collaboration between academic institutions, healthcare providers, and industry partners creates opportunities for breakthrough innovations in wound care management. Public-private partnerships can accelerate product development while ensuring clinical relevance and market viability.

Supply and demand dynamics in the UK wound care management market reflect complex interactions between healthcare needs, technological capabilities, and economic considerations. Increasing demand driven by demographic trends meets expanding supply capabilities through continuous innovation and manufacturing capacity enhancement.

Competitive intensity has increased significantly as established medical device manufacturers compete with emerging biotechnology companies and digital health startups. This competition drives innovation while potentially pressuring profit margins and requiring companies to differentiate through superior clinical outcomes and value propositions.

Healthcare policy influences market dynamics through funding decisions, clinical guidelines, and regulatory requirements that shape product development and adoption patterns. Government initiatives supporting healthcare innovation and patient outcome improvement create favorable conditions for market growth.

Technology convergence between traditional wound care products and digital health solutions creates new market categories and business models. The integration of artificial intelligence, machine learning, and IoT technologies with wound care products generates opportunities for enhanced functionality and improved patient outcomes.

Value chain evolution encompasses manufacturers, distributors, healthcare providers, and patients in increasingly integrated relationships that emphasize outcome-based partnerships and shared risk models. This evolution requires companies to develop comprehensive service offerings beyond traditional product supply.

Comprehensive analysis of the UK wound care management market employs multiple research methodologies to ensure accuracy and reliability of findings. Primary research includes surveys and interviews with healthcare professionals, industry executives, and key stakeholders across the wound care ecosystem.

Secondary research incorporates analysis of published studies, clinical trials, regulatory filings, and industry reports to provide comprehensive market understanding. Government healthcare statistics, NHS data, and academic research contribute to evidence-based market assessment and trend identification.

Market modeling utilizes statistical analysis and forecasting techniques to project future market trends and growth patterns. Quantitative analysis of historical data combined with qualitative insights from industry experts enables robust market projections and scenario planning.

Stakeholder engagement includes consultation with wound care specialists, hospital administrators, procurement professionals, and patient advocacy groups to ensure comprehensive perspective representation. This multi-stakeholder approach provides balanced insights into market dynamics and future opportunities.

Data validation processes ensure research findings accuracy through triangulation of multiple data sources and expert review. Continuous monitoring of market developments and regular research updates maintain current and relevant market intelligence for stakeholders.

England dominates the UK wound care management market, accounting for approximately 84% of total market activity due to its large population base and concentrated healthcare infrastructure. London and the Southeast regions lead in advanced wound care adoption, driven by major teaching hospitals and research institutions that pioneer innovative treatment approaches.

Scotland represents a significant market segment with strong emphasis on evidence-based healthcare delivery and cost-effectiveness analysis. Scottish healthcare policies supporting innovation and outcome measurement create favorable conditions for advanced wound care technology adoption, particularly in chronic wound management applications.

Wales demonstrates growing market potential with increasing investment in community healthcare services and home care delivery models. Rural healthcare challenges in Wales drive demand for portable, user-friendly wound care solutions that can be effectively utilized in remote settings with limited specialist support.

Northern Ireland shows steady market growth supported by healthcare system modernization initiatives and cross-border collaboration with the Republic of Ireland. The region benefits from shared expertise and resource optimization that enhances wound care service delivery and product accessibility.

Urban-rural disparities influence market dynamics, with metropolitan areas experiencing faster adoption of advanced technologies while rural regions rely more heavily on traditional wound care approaches. Telemedicine and remote monitoring solutions help bridge these gaps by extending specialist expertise to underserved areas.

Market leadership in the UK wound care management sector features a diverse mix of multinational corporations, specialized medical device companies, and emerging biotechnology firms. The competitive environment emphasizes innovation, clinical evidence, and comprehensive service offerings that address evolving healthcare needs.

Product segmentation reveals distinct market categories based on wound care technology sophistication and clinical application requirements. Advanced wound dressings represent the largest segment, driven by superior healing outcomes and healthcare provider preference for evidence-based solutions.

By Product Type:

By Wound Type:

By End User:

Advanced wound dressings command significant market share due to their superior clinical performance and cost-effectiveness compared to traditional alternatives. These products incorporate sophisticated materials and technologies that promote optimal healing environments while reducing infection risk and treatment duration.

Chronic wound management represents the fastest-growing category, driven by increasing prevalence of diabetes, cardiovascular disease, and aging-related conditions. Diabetic foot ulcers alone affect approximately 15% of diabetic patients during their lifetime, creating substantial demand for specialized treatment solutions.

Negative pressure wound therapy has gained significant traction in both hospital and home care settings, with adoption rates increasing by 12% annually due to demonstrated effectiveness in complex wound healing. This technology offers particular benefits for surgical wounds, traumatic injuries, and chronic wounds that fail to heal with conventional treatments.

Antimicrobial dressings address growing concerns about healthcare-associated infections and antibiotic resistance by providing localized infection control without systemic antibiotic exposure. These products demonstrate particular value in high-risk patient populations and healthcare settings with elevated infection rates.

Smart wound care technologies represent an emerging category with significant growth potential, incorporating sensors, connectivity, and data analytics to optimize treatment decisions and patient outcomes. Early adoption in specialized wound care centers demonstrates promising results for remote monitoring and personalized treatment protocols.

Healthcare providers benefit from advanced wound care solutions through improved patient outcomes, reduced treatment costs, and enhanced clinical efficiency. Evidence-based wound care protocols supported by innovative products enable healthcare professionals to achieve better healing rates while optimizing resource utilization.

Patients experience significant advantages through faster healing times, reduced pain and discomfort, and improved quality of life during treatment. Advanced wound care products minimize dressing changes, reduce infection risk, and enable greater mobility and independence during the healing process.

Healthcare systems realize substantial cost savings through reduced hospital readmissions, shorter treatment durations, and prevention of wound complications. MarkWide Research analysis indicates that advanced wound care adoption can reduce total treatment costs by up to 25% compared to traditional approaches.

Industry manufacturers benefit from growing market demand, opportunities for innovation, and potential for premium pricing of advanced products. Strong clinical evidence supporting product efficacy enables companies to differentiate their offerings and build sustainable competitive advantages.

Research institutions gain access to collaborative opportunities with industry partners, funding for clinical studies, and platforms for translating research discoveries into practical healthcare solutions. Academic-industry partnerships accelerate innovation while ensuring clinical relevance and patient benefit.

Strengths:

Weaknesses:

Opportunities:

Threats:

Personalized wound care emerges as a dominant trend, with healthcare providers increasingly adopting individualized treatment protocols based on patient-specific factors, wound characteristics, and healing patterns. This approach optimizes outcomes while reducing unnecessary treatments and associated costs.

Digital transformation accelerates across the wound care sector, with smart dressings, mobile applications, and artificial intelligence platforms enhancing clinical decision-making and patient monitoring capabilities. Digital health solutions enable remote care delivery and real-time treatment optimization.

Sustainability focus influences product development and procurement decisions, with healthcare organizations seeking environmentally responsible wound care solutions that minimize waste and environmental impact. Biodegradable materials and sustainable packaging gain importance in product selection criteria.

Value-based care models reshape market dynamics by emphasizing patient outcomes and cost-effectiveness rather than product volume. This trend encourages development of comprehensive wound care solutions that demonstrate measurable improvements in healing rates and reduced complications.

Preventive strategies gain prominence as healthcare systems recognize the cost-effectiveness of wound prevention compared to treatment. Risk assessment tools, patient education programs, and preventive interventions become integral components of comprehensive wound care management.

Technological innovation continues to drive industry evolution, with recent developments in bioactive materials, nanotechnology applications, and smart monitoring systems creating new possibilities for enhanced wound healing outcomes. These innovations address previously challenging wound types and patient populations.

Regulatory advancement includes updated guidelines for wound care product evaluation and approval, streamlining market entry for innovative solutions while maintaining safety standards. Recent regulatory changes support faster access to breakthrough technologies for patients with unmet medical needs.

Clinical evidence generation through large-scale studies and real-world evidence collection strengthens the foundation for evidence-based wound care practice. Recent clinical trials demonstrate significant improvements in healing rates and patient satisfaction with advanced wound care technologies.

Partnership formation between technology companies, healthcare providers, and research institutions accelerates innovation and market adoption. Strategic collaborations combine complementary expertise to develop comprehensive wound care solutions that address complex clinical challenges.

Market consolidation through mergers and acquisitions creates larger, more capable organizations with comprehensive product portfolios and enhanced research and development capabilities. This consolidation enables greater investment in innovation while improving market access and customer service.

Investment prioritization should focus on digital health integration and personalized medicine applications that demonstrate clear clinical and economic benefits. Companies should allocate resources toward developing connected wound care solutions that enable remote monitoring and data-driven treatment optimization.

Market positioning strategies should emphasize clinical evidence and outcome measurement capabilities that support value-based care initiatives. Organizations must develop comprehensive data collection and analysis capabilities to demonstrate product effectiveness and cost-effectiveness to healthcare decision-makers.

Partnership development with healthcare providers, technology companies, and research institutions can accelerate innovation and market penetration. Strategic alliances should focus on complementary capabilities that create comprehensive wound care ecosystems addressing diverse patient needs.

Regulatory preparation for evolving medical device requirements and digital health regulations ensures continued market access and competitive advantage. Companies should invest in regulatory expertise and compliance systems that support rapid product development and market introduction.

Geographic expansion opportunities exist in underserved regions and international markets where UK expertise and innovation can create significant value. Export strategies should leverage the UK’s reputation for healthcare excellence and advanced wound care technologies.

Market expansion is projected to continue at a robust pace, driven by demographic trends, technological advancement, and increasing healthcare focus on patient outcomes and cost-effectiveness. The market is expected to maintain a compound annual growth rate of 6.2% through the forecast period, reflecting strong underlying demand drivers.

Technology integration will accelerate, with artificial intelligence, machine learning, and IoT technologies becoming standard components of advanced wound care solutions. MWR projects that connected wound care devices will achieve 35% market penetration within the next five years, transforming care delivery models.

Healthcare delivery evolution toward community-based and home care settings will create substantial opportunities for user-friendly, cost-effective wound care products. The shift away from hospital-centric care models requires innovative solutions that maintain clinical effectiveness while enabling patient self-management.

Regulatory environment development will support faster market access for innovative technologies while maintaining rigorous safety and efficacy standards. Streamlined approval processes for breakthrough devices will accelerate patient access to advanced wound care solutions.

Global competitiveness of UK wound care companies will strengthen through continued investment in research and development, strategic partnerships, and international market expansion. The UK’s position as a leader in healthcare innovation provides a strong foundation for future market growth and export success.

The UK wound care management market represents a dynamic and rapidly evolving sector with substantial growth potential driven by demographic trends, technological innovation, and healthcare system transformation. The market demonstrates strong fundamentals with increasing demand for advanced wound care solutions that deliver superior clinical outcomes while supporting cost-effective healthcare delivery.

Key success factors for market participants include investment in innovative technologies, development of comprehensive clinical evidence, and creation of value-based partnerships with healthcare providers. The integration of digital health solutions and personalized medicine approaches will define competitive advantage in the evolving market landscape.

Future opportunities are substantial, with the convergence of advanced materials science, digital technologies, and evidence-based medicine creating possibilities for breakthrough innovations in wound care management. Companies that successfully navigate regulatory requirements, demonstrate clinical value, and build sustainable partnerships will capture the greatest share of market growth and establish leadership positions in this critical healthcare sector.

What is Wound Care Management?

Wound Care Management refers to the processes and practices involved in treating and healing wounds, including surgical, chronic, and traumatic wounds. It encompasses various products and techniques aimed at promoting healing and preventing infection.

What are the key players in the UK Wound Care Management Market?

Key players in the UK Wound Care Management Market include Smith & Nephew, Mölnlycke Health Care, and Coloplast, among others. These companies are known for their innovative wound care products and solutions that cater to various types of wounds.

What are the main drivers of the UK Wound Care Management Market?

The main drivers of the UK Wound Care Management Market include the increasing prevalence of chronic wounds, the aging population, and advancements in wound care technologies. These factors contribute to a growing demand for effective wound management solutions.

What challenges does the UK Wound Care Management Market face?

The UK Wound Care Management Market faces challenges such as high treatment costs, the complexity of wound care, and the need for skilled healthcare professionals. These factors can hinder access to effective wound management solutions.

What opportunities exist in the UK Wound Care Management Market?

Opportunities in the UK Wound Care Management Market include the development of advanced wound care products, increased focus on home healthcare, and the integration of digital health technologies. These trends can enhance patient outcomes and streamline care processes.

What trends are shaping the UK Wound Care Management Market?

Trends shaping the UK Wound Care Management Market include the rise of bioactive dressings, the use of telemedicine for wound assessment, and a growing emphasis on personalized wound care solutions. These innovations are transforming how wounds are managed and treated.

UK Wound Care Management Market

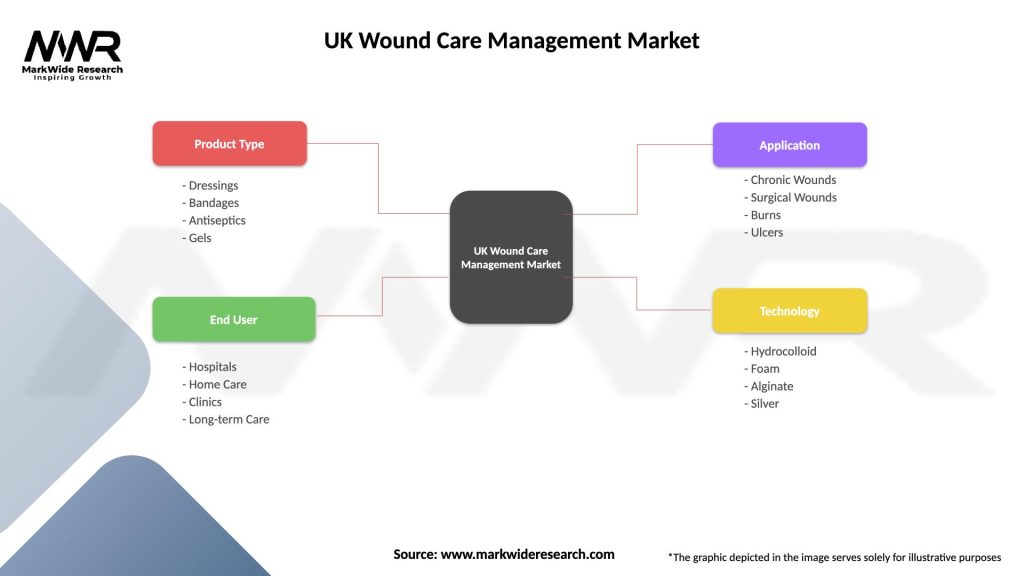

| Segmentation Details | Description |

|---|---|

| Product Type | Dressings, Bandages, Antiseptics, Gels |

| End User | Hospitals, Home Care, Clinics, Long-term Care |

| Application | Chronic Wounds, Surgical Wounds, Burns, Ulcers |

| Technology | Hydrocolloid, Foam, Alginate, Silver |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the UK Wound Care Management Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at