444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

The membranes for water and wastewater market represents a critical component of global water treatment infrastructure, experiencing unprecedented growth driven by increasing water scarcity, stringent environmental regulations, and rising demand for clean water across industrial and municipal sectors. This dynamic market encompasses various membrane technologies including reverse osmosis, ultrafiltration, microfiltration, and nanofiltration systems designed to address diverse water treatment challenges.

Market dynamics indicate robust expansion with the sector demonstrating a compound annual growth rate (CAGR) of 8.2% over the forecast period. The increasing adoption of membrane-based water treatment solutions across industries such as pharmaceuticals, food and beverage, chemicals, and municipal water treatment facilities continues to drive substantial market momentum.

Regional distribution shows North America and Europe maintaining significant market positions, while Asia-Pacific emerges as the fastest-growing region with 45% of global membrane installations concentrated in developing economies. The market’s evolution reflects growing awareness of water quality standards and the critical need for sustainable water management solutions worldwide.

Technology advancement in membrane materials and manufacturing processes has enhanced system efficiency, reduced operational costs, and expanded application possibilities. Modern membrane systems achieve water recovery rates exceeding 95% in many applications, making them increasingly attractive for water-stressed regions and industries requiring high-quality water treatment solutions.

The membranes for water and wastewater market refers to the comprehensive industry encompassing the development, manufacturing, and deployment of semi-permeable barriers designed to separate contaminants, particles, and dissolved substances from water through various filtration mechanisms including size exclusion, charge interaction, and molecular diffusion processes.

Membrane technology operates on the principle of selective permeability, allowing water molecules to pass through while retaining contaminants based on size, charge, or chemical properties. These sophisticated systems serve as the backbone of modern water treatment infrastructure, enabling the production of high-quality water for drinking, industrial processes, and environmental protection applications.

Market scope includes various membrane types such as polymeric and ceramic membranes, each designed for specific applications ranging from municipal water treatment and industrial process water to wastewater reclamation and desalination. The technology’s versatility makes it applicable across diverse sectors including healthcare, electronics manufacturing, power generation, and agricultural irrigation systems.

System integration involves combining membrane modules with supporting equipment including pumps, monitoring systems, cleaning mechanisms, and control systems to create comprehensive water treatment solutions. This holistic approach ensures optimal performance, extended membrane life, and consistent water quality output across various operating conditions.

Strategic market analysis reveals the membranes for water and wastewater sector as a rapidly evolving industry driven by global water challenges, technological innovations, and regulatory pressures. The market demonstrates strong growth potential with increasing adoption across municipal, industrial, and commercial applications worldwide.

Key growth drivers include escalating water scarcity affecting 40% of the global population, stricter environmental regulations mandating advanced water treatment, and growing industrial demand for high-purity water. The pharmaceutical and semiconductor industries particularly drive demand for ultra-pure water systems, requiring advanced membrane technologies.

Technology trends focus on developing next-generation membranes with enhanced selectivity, improved fouling resistance, and extended operational life. Innovations in membrane materials, surface modifications, and module design continue to expand application possibilities while reducing total cost of ownership for end users.

Market segmentation reveals reverse osmosis membranes maintaining the largest share, followed by ultrafiltration and microfiltration technologies. Municipal water treatment represents the dominant application segment, while industrial applications show the highest growth rates driven by increasing water quality requirements and process optimization needs.

Competitive landscape features established players investing heavily in research and development, strategic partnerships, and geographic expansion to capture emerging market opportunities. The industry’s evolution toward sustainable and energy-efficient solutions positions membrane technology as essential for addressing global water challenges.

Primary market insights highlight the transformative impact of membrane technology on global water treatment practices, with key developments shaping industry direction and growth trajectories:

Performance metrics indicate significant improvements in membrane durability, with modern systems achieving operational lifespans exceeding 7 years under optimal conditions. These advancements reduce replacement costs and improve overall system economics for end users across various applications.

Water scarcity challenges represent the primary driver for membrane technology adoption, with global freshwater resources under increasing pressure from population growth, climate change, and industrial development. Membrane systems offer efficient solutions for water reuse, desalination, and treatment of contaminated water sources.

Regulatory compliance requirements drive significant market demand as governments worldwide implement stricter water quality standards and environmental protection measures. Industries must invest in advanced treatment technologies to meet discharge limits and drinking water standards, creating sustained demand for membrane systems.

Industrial water quality requirements continue expanding as manufacturing processes become more sophisticated and quality-sensitive. The electronics, pharmaceutical, and food processing industries require ultra-pure water, driving adoption of advanced membrane technologies capable of removing trace contaminants and achieving consistent water quality.

Urbanization trends in developing regions create massive infrastructure needs for municipal water treatment systems. Growing urban populations require reliable water supply and wastewater treatment infrastructure, with membrane technology offering compact, efficient solutions suitable for space-constrained urban environments.

Cost competitiveness improvements make membrane technology increasingly attractive compared to conventional treatment methods. Advances in membrane manufacturing, system design, and operational efficiency reduce total cost of ownership while improving treatment performance and reliability.

Environmental sustainability concerns drive adoption of membrane systems for water recycling, resource recovery, and minimizing environmental impact. Companies and municipalities increasingly prioritize sustainable water management practices, with membrane technology enabling circular water economy approaches.

High capital investment requirements present significant barriers for market entry, particularly in developing regions where financial resources may be limited. Initial system costs, installation expenses, and infrastructure requirements can deter adoption despite long-term operational benefits.

Membrane fouling remains a persistent challenge affecting system performance and operational costs. Fouling reduces membrane efficiency, increases energy consumption, and necessitates frequent cleaning or replacement, impacting overall system economics and reliability.

Energy consumption concerns limit adoption in energy-constrained environments, as membrane systems, particularly reverse osmosis, require significant energy input for operation. High energy costs can make membrane treatment economically unfeasible in certain applications or regions.

Technical complexity of membrane systems requires specialized knowledge for operation and maintenance, creating barriers in regions lacking technical expertise. Proper system management is crucial for optimal performance, and inadequate technical support can lead to premature system failure.

Concentrate disposal challenges arise from membrane processes that generate concentrated waste streams requiring proper management. Environmental regulations and disposal costs for membrane concentrates can add complexity and expense to system operation.

Competition from alternatives including conventional treatment methods and emerging technologies may limit market growth in certain applications. Traditional treatment approaches may remain cost-effective for specific use cases, while new technologies could potentially displace membrane systems in the future.

Emerging market expansion presents substantial growth opportunities as developing economies invest in water infrastructure development. Rapid industrialization and urbanization in Asia-Pacific, Latin America, and Africa create significant demand for membrane-based water treatment solutions.

Industrial water reuse applications offer expanding opportunities as companies seek to reduce water consumption and environmental impact. Zero liquid discharge systems, process water recycling, and resource recovery applications drive demand for specialized membrane technologies.

Desalination market growth creates opportunities for membrane manufacturers as water-stressed regions increasingly turn to seawater and brackish water treatment. Advances in energy recovery and system efficiency make desalination more economically viable for broader applications.

Smart membrane systems incorporating Internet of Things (IoT) technology, artificial intelligence, and predictive analytics represent emerging opportunities. These advanced systems offer improved performance monitoring, predictive maintenance, and optimized operation, creating value-added service opportunities.

Specialized applications in pharmaceuticals, biotechnology, and high-tech manufacturing continue expanding as quality requirements become more stringent. These niche markets often accept premium pricing for specialized membrane solutions, offering attractive profit margins.

Membrane material innovations including graphene-based membranes, biomimetic materials, and nanostructured surfaces promise breakthrough performance improvements. Companies investing in next-generation membrane technologies may capture significant market advantages.

Supply chain evolution reflects increasing vertical integration as major players seek to control membrane manufacturing, system integration, and service delivery. This trend improves quality control, reduces costs, and enables better customer support while creating barriers for new entrants.

Technology convergence drives integration of membrane systems with other treatment technologies, creating hybrid solutions that address complex water treatment challenges. Combined systems offer enhanced performance and expanded application possibilities while optimizing overall treatment efficiency.

Service model transformation shifts focus from equipment sales to comprehensive service offerings including system operation, maintenance, and performance guarantees. This evolution creates recurring revenue streams while reducing customer operational complexity and risk.

Regional manufacturing strategies emerge as companies establish local production facilities to serve growing regional markets. This approach reduces transportation costs, improves customer service, and helps navigate trade barriers while supporting local economic development.

Partnership strategies become increasingly important as companies collaborate with technology providers, engineering firms, and end users to develop customized solutions. Strategic alliances accelerate innovation, expand market reach, and share development risks across multiple partners.

Sustainability integration influences all aspects of market dynamics, from membrane material selection to system design and operation. Companies prioritizing environmental responsibility gain competitive advantages while meeting growing customer demands for sustainable solutions.

Comprehensive market analysis employs multiple research methodologies to ensure accurate and reliable market insights. Primary research includes extensive interviews with industry executives, technology developers, end users, and regulatory officials across key geographic markets.

Secondary research incorporates analysis of industry reports, technical publications, patent filings, and regulatory documents to understand technology trends, competitive dynamics, and market developments. This approach provides historical context and identifies emerging patterns affecting market evolution.

Quantitative analysis utilizes statistical modeling, trend analysis, and forecasting techniques to project market growth, segment performance, and regional development patterns. Data validation through multiple sources ensures accuracy and reliability of market projections.

Qualitative assessment includes expert interviews, focus groups, and case study analysis to understand market drivers, challenges, and opportunities from multiple stakeholder perspectives. This approach provides insights into decision-making processes and market dynamics.

Technology evaluation involves assessment of membrane performance characteristics, manufacturing processes, and application suitability across various market segments. Technical analysis helps identify innovation trends and competitive advantages.

Market validation through cross-referencing multiple data sources, expert review, and stakeholder feedback ensures research accuracy and relevance. This rigorous approach provides confidence in market insights and projections presented in the analysis.

North America maintains a mature market position with 35% of global membrane installations, driven by stringent environmental regulations, aging infrastructure replacement needs, and advanced industrial applications. The region demonstrates steady growth in municipal water treatment upgrades and industrial water reuse applications.

Europe represents a sophisticated market emphasizing sustainability and energy efficiency, with strong demand for membrane systems in water recycling and resource recovery applications. The region’s focus on circular economy principles drives innovation in membrane technology and system integration.

Asia-Pacific emerges as the fastest-growing region, accounting for 45% of new membrane system installations globally. Rapid industrialization, urbanization, and infrastructure development in China, India, and Southeast Asia create substantial market opportunities across all application segments.

Middle East and Africa demonstrate strong growth potential driven by water scarcity challenges and desalination project development. The region’s harsh operating conditions drive demand for robust, high-performance membrane systems capable of handling challenging feed water conditions.

Latin America shows increasing adoption of membrane technology for municipal water treatment and industrial applications. Growing environmental awareness and regulatory development support market expansion, particularly in Brazil, Mexico, and other major economies.

Regional manufacturing strategies reflect market maturity and growth patterns, with established players expanding production capacity in high-growth regions while maintaining technology centers in developed markets for innovation and advanced applications.

Market leadership reflects a combination of technological innovation, manufacturing scale, global presence, and customer relationships. Leading companies invest heavily in research and development while expanding geographic reach through strategic acquisitions and partnerships.

Key market players include:

Competitive strategies emphasize technology differentiation, cost optimization, and service excellence. Companies invest in next-generation membrane materials, smart system integration, and comprehensive customer support to maintain competitive advantages in evolving markets.

Innovation focus drives continuous product development, with companies pursuing breakthrough technologies including biomimetic membranes, nanostructured materials, and energy-efficient system designs. Patent activity remains high as companies protect intellectual property and maintain technology leadership.

By Technology:

By Material:

By Application:

By End User:

Reverse Osmosis Systems dominate the market with superior contaminant removal capabilities and proven performance across diverse applications. These systems achieve rejection rates exceeding 99% for most contaminants, making them ideal for high-purity water production and desalination applications.

Ultrafiltration Technology demonstrates strong growth in municipal water treatment applications, offering effective removal of bacteria, viruses, and suspended solids while maintaining lower energy requirements compared to reverse osmosis systems. This technology particularly suits applications requiring pathogen removal without extensive dissolved solids reduction.

Microfiltration Applications serve as essential pretreatment systems and standalone solutions for specific filtration requirements. These systems excel in removing suspended particles and some microorganisms while allowing dissolved substances to pass through, making them suitable for various industrial and municipal applications.

Nanofiltration Systems occupy a specialized niche between ultrafiltration and reverse osmosis, offering selective separation capabilities for specific applications. These systems effectively remove divalent ions and organic molecules while allowing monovalent ions to pass, making them ideal for water softening and selective separation applications.

Ceramic Membranes serve demanding applications requiring chemical resistance, high-temperature operation, and extended service life. Despite higher initial costs, these membranes offer superior durability and performance in harsh operating conditions, making them cost-effective for specialized applications.

Smart Membrane Systems represent the technology frontier, incorporating sensors, automation, and data analytics to optimize performance and reduce operational costs. These advanced systems enable predictive maintenance, real-time performance monitoring, and automated system optimization.

Manufacturers benefit from expanding market opportunities driven by global water challenges and increasing regulatory requirements. The growing demand for advanced water treatment solutions creates opportunities for innovation, market expansion, and revenue growth across diverse application segments.

End Users gain access to reliable, efficient water treatment solutions that improve water quality, reduce operational costs, and ensure regulatory compliance. Membrane systems offer consistent performance, automated operation, and reduced maintenance requirements compared to conventional treatment methods.

System Integrators find opportunities in designing and implementing comprehensive water treatment solutions that combine membrane technology with supporting systems. This approach creates value through customized solutions, ongoing service relationships, and system optimization services.

Technology Developers benefit from continuous innovation opportunities in membrane materials, system design, and application development. The evolving market demands drive research and development investments while creating intellectual property value and competitive advantages.

Service Providers capitalize on growing demand for membrane system operation, maintenance, and optimization services. The complexity of modern membrane systems creates opportunities for specialized service companies offering technical expertise and performance guarantees.

Environmental Stakeholders benefit from membrane technology’s contribution to sustainable water management, reduced environmental impact, and resource conservation. These systems enable water reuse, reduce discharge volumes, and support circular economy principles in water management.

Strengths:

Weaknesses:

Opportunities:

Threats:

Digitalization Integration transforms membrane system operation through IoT sensors, cloud-based monitoring, and artificial intelligence applications. These technologies enable predictive maintenance, performance optimization, and remote system management, reducing operational costs and improving reliability.

Sustainability Focus drives development of energy-efficient membrane systems, sustainable manufacturing processes, and circular economy applications. Companies increasingly prioritize environmental responsibility while meeting growing customer demands for sustainable water treatment solutions.

Modular System Design enables flexible, scalable installations that can adapt to changing capacity requirements and application needs. This approach reduces initial capital investment while providing expansion capabilities as demand grows or requirements change.

Advanced Materials Development focuses on next-generation membrane materials including graphene-based membranes, biomimetic surfaces, and nanostructured materials. These innovations promise improved performance, reduced fouling, and extended operational life.

Hybrid Treatment Systems combine membrane technology with other treatment processes to address complex water quality challenges. These integrated approaches optimize performance while reducing overall treatment costs and energy consumption.

Service-Oriented Business Models shift focus from equipment sales to comprehensive service offerings including system operation, maintenance, and performance guarantees. This evolution creates recurring revenue streams while reducing customer operational complexity.

Technology Partnerships between membrane manufacturers and technology companies accelerate innovation in smart systems, advanced materials, and application development. These collaborations combine complementary expertise to develop breakthrough solutions for emerging market needs.

Manufacturing Expansion reflects growing market demand with major players investing in new production facilities and capacity expansion projects. MarkWide Research indicates that global membrane manufacturing capacity has increased by 25% over the past three years to meet growing demand.

Acquisition Activity consolidates the industry as larger companies acquire specialized technology providers, regional manufacturers, and service companies. This consolidation accelerates technology development while expanding geographic reach and market coverage.

Regulatory Developments continue shaping market dynamics through updated water quality standards, environmental regulations, and industry guidelines. These changes drive technology adoption while creating opportunities for advanced membrane systems.

Research Investments focus on breakthrough membrane materials, energy-efficient processes, and specialized applications. Universities, government agencies, and private companies collaborate on research projects addressing fundamental challenges in membrane technology.

Market Expansion into new geographic regions and application segments creates growth opportunities while diversifying market risk. Companies establish local partnerships and manufacturing capabilities to serve emerging markets effectively.

Technology Investment priorities should focus on next-generation membrane materials, smart system integration, and energy-efficient processes. Companies investing in breakthrough technologies may capture significant competitive advantages as market demands evolve toward higher performance and sustainability.

Market Diversification strategies should explore emerging applications including resource recovery, specialized industrial processes, and niche markets requiring customized solutions. This approach reduces dependence on traditional markets while capturing higher-value opportunities.

Geographic Expansion into high-growth regions requires careful market analysis, local partnerships, and adapted business models. Companies should prioritize markets with strong regulatory support, infrastructure development programs, and growing industrial bases.

Service Integration offers opportunities to create recurring revenue streams and strengthen customer relationships. Companies should develop comprehensive service capabilities including system operation, maintenance, and performance optimization to differentiate their offerings.

Sustainability Leadership becomes increasingly important as customers prioritize environmental responsibility. Companies should integrate sustainability throughout their operations, from membrane manufacturing to system design and end-of-life management.

Partnership Strategies should focus on complementary capabilities, shared risk, and accelerated innovation. Strategic alliances with technology providers, engineering firms, and end users can accelerate market penetration and technology development.

Market evolution toward smart, sustainable membrane systems will define the industry’s future direction. Integration of artificial intelligence, IoT connectivity, and advanced materials will create next-generation systems offering superior performance, reduced operational costs, and enhanced reliability.

Growth projections indicate continued market expansion driven by global water challenges, regulatory requirements, and technological advancement. MWR analysis suggests the market will maintain robust growth with compound annual growth rates exceeding 8% through the forecast period.

Technology convergence will create hybrid systems combining membrane technology with other treatment processes, energy recovery systems, and resource recovery capabilities. These integrated approaches will address complex water treatment challenges while optimizing overall system performance and economics.

Regional development patterns will shift toward emerging markets as infrastructure investment accelerates in developing regions. Asia-Pacific, Latin America, and Africa will drive significant growth while developed markets focus on system upgrades and advanced applications.

Application expansion will extend membrane technology into new sectors including agriculture, mining, and specialized manufacturing processes. These emerging applications will create niche markets with premium pricing opportunities for specialized membrane solutions.

Sustainability integration will become a fundamental requirement rather than a competitive advantage, driving innovation in energy-efficient processes, sustainable materials, and circular economy applications. Companies prioritizing environmental responsibility will capture growing market opportunities while meeting evolving customer expectations.

The membranes for water and wastewater market represents a dynamic and essential industry addressing critical global water challenges through innovative technology solutions. Market growth remains robust, driven by increasing water scarcity, stringent environmental regulations, and expanding industrial applications requiring high-quality water treatment.

Technology advancement continues transforming the industry through smart systems, advanced materials, and integrated solutions that improve performance while reducing operational costs. The evolution toward sustainable, energy-efficient membrane systems positions the industry to address growing environmental concerns while meeting expanding market demands.

Market opportunities abound in emerging regions, specialized applications, and next-generation technologies. Companies investing in innovation, geographic expansion, and comprehensive service capabilities will capture significant growth opportunities while contributing to global water security and environmental sustainability.

Future success will depend on balancing technological innovation with cost-effectiveness, sustainability with performance, and global reach with local expertise. The membranes for water and wastewater market stands poised for continued growth as an essential component of global water infrastructure, supporting economic development, environmental protection, and human health worldwide.

What is Membranes for Water and Wastewater?

Membranes for Water and Wastewater refer to filtration technologies used to separate contaminants from water and wastewater. These membranes are crucial in various applications, including desalination, wastewater treatment, and water purification.

What are the key companies in the Membranes for Water and Wastewater Market?

Key companies in the Membranes for Water and Wastewater Market include Dow Water & Process Solutions, Hydranautics, and Toray Industries, among others. These companies are known for their innovative membrane technologies and solutions for water treatment.

What are the growth factors driving the Membranes for Water and Wastewater Market?

The Membranes for Water and Wastewater Market is driven by increasing water scarcity, stringent regulations on wastewater discharge, and the growing demand for clean water. Additionally, advancements in membrane technology are enhancing efficiency and reducing costs.

What challenges does the Membranes for Water and Wastewater Market face?

Challenges in the Membranes for Water and Wastewater Market include membrane fouling, high operational costs, and the need for regular maintenance. These factors can limit the efficiency and longevity of membrane systems.

What opportunities exist in the Membranes for Water and Wastewater Market?

Opportunities in the Membranes for Water and Wastewater Market include the development of advanced membrane materials, increasing investments in water infrastructure, and the rising adoption of membrane bioreactors. These trends are expected to enhance treatment capabilities and expand market reach.

What trends are shaping the Membranes for Water and Wastewater Market?

Trends in the Membranes for Water and Wastewater Market include the integration of smart technologies for monitoring and control, the shift towards sustainable water management practices, and the increasing use of nanotechnology in membrane development. These trends are driving innovation and efficiency in water treatment processes.

Membranes for Water and Wastewater Market

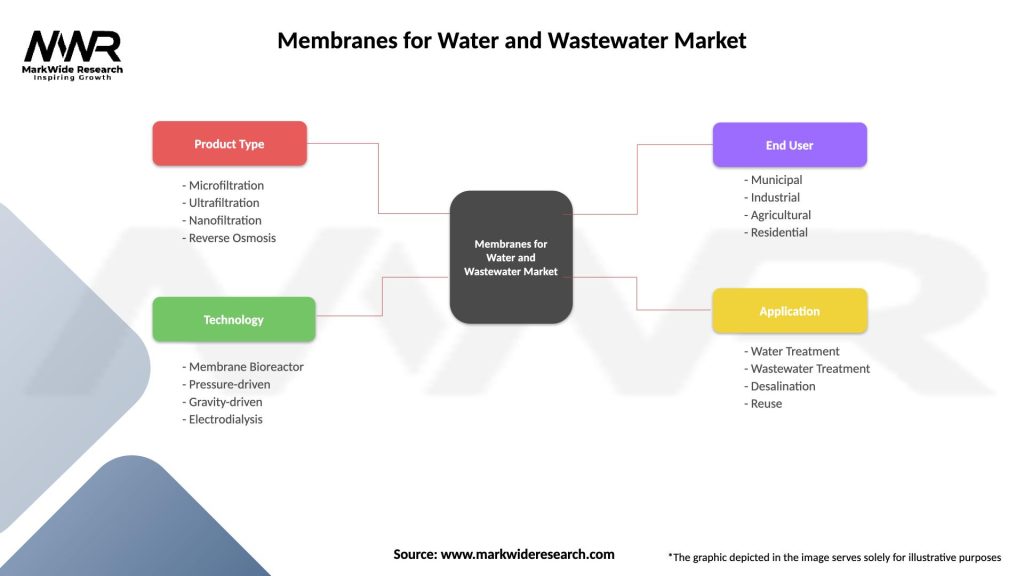

| Segmentation Details | Description |

|---|---|

| Product Type | Microfiltration, Ultrafiltration, Nanofiltration, Reverse Osmosis |

| Technology | Membrane Bioreactor, Pressure-driven, Gravity-driven, Electrodialysis |

| End User | Municipal, Industrial, Agricultural, Residential |

| Application | Water Treatment, Wastewater Treatment, Desalination, Reuse |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Membranes for Water and Wastewater Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at