444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Spain commercial greenhouse market represents a dynamic and rapidly evolving sector within the country’s agricultural landscape. Spain’s greenhouse industry has established itself as a cornerstone of Mediterranean agriculture, leveraging advanced cultivation technologies and sustainable farming practices to meet growing domestic and international demand for fresh produce. The market encompasses various greenhouse types, from traditional glass structures to modern polycarbonate and plastic film installations, each designed to optimize growing conditions for diverse crop varieties.

Market dynamics indicate robust growth driven by increasing consumer demand for year-round fresh vegetables, fruits, and ornamental plants. The sector benefits from Spain’s favorable climate conditions, particularly in regions like Andalusia, Valencia, and Murcia, where greenhouse cultivation has become integral to local economies. Technological advancement continues to reshape the industry, with automated climate control systems, precision irrigation, and integrated pest management solutions becoming standard features in modern commercial greenhouses.

Regional concentration remains significant, with approximately 75% of commercial greenhouse operations located in southern Spain, capitalizing on optimal solar radiation and temperature conditions. The market demonstrates strong export orientation, with Spanish greenhouse products reaching markets across Europe, North Africa, and beyond, establishing Spain as a leading supplier of greenhouse-grown produce in the Mediterranean region.

The Spain commercial greenhouse market refers to the comprehensive ecosystem of controlled-environment agriculture facilities designed for large-scale production of crops, vegetables, fruits, and ornamental plants within Spanish territory. This market encompasses the design, construction, operation, and technological enhancement of greenhouse structures specifically intended for commercial agricultural purposes, distinguishing it from residential or hobbyist greenhouse applications.

Commercial greenhouses in Spain typically feature sophisticated environmental control systems, including automated ventilation, heating, cooling, and irrigation infrastructure. These facilities enable year-round cultivation regardless of external weather conditions, maximizing crop yields while minimizing resource consumption. The market includes various greenhouse types, from simple tunnel structures to high-tech glass houses equipped with advanced monitoring and automation technologies.

Market scope extends beyond physical structures to include supporting technologies, equipment, and services essential for successful greenhouse operations. This comprehensive approach encompasses climate control systems, growing media, fertilizers, pest management solutions, and specialized greenhouse management software that collectively contribute to the sector’s operational efficiency and productivity.

Spain’s commercial greenhouse sector demonstrates remarkable resilience and growth potential, driven by increasing demand for sustainable agricultural practices and year-round fresh produce availability. The market benefits from Spain’s strategic geographic location, favorable climate conditions, and established agricultural expertise, positioning the country as a leading greenhouse producer in Europe and the Mediterranean basin.

Key market drivers include rising consumer awareness of food security, growing demand for organic and locally-produced vegetables, and increasing adoption of precision agriculture technologies. The sector shows strong growth momentum, with greenhouse cultivation area expanding at approximately 6.2% annually, reflecting both domestic market expansion and export opportunities.

Technological innovation plays a crucial role in market development, with smart greenhouse solutions, IoT integration, and sustainable energy systems becoming increasingly prevalent. The market demonstrates strong investment attraction, with both domestic and international companies recognizing Spain’s potential as a greenhouse production hub. Export performance remains robust, with Spanish greenhouse products maintaining competitive market share of 28% in key European markets.

Future prospects appear highly favorable, supported by government initiatives promoting sustainable agriculture, EU agricultural policies encouraging greenhouse adoption, and growing consumer preference for traceable, high-quality produce. The market is expected to continue its upward trajectory, driven by ongoing technological advancement and expanding international market opportunities.

Strategic market positioning reveals several critical insights that define Spain’s commercial greenhouse landscape. The sector demonstrates exceptional adaptability to changing market conditions, consumer preferences, and technological innovations, establishing a foundation for sustained growth and competitiveness.

Consumer demand evolution represents the primary driver propelling Spain’s commercial greenhouse market forward. Increasing consumer awareness of food quality, safety, and traceability creates sustained demand for greenhouse-grown produce, which offers superior consistency and reduced pesticide residues compared to traditional field cultivation. Year-round availability of fresh vegetables and fruits has become a consumer expectation, driving greenhouse operators to expand production capacity and diversify crop portfolios.

Climate change adaptation emerges as a significant market driver, with greenhouse cultivation offering protection against extreme weather events, droughts, and unpredictable seasonal variations. Spanish farmers increasingly recognize controlled-environment agriculture as a risk mitigation strategy, ensuring consistent production despite external climate challenges. Water scarcity concerns further accelerate greenhouse adoption, as these facilities typically achieve superior water use efficiency through precision irrigation and recycling systems.

Export market opportunities continue driving sector expansion, with European markets showing strong demand for Spanish greenhouse products. The country’s competitive advantages in production costs, quality standards, and logistics infrastructure position Spanish greenhouse operators favorably in international markets. Government support initiatives including subsidies for sustainable agriculture, technology adoption incentives, and export promotion programs provide additional momentum for market growth.

Technological advancement creates new possibilities for greenhouse optimization, from automated climate control to precision nutrient management. These innovations enable higher yields, improved quality, and reduced operational costs, making greenhouse cultivation increasingly attractive to commercial producers. Labor shortage challenges in traditional agriculture also drive automation adoption in greenhouse operations, creating demand for advanced technological solutions.

High initial investment requirements represent the most significant barrier to market entry and expansion in Spain’s commercial greenhouse sector. Modern greenhouse facilities require substantial capital investment for construction, equipment installation, and technology integration, creating financial challenges for smaller operators and new market entrants. Financing accessibility remains limited for many potential investors, particularly those lacking established agricultural backgrounds or sufficient collateral.

Energy cost volatility poses ongoing operational challenges, as greenhouse facilities require consistent heating, cooling, and lighting to maintain optimal growing conditions. Fluctuating energy prices directly impact operational profitability, forcing operators to balance production optimization with cost management. Regulatory compliance requirements continue increasing in complexity, encompassing environmental standards, food safety protocols, and labor regulations that add administrative burden and compliance costs.

Market competition intensity creates pressure on profit margins, with both domestic and international producers competing for market share. Price competition from lower-cost producing regions, particularly in North Africa and Eastern Europe, challenges Spanish greenhouse operators to maintain competitiveness while preserving quality standards. Skilled labor shortage affects operational efficiency, as greenhouse management requires specialized knowledge in horticulture, technology operation, and integrated pest management.

Climate variability despite controlled environments still impacts operations through energy consumption fluctuations and extreme weather events affecting infrastructure. Supply chain disruptions for essential inputs including seeds, fertilizers, and equipment can significantly impact production schedules and costs, highlighting the sector’s dependence on reliable supplier networks.

Organic production expansion presents substantial growth opportunities as consumer demand for organic greenhouse products continues rising. Spanish greenhouse operators can capitalize on premium pricing for certified organic produce while leveraging controlled-environment advantages to meet strict organic production standards. Specialty crop cultivation offers high-value opportunities, including exotic vegetables, medicinal herbs, and premium ornamental plants that command superior market prices.

Technology integration opportunities span artificial intelligence, machine learning, and IoT applications that can revolutionize greenhouse operations. Smart greenhouse systems offering predictive analytics, automated decision-making, and remote monitoring capabilities represent significant market potential. Renewable energy integration creates opportunities for energy independence and cost reduction, with solar panels, geothermal systems, and biomass heating becoming increasingly viable options.

Export market diversification beyond traditional European destinations offers growth potential, particularly in Middle Eastern, North African, and Asian markets where demand for high-quality produce continues expanding. Agritourism integration provides additional revenue streams, combining greenhouse operations with educational tours, farm-to-table experiences, and direct consumer sales.

Vertical farming adoption represents an emerging opportunity for maximizing production in limited space, particularly near urban centers where land costs are prohibitive for traditional greenhouse expansion. Partnership opportunities with research institutions, technology providers, and international distributors can accelerate innovation adoption and market access, creating competitive advantages for forward-thinking operators.

Supply and demand equilibrium in Spain’s commercial greenhouse market reflects complex interactions between production capacity, consumer preferences, and international trade dynamics. Seasonal demand fluctuations continue influencing market dynamics, despite greenhouse cultivation’s year-round production capabilities, as consumer preferences and pricing patterns still follow traditional seasonal cycles for many crops.

Price volatility remains a defining characteristic, influenced by factors including weather conditions affecting competing production regions, fuel cost fluctuations impacting transportation, and currency exchange rates affecting export competitiveness. Market consolidation trends show larger greenhouse operations gaining market share through economies of scale, technological advantages, and superior distribution networks, while smaller operators focus on niche markets and specialty products.

Innovation cycles drive continuous market evolution, with new technologies, growing techniques, and crop varieties regularly entering the market. MarkWide Research analysis indicates that greenhouse operators adopting advanced technologies achieve productivity improvements of 25-30% within three years of implementation, demonstrating the competitive advantage of innovation adoption.

International market integration increasingly influences domestic market dynamics, with global supply chains, international quality standards, and cross-border competition shaping local market conditions. Sustainability requirements from major retailers and consumers drive operational changes throughout the supply chain, creating both challenges and opportunities for greenhouse operators willing to invest in sustainable practices.

Comprehensive market analysis employed multiple research methodologies to ensure accurate and reliable insights into Spain’s commercial greenhouse market. Primary research included extensive interviews with greenhouse operators, technology suppliers, agricultural consultants, and industry associations across major production regions including Andalusia, Valencia, Murcia, and Catalonia.

Secondary research encompassed analysis of government agricultural statistics, industry reports, trade publications, and academic research focusing on greenhouse cultivation trends, technological developments, and market dynamics. Data triangulation methods ensured consistency and reliability across multiple information sources, providing robust foundation for market insights and projections.

Field research involved site visits to representative greenhouse facilities ranging from small family operations to large commercial installations, enabling direct observation of operational practices, technology implementation, and market challenges. Expert consultations with agricultural engineers, horticulture specialists, and market analysts provided technical validation and industry perspective on market trends and future developments.

Quantitative analysis utilized statistical modeling techniques to identify market patterns, growth trends, and correlation factors affecting market performance. Qualitative research through focus groups and in-depth interviews captured nuanced insights into market dynamics, competitive strategies, and emerging opportunities that quantitative methods alone cannot reveal.

Andalusia dominates Spain’s commercial greenhouse landscape, accounting for approximately 65% of total greenhouse production area and establishing the region as Europe’s largest greenhouse concentration. The provinces of Almería and Granada lead production, benefiting from optimal solar radiation, mild winters, and established supply chain infrastructure. Almería’s greenhouse cluster represents one of the world’s most intensive greenhouse production areas, with over 30,000 hectares under protection.

Valencia region maintains strong market position, particularly in citrus greenhouse cultivation and ornamental plant production. The region’s proximity to major European markets and well-developed transportation infrastructure provide competitive advantages for export-oriented operations. Technological innovation shows particular strength in Valencia, with several research institutions and technology companies driving advancement in greenhouse automation and precision agriculture.

Murcia region demonstrates rapid growth in greenhouse adoption, leveraging favorable climate conditions and water management expertise developed through traditional agriculture. The region shows increasing specialization in high-value crops including exotic vegetables and medicinal herbs. Catalonia’s greenhouse sector focuses primarily on ornamental plants and flowers, serving both domestic and international markets with emphasis on quality and innovation.

Northern regions including Galicia and Asturias show emerging greenhouse development, particularly for specialty crops requiring cooler growing conditions. These regions benefit from abundant water resources and lower land costs, creating opportunities for greenhouse expansion targeting specific market niches. Island territories including the Canary Islands and Balearic Islands maintain smaller but significant greenhouse sectors, focusing on local market supply and tourist industry demand.

Market leadership in Spain’s commercial greenhouse sector encompasses both large-scale commercial operators and specialized technology providers, creating a diverse competitive environment. Integrated producers combining greenhouse cultivation with processing and distribution capabilities maintain competitive advantages through vertical integration and supply chain control.

Technology suppliers play crucial roles in market development, providing greenhouse construction, climate control systems, and automation solutions. International companies including Dutch greenhouse technology specialists maintain strong presence in Spanish market, bringing advanced technologies and expertise to local operations.

By Greenhouse Type: The market segments into multiple categories based on structural design and technology integration. Glass greenhouses represent the premium segment, offering superior light transmission and durability for high-value crop production. Polycarbonate structures provide excellent insulation properties and impact resistance, making them suitable for regions with extreme weather conditions.

Plastic film greenhouses dominate market volume due to lower initial investment requirements and flexibility in design modification. Multi-span structures offer economies of scale for large commercial operations, while single-span designs provide flexibility for smaller producers and specialized applications.

By Crop Type: Market segmentation reflects diverse agricultural applications and consumer demands. Vegetable production represents the largest segment, including tomatoes, peppers, cucumbers, and leafy greens. Ornamental plants and flowers constitute a significant high-value segment, particularly in regions with established horticultural expertise.

Fruit cultivation shows growing importance, including strawberries, melons, and exotic fruits requiring controlled growing conditions. Herb production represents an emerging segment, driven by increasing demand for fresh culinary and medicinal herbs.

By Technology Level: Segmentation based on automation and technology integration reveals market sophistication trends. Basic greenhouses with minimal automation serve cost-sensitive market segments, while advanced facilities featuring climate control, automated irrigation, and monitoring systems target premium markets and export applications.

Vegetable Production Category maintains market dominance, driven by consistent consumer demand and established supply chains. Tomato cultivation represents the largest single crop category, with Spanish greenhouse tomatoes achieving premium positioning in European markets through superior quality and year-round availability. Pepper production shows strong growth, particularly for specialty varieties including sweet peppers and exotic cultivars commanding premium prices.

Cucumber and zucchini cultivation demonstrates steady demand, with greenhouse production enabling consistent quality and extended growing seasons. Leafy greens including lettuce, spinach, and specialty salads show rapid growth, driven by health-conscious consumer trends and restaurant industry demand.

Ornamental Plant Category exhibits high-value characteristics with strong profit margins for successful operators. Cut flower production maintains traditional strength, particularly in roses, carnations, and seasonal flowers for domestic and export markets. Potted plant cultivation shows growth potential, serving both retail garden centers and landscaping industry demand.

Fruit Production Category represents emerging opportunities with significant growth potential. Strawberry cultivation in greenhouses enables extended seasons and premium quality, while berry production including blueberries and raspberries commands high market prices. Exotic fruit cultivation offers niche opportunities for specialized producers targeting premium market segments.

Greenhouse operators benefit from enhanced production control, enabling consistent crop quality regardless of external weather conditions. Yield optimization through controlled environments typically achieves productivity increases of 300-500% compared to traditional field cultivation, while reducing crop loss risks and enabling multiple growing cycles annually.

Resource efficiency represents a major advantage, with greenhouse cultivation achieving superior water and fertilizer use efficiency through precision application and recycling systems. Pest and disease management benefits from controlled environments, reducing pesticide requirements and enabling integrated pest management strategies that improve product quality and environmental sustainability.

Consumers benefit from year-round availability of fresh, high-quality produce with consistent flavor and nutritional content. Traceability advantages enable consumers to verify product origin and production methods, supporting informed purchasing decisions and food safety confidence.

Environmental stakeholders benefit from reduced agricultural land pressure, lower water consumption, and decreased pesticide use associated with greenhouse cultivation. Economic stakeholders including rural communities benefit from job creation, technology investment, and export revenue generation that greenhouse operations provide.

Supply chain partners including distributors and retailers benefit from consistent product availability, predictable quality standards, and extended shelf life that greenhouse products typically offer. Research institutions benefit from collaboration opportunities in technology development, crop improvement, and sustainable agriculture practices.

Strengths:

Weaknesses:

Opportunities:

Threats:

Automation acceleration represents the most significant trend reshaping Spain’s commercial greenhouse sector. Robotic systems for planting, harvesting, and crop monitoring are becoming increasingly sophisticated and cost-effective, enabling greenhouse operators to address labor shortages while improving operational efficiency. Artificial intelligence integration in climate control and crop management systems provides predictive capabilities that optimize growing conditions and resource utilization.

Sustainability focus continues intensifying, with greenhouse operators increasingly adopting renewable energy systems, water recycling technologies, and sustainable growing practices. Circular economy principles guide waste reduction efforts and resource optimization strategies, while carbon footprint reduction becomes a competitive differentiator in premium markets.

Precision agriculture adoption enables data-driven decision making through sensor networks, monitoring systems, and analytics platforms. IoT connectivity allows remote monitoring and control capabilities, while blockchain technology enhances traceability and supply chain transparency.

Crop diversification trends show movement beyond traditional vegetables toward high-value specialty crops, medicinal plants, and exotic varieties. Vertical farming integration maximizes space utilization in high-value locations, while aquaponics systems combine fish farming with plant cultivation for enhanced sustainability and productivity.

Direct marketing growth includes farm-to-table initiatives, online sales platforms, and agritourism integration that create additional revenue streams and strengthen consumer connections. Collaborative partnerships between greenhouse operators, technology providers, and research institutions accelerate innovation adoption and market development.

Technology partnerships between Spanish greenhouse operators and international technology companies have accelerated innovation adoption throughout the sector. Major investments in research and development facilities, particularly in Andalusia and Valencia, demonstrate industry commitment to technological advancement and competitive positioning.

Government initiatives including the Spanish National Strategy for Sustainable Agriculture provide policy support and financial incentives for greenhouse modernization and sustainable practice adoption. EU agricultural policy alignment creates additional opportunities for funding and market access support.

Infrastructure developments include expansion of renewable energy installations, water treatment facilities, and transportation networks supporting greenhouse operations. MarkWide Research indicates that recent infrastructure investments have contributed to operational cost reductions of 15-20% for participating greenhouse facilities.

Market consolidation activities include mergers and acquisitions among greenhouse operators seeking economies of scale and market expansion opportunities. International expansion by Spanish greenhouse companies into North African and Latin American markets demonstrates sector confidence and growth ambitions.

Certification program expansion includes organic certification, sustainability standards, and quality assurance systems that enhance market access and premium positioning. Research collaborations with universities and agricultural institutes continue advancing greenhouse cultivation techniques and crop development programs.

Strategic recommendations for greenhouse operators emphasize technology investment as essential for maintaining competitiveness in evolving market conditions. Automation adoption should prioritize systems offering measurable return on investment through labor cost reduction and productivity improvement. Energy efficiency improvements through renewable energy integration and advanced climate control systems provide both cost savings and sustainability benefits.

Market positioning strategies should focus on quality differentiation and specialty crop development rather than competing solely on price with lower-cost international producers. Brand development and direct marketing initiatives can capture premium pricing and strengthen consumer relationships, while export diversification reduces dependence on traditional European markets.

Collaboration opportunities with technology providers, research institutions, and other greenhouse operators can accelerate innovation adoption and reduce individual investment risks. Sustainability initiatives should be viewed as competitive advantages rather than compliance requirements, as consumer and retailer preferences increasingly favor environmentally responsible producers.

Financial management recommendations include diversifying revenue streams through value-added services, maintaining adequate cash reserves for technology investments, and exploring alternative financing options for expansion projects. Risk management strategies should address climate risks, market volatility, and supply chain disruptions through appropriate insurance coverage and contingency planning.

Growth projections for Spain’s commercial greenhouse market indicate continued expansion driven by technology adoption, sustainability requirements, and evolving consumer preferences. Market evolution will likely favor operators embracing automation, precision agriculture, and sustainable practices while maintaining focus on quality and innovation.

Technology integration will accelerate, with artificial intelligence, machine learning, and IoT systems becoming standard features in commercial greenhouse operations. Sustainability requirements will intensify, creating competitive advantages for operators investing in renewable energy, water conservation, and circular economy practices.

Export opportunities are expected to expand beyond traditional European markets, with growing demand in Middle Eastern, North African, and Asian markets for high-quality greenhouse products. MWR analysis suggests that greenhouse operators achieving technology integration targets could realize productivity gains of 40-50% over the next five years.

Market consolidation trends will likely continue, with larger operations gaining market share through economies of scale and technological advantages. Specialty crop cultivation will expand, driven by consumer demand for diverse, high-quality produce and premium pricing opportunities.

Innovation focus will emphasize resource efficiency, automation, and sustainability, while regulatory environment will continue supporting greenhouse adoption through agricultural policies and environmental incentives. Investment attraction from both domestic and international sources will support sector modernization and expansion initiatives.

Spain’s commercial greenhouse market demonstrates exceptional potential for continued growth and development, supported by favorable geographic conditions, established agricultural expertise, and increasing technology adoption. The sector’s evolution from traditional cultivation methods to sophisticated controlled-environment agriculture reflects broader trends toward sustainability, efficiency, and quality in modern agriculture.

Market dynamics favor operators embracing innovation, sustainability, and quality differentiation strategies while maintaining focus on export competitiveness and operational efficiency. Technology integration will continue driving productivity improvements and competitive advantages, while sustainability requirements create both challenges and opportunities for forward-thinking greenhouse operators.

Future success in Spain’s commercial greenhouse market will depend on strategic investment in technology, sustainable practices, and market diversification, combined with effective risk management and stakeholder collaboration. The sector’s strong foundation and growth trajectory position Spanish greenhouse agriculture for continued leadership in Mediterranean and European markets, while emerging opportunities in specialty crops and new geographic markets offer additional growth potential for innovative operators.

What is Commercial Green House?

Commercial Green House refers to structures designed for the cultivation of plants in a controlled environment, optimizing conditions such as temperature, humidity, and light. These facilities are used for various agricultural purposes, including vegetable production, flower cultivation, and research.

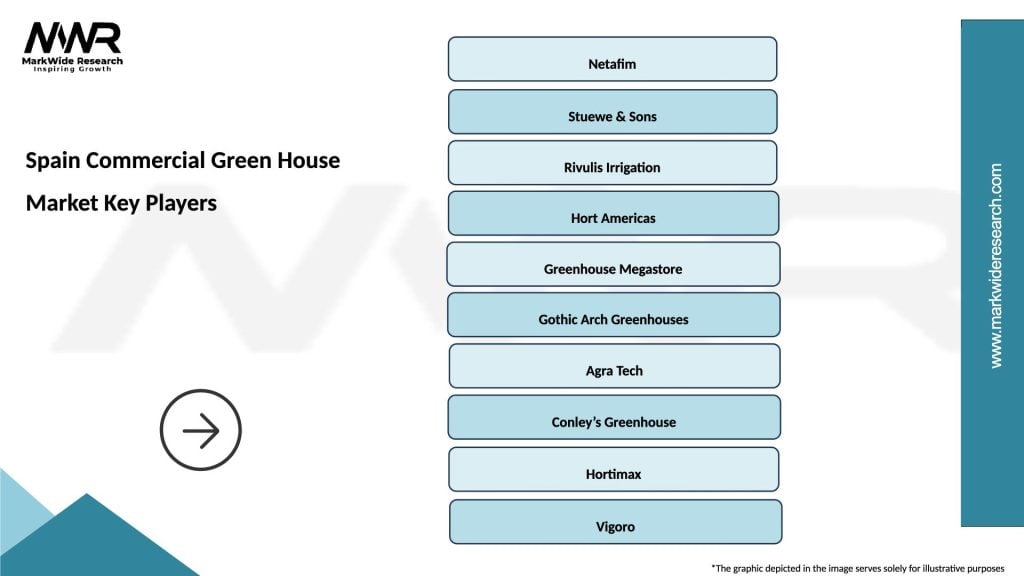

What are the key players in the Spain Commercial Green House Market?

Key players in the Spain Commercial Green House Market include companies like Netafim, Stuewe & Sons, and A.M.A. Horticulture, which provide innovative solutions and technologies for greenhouse cultivation, among others.

What are the main drivers of growth in the Spain Commercial Green House Market?

The main drivers of growth in the Spain Commercial Green House Market include the increasing demand for fresh produce, advancements in greenhouse technology, and the rising trend of urban farming. These factors contribute to enhanced agricultural productivity and sustainability.

What challenges does the Spain Commercial Green House Market face?

The Spain Commercial Green House Market faces challenges such as high initial investment costs, the need for skilled labor, and potential regulatory hurdles. These factors can hinder the expansion and adoption of greenhouse technologies.

What opportunities exist in the Spain Commercial Green House Market?

Opportunities in the Spain Commercial Green House Market include the growing interest in organic farming, the development of smart greenhouse technologies, and the potential for export of high-quality produce. These trends can enhance market growth and innovation.

What trends are shaping the Spain Commercial Green House Market?

Trends shaping the Spain Commercial Green House Market include the integration of automation and IoT technologies, the shift towards sustainable practices, and the increasing popularity of vertical farming. These trends are transforming how greenhouse operations are managed and optimized.

Spain Commercial Green House Market

| Segmentation Details | Description |

|---|---|

| Product Type | Hydroponics, Aeroponics, Soil-Based, Vertical Farming |

| Technology | LED Lighting, Climate Control, Irrigation Systems, Automation |

| End User | Retailers, Wholesalers, Agricultural Producers, Research Institutions |

| Distribution Channel | Direct Sales, Online Retail, Distributors, Trade Shows |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Spain Commercial Green House Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at