444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2150

The Singapore system integration market represents a dynamic and rapidly evolving sector that serves as a cornerstone of the nation’s digital transformation initiatives. System integration encompasses the comprehensive process of connecting disparate computing systems and software applications physically or functionally to act as a coordinated whole. Singapore’s strategic position as a regional technology hub has positioned it at the forefront of system integration adoption across multiple industries.

Market dynamics indicate robust growth driven by increasing digitalization efforts across government agencies, financial institutions, healthcare organizations, and manufacturing sectors. The market demonstrates exceptional resilience with growth rates exceeding 8.5% CAGR as organizations prioritize seamless connectivity and operational efficiency. Government initiatives such as the Smart Nation program have accelerated demand for sophisticated integration solutions that enable real-time data exchange and process automation.

Technology advancement continues to reshape the landscape, with cloud-based integration platforms gaining significant traction among enterprises seeking scalable and cost-effective solutions. The integration of artificial intelligence, machine learning, and Internet of Things technologies has created new opportunities for system integrators to deliver innovative solutions that address complex business challenges.

The Singapore system integration market refers to the comprehensive ecosystem of services, technologies, and solutions that enable organizations to connect, coordinate, and optimize their diverse IT systems and business processes. System integration involves combining different computing systems and software applications to function as a unified, efficient operational framework that enhances productivity and decision-making capabilities.

Core components of system integration include middleware solutions, application programming interfaces (APIs), enterprise service buses, data integration platforms, and cloud integration services. These elements work collectively to eliminate data silos, streamline workflows, and enable seamless communication between previously isolated systems.

Strategic importance extends beyond technical connectivity, encompassing business process optimization, regulatory compliance, and competitive advantage creation. Organizations leverage system integration to achieve operational excellence, reduce costs, improve customer experiences, and accelerate innovation cycles in Singapore’s highly competitive business environment.

Singapore’s system integration market demonstrates exceptional growth momentum driven by accelerating digital transformation initiatives across public and private sectors. The market benefits from strong government support, advanced technological infrastructure, and a highly skilled workforce that positions Singapore as a regional leader in integration services.

Key growth drivers include increasing adoption of cloud technologies, rising demand for real-time analytics, and the need for enhanced cybersecurity measures. Financial services organizations lead adoption rates at approximately 35% market share, followed by government agencies and healthcare institutions seeking to modernize legacy systems and improve service delivery.

Competitive landscape features a mix of global technology giants, regional specialists, and local system integrators offering comprehensive solutions ranging from basic connectivity services to advanced artificial intelligence-powered integration platforms. The market demonstrates strong potential for continued expansion as organizations increasingly recognize the strategic value of seamless system connectivity.

Market intelligence reveals several critical insights that shape the Singapore system integration landscape:

Digital transformation initiatives serve as the primary catalyst propelling Singapore’s system integration market forward. Organizations across all sectors recognize the imperative to modernize legacy systems and create interconnected digital ecosystems that support agile business operations and enhanced customer experiences.

Government support through comprehensive digitalization programs creates substantial demand for integration services. The Smart Nation initiative, GovTech programs, and various industry-specific digital transformation mandates generate consistent project pipelines for system integrators. Regulatory requirements in financial services, healthcare, and other regulated industries necessitate robust integration solutions that ensure compliance while maintaining operational efficiency.

Cloud adoption acceleration drives demand for sophisticated integration platforms that can seamlessly connect on-premises systems with cloud-based applications and services. Organizations migrating to multi-cloud environments require expert integration services to maintain data consistency, security, and performance across diverse technological platforms.

Data analytics requirements fuel integration demand as organizations seek to leverage data from multiple sources for business intelligence and decision-making. The need for real-time analytics and artificial intelligence capabilities requires advanced integration solutions that can process and analyze data streams from various systems simultaneously.

Implementation complexity presents significant challenges for organizations considering comprehensive system integration projects. The technical complexity of connecting disparate systems, ensuring data integrity, and maintaining security standards requires specialized expertise that may be limited or expensive to acquire.

Legacy system constraints create substantial obstacles for integration initiatives, particularly in established organizations with decades-old technology infrastructure. Older systems may lack modern APIs, have limited connectivity options, or require extensive customization to integrate effectively with contemporary platforms.

Cost considerations influence integration decisions, as comprehensive system integration projects often require substantial upfront investments in technology, consulting services, and staff training. Organizations must carefully balance integration benefits against implementation costs and ongoing maintenance requirements.

Security concerns regarding data protection and system vulnerabilities can slow integration adoption, particularly in highly regulated industries. Organizations must ensure that integration solutions maintain or enhance existing security postures while enabling improved connectivity and functionality.

Artificial intelligence integration presents tremendous opportunities for system integrators to develop innovative solutions that combine AI capabilities with traditional integration services. Organizations increasingly seek intelligent integration platforms that can automate decision-making, predict system failures, and optimize performance dynamically.

Internet of Things expansion creates new integration requirements as organizations deploy connected devices and sensors across their operations. IoT integration services enable real-time monitoring, predictive maintenance, and automated responses that enhance operational efficiency and reduce costs.

Industry 4.0 initiatives in manufacturing and logistics sectors generate demand for sophisticated integration solutions that connect production systems, supply chain platforms, and customer management applications. Smart manufacturing requires seamless data flow between operational technology and information technology systems.

Fintech innovation in Singapore’s thriving financial technology sector creates opportunities for specialized integration services that enable rapid deployment of new financial products and services while maintaining regulatory compliance and security standards.

Technological evolution continuously reshapes market dynamics as new integration technologies emerge and mature. The shift toward microservices architectures, containerization, and serverless computing models requires adaptive integration strategies that can support modern application development and deployment practices.

Competitive pressures drive organizations to seek integration solutions that provide competitive advantages through improved operational efficiency, enhanced customer experiences, and accelerated innovation cycles. Companies that successfully implement comprehensive integration strategies often achieve 25-30% efficiency improvements in key business processes.

Talent availability influences market dynamics as organizations compete for skilled integration specialists, solution architects, and project managers. The growing demand for integration expertise has led to increased investment in training programs and partnerships with educational institutions.

Vendor ecosystem evolution affects market dynamics as traditional software vendors expand integration capabilities while specialized integration platform providers enhance their offerings. This convergence creates both opportunities and challenges for organizations selecting integration solutions.

Comprehensive market analysis employs multiple research methodologies to ensure accurate and reliable insights into Singapore’s system integration market. Primary research includes extensive interviews with industry executives, technology leaders, and integration specialists across various sectors to gather firsthand perspectives on market trends and challenges.

Secondary research encompasses analysis of government publications, industry reports, technology vendor documentation, and academic studies related to system integration trends and technologies. This approach provides broad market context and validates primary research findings through multiple data sources.

Quantitative analysis involves examination of market data, adoption rates, and performance metrics collected from various industry sources and proprietary databases. Statistical analysis techniques help identify significant trends and correlations within the market data.

Qualitative assessment includes detailed evaluation of market dynamics, competitive positioning, and strategic implications for various stakeholders. Expert analysis provides insights into future market directions and potential disruptions that may affect the integration services landscape.

Singapore’s central business district concentrates the highest density of system integration activity, with financial services organizations and multinational corporations driving substantial demand for sophisticated integration solutions. This region accounts for approximately 45% of total market activity due to the presence of major banks, insurance companies, and technology firms.

Jurong Innovation District emerges as a significant growth area for system integration services, particularly in manufacturing and logistics sectors. The concentration of advanced manufacturing facilities and research institutions creates demand for specialized integration solutions that support Industry 4.0 initiatives and smart manufacturing processes.

Government sector integration spans multiple locations across Singapore, with major projects centered around key government agencies and statutory boards. Public sector integration initiatives focus on citizen services improvement, inter-agency collaboration, and digital government transformation programs.

Healthcare integration concentrates around major medical institutions and healthcare clusters, where integration services enable electronic health records, telemedicine platforms, and medical device connectivity. The healthcare sector represents approximately 15% of total integration services demand with strong growth potential.

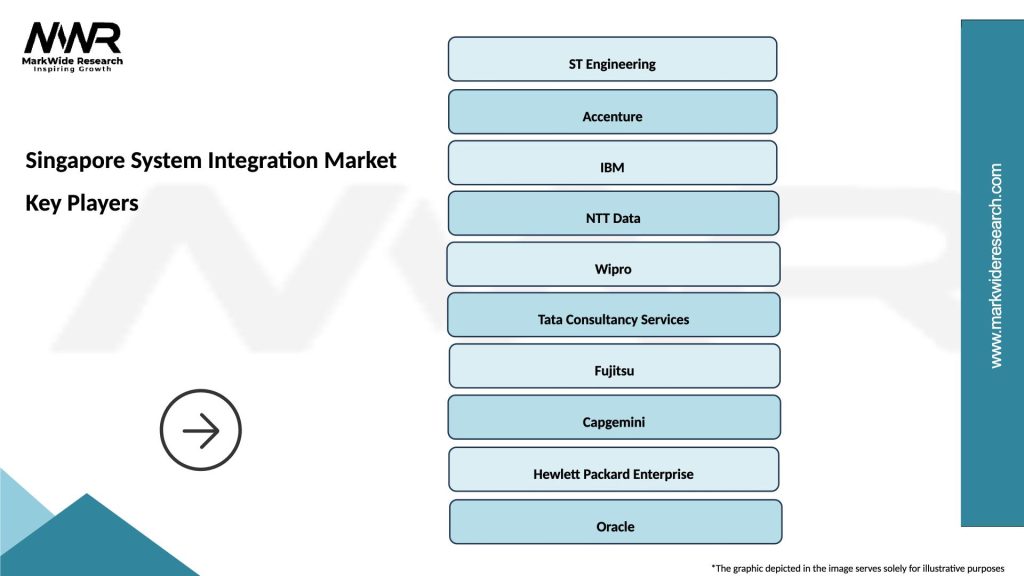

Market leadership features a diverse ecosystem of global technology companies, regional specialists, and local system integrators offering comprehensive solutions across various industry verticals:

By Service Type:

By Technology Platform:

By Industry Vertical:

Financial Services Integration dominates the Singapore market with sophisticated requirements for real-time transaction processing, regulatory compliance, and risk management. Banks and financial institutions invest heavily in integration solutions that enable digital banking services, automated compliance reporting, and seamless customer experiences across multiple channels.

Government Integration focuses on citizen service improvement and inter-agency collaboration through comprehensive digital government initiatives. MarkWide Research indicates that government integration projects emphasize security, scalability, and interoperability to support Singapore’s Smart Nation objectives and enhance public service delivery.

Healthcare Integration addresses critical needs for patient data sharing, medical device connectivity, and telemedicine platform integration. The sector requires specialized solutions that comply with healthcare regulations while enabling improved patient care coordination and clinical decision support.

Manufacturing Integration supports Industry 4.0 transformation through connections between operational technology and information technology systems. Smart manufacturing initiatives require integration solutions that enable predictive maintenance, quality control automation, and supply chain optimization.

Operational Efficiency represents the primary benefit for organizations implementing comprehensive system integration solutions. Integrated systems eliminate manual data entry, reduce processing errors, and accelerate business processes, typically resulting in 20-35% productivity improvements across key operational areas.

Cost Reduction occurs through elimination of redundant systems, reduced manual processes, and improved resource utilization. Organizations often achieve significant cost savings through streamlined operations, reduced IT maintenance requirements, and optimized software licensing arrangements.

Enhanced Decision Making results from improved data visibility and real-time analytics capabilities enabled by integrated systems. Decision makers gain access to comprehensive, up-to-date information that supports more informed strategic and operational decisions.

Competitive Advantage emerges from improved agility, faster time-to-market for new products and services, and enhanced customer experiences. Organizations with well-integrated systems can respond more quickly to market changes and customer demands.

Risk Mitigation occurs through improved data governance, enhanced security controls, and better compliance management. Integrated systems provide better audit trails, centralized security management, and automated compliance reporting capabilities.

Strengths:

Weaknesses:

Opportunities:

Threats:

API-First Integration emerges as a dominant trend with organizations prioritizing application programming interface strategies that enable rapid application development and deployment. This approach supports microservices architectures and facilitates easier system connectivity and maintenance.

Low-Code Integration Platforms gain significant traction as organizations seek to democratize integration capabilities and reduce dependence on specialized technical resources. These platforms enable business users to create and manage simple integrations while maintaining enterprise-grade security and governance.

Real-Time Integration becomes increasingly critical as organizations require immediate data synchronization and processing capabilities. Event-driven architectures and streaming integration platforms support real-time analytics, automated decision-making, and responsive customer experiences.

Security-First Integration reflects growing cybersecurity awareness with organizations prioritizing security considerations throughout integration design and implementation processes. Zero-trust security models and encrypted data transmission become standard requirements for integration solutions.

Cloud-Native Integration accelerates as organizations migrate to cloud-first strategies and require integration solutions designed specifically for cloud environments. Container-based integration platforms and serverless integration services support scalable and cost-effective integration approaches.

Government Digital Transformation initiatives continue expanding with new programs focused on citizen service improvement and inter-agency collaboration. Recent developments include enhanced digital identity systems, integrated government service portals, and automated compliance reporting platforms that require sophisticated integration solutions.

Financial Services Innovation accelerates with new digital banking licenses, cryptocurrency regulations, and fintech partnerships creating demand for specialized integration services. Banks invest in open banking platforms, real-time payment systems, and regulatory technology solutions that require expert integration support.

Healthcare Digitalization advances through telemedicine platform deployments, electronic health record implementations, and medical device integration projects. The COVID-19 pandemic accelerated healthcare digital transformation initiatives, creating sustained demand for healthcare-specific integration solutions.

Smart City Initiatives expand across Singapore with new Internet of Things deployments, smart transportation systems, and environmental monitoring platforms. These initiatives require comprehensive integration solutions that connect diverse systems and enable real-time data analysis and automated responses.

Investment Prioritization should focus on cloud-native integration platforms and artificial intelligence-enhanced solutions that provide long-term competitive advantages. Organizations should evaluate integration investments based on strategic value rather than short-term cost considerations to maximize return on investment.

Skill Development represents a critical success factor with organizations needing to invest in training programs and partnerships with educational institutions to develop internal integration capabilities. MWR analysis suggests that organizations with strong internal integration expertise achieve better project outcomes and lower long-term costs.

Vendor Selection requires careful evaluation of platform capabilities, scalability, security features, and long-term viability. Organizations should prioritize vendors with strong local presence, proven track records in relevant industries, and comprehensive support capabilities.

Security Integration must be considered from project inception rather than as an afterthought. Organizations should implement security-first integration approaches that include encryption, access controls, audit trails, and compliance monitoring capabilities throughout the integration architecture.

Market expansion is projected to continue with strong growth driven by accelerating digital transformation initiatives across all sectors. The integration services market demonstrates resilience and adaptability, with growth rates expected to maintain 8-10% annual increases over the next five years as organizations prioritize system connectivity and operational efficiency.

Technology evolution will reshape service offerings with artificial intelligence, machine learning, and automation becoming integral components of integration solutions. MarkWide Research projects that AI-enhanced integration platforms will account for over 40% of new implementations within the next three years as organizations seek intelligent automation capabilities.

Industry specialization will increase as integration service providers develop deeper expertise in specific vertical markets and create tailored solutions for unique industry requirements. This trend supports better project outcomes and enables premium pricing for specialized services.

Regional expansion opportunities will emerge as Singapore-based integration service providers leverage their expertise and experience to serve other Southeast Asian markets. The region’s growing digital transformation initiatives create substantial opportunities for experienced integration specialists.

Singapore’s system integration market represents a dynamic and rapidly evolving sector that plays a crucial role in the nation’s digital transformation journey. The market demonstrates exceptional growth potential driven by strong government support, advanced technological infrastructure, and increasing organizational recognition of integration’s strategic value.

Key success factors include comprehensive planning, security-first approaches, skilled resource management, and strategic vendor partnerships. Organizations that prioritize integration as a strategic capability rather than a tactical necessity achieve better outcomes and sustainable competitive advantages in Singapore’s highly competitive business environment.

Future prospects remain highly positive with continued growth expected across all market segments. The integration of emerging technologies such as artificial intelligence, Internet of Things, and advanced analytics will create new opportunities for innovation and value creation, positioning Singapore as a regional leader in system integration services and digital transformation excellence.

What is System Integration?

System integration refers to the process of bringing together various subsystems into a single cohesive system, ensuring they function together effectively. This can involve hardware, software, and networking components across different industries.

What are the key players in the Singapore System Integration Market?

Key players in the Singapore System Integration Market include companies like ST Engineering, NCS Group, and Accenture, which provide a range of integration services across sectors such as telecommunications, finance, and healthcare, among others.

What are the growth factors driving the Singapore System Integration Market?

The growth of the Singapore System Integration Market is driven by the increasing demand for automation, the rise of smart city initiatives, and the need for enhanced cybersecurity solutions across various industries.

What challenges does the Singapore System Integration Market face?

Challenges in the Singapore System Integration Market include the complexity of integrating diverse technologies, the shortage of skilled professionals, and the rapid pace of technological change that can outstrip current capabilities.

What opportunities exist in the Singapore System Integration Market?

Opportunities in the Singapore System Integration Market include the expansion of cloud computing services, the growing Internet of Things (IoT) applications, and the increasing focus on digital transformation across businesses.

What trends are shaping the Singapore System Integration Market?

Trends in the Singapore System Integration Market include the adoption of artificial intelligence for system optimization, the integration of advanced analytics for better decision-making, and the shift towards more agile and flexible integration solutions.

Singapore System Integration Market

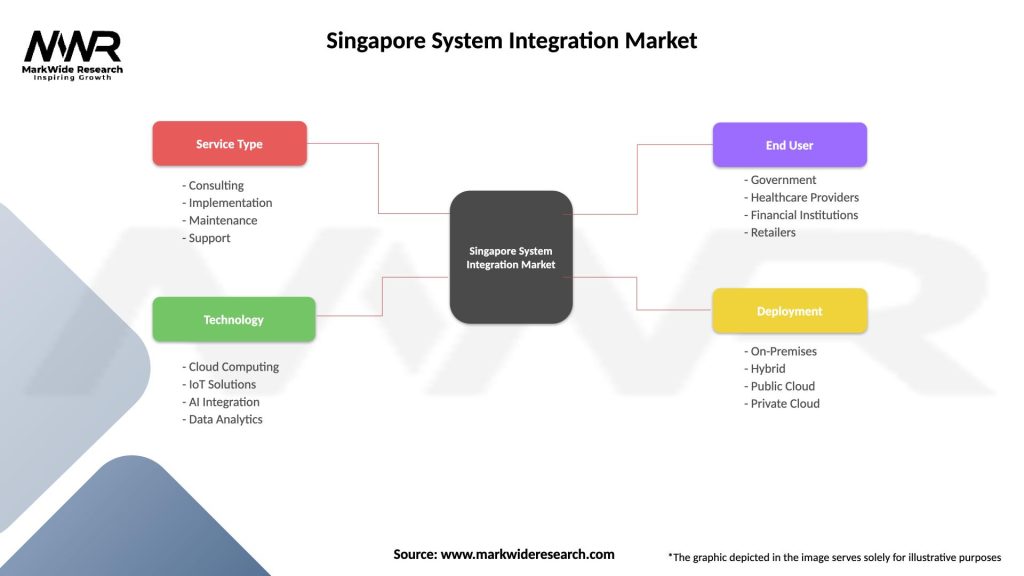

| Segmentation Details | Description |

|---|---|

| Service Type | Consulting, Implementation, Maintenance, Support |

| Technology | Cloud Computing, IoT Solutions, AI Integration, Data Analytics |

| End User | Government, Healthcare Providers, Financial Institutions, Retailers |

| Deployment | On-Premises, Hybrid, Public Cloud, Private Cloud |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Singapore System Integration Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at