444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Ireland cement market represents a cornerstone of the nation’s construction and infrastructure development sector, experiencing steady growth driven by robust residential construction, commercial development, and government infrastructure investments. Ireland’s cement industry has demonstrated remarkable resilience, adapting to evolving construction demands while maintaining its position as a critical component of the country’s economic development framework.

Market dynamics indicate that Ireland’s cement sector is experiencing a significant transformation, with traditional Portland cement production being complemented by innovative sustainable alternatives. The market is characterized by growing demand from the residential housing sector, which accounts for approximately 45% of total cement consumption in Ireland. Commercial construction projects and infrastructure development initiatives continue to drive substantial demand, particularly in Dublin and other major urban centers.

Regional distribution shows that the Greater Dublin Area represents the largest consumption hub, accounting for nearly 35% of national cement demand. The market is experiencing steady growth at a compound annual growth rate (CAGR) of 4.2%, reflecting the country’s ongoing construction boom and infrastructure modernization efforts. Sustainability initiatives are increasingly influencing market dynamics, with green building practices and carbon reduction targets shaping future cement production and consumption patterns.

The Ireland cement market refers to the comprehensive ecosystem encompassing the production, distribution, and consumption of cement products within the Republic of Ireland. This market includes various cement types, from traditional Portland cement to specialized blended cements, serving diverse construction applications across residential, commercial, and infrastructure sectors.

Cement production in Ireland involves the manufacturing of hydraulic cement through the heating of limestone, clay, and other materials in kilns at high temperatures. The resulting clinker is then ground with gypsum to produce the final cement product. Market participants include major cement manufacturers, distributors, construction companies, and end-users ranging from large-scale developers to individual homebuilders.

Market scope encompasses both domestic production and imports, with Ireland maintaining strategic cement manufacturing facilities while also relying on international suppliers to meet peak demand periods. The market serves critical functions in supporting Ireland’s construction industry, urban development initiatives, and infrastructure modernization programs essential for economic growth.

Ireland’s cement market demonstrates robust fundamentals supported by sustained construction activity, government infrastructure investments, and a recovering residential property sector. The market has successfully navigated recent economic challenges, emerging with strengthened operational efficiency and enhanced focus on sustainable production practices.

Key market drivers include Ireland’s housing shortage, which has intensified demand for residential construction materials, and the government’s National Development Plan allocating substantial resources for infrastructure development. Technological advancement in cement production has enabled manufacturers to improve efficiency while reducing environmental impact, with carbon emissions per ton of cement production decreasing by approximately 15% over the past five years.

Market consolidation has characterized recent industry evolution, with leading players expanding their market presence through strategic acquisitions and capacity expansions. The sector benefits from Ireland’s strategic location as a gateway to European markets, facilitating both domestic supply and export opportunities. Sustainability trends are reshaping market dynamics, with increasing adoption of alternative cementitious materials and circular economy principles driving innovation in product development and manufacturing processes.

Market intelligence reveals several critical insights shaping Ireland’s cement industry landscape. The sector demonstrates strong correlation with broader economic indicators, particularly GDP growth, employment rates, and construction sector performance.

Primary market drivers propelling Ireland’s cement industry include robust construction sector growth, government infrastructure commitments, and demographic trends supporting sustained housing demand. The country’s economic recovery and population growth create fundamental demand drivers for cement products across multiple application segments.

Housing shortage represents the most significant demand driver, with Ireland facing an estimated deficit of residential units that requires substantial construction activity to address. Government initiatives including the Housing for All plan and various affordable housing schemes directly translate into increased cement consumption. Commercial development in major urban centers, particularly Dublin, Cork, and Galway, generates substantial demand for high-performance cement products.

Infrastructure modernization programs encompass transport networks, utilities, healthcare facilities, and educational institutions, creating diverse demand streams for specialized cement applications. Foreign direct investment in Ireland’s economy drives commercial and industrial construction projects requiring significant cement volumes. Additionally, renovation and retrofit activities in existing building stock contribute to steady baseline demand, particularly as energy efficiency requirements drive building upgrade projects.

Market constraints facing Ireland’s cement industry include environmental regulations, raw material availability, energy costs, and competitive pressures from alternative construction materials. These factors create operational challenges while potentially limiting market expansion opportunities.

Environmental compliance requirements impose significant costs on cement manufacturers, particularly regarding carbon emissions reduction and air quality standards. The European Union’s carbon pricing mechanisms and Ireland’s climate action commitments create ongoing regulatory pressures. Energy costs represent a substantial operational expense, with cement production being highly energy-intensive and vulnerable to energy price volatility.

Raw material constraints occasionally impact production capacity, particularly regarding limestone quarrying permissions and transportation logistics. Labor shortages in skilled construction trades can limit construction activity, indirectly affecting cement demand. Alternative materials including steel, timber, and composite materials compete with concrete in certain applications, potentially constraining cement market growth in specific segments.

Significant opportunities exist within Ireland’s cement market, driven by infrastructure development needs, sustainability trends, and technological innovation. The market presents multiple avenues for growth and diversification across various application segments and geographic regions.

Green building initiatives create opportunities for sustainable cement products, including low-carbon formulations and recycled content materials. The growing emphasis on circular economy principles opens markets for cement products incorporating industrial waste materials. Infrastructure investment programs present substantial opportunities, particularly in transport, renewable energy, and digital infrastructure projects requiring specialized cement applications.

Export potential exists for Irish cement producers, leveraging the country’s strategic location and reputation for quality products. Technology adoption opportunities include digital supply chain management, predictive maintenance systems, and automated production processes that can improve efficiency and reduce costs. Value-added products such as ready-mix concrete, precast elements, and specialized cement formulations offer higher margin opportunities compared to commodity cement sales.

Market dynamics in Ireland’s cement sector reflect the interplay between supply-side factors, demand drivers, and external influences shaping industry evolution. The market demonstrates cyclical characteristics aligned with construction sector performance while exhibiting underlying structural growth trends.

Supply chain dynamics involve complex relationships between raw material suppliers, cement manufacturers, distributors, and end-users. Capacity utilization rates fluctuate based on seasonal demand patterns and economic cycles, with manufacturers optimizing production schedules to match market requirements. The industry has achieved approximately 78% average capacity utilization over recent years, indicating healthy demand-supply balance.

Competitive dynamics feature both domestic producers and international suppliers competing across price, quality, and service dimensions. Market consolidation trends have created larger, more efficient operators capable of serving diverse customer requirements. Innovation dynamics drive continuous product development, with manufacturers investing in research and development to create differentiated offerings that meet evolving construction industry needs.

Comprehensive research methodology employed in analyzing Ireland’s cement market incorporates multiple data sources, analytical frameworks, and validation processes to ensure accuracy and reliability of market insights. The research approach combines quantitative analysis with qualitative assessments to provide holistic market understanding.

Primary research involves direct engagement with industry participants including cement manufacturers, distributors, construction companies, and regulatory authorities. Structured interviews and surveys capture real-time market conditions, emerging trends, and strategic perspectives from key stakeholders. Secondary research encompasses analysis of industry reports, government statistics, trade publications, and academic studies relevant to Ireland’s cement and construction sectors.

Data validation processes include cross-referencing multiple sources, statistical analysis of trends, and expert review of findings to ensure consistency and accuracy. Market modeling techniques incorporate economic indicators, demographic trends, and construction sector forecasts to project future market scenarios. The methodology ensures comprehensive coverage of market segments, geographic regions, and application areas within Ireland’s cement industry.

Regional market analysis reveals significant geographic variations in cement demand patterns across Ireland, reflecting differences in construction activity, population density, and economic development levels. The analysis encompasses both provincial and county-level market characteristics.

Leinster province dominates cement consumption, accounting for approximately 52% of national demand, driven primarily by Dublin’s construction boom and surrounding county development. Dublin metropolitan area represents the single largest market concentration, with residential construction, commercial development, and infrastructure projects generating substantial cement requirements. Munster province contributes roughly 28% of total consumption, with Cork serving as the regional hub for construction activity.

Connacht and Ulster regions collectively represent the remaining market share, with Galway and other urban centers driving regional demand. Rural markets demonstrate different consumption patterns, with agricultural construction, residential development, and local infrastructure projects creating steady but lower-volume demand streams. Coastal regions experience specific demand for marine-grade cement products due to harsh environmental conditions requiring enhanced durability specifications.

Ireland’s cement market features a concentrated competitive landscape with several major players maintaining significant market positions through operational excellence, strategic positioning, and customer relationship management. The competitive environment balances domestic production capabilities with international supply sources.

Competitive strategies focus on operational efficiency, product quality, customer service, and strategic partnerships with construction industry participants. Market positioning varies among competitors, with some emphasizing cost leadership while others differentiate through specialized products or superior service capabilities.

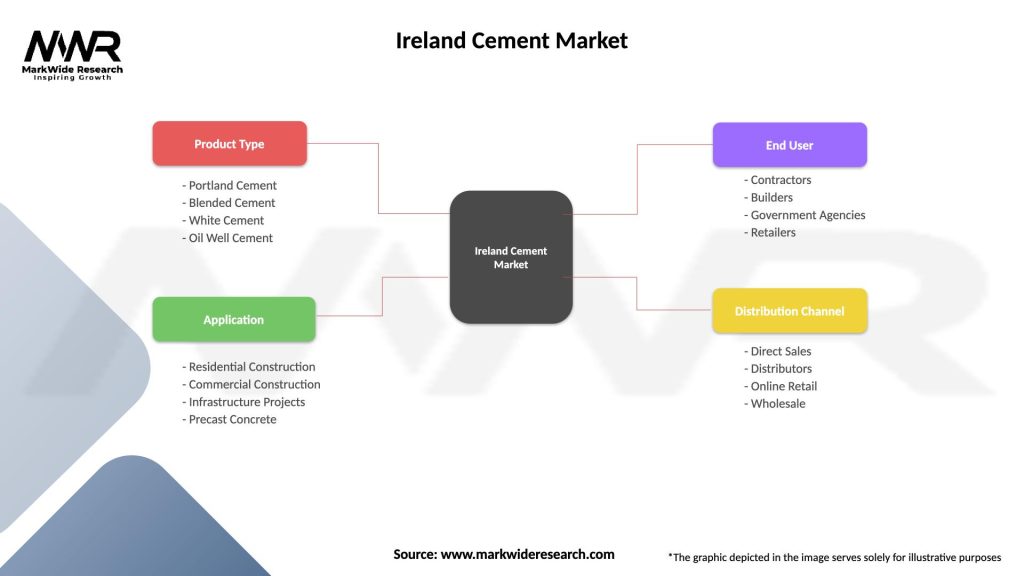

Market segmentation analysis reveals distinct cement product categories and application segments serving diverse construction industry requirements. Segmentation provides insights into market dynamics, growth opportunities, and competitive positioning across different market niches.

By Product Type:

By Application:

Detailed category analysis provides comprehensive understanding of market dynamics within specific cement product segments and application areas. Each category demonstrates unique characteristics, growth patterns, and competitive dynamics.

Portland Cement Category maintains market dominance due to versatility, established supply chains, and cost-effectiveness for general construction applications. This segment benefits from standardized specifications and widespread acceptance among construction professionals. Performance characteristics include reliable strength development, consistent quality, and compatibility with various construction methods.

Blended Cement Category experiences the fastest growth, driven by sustainability requirements and performance advantages. These products incorporate fly ash, slag, or other supplementary materials to reduce carbon footprint while maintaining or enhancing performance characteristics. Market adoption is increasing at approximately 12% annually as environmental considerations become more prominent in construction project specifications.

Specialty Cement Applications serve niche markets requiring specific performance characteristics such as rapid setting, high durability, or chemical resistance. These segments command premium pricing but require specialized technical expertise and targeted marketing approaches.

Industry participants across Ireland’s cement value chain realize significant benefits from market participation, ranging from economic returns to strategic positioning advantages. These benefits extend to manufacturers, distributors, construction companies, and end-users.

For Cement Manufacturers:

For Construction Industry:

Strengths:

Weaknesses:

Opportunities:

Threats:

Transformative trends are reshaping Ireland’s cement market, driven by technological innovation, sustainability imperatives, and evolving construction industry requirements. These trends create both opportunities and challenges for market participants.

Sustainability Integration represents the most significant trend, with manufacturers investing in carbon reduction technologies, alternative fuel sources, and circular economy initiatives. Carbon capture and utilization technologies are being evaluated for potential implementation in Irish cement plants. The trend toward green building certification is driving demand for low-carbon cement products and environmental product declarations.

Digital Transformation encompasses supply chain digitization, predictive maintenance systems, and customer relationship management platforms. Industry 4.0 technologies including IoT sensors, data analytics, and automation are improving operational efficiency and product quality. E-commerce platforms are emerging for cement distribution, particularly serving smaller construction companies and contractors.

Product Innovation focuses on developing specialized cement formulations for specific applications, including rapid-setting products, high-performance concrete, and architectural applications. Collaborative innovation between cement manufacturers and construction companies is accelerating product development cycles and market adoption of new technologies.

Recent industry developments highlight the dynamic nature of Ireland’s cement market, with significant investments, strategic partnerships, and regulatory changes shaping market evolution. These developments indicate industry adaptation to changing market conditions and future growth opportunities.

Capacity Expansion Projects have been announced by major manufacturers to meet growing demand from construction sector recovery. Technology upgrades at existing facilities focus on improving energy efficiency and reducing environmental impact while maintaining production capacity. MarkWide Research analysis indicates that these investments represent strategic positioning for long-term market growth.

Sustainability Initiatives include partnerships with waste management companies to increase alternative fuel usage and development of carbon reduction roadmaps aligned with national climate targets. Research collaborations with universities and technology companies are advancing innovation in cement chemistry and production processes.

Market Consolidation activities include strategic acquisitions and joint ventures aimed at strengthening market positions and achieving operational synergies. International partnerships are expanding market access and technology transfer opportunities for Irish cement companies.

Strategic recommendations for Ireland cement market participants focus on positioning for sustainable growth while addressing current market challenges and opportunities. These suggestions are based on comprehensive market analysis and industry best practices.

For Manufacturers: Prioritize sustainability investments including carbon reduction technologies and alternative fuel development to meet regulatory requirements and market demands. Product diversification into specialty cement products and value-added services can improve margins and competitive positioning. Digital transformation initiatives should focus on operational efficiency and customer service enhancement.

For Distributors: Develop comprehensive service offerings including technical support, logistics optimization, and inventory management to differentiate from competitors. Market expansion into underserved geographic regions or customer segments can drive growth. Partnership strategies with manufacturers and construction companies can strengthen market position.

For Construction Companies: Establish strategic supplier relationships to ensure reliable cement supply and access to technical expertise. Sustainability planning should incorporate low-carbon cement products to meet project environmental requirements. Supply chain optimization can reduce costs and improve project efficiency through better cement procurement and management practices.

Future market prospects for Ireland’s cement industry appear positive, supported by sustained construction demand, infrastructure investment commitments, and successful adaptation to sustainability requirements. Market growth is projected to continue at a steady pace, with annual expansion rates of approximately 3.8% to 4.5% expected over the medium term.

Demand drivers will continue to include residential construction addressing housing shortages, commercial development in major urban centers, and infrastructure modernization programs. MWR projections indicate that infrastructure spending will represent an increasing share of total cement consumption, potentially reaching 32% by 2028. Sustainability trends will accelerate adoption of low-carbon cement products and circular economy practices.

Technology integration will transform production processes, supply chain management, and customer relationships. Market consolidation may continue as companies seek scale advantages and operational synergies. Export opportunities are expected to expand as Irish cement manufacturers leverage quality reputation and strategic location advantages. The market outlook reflects balanced growth prospects with opportunities for companies that successfully adapt to evolving industry requirements and customer expectations.

Ireland’s cement market demonstrates robust fundamentals and positive growth prospects, driven by sustained construction activity, infrastructure investment, and successful industry adaptation to sustainability requirements. The market has evolved from a traditional commodity business to a more sophisticated industry focused on product innovation, environmental responsibility, and customer service excellence.

Key success factors for market participants include operational efficiency, sustainability leadership, product quality, and strategic customer relationships. The industry’s ability to balance growth objectives with environmental responsibilities will determine long-term competitiveness and market positioning. Strategic investments in technology, sustainability, and market development will enable companies to capitalize on emerging opportunities while addressing evolving market challenges.

Market outlook remains positive, with continued growth expected across residential, commercial, and infrastructure segments. The Ireland cement market is well-positioned to support the country’s construction industry needs while contributing to economic development and sustainability objectives. Success in this dynamic market will require continued innovation, strategic positioning, and commitment to meeting evolving customer and regulatory requirements.

What is Cement?

Cement is a binding material used in construction that sets and hardens when mixed with water. It is a key ingredient in concrete and mortar, essential for building infrastructure, homes, and various structures.

What are the major companies in the Ireland Cement Market?

Major companies in the Ireland Cement Market include CRH plc, Irish Cement Limited, and LafargeHolcim, among others. These companies play a significant role in the production and supply of cement for various construction projects.

What are the growth factors driving the Ireland Cement Market?

The growth of the Ireland Cement Market is driven by increasing construction activities, urbanization, and infrastructure development. Additionally, government initiatives to enhance public infrastructure contribute to market expansion.

What challenges does the Ireland Cement Market face?

The Ireland Cement Market faces challenges such as environmental regulations, competition from alternative materials, and fluctuations in raw material prices. These factors can impact production costs and market dynamics.

What opportunities exist in the Ireland Cement Market?

Opportunities in the Ireland Cement Market include the growing demand for sustainable construction materials and innovations in cement production technologies. The shift towards eco-friendly practices presents avenues for growth.

What trends are shaping the Ireland Cement Market?

Trends in the Ireland Cement Market include the adoption of green cement technologies and the use of recycled materials in cement production. Additionally, digitalization in construction processes is influencing market practices.

Ireland Cement Market

| Segmentation Details | Description |

|---|---|

| Product Type | Portland Cement, Blended Cement, White Cement, Oil Well Cement |

| Application | Residential Construction, Commercial Construction, Infrastructure Projects, Precast Concrete |

| End User | Contractors, Builders, Government Agencies, Retailers |

| Distribution Channel | Direct Sales, Distributors, Online Retail, Wholesale |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Ireland Cement Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at