444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The South Korea Intensive Care Unit (ICU) beds and surfaces market represents a critical segment of the nation’s healthcare infrastructure, experiencing unprecedented growth driven by demographic shifts and technological advancements. South Korea’s aging population and increasing prevalence of chronic diseases have created substantial demand for advanced ICU facilities, positioning the market for robust expansion with a projected CAGR of 6.8% through the forecast period.

Healthcare modernization initiatives across South Korean hospitals have accelerated the adoption of sophisticated ICU bed systems featuring integrated monitoring capabilities, pressure redistribution technologies, and infection control mechanisms. The market encompasses specialized beds designed for critical care environments, including electric ICU beds, manual ICU beds, and advanced surface systems that prevent pressure ulcers and enhance patient comfort during extended care periods.

Government healthcare investments and the expansion of tertiary care facilities have significantly influenced market dynamics, with public and private hospitals upgrading their critical care infrastructure to meet international standards. The integration of smart technologies and IoT-enabled monitoring systems has transformed traditional ICU beds into comprehensive patient care platforms, driving market evolution and creating new opportunities for healthcare providers.

The South Korea Intensive Care Unit (ICU) beds and surfaces market refers to the comprehensive ecosystem of specialized medical beds, mattresses, and support surfaces designed specifically for critical care environments within South Korean healthcare facilities. This market encompasses advanced bed systems that provide life-supporting functions, patient positioning capabilities, and therapeutic surfaces essential for intensive care treatment protocols.

ICU beds and surfaces in this context include electrically operated beds with multiple positioning options, integrated weighing systems, cardiac chair positions, and advanced safety features. The surfaces component covers specialized mattresses, overlays, and support systems designed to prevent pressure injuries, manage moisture, and provide optimal patient comfort during critical care situations.

Market participants include manufacturers of medical beds, surface technology providers, healthcare facility planners, and end-users comprising hospitals, specialized care centers, and emergency medical facilities throughout South Korea’s healthcare network.

South Korea’s ICU beds and surfaces market demonstrates exceptional growth potential, driven by the nation’s commitment to healthcare excellence and technological innovation. The market benefits from strong government support for healthcare infrastructure development, with 75% of hospitals planning significant ICU upgrades within the next three years according to recent healthcare facility surveys.

Key market drivers include the rapid aging of South Korea’s population, increasing incidence of cardiovascular diseases, and the ongoing digital transformation of healthcare facilities. The COVID-19 pandemic has further emphasized the critical importance of ICU capacity and advanced bed systems, leading to accelerated procurement and modernization initiatives across the healthcare sector.

Technology integration represents a defining characteristic of the market, with smart bed systems incorporating patient monitoring, automated positioning, and data connectivity features gaining significant traction. The market’s competitive landscape features both international medical device manufacturers and emerging domestic players focused on innovative surface technologies and patient care solutions.

Regional distribution shows concentration in major metropolitan areas, with Seoul, Busan, and Incheon accounting for approximately 60% of market demand, reflecting the distribution of tertiary care facilities and population density patterns across South Korea.

Market dynamics reveal several critical insights shaping the South Korean ICU beds and surfaces landscape:

Demographic pressures serve as the primary catalyst for South Korea’s ICU beds and surfaces market expansion. The nation’s aging population, with individuals over 65 representing an increasing percentage of the total population, creates sustained demand for critical care services and specialized bed systems designed for elderly patients with complex medical conditions.

Healthcare infrastructure modernization initiatives across South Korea drive significant market growth, as hospitals upgrade aging facilities and expand ICU capacity to meet growing demand. Government healthcare policies supporting advanced medical technology adoption and facility improvements provide substantial momentum for market participants.

Technology advancement in medical bed systems creates new market opportunities, with healthcare facilities seeking integrated solutions that combine patient care, monitoring, and data management capabilities. The integration of artificial intelligence, IoT connectivity, and automated patient positioning systems transforms traditional ICU beds into comprehensive care platforms.

Quality of care expectations among patients and healthcare providers drive demand for advanced surface technologies that prevent pressure ulcers, manage moisture, and enhance patient comfort during extended ICU stays. These expectations align with international best practices and accreditation requirements for healthcare facilities.

Chronic disease prevalence continues rising in South Korea, with cardiovascular diseases, diabetes, and respiratory conditions requiring intensive care management. This trend creates sustained demand for specialized ICU beds equipped with cardiac positioning, respiratory support integration, and continuous monitoring capabilities.

High capital costs associated with advanced ICU bed systems present significant challenges for healthcare facilities, particularly smaller hospitals and specialized care centers operating with limited budgets. The substantial investment required for comprehensive bed system upgrades can delay procurement decisions and limit market penetration in certain segments.

Technical complexity of modern ICU bed systems creates operational challenges for healthcare staff, requiring extensive training and ongoing technical support. The integration of multiple technologies and sophisticated control systems can overwhelm facilities lacking adequate technical infrastructure or staff expertise.

Maintenance requirements for advanced bed systems generate ongoing operational costs and complexity, as healthcare facilities must maintain specialized technical capabilities and spare parts inventory. These requirements can strain facility resources and create dependencies on manufacturer support services.

Regulatory compliance challenges in South Korea’s medical device market create barriers for new entrants and can delay product introductions. Stringent safety and efficacy requirements, while ensuring quality, can limit innovation speed and increase development costs for manufacturers.

Space constraints in existing healthcare facilities limit the adoption of larger, more sophisticated bed systems. Many South Korean hospitals operate in older buildings with limited room dimensions and infrastructure capabilities that cannot accommodate the latest ICU bed technologies.

Smart healthcare integration presents substantial opportunities for ICU bed manufacturers to develop connected systems that integrate with hospital information systems, electronic health records, and remote monitoring platforms. The growing emphasis on data-driven healthcare creates demand for beds that can collect, analyze, and transmit patient data seamlessly.

Preventive care technologies offer significant market potential, with advanced surface systems that actively prevent pressure ulcers, monitor patient positioning, and alert staff to potential complications. These technologies align with South Korea’s focus on improving patient outcomes while reducing healthcare costs.

Home healthcare expansion creates new market segments for portable and semi-portable ICU-grade bed systems suitable for home-based critical care. The growing preference for home healthcare services, accelerated by demographic trends and healthcare cost considerations, opens new distribution channels and product categories.

Regional healthcare development initiatives aimed at improving healthcare access in rural and underserved areas create opportunities for cost-effective ICU bed solutions. Government programs supporting regional hospital development provide market expansion opportunities beyond major metropolitan areas.

Export potential exists for South Korean manufacturers to leverage domestic market success and technological capabilities to expand into other Asian markets facing similar demographic and healthcare challenges. The nation’s reputation for quality manufacturing and technology innovation supports international expansion opportunities.

Supply chain dynamics in the South Korean ICU beds and surfaces market reflect a complex interplay between international manufacturers, domestic producers, and healthcare facility procurement processes. The market demonstrates strong relationships between manufacturers and healthcare providers, with long-term service agreements and technology partnerships becoming increasingly common.

Competitive pressures drive continuous innovation in bed design, surface technologies, and integrated systems. Manufacturers compete on multiple dimensions including technology sophistication, reliability, service support, and total cost of ownership, creating a dynamic environment that benefits healthcare providers through improved products and competitive pricing.

Healthcare policy influences significantly impact market dynamics, with government initiatives supporting healthcare modernization, quality improvement, and technology adoption. Policy changes regarding healthcare reimbursement, facility standards, and medical device regulations directly affect market demand patterns and competitive positioning.

Technology convergence between ICU beds, monitoring systems, and hospital infrastructure creates new market dynamics as traditional product boundaries blur. This convergence requires manufacturers to develop broader capabilities and partnerships while creating opportunities for integrated solution providers.

User behavior evolution among healthcare providers reflects increasing sophistication in ICU bed procurement, with emphasis on evidence-based decision making, total cost of ownership analysis, and long-term partnership relationships. Healthcare facilities increasingly seek comprehensive solutions rather than individual products, driving market consolidation and service expansion.

Comprehensive market analysis for the South Korean ICU beds and surfaces market employed multiple research methodologies to ensure accuracy and depth of insights. Primary research included extensive interviews with healthcare facility administrators, ICU directors, procurement specialists, and clinical staff across various hospital types and regions throughout South Korea.

Secondary research encompassed analysis of government healthcare statistics, hospital procurement records, manufacturer financial reports, and industry publications. Healthcare facility databases provided insights into ICU capacity, bed utilization rates, and modernization plans across public and private hospital systems.

Market sizing methodology utilized bottom-up analysis based on hospital bed counts, ICU capacity data, replacement cycles, and new facility development projects. Cross-validation through top-down analysis using healthcare expenditure data and medical device market statistics ensured accuracy of market assessments.

Competitive analysis involved detailed examination of manufacturer product portfolios, pricing strategies, distribution networks, and market positioning. Technology assessment included evaluation of product features, innovation trends, and emerging technologies affecting the ICU beds and surfaces market.

Trend analysis incorporated demographic projections, healthcare policy developments, and technology advancement trajectories to project future market evolution. Scenario modeling assessed various growth trajectories under different economic and healthcare policy conditions.

Seoul Metropolitan Area dominates the South Korean ICU beds and surfaces market, accounting for approximately 35% of total demand due to the concentration of major tertiary care hospitals, specialized medical centers, and healthcare infrastructure. The region’s advanced healthcare facilities drive adoption of premium ICU bed systems and innovative surface technologies.

Busan and surrounding regions represent the second-largest market segment, with significant healthcare facility expansion and modernization projects supporting market growth. The region’s role as a major port city and industrial center creates demand for advanced emergency and critical care capabilities, driving ICU bed procurement.

Incheon and Gyeonggi Province demonstrate rapid market growth, supported by new hospital construction, healthcare facility expansion, and proximity to Seoul’s healthcare ecosystem. The region benefits from government healthcare development initiatives and growing population density requiring enhanced critical care capacity.

Regional cities including Daegu, Daejeon, and Gwangju show increasing market activity as healthcare decentralization policies promote regional healthcare center development. These markets favor cost-effective ICU bed solutions while maintaining quality standards appropriate for regional healthcare needs.

Rural and underserved areas represent emerging market opportunities, with government initiatives supporting healthcare access improvement and regional hospital development. These markets require specialized approaches focusing on essential functionality, reliability, and cost-effectiveness rather than premium features.

Market leadership in South Korea’s ICU beds and surfaces market features a mix of established international manufacturers and emerging domestic players, creating a competitive environment that drives innovation and service excellence.

Competitive strategies focus on technology differentiation, service excellence, and long-term partnership development with healthcare providers. Manufacturers increasingly emphasize total cost of ownership, clinical outcomes, and integration capabilities rather than competing solely on initial purchase price.

By Product Type:

By Technology:

By End User:

Electric ICU beds represent the fastest-growing category, with healthcare facilities increasingly prioritizing automated positioning, integrated monitoring, and staff efficiency features. These beds demonstrate superior clinical outcomes through precise patient positioning, reduced staff workload, and enhanced patient comfort during extended critical care periods.

Advanced surface technologies show remarkable growth as healthcare providers focus on pressure ulcer prevention and patient comfort optimization. MarkWide Research indicates that facilities using advanced surface systems report 40% reduction in pressure-related complications, driving adoption across various healthcare settings.

Smart bed integration emerges as a key differentiator, with healthcare facilities seeking beds that seamlessly connect with hospital information systems, electronic health records, and remote monitoring platforms. These systems provide real-time patient data, automated alerts, and comprehensive care documentation capabilities.

Infection control features gain prominence following pandemic experiences, with healthcare facilities prioritizing beds with antimicrobial surfaces, easy-to-clean designs, and minimal crevices where pathogens might accumulate. These features become standard requirements rather than premium options in procurement specifications.

Pediatric and specialized populations create niche market segments requiring customized bed solutions. Pediatric ICU beds incorporate safety features, size adjustability, and family accommodation elements, while bariatric ICU beds address the growing need for higher weight capacity and specialized positioning capabilities.

Healthcare providers benefit from improved patient outcomes through advanced ICU bed systems that enhance care quality, reduce complications, and optimize staff efficiency. Modern bed systems contribute to shorter length of stay, reduced readmission rates, and improved patient satisfaction scores, directly impacting facility performance metrics and financial outcomes.

Clinical staff experience significant workflow improvements through ergonomic bed designs, automated positioning features, and integrated monitoring capabilities. These benefits reduce physical strain, minimize manual tasks, and enable more time for direct patient care, addressing healthcare worker shortage challenges while improving job satisfaction.

Patients and families receive enhanced care experiences through comfortable, safe, and technologically advanced bed systems that support healing and recovery. Advanced surface technologies prevent complications, while smart features enable better communication and family involvement in care processes.

Manufacturers access a growing market with strong demand fundamentals, government support for healthcare modernization, and increasing sophistication in healthcare facility procurement. The market rewards innovation, quality, and service excellence, creating opportunities for sustainable competitive advantages and long-term partnerships.

Healthcare systems achieve operational efficiency improvements through standardized bed platforms, reduced maintenance complexity, and integrated technology systems. These benefits support cost management objectives while maintaining high-quality patient care standards across multiple facilities and service lines.

Strengths:

Weaknesses:

Opportunities:

Threats:

Digital transformation drives the integration of IoT sensors, artificial intelligence, and predictive analytics into ICU bed systems, creating smart platforms that monitor patient conditions, predict complications, and optimize care protocols. These technologies enable proactive intervention and personalized treatment approaches that improve outcomes while reducing costs.

Patient-centered design becomes increasingly important as healthcare facilities recognize the impact of patient experience on outcomes and satisfaction. Modern ICU beds incorporate noise reduction technologies, family accommodation features, and comfort optimization systems that support healing environments and family involvement in care processes.

Sustainability initiatives influence ICU bed procurement decisions, with healthcare facilities seeking energy-efficient systems, recyclable materials, and longer product lifecycles. Manufacturers respond with eco-friendly designs, sustainable manufacturing processes, and comprehensive recycling programs that align with environmental responsibility goals.

Modular design concepts gain traction as healthcare facilities seek flexible bed systems that can adapt to changing clinical needs, patient populations, and care protocols. These systems enable configuration changes, feature upgrades, and functionality expansion without complete bed replacement, optimizing capital utilization and operational flexibility.

Evidence-based procurement becomes standard practice, with healthcare facilities demanding clinical evidence, outcome data, and cost-effectiveness analysis to support purchasing decisions. This trend drives manufacturers to invest in clinical research, outcome studies, and comprehensive documentation of product benefits and performance metrics.

Technology partnerships between ICU bed manufacturers and healthcare technology companies create integrated solutions that combine bed systems with monitoring devices, electronic health records, and hospital information systems. These collaborations enable seamless data flow and comprehensive patient management platforms that enhance care coordination and clinical decision-making.

Regulatory framework evolution in South Korea’s medical device sector introduces new standards for connected devices, data security, and patient privacy protection. These developments ensure market quality while creating compliance requirements that influence product development and market entry strategies for manufacturers.

Healthcare facility expansion projects across South Korea include significant ICU capacity additions and modernization initiatives. Major hospital systems announce comprehensive bed replacement programs, new facility construction, and technology upgrade projects that create substantial market opportunities for ICU bed manufacturers.

Research and development investments by leading manufacturers focus on next-generation bed technologies, including advanced surface materials, integrated monitoring systems, and artificial intelligence applications. These investments drive innovation cycles and create competitive differentiation opportunities in the evolving market landscape.

Service model evolution sees manufacturers expanding beyond product sales to comprehensive service offerings including maintenance, training, technology support, and outcome optimization consulting. This shift creates recurring revenue opportunities while strengthening customer relationships and market positioning.

Healthcare providers should prioritize total cost of ownership analysis when evaluating ICU bed systems, considering not only initial purchase price but also maintenance costs, training requirements, and operational efficiency gains. MWR analysis suggests that facilities focusing on comprehensive cost evaluation achieve 25% better return on investment compared to those emphasizing initial cost minimization.

Manufacturers should invest in local service capabilities, technical support infrastructure, and clinical evidence development to strengthen market position in South Korea’s sophisticated healthcare environment. Building strong relationships with healthcare providers through value-added services and outcome-focused partnerships creates sustainable competitive advantages.

Technology integration represents a critical success factor, with manufacturers needing to develop seamless connectivity with existing hospital systems while ensuring data security and regulatory compliance. The ability to provide integrated solutions rather than standalone products becomes increasingly important for market success.

Market entry strategies for new participants should focus on niche segments, specialized applications, or innovative technologies that address unmet needs in the current market. Direct competition with established players requires significant resources and differentiated value propositions to achieve market penetration.

Investment priorities should emphasize research and development, service capability development, and strategic partnerships that enhance market access and customer relationships. The market rewards companies that demonstrate long-term commitment to the South Korean healthcare sector through local investments and expertise development.

Market evolution through the forecast period indicates continued strong growth driven by demographic trends, healthcare modernization, and technology advancement. The market is expected to maintain robust expansion with increasing sophistication in product offerings and service capabilities as healthcare facilities pursue comprehensive care optimization strategies.

Technology advancement will accelerate the integration of artificial intelligence, machine learning, and predictive analytics into ICU bed systems, creating intelligent platforms that actively support clinical decision-making and patient management. These developments will transform beds from passive support devices into active participants in care delivery processes.

Market consolidation may occur as smaller manufacturers struggle to meet increasing technology and service requirements, while larger companies expand through acquisitions and strategic partnerships. This consolidation could create opportunities for specialized players focusing on niche markets or innovative technologies.

Regional expansion beyond major metropolitan areas will create new market segments as government healthcare initiatives improve access and facility development in underserved regions. These markets will require adapted product offerings and service models appropriate for different healthcare environments and resource constraints.

International competitiveness of South Korean healthcare facilities will drive continued demand for world-class ICU bed systems and surface technologies. The nation’s commitment to healthcare excellence and medical tourism development supports premium product adoption and market growth across all segments.

South Korea’s ICU beds and surfaces market presents exceptional opportunities for sustained growth and innovation, driven by powerful demographic trends, healthcare modernization initiatives, and advancing technology integration. The market’s sophisticated healthcare infrastructure, government support for quality improvement, and increasing patient expectations create a favorable environment for premium product adoption and comprehensive service solutions.

Market participants who focus on technology integration, clinical outcomes, and long-term partnership development will achieve the strongest competitive positions in this evolving landscape. The emphasis on evidence-based procurement, total cost of ownership optimization, and comprehensive care solutions rewards manufacturers who can demonstrate clear value propositions and measurable benefits for healthcare providers.

Future success in the South Korean ICU beds and surfaces market will depend on the ability to navigate increasing complexity in healthcare delivery, technology integration, and regulatory compliance while maintaining focus on improved patient outcomes and operational efficiency. The market’s continued evolution toward smart, connected, and outcome-focused solutions creates opportunities for innovative companies committed to advancing critical care capabilities and supporting South Korea’s world-class healthcare system.

What is Intensive Care Unit (ICU) Beds And Surfaces?

Intensive Care Unit (ICU) Beds And Surfaces refer to specialized medical equipment and surfaces designed for critically ill patients requiring constant monitoring and support. These beds are equipped with advanced features to enhance patient comfort and facilitate medical procedures.

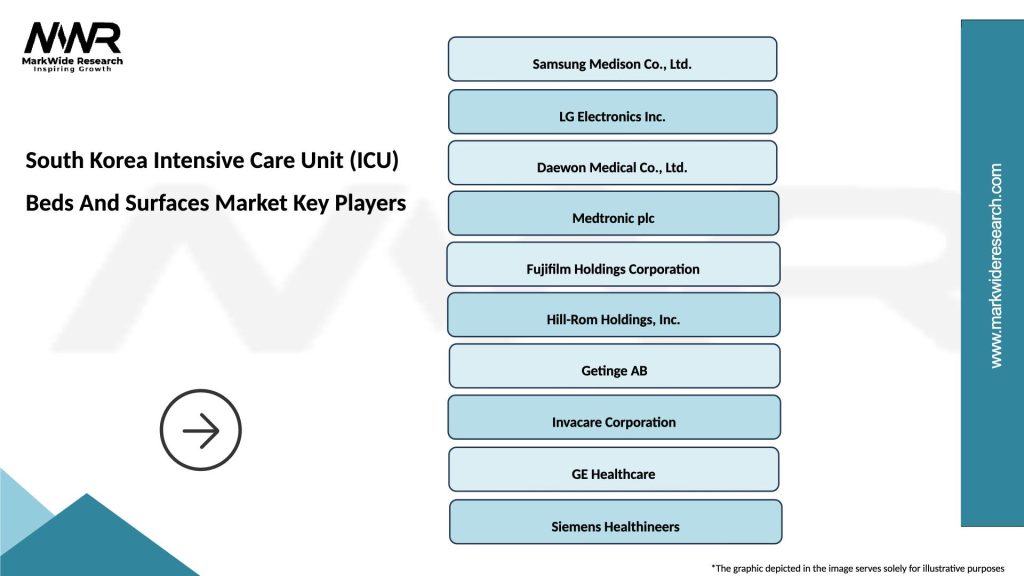

What are the key players in the South Korea Intensive Care Unit (ICU) Beds And Surfaces Market?

Key players in the South Korea Intensive Care Unit (ICU) Beds And Surfaces Market include companies like Hill-Rom, Stryker, and Getinge, which provide innovative solutions for critical care environments. These companies focus on enhancing patient safety and comfort through advanced technology and design, among others.

What are the growth factors driving the South Korea Intensive Care Unit (ICU) Beds And Surfaces Market?

The growth of the South Korea Intensive Care Unit (ICU) Beds And Surfaces Market is driven by an increasing prevalence of chronic diseases, a rise in the aging population, and advancements in healthcare technology. Additionally, the demand for better patient care and comfort in critical settings contributes to market expansion.

What challenges does the South Korea Intensive Care Unit (ICU) Beds And Surfaces Market face?

The South Korea Intensive Care Unit (ICU) Beds And Surfaces Market faces challenges such as high costs associated with advanced ICU equipment and the need for regular maintenance and training. Furthermore, regulatory compliance and the rapid pace of technological change can pose difficulties for manufacturers.

What opportunities exist in the South Korea Intensive Care Unit (ICU) Beds And Surfaces Market?

Opportunities in the South Korea Intensive Care Unit (ICU) Beds And Surfaces Market include the development of smart beds with integrated monitoring systems and the potential for growth in home healthcare settings. Additionally, increasing investments in healthcare infrastructure present avenues for expansion.

What trends are shaping the South Korea Intensive Care Unit (ICU) Beds And Surfaces Market?

Trends in the South Korea Intensive Care Unit (ICU) Beds And Surfaces Market include the integration of telemedicine and remote monitoring technologies, as well as a focus on ergonomic designs for improved patient comfort. Sustainability initiatives are also gaining traction, influencing product development and manufacturing processes.

South Korea Intensive Care Unit (ICU) Beds And Surfaces Market

| Segmentation Details | Description |

|---|---|

| Product Type | Electric Beds, Manual Beds, Stretchers, Surfaces |

| End User | Public Hospitals, Private Clinics, Rehabilitation Centers, Emergency Services |

| Technology | Smart Beds, Pressure Relief Systems, Monitoring Devices, Adjustable Surfaces |

| Application | Critical Care, Postoperative Recovery, Trauma Care, Long-term Care |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the South Korea Intensive Care Unit (ICU) Beds And Surfaces Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at