444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Ukraine electrocardiograph (ECG) market represents a critical segment of the country’s healthcare technology landscape, experiencing significant transformation despite ongoing geopolitical challenges. This specialized medical device market encompasses various ECG systems, from traditional 12-lead machines to advanced digital monitoring solutions that enable healthcare providers to diagnose and monitor cardiac conditions effectively. The market demonstrates remarkable resilience, with healthcare facilities prioritizing essential cardiac diagnostic equipment even amid economic uncertainties.

Market dynamics in Ukraine’s ECG sector reflect a growing emphasis on modernizing healthcare infrastructure and improving patient care standards. The demand for electrocardiograph systems has intensified as healthcare providers recognize the critical importance of early cardiac disease detection and continuous monitoring capabilities. Recent developments show that portable ECG devices account for approximately 35% of total market adoption, indicating a shift toward more flexible and accessible diagnostic solutions.

Healthcare digitization initiatives across Ukraine have accelerated the adoption of advanced ECG technologies, with telemedicine integration becoming increasingly important. The market encompasses both public healthcare institutions and private medical facilities, each contributing to the overall demand for sophisticated cardiac monitoring equipment. Regional distribution shows that urban medical centers represent approximately 60% of ECG system deployments, while rural healthcare facilities are gradually increasing their adoption rates through government-supported modernization programs.

The Ukraine electrocardiograph (ECG) market refers to the comprehensive ecosystem of medical devices, technologies, and services dedicated to cardiac electrical activity monitoring and diagnosis within Ukraine’s healthcare system. This market encompasses the manufacturing, distribution, installation, and maintenance of various ECG equipment types, ranging from basic single-channel devices to sophisticated multi-lead systems with advanced analytical capabilities.

ECG technology in the Ukrainian context includes traditional resting electrocardiographs, stress testing systems, Holter monitors for continuous cardiac monitoring, and emerging wireless ECG solutions that support remote patient monitoring. The market definition extends beyond hardware to include software solutions, data management systems, and integrated platforms that enable healthcare providers to efficiently capture, analyze, and store cardiac diagnostic information.

Market scope encompasses both domestic and imported ECG systems, with various stakeholders including medical device manufacturers, distributors, healthcare facilities, and regulatory bodies contributing to the overall market ecosystem. The definition also includes aftermarket services such as equipment maintenance, calibration, training programs, and technical support that ensure optimal device performance and compliance with medical standards.

Ukraine’s ECG market demonstrates remarkable adaptability and growth potential despite facing unprecedented challenges from geopolitical tensions and economic pressures. The market has shown resilience through strategic partnerships with international medical device manufacturers and continued investment in healthcare infrastructure modernization. Digital transformation initiatives have accelerated the adoption of advanced ECG technologies, with healthcare facilities prioritizing equipment that offers enhanced diagnostic capabilities and improved patient outcomes.

Key market drivers include the increasing prevalence of cardiovascular diseases, growing awareness of preventive healthcare measures, and government initiatives to modernize medical infrastructure. The market benefits from approximately 42% of healthcare facilities actively upgrading their cardiac diagnostic equipment, indicating strong demand for modern ECG solutions. Technological advancement remains a primary focus, with artificial intelligence integration and cloud-based data management becoming increasingly important for healthcare providers.

Competitive landscape features a mix of international medical device manufacturers and local distributors working collaboratively to meet market demands. The market shows promising growth trajectories, with portable and wireless ECG systems experiencing particularly strong adoption rates. Future prospects remain positive, supported by continued healthcare investment, technological innovation, and the critical importance of cardiac care in Ukraine’s medical system.

Strategic market analysis reveals several critical insights that define the Ukraine ECG market landscape. The following key insights provide comprehensive understanding of market dynamics and opportunities:

Primary market drivers propelling Ukraine’s ECG market growth stem from multiple healthcare, technological, and demographic factors. The increasing prevalence of cardiovascular diseases across all age groups creates sustained demand for advanced cardiac diagnostic equipment. Healthcare modernization initiatives supported by government programs and international partnerships drive significant investment in medical technology infrastructure, with ECG systems representing essential diagnostic tools for comprehensive patient care.

Technological advancement serves as a crucial market driver, with healthcare providers seeking ECG solutions that offer enhanced diagnostic accuracy, improved workflow efficiency, and seamless integration with existing medical systems. The growing emphasis on preventive healthcare measures encourages medical facilities to invest in sophisticated ECG equipment capable of early cardiac condition detection and continuous patient monitoring capabilities.

Digital health transformation initiatives across Ukraine’s healthcare system create substantial opportunities for advanced ECG technologies. The integration of artificial intelligence, machine learning algorithms, and cloud-based data management systems drives demand for next-generation ECG solutions. Telemedicine expansion particularly accelerates the adoption of portable and wireless ECG devices that enable remote patient monitoring and consultation services, addressing healthcare accessibility challenges in rural and underserved areas.

Professional healthcare training programs and medical education initiatives contribute to market growth by increasing awareness of advanced ECG diagnostic capabilities. Healthcare providers recognize the critical importance of accurate cardiac assessment tools, driving investment in sophisticated ECG systems that support comprehensive patient evaluation and treatment planning processes.

Significant market restraints challenge the Ukraine ECG market’s growth trajectory, primarily stemming from economic uncertainties and geopolitical tensions that impact healthcare spending and infrastructure development. Budget constraints within public healthcare institutions limit the procurement of advanced ECG equipment, forcing facilities to prioritize essential medical devices over sophisticated diagnostic technologies.

Supply chain disruptions pose considerable challenges for ECG equipment availability and maintenance services. International sanctions and trade restrictions affect the importation of medical devices and spare parts, creating potential delays in equipment delivery and ongoing technical support. Currency fluctuations further complicate procurement processes, making it difficult for healthcare facilities to plan long-term equipment investments and budget allocations effectively.

Technical infrastructure limitations in certain regions restrict the deployment of advanced ECG systems that require reliable internet connectivity and robust IT support. Rural healthcare facilities often lack the necessary technological infrastructure to support sophisticated digital ECG solutions, limiting market penetration in these areas. Skilled personnel shortages also constrain market growth, as healthcare facilities require trained technicians and medical professionals capable of operating and maintaining advanced ECG equipment.

Regulatory compliance challenges and certification processes can delay the introduction of new ECG technologies into the Ukrainian market. Complex approval procedures and documentation requirements may discourage some international manufacturers from entering the market, potentially limiting product availability and competitive pricing options for healthcare providers.

Substantial market opportunities emerge from Ukraine’s healthcare modernization efforts and the growing recognition of cardiac care importance. The expansion of telemedicine services creates significant demand for portable and wireless ECG devices that enable remote patient monitoring and consultation capabilities. Healthcare providers increasingly seek ECG solutions that support virtual care delivery models, particularly for elderly patients and those in rural areas with limited access to specialized cardiac care.

Public-private partnerships present valuable opportunities for ECG market expansion, with international healthcare organizations and medical device manufacturers collaborating to improve Ukraine’s cardiac diagnostic capabilities. These partnerships often include equipment donations, training programs, and technical support services that facilitate the adoption of advanced ECG technologies across various healthcare settings.

Digital health integration opportunities abound as healthcare facilities seek ECG systems with advanced connectivity features and data analytics capabilities. The development of AI-powered diagnostic algorithms and machine learning applications creates new market segments for intelligent ECG solutions that enhance diagnostic accuracy and clinical decision-making processes. Cloud-based ECG platforms offer opportunities for scalable solutions that support multi-facility healthcare networks and centralized cardiac care management.

Educational and training initiatives create opportunities for comprehensive ECG solution packages that include equipment, software, and professional development programs. Healthcare institutions value suppliers who provide complete solutions encompassing technology, training, and ongoing support services, creating opportunities for long-term partnerships and market expansion.

Complex market dynamics shape the Ukraine ECG market through interconnected factors including healthcare policy changes, technological innovation, and economic conditions. The market demonstrates cyclical patterns influenced by government healthcare budget allocations and international aid programs that support medical infrastructure development. Seasonal variations in procurement activities often align with fiscal year planning cycles and budget approval processes within public healthcare institutions.

Competitive dynamics reflect a balance between established international medical device manufacturers and emerging local distributors who provide specialized market knowledge and customer support services. The market benefits from approximately 28% annual equipment replacement rates, indicating healthy demand for upgraded ECG systems and modernization initiatives across healthcare facilities.

Technology adoption cycles influence market dynamics significantly, with healthcare providers gradually transitioning from analog to digital ECG systems and embracing wireless connectivity features. The integration of artificial intelligence and automated diagnostic algorithms creates new market segments while potentially disrupting traditional ECG interpretation workflows. Data security considerations increasingly impact purchasing decisions as healthcare facilities prioritize ECG systems with robust cybersecurity features and compliance with medical data protection standards.

Stakeholder relationships between manufacturers, distributors, healthcare facilities, and regulatory bodies create complex market dynamics that require careful navigation. Successful market participants demonstrate ability to adapt to changing conditions while maintaining consistent product quality and customer support standards throughout various market cycles and external challenges.

Comprehensive research methodology employed for analyzing the Ukraine ECG market incorporates multiple data collection techniques and analytical approaches to ensure accurate market assessment. Primary research activities include structured interviews with healthcare administrators, medical professionals, and ECG equipment users across various healthcare settings to gather firsthand insights about market conditions, technology preferences, and procurement challenges.

Secondary research components encompass analysis of healthcare industry reports, government healthcare statistics, medical device registration databases, and international trade data related to ECG equipment imports and exports. MarkWide Research methodologies integrate quantitative data analysis with qualitative market insights to provide comprehensive understanding of market dynamics and growth opportunities.

Data validation processes include cross-referencing information from multiple sources, conducting follow-up interviews with key market participants, and analyzing historical market trends to ensure research accuracy and reliability. The methodology incorporates regional analysis techniques that account for geographic variations in healthcare infrastructure, economic conditions, and market development patterns across different areas of Ukraine.

Market segmentation analysis employs systematic categorization approaches based on product types, end-user categories, technology features, and price ranges to provide detailed market structure understanding. Research methodology includes competitive landscape analysis, regulatory environment assessment, and future market projection modeling to deliver comprehensive market intelligence for stakeholders and decision-makers.

Regional market distribution across Ukraine reveals significant variations in ECG equipment adoption and healthcare infrastructure development. Western regions demonstrate strong market activity, with approximately 38% of total ECG installations concentrated in major cities like Lviv, Ivano-Frankivsk, and Ternopil, where healthcare facilities benefit from proximity to European medical technology suppliers and international healthcare partnerships.

Central Ukraine represents the largest market segment, anchored by Kyiv’s extensive healthcare network and surrounding metropolitan areas. The capital region accounts for substantial ECG market share due to the concentration of major hospitals, specialized cardiac centers, and medical research institutions. Government healthcare facilities in central regions drive significant demand for standardized ECG systems that meet national healthcare protocols and quality standards.

Eastern and southern regions present unique market challenges and opportunities, with healthcare facilities adapting to changing conditions while maintaining essential cardiac diagnostic capabilities. These areas show increasing demand for portable and ruggedized ECG systems that can operate reliably under various environmental conditions. Regional healthcare networks in these areas often prioritize ECG equipment with minimal maintenance requirements and robust technical support availability.

Rural healthcare expansion initiatives create emerging market opportunities across all regions, with government programs supporting the deployment of basic ECG equipment in smaller medical facilities and community health centers. These initiatives typically focus on cost-effective, user-friendly ECG solutions that require minimal specialized training and technical infrastructure, representing approximately 22% of new market installations annually.

Competitive market structure in Ukraine’s ECG sector features a diverse mix of international medical device manufacturers and specialized local distributors who collaborate to serve various healthcare market segments. The competitive landscape demonstrates healthy market dynamics with multiple players offering different technology solutions and service approaches to meet diverse customer needs.

Leading market participants include:

Competitive strategies focus on product differentiation through advanced features, comprehensive service packages, and flexible financing options that accommodate healthcare facility budget constraints. Market leaders emphasize training programs, technical support excellence, and long-term partnership approaches that build customer loyalty and market share retention.

Local distribution networks play crucial roles in competitive positioning, with successful companies establishing strong relationships with regional healthcare administrators and medical professionals who influence ECG equipment procurement decisions.

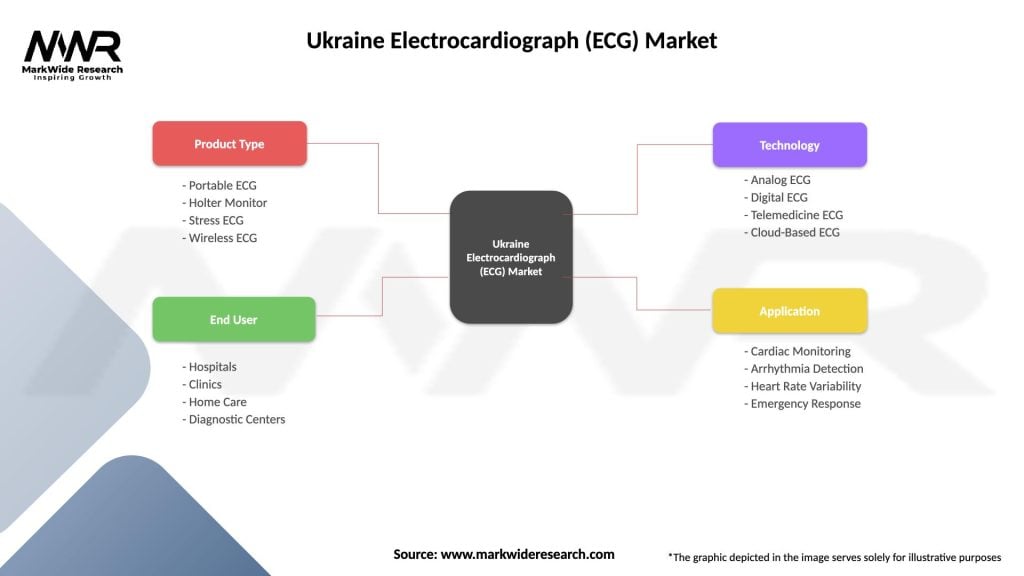

Market segmentation analysis reveals distinct categories within Ukraine’s ECG market, each serving specific healthcare needs and customer requirements. Product-based segmentation encompasses various ECG system types, from basic single-channel devices to sophisticated multi-lead systems with advanced analytical capabilities and connectivity features.

By Product Type:

By End User:

By Technology:

Resting ECG systems represent the largest market category, accounting for approximately 45% of total market installations across Ukrainian healthcare facilities. These traditional 12-lead systems remain essential for routine cardiac assessment and diagnostic procedures, with healthcare providers prioritizing reliability, accuracy, and ease of use. Digital resting ECG systems show particularly strong adoption rates as facilities upgrade from analog equipment to modern solutions with electronic data management capabilities.

Portable ECG devices demonstrate the fastest growth trajectory within the market, driven by increasing demand for flexible diagnostic solutions and point-of-care testing capabilities. This category benefits from telemedicine expansion and the need for cardiac monitoring in various healthcare settings beyond traditional hospital environments. Wireless connectivity features in portable ECG systems create additional value for healthcare providers seeking integrated diagnostic workflows.

Holter monitoring systems represent a specialized but growing market segment, with approximately 18% market share among continuous cardiac monitoring solutions. Healthcare facilities recognize the diagnostic value of extended cardiac rhythm analysis, driving demand for comfortable, reliable Holter devices that provide comprehensive patient monitoring data. Advanced Holter systems with automated analysis capabilities particularly appeal to busy cardiology practices and hospital cardiac units.

Stress test ECG systems serve specialized market needs within cardiac rehabilitation centers and comprehensive cardiology practices. This category requires sophisticated equipment capable of monitoring cardiac response during controlled exercise protocols, with emphasis on patient safety features and accurate data capture during physical stress conditions.

Healthcare providers benefit significantly from advanced ECG technologies through improved diagnostic accuracy, enhanced workflow efficiency, and better patient care outcomes. Modern ECG systems enable faster diagnosis of cardiac conditions, reducing patient waiting times and supporting more efficient clinical decision-making processes. Integration capabilities with electronic health records streamline documentation and data management, allowing medical professionals to focus more time on patient care rather than administrative tasks.

Patients experience substantial benefits from advanced ECG technologies, including more comfortable testing procedures, faster diagnostic results, and improved access to cardiac care through telemedicine applications. Portable ECG devices enable cardiac monitoring in convenient settings, reducing the need for hospital visits while maintaining high-quality diagnostic capabilities. Remote monitoring capabilities particularly benefit elderly patients and those with mobility limitations who require regular cardiac assessment.

Medical device manufacturers gain market opportunities through Ukraine’s healthcare modernization initiatives and growing demand for advanced diagnostic technologies. The market provides opportunities for product innovation, technology demonstration, and long-term partnership development with healthcare institutions. Service-oriented business models create recurring revenue streams through maintenance contracts, training programs, and technical support services.

Healthcare administrators benefit from ECG systems that offer cost-effective diagnostic solutions, reliable performance, and comprehensive support services. Modern ECG equipment helps healthcare facilities improve operational efficiency, reduce diagnostic errors, and enhance patient satisfaction scores. Data analytics capabilities in advanced ECG systems support quality improvement initiatives and clinical outcome measurement programs.

Strengths:

Weaknesses:

Opportunities:

Threats:

Digital transformation represents the most significant trend shaping Ukraine’s ECG market, with healthcare facilities increasingly adopting digital ECG systems that offer electronic data storage, automated analysis, and seamless integration with hospital information systems. This trend accelerates as healthcare providers recognize the operational efficiency benefits and improved diagnostic capabilities offered by digital ECG technologies. Cloud-based ECG platforms gain popularity for their scalability and remote access capabilities.

Artificial intelligence integration emerges as a transformative trend, with AI-powered ECG analysis algorithms providing automated interpretation assistance and enhanced diagnostic accuracy. Healthcare providers show growing interest in ECG systems that incorporate machine learning capabilities to support clinical decision-making and reduce interpretation errors. Predictive analytics applications in ECG technology offer opportunities for early cardiac risk assessment and preventive care interventions.

Portable and wireless ECG solutions experience accelerated adoption driven by telemedicine expansion and the need for flexible diagnostic capabilities. Healthcare facilities increasingly value ECG devices that enable point-of-care testing and remote patient monitoring, particularly for elderly patients and those in rural areas. Smartphone-compatible ECG devices represent an emerging trend that could democratize cardiac monitoring capabilities.

Integrated healthcare platforms drive demand for ECG systems with comprehensive connectivity features and interoperability with electronic health records. Healthcare providers seek ECG solutions that seamlessly integrate with existing medical systems and support coordinated care delivery models. Data standardization initiatives promote ECG systems that comply with international healthcare data exchange protocols.

Recent industry developments highlight significant advancements in ECG technology and market expansion initiatives within Ukraine’s healthcare sector. International partnerships between Ukrainian healthcare institutions and global medical device manufacturers have facilitated the introduction of advanced ECG systems and comprehensive training programs for medical professionals.

Technology innovations include the development of ultra-portable ECG devices with smartphone connectivity, enabling healthcare providers to perform cardiac assessments in various settings while maintaining diagnostic accuracy. AI-powered ECG analysis systems have been introduced that provide automated interpretation assistance and flag potential cardiac abnormalities for physician review.

Regulatory developments include updated medical device certification processes that streamline the approval of advanced ECG technologies while maintaining safety and quality standards. These regulatory improvements facilitate faster market entry for innovative ECG solutions and encourage technology advancement within the healthcare sector.

Healthcare infrastructure projects supported by international aid organizations have resulted in the deployment of modern ECG equipment in previously underserved areas. These initiatives often include comprehensive packages encompassing equipment donation, installation, training, and ongoing technical support to ensure sustainable cardiac diagnostic capabilities.

Educational initiatives have expanded to include specialized ECG interpretation training programs for healthcare professionals, supporting the effective utilization of advanced diagnostic equipment and improving overall cardiac care quality across Ukrainian healthcare facilities.

Strategic recommendations for ECG market participants emphasize the importance of developing flexible, cost-effective solutions that address the unique challenges and opportunities within Ukraine’s healthcare environment. MWR analysis suggests that successful market strategies should focus on comprehensive service packages that include equipment, training, and ongoing technical support to maximize customer value and long-term relationships.

Technology development priorities should emphasize portability, reliability, and ease of use, with particular attention to ECG systems that can operate effectively in various environmental conditions and with minimal technical infrastructure requirements. Wireless connectivity features and telemedicine compatibility represent essential capabilities for future ECG solutions in the Ukrainian market.

Partnership strategies should leverage local distribution networks and healthcare relationships to ensure effective market penetration and customer support. International manufacturers benefit from collaborating with established local partners who understand regional healthcare needs and can provide culturally appropriate customer service and technical support.

Pricing strategies must balance advanced technology features with budget constraints faced by many Ukrainian healthcare facilities. Flexible financing options and leasing programs can help healthcare providers access modern ECG equipment while managing cash flow and budget limitations effectively.

Training and education investments represent critical success factors, with market participants encouraged to develop comprehensive professional development programs that ensure healthcare providers can maximize the diagnostic value of advanced ECG technologies. These programs should include both initial training and ongoing education to support technology advancement and clinical best practices.

Future market prospects for Ukraine’s ECG sector remain positive despite ongoing challenges, with healthcare modernization initiatives and technological advancement driving sustained demand for advanced cardiac diagnostic equipment. The market is expected to experience steady growth as healthcare facilities continue upgrading from legacy systems to modern digital ECG solutions with enhanced capabilities and connectivity features.

Technology evolution will likely focus on artificial intelligence integration, with ECG systems incorporating increasingly sophisticated automated analysis algorithms that support clinical decision-making and improve diagnostic accuracy. Machine learning applications in ECG interpretation are projected to become standard features, helping healthcare providers identify subtle cardiac abnormalities and predict potential cardiac events.

Telemedicine integration will continue expanding, with ECG devices becoming increasingly connected and capable of supporting remote patient monitoring and virtual consultation services. This trend particularly benefits rural healthcare access and elderly patient care, creating new market segments and service delivery models. Cloud-based ECG platforms are expected to gain significant market share as healthcare facilities embrace scalable, remotely accessible diagnostic solutions.

Market consolidation may occur as successful ECG manufacturers and distributors expand their market presence through strategic partnerships and service enhancement initiatives. MarkWide Research projections indicate that companies offering comprehensive ECG solutions with integrated training and support services will achieve the strongest market positions and customer loyalty.

Regulatory environment improvements are anticipated to facilitate faster introduction of innovative ECG technologies while maintaining appropriate safety and quality standards. These developments should encourage continued investment in ECG technology advancement and market expansion initiatives across Ukraine’s healthcare sector.

Ukraine’s electrocardiograph (ECG) market demonstrates remarkable resilience and growth potential despite facing significant geopolitical and economic challenges. The market benefits from the essential nature of cardiac diagnostic equipment and continued healthcare modernization efforts that prioritize advanced medical technology adoption. Digital transformation initiatives and telemedicine expansion create substantial opportunities for innovative ECG solutions that support improved patient care and operational efficiency.

Market dynamics reflect a healthy balance between established international manufacturers and local distribution partners who collaborate to serve diverse healthcare facility needs across urban and rural settings. The competitive landscape encourages innovation while maintaining focus on cost-effectiveness and comprehensive customer support services that are essential for market success in Ukraine’s healthcare environment.

Future growth prospects remain positive, supported by artificial intelligence integration, wireless connectivity advancement, and continued investment in healthcare infrastructure development. The market’s evolution toward more sophisticated, user-friendly ECG solutions positions it well for sustained expansion and technological advancement. Strategic partnerships between international technology providers and local healthcare stakeholders will continue driving market development and ensuring Ukrainian patients have access to world-class cardiac diagnostic capabilities.

What is Electrocardiograph (ECG)?

An Electrocardiograph (ECG) is a medical device that records the electrical activity of the heart over a period of time. It is commonly used to diagnose heart conditions, monitor heart health, and guide treatment decisions.

What are the key players in the Ukraine Electrocardiograph (ECG) Market?

Key players in the Ukraine Electrocardiograph (ECG) Market include GE Healthcare, Philips Healthcare, and Siemens Healthineers, among others. These companies are known for their innovative ECG technologies and comprehensive healthcare solutions.

What are the growth factors driving the Ukraine Electrocardiograph (ECG) Market?

The Ukraine Electrocardiograph (ECG) Market is driven by factors such as the increasing prevalence of cardiovascular diseases, advancements in ECG technology, and the growing demand for remote patient monitoring solutions.

What challenges does the Ukraine Electrocardiograph (ECG) Market face?

Challenges in the Ukraine Electrocardiograph (ECG) Market include regulatory hurdles, the high cost of advanced ECG systems, and the need for skilled professionals to operate and interpret ECG data.

What opportunities exist in the Ukraine Electrocardiograph (ECG) Market?

Opportunities in the Ukraine Electrocardiograph (ECG) Market include the expansion of telemedicine services, increasing investments in healthcare infrastructure, and the rising awareness of preventive healthcare measures.

What trends are shaping the Ukraine Electrocardiograph (ECG) Market?

Trends in the Ukraine Electrocardiograph (ECG) Market include the integration of artificial intelligence in ECG analysis, the development of portable ECG devices, and the growing emphasis on patient-centric healthcare solutions.

Ukraine Electrocardiograph (ECG) Market

| Segmentation Details | Description |

|---|---|

| Product Type | Portable ECG, Holter Monitor, Stress ECG, Wireless ECG |

| End User | Hospitals, Clinics, Home Care, Diagnostic Centers |

| Technology | Analog ECG, Digital ECG, Telemedicine ECG, Cloud-Based ECG |

| Application | Cardiac Monitoring, Arrhythmia Detection, Heart Rate Variability, Emergency Response |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Ukraine Electrocardiograph (ECG) Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at