444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

The veterinary and animal healthcare logistics market represents a specialized segment within the broader healthcare supply chain industry, focusing on the efficient distribution and management of veterinary pharmaceuticals, medical devices, vaccines, and diagnostic equipment. This market has experienced remarkable transformation driven by increasing pet ownership, growing awareness of animal welfare, and the expansion of livestock farming operations globally.

Market dynamics indicate robust growth potential, with the sector demonstrating resilience even during economic uncertainties. The integration of advanced technologies such as cold chain management systems, real-time tracking solutions, and automated inventory management has revolutionized how veterinary products reach end-users. Temperature-sensitive products constitute approximately 45% of veterinary logistics, requiring sophisticated cold chain infrastructure to maintain product efficacy.

Regional distribution patterns show North America and Europe leading in market maturity, while Asia-Pacific regions demonstrate the highest growth rates at approximately 8.2% annually. The market encompasses various stakeholders including pharmaceutical manufacturers, third-party logistics providers, veterinary clinics, animal hospitals, and agricultural enterprises. E-commerce penetration in veterinary product distribution has reached 28% market share, accelerating the need for specialized last-mile delivery solutions.

Supply chain complexity in veterinary logistics stems from diverse product categories ranging from routine medications to specialized surgical equipment. The market serves multiple animal segments including companion animals, livestock, aquaculture, and wildlife conservation programs. Regulatory compliance requirements vary significantly across regions, with approximately 75% of veterinary logistics operations requiring specialized handling protocols for controlled substances and biologics.

The veterinary and animal healthcare logistics market refers to the comprehensive ecosystem of supply chain services, infrastructure, and technologies dedicated to the storage, transportation, and distribution of veterinary pharmaceuticals, medical devices, vaccines, diagnostic equipment, and related healthcare products for animals. This specialized logistics sector encompasses the entire journey from manufacturer to end-user, including veterinary clinics, animal hospitals, farms, pet retailers, and direct-to-consumer channels.

Core components of this market include warehousing facilities with specialized storage conditions, temperature-controlled transportation networks, inventory management systems, regulatory compliance protocols, and last-mile delivery services. The market addresses unique challenges such as maintaining cold chain integrity for vaccines and biologics, managing controlled substances according to regulatory requirements, and ensuring rapid delivery for emergency veterinary situations.

Stakeholder integration involves pharmaceutical manufacturers, biotechnology companies, medical device producers, third-party logistics providers, distributors, wholesalers, and end-users across companion animal and livestock sectors. The market facilitates seamless product flow while maintaining quality standards, regulatory compliance, and cost-effectiveness throughout the supply chain network.

Market evolution in veterinary and animal healthcare logistics reflects the growing sophistication of animal healthcare delivery systems worldwide. The sector has transformed from traditional distribution models to technology-enabled, integrated supply chain solutions that prioritize product integrity, delivery speed, and regulatory compliance. Digital transformation initiatives have penetrated approximately 62% of logistics operations, enhancing visibility and operational efficiency.

Key growth drivers include increasing pet humanization trends, expansion of livestock farming operations, rising awareness of zoonotic diseases, and growing demand for specialized veterinary treatments. The market benefits from technological advancements in cold chain management, IoT-enabled tracking systems, and automated warehouse operations. Companion animal segment accounts for approximately 55% of logistics volume, driven by premium pet care trends and increasing veterinary visit frequencies.

Competitive landscape features established pharmaceutical logistics companies expanding into veterinary segments alongside specialized animal healthcare distributors. Market consolidation trends have accelerated, with major players acquiring regional distributors to enhance geographic coverage and service capabilities. Service diversification includes value-added services such as inventory management, regulatory consulting, and direct-to-consumer fulfillment solutions.

Future prospects indicate continued market expansion supported by emerging markets adoption, technological innovation, and evolving animal healthcare standards. The integration of artificial intelligence, blockchain technology, and sustainable logistics practices represents key development areas for market participants seeking competitive advantages.

Market segmentation analysis reveals distinct patterns across product categories, geographic regions, and end-user segments. The following insights provide comprehensive understanding of market dynamics:

Emerging trends include the rise of direct-to-consumer veterinary product sales, integration of telemedicine platforms with logistics services, and development of specialized rural delivery networks. Customer behavior shifts toward online purchasing have accelerated, particularly in companion animal segments where convenience and product availability drive purchasing decisions.

Primary growth catalysts propelling the veterinary and animal healthcare logistics market stem from fundamental shifts in animal healthcare consumption patterns and technological capabilities. The increasing humanization of pets has created demand for sophisticated medical treatments requiring specialized logistics support.

Pet ownership trends continue expanding globally, with household pet ownership rates reaching historic highs in developed markets. This demographic shift drives consistent demand for veterinary services and associated product distribution. Premium pet care adoption has increased by approximately 35% over five years, creating opportunities for specialized logistics services supporting high-value treatments and medications.

Livestock industry expansion in emerging markets generates substantial demand for veterinary logistics services. Growing protein consumption worldwide necessitates enhanced animal health management, driving demand for vaccines, pharmaceuticals, and diagnostic products. Commercial farming operations increasingly rely on just-in-time delivery systems to optimize inventory costs while ensuring product availability.

Regulatory evolution toward stricter animal welfare standards creates opportunities for logistics providers offering compliance expertise and specialized handling capabilities. Enhanced traceability requirements for animal pharmaceuticals drive adoption of advanced tracking technologies and documentation systems.

Technological advancement in cold chain management, IoT sensors, and predictive analytics enables more sophisticated logistics solutions. These capabilities support market expansion by reducing product waste, improving delivery reliability, and enabling new service models such as temperature-guaranteed delivery and real-time inventory optimization.

E-commerce penetration in veterinary product sales accelerates demand for last-mile delivery solutions and direct-to-consumer fulfillment capabilities. Online veterinary pharmacy growth creates new distribution channels requiring specialized logistics support for prescription management and customer service integration.

Operational challenges within the veterinary and animal healthcare logistics market create significant barriers to growth and profitability. Complex regulatory frameworks governing veterinary pharmaceuticals and controlled substances require substantial compliance investments and ongoing operational adjustments.

Cold chain infrastructure limitations pose substantial challenges, particularly in emerging markets where temperature-controlled storage and transportation capabilities remain underdeveloped. The requirement for continuous temperature monitoring and backup systems increases operational costs and complexity, limiting market accessibility for smaller logistics providers.

Regulatory compliance costs associated with veterinary pharmaceutical distribution create significant barriers to entry. Requirements for specialized licensing, facility certifications, and personnel training represent substantial fixed costs that may not be economically viable for smaller market participants. Compliance-related expenses can account for up to 15% of operational costs for specialized veterinary logistics providers.

Geographic distribution challenges in rural and remote areas limit market penetration and service quality. The scattered nature of veterinary practices and agricultural operations creates logistical complexities that increase delivery costs and reduce service frequency. Rural delivery costs can be 40% higher than urban distribution due to distance and volume constraints.

Inventory management complexity stems from diverse product portfolios with varying shelf lives, storage requirements, and demand patterns. Managing slow-moving specialty products alongside high-turnover items requires sophisticated forecasting and inventory optimization capabilities that may exceed the resources of smaller logistics providers.

Technology investment requirements for advanced tracking, monitoring, and compliance systems represent significant capital expenditures. The need for continuous technology upgrades to meet evolving regulatory and customer requirements creates ongoing financial pressures, particularly for regional logistics providers with limited resources.

Emerging market expansion presents substantial growth opportunities as developing regions experience rising pet ownership rates and modernizing livestock operations. Countries in Asia-Pacific, Latin America, and Africa demonstrate increasing demand for veterinary services and associated logistics support, creating opportunities for market entry and expansion.

Technology integration opportunities include the development of AI-powered demand forecasting systems, blockchain-based traceability solutions, and automated warehouse operations. These technological advances can improve operational efficiency, reduce costs, and enable new service offerings that differentiate providers in competitive markets.

Specialized service development in areas such as emergency delivery services, clinical trial logistics, and direct-to-consumer fulfillment creates opportunities for premium pricing and customer loyalty. Emergency delivery services command price premiums of 25-40% compared to standard delivery options, reflecting the critical nature of veterinary care timing.

Partnership opportunities with veterinary practice management companies, telemedicine platforms, and e-commerce marketplaces enable logistics providers to access new customer segments and revenue streams. Integration with digital health platforms creates opportunities for value-added services such as automated reordering and inventory management.

Sustainability initiatives present opportunities for differentiation and cost reduction through optimized routing, packaging innovations, and alternative fuel adoption. Environmental considerations increasingly influence purchasing decisions, creating competitive advantages for logistics providers demonstrating sustainability leadership.

Consolidation opportunities exist for well-capitalized logistics providers to acquire regional distributors and specialized service providers. Market fragmentation creates opportunities for strategic acquisitions that enhance geographic coverage, service capabilities, and operational scale.

Competitive forces within the veterinary and animal healthcare logistics market reflect the interplay between established pharmaceutical distributors, specialized veterinary logistics providers, and emerging technology-enabled service companies. Market dynamics are characterized by ongoing consolidation, technological innovation, and evolving customer expectations.

Supply chain evolution toward more integrated and technology-enabled solutions drives competitive differentiation. Companies investing in advanced warehouse automation, predictive analytics, and customer portal technologies gain competitive advantages through improved service quality and operational efficiency. Technology adoption rates among leading providers exceed 80% for core logistics management systems.

Customer relationship dynamics emphasize long-term partnerships over transactional relationships. Veterinary practices and agricultural operations increasingly seek logistics partners capable of providing comprehensive supply chain solutions including inventory management, regulatory compliance, and emergency delivery services.

Pricing pressures from cost-conscious customers drive operational efficiency improvements and service innovation. Logistics providers must balance competitive pricing with service quality requirements, leading to increased focus on automation and process optimization. Cost reduction initiatives have improved operational margins by approximately 12% for leading market participants.

Regulatory dynamics continue evolving with enhanced traceability requirements, stricter cold chain standards, and expanded controlled substance regulations. These changes create both challenges and opportunities, favoring providers with robust compliance capabilities while creating barriers for less sophisticated competitors.

Market maturation in developed regions drives focus on service differentiation and value-added offerings, while emerging markets prioritize basic distribution capabilities and geographic coverage expansion. This dual dynamic requires flexible business models capable of addressing diverse market requirements.

Comprehensive market analysis for the veterinary and animal healthcare logistics sector employs multi-faceted research approaches combining primary data collection, secondary source analysis, and industry expert consultations. The methodology ensures accurate market characterization and reliable trend identification across diverse geographic and product segments.

Primary research activities include structured interviews with logistics executives, veterinary practice managers, pharmaceutical manufacturers, and regulatory officials. Survey methodologies capture quantitative data on market sizing, growth rates, and competitive positioning while qualitative discussions provide insights into market dynamics and future trends.

Secondary research sources encompass industry publications, regulatory filings, company annual reports, and trade association data. Government statistics on pet ownership, livestock populations, and veterinary spending provide foundational market sizing information. Academic research on supply chain optimization and cold chain management contributes technical insights.

Data validation processes include cross-referencing multiple sources, conducting follow-up interviews for clarification, and applying statistical analysis to identify data consistency and reliability. Market sizing estimates undergo triangulation using multiple calculation methodologies to ensure accuracy.

Geographic coverage spans major developed markets in North America and Europe alongside high-growth emerging markets in Asia-Pacific, Latin America, and select African regions. Regional analysis considers local regulatory environments, infrastructure capabilities, and market development stages.

Analytical frameworks include Porter’s Five Forces analysis for competitive assessment, SWOT analysis for strategic positioning evaluation, and scenario modeling for future market projections. MarkWide Research analytical methodologies ensure comprehensive market understanding and actionable insights for stakeholders.

North American market leadership reflects mature veterinary care infrastructure, high pet ownership rates, and sophisticated logistics capabilities. The region demonstrates strong demand for premium veterinary services and associated logistics support, with companion animal logistics representing approximately 60% of regional volume. Advanced cold chain infrastructure and regulatory compliance capabilities support complex product distribution requirements.

European market dynamics emphasize regulatory compliance and sustainability considerations. Stringent animal welfare regulations and environmental standards drive demand for specialized logistics services. The region’s fragmented geographic structure creates opportunities for regional logistics providers while challenging pan-European distribution strategies. Cross-border logistics complexity requires sophisticated regulatory expertise and documentation management capabilities.

Asia-Pacific growth trajectory represents the most dynamic regional market, driven by rising pet ownership, expanding livestock operations, and improving veterinary care standards. Countries such as China, India, and Southeast Asian nations demonstrate rapid market development with annual growth rates exceeding 10% in key segments. Infrastructure development and regulatory modernization support market expansion opportunities.

Latin American markets show increasing sophistication in veterinary care delivery and logistics requirements. Brazil and Mexico lead regional development with established livestock industries and growing companion animal segments. Rural distribution challenges create opportunities for innovative logistics solutions addressing geographic and infrastructure constraints.

Middle East and Africa represent emerging opportunities with developing veterinary care infrastructure and increasing awareness of animal health importance. Oil-rich nations demonstrate high spending on premium pet care while agricultural economies focus on livestock health management. Infrastructure limitations require creative logistics solutions and local partnership strategies.

Regional market share distribution shows North America and Europe accounting for approximately 65% of global market value, while Asia-Pacific represents the fastest-growing segment with expanding market share expectations over the forecast period.

Market leadership in veterinary and animal healthcare logistics involves established pharmaceutical distributors, specialized veterinary logistics companies, and emerging technology-enabled service providers. The competitive environment reflects ongoing consolidation trends and increasing emphasis on technological capabilities and service differentiation.

Major market participants include:

Competitive strategies focus on geographic expansion, technology integration, and service portfolio diversification. Leading companies invest heavily in warehouse automation, tracking systems, and customer service platforms to differentiate their offerings and improve operational efficiency.

Market consolidation trends continue as larger players acquire regional distributors and specialized service providers to enhance geographic coverage and service capabilities. These acquisitions enable scale economies and improved service delivery while creating barriers to entry for new competitors.

Innovation focus areas include cold chain optimization, real-time tracking capabilities, automated inventory management, and integrated e-commerce platforms. Companies developing superior technological capabilities gain competitive advantages through improved service quality and operational efficiency.

Product-based segmentation reveals distinct market characteristics across veterinary pharmaceutical categories, medical devices, vaccines, and diagnostic equipment. Each segment demonstrates unique logistics requirements, regulatory considerations, and growth patterns that influence service delivery strategies and competitive positioning.

By Product Type:

By End User:

By Geographic Region:

Pharmaceutical logistics represents the most complex and regulated segment within veterinary healthcare distribution. This category encompasses prescription medications, controlled substances, and over-the-counter treatments requiring sophisticated compliance management and secure handling protocols. Controlled substance distribution accounts for approximately 25% of pharmaceutical logistics volume but requires specialized licensing and security measures.

Cold chain logistics for vaccines and biologics demands the highest level of technical expertise and infrastructure investment. Temperature excursions can render products ineffective, creating liability concerns and customer satisfaction issues. Advanced monitoring systems and backup refrigeration capabilities are essential for maintaining product integrity throughout the distribution process.

Medical device distribution involves diverse product categories ranging from small diagnostic instruments to large surgical equipment. Logistics requirements vary significantly based on product size, fragility, and regulatory classification. High-value equipment often requires specialized handling, installation services, and technical support capabilities.

Emergency delivery services represent a premium category addressing critical veterinary care situations. These services require 24/7 availability, rapid response capabilities, and comprehensive product inventory to support urgent medical needs. Emergency services typically command premium pricing of 30-50% above standard delivery rates.

Direct-to-consumer fulfillment has emerged as a significant growth category driven by e-commerce adoption and prescription management requirements. This segment requires integration with veterinary practice management systems, prescription verification capabilities, and consumer-friendly packaging and delivery options.

Bulk agricultural distribution serves large-scale livestock operations with specialized handling equipment and delivery scheduling to accommodate operational requirements. This category emphasizes cost efficiency and reliability over speed, with bulk deliveries representing approximately 35% of livestock segment volume.

Veterinary practices benefit from specialized logistics services through improved inventory management, reduced carrying costs, and enhanced product availability. Professional logistics providers offer expertise in regulatory compliance, cold chain management, and emergency delivery capabilities that would be difficult for individual practices to develop independently.

Pharmaceutical manufacturers gain access to specialized distribution networks with veterinary market expertise and established customer relationships. Logistics partners provide market intelligence, regulatory compliance support, and efficient distribution capabilities that enable manufacturers to focus on product development and marketing activities.

Livestock operations achieve cost savings through optimized inventory management, bulk purchasing opportunities, and reliable delivery scheduling that supports operational efficiency. Specialized logistics providers understand agricultural operational requirements and can adapt service delivery to accommodate seasonal variations and production cycles.

Pet owners benefit from improved product availability, faster delivery times, and enhanced convenience through direct-to-consumer services. Professional logistics networks ensure product quality and authenticity while providing customer service support for questions and concerns.

Logistics service providers access growing market opportunities with premium pricing potential and long-term customer relationships. The specialized nature of veterinary logistics creates competitive barriers and customer loyalty that support sustainable business models.

Regulatory authorities benefit from professional logistics providers’ compliance expertise and systematic approach to product traceability and quality management. Established logistics networks facilitate regulatory oversight and enforcement activities while supporting public health objectives.

Investment community recognizes veterinary logistics as a stable, growing market segment with defensive characteristics and attractive returns. The essential nature of animal healthcare creates consistent demand patterns that support predictable revenue streams and long-term growth prospects.

Strengths:

Weaknesses:

Opportunities:

Threats:

Digital transformation acceleration continues reshaping veterinary logistics operations through advanced analytics, automation, and customer portal technologies. Digital adoption rates have increased by approximately 55% over recent years, driven by customer expectations for real-time visibility and self-service capabilities.

Cold chain optimization represents a critical trend as temperature-sensitive products become increasingly important in veterinary medicine. Advanced monitoring systems, predictive maintenance, and backup refrigeration capabilities are becoming standard requirements for premium logistics services.

Sustainability focus influences packaging choices, transportation mode selection, and facility operations as environmental considerations gain importance among customers and regulatory authorities. Sustainable packaging adoption has reached approximately 40% of shipments among leading logistics providers.

Direct-to-consumer growth accelerates as pet owners seek convenience and veterinary practices explore new revenue models. This trend requires integration with prescription management systems, consumer-friendly packaging, and last-mile delivery capabilities.

Consolidation momentum continues as larger logistics providers acquire regional distributors and specialized service companies to enhance geographic coverage and service capabilities. Market consolidation creates opportunities for scale economies while potentially reducing competitive intensity.

Technology integration with veterinary practice management systems enables automated reordering, inventory optimization, and seamless workflow integration. These capabilities improve operational efficiency for veterinary practices while creating customer loyalty for logistics providers.

Emergency service expansion addresses critical care situations requiring rapid product delivery and 24/7 availability. This premium service category demonstrates strong growth potential with attractive pricing margins for specialized logistics providers.

Strategic acquisitions continue reshaping the competitive landscape as major logistics companies expand their veterinary market presence through targeted acquisitions of specialized distributors and regional service providers. These transactions enhance geographic coverage, service capabilities, and customer relationships while creating operational synergies.

Technology partnerships between logistics providers and software companies enable advanced inventory management, predictive analytics, and customer portal capabilities. These collaborations accelerate digital transformation while reducing individual company development costs and implementation risks.

Regulatory developments in traceability requirements and cold chain standards drive operational improvements and technology investments. Enhanced compliance capabilities become competitive advantages while creating barriers to entry for less sophisticated providers.

Infrastructure investments in automated warehouses, advanced refrigeration systems, and tracking technologies improve operational efficiency and service quality. Leading companies demonstrate commitment to long-term market leadership through substantial capital expenditures in logistics infrastructure.

Service innovation includes development of specialized delivery services for emergency situations, integration with telemedicine platforms, and expansion of direct-to-consumer fulfillment capabilities. These innovations address evolving customer needs while creating competitive differentiation.

Geographic expansion into emerging markets accelerates as companies seek growth opportunities beyond mature developed markets. International expansion requires adaptation to local regulatory environments, infrastructure limitations, and cultural considerations.

Sustainability initiatives encompass alternative fuel adoption, packaging optimization, and carbon footprint reduction programs. Environmental considerations increasingly influence customer purchasing decisions and regulatory requirements, driving operational changes across the industry.

Investment prioritization should focus on technology infrastructure development, particularly in areas of cold chain management, real-time tracking, and customer portal capabilities. Companies demonstrating superior technological capabilities gain competitive advantages through improved service quality and operational efficiency.

Geographic expansion strategies should emphasize emerging markets with growing pet ownership and modernizing livestock operations. MWR analysis indicates that Asia-Pacific and Latin American markets offer the highest growth potential, though infrastructure development and regulatory adaptation require careful planning and local partnerships.

Service diversification opportunities include value-added offerings such as inventory management, regulatory consulting, and emergency delivery services. These premium services command higher margins while creating customer loyalty and competitive differentiation.

Partnership development with veterinary practice management companies, e-commerce platforms, and telemedicine providers can access new customer segments and revenue streams. Strategic alliances enable market expansion while sharing development costs and risks.

Operational excellence initiatives should emphasize automation, process optimization, and quality management systems. Continuous improvement programs reduce costs while enhancing service reliability and customer satisfaction.

Regulatory compliance investment remains essential for market participation and competitive positioning. Companies with superior compliance capabilities gain customer trust and regulatory authority support while avoiding operational disruptions and penalties.

Sustainability leadership creates competitive advantages as environmental considerations increasingly influence customer decisions and regulatory requirements. Early adoption of sustainable practices positions companies favorably for future market developments.

Market evolution toward more integrated and technology-enabled logistics solutions will continue accelerating, driven by customer expectations for superior service quality and operational transparency. The integration of artificial intelligence, machine learning, and predictive analytics will enable more sophisticated demand forecasting, inventory optimization, and route planning capabilities.

Growth trajectory remains positive across all major market segments, with companion animal logistics demonstrating the strongest growth potential in developed markets while livestock logistics shows significant expansion opportunities in emerging economies. MarkWide Research projections indicate sustained growth momentum supported by fundamental demand drivers and technological advancement.

Technology transformation will reshape operational capabilities through automation, real-time monitoring, and integrated customer service platforms. Companies investing in advanced technologies will gain competitive advantages while those failing to adapt may face market share erosion and operational challenges.

Regulatory evolution toward enhanced traceability, stricter cold chain requirements, and expanded controlled substance oversight will create both challenges and opportunities. Providers with superior compliance capabilities will benefit from competitive barriers while less sophisticated competitors may face market exit pressures.

Market consolidation will continue as larger companies acquire regional distributors and specialized service providers to enhance geographic coverage and service capabilities. This trend will create scale economies and improved service delivery while potentially reducing competitive intensity in mature markets.

Emerging market development represents the most significant long-term growth opportunity as developing regions experience rising pet ownership, modernizing livestock operations, and improving veterinary care standards. Success in these markets requires adaptation to local conditions and long-term commitment to infrastructure development.

Sustainability integration will become increasingly important as environmental considerations influence customer decisions and regulatory requirements. Companies demonstrating leadership in sustainable logistics practices will gain competitive advantages and regulatory support.

The veterinary and animal healthcare logistics market represents a dynamic and growing sector within the broader healthcare supply chain industry, characterized by specialized requirements, regulatory complexity, and strong underlying demand drivers. Market evolution reflects increasing sophistication in animal healthcare delivery systems, technological advancement, and changing customer expectations for service quality and convenience.

Growth fundamentals remain robust, supported by pet humanization trends, expanding livestock operations, and increasing awareness of animal health importance. The market benefits from defensive characteristics including essential service nature, customer loyalty, and regulatory barriers that create competitive advantages for established providers.

Competitive dynamics emphasize technological capabilities, service quality, and regulatory compliance expertise as key differentiators. Market consolidation trends create opportunities for scale economies while potentially reducing competitive intensity in mature segments. Success requires continuous investment in infrastructure, technology, and service innovation to meet evolving customer needs.

Future prospects indicate continued market expansion supported by emerging market development, technological innovation, and service diversification opportunities. Companies positioning themselves as comprehensive logistics partners rather than transactional service providers will capture the greatest value from market growth trends. The integration of sustainability practices, advanced technologies, and customer-centric service models will define market leadership in the evolving veterinary and animal healthcare logistics landscape.

What is Veterinary And Animal Healthcare Logistics?

Veterinary And Animal Healthcare Logistics refers to the processes and systems involved in the transportation, storage, and distribution of veterinary products and animal healthcare supplies. This includes pharmaceuticals, vaccines, and medical equipment necessary for animal treatment and care.

What are the key players in the Veterinary And Animal Healthcare Logistics Market?

Key players in the Veterinary And Animal Healthcare Logistics Market include companies like Zoetis, Merck Animal Health, and Elanco Animal Health, which provide a range of products and services for animal healthcare logistics, among others.

What are the main drivers of growth in the Veterinary And Animal Healthcare Logistics Market?

The growth of the Veterinary And Animal Healthcare Logistics Market is driven by increasing pet ownership, rising demand for animal-derived food products, and advancements in veterinary medicine. Additionally, the need for efficient supply chain management in animal healthcare is also a significant factor.

What challenges does the Veterinary And Animal Healthcare Logistics Market face?

Challenges in the Veterinary And Animal Healthcare Logistics Market include regulatory compliance issues, the complexity of cold chain logistics for temperature-sensitive products, and the need for skilled personnel. These factors can hinder the efficiency and effectiveness of logistics operations.

What opportunities exist in the Veterinary And Animal Healthcare Logistics Market?

Opportunities in the Veterinary And Animal Healthcare Logistics Market include the integration of technology for better tracking and management of logistics, the expansion of e-commerce for veterinary products, and the growing focus on sustainability in supply chain practices. These trends can enhance operational efficiency and customer satisfaction.

What trends are shaping the Veterinary And Animal Healthcare Logistics Market?

Trends in the Veterinary And Animal Healthcare Logistics Market include the increasing use of telemedicine for veterinary consultations, the rise of automated logistics solutions, and a growing emphasis on supply chain transparency. These innovations are transforming how veterinary products are delivered and managed.

Veterinary And Animal Healthcare Logistics Market

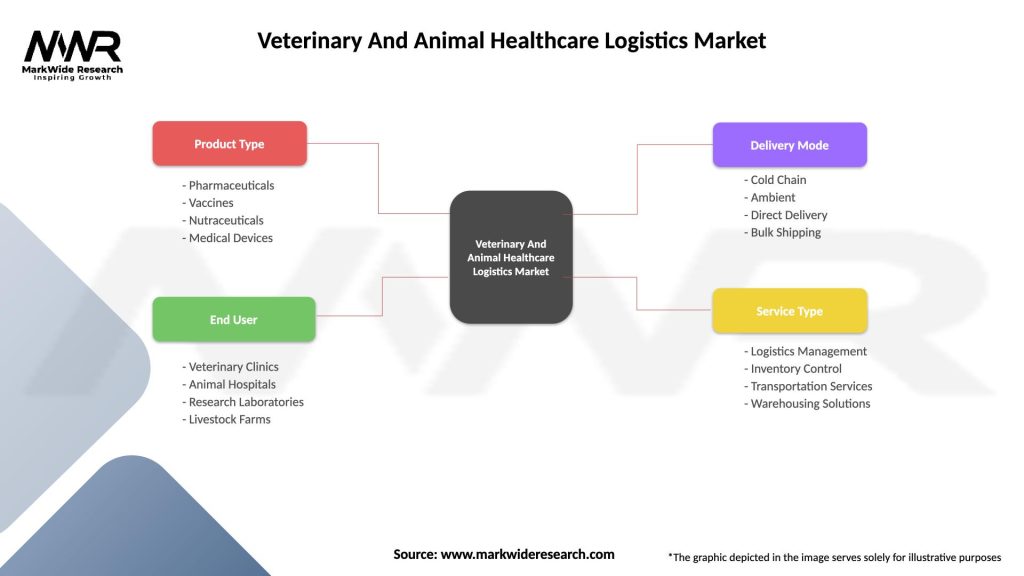

| Segmentation Details | Description |

|---|---|

| Product Type | Pharmaceuticals, Vaccines, Nutraceuticals, Medical Devices |

| End User | Veterinary Clinics, Animal Hospitals, Research Laboratories, Livestock Farms |

| Delivery Mode | Cold Chain, Ambient, Direct Delivery, Bulk Shipping |

| Service Type | Logistics Management, Inventory Control, Transportation Services, Warehousing Solutions |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Veterinary And Animal Healthcare Logistics Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at