444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The United States white glove delivery service market represents a rapidly expanding segment within the broader logistics and delivery industry, characterized by premium service offerings that extend far beyond traditional shipping methods. This specialized market encompasses comprehensive delivery solutions including unpacking, assembly, installation, and placement services that cater to high-value merchandise and customer-centric experiences. Market dynamics indicate robust growth driven by evolving consumer expectations, e-commerce expansion, and the increasing demand for seamless last-mile delivery solutions.

Industry transformation has accelerated significantly as retailers and manufacturers recognize the competitive advantage of offering premium delivery experiences. The market demonstrates strong momentum with growth rates exceeding 12% annually, reflecting the shift toward experience-driven commerce and the willingness of consumers to pay premium prices for exceptional service quality. Service providers are expanding their capabilities to include specialized handling of furniture, appliances, electronics, and other high-value items requiring careful installation and setup.

Geographic distribution shows concentrated activity in metropolitan areas where disposable income levels support premium service adoption, with approximately 68% of market activity centered in major urban centers. The market encompasses diverse service categories including furniture delivery, appliance installation, electronics setup, and specialized handling of fragile or valuable merchandise, creating multiple revenue streams for service providers.

The United States white glove delivery service market refers to the comprehensive ecosystem of premium logistics providers offering specialized delivery services that include unpacking, assembly, installation, placement, and often removal of packaging materials, providing customers with a complete end-to-end delivery experience that goes significantly beyond standard shipping methods.

Service differentiation distinguishes white glove delivery through its emphasis on customer experience, professional handling, and value-added services that transform the delivery process from a transactional interaction into a service experience. These services typically involve trained professionals who handle high-value merchandise with specialized care, ensuring proper installation and customer satisfaction while maintaining the integrity of both the product and the customer’s property.

Market participants include specialized logistics companies, furniture retailers with integrated delivery services, appliance manufacturers offering installation services, and third-party logistics providers who have expanded their capabilities to include premium delivery options. The market serves both business-to-consumer and business-to-business segments, with particular strength in residential furniture, home appliances, and commercial equipment delivery.

Market momentum in the United States white glove delivery service sector reflects fundamental shifts in consumer behavior and retail strategy, with companies increasingly recognizing premium delivery as a key differentiator in competitive markets. The convergence of e-commerce growth, urbanization trends, and evolving customer expectations has created substantial opportunities for service providers who can deliver exceptional experiences while maintaining operational efficiency.

Growth drivers include the expansion of online furniture and appliance sales, which account for approximately 34% of white glove delivery demand, alongside increasing consumer willingness to pay for convenience and professional service. The market benefits from demographic trends including aging populations who value assistance with heavy lifting and assembly, as well as busy professionals who prioritize time-saving services.

Competitive landscape features a mix of established logistics companies expanding into premium services, specialized white glove providers, and retailer-integrated delivery operations. Innovation focuses on technology integration, route optimization, and service standardization while maintaining the personalized touch that defines white glove service quality.

Future trajectory indicates continued expansion driven by e-commerce growth, with particular strength expected in metropolitan markets where service adoption rates currently exceed 45% among target demographics. Market evolution will likely emphasize sustainability, technology integration, and expanded service offerings to capture growing demand for premium delivery experiences.

Consumer behavior analysis reveals significant insights into white glove delivery adoption patterns and preferences that shape market development strategies. Understanding these patterns enables service providers to optimize their offerings and target the most receptive customer segments effectively.

E-commerce expansion serves as the primary catalyst driving white glove delivery service demand, as online retailers seek to replicate and exceed the service levels traditionally associated with brick-and-mortar shopping experiences. The shift toward online purchasing of large, complex items has created substantial demand for professional delivery and installation services that ensure customer satisfaction and reduce return rates.

Consumer lifestyle changes contribute significantly to market growth, with busy professionals and dual-income households increasingly valuing time-saving services that eliminate the hassle of product assembly and installation. Demographic trends including aging populations who require assistance with heavy lifting and technical setup further expand the addressable market for premium delivery services.

Retailer differentiation strategies drive adoption as companies recognize white glove delivery as a competitive advantage that can justify premium pricing and enhance customer loyalty. Retailers report that offering white glove services increases average order values by approximately 22% while reducing customer service complaints and return rates significantly.

Urbanization patterns create favorable conditions for white glove delivery services, as dense metropolitan areas provide efficient route optimization opportunities while concentrating high-income demographics who value premium service offerings. The concentration of apartment dwellers and condominium residents creates additional demand for services that navigate complex delivery logistics in multi-unit buildings.

Cost considerations represent the most significant barrier to broader white glove delivery adoption, as premium pricing limits market penetration among price-sensitive consumer segments. The labor-intensive nature of white glove services creates inherent cost structures that may not align with mass-market pricing expectations, potentially restricting growth to higher-income demographics.

Operational complexity challenges service providers with requirements for specialized training, insurance coverage, and quality control systems that exceed standard delivery operations. Managing skilled labor forces, maintaining service consistency, and coordinating complex scheduling requirements create operational hurdles that can impact profitability and scalability.

Geographic limitations constrain market expansion in rural and low-density areas where route economics may not support premium service delivery. The concentration of demand in metropolitan areas creates challenges for providers seeking to expand their geographic footprint while maintaining service quality and cost effectiveness.

Liability concerns associated with in-home services, product installation, and potential property damage create risk management challenges that require comprehensive insurance coverage and careful staff screening. These requirements add operational costs and complexity that can impact service provider margins and pricing strategies.

Technology integration presents substantial opportunities for market expansion through enhanced customer experiences, operational efficiency improvements, and new service capabilities. Advanced scheduling systems, real-time tracking, and mobile applications can differentiate service providers while reducing operational costs and improving customer satisfaction rates.

Service expansion opportunities exist in adjacent markets including commercial delivery, healthcare equipment installation, and specialized handling of high-value items such as artwork and antiques. MarkWide Research analysis indicates that providers expanding beyond traditional furniture and appliance delivery see revenue growth rates exceeding 18% annually.

Partnership development with e-commerce platforms, furniture manufacturers, and appliance retailers creates opportunities for integrated service offerings that can capture larger market shares while providing predictable revenue streams. Strategic partnerships can also facilitate geographic expansion and service standardization across broader market areas.

Sustainability initiatives offer differentiation opportunities as environmentally conscious consumers increasingly value service providers who demonstrate commitment to sustainable practices through packaging reduction, route optimization, and responsible disposal of packaging materials.

Supply chain evolution continues reshaping the white glove delivery landscape as traditional logistics companies expand their service capabilities to capture premium market segments. This evolution creates both competitive pressure and collaboration opportunities as established players leverage their infrastructure advantages while specialized providers maintain service quality leadership.

Customer expectations continue escalating as successful white glove experiences set new standards for service quality across the delivery industry. Companies must continuously innovate their service offerings while maintaining cost structures that support sustainable business models in increasingly competitive markets.

Technology adoption accelerates across the industry as providers recognize the competitive advantages of digital tools for scheduling, communication, and service delivery. Companies implementing comprehensive technology solutions report operational efficiency improvements of approximately 26% while achieving higher customer satisfaction scores.

Market consolidation trends indicate increasing merger and acquisition activity as larger logistics companies seek to acquire specialized white glove capabilities while smaller providers look for strategic partnerships to compete effectively. This consolidation creates opportunities for market leaders to expand their geographic reach and service capabilities.

Data collection for this comprehensive market analysis employed multiple research methodologies to ensure accuracy and completeness of market insights. Primary research included extensive interviews with industry executives, service providers, and customers to understand market dynamics, growth drivers, and emerging trends affecting the white glove delivery service sector.

Secondary research encompassed analysis of industry reports, company financial statements, regulatory filings, and trade association data to validate primary research findings and provide quantitative context for market trends. This approach ensured comprehensive coverage of market segments, competitive dynamics, and regional variations in service adoption patterns.

Market sizing methodology utilized bottom-up analysis combining service provider revenue data, customer adoption rates, and pricing analysis to develop accurate market assessments. Cross-validation through multiple data sources ensured reliability of growth projections and market trend analysis.

Competitive analysis included detailed evaluation of major market participants, service offerings, pricing strategies, and geographic coverage to provide comprehensive understanding of competitive dynamics and market positioning strategies employed by leading providers.

Northeast region demonstrates the highest concentration of white glove delivery activity, with metropolitan areas including New York, Boston, and Philadelphia generating approximately 32% of national market activity. High population density, elevated income levels, and strong e-commerce adoption rates create favorable conditions for premium delivery services in this region.

West Coast markets show robust growth driven by technology sector employment and lifestyle preferences that value convenience services. California leads regional activity with approximately 28% market share, while Seattle and Portland demonstrate strong adoption rates among environmentally conscious consumers who appreciate sustainable delivery practices.

Southeast expansion represents significant growth opportunity as metropolitan areas including Atlanta, Miami, and Charlotte experience rapid population growth and rising income levels. This region currently accounts for 18% of market activity but shows potential for accelerated growth as service providers expand their geographic coverage.

Midwest markets demonstrate steady growth centered around major metropolitan areas including Chicago, Detroit, and Minneapolis. While representing 22% of current market activity, this region shows potential for expansion as awareness of white glove services increases among target demographics.

Market leadership remains distributed among several categories of service providers, each bringing distinct advantages and competitive positioning strategies to capture market share in this growing sector.

Service type segmentation reveals distinct market categories based on the level of service provided and customer requirements, each representing different growth opportunities and competitive dynamics within the broader white glove delivery market.

By Service Level:

By Product Category:

By Customer Type:

Furniture delivery services represent the largest segment within the white glove delivery market, driven by the growth of online furniture sales and consumer preference for professional assembly services. This category benefits from high average transaction values and strong customer satisfaction rates when services are executed properly.

Appliance installation demonstrates consistent demand driven by home renovation trends and the complexity of modern appliance installation requirements. Service providers in this category often develop specialized expertise in electrical, plumbing, and ventilation requirements that create competitive advantages and customer loyalty.

Electronics setup services show growing demand as home entertainment systems become increasingly complex and consumers seek professional installation to ensure optimal performance. This category offers opportunities for recurring service relationships through maintenance and upgrade services.

Commercial delivery services provide stable revenue streams through contract relationships with businesses requiring regular furniture and equipment delivery. MWR analysis indicates that commercial clients generate approximately 35% higher lifetime value compared to residential customers due to repeat business and larger order volumes.

Service providers benefit from premium pricing opportunities that can generate significantly higher margins compared to standard delivery services. The specialized nature of white glove delivery creates barriers to entry that protect market position while building customer loyalty through exceptional service experiences.

Retailers and manufacturers gain competitive advantages through white glove delivery partnerships that enhance customer satisfaction, reduce return rates, and justify premium pricing for their products. These partnerships can also provide valuable customer feedback and market insights that inform product development strategies.

Customers receive comprehensive value through time savings, professional installation quality, and peace of mind knowing their valuable purchases are handled by trained professionals. The convenience factor often justifies premium pricing while creating positive brand associations with retailers offering these services.

Technology providers find opportunities to develop specialized software solutions for scheduling, routing, and customer communication that address the unique requirements of white glove delivery operations. These solutions can command premium pricing while creating recurring revenue streams through ongoing support and updates.

Strengths:

Weaknesses:

Opportunities:

Threats:

Sustainability integration emerges as a significant trend as environmentally conscious consumers increasingly prefer service providers who demonstrate commitment to sustainable practices. Companies implementing eco-friendly packaging, route optimization, and responsible disposal practices report enhanced brand perception and customer loyalty among target demographics.

Technology advancement continues transforming service delivery through mobile applications, real-time tracking, and automated scheduling systems that enhance customer experience while improving operational efficiency. Service providers investing in comprehensive technology platforms report customer satisfaction improvements exceeding 24% compared to traditional service models.

Service customization trends indicate growing demand for personalized delivery experiences that accommodate specific customer preferences, scheduling requirements, and special handling needs. This trend creates opportunities for premium pricing while building stronger customer relationships through tailored service delivery.

Market consolidation accelerates as larger logistics companies acquire specialized white glove providers to expand their service capabilities, while smaller companies seek strategic partnerships to compete effectively in increasingly competitive markets.

Strategic acquisitions continue reshaping the competitive landscape as major logistics companies recognize the growth potential and margin opportunities in white glove delivery services. These acquisitions often focus on acquiring specialized expertise, customer relationships, and geographic coverage that complement existing logistics capabilities.

Technology partnerships between service providers and software companies create innovative solutions for route optimization, customer communication, and service quality management. These partnerships enable smaller providers to access enterprise-level technology capabilities while maintaining their specialized service focus.

Retailer integration trends show increasing numbers of furniture and appliance retailers developing internal white glove delivery capabilities to maintain control over customer experience and capture additional revenue streams. This vertical integration creates both competitive pressure and partnership opportunities for independent service providers.

Regulatory developments in areas including worker classification, insurance requirements, and safety standards continue evolving to address the unique characteristics of in-home delivery services. MarkWide Research monitoring indicates that regulatory compliance costs account for approximately 8-12% of operational expenses for white glove delivery providers.

Investment priorities should focus on technology infrastructure development that can differentiate service providers through superior customer experience and operational efficiency. Companies that successfully integrate advanced scheduling, tracking, and communication systems position themselves for sustainable competitive advantages in growing markets.

Geographic expansion strategies should prioritize metropolitan markets with favorable demographics while carefully evaluating route economics and competitive dynamics. Successful expansion requires balancing growth ambitions with service quality maintenance and operational efficiency requirements.

Partnership development represents a critical success factor for companies seeking to scale their operations while maintaining service quality. Strategic alliances with retailers, manufacturers, and technology providers can provide access to customers, capabilities, and resources that support sustainable growth.

Service differentiation through specialized capabilities, sustainability initiatives, and customer experience enhancements can justify premium pricing while building customer loyalty. Companies should focus on developing unique value propositions that address specific customer needs and preferences within their target markets.

Market expansion trajectory indicates continued robust growth driven by e-commerce evolution, changing consumer preferences, and increasing recognition of white glove delivery as a competitive differentiator. Growth rates are expected to remain strong, with particular acceleration in metropolitan markets where service adoption continues expanding among target demographics.

Technology integration will increasingly define competitive success as customers expect seamless digital experiences combined with exceptional physical service delivery. Companies investing in comprehensive technology platforms while maintaining service quality leadership are positioned to capture disproportionate market share growth.

Service evolution trends suggest expanding definitions of white glove delivery to include additional value-added services, sustainability features, and customization options that address evolving customer preferences. This evolution creates opportunities for revenue growth and market differentiation among forward-thinking service providers.

Market maturation will likely result in increased consolidation as successful companies expand their geographic reach and service capabilities while smaller providers either scale successfully or seek strategic partnerships. This maturation process should result in improved service standardization and operational efficiency across the industry.

The United States white glove delivery service market represents a dynamic and rapidly growing sector within the broader logistics industry, driven by fundamental shifts in consumer behavior, e-commerce expansion, and evolving expectations for premium service experiences. Market participants who successfully balance service quality, operational efficiency, and customer satisfaction are positioned to capture significant opportunities in this expanding market.

Strategic success in this market requires careful attention to service differentiation, technology integration, and geographic expansion strategies that align with customer needs and competitive dynamics. Companies that develop sustainable competitive advantages through specialized capabilities, strategic partnerships, and exceptional customer experiences will likely achieve disproportionate growth and profitability.

Future market development will be shaped by continued e-commerce growth, technology advancement, and evolving consumer preferences for convenience and premium service experiences. The companies that adapt successfully to these trends while maintaining operational excellence and customer focus will define the next phase of market evolution and capture the greatest share of expanding opportunities in the United States white glove delivery service market.

What is White Glove Delivery Service?

White Glove Delivery Service refers to a premium delivery option that includes specialized handling, setup, and installation of items, ensuring they arrive in perfect condition. This service is commonly used for high-value or fragile items such as electronics, furniture, and artwork.

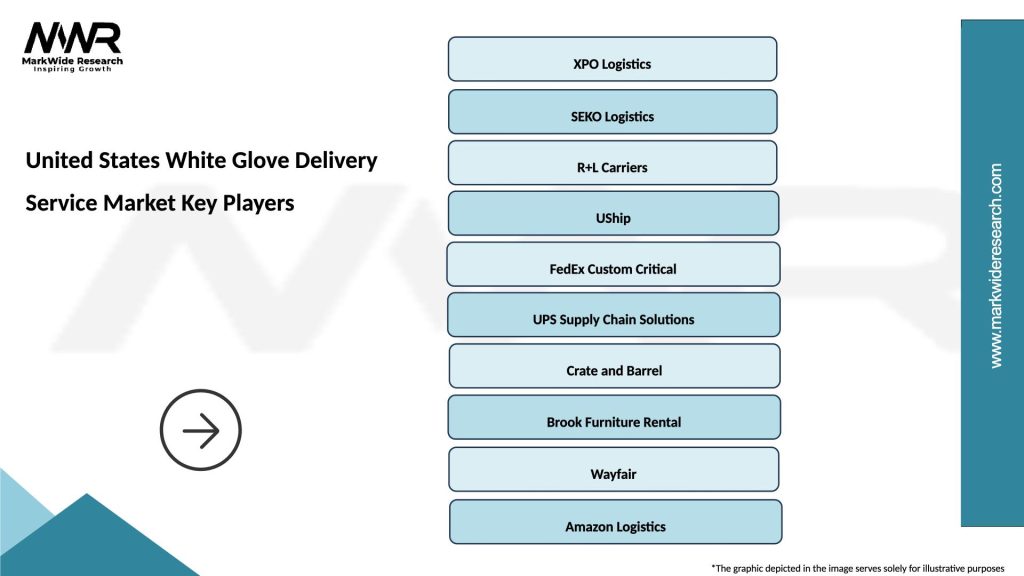

What are the key players in the United States White Glove Delivery Service Market?

Key players in the United States White Glove Delivery Service Market include companies like XPO Logistics, SEKO Logistics, and UPS, which offer tailored delivery solutions to meet customer needs, among others.

What are the growth factors driving the United States White Glove Delivery Service Market?

The growth of the United States White Glove Delivery Service Market is driven by increasing consumer demand for high-quality delivery experiences, the rise of e-commerce, and the need for specialized handling of luxury goods.

What challenges does the United States White Glove Delivery Service Market face?

Challenges in the United States White Glove Delivery Service Market include high operational costs, the need for skilled labor, and competition from standard delivery services that may offer lower prices.

What opportunities exist in the United States White Glove Delivery Service Market?

Opportunities in the United States White Glove Delivery Service Market include expanding into new geographic areas, enhancing technology for tracking and customer communication, and developing partnerships with luxury brands for exclusive delivery services.

What trends are shaping the United States White Glove Delivery Service Market?

Trends in the United States White Glove Delivery Service Market include the integration of technology for real-time tracking, an emphasis on sustainability in packaging and delivery methods, and a growing focus on customer experience and personalization.

United States White Glove Delivery Service Market

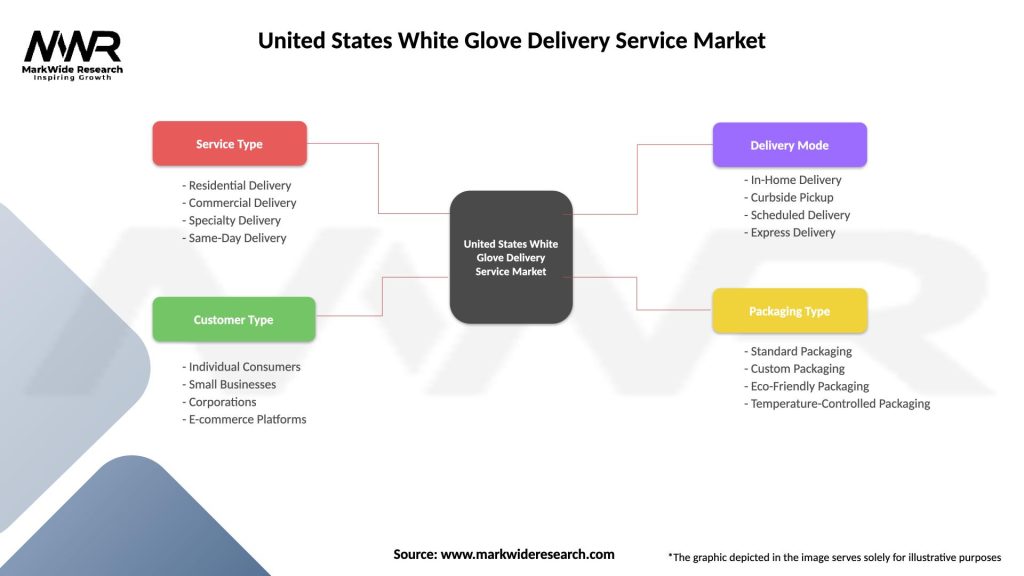

| Segmentation Details | Description |

|---|---|

| Service Type | Residential Delivery, Commercial Delivery, Specialty Delivery, Same-Day Delivery |

| Customer Type | Individual Consumers, Small Businesses, Corporations, E-commerce Platforms |

| Delivery Mode | In-Home Delivery, Curbside Pickup, Scheduled Delivery, Express Delivery |

| Packaging Type | Standard Packaging, Custom Packaging, Eco-Friendly Packaging, Temperature-Controlled Packaging |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the United States White Glove Delivery Service Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at