444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The China cross-border e-commerce logistics market represents one of the most dynamic and rapidly evolving segments within the global logistics industry. This specialized market encompasses the comprehensive infrastructure, services, and technologies required to facilitate international trade through digital platforms, connecting Chinese businesses with global consumers and vice versa. Cross-border e-commerce logistics in China has experienced unprecedented growth, driven by increasing consumer demand for international products, government policy support, and technological innovations in supply chain management.

Market dynamics indicate that China’s cross-border e-commerce logistics sector is experiencing robust expansion, with growth rates consistently outpacing traditional logistics segments. The market encompasses various service categories including warehousing, transportation, customs clearance, last-mile delivery, and integrated supply chain solutions. Digital transformation has become a cornerstone of this market, with companies leveraging artificial intelligence, blockchain technology, and automated sorting systems to enhance operational efficiency and reduce delivery times.

Regional distribution shows that major Chinese cities including Shanghai, Shenzhen, Guangzhou, and Beijing serve as primary hubs for cross-border logistics operations, accounting for approximately 75% of total market activity. The integration of free trade zones, bonded warehouses, and special economic zones has created a sophisticated ecosystem that supports seamless international trade operations. Consumer behavior patterns reveal increasing preference for faster delivery times and enhanced tracking capabilities, driving logistics providers to invest heavily in technology infrastructure and service optimization.

The China cross-border e-commerce logistics market refers to the comprehensive network of services, infrastructure, and technologies that facilitate the movement of goods between China and international markets through digital commerce platforms. This market encompasses all aspects of the supply chain required to support cross-border online retail transactions, from initial order processing to final delivery at the consumer’s doorstep.

Cross-border e-commerce logistics involves multiple specialized components including international warehousing facilities, customs clearance services, multi-modal transportation networks, payment processing systems, and regulatory compliance management. The market serves both inbound logistics, where international products are imported to Chinese consumers, and outbound logistics, where Chinese products are exported to global markets through e-commerce channels.

Key characteristics of this market include integration with digital platforms, real-time tracking capabilities, automated customs processing, and flexible delivery options. The sector requires sophisticated coordination between multiple stakeholders including e-commerce platforms, logistics service providers, customs authorities, financial institutions, and technology vendors to ensure seamless cross-border transactions.

China’s cross-border e-commerce logistics market has emerged as a critical enabler of international digital trade, demonstrating remarkable resilience and growth potential. The market is characterized by rapid technological adoption, increasing consumer sophistication, and evolving regulatory frameworks that support international commerce. Growth trajectories indicate sustained expansion driven by rising middle-class purchasing power, improved logistics infrastructure, and enhanced digital payment systems.

Market segmentation reveals diverse service offerings ranging from basic shipping solutions to comprehensive end-to-end logistics management. Major market participants include established logistics giants, emerging technology-driven startups, and integrated e-commerce platforms that have developed proprietary logistics capabilities. Competitive dynamics emphasize service quality, delivery speed, cost efficiency, and technological innovation as primary differentiating factors.

Strategic developments within the market include increased investment in automation technologies, expansion of bonded warehouse networks, and development of specialized cross-border logistics hubs. The integration of artificial intelligence and machine learning technologies has enabled predictive analytics, route optimization, and enhanced customer service capabilities. Regulatory support from Chinese government initiatives has created favorable conditions for market expansion, with approximately 85% of logistics providers reporting positive regulatory impact on their operations.

Fundamental market insights reveal several critical trends shaping the China cross-border e-commerce logistics landscape:

Market maturation is evidenced by the emergence of specialized service providers focusing on specific product categories, geographic regions, or customer segments. The development of comprehensive logistics ecosystems that integrate multiple service providers under unified platforms has become a defining characteristic of market evolution.

Primary market drivers propelling the China cross-border e-commerce logistics market include several interconnected factors that create sustained growth momentum. Consumer demand evolution represents the most significant driver, with Chinese consumers increasingly seeking access to international brands and products not readily available in domestic markets. This trend has been accelerated by rising disposable incomes and growing awareness of global product offerings through social media and digital marketing channels.

Government policy support has created a favorable regulatory environment through initiatives such as the Cross-Border E-Commerce Comprehensive Pilot Zones, which provide streamlined customs procedures and tax incentives. These policies have reduced operational complexities and costs for logistics providers, encouraging market entry and expansion. Digital infrastructure development including 5G networks, cloud computing platforms, and mobile payment systems has enabled sophisticated logistics management capabilities.

Technological advancement continues to drive market growth through automation, artificial intelligence, and data analytics applications that improve operational efficiency and customer experience. The integration of smart logistics solutions has reduced delivery times and enhanced tracking accuracy, meeting evolving consumer expectations. E-commerce platform expansion by major Chinese technology companies has created integrated ecosystems that combine retail, logistics, and financial services, driving demand for specialized cross-border logistics capabilities.

Significant market restraints continue to challenge the growth and development of China’s cross-border e-commerce logistics sector. Regulatory complexity remains a primary constraint, as logistics providers must navigate varying international trade regulations, customs requirements, and compliance standards across multiple jurisdictions. These regulatory challenges often result in increased operational costs and extended delivery times, particularly for smaller logistics providers lacking extensive international expertise.

Infrastructure limitations in certain regions and for specific transportation modes create bottlenecks that impact service quality and cost efficiency. Limited air cargo capacity during peak seasons and insufficient last-mile delivery networks in rural areas restrict market penetration and service reliability. Currency fluctuation risks and international payment processing complexities add financial uncertainty and operational challenges for cross-border logistics operations.

Competition intensity has led to margin pressure and price wars among logistics providers, potentially compromising service quality and long-term sustainability. The high capital requirements for establishing comprehensive cross-border logistics infrastructure create barriers to entry for smaller companies. Geopolitical tensions and trade policy uncertainties can disrupt established logistics routes and require rapid operational adjustments, creating additional costs and complexity for market participants.

Substantial market opportunities exist within the China cross-border e-commerce logistics sector, driven by emerging trends and evolving consumer behaviors. Rural market penetration represents a significant growth opportunity, as improved internet infrastructure and rising rural incomes create demand for international products in previously underserved markets. The development of specialized logistics solutions for rural delivery could capture this expanding consumer base.

Technology integration opportunities include the implementation of advanced automation systems, drone delivery networks, and blockchain-based tracking solutions that can differentiate service offerings and improve operational efficiency. The growing demand for sustainable logistics solutions creates opportunities for providers to develop environmentally friendly delivery options and packaging solutions that appeal to environmentally conscious consumers.

Vertical specialization opportunities exist in sectors such as healthcare products, luxury goods, and perishable items that require specialized handling and compliance expertise. The expansion of cross-border return logistics services addresses a growing consumer need and creates additional revenue streams. Partnership opportunities with international logistics providers, e-commerce platforms, and technology companies can enable market expansion and service enhancement while sharing investment costs and risks.

Market dynamics within the China cross-border e-commerce logistics sector reflect the complex interplay of technological innovation, regulatory evolution, and changing consumer expectations. Competitive forces are intensifying as traditional logistics companies compete with technology-driven startups and integrated e-commerce platforms that have developed proprietary logistics capabilities. This competition drives continuous innovation and service improvement while creating pressure on profit margins.

Supply chain integration has become increasingly sophisticated, with logistics providers developing end-to-end solutions that encompass warehousing, transportation, customs clearance, and last-mile delivery. The trend toward vertical integration allows companies to maintain better control over service quality and costs while providing customers with seamless experiences. Customer relationship management has evolved beyond basic tracking services to include proactive communication, flexible delivery options, and comprehensive customer support.

Operational efficiency improvements through technology adoption have enabled logistics providers to handle increasing volumes while maintaining service quality. According to MarkWide Research analysis, companies implementing advanced automation systems have achieved efficiency gains of approximately 35% in processing times. Risk management strategies have become more sophisticated, incorporating predictive analytics and scenario planning to address potential disruptions in international supply chains.

Comprehensive research methodology employed for analyzing the China cross-border e-commerce logistics market incorporates multiple data collection and analysis techniques to ensure accuracy and reliability. Primary research includes extensive interviews with industry executives, logistics service providers, e-commerce platform operators, and regulatory officials to gather firsthand insights into market trends, challenges, and opportunities.

Secondary research encompasses analysis of industry reports, government publications, company financial statements, and trade association data to establish market baselines and validate primary research findings. Quantitative analysis utilizes statistical modeling and trend analysis to project market growth patterns and identify key performance indicators across different market segments and geographic regions.

Data validation processes include cross-referencing multiple sources, conducting follow-up interviews, and utilizing industry expert panels to verify research conclusions. Market segmentation analysis employs clustering techniques and demographic analysis to identify distinct customer groups and service categories within the broader market. The research methodology ensures comprehensive coverage of market dynamics while maintaining objectivity and analytical rigor throughout the investigation process.

Regional market distribution within China’s cross-border e-commerce logistics sector demonstrates significant concentration in major economic centers while showing expanding activity in secondary cities. Eastern China dominates market activity, with Shanghai, Hangzhou, and Ningbo serving as primary cross-border logistics hubs, collectively accounting for approximately 45% of total market volume. These cities benefit from established port infrastructure, proximity to manufacturing centers, and advanced digital infrastructure.

Southern China represents another major market concentration, with Shenzhen and Guangzhou leveraging their proximity to Hong Kong and established manufacturing base to capture significant market share. The Pearl River Delta region has developed specialized cross-border logistics capabilities, particularly for electronics and consumer goods exports. Northern China markets, centered around Beijing and Tianjin, focus primarily on serving domestic consumer demand for imported products.

Western China presents emerging opportunities as government initiatives promote inland economic development and improved transportation infrastructure. Cities such as Chengdu, Xi’an, and Chongqing are developing cross-border logistics capabilities to serve regional markets and connect with Central Asian trade routes. Market penetration rates vary significantly by region, with tier-one cities showing 78% adoption rates for cross-border e-commerce services compared to 32% in tier-three cities, indicating substantial growth potential in smaller markets.

Competitive landscape analysis reveals a diverse ecosystem of market participants ranging from global logistics giants to specialized cross-border service providers. Market leaders have established comprehensive service networks and technological capabilities that enable end-to-end cross-border logistics solutions:

Competitive strategies focus on technology differentiation, service quality enhancement, and strategic partnerships to capture market share. Companies are investing heavily in automation, artificial intelligence, and data analytics to improve operational efficiency and customer experience. Market consolidation trends indicate increasing merger and acquisition activity as companies seek to expand capabilities and geographic coverage.

Market segmentation within the China cross-border e-commerce logistics sector reveals distinct categories based on service type, customer segment, and geographic scope. By Service Type:

By Customer Segment:

By Geographic Scope:

Express delivery services represent the highest-growth segment within the cross-border e-commerce logistics market, driven by consumer demand for faster delivery times and premium service quality. This category commands premium pricing but requires significant infrastructure investment and operational expertise. Service differentiation in this segment focuses on delivery speed, tracking accuracy, and customer communication capabilities.

Warehousing and fulfillment services have become increasingly sophisticated, incorporating automated sorting systems, inventory management technologies, and integration with e-commerce platforms. This segment benefits from economies of scale and recurring revenue models, making it attractive for long-term investment. Technology integration in warehousing operations has improved processing efficiency by approximately 42% according to industry benchmarks.

Customs clearance services require specialized expertise and regulatory knowledge, creating barriers to entry that protect established providers. This segment benefits from increasing regulatory complexity and growing demand for compliance assurance. Digital transformation in customs processing has reduced clearance times and improved accuracy, creating competitive advantages for technology-enabled providers.

Last-mile delivery solutions represent a critical differentiator in customer experience, with companies investing in flexible delivery options, real-time tracking, and customer communication systems. This segment faces challenges in rural areas and requires local market knowledge and infrastructure investment.

Industry participants in the China cross-border e-commerce logistics market realize substantial benefits through participation in this dynamic sector. Logistics service providers benefit from access to high-growth market segments, opportunities for service diversification, and potential for premium pricing through specialized capabilities. The market enables companies to leverage existing infrastructure investments while expanding into new geographic markets and customer segments.

E-commerce platforms gain competitive advantages through reliable logistics partnerships that enhance customer experience and enable market expansion. Integrated logistics capabilities allow platforms to offer comprehensive solutions that differentiate their services and improve customer retention. Technology vendors benefit from increasing demand for automation, tracking, and analytics solutions that improve operational efficiency and service quality.

Government stakeholders realize economic benefits through increased trade volumes, job creation, and tax revenue generation. The development of cross-border logistics infrastructure supports broader economic development objectives and enhances China’s position in global trade networks. Consumers benefit from expanded product access, competitive pricing, and improved delivery services that enhance their shopping experience and lifestyle options.

Manufacturing companies gain access to global markets through efficient logistics networks that reduce barriers to international expansion. Small and medium enterprises particularly benefit from logistics services that provide economies of scale and professional expertise previously available only to large corporations.

Strengths:

Weaknesses:

Opportunities:

Threats:

Technological transformation represents the most significant trend shaping the China cross-border e-commerce logistics market. Artificial intelligence integration is revolutionizing route optimization, demand forecasting, and customer service capabilities, enabling logistics providers to improve efficiency while reducing costs. Machine learning algorithms are being deployed to predict shipping delays, optimize inventory placement, and enhance customer communication systems.

Sustainability initiatives are gaining momentum as consumers and regulators increasingly prioritize environmental responsibility. Logistics providers are investing in electric delivery vehicles, sustainable packaging solutions, and carbon-neutral shipping options. Green logistics has become a competitive differentiator, with approximately 58% of consumers indicating willingness to pay premium prices for environmentally friendly delivery options.

Omnichannel integration is driving logistics providers to develop seamless connections between online and offline retail channels. This trend requires sophisticated inventory management systems and flexible fulfillment capabilities that can support multiple sales channels simultaneously. Real-time visibility throughout the supply chain has become a standard expectation, requiring investment in tracking technologies and customer communication systems.

Micro-fulfillment centers are emerging as a solution for last-mile delivery challenges, enabling faster delivery times and reduced costs in urban areas. These smaller, automated facilities are strategically located to serve specific geographic areas or customer segments, improving service quality while optimizing operational costs.

Recent industry developments demonstrate the rapid evolution and maturation of the China cross-border e-commerce logistics market. Infrastructure investments by major logistics providers have expanded bonded warehouse capacity and automated sorting capabilities in key markets. These investments enable higher processing volumes and improved service quality while reducing operational costs through economies of scale.

Strategic partnerships between Chinese logistics providers and international companies have created comprehensive global networks that enhance service capabilities and geographic coverage. These alliances enable companies to offer seamless cross-border services while sharing investment costs and risks. Technology acquisitions have accelerated the integration of advanced capabilities including robotics, artificial intelligence, and blockchain technologies.

Regulatory developments including streamlined customs procedures and digital documentation systems have reduced processing times and compliance costs. The implementation of single-window clearance systems and electronic data interchange has improved operational efficiency across the industry. MWR analysis indicates that these regulatory improvements have contributed to processing time reductions of approximately 38% for routine cross-border shipments.

Market consolidation activities have reshaped competitive dynamics, with larger companies acquiring specialized service providers to expand capabilities and market coverage. These consolidation trends are creating more comprehensive service offerings while potentially reducing competition in certain market segments.

Strategic recommendations for market participants focus on leveraging technology differentiation and customer experience enhancement to achieve sustainable competitive advantages. Investment priorities should emphasize automation technologies, data analytics capabilities, and customer communication systems that improve operational efficiency while enhancing service quality. Companies should consider developing specialized expertise in high-growth product categories or geographic markets to differentiate their offerings.

Partnership strategies represent critical success factors, particularly for smaller companies seeking to compete with integrated logistics platforms. Strategic alliances with technology providers, international logistics companies, and e-commerce platforms can provide access to capabilities and markets that would be difficult to develop independently. Risk management strategies should address geopolitical uncertainties, regulatory changes, and operational disruptions through diversified service offerings and flexible operational models.

Customer relationship management should focus on providing transparent communication, flexible service options, and proactive problem resolution to build customer loyalty and differentiate services. Companies should invest in customer data analytics to understand behavior patterns and preferences that inform service development and marketing strategies. Sustainability initiatives should be integrated into core business strategies rather than treated as peripheral activities, given growing consumer and regulatory focus on environmental responsibility.

Technology adoption should be approached strategically, focusing on solutions that provide clear return on investment and competitive differentiation rather than pursuing technology for its own sake. Companies should develop internal capabilities for technology evaluation and implementation to ensure successful integration with existing operations.

Future market prospects for the China cross-border e-commerce logistics sector remain highly positive, with multiple growth drivers supporting continued expansion. Market evolution is expected to be characterized by increasing sophistication in service offerings, technology integration, and customer experience management. The sector is projected to maintain robust growth rates, with MarkWide Research projections indicating sustained expansion driven by rising consumer demand and improving infrastructure capabilities.

Technology advancement will continue to reshape operational models, with artificial intelligence, automation, and blockchain technologies becoming standard components of logistics operations. The integration of Internet of Things sensors and 5G networks will enable real-time monitoring and management of shipments throughout the supply chain. Predictive analytics capabilities will improve demand forecasting and inventory management, reducing costs while improving service quality.

Geographic expansion into rural markets and secondary cities will drive market growth as infrastructure development and consumer adoption rates improve. The development of specialized logistics solutions for emerging product categories and customer segments will create new revenue opportunities. International expansion by Chinese logistics providers will enhance global service capabilities while creating opportunities for reverse logistics and return management services.

Regulatory evolution is expected to further streamline cross-border trade processes, reducing compliance costs and processing times. The implementation of digital trade facilitation measures and harmonized international standards will improve operational efficiency across the industry. Sustainability requirements will become increasingly important, driving innovation in environmentally friendly logistics solutions and creating competitive advantages for early adopters.

The China cross-border e-commerce logistics market represents a dynamic and rapidly evolving sector that plays a crucial role in facilitating international digital commerce. The market demonstrates strong fundamentals driven by robust consumer demand, supportive government policies, and continuous technological innovation. Growth prospects remain highly favorable, with multiple expansion opportunities in rural markets, specialized service categories, and international partnerships.

Competitive dynamics emphasize the importance of technology differentiation, service quality, and customer experience as key success factors. Companies that successfully integrate advanced technologies while maintaining operational excellence and customer focus are positioned to capture disproportionate market share and achieve sustainable competitive advantages. Strategic partnerships and market consolidation trends will continue to reshape the competitive landscape, creating both opportunities and challenges for market participants.

Future success in this market will require continuous adaptation to evolving consumer expectations, regulatory requirements, and technological capabilities. Companies must balance investment in growth opportunities with operational efficiency and risk management to achieve long-term sustainability. The China cross-border e-commerce logistics market will continue to serve as a critical enabler of global digital commerce, connecting Chinese businesses and consumers with international markets through increasingly sophisticated and efficient logistics solutions.

What is China Cross-Border E-Commerce Logistics?

China Cross-Border E-Commerce Logistics refers to the systems and processes involved in the transportation and delivery of goods purchased online from international sellers to consumers in China. This includes various logistics services such as warehousing, customs clearance, and last-mile delivery.

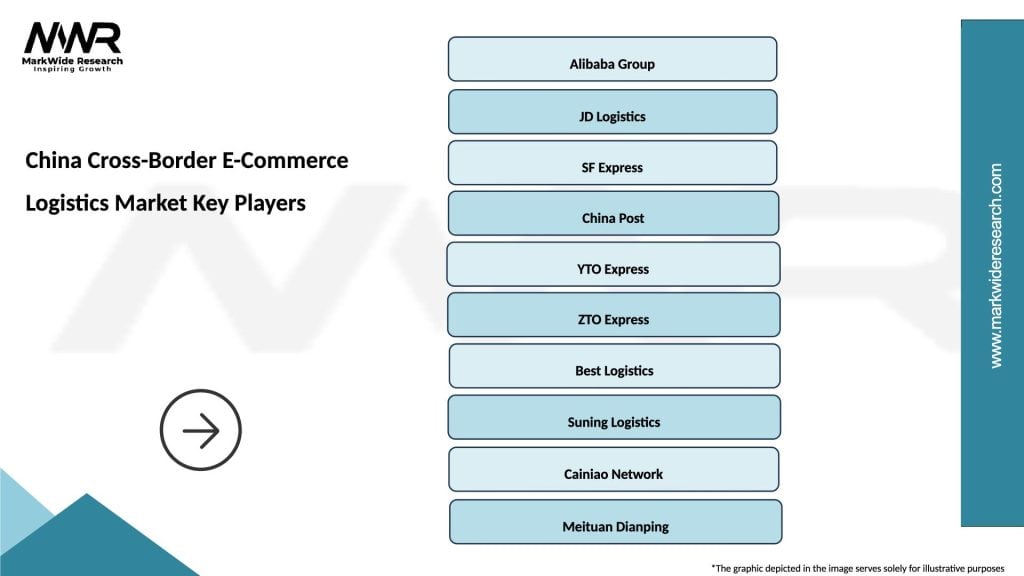

What are the key players in the China Cross-Border E-Commerce Logistics Market?

Key players in the China Cross-Border E-Commerce Logistics Market include Alibaba Group, JD Logistics, SF Express, and ZTO Express, among others. These companies provide a range of logistics solutions tailored to the needs of cross-border e-commerce.

What are the main drivers of the China Cross-Border E-Commerce Logistics Market?

The main drivers of the China Cross-Border E-Commerce Logistics Market include the increasing demand for international products among Chinese consumers, the growth of online shopping platforms, and advancements in logistics technology that enhance efficiency and reduce delivery times.

What challenges does the China Cross-Border E-Commerce Logistics Market face?

Challenges in the China Cross-Border E-Commerce Logistics Market include complex customs regulations, varying international shipping standards, and the need for efficient last-mile delivery solutions in urban areas. These factors can complicate logistics operations and increase costs.

What opportunities exist in the China Cross-Border E-Commerce Logistics Market?

Opportunities in the China Cross-Border E-Commerce Logistics Market include the expansion of e-commerce platforms, the rise of social commerce, and the potential for partnerships with international retailers. These trends can enhance logistics capabilities and improve service offerings.

What trends are shaping the China Cross-Border E-Commerce Logistics Market?

Trends shaping the China Cross-Border E-Commerce Logistics Market include the adoption of automation and AI in logistics operations, the growth of direct-to-consumer shipping models, and the increasing focus on sustainability in logistics practices. These trends are transforming how goods are moved across borders.

China Cross-Border E-Commerce Logistics Market

| Segmentation Details | Description |

|---|---|

| Service Type | Express Delivery, Freight Forwarding, Warehousing, Customs Clearance |

| Customer Type | B2B, B2C, C2C, E-retailers |

| Technology | Blockchain, IoT, AI, Cloud Computing |

| Distribution Channel | Online Marketplaces, Direct Sales, Third-Party Logistics, Social Commerce |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the China Cross-Border E-Commerce Logistics Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at