444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The US forklift market represents a cornerstone of American industrial infrastructure, serving as the backbone for material handling operations across diverse sectors including manufacturing, warehousing, construction, and retail distribution. This dynamic market encompasses a comprehensive range of powered industrial trucks designed to lift, move, and stack materials with precision and efficiency. The market has experienced substantial growth driven by the rapid expansion of e-commerce, increased warehouse automation, and the ongoing modernization of supply chain operations throughout the United States.

Market dynamics indicate robust demand patterns influenced by technological advancements in electric powertrains, autonomous navigation systems, and integrated fleet management solutions. The sector demonstrates remarkable resilience with consistent growth rates of approximately 6.2% CAGR projected through the forecast period. Electric forklifts have gained significant traction, capturing nearly 58% market share as businesses prioritize environmental sustainability and operational cost reduction.

Regional distribution shows concentrated demand in industrial corridors across the Midwest, Southeast, and West Coast, with California, Texas, and Illinois leading consumption patterns. The market’s evolution reflects broader trends in industrial automation, with smart forklift technologies and IoT integration becoming increasingly prevalent across fleet operations.

The US forklift market refers to the comprehensive ecosystem of powered industrial vehicles designed for lifting, transporting, and positioning materials within warehouses, manufacturing facilities, construction sites, and distribution centers across the United States. This market encompasses various forklift types including counterbalance trucks, reach trucks, pallet jacks, and specialized material handling equipment.

Market scope extends beyond equipment sales to include rental services, maintenance contracts, parts distribution, and technology integration services. The definition encompasses both traditional internal combustion engine models and modern electric variants, along with emerging autonomous and semi-autonomous systems that represent the future of material handling operations.

Industry classification includes manufacturers, dealers, rental companies, service providers, and technology integrators who collectively support the material handling needs of American businesses. The market serves critical functions in supply chain optimization, warehouse efficiency, and industrial productivity enhancement across multiple economic sectors.

Strategic positioning of the US forklift market demonstrates exceptional growth potential driven by accelerating e-commerce expansion, warehouse automation initiatives, and infrastructure modernization projects. The market exhibits strong fundamentals with increasing adoption of electric powertrains and advanced technology integration reshaping operational paradigms across industrial sectors.

Key growth drivers include the surge in online retail fulfillment centers, expansion of cold storage facilities, and increased focus on workplace safety regulations. The market benefits from favorable economic conditions supporting capital equipment investments, with businesses prioritizing efficiency improvements and operational cost reduction strategies.

Technology transformation represents a pivotal market characteristic, with approximately 34% of new forklift purchases incorporating advanced features such as telematics, collision avoidance systems, and fleet management software. This technological evolution enhances productivity while addressing critical safety concerns in material handling operations.

Competitive landscape features established global manufacturers alongside specialized regional players, creating a dynamic environment that fosters innovation and competitive pricing. The market’s maturity provides stability while emerging technologies offer significant growth opportunities for forward-thinking industry participants.

Fundamental market characteristics reveal several critical insights that define the current state and future trajectory of the US forklift industry:

Market maturation indicators suggest a well-established industry with sophisticated customer requirements and evolving technology standards that continue driving innovation and competitive differentiation among market participants.

E-commerce expansion serves as the primary catalyst propelling US forklift market growth, with online retail fulfillment centers requiring extensive material handling capabilities to manage increasing order volumes and delivery expectations. The proliferation of distribution centers and last-mile delivery facilities creates sustained demand for efficient forklift solutions across diverse operational environments.

Warehouse automation initiatives drive significant market momentum as businesses invest in modernizing their material handling infrastructure to improve productivity and reduce operational costs. The integration of automated storage and retrieval systems with forklift operations enhances overall warehouse efficiency while creating opportunities for advanced equipment deployment.

Infrastructure development projects across construction, manufacturing, and logistics sectors generate substantial forklift demand for material movement and positioning applications. Government investments in infrastructure renewal and expansion create favorable market conditions supporting equipment sales and rental activities.

Environmental regulations increasingly favor electric forklift adoption, with businesses seeking to reduce emissions and comply with sustainability mandates. The transition toward cleaner energy sources and carbon footprint reduction initiatives accelerate the shift from internal combustion to electric powertrains across industrial applications.

Labor market dynamics including skilled operator shortages drive demand for user-friendly forklift technologies and automated systems that reduce training requirements while maintaining operational efficiency. Advanced safety features and operator assistance systems help address workforce challenges in material handling operations.

High capital costs associated with advanced forklift systems present significant barriers for small and medium-sized enterprises seeking to modernize their material handling capabilities. The substantial initial investment required for electric forklifts and technology-integrated solutions can limit market penetration among cost-sensitive customers.

Maintenance complexity of modern forklift systems requires specialized technical expertise and sophisticated diagnostic equipment, potentially increasing operational costs and service dependencies for end users. The integration of advanced electronics and software systems creates new maintenance challenges that may deter some potential customers.

Economic uncertainty and cyclical downturns in key industries can significantly impact forklift demand, as businesses defer capital equipment purchases during periods of financial constraint. Market volatility affects both new equipment sales and rental activities, creating revenue fluctuations for industry participants.

Regulatory compliance costs associated with safety standards and environmental requirements add complexity and expense to forklift operations, particularly for smaller businesses with limited resources for compliance management. Evolving regulations require ongoing investments in training, equipment upgrades, and operational modifications.

Technology adoption barriers including workforce training requirements and system integration challenges can slow the implementation of advanced forklift technologies, particularly in traditional industrial environments with established operational procedures and limited technical resources.

Autonomous technology development presents transformative opportunities for the US forklift market, with fully automated material handling systems offering significant productivity improvements and operational cost reductions. The advancement of artificial intelligence and machine learning capabilities enables sophisticated navigation and decision-making systems that can revolutionize warehouse operations.

Cold storage expansion driven by increased demand for fresh and frozen food distribution creates specialized market opportunities for temperature-resistant forklift systems. The growth of pharmaceutical and biotechnology industries requiring controlled environment storage generates additional demand for specialized material handling equipment.

Fleet management services represent substantial growth opportunities as businesses seek comprehensive solutions for equipment optimization, maintenance scheduling, and operational analytics. The integration of telematics platforms with predictive maintenance capabilities offers recurring revenue potential for service providers.

Sustainability initiatives create market opportunities for electric forklift manufacturers and renewable energy integration solutions. The development of hydrogen fuel cell technology for material handling applications offers potential alternatives to traditional battery systems with enhanced performance characteristics.

Emerging market segments including micro-fulfillment centers, urban distribution facilities, and specialized industrial applications provide new avenues for forklift deployment and customization. The evolution of supply chain strategies creates diverse opportunities for innovative material handling solutions.

Supply chain integration fundamentally shapes US forklift market dynamics, with equipment manufacturers, dealers, and service providers forming complex networks that deliver comprehensive material handling solutions. The interdependence of these market participants creates both opportunities for collaboration and challenges related to coordination and quality control across the value chain.

Technology convergence between traditional material handling equipment and advanced digital systems drives market evolution, with approximately 41% of forklift operators now utilizing some form of connected technology in their daily operations. This convergence creates new competitive dynamics and requires continuous innovation to maintain market position.

Customer behavior shifts toward flexible equipment solutions and service-based models influence market dynamics, with rental and leasing options gaining preference over outright purchases. This trend affects revenue models and requires market participants to adapt their business strategies to meet evolving customer preferences.

Regulatory environment changes including safety standards updates and environmental requirements create dynamic market conditions that require continuous adaptation and investment. The implementation of new regulations can create both challenges and opportunities for different market segments and technology approaches.

Global supply chain considerations affect component availability, pricing structures, and delivery schedules, creating market dynamics that extend beyond domestic boundaries. International trade policies and economic conditions influence market stability and growth patterns across the US forklift industry.

Comprehensive data collection methodologies employed in analyzing the US forklift market combine primary research through industry interviews, surveys, and direct observation with extensive secondary research utilizing industry reports, government statistics, and trade association data. This multi-faceted approach ensures robust market intelligence and accurate trend identification.

Primary research activities include structured interviews with key industry stakeholders including manufacturers, dealers, rental companies, and end users across diverse geographic regions and industry sectors. Survey methodologies capture quantitative data on market preferences, purchasing patterns, and technology adoption rates among forklift operators and fleet managers.

Secondary research sources encompass government databases, industry publications, trade association reports, and academic studies that provide historical context and market validation. The integration of multiple data sources enables comprehensive market analysis and trend verification across different information channels.

Data validation processes ensure accuracy and reliability through cross-referencing multiple sources, statistical analysis of data consistency, and expert review of findings. Quality control measures include peer review, data triangulation, and sensitivity analysis to identify potential biases or inconsistencies in market intelligence.

Analytical frameworks utilize both quantitative and qualitative research methodologies to develop comprehensive market insights, including statistical modeling, trend analysis, and scenario planning to project future market conditions and opportunities.

Geographic distribution of the US forklift market reveals distinct regional patterns influenced by industrial concentration, economic activity levels, and infrastructure development. The Midwest region maintains the largest market share at approximately 28%, driven by extensive manufacturing operations and agricultural processing facilities that require substantial material handling capabilities.

West Coast markets including California, Washington, and Oregon demonstrate strong growth momentum fueled by technology sector expansion, port activities, and e-commerce fulfillment center development. The region’s emphasis on environmental sustainability drives higher adoption rates of electric forklift systems compared to national averages.

Southeast region shows robust market expansion supported by automotive manufacturing, food processing, and distribution center growth. States including Texas, Florida, and Georgia lead regional demand with diverse industrial bases requiring varied forklift applications and configurations.

Northeast corridor maintains steady market demand despite mature industrial infrastructure, with urban distribution centers and pharmaceutical manufacturing driving equipment requirements. The region’s focus on operational efficiency and space optimization creates opportunities for specialized forklift solutions.

Mountain and Plains states demonstrate growing market potential driven by energy sector activities, agricultural operations, and logistics hub development. The region’s emphasis on cost-effective solutions influences equipment selection and service preferences among local businesses.

Market leadership in the US forklift industry features a combination of established global manufacturers and specialized regional players who compete across multiple dimensions including product innovation, service quality, and pricing strategies. The competitive environment fosters continuous improvement and technological advancement while maintaining market stability.

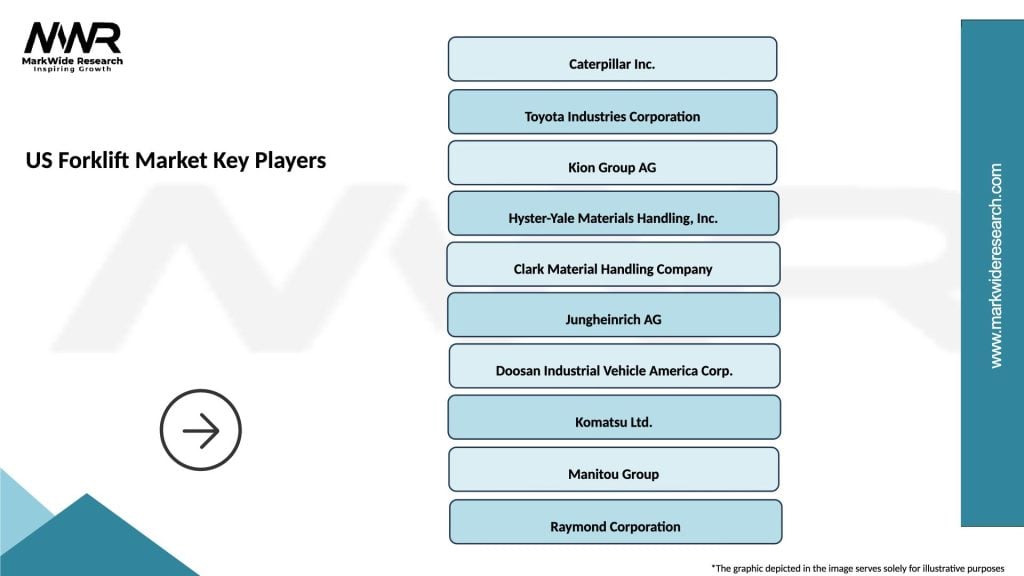

Leading market participants include:

Competitive strategies emphasize product differentiation through technology integration, service excellence, and customer relationship management. Market participants invest heavily in research and development to maintain competitive advantages while expanding service capabilities to capture recurring revenue opportunities.

Market consolidation trends indicate ongoing merger and acquisition activities as companies seek to expand geographic coverage, enhance product portfolios, and achieve operational efficiencies in an increasingly competitive environment.

Product segmentation of the US forklift market encompasses diverse equipment categories designed to meet specific operational requirements across various industrial applications:

By Power Source:

By Product Type:

By Application:

Electric forklift category demonstrates exceptional growth momentum with technological advancements in battery systems, charging infrastructure, and energy management creating compelling value propositions for end users. Lithium-ion battery adoption reaches approximately 45% penetration among new electric forklift purchases, offering improved performance and reduced maintenance requirements compared to traditional lead-acid systems.

Warehouse application category shows the strongest demand patterns driven by e-commerce expansion and distribution center modernization projects. The integration of warehouse management systems with forklift operations enhances productivity while providing real-time visibility into material handling activities and equipment utilization.

Rental service category experiences accelerated growth as businesses seek flexible equipment solutions without significant capital investments. The rental model provides access to latest technology while transferring maintenance responsibilities to service providers, creating attractive value propositions for cost-conscious customers.

Technology integration category represents the fastest-growing segment with advanced features including telematics, collision avoidance, and fleet management systems becoming standard offerings. IoT connectivity enables predictive maintenance, operational optimization, and enhanced safety monitoring across forklift fleets.

Specialized application category including cold storage, hazardous material handling, and clean room operations demonstrates strong growth potential with customized solutions commanding premium pricing and creating differentiation opportunities for manufacturers.

Manufacturers benefit from expanding market opportunities driven by technology advancement, sustainability trends, and evolving customer requirements. The development of innovative solutions creates competitive advantages while recurring service revenue streams provide stable income sources and enhanced customer relationships.

Dealers and distributors capitalize on comprehensive service offerings including sales, rental, maintenance, and fleet management solutions. The integration of digital platforms enhances customer engagement while providing valuable data insights for business optimization and market expansion strategies.

End users realize significant operational benefits including improved productivity, enhanced safety, reduced operational costs, and better regulatory compliance. Advanced forklift technologies enable data-driven decision making and operational optimization while supporting sustainability initiatives and corporate responsibility goals.

Service providers benefit from growing demand for maintenance contracts, fleet management services, and technology support solutions. The complexity of modern forklift systems creates opportunities for specialized service offerings and long-term customer relationships that generate recurring revenue streams.

Technology companies find expanding opportunities for integration partnerships, software solutions, and component supply relationships within the forklift ecosystem. The convergence of material handling equipment with digital technologies creates new market segments and revenue opportunities.

Financial institutions benefit from growing equipment financing and leasing opportunities as businesses seek flexible acquisition methods for forklift investments. The stable nature of material handling equipment provides attractive collateral for lending activities while supporting business growth initiatives.

Strengths:

Weaknesses:

Opportunities:

Threats:

Electrification acceleration represents the most significant trend reshaping the US forklift market, with electric powertrains gaining preference across diverse applications due to environmental benefits, operational cost advantages, and improved performance characteristics. The transition from internal combustion engines continues at an accelerated pace with electric forklift adoption growing at approximately 8.5% annually.

Automation integration emerges as a transformative trend with semi-autonomous and fully autonomous forklift systems becoming viable solutions for repetitive material handling tasks. The development of artificial intelligence and machine learning capabilities enables sophisticated navigation and operational optimization in warehouse environments.

Connectivity expansion through IoT integration and telematics platforms provides real-time visibility into forklift operations, enabling predictive maintenance, fleet optimization, and enhanced safety monitoring. Connected forklift systems demonstrate improved operational efficiency and reduced downtime compared to traditional equipment.

Service model evolution toward comprehensive solutions including equipment-as-a-service offerings, fleet management contracts, and integrated technology support creates new revenue streams while addressing customer preferences for operational flexibility and reduced capital commitments.

Safety technology advancement including collision detection systems, operator assistance features, and automated safety protocols addresses critical workplace safety concerns while improving operational efficiency and regulatory compliance across industrial applications.

Customization demand for specialized forklift configurations tailored to specific applications such as cold storage, clean rooms, and hazardous material handling creates opportunities for premium solutions and enhanced customer value propositions.

Technology partnerships between traditional forklift manufacturers and technology companies accelerate innovation in autonomous systems, fleet management platforms, and advanced safety features. These collaborations combine material handling expertise with cutting-edge digital technologies to create next-generation solutions.

Manufacturing investments in domestic production facilities support supply chain resilience while reducing dependency on international component sources. Several major manufacturers have announced significant capacity expansions and technology upgrades to meet growing market demand.

Sustainability initiatives including carbon-neutral manufacturing processes, renewable energy integration, and circular economy principles gain prominence across the industry. MarkWide Research indicates that sustainability considerations influence approximately 67% of forklift purchasing decisions among large fleet operators.

Regulatory developments including updated safety standards and environmental requirements drive industry adaptation and technology advancement. New regulations create both challenges and opportunities for market participants while ensuring improved workplace safety and environmental protection.

Market consolidation activities including strategic acquisitions and partnerships reshape competitive dynamics while creating opportunities for enhanced product portfolios, expanded geographic coverage, and improved operational efficiencies across the value chain.

Digital transformation initiatives encompassing e-commerce platforms, digital service delivery, and data analytics capabilities enhance customer engagement while providing valuable insights for business optimization and market development strategies.

Strategic positioning recommendations emphasize the importance of technology leadership and service excellence in maintaining competitive advantages within the evolving US forklift market. Companies should prioritize investments in electric powertrains, automation capabilities, and digital integration to meet changing customer requirements and regulatory expectations.

Market expansion strategies should focus on emerging applications including e-commerce fulfillment, cold storage operations, and specialized industrial segments that offer growth potential and premium pricing opportunities. Geographic expansion into underserved markets can provide additional revenue sources while diversifying market exposure.

Service development initiatives should emphasize comprehensive solutions including fleet management, predictive maintenance, and technology integration services that create recurring revenue streams and enhance customer relationships. The evolution toward service-based business models provides stability and growth opportunities.

Technology investment priorities should focus on autonomous systems, connectivity platforms, and advanced safety features that address critical customer needs while creating differentiation opportunities. Partnerships with technology companies can accelerate innovation while sharing development costs and risks.

Sustainability integration should become a core business strategy encompassing product development, manufacturing processes, and customer solutions. Environmental responsibility creates competitive advantages while addressing regulatory requirements and customer preferences for sustainable operations.

Customer engagement strategies should leverage digital platforms and data analytics to enhance service delivery while providing valuable insights for operational optimization. Understanding customer needs and preferences enables targeted solutions and improved satisfaction levels.

Market trajectory for the US forklift industry indicates sustained growth driven by continued e-commerce expansion, warehouse automation initiatives, and infrastructure modernization projects. MWR projections suggest the market will maintain robust growth momentum with electric forklift adoption reaching approximately 72% market share within the next five years.

Technology evolution will fundamentally transform forklift operations with autonomous systems, artificial intelligence, and advanced connectivity becoming standard features rather than premium options. The integration of these technologies will create new operational paradigms while improving safety, efficiency, and cost-effectiveness across material handling applications.

Sustainability focus will intensify with environmental regulations and corporate responsibility initiatives driving accelerated adoption of electric powertrains and renewable energy integration. The development of hydrogen fuel cell technology may provide alternative solutions for specific applications requiring extended runtime capabilities.

Service transformation toward comprehensive solutions and equipment-as-a-service models will reshape industry business models while creating new revenue opportunities and customer value propositions. The evolution of service offerings will emphasize technology integration, data analytics, and operational optimization.

Market consolidation trends will continue as companies seek to achieve scale advantages, expand geographic coverage, and enhance technological capabilities through strategic acquisitions and partnerships. This consolidation will create stronger market participants while maintaining competitive dynamics.

Global integration will influence market development with international technology transfer, component sourcing, and competitive dynamics affecting domestic market conditions. The balance between global integration and supply chain resilience will shape strategic decisions across the industry.

The US forklift market stands at a pivotal juncture characterized by technological transformation, evolving customer requirements, and expanding application opportunities. The industry’s strong fundamentals, combined with favorable market dynamics and continuous innovation, position it for sustained growth and development in the coming years.

Key success factors for market participants include technology leadership, service excellence, sustainability integration, and customer-centric solutions that address evolving operational requirements. The transition toward electric powertrains, automation capabilities, and comprehensive service offerings creates both challenges and opportunities for industry stakeholders.

Market outlook remains positive with robust demand drivers including e-commerce growth, warehouse automation, and infrastructure development supporting continued expansion. The industry’s ability to adapt to changing requirements while maintaining operational excellence will determine long-term success and market position.

Strategic priorities should focus on innovation, sustainability, and customer value creation while building resilient business models capable of adapting to evolving market conditions. The US forklift market’s future success depends on industry participants’ ability to embrace change while delivering exceptional value to customers across diverse applications and operational environments.

What is Forklift?

A forklift is a powered industrial truck used to lift and move materials over short distances. They are commonly used in warehouses, construction sites, and manufacturing facilities for transporting heavy loads.

What are the key players in the US Forklift Market?

Key players in the US Forklift Market include companies like Toyota Material Handling, Hyster-Yale Materials Handling, and Crown Equipment Corporation, among others. These companies are known for their innovative designs and extensive product ranges.

What are the main drivers of growth in the US Forklift Market?

The growth of the US Forklift Market is driven by the increasing demand for efficient material handling solutions in sectors such as e-commerce, manufacturing, and logistics. Additionally, advancements in technology and automation are enhancing forklift capabilities.

What challenges does the US Forklift Market face?

The US Forklift Market faces challenges such as high operational costs and the need for skilled operators. Additionally, regulatory compliance and safety standards can pose hurdles for manufacturers and users alike.

What opportunities exist in the US Forklift Market?

Opportunities in the US Forklift Market include the growing trend towards electric and automated forklifts, which offer sustainability benefits and lower operating costs. The expansion of e-commerce also presents new avenues for growth.

What trends are shaping the US Forklift Market?

Trends in the US Forklift Market include the increasing adoption of smart technology, such as IoT and telematics, which enhance operational efficiency. Additionally, there is a shift towards more sustainable and energy-efficient forklift solutions.

US Forklift Market

| Segmentation Details | Description |

|---|---|

| Product Type | Electric Forklifts, Diesel Forklifts, LPG Forklifts, Reach Trucks |

| End User | Warehousing, Manufacturing, Construction, Retail |

| Technology | Automated Guided Vehicles, Telemetry Systems, IoT Integration, Battery Management Systems |

| Capacity | 1-3 Tons, 4-6 Tons, 7-10 Tons, Above 10 Tons |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the US Forklift Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at