444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The United States house call market represents a transformative shift in healthcare delivery, bringing medical services directly to patients’ homes. This rapidly expanding sector encompasses various healthcare services including primary care visits, specialist consultations, diagnostic procedures, and chronic disease management delivered in residential settings. Healthcare providers are increasingly recognizing the value proposition of home-based care delivery, driven by patient preferences for convenience, aging demographics, and technological advancements that enable remote monitoring and telemedicine integration.

Market dynamics indicate robust growth potential as traditional healthcare delivery models evolve to meet changing consumer expectations. The sector benefits from significant adoption rates among elderly populations, with approximately 78% of seniors expressing preference for receiving care at home when possible. Technology integration has become a cornerstone of modern house call services, enabling healthcare providers to deliver comprehensive care while maintaining connectivity with hospital systems and electronic health records.

Service diversification continues to expand beyond basic primary care, encompassing specialized services such as geriatric care, post-operative follow-ups, mental health counseling, and preventive care screenings. The market demonstrates strong geographic penetration across urban, suburban, and rural areas, with rural adoption rates showing particularly impressive growth of 12.4% annually as communities seek to address healthcare access challenges.

The United States house call market refers to the comprehensive ecosystem of healthcare services delivered directly to patients in their residential environments, encompassing medical consultations, diagnostic procedures, treatment administration, and ongoing care management conducted outside traditional clinical settings. This market includes various service providers ranging from independent physicians and nurse practitioners to large healthcare organizations and specialized home care companies that offer on-demand and scheduled medical visits.

House call services represent a patient-centered approach to healthcare delivery that prioritizes convenience, accessibility, and personalized care. The model encompasses both urgent care responses and routine medical services, utilizing portable diagnostic equipment, mobile health technologies, and coordinated care teams to deliver comprehensive medical attention in familiar home environments.

Market transformation in the United States house call sector reflects fundamental changes in healthcare delivery preferences and technological capabilities. The industry has experienced substantial growth momentum, driven by demographic shifts, consumer demand for convenient care options, and healthcare system recognition of cost-effective care delivery models. Key growth drivers include an aging population with 65% of adults over 75 preferring home-based care, technological advancements enabling remote diagnostics, and healthcare policy changes supporting alternative care delivery methods.

Service expansion has broadened significantly beyond traditional primary care visits to include specialized medical services, chronic disease management, post-acute care, and preventive health screenings. The market demonstrates strong adoption across diverse demographic segments, with particular strength in geriatric care, chronic condition management, and post-surgical follow-up services. Technology integration has become increasingly sophisticated, incorporating telemedicine platforms, mobile diagnostic equipment, and real-time health monitoring systems.

Competitive dynamics feature a mix of traditional healthcare providers expanding service offerings, technology-enabled startups, and specialized house call companies. Market participants are investing heavily in mobile health technologies, care coordination platforms, and provider network expansion to capture growing demand for home-based healthcare services.

Strategic insights reveal several critical trends shaping the United States house call market landscape:

Primary market drivers propelling growth in the United States house call market stem from convergent demographic, technological, and healthcare system factors. The aging population represents the most significant driver, with adults over 65 projected to comprise an increasing percentage of the total population, creating sustained demand for accessible healthcare services that accommodate mobility limitations and chronic condition management needs.

Consumer preference shifts toward convenient, personalized healthcare experiences drive market expansion as patients increasingly value care delivery that fits their lifestyle and schedule constraints. Technology advancement enables sophisticated diagnostic capabilities and real-time health monitoring in home environments, making house call services more comprehensive and clinically effective than traditional models.

Healthcare cost containment pressures motivate healthcare systems to adopt more efficient care delivery models, with house call services demonstrating substantial cost savings compared to emergency department visits and hospital admissions for routine care needs. Policy support through expanded Medicare coverage and state healthcare initiatives creates favorable reimbursement environments for home-based care delivery.

Chronic disease prevalence continues rising, creating demand for ongoing care management services that can be effectively delivered in home settings. Healthcare provider recognition of improved patient outcomes and satisfaction associated with home-based care drives investment in house call service capabilities and infrastructure development.

Significant challenges constrain growth potential in the United States house call market, primarily centered around regulatory complexity, reimbursement limitations, and operational scalability issues. Regulatory compliance requirements create substantial administrative burden for house call providers, particularly regarding documentation standards, quality assurance protocols, and coordination with existing healthcare systems.

Reimbursement constraints limit service expansion as insurance coverage for house call services remains inconsistent across different payers and geographic regions. Provider availability represents a critical constraint, with shortages of qualified healthcare professionals willing and able to provide home-based care services, particularly in rural and underserved areas.

Technology infrastructure requirements demand significant capital investment in mobile diagnostic equipment, secure communication systems, and electronic health record integration capabilities. Liability concerns related to providing medical care in uncontrolled home environments create additional insurance and risk management challenges for healthcare providers.

Scalability limitations arise from the inherently labor-intensive nature of house call services, making it challenging to achieve economies of scale compared to traditional clinic-based care delivery models. Quality assurance complexities in home environments require sophisticated protocols and monitoring systems to maintain clinical standards and patient safety.

Substantial opportunities exist for expansion and innovation within the United States house call market, driven by evolving healthcare needs and technological capabilities. Technology integration presents significant opportunities for developing advanced mobile diagnostic platforms, artificial intelligence-powered health monitoring systems, and seamless electronic health record connectivity that enhances care quality and provider efficiency.

Service diversification opportunities include expanding into specialized care areas such as mental health services, rehabilitation therapy, and preventive care screenings delivered in home environments. Partnership development with hospitals, insurance companies, and technology providers creates opportunities for integrated care delivery models that improve patient outcomes while reducing overall healthcare costs.

Geographic expansion into underserved rural and urban areas presents opportunities to address healthcare access gaps while capturing new market segments. Chronic disease management specialization offers opportunities to develop comprehensive home-based care programs for diabetes, heart disease, and other prevalent conditions requiring ongoing monitoring and intervention.

Corporate wellness programs represent emerging opportunities as employers seek convenient healthcare options for employees, particularly for routine care and preventive services. Insurance partnership opportunities continue expanding as payers recognize cost savings and improved outcomes associated with home-based care delivery models.

Complex market dynamics shape the United States house call market through interacting forces of supply, demand, technology, and regulatory factors. Demand dynamics demonstrate strong growth momentum driven by demographic trends, with patient satisfaction rates for house call services consistently exceeding 90% across multiple studies, indicating robust consumer acceptance and preference for home-based care delivery.

Supply-side dynamics reflect healthcare provider adaptation to changing market conditions, with traditional healthcare organizations increasingly investing in house call capabilities while new market entrants focus on technology-enabled service delivery models. Competitive dynamics feature differentiation strategies based on service scope, technology integration, and geographic coverage, with successful providers emphasizing care quality and patient experience.

Technology dynamics drive continuous innovation in mobile diagnostic capabilities, telemedicine integration, and health monitoring systems that enhance the clinical effectiveness of house call services. Regulatory dynamics continue evolving to accommodate innovative care delivery models while maintaining quality and safety standards, with policy developments generally supporting expanded access to home-based healthcare services.

Economic dynamics demonstrate favorable cost-effectiveness profiles for house call services, with studies indicating average cost reductions of 25-35% compared to traditional care delivery for routine medical services. MarkWide Research analysis indicates that market dynamics support sustained growth as healthcare systems increasingly recognize the value proposition of home-based care delivery models.

Comprehensive research methodology employed in analyzing the United States house call market incorporates multiple data sources and analytical approaches to ensure accuracy and reliability of market insights. Primary research includes extensive interviews with healthcare providers, house call service companies, patients, and industry experts to gather firsthand perspectives on market trends, challenges, and opportunities.

Secondary research encompasses analysis of healthcare industry reports, government healthcare statistics, academic studies on home-based care delivery, and regulatory documentation related to house call services. Market analysis utilizes both quantitative and qualitative research methods to assess market size, growth patterns, competitive dynamics, and future development potential.

Data validation processes include cross-referencing multiple sources, expert review panels, and statistical analysis to ensure research findings accuracy and reliability. Trend analysis incorporates historical data review, current market assessment, and forward-looking projections based on identified growth drivers and market dynamics.

Geographic analysis covers regional variations in house call service adoption, regulatory environments, and market development patterns across different states and metropolitan areas. Segmentation analysis examines market dynamics across different service types, patient demographics, and provider categories to provide comprehensive market understanding.

Regional market dynamics in the United States house call market demonstrate significant variation based on demographic composition, healthcare infrastructure, and regulatory environments. Northeast region shows strong market development with high adoption rates in urban areas, driven by dense population centers, aging demographics, and well-established healthcare systems that support innovative care delivery models.

West Coast markets lead in technology integration and innovative service delivery approaches, with California representing approximately 22% of national house call service activity. Technology adoption in western markets exceeds national averages, with sophisticated telemedicine integration and mobile diagnostic capabilities enhancing service quality and provider efficiency.

Southeast region demonstrates rapid growth momentum, particularly in Florida markets where aging population concentrations drive sustained demand for home-based healthcare services. Rural market penetration shows strongest growth in southern and midwestern states where house call services address critical healthcare access challenges in underserved communities.

Midwest markets show steady adoption patterns with particular strength in chronic disease management services and post-acute care delivery. Texas market represents significant growth opportunity with diverse demographic segments and expanding healthcare infrastructure supporting house call service development. Regional reimbursement variations create different market dynamics, with some states offering more favorable coverage policies for home-based care delivery.

Competitive landscape in the United States house call market features diverse participants ranging from traditional healthcare organizations to innovative technology-enabled startups. Market leaders include established healthcare systems expanding into home-based care delivery and specialized house call companies focusing exclusively on residential healthcare services.

Competitive strategies emphasize technology differentiation, service quality, geographic expansion, and insurance partnership development. Market consolidation trends include healthcare system acquisitions of house call companies and technology platform partnerships to enhance service capabilities.

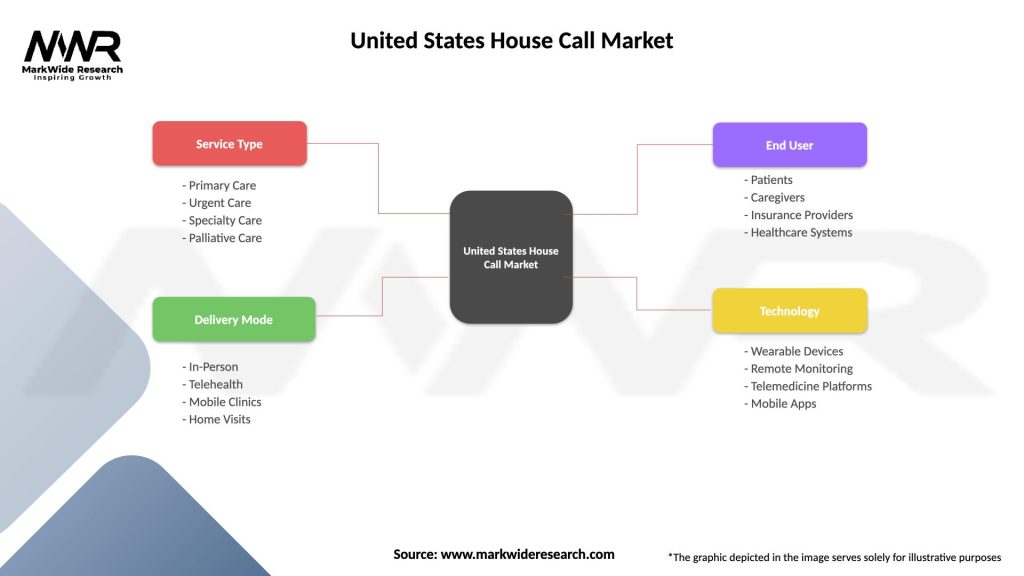

Market segmentation in the United States house call market reflects diverse service categories, patient demographics, and delivery models that address varying healthcare needs and preferences.

By Service Type:

By Patient Demographics:

Primary care services represent the largest segment within the United States house call market, encompassing routine medical consultations, health screenings, and preventive care services. This category demonstrates consistent growth patterns with patient satisfaction rates exceeding 92% due to personalized attention and convenient scheduling options that accommodate patient preferences and lifestyle constraints.

Urgent care services show rapid expansion as patients seek alternatives to emergency room visits for non-critical medical needs. Response time improvements and cost-effectiveness compared to traditional urgent care facilities drive adoption, with average cost savings of approximately 40% compared to emergency department visits for similar conditions.

Chronic disease management represents a high-growth category with specialized services for diabetes, hypertension, and heart disease showing exceptional patient outcomes. Technology integration in this category includes remote monitoring devices and real-time health data transmission that enable proactive intervention and improved disease control.

Geriatric care services demonstrate strong market potential driven by aging population demographics and preference for aging in place. Specialized geriatric house call programs show reduced hospitalization rates and improved quality of life measures for elderly patients receiving regular home-based medical attention.

Mental health services delivered through house calls address growing demand for accessible mental healthcare, particularly in comfortable home environments that reduce anxiety and improve therapeutic outcomes. This category shows increasing adoption rates as stigma around mental health services decreases and patients seek convenient treatment options.

Healthcare providers benefit from house call services through improved patient relationships, reduced overhead costs compared to traditional clinic operations, and ability to serve broader geographic areas. Provider satisfaction increases due to more personalized patient interactions and flexible scheduling that accommodates both provider and patient preferences.

Patients experience significant benefits including convenient access to healthcare services, reduced travel time and costs, personalized attention in comfortable home environments, and improved continuity of care. Patient outcomes improve through better medication compliance, reduced hospital readmissions, and early intervention for health issues.

Healthcare systems realize cost savings through reduced emergency department utilization, decreased hospital readmissions, and more efficient resource allocation. System efficiency improves through better care coordination and reduced administrative overhead associated with traditional facility-based care delivery.

Insurance companies benefit from reduced claims costs, improved patient outcomes, and enhanced member satisfaction. Cost containment achievements through house call services demonstrate measurable savings in overall healthcare expenditures while maintaining or improving care quality standards.

Technology companies find opportunities in developing specialized mobile diagnostic equipment, telemedicine platforms, and health monitoring systems designed for home-based care delivery. Innovation opportunities continue expanding as the market demands more sophisticated technology solutions.

Strengths:

Weaknesses:

Opportunities:

Threats:

Technology integration represents the most significant trend shaping the United States house call market, with providers increasingly adopting sophisticated mobile diagnostic equipment, telemedicine platforms, and real-time health monitoring systems. Artificial intelligence integration enables predictive health analytics and personalized care recommendations that enhance clinical decision-making in home environments.

Service specialization trends include development of focused programs for specific conditions such as diabetes management, post-surgical care, and geriatric services. Chronic disease management programs demonstrate particularly strong growth with specialized care protocols designed for home-based delivery showing improved patient outcomes and cost effectiveness.

Partnership development between house call providers and traditional healthcare systems creates integrated care delivery models that combine facility-based and home-based services. Insurance collaboration trends include development of specialized reimbursement programs and value-based care contracts that support house call service expansion.

Geographic expansion into rural and underserved areas addresses healthcare access challenges while capturing new market opportunities. MWR analysis indicates that rural market penetration shows accelerating growth rates as communities recognize the value of accessible home-based healthcare services.

Consumer-centric service design emphasizes convenience, personalization, and patient experience optimization. Digital health integration includes mobile apps for appointment scheduling, health record access, and communication with healthcare providers that enhance overall service experience.

Recent industry developments demonstrate accelerating innovation and investment in the United States house call market. Major healthcare systems are expanding house call capabilities through acquisitions of specialized providers and development of internal programs that integrate home-based care with traditional facility services.

Technology advancement includes deployment of advanced mobile diagnostic equipment capable of performing complex tests in home environments, including portable imaging systems, laboratory testing capabilities, and real-time health monitoring devices. Telemedicine integration has become increasingly sophisticated, enabling seamless coordination between in-person house calls and virtual care consultations.

Regulatory developments include expanded Medicare coverage for house call services and state-level initiatives supporting home-based care delivery. Policy changes generally favor increased access to alternative care delivery models that demonstrate cost effectiveness and improved patient outcomes.

Investment activity in house call companies has increased significantly, with venture capital and private equity firms recognizing growth potential in home-based healthcare delivery. Market consolidation trends include strategic acquisitions and partnerships that enhance service capabilities and geographic coverage.

Quality improvement initiatives focus on developing standardized protocols for home-based care delivery, including safety procedures, clinical guidelines, and outcome measurement systems that ensure consistent care quality across different home environments.

Strategic recommendations for success in the United States house call market emphasize technology investment, service differentiation, and partnership development. Healthcare providers should prioritize investment in mobile diagnostic capabilities and telemedicine platforms that enable comprehensive care delivery while maintaining connectivity with existing healthcare systems and electronic health records.

Market entry strategies should focus on specific geographic areas or patient demographics where house call services can address clear healthcare access gaps or unmet needs. Service specialization in areas such as chronic disease management or geriatric care provides opportunities for differentiation and premium pricing compared to general house call services.

Partnership development with insurance companies, healthcare systems, and technology providers creates opportunities for integrated service delivery and improved reimbursement arrangements. Quality assurance investments in protocols, training, and monitoring systems ensure consistent care delivery and patient safety in home environments.

Technology adoption should emphasize solutions that enhance clinical capabilities while improving operational efficiency and patient experience. MarkWide Research recommends focusing on scalable technology platforms that can support growth while maintaining personalized care delivery that patients value in house call services.

Geographic expansion strategies should consider regulatory environments, demographic characteristics, and competitive landscapes in target markets. Rural market opportunities offer significant potential but require different service delivery models and technology solutions compared to urban markets.

Future prospects for the United States house call market appear exceptionally positive, driven by demographic trends, technology advancement, and evolving healthcare delivery preferences. Growth projections indicate sustained expansion with annual growth rates expected to exceed 15% over the next five years as market adoption accelerates across diverse patient populations and geographic regions.

Technology evolution will continue driving market development through advanced mobile diagnostics, artificial intelligence integration, and sophisticated health monitoring systems that enhance clinical capabilities in home environments. Telemedicine integration will become increasingly seamless, creating hybrid care delivery models that combine in-person house calls with virtual consultations and remote monitoring.

Market expansion into rural and underserved areas represents significant growth opportunity as healthcare systems seek to address access challenges while controlling costs. Service diversification will continue expanding beyond primary care to include specialized services, mental health care, and corporate wellness programs that address diverse healthcare needs.

Regulatory environment trends support continued market growth through expanded reimbursement coverage and policy initiatives that encourage innovative care delivery models. Insurance integration will deepen as payers recognize cost savings and improved outcomes associated with home-based care delivery.

Competitive landscape evolution will likely include continued consolidation as successful providers expand geographic coverage and service capabilities through acquisitions and partnerships. Innovation focus will emphasize patient experience optimization, clinical outcome improvement, and operational efficiency enhancement that supports sustainable market growth.

The United States house call market represents a transformative opportunity in healthcare delivery, driven by compelling demographic trends, technological advancement, and evolving patient preferences for convenient, personalized care. Market fundamentals demonstrate strong growth potential with sustainable competitive advantages for providers who successfully integrate technology capabilities with high-quality clinical care delivery in home environments.

Strategic success factors include technology investment, service specialization, partnership development, and geographic expansion strategies that address specific market needs and opportunities. The convergence of aging demographics, chronic disease prevalence, and technology capabilities creates favorable conditions for continued market expansion and innovation in home-based healthcare services.

Future market development will be characterized by increasing sophistication in service delivery, deeper integration with traditional healthcare systems, and expanded coverage of specialized medical services delivered in residential settings. Organizations that effectively navigate regulatory requirements, invest in appropriate technology infrastructure, and maintain focus on patient experience and clinical outcomes will be well-positioned to capture significant opportunities in this rapidly evolving market segment.

What is House Call?

House Call refers to a healthcare service where medical professionals visit patients at their homes to provide care, treatment, or consultations. This approach enhances accessibility and convenience for patients who may have difficulty traveling to healthcare facilities.

What are the key players in the United States House Call Market?

Key players in the United States House Call Market include companies like DispatchHealth, Heal, and MDLIVE, which offer various home healthcare services. These companies focus on providing urgent care, primary care, and specialized medical services directly to patients’ homes, among others.

What are the growth factors driving the United States House Call Market?

The growth of the United States House Call Market is driven by factors such as the increasing aging population, rising demand for convenient healthcare services, and advancements in telemedicine technology. Additionally, the desire for personalized care and reduced hospital visits contributes to this market’s expansion.

What challenges does the United States House Call Market face?

Challenges in the United States House Call Market include regulatory hurdles, reimbursement issues, and the need for adequate infrastructure to support home healthcare services. Additionally, ensuring the quality of care and managing logistics for home visits can be complex.

What opportunities exist in the United States House Call Market?

Opportunities in the United States House Call Market include the potential for integrating technology such as remote monitoring and telehealth services. There is also a growing interest in preventive care and chronic disease management, which can be effectively addressed through house call services.

What trends are shaping the United States House Call Market?

Trends in the United States House Call Market include the increasing adoption of telehealth solutions, a focus on patient-centered care, and the expansion of services offered by home healthcare providers. Additionally, there is a rising emphasis on mental health services delivered in home settings.

United States House Call Market

| Segmentation Details | Description |

|---|---|

| Service Type | Primary Care, Urgent Care, Specialty Care, Palliative Care |

| Delivery Mode | In-Person, Telehealth, Mobile Clinics, Home Visits |

| End User | Patients, Caregivers, Insurance Providers, Healthcare Systems |

| Technology | Wearable Devices, Remote Monitoring, Telemedicine Platforms, Mobile Apps |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the United States House Call Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at