444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Spain data center processor market represents a dynamic and rapidly evolving segment of the country’s technology infrastructure landscape. As digital transformation accelerates across Spanish enterprises and government institutions, the demand for high-performance data center processors has experienced unprecedented growth. The market encompasses a comprehensive range of processing solutions, from traditional x86 architectures to emerging ARM-based processors and specialized AI accelerators.

Market dynamics in Spain reflect the broader European trend toward edge computing, cloud migration, and artificial intelligence adoption. Spanish data centers are increasingly deploying advanced processor technologies to support demanding workloads including machine learning, real-time analytics, and high-frequency trading applications. The market is experiencing robust expansion, with industry analysts projecting a compound annual growth rate (CAGR) of 8.2% through the forecast period.

Key market drivers include the Spanish government’s digital agenda initiatives, increasing enterprise cloud adoption rates of 73% among large corporations, and the growing presence of hyperscale data center operators in strategic locations like Madrid and Barcelona. The market landscape is characterized by intense competition among leading processor manufacturers, each vying to capture market share in this lucrative and strategically important segment.

The Spain data center processor market refers to the comprehensive ecosystem of central processing units (CPUs), graphics processing units (GPUs), and specialized accelerators deployed within Spanish data center facilities to power computing workloads, storage operations, and network functions. This market encompasses processors used across various data center types, including enterprise facilities, colocation centers, cloud service provider infrastructure, and edge computing deployments throughout Spain.

Data center processors serve as the computational backbone of modern digital infrastructure, enabling everything from basic web hosting services to complex artificial intelligence applications. In the Spanish context, these processors must meet stringent performance requirements while adhering to European Union regulations regarding energy efficiency, data sovereignty, and environmental sustainability standards.

Market scope includes both traditional server processors optimized for general-purpose computing tasks and specialized processors designed for specific workloads such as machine learning inference, cryptocurrency mining, and high-performance computing applications. The Spanish market particularly emphasizes processors that can deliver optimal performance per watt ratios, reflecting the country’s commitment to sustainable technology deployment.

Strategic positioning within the European data center ecosystem has established Spain as a critical hub for digital infrastructure investment and processor deployment. The Spanish market demonstrates remarkable resilience and growth potential, driven by favorable geographic location, competitive energy costs, and supportive regulatory frameworks that encourage technology innovation and foreign investment.

Market segmentation reveals diverse processor adoption patterns across different industry verticals, with financial services leading adoption at 34% market share, followed by telecommunications and media companies. The emergence of edge computing applications has created new demand categories for low-power, high-efficiency processors capable of operating in distributed environments with limited cooling infrastructure.

Competitive landscape features established semiconductor giants competing alongside emerging players specializing in AI-optimized silicon and energy-efficient architectures. Spanish data center operators are increasingly evaluating processor choices based on total cost of ownership metrics that include performance, power consumption, and software ecosystem compatibility factors.

Future outlook indicates continued market expansion driven by 5G network rollouts, Internet of Things deployments, and increasing demand for real-time data processing capabilities. Industry experts anticipate that processor efficiency improvements will enable 45% reduction in power consumption per compute unit over the next five years, supporting Spain’s ambitious carbon neutrality goals.

Technological evolution within the Spanish data center processor market reflects global trends toward heterogeneous computing architectures that combine traditional CPUs with specialized accelerators for optimal workload performance. This shift has created opportunities for innovative processor designs that can adapt to diverse computational requirements while maintaining energy efficiency standards.

Digital transformation initiatives across Spanish enterprises have created unprecedented demand for high-performance data center processors capable of supporting modern application architectures, cloud-native workloads, and real-time analytics platforms. Organizations are investing heavily in processor upgrades to enable competitive advantages through faster data processing and improved customer experiences.

Government digitalization programs represent a significant market driver, with Spanish public sector agencies modernizing their IT infrastructure to deliver enhanced citizen services and improve operational efficiency. These initiatives require robust processor capabilities to handle increasing data volumes and complex computational requirements associated with smart city implementations and e-government platforms.

Cloud adoption acceleration has fundamentally transformed processor requirements within Spanish data centers, as organizations migrate workloads to cloud-based architectures that demand flexible, scalable computing resources. Cloud service providers operating in Spain are continuously upgrading their processor infrastructure to maintain competitive service offerings and meet growing customer demands.

Artificial intelligence proliferation across Spanish industries has created substantial demand for specialized processors optimized for machine learning workloads, natural language processing, and computer vision applications. Financial institutions, healthcare providers, and manufacturing companies are deploying AI-capable processors to unlock insights from their data assets and automate complex business processes.

5G network deployment throughout Spain requires advanced processor capabilities to support ultra-low latency applications, massive IoT connectivity, and edge computing scenarios that bring processing power closer to end users. Telecommunications operators are investing in processor infrastructure that can handle the computational demands of next-generation network services.

High capital investment requirements for advanced processor technologies present significant barriers for smaller data center operators and enterprises with limited IT budgets. The substantial upfront costs associated with processor upgrades, including supporting infrastructure modifications and software licensing fees, can delay adoption decisions and limit market growth potential.

Supply chain disruptions have created challenges for processor availability and pricing stability within the Spanish market. Global semiconductor shortages and geopolitical tensions affecting chip manufacturing have led to extended lead times and increased costs for data center operators seeking to expand or upgrade their processing capabilities.

Technical complexity associated with modern processor architectures requires specialized expertise for optimal deployment and management. Many Spanish organizations struggle to find qualified personnel capable of designing, implementing, and maintaining advanced processor-based systems, creating bottlenecks in adoption and limiting the market’s growth trajectory.

Energy infrastructure limitations in certain Spanish regions constrain the deployment of high-performance processors that require substantial power and cooling resources. Data center operators must carefully balance processor performance requirements with available electrical capacity and cooling infrastructure capabilities.

Regulatory compliance requirements related to data sovereignty, privacy protection, and environmental standards add complexity and cost to processor deployment decisions. Spanish data center operators must ensure their processor choices align with evolving European Union regulations while maintaining operational efficiency and competitive positioning.

Edge computing expansion presents substantial opportunities for processor vendors to develop specialized solutions optimized for distributed computing environments throughout Spain. The growing demand for low-latency applications and local data processing creates new market segments for compact, energy-efficient processors capable of operating in challenging environmental conditions.

Sustainability initiatives offer opportunities for processor manufacturers to differentiate their products through superior energy efficiency and environmental performance metrics. Spanish data center operators are increasingly prioritizing green technology solutions that can help achieve carbon reduction targets while maintaining operational excellence.

Industry 4.0 adoption across Spanish manufacturing sectors creates demand for processors capable of supporting industrial IoT applications, predictive maintenance systems, and automated production processes. This trend opens new market opportunities for ruggedized processors designed for industrial environments and real-time control applications.

Financial technology innovation in Spain’s banking and fintech sectors requires high-performance processors capable of handling complex algorithmic trading, risk analysis, and fraud detection workloads. The growing importance of real-time financial services creates opportunities for specialized processor solutions optimized for financial applications.

Research and development collaborations between Spanish universities, technology companies, and government agencies present opportunities for processor vendors to participate in cutting-edge computing research and develop next-generation solutions tailored to specific market needs and applications.

Competitive intensity within the Spanish data center processor market has intensified as established semiconductor companies face challenges from emerging players offering innovative architectures and specialized solutions. This dynamic environment drives continuous innovation and creates opportunities for differentiation through performance, efficiency, and cost optimization strategies.

Technology convergence trends are reshaping processor requirements as data centers increasingly deploy converged infrastructure solutions that integrate computing, storage, and networking functions. This convergence creates demand for processors that can efficiently handle diverse workloads while maintaining optimal resource utilization across integrated systems.

Customer expectations continue to evolve as Spanish organizations demand processors that deliver not only superior performance but also enhanced security features, simplified management capabilities, and seamless integration with existing infrastructure investments. These expectations drive processor vendors to develop comprehensive solutions that address multiple customer requirements simultaneously.

Market maturation in traditional server processor segments has prompted vendors to explore new growth opportunities in emerging areas such as AI acceleration, quantum computing preparation, and neuromorphic processing architectures. This diversification strategy helps maintain growth momentum while addressing evolving computational requirements.

Partnership ecosystems play an increasingly important role in market dynamics, as processor vendors collaborate with software developers, system integrators, and cloud service providers to deliver optimized solutions for specific use cases and industry verticals within the Spanish market.

Comprehensive market analysis for the Spanish data center processor market employed a multi-faceted research approach combining primary data collection, secondary research, and quantitative modeling techniques. The methodology ensured accurate representation of market conditions, competitive dynamics, and future growth projections across all relevant market segments and geographic regions within Spain.

Primary research activities included structured interviews with key stakeholders across the Spanish data center ecosystem, including facility operators, technology vendors, system integrators, and end-user organizations. These interviews provided valuable insights into purchasing decisions, technology preferences, and market trends that influence processor adoption patterns.

Secondary research encompassed analysis of industry reports, financial statements, patent filings, and regulatory documents to establish comprehensive understanding of market structure, competitive positioning, and technological developments. This research foundation enabled accurate assessment of market size, growth rates, and segmentation characteristics.

Data validation processes ensured research accuracy through triangulation of information sources, cross-verification of statistical data, and validation of findings with industry experts and market participants. MarkWide Research analysts employed rigorous quality control measures to maintain research integrity and reliability throughout the analysis process.

Quantitative modeling techniques incorporated statistical analysis, trend extrapolation, and scenario planning to develop robust market forecasts and identify key growth drivers and restraints affecting the Spanish data center processor market over the forecast period.

Madrid metropolitan area dominates the Spanish data center processor market, accounting for approximately 42% of total market share due to its concentration of financial institutions, government agencies, and multinational corporations requiring high-performance computing capabilities. The region benefits from excellent connectivity infrastructure, skilled workforce availability, and proximity to major European markets.

Catalonia region, centered around Barcelona, represents the second-largest market segment with 28% market share, driven by strong technology sector presence, manufacturing industries, and growing startup ecosystem. The region’s focus on innovation and digital transformation initiatives creates sustained demand for advanced processor technologies across diverse application areas.

Valencia and surrounding areas contribute 12% of market share, supported by growing logistics and e-commerce sectors that require robust data processing capabilities for supply chain optimization and customer service applications. The region’s strategic location and competitive operating costs attract data center investments and processor deployments.

Andalusia region represents an emerging market opportunity with 8% current market share but significant growth potential driven by tourism digitalization, agricultural technology adoption, and renewable energy sector expansion. The region’s favorable climate conditions and energy resources support sustainable data center operations.

Northern regions including the Basque Country and Galicia collectively account for 10% of market share, with strong industrial bases and growing technology sectors driving processor demand for manufacturing automation, logistics optimization, and emerging digital services applications.

Market leadership in the Spanish data center processor segment is characterized by intense competition among established semiconductor giants and innovative emerging players, each pursuing distinct strategies to capture market share and establish competitive advantages in this dynamic and rapidly evolving market environment.

Competitive strategies focus on differentiation through performance leadership, energy efficiency improvements, specialized workload optimization, and comprehensive software ecosystem development to address evolving customer requirements and market opportunities within the Spanish data center processor market.

By Processor Type: The Spanish data center processor market encompasses diverse processor categories, each serving specific computational requirements and application scenarios within modern data center environments.

By Architecture: Processor architecture preferences reflect evolving computational requirements and energy efficiency priorities within Spanish data center deployments.

By Application: Diverse application categories drive distinct processor requirements and performance optimization strategies across the Spanish market.

Enterprise Data Centers represent the largest category within the Spanish processor market, driven by organizations modernizing their IT infrastructure to support digital transformation initiatives and hybrid cloud deployments. These facilities require processors that balance performance, reliability, and cost-effectiveness while supporting diverse workload requirements.

Colocation Facilities demonstrate strong growth in processor deployments as Spanish businesses increasingly adopt colocation strategies to access enterprise-grade infrastructure without substantial capital investments. These facilities require flexible processor solutions that can accommodate diverse customer requirements and rapid scaling demands.

Cloud Service Providers operating in Spain are driving significant processor demand through continuous infrastructure expansion and technology refresh cycles. These providers prioritize processors that deliver optimal performance per euro and support efficient resource utilization across multi-tenant environments.

Edge Computing Deployments represent the fastest-growing category, with specialized processor requirements for distributed computing scenarios that demand low power consumption, compact form factors, and reliable operation in challenging environmental conditions throughout Spain.

Hyperscale Data Centers operated by global technology companies require massive processor deployments optimized for specific workloads and applications. These facilities drive demand for custom processor solutions and innovative architectures that can deliver superior efficiency at scale.

Data Center Operators benefit from advanced processor technologies through improved computational efficiency, reduced operational costs, and enhanced service delivery capabilities that enable competitive differentiation and customer satisfaction. Modern processors provide superior performance density, enabling operators to maximize revenue per rack unit while minimizing infrastructure requirements.

Enterprise Customers gain access to enhanced computing capabilities that accelerate business processes, improve decision-making through faster analytics, and enable innovative applications that drive competitive advantages. Advanced processors support digital transformation initiatives and enable organizations to respond quickly to changing market conditions.

Technology Vendors benefit from growing processor demand through expanded market opportunities, increased revenue potential, and opportunities to develop specialized solutions for emerging applications and use cases within the Spanish market. Strong processor demand supports continued innovation and investment in next-generation technologies.

System Integrators gain opportunities to deliver comprehensive solutions that combine advanced processors with complementary technologies, creating value-added services and recurring revenue streams. The complexity of modern processor deployments requires specialized expertise that system integrators can provide to customers.

Software Developers benefit from advanced processor capabilities that enable more sophisticated applications, improved user experiences, and new business models based on real-time data processing and artificial intelligence capabilities. Modern processors provide the computational foundation for innovative software solutions.

Strengths:

Weaknesses:

Opportunities:

Threats:

Artificial Intelligence Integration has emerged as a dominant trend within the Spanish data center processor market, with organizations across all sectors deploying AI-capable processors to unlock insights from their data assets and automate complex business processes. This trend is driving demand for specialized AI accelerators and processors optimized for machine learning workloads.

Edge Computing Proliferation represents a transformative trend as Spanish organizations seek to process data closer to its source to reduce latency, improve performance, and enhance user experiences. This trend creates demand for compact, energy-efficient processors capable of operating in distributed environments with limited infrastructure support.

Sustainability Prioritization has become a critical trend as Spanish data center operators face increasing pressure to reduce their environmental impact and achieve carbon neutrality goals. This trend drives adoption of energy-efficient processors and renewable energy integration strategies that minimize operational carbon footprints.

Hybrid Cloud Adoption continues to reshape processor requirements as Spanish organizations implement hybrid cloud strategies that combine on-premises infrastructure with public cloud services. This trend requires flexible processor solutions that can support diverse workloads and seamless integration across hybrid environments.

Security Enhancement has become increasingly important as cyber threats evolve and Spanish organizations face growing regulatory requirements for data protection and privacy. This trend drives demand for processors with built-in security features and hardware-based encryption capabilities.

Major Infrastructure Investments by leading cloud service providers have significantly expanded data center capacity throughout Spain, creating substantial demand for advanced processor technologies. These investments demonstrate confidence in the Spanish market and support continued growth in processor deployments across multiple facility types and applications.

Government Digital Initiatives including smart city projects, e-government platforms, and digital health systems have created new processor demand categories and accelerated technology adoption across public sector organizations. These initiatives require robust computing capabilities and drive innovation in processor applications.

Technology Partnerships between Spanish organizations and international processor vendors have facilitated knowledge transfer, accelerated innovation, and created opportunities for customized solutions that address specific market requirements and application scenarios within the Spanish context.

Research Collaborations between Spanish universities, technology companies, and government agencies have advanced processor technology development and created opportunities for next-generation computing solutions. These collaborations support Spain’s position as a technology innovation hub within Europe.

Regulatory Developments including data sovereignty requirements, environmental standards, and cybersecurity regulations have influenced processor selection criteria and created opportunities for vendors that can address compliance requirements while maintaining performance and cost-effectiveness.

Strategic Focus on energy efficiency and sustainability should be a primary consideration for processor vendors targeting the Spanish market, as data center operators increasingly prioritize environmental responsibility and operational cost optimization. MarkWide Research analysis indicates that energy-efficient processors can provide significant competitive advantages in this market environment.

Partnership Development with local system integrators, software developers, and service providers can help processor vendors establish strong market presence and deliver comprehensive solutions that address specific Spanish market requirements and customer preferences.

Application Specialization in emerging areas such as artificial intelligence, edge computing, and 5G infrastructure can create differentiation opportunities and enable premium pricing for processors optimized for these high-growth application categories.

Customer Education initiatives that demonstrate the value proposition of advanced processor technologies can accelerate adoption and help customers understand the benefits of upgrading from legacy systems to modern, high-performance solutions.

Regulatory Compliance expertise and support services can provide significant value to Spanish customers navigating complex European Union regulations and data sovereignty requirements that impact processor deployment decisions.

Market expansion prospects for the Spanish data center processor market remain highly favorable, driven by continued digital transformation initiatives, growing cloud adoption, and increasing demand for artificial intelligence and edge computing capabilities. MWR projections indicate sustained growth momentum across all major market segments and application categories.

Technology evolution will continue to reshape processor requirements as Spanish organizations adopt more sophisticated computing architectures, including heterogeneous processing systems that combine multiple processor types for optimal workload performance. This evolution creates opportunities for innovative processor designs and specialized solutions.

Sustainability imperatives will increasingly influence processor selection decisions as Spanish data center operators work to achieve carbon neutrality goals and comply with environmental regulations. Energy-efficient processors that can deliver superior performance per watt will gain competitive advantages in this evolving market environment.

Edge computing growth will create new market segments and demand categories for processors optimized for distributed computing scenarios, low-latency applications, and resource-constrained environments throughout Spain. This trend represents a significant growth opportunity for processor vendors.

Innovation acceleration in areas such as quantum computing preparation, neuromorphic processing, and advanced AI capabilities will create new market opportunities and drive continued investment in next-generation processor technologies tailored to Spanish market requirements and applications.

The Spain data center processor market represents a dynamic and rapidly evolving segment of the country’s technology infrastructure landscape, characterized by strong growth momentum, increasing sophistication, and expanding application diversity. Market fundamentals remain robust, supported by favorable government policies, strategic geographic positioning, and growing enterprise demand for advanced computing capabilities.

Key success factors for market participants include focus on energy efficiency, application specialization, and comprehensive solution delivery that addresses the unique requirements of Spanish customers across diverse industry verticals. The market rewards innovation, sustainability, and customer-centric approaches that deliver measurable value and competitive advantages.

Future prospects indicate continued market expansion driven by digital transformation acceleration, artificial intelligence adoption, edge computing proliferation, and 5G network deployment throughout Spain. These trends create substantial opportunities for processor vendors that can deliver innovative, efficient, and cost-effective solutions tailored to evolving market requirements and customer expectations in this strategically important European market.

What is Data Center Processor?

Data Center Processor refers to specialized computing units designed to manage and process data in data centers. These processors are optimized for high performance, energy efficiency, and reliability, catering to various applications such as cloud computing, big data analytics, and enterprise resource management.

What are the key companies in the Spain Data Center Processor Market?

Key companies in the Spain Data Center Processor Market include Intel Corporation, AMD, and ARM Holdings, which are known for their innovative processor technologies. These companies compete to provide high-performance solutions for data centers, among others.

What are the growth factors driving the Spain Data Center Processor Market?

The Spain Data Center Processor Market is driven by the increasing demand for cloud services, the rise of big data analytics, and the need for enhanced data security. Additionally, the growing adoption of artificial intelligence and machine learning applications is further fueling market growth.

What challenges does the Spain Data Center Processor Market face?

The Spain Data Center Processor Market faces challenges such as high energy consumption and the need for advanced cooling solutions. Additionally, the rapid pace of technological advancements can lead to obsolescence, making it difficult for companies to keep up.

What opportunities exist in the Spain Data Center Processor Market?

Opportunities in the Spain Data Center Processor Market include the expansion of edge computing and the increasing investment in data center infrastructure. Furthermore, the growing trend of hybrid cloud solutions presents new avenues for processor innovation.

What trends are shaping the Spain Data Center Processor Market?

Trends shaping the Spain Data Center Processor Market include the shift towards energy-efficient processors and the integration of AI capabilities into data center operations. Additionally, the rise of virtualization technologies is influencing how processors are utilized in data centers.

Spain Data Center Processor Market

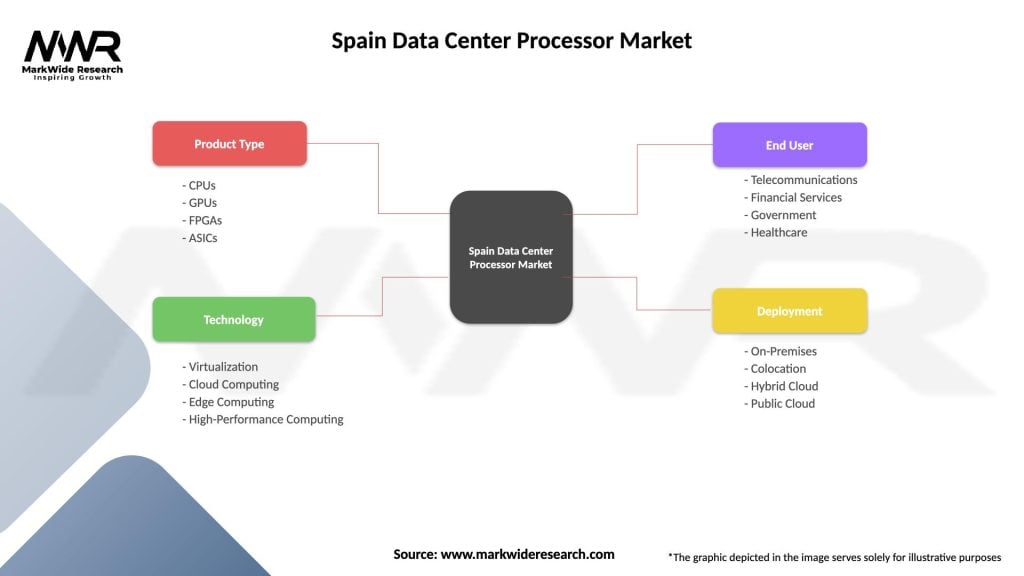

| Segmentation Details | Description |

|---|---|

| Product Type | CPUs, GPUs, FPGAs, ASICs |

| Technology | Virtualization, Cloud Computing, Edge Computing, High-Performance Computing |

| End User | Telecommunications, Financial Services, Government, Healthcare |

| Deployment | On-Premises, Colocation, Hybrid Cloud, Public Cloud |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Spain Data Center Processor Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at