444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Italy Fixed Wireless Access (FWA) market represents a transformative segment of the telecommunications landscape, experiencing unprecedented growth as the nation accelerates its digital infrastructure modernization. Fixed Wireless Access technology has emerged as a critical solution for bridging the digital divide, particularly in rural and underserved areas where traditional fiber-optic installations face geographical and economic challenges. The Italian telecommunications sector is witnessing a significant shift toward FWA solutions, driven by the government’s ambitious digitalization agenda and the increasing demand for high-speed internet connectivity across diverse geographical terrains.

Market dynamics indicate robust adoption rates, with FWA technology demonstrating a compound annual growth rate (CAGR) of 12.8% over the recent assessment period. This growth trajectory reflects the technology’s ability to deliver fiber-like speeds without the extensive infrastructure investments traditionally required for last-mile connectivity. Italian telecommunications operators are increasingly recognizing FWA as a strategic enabler for expanding their service coverage while maintaining competitive operational costs.

Regional deployment patterns show particularly strong momentum in Southern Italy and mountainous regions, where conventional broadband infrastructure development has historically lagged. The technology’s flexibility in overcoming geographical barriers has made it an essential component of Italy’s National Recovery and Resilience Plan (PNRR), which allocates substantial resources toward digital infrastructure enhancement. 5G-enabled FWA solutions are gaining traction, offering enhanced performance capabilities that position Italy as a leader in next-generation wireless broadband deployment across European markets.

The Italy Fixed Wireless Access market refers to the comprehensive ecosystem of wireless broadband technologies, infrastructure, and services that deliver high-speed internet connectivity to fixed locations without requiring physical cable connections. FWA technology utilizes radio frequencies to establish point-to-point or point-to-multipoint connections between base stations and customer premises equipment, effectively replacing traditional copper or fiber-optic last-mile connections with wireless alternatives.

This market encompasses various technological approaches, including millimeter-wave solutions, sub-6 GHz deployments, and hybrid systems that combine multiple frequency bands for optimal performance. The Italian FWA landscape includes both 4G LTE-based solutions and advanced 5G implementations, with operators strategically deploying these technologies based on coverage requirements, capacity demands, and geographical constraints. The market definition extends beyond mere connectivity provision to include comprehensive service packages, equipment manufacturing, network infrastructure development, and ongoing maintenance services.

Stakeholder participation in the Italian FWA market includes major telecommunications operators, equipment manufacturers, technology integrators, and regulatory bodies working collaboratively to establish robust wireless broadband networks. The market’s scope encompasses both urban deployments aimed at providing competitive alternatives to fiber services and rural implementations focused on bridging connectivity gaps in previously underserved areas.

Italy’s Fixed Wireless Access market stands at a pivotal juncture, characterized by accelerating adoption rates and substantial infrastructure investments that position the nation as a European leader in wireless broadband deployment. The market has demonstrated remarkable resilience and growth potential, with penetration rates increasing by 18.5% annually as operators expand their FWA service portfolios to address diverse customer segments and geographical challenges.

Key market drivers include the Italian government’s digital transformation initiatives, increasing consumer demand for high-speed internet services, and the economic advantages of FWA deployment compared to traditional fiber-optic infrastructure. The technology’s ability to deliver gigabit-class speeds while maintaining cost-effective deployment models has attracted significant operator investment, with major telecommunications companies allocating substantial resources toward FWA network expansion and enhancement.

Competitive dynamics reveal a market dominated by established telecommunications operators who are leveraging their existing cellular infrastructure to deploy comprehensive FWA solutions. The integration of 5G technology has created new opportunities for service differentiation, enabling operators to offer enhanced performance characteristics and support emerging applications requiring ultra-low latency and high-bandwidth connectivity.

Market challenges include spectrum allocation complexities, regulatory compliance requirements, and the need for continuous technology upgrades to maintain competitive performance standards. However, these challenges are being addressed through collaborative industry initiatives and supportive government policies that facilitate FWA deployment and adoption across diverse market segments.

Strategic market analysis reveals several critical insights that define the Italian FWA landscape and its future trajectory. The market demonstrates strong fundamentals supported by favorable regulatory environments, technological advancement, and increasing consumer acceptance of wireless broadband alternatives.

Government digitalization initiatives serve as the primary catalyst driving Italy’s FWA market expansion, with comprehensive policy frameworks supporting wireless broadband deployment across diverse geographical regions. The National Recovery and Resilience Plan has allocated substantial resources toward digital infrastructure development, creating favorable conditions for FWA technology adoption and network expansion.

Economic efficiency considerations significantly influence operator investment decisions, as FWA solutions offer compelling cost advantages compared to traditional fiber-optic deployments, particularly in challenging geographical terrains. The technology’s ability to deliver high-performance connectivity without extensive civil works or lengthy installation timelines makes it an attractive option for operators seeking to expand their service coverage rapidly and cost-effectively.

Consumer demand evolution reflects increasing expectations for high-speed internet access, driven by remote work trends, digital entertainment consumption, and emerging applications requiring robust connectivity. Italian consumers are demonstrating strong willingness to adopt wireless broadband solutions that offer competitive performance characteristics and flexible service options.

Technological advancement in 5G networks and millimeter-wave technologies has created new possibilities for FWA deployment, enabling operators to deliver fiber-like performance through wireless infrastructure. These technological improvements have expanded the addressable market for FWA solutions and enhanced their competitive positioning against traditional broadband alternatives.

Geographic challenges in Italy’s diverse landscape create natural demand for FWA solutions, as mountainous regions, islands, and rural areas present significant obstacles for conventional broadband infrastructure deployment. The technology’s flexibility in overcoming these geographical barriers positions it as an essential connectivity solution for ensuring nationwide digital inclusion.

Spectrum availability limitations present ongoing challenges for FWA market expansion, as operators compete for finite radio frequency resources while managing interference concerns and regulatory compliance requirements. The complexity of spectrum management requires careful coordination between operators and regulatory authorities to optimize network performance and minimize service disruptions.

Infrastructure investment requirements remain substantial despite FWA’s cost advantages over fiber deployment, with operators needing to invest in base station equipment, backhaul connectivity, and customer premises equipment to deliver competitive service quality. These capital expenditure demands can strain operator resources and impact deployment timelines, particularly for smaller telecommunications companies.

Performance variability associated with wireless technologies can create customer satisfaction challenges, as factors such as weather conditions, geographical obstacles, and network congestion may impact service quality. Managing these technical limitations requires ongoing network optimization and customer education efforts to maintain competitive service standards.

Regulatory complexity surrounding wireless broadband deployment involves multiple approval processes, environmental assessments, and compliance requirements that can delay network expansion initiatives. The need to navigate diverse regulatory frameworks at national, regional, and local levels adds complexity to FWA deployment strategies and operational planning.

Competition from fiber networks continues to intensify as traditional broadband infrastructure expands, potentially limiting FWA market opportunities in areas where fiber-optic services become available. Operators must carefully balance their technology investment strategies to maintain competitive positioning across diverse market segments and geographical regions.

5G network evolution creates unprecedented opportunities for FWA market expansion, with advanced wireless technologies enabling new service capabilities and performance levels that rival traditional broadband solutions. The deployment of millimeter-wave 5G networks opens possibilities for ultra-high-speed FWA services that can address enterprise and residential market segments with demanding connectivity requirements.

Rural connectivity initiatives present substantial growth opportunities as government programs and European Union funding mechanisms prioritize digital inclusion in underserved areas. The Italian government’s commitment to universal broadband access creates a favorable environment for FWA deployment in regions where traditional infrastructure development faces economic or geographical constraints.

Enterprise market expansion offers significant revenue potential as businesses increasingly seek flexible, scalable connectivity solutions that can support digital transformation initiatives. FWA technology’s ability to provide rapid deployment and service activation makes it particularly attractive for enterprise customers requiring quick connectivity solutions or backup services.

Smart city applications represent emerging opportunities for FWA integration, with wireless broadband networks serving as foundational infrastructure for IoT deployments, traffic management systems, and public safety applications. The technology’s flexibility and scalability position it as an enabling platform for comprehensive smart city initiatives across Italian municipalities.

International expansion possibilities emerge as Italian operators develop expertise in FWA deployment and service delivery, creating opportunities for technology export and consulting services in other European markets facing similar connectivity challenges. This knowledge transfer potential can generate additional revenue streams and strengthen Italy’s position in the global telecommunications market.

Competitive intensity within the Italian FWA market continues to escalate as major telecommunications operators expand their wireless broadband portfolios and new entrants explore market opportunities. This competitive environment drives innovation acceleration and service improvement initiatives that benefit consumers through enhanced performance and competitive pricing structures.

Technology convergence between cellular and broadband networks creates synergistic opportunities for operators to leverage existing infrastructure investments while expanding service capabilities. The integration of FWA solutions with traditional mobile networks enables operators to optimize resource utilization and improve overall network efficiency.

Regulatory evolution continues to shape market dynamics through spectrum allocation decisions, service quality requirements, and infrastructure sharing policies. MarkWide Research analysis indicates that regulatory frameworks are becoming increasingly supportive of FWA deployment, with streamlined approval processes and favorable spectrum policies facilitating market growth.

Customer behavior shifts reflect growing acceptance of wireless broadband alternatives, with consumers demonstrating increased willingness to adopt FWA services based on performance improvements and competitive pricing. This market maturation creates opportunities for operators to expand their customer base and develop differentiated service offerings.

Investment patterns show sustained commitment from both private sector operators and government initiatives, with funding allocation supporting network expansion and technology upgrades. The alignment of public and private investment creates favorable conditions for accelerated FWA market development and geographic coverage expansion.

Comprehensive market analysis for the Italy FWA market employs multi-faceted research methodologies combining quantitative data collection, qualitative insights, and industry expert consultations to provide accurate market assessment and forecasting. The research approach integrates primary and secondary data sources to ensure comprehensive coverage of market dynamics, competitive landscapes, and emerging trends.

Primary research activities include structured interviews with telecommunications operators, equipment manufacturers, regulatory officials, and industry consultants to gather firsthand insights into market conditions, challenges, and opportunities. These stakeholder consultations provide valuable perspectives on technology deployment strategies, customer adoption patterns, and competitive positioning within the Italian market.

Secondary research components encompass analysis of government publications, regulatory filings, industry reports, and financial disclosures from major market participants. This documentary analysis provides quantitative data on market performance, investment levels, and regulatory developments that influence FWA market dynamics.

Data validation processes ensure research accuracy through cross-referencing multiple sources, statistical verification, and expert review procedures. The methodology incorporates triangulation techniques to confirm findings and eliminate potential biases or inconsistencies in data interpretation.

Market modeling approaches utilize advanced analytical frameworks to project future market trends, assess growth scenarios, and evaluate the impact of various factors on market development. These forecasting methodologies provide stakeholders with reliable insights for strategic planning and investment decision-making processes.

Northern Italy demonstrates the highest FWA adoption rates, with major metropolitan areas including Milan, Turin, and Venice leading in advanced 5G FWA deployments. The region’s industrial concentration and high digital literacy rates create favorable conditions for enterprise FWA services, with businesses increasingly adopting wireless broadband solutions for primary connectivity and backup services. Market penetration rates in Northern Italy reach approximately 32% of eligible premises, reflecting strong consumer acceptance and competitive service offerings.

Central Italy shows balanced growth patterns, with Rome serving as a key market for both residential and enterprise FWA services. The region benefits from government digitalization initiatives and proximity to regulatory decision-making centers, facilitating rapid deployment of new FWA technologies and services. Coverage expansion in Central Italy has achieved 28% market penetration, with operators focusing on service quality improvements and network capacity enhancements.

Southern Italy represents the fastest-growing FWA market segment, driven by government initiatives to bridge the digital divide and improve connectivity in historically underserved areas. The region’s geographical challenges make FWA particularly attractive as an alternative to traditional broadband infrastructure, with deployment costs significantly lower than fiber-optic alternatives. Growth rates in Southern Italy exceed 22% annually, reflecting the technology’s effectiveness in addressing connectivity gaps.

Island territories including Sicily and Sardinia demonstrate exceptional FWA adoption potential, with wireless broadband solutions offering practical alternatives to submarine cable deployments for improved connectivity. These regions benefit from dedicated government funding and European Union support for digital infrastructure development, creating favorable conditions for accelerated FWA deployment and service expansion.

Major telecommunications operators dominate the Italian FWA market through comprehensive service portfolios and extensive network infrastructure investments. The competitive environment reflects a mix of established cellular operators leveraging existing infrastructure and specialized broadband providers developing dedicated FWA solutions.

Competitive strategies emphasize service differentiation through technology advancement, geographic coverage expansion, and integrated service offerings that combine FWA connectivity with value-added services. Operators are investing heavily in 5G network upgrades and millimeter-wave technologies to maintain competitive advantages and support premium service tiers.

Market consolidation trends reflect ongoing industry evolution, with operators exploring partnership opportunities, infrastructure sharing agreements, and strategic acquisitions to strengthen their competitive positions. These collaborative initiatives enable more efficient resource utilization and accelerated market coverage expansion.

Technology-based segmentation reveals distinct market categories based on wireless broadband technologies and performance characteristics. The Italian FWA market encompasses multiple technology approaches, each serving specific customer requirements and deployment scenarios.

By Technology:

By Application:

By Geography:

Residential FWA services represent the largest market category, driven by increasing consumer demand for high-speed internet access and competitive alternatives to traditional broadband options. This segment demonstrates strong growth momentum with adoption rates increasing as service quality improvements and competitive pricing make FWA attractive to mainstream consumers. Customer satisfaction levels in the residential category have improved significantly, with service reliability ratings exceeding 88% as operators optimize their networks and enhance customer support capabilities.

Enterprise FWA solutions constitute a high-value market segment characterized by demanding performance requirements and willingness to pay premium pricing for enhanced service levels. Business customers increasingly view FWA as a strategic connectivity option that offers deployment flexibility and scalability advantages over traditional broadband alternatives. The enterprise segment shows particular strength in backup connectivity applications and temporary site deployments where rapid service activation is essential.

Government and public sector applications represent an emerging category with substantial growth potential as Italian municipalities and government agencies modernize their digital infrastructure. These deployments often serve as anchor customers for FWA network expansion in underserved areas, providing operators with stable revenue streams while supporting public policy objectives for digital inclusion.

Industrial and IoT applications constitute a specialized category focusing on connectivity requirements for manufacturing, logistics, and smart infrastructure deployments. This segment benefits from FWA’s ability to provide flexible, scalable connectivity that can adapt to changing operational requirements and support emerging industrial digitalization initiatives.

Telecommunications operators benefit from FWA technology through accelerated market expansion capabilities and improved return on infrastructure investments. The technology enables operators to leverage existing cellular infrastructure for broadband service delivery, reducing deployment costs and time-to-market compared to traditional fiber-optic alternatives. Revenue diversification opportunities emerge as operators can address previously underserved market segments and develop new service categories.

Equipment manufacturers gain from increasing demand for FWA infrastructure components, customer premises equipment, and network optimization solutions. The market expansion creates sustained revenue streams from both initial deployments and ongoing technology upgrades as operators enhance their network capabilities and service offerings.

Government stakeholders achieve policy objectives related to digital inclusion and economic development through FWA deployment in underserved areas. The technology supports national digitalization goals while providing cost-effective solutions for bridging connectivity gaps in challenging geographical regions.

End customers benefit from increased broadband options, competitive pricing, and improved service availability, particularly in areas where traditional broadband infrastructure is limited or unavailable. FWA services offer flexible connectivity solutions that can adapt to changing requirements and provide reliable alternatives to conventional broadband services.

Economic development benefits include job creation in telecommunications and technology sectors, increased digital literacy, and enhanced business competitiveness through improved connectivity infrastructure. The FWA market contributes to overall economic growth by enabling digital transformation initiatives across various industry sectors.

Strengths:

Weaknesses:

Opportunities:

Threats:

5G integration acceleration represents the most significant trend shaping the Italian FWA market, with operators rapidly deploying advanced wireless technologies to deliver enhanced performance and support emerging applications. This trend enables gigabit-class speeds and ultra-low latency services that position FWA as a competitive alternative to fiber-optic broadband in various market segments.

Rural connectivity prioritization continues to drive market expansion as government initiatives and European Union funding programs focus on bridging digital divides in underserved areas. This trend creates substantial deployment opportunities for FWA solutions in regions where traditional broadband infrastructure faces economic or geographical constraints.

Enterprise market sophistication reflects growing business adoption of FWA solutions for primary connectivity, backup services, and temporary site deployments. Companies are increasingly recognizing the strategic value of wireless broadband alternatives that offer deployment flexibility and operational advantages over traditional connectivity options.

Technology convergence between cellular and broadband networks enables operators to optimize infrastructure investments and improve service delivery efficiency. This trend supports integrated service offerings that combine mobile and fixed wireless services through unified network platforms and customer management systems.

Sustainability focus influences FWA deployment strategies as operators and government stakeholders prioritize environmentally responsible infrastructure development. The technology’s reduced civil works requirements and energy efficiency advantages align with broader sustainability objectives and corporate responsibility initiatives.

Customer experience enhancement drives continuous improvements in service quality, installation processes, and customer support capabilities. Operators are investing in digital transformation initiatives that streamline customer interactions and provide transparent service monitoring and management tools.

Major infrastructure investments by leading telecommunications operators have accelerated FWA network expansion across Italy, with companies allocating substantial resources toward 5G upgrades and coverage enhancement initiatives. These investments demonstrate strong market confidence and commitment to wireless broadband technology advancement.

Regulatory framework evolution has created more favorable conditions for FWA deployment through streamlined approval processes, spectrum allocation improvements, and supportive policy initiatives. Recent regulatory developments have reduced deployment barriers and facilitated faster network expansion timelines.

Technology partnerships between operators and equipment manufacturers have resulted in innovative FWA solutions optimized for Italian market conditions and customer requirements. These collaborative initiatives have produced advanced network technologies and improved service delivery capabilities.

Government digitalization programs have provided substantial funding and policy support for FWA deployment in underserved areas, creating opportunities for accelerated market expansion and digital inclusion initiatives. These programs demonstrate public sector commitment to comprehensive broadband coverage and economic development objectives.

Customer adoption milestones reflect growing market acceptance of FWA services, with operators reporting significant increases in subscriber numbers and customer satisfaction ratings. These achievements indicate successful market education and service quality improvements that support continued growth momentum.

International collaboration initiatives have facilitated knowledge sharing and technology transfer opportunities, positioning Italian operators as leaders in European FWA deployment and service innovation. These collaborative efforts enhance competitive capabilities and support export opportunities for Italian telecommunications expertise.

Strategic focus recommendations emphasize the importance of continued investment in 5G FWA technologies and network optimization initiatives to maintain competitive advantages and support market expansion objectives. MWR analysis suggests that operators should prioritize millimeter-wave deployments in high-value market segments while maintaining cost-effective sub-6 GHz solutions for broader coverage requirements.

Market positioning strategies should emphasize FWA’s unique value propositions, including rapid deployment capabilities, cost-effectiveness, and flexibility advantages over traditional broadband alternatives. Operators are advised to develop differentiated service offerings that address specific customer segments and application requirements while maintaining competitive pricing structures.

Partnership development opportunities should be explored to enhance service capabilities, reduce deployment costs, and accelerate market expansion timelines. Collaborative initiatives with equipment manufacturers, infrastructure providers, and government agencies can create synergistic benefits that strengthen competitive positioning and market presence.

Customer education initiatives remain essential for continued market growth, with operators advised to invest in awareness campaigns and demonstration programs that highlight FWA performance capabilities and service benefits. These efforts should focus on addressing misconceptions about wireless broadband technology and demonstrating competitive performance characteristics.

Technology roadmap planning should incorporate emerging wireless technologies and standards to ensure long-term competitive viability and service evolution capabilities. Operators should maintain flexible network architectures that can accommodate future technology upgrades and changing market requirements.

Regulatory engagement activities should focus on supporting favorable policy development and spectrum allocation decisions that facilitate continued FWA market expansion. Active participation in industry associations and regulatory consultations can help shape favorable market conditions and address potential deployment barriers.

Market trajectory projections indicate sustained growth momentum for the Italian FWA market, driven by continued technology advancement, supportive government policies, and increasing customer acceptance of wireless broadband alternatives. The market is expected to maintain robust expansion rates as operators complete their 5G network deployments and expand service coverage to previously underserved areas.

Technology evolution will continue to enhance FWA performance capabilities, with advanced 5G implementations and emerging wireless technologies enabling new service categories and application support. These technological improvements will position FWA as an increasingly competitive alternative to traditional broadband solutions across diverse market segments.

Geographic expansion opportunities remain substantial, particularly in rural and mountainous regions where FWA offers significant advantages over conventional broadband infrastructure. Government digitalization initiatives and European Union funding programs will continue to support accelerated deployment in these underserved areas.

Service innovation trends will drive the development of integrated offerings that combine FWA connectivity with value-added services, cloud solutions, and IoT capabilities. These comprehensive service packages will create new revenue opportunities and strengthen customer relationships through enhanced value propositions.

Competitive dynamics will continue to evolve as operators refine their FWA strategies and new market entrants explore opportunities in specialized segments. The market is expected to maintain healthy competition levels that drive innovation and benefit consumers through improved service quality and competitive pricing.

Investment patterns suggest continued commitment from both private sector operators and government initiatives, with funding allocation supporting network expansion, technology upgrades, and service enhancement initiatives. This sustained investment momentum provides a strong foundation for long-term market growth and development.

The Italy Fixed Wireless Access market represents a dynamic and rapidly evolving segment of the telecommunications industry, characterized by strong growth momentum, technological advancement, and increasing market acceptance. The market has successfully established itself as a viable alternative to traditional broadband solutions, particularly in challenging geographical areas where conventional infrastructure deployment faces significant obstacles.

Key success factors include supportive government policies, substantial infrastructure investments by major operators, and continuous technology improvements that enhance service quality and performance capabilities. The integration of 5G technologies has created new opportunities for service differentiation and market expansion, positioning Italian operators as leaders in European FWA deployment and innovation.

Market fundamentals remain strong, with favorable regulatory environments, sustained investment commitments, and growing customer acceptance supporting continued expansion across diverse geographical regions and customer segments. The technology’s ability to address digital inclusion objectives while providing cost-effective connectivity solutions aligns with broader national digitalization goals and economic development priorities.

Future prospects indicate continued market growth and evolution, driven by ongoing technology advancement, geographic expansion opportunities, and service innovation initiatives. The Italian FWA market is well-positioned to maintain its growth trajectory while contributing to the nation’s digital transformation objectives and competitive positioning in the global telecommunications landscape.

What is Fixed Wireless Access (FWA)?

Fixed Wireless Access (FWA) refers to a technology that provides internet connectivity to homes and businesses using wireless signals instead of traditional wired connections. It is particularly useful in areas where laying cables is impractical or too costly.

What are the key players in the Italy Fixed Wireless Access (FWA) Market?

Key players in the Italy Fixed Wireless Access (FWA) Market include Telecom Italia, Fastweb, and Linkem, among others. These companies are actively expanding their FWA offerings to meet the growing demand for high-speed internet in urban and rural areas.

What are the growth factors driving the Italy Fixed Wireless Access (FWA) Market?

The growth of the Italy Fixed Wireless Access (FWA) Market is driven by increasing demand for high-speed internet, the expansion of digital services, and the need for reliable connectivity in remote areas. Additionally, advancements in wireless technology are enhancing service quality.

What challenges does the Italy Fixed Wireless Access (FWA) Market face?

The Italy Fixed Wireless Access (FWA) Market faces challenges such as competition from fiber-optic services, regulatory hurdles, and the need for significant infrastructure investment. These factors can impact the speed and quality of service delivery.

What opportunities exist in the Italy Fixed Wireless Access (FWA) Market?

Opportunities in the Italy Fixed Wireless Access (FWA) Market include the potential for expanding services in underserved areas, the integration of new technologies like 5G, and partnerships with local governments to enhance connectivity. These factors can lead to increased market penetration.

What trends are shaping the Italy Fixed Wireless Access (FWA) Market?

Trends shaping the Italy Fixed Wireless Access (FWA) Market include the growing adoption of smart home technologies, increased demand for mobile broadband, and the shift towards hybrid work models. These trends are influencing how consumers and businesses utilize internet services.

Italy Fixed Wireless Access (FWA) Market

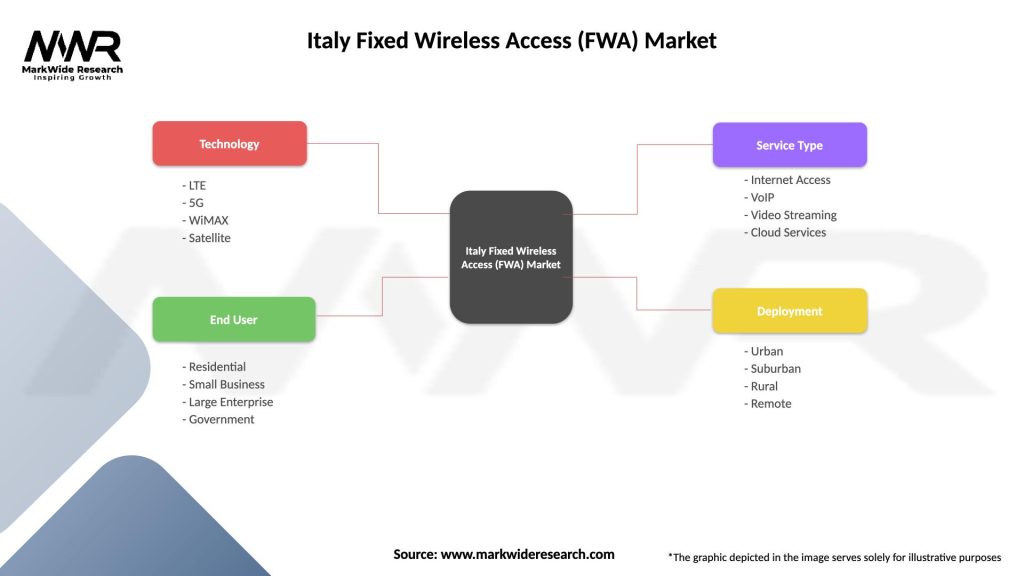

| Segmentation Details | Description |

|---|---|

| Technology | LTE, 5G, WiMAX, Satellite |

| End User | Residential, Small Business, Large Enterprise, Government |

| Service Type | Internet Access, VoIP, Video Streaming, Cloud Services |

| Deployment | Urban, Suburban, Rural, Remote |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Italy Fixed Wireless Access (FWA) Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at