444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The UAE e-waste management market represents a rapidly evolving sector driven by increasing digitalization, technological advancement, and growing environmental consciousness across the Emirates. Electronic waste management has emerged as a critical component of the nation’s sustainability initiatives, with the UAE positioning itself as a regional leader in responsible technology disposal and recycling practices.

Market dynamics indicate robust growth potential, with the sector experiencing a compound annual growth rate (CAGR) of 8.2% driven by stringent regulatory frameworks and increasing corporate responsibility initiatives. The market encompasses comprehensive services including collection, sorting, processing, and recycling of electronic devices ranging from consumer electronics to industrial equipment.

Government initiatives have significantly accelerated market development, with the UAE implementing progressive policies that mandate proper e-waste disposal and encourage circular economy practices. The integration of advanced recycling technologies and strategic partnerships with international waste management companies has positioned the UAE as a hub for sustainable electronic waste processing in the Middle East region.

Regional leadership in smart city development and digital transformation has simultaneously increased electronic device consumption and created substantial opportunities for specialized e-waste management services. The market benefits from strong infrastructure development, technological innovation, and increasing awareness among both businesses and consumers regarding environmental sustainability.

The UAE e-waste management market refers to the comprehensive ecosystem of services, technologies, and processes dedicated to the collection, processing, recycling, and responsible disposal of electronic waste generated across the United Arab Emirates. This market encompasses specialized facilities, equipment, and expertise required to handle various categories of electronic devices while ensuring environmental compliance and resource recovery.

Electronic waste management involves systematic approaches to handling discarded electronic equipment including smartphones, computers, televisions, appliances, and industrial electronics. The market includes both formal recycling operations and emerging technologies that extract valuable materials while minimizing environmental impact through proper treatment of hazardous substances.

Scope expansion includes not only traditional recycling services but also refurbishment programs, component recovery operations, and specialized handling of batteries and rare earth elements. The market serves diverse stakeholders including government entities, corporations, educational institutions, and individual consumers seeking responsible disposal solutions for their electronic devices.

Strategic positioning of the UAE e-waste management market reflects the nation’s commitment to environmental sustainability and circular economy principles. The market has experienced significant transformation driven by regulatory mandates, technological advancement, and increasing corporate environmental responsibility initiatives across various sectors.

Market expansion is characterized by growing adoption of advanced recycling technologies, with approximately 72% of major facilities implementing automated sorting and processing systems. The integration of artificial intelligence and robotics has enhanced operational efficiency while improving material recovery rates and reducing processing costs.

Regulatory framework development has created a structured environment for market growth, with government policies establishing clear guidelines for e-waste collection, processing, and disposal. These regulations have stimulated investment in specialized infrastructure and encouraged international partnerships that bring global best practices to the UAE market.

Future prospects indicate continued expansion driven by increasing electronic device penetration, smart city initiatives, and growing environmental awareness. The market is positioned to benefit from regional expansion opportunities and potential export of recycling expertise to neighboring countries seeking sustainable waste management solutions.

Market intelligence reveals several critical insights that define the current landscape and future trajectory of the UAE e-waste management sector:

Regulatory mandates serve as the primary catalyst for market expansion, with government policies establishing comprehensive frameworks for electronic waste management. These regulations require businesses and institutions to demonstrate responsible disposal practices while creating market opportunities for specialized service providers.

Digital transformation initiatives across the UAE have accelerated electronic device adoption, simultaneously increasing waste generation and creating demand for professional management services. Smart city projects, government digitization programs, and corporate technology upgrades contribute significantly to the growing e-waste stream requiring proper handling.

Environmental consciousness among businesses and consumers has elevated the importance of sustainable waste management practices. Corporate sustainability reporting requirements and consumer preference for environmentally responsible companies have driven increased investment in proper e-waste disposal and recycling programs.

Economic incentives associated with material recovery and resource extraction have made e-waste management financially attractive. The recovery of precious metals, rare earth elements, and reusable components creates revenue streams that support market viability while promoting circular economy principles.

Technological advancement in recycling processes has improved efficiency and reduced operational costs, making professional e-waste management more accessible to smaller businesses and organizations. Advanced sorting technologies and automated processing systems have enhanced the economic viability of comprehensive recycling operations.

High capital requirements for establishing advanced e-waste processing facilities present significant barriers to market entry. The investment needed for specialized equipment, facility development, and regulatory compliance can limit the number of new market participants and slow overall capacity expansion.

Technical complexity associated with processing diverse electronic devices requires specialized expertise and equipment. The variety of materials, components, and hazardous substances found in electronic waste necessitates sophisticated handling procedures that can be challenging and expensive to implement effectively.

Collection challenges persist in reaching all segments of the market, particularly smaller businesses and individual consumers. The logistics of comprehensive collection networks and the costs associated with reaching dispersed waste generators can limit the effectiveness of e-waste management programs.

Market fragmentation with numerous small-scale operators can lead to inconsistent service quality and regulatory compliance issues. The presence of informal recycling activities may undermine formal market development and create unfair competition for licensed operators.

Limited awareness among certain market segments regarding proper e-waste disposal procedures continues to restrict market growth. Educational initiatives require ongoing investment and time to achieve widespread behavior change among all stakeholders.

Regional expansion presents significant opportunities for UAE-based e-waste management companies to extend services throughout the Middle East and North Africa region. The UAE’s advanced infrastructure and expertise position it well to serve neighboring markets seeking sustainable waste management solutions.

Technology innovation opportunities include development of more efficient recycling processes, improved material recovery techniques, and integration of emerging technologies such as artificial intelligence and blockchain for enhanced tracking and processing capabilities.

Circular economy initiatives create opportunities for expanded services including device refurbishment, component remanufacturing, and development of secondary markets for recovered materials. These value-added services can enhance profitability while supporting sustainability objectives.

Public-private partnerships offer opportunities for collaborative development of comprehensive e-waste management infrastructure. Government support for private sector investment can accelerate market development while ensuring alignment with national sustainability goals.

Export potential for processed materials and recycling expertise represents an emerging opportunity as global demand for sustainable waste management solutions continues to grow. The UAE’s strategic location and advanced capabilities position it well for international market expansion.

Supply chain evolution within the UAE e-waste management market reflects increasing sophistication and integration across collection, processing, and material recovery operations. MarkWide Research analysis indicates that streamlined supply chains have improved overall efficiency by 32% while reducing processing costs and environmental impact.

Competitive dynamics are characterized by consolidation among larger operators and specialization among smaller service providers. Market leaders are expanding their service offerings while smaller companies focus on niche segments such as specific device types or specialized processing techniques.

Technology adoption continues to reshape market operations, with automated sorting systems, advanced material recovery processes, and digital tracking technologies becoming standard components of modern e-waste management facilities. These technological improvements enhance operational efficiency while improving environmental outcomes.

Regulatory evolution maintains pressure for continuous improvement in industry standards and practices. Ongoing policy development creates both challenges and opportunities as companies must adapt to changing requirements while benefiting from clearer regulatory frameworks.

Market maturation is evident in the development of industry standards, professional certifications, and best practice guidelines that enhance overall market credibility and effectiveness. This maturation process supports long-term market stability and growth potential.

Comprehensive analysis of the UAE e-waste management market employs multiple research methodologies to ensure accuracy and completeness of market insights. Primary research includes direct engagement with industry participants, government officials, and market stakeholders through structured interviews and surveys.

Secondary research incorporates analysis of government publications, industry reports, regulatory documents, and company financial statements to provide comprehensive market understanding. This approach ensures that all relevant market factors and trends are properly identified and analyzed.

Data validation processes include cross-referencing multiple sources, expert review, and statistical analysis to ensure reliability and accuracy of market information. Quantitative data is verified through multiple channels while qualitative insights are validated through expert consultation.

Market modeling techniques incorporate historical data analysis, trend identification, and scenario planning to develop accurate market projections and insights. These models account for various market factors including regulatory changes, technological advancement, and economic conditions.

Continuous monitoring ensures that market analysis remains current and relevant through ongoing data collection and analysis. This approach enables identification of emerging trends and market developments that may impact future market dynamics.

Dubai emirate leads the UAE e-waste management market, accounting for approximately 42% of total market activity due to its status as a major commercial and technology hub. The emirate’s advanced infrastructure, large corporate presence, and progressive environmental policies create ideal conditions for comprehensive e-waste management services.

Abu Dhabi represents the second-largest market segment with 28% market share, driven by government initiatives, major industrial operations, and significant institutional demand for e-waste services. The emirate’s focus on sustainability and circular economy principles supports continued market expansion.

Sharjah contributes approximately 15% of market activity, with growing industrial sectors and increasing environmental awareness driving demand for professional e-waste management services. The emirate’s strategic location and developing infrastructure support market growth potential.

Northern Emirates collectively account for the remaining 15% of market share, with emerging opportunities in Ajman, Fujairah, Ras Al Khaimah, and Umm Al Quwain. These regions show increasing adoption of formal e-waste management practices as awareness and regulatory compliance improve.

Cross-emirate coordination initiatives are developing integrated approaches to e-waste management that optimize resource utilization and improve overall system efficiency. These collaborative efforts enhance market effectiveness while reducing operational costs across the region.

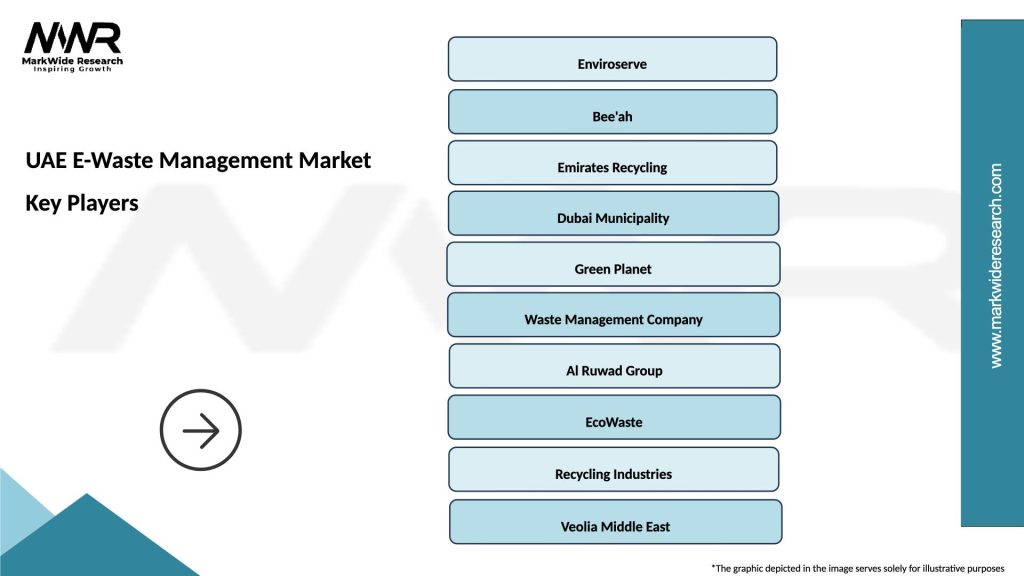

Market leadership is distributed among several key players who have established comprehensive service capabilities and strong regulatory compliance records:

Competitive strategies focus on technology advancement, service expansion, and strategic partnerships to enhance market position. Companies are investing in advanced processing equipment, expanding collection networks, and developing specialized services for different market segments.

Market consolidation trends indicate potential for merger and acquisition activity as larger players seek to expand capabilities and market reach while smaller companies look for growth opportunities through strategic partnerships.

By Source Type:

By Device Category:

By Service Type:

Consumer electronics represent the fastest-growing segment within the UAE e-waste management market, driven by rapid technology adoption and shorter device lifecycles. This category benefits from established collection networks and standardized processing procedures that enable efficient handling and material recovery.

IT equipment disposal commands premium pricing due to security requirements and specialized handling needs. Corporate clients prioritize certified data destruction and compliance documentation, creating opportunities for value-added services and long-term client relationships.

Large appliance recycling requires specialized infrastructure and handling capabilities but offers substantial material recovery opportunities. The segment benefits from established collection networks and growing consumer awareness of proper disposal requirements.

Industrial electronics represent a niche but profitable segment requiring specialized expertise and equipment. These devices often contain valuable materials and require careful handling due to potential hazardous components.

Emerging categories including electric vehicle batteries and renewable energy equipment represent future growth opportunities as these technologies become more prevalent in the UAE market.

Environmental benefits include significant reduction in landfill waste, prevention of hazardous material contamination, and conservation of natural resources through material recovery and recycling. Proper e-waste management contributes to the UAE’s sustainability goals while protecting environmental health.

Economic advantages encompass job creation, revenue generation through material recovery, and cost savings through efficient waste management practices. The industry supports circular economy principles while creating value from waste materials that would otherwise represent disposal costs.

Regulatory compliance benefits help businesses and organizations meet environmental requirements while avoiding potential penalties and reputational risks. Professional e-waste management ensures proper documentation and compliance with all relevant regulations.

Resource recovery opportunities enable extraction of valuable materials including precious metals, rare earth elements, and reusable components. These recovered materials support manufacturing industries while reducing dependence on virgin material extraction.

Innovation opportunities arise from technology development, process improvement, and service expansion that benefit the entire industry ecosystem. Continuous innovation enhances efficiency while creating new market opportunities and competitive advantages.

Strengths:

Weaknesses:

Opportunities:

Threats:

Automation integration is transforming e-waste processing operations with advanced robotics and artificial intelligence systems improving sorting accuracy and processing efficiency. These technologies enable handling of complex waste streams while reducing labor costs and improving safety conditions.

Blockchain implementation for waste tracking and transparency is gaining traction among major operators seeking to enhance accountability and regulatory compliance. This technology provides end-to-end visibility of the waste management process while building trust with clients and regulators.

Circular economy integration is expanding beyond traditional recycling to include refurbishment, remanufacturing, and component recovery services. This trend creates additional revenue streams while supporting broader sustainability objectives and resource conservation goals.

Mobile collection services are emerging to improve accessibility and convenience for smaller businesses and residential customers. These services utilize technology platforms to optimize collection routes and scheduling while expanding market reach.

Specialized processing for emerging device categories including electric vehicle batteries, solar panels, and advanced electronics is developing as these technologies become more prevalent in the UAE market.

Regulatory advancement includes implementation of extended producer responsibility programs that require manufacturers to take greater responsibility for end-of-life management of their products. These policies are reshaping industry dynamics and creating new business models.

Infrastructure expansion projects include development of new processing facilities with advanced capabilities and increased capacity to meet growing market demand. These investments demonstrate industry confidence and commitment to long-term market development.

Technology partnerships between local operators and international technology providers are bringing advanced processing capabilities to the UAE market. These collaborations enhance technical capabilities while supporting knowledge transfer and skill development.

Certification programs are being developed to establish industry standards and ensure consistent service quality across the market. These programs enhance professional credibility while providing clients with confidence in service providers.

Research initiatives focusing on advanced recycling technologies and process optimization are being conducted in partnership with academic institutions and research organizations. These efforts support continuous improvement and innovation within the industry.

Strategic recommendations for market participants include investment in advanced processing technologies that improve efficiency and material recovery rates. MWR analysis suggests that companies adopting automated sorting and processing systems achieve 25% higher profitability compared to traditional operations.

Market expansion strategies should focus on developing comprehensive service offerings that address diverse client needs while building long-term relationships. Companies should consider vertical integration opportunities that enhance control over the value chain and improve service quality.

Technology investment priorities should emphasize systems that improve operational efficiency, enhance regulatory compliance, and provide competitive advantages. Digital platforms for client management, waste tracking, and reporting can significantly enhance service delivery and client satisfaction.

Partnership development with international operators, technology providers, and research institutions can accelerate capability development while providing access to global best practices and advanced technologies.

Regulatory engagement is essential for staying ahead of policy developments and contributing to industry standard development. Active participation in regulatory discussions can help shape favorable policy environments while ensuring compliance readiness.

Market expansion prospects remain strong with continued growth expected across all major segments driven by increasing electronic device adoption, regulatory enforcement, and environmental awareness. The market is projected to maintain robust growth rates as infrastructure development and technology adoption continue.

Technology evolution will continue to reshape industry operations with advanced automation, artificial intelligence, and innovative processing techniques improving efficiency and expanding capabilities. These developments will enhance the economic viability of comprehensive e-waste management while improving environmental outcomes.

Regional leadership positioning of the UAE in Middle East e-waste management is expected to strengthen through continued investment in infrastructure, technology, and expertise development. This leadership position creates opportunities for service export and regional market expansion.

Regulatory development will continue to drive market formalization and professional standards while creating new requirements and opportunities for service providers. Extended producer responsibility and circular economy policies will reshape industry dynamics and business models.

Innovation opportunities in emerging technology areas including electric vehicle batteries, renewable energy equipment, and advanced electronics will create new market segments and revenue opportunities for forward-thinking operators.

The UAE e-waste management market represents a dynamic and rapidly evolving sector positioned for continued growth and development. Strong regulatory support, advanced infrastructure, and increasing environmental awareness create favorable conditions for market expansion and innovation.

Strategic opportunities exist across all market segments for companies that invest in advanced technologies, develop comprehensive service capabilities, and build strong client relationships. The market’s evolution toward greater sophistication and integration presents numerous possibilities for value creation and competitive advantage.

Long-term prospects remain positive with continued technology adoption, regulatory development, and regional expansion opportunities supporting sustained market growth. The UAE’s position as a regional leader in sustainability and innovation provides a strong foundation for continued market development and international expansion.

Success factors for market participants include technology investment, regulatory compliance, service quality, and strategic partnerships that enhance capabilities and market reach. Companies that adapt to changing market conditions while maintaining focus on environmental sustainability and operational excellence are well-positioned for long-term success in this growing market.

What is E-Waste Management?

E-Waste Management refers to the processes involved in the disposal, recycling, and recovery of electronic waste, which includes discarded electronic devices and components. This practice is essential for minimizing environmental impact and promoting resource recovery.

What are the key players in the UAE E-Waste Management Market?

Key players in the UAE E-Waste Management Market include Enviroserve, E-Waste Recycling, and Bee’ah, among others. These companies are involved in various aspects of e-waste processing, including collection, recycling, and safe disposal.

What are the main drivers of the UAE E-Waste Management Market?

The main drivers of the UAE E-Waste Management Market include the rapid growth of electronic consumption, increasing awareness of environmental sustainability, and government regulations promoting responsible e-waste disposal. These factors contribute to a rising demand for effective e-waste management solutions.

What challenges does the UAE E-Waste Management Market face?

The UAE E-Waste Management Market faces challenges such as inadequate recycling infrastructure, lack of public awareness regarding e-waste disposal, and the complexity of recycling certain electronic components. These issues hinder the effective management of electronic waste.

What opportunities exist in the UAE E-Waste Management Market?

Opportunities in the UAE E-Waste Management Market include the development of advanced recycling technologies, partnerships between public and private sectors, and increasing investment in sustainable waste management practices. These factors can enhance the efficiency of e-waste processing.

What trends are shaping the UAE E-Waste Management Market?

Trends shaping the UAE E-Waste Management Market include the rise of circular economy initiatives, increased regulatory focus on e-waste, and the adoption of innovative recycling technologies. These trends are driving improvements in e-waste management practices.

UAE E-Waste Management Market

| Segmentation Details | Description |

|---|---|

| Product Type | Computers, Mobile Phones, Televisions, Printers |

| End User | Households, Corporations, Educational Institutions, Government Agencies |

| Collection Method | Drop-off Centers, Curbside Pickup, Retail Take-back, Events |

| Recycling Technology | Mechanical Processing, Pyrometallurgy, Hydrometallurgy, Biotechnological Methods |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the UAE E-Waste Management Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at