444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The Middle East and Africa pharmaceutical glass packaging market represents a rapidly expanding sector driven by increasing healthcare investments, growing pharmaceutical manufacturing capabilities, and rising demand for safe drug storage solutions. This market encompasses various glass packaging formats including vials, ampoules, cartridges, bottles, and prefilled syringes used across the pharmaceutical industry. The region’s strategic position as a pharmaceutical hub connecting Europe, Asia, and Africa has positioned it as a critical market for glass packaging solutions.

Market dynamics indicate robust growth potential, with the sector experiencing a compound annual growth rate (CAGR) of 8.2% driven by expanding pharmaceutical production and increasing regulatory compliance requirements. The market benefits from growing investments in healthcare infrastructure, particularly in countries like Saudi Arabia, UAE, South Africa, and Egypt, which are establishing themselves as pharmaceutical manufacturing centers.

Regional pharmaceutical companies are increasingly adopting advanced glass packaging solutions to meet international quality standards and export requirements. The market’s growth trajectory is supported by rising healthcare expenditure, growing population demographics, and increasing prevalence of chronic diseases requiring specialized drug delivery systems. Glass packaging adoption has reached approximately 72% penetration in the region’s pharmaceutical sector, reflecting the industry’s commitment to product safety and quality assurance.

The Middle East and Africa pharmaceutical glass packaging market refers to the comprehensive ecosystem of glass-based containers, vials, bottles, and specialized packaging solutions designed specifically for pharmaceutical products across the MEA region. This market encompasses primary packaging materials that come into direct contact with pharmaceutical substances, ensuring product integrity, sterility, and stability throughout the supply chain.

Pharmaceutical glass packaging includes various product categories such as tubular glass vials, molded glass bottles, ampoules for injectable medications, cartridges for pen injectors, and prefilled syringes for biologics and vaccines. These packaging solutions are manufactured using specialized pharmaceutical-grade glass materials, primarily borosilicate glass and soda-lime glass, designed to meet stringent regulatory requirements and maintain drug efficacy.

The market significance extends beyond mere containment, encompassing critical functions including drug stability preservation, contamination prevention, dosage accuracy, and patient safety assurance. Glass packaging serves as a barrier against environmental factors while enabling precise drug delivery mechanisms essential for modern pharmaceutical applications across the diverse healthcare landscape of the Middle East and Africa.

Market expansion in the Middle East and Africa pharmaceutical glass packaging sector reflects the region’s transformation into a significant pharmaceutical manufacturing hub. The market demonstrates strong fundamentals driven by increasing healthcare investments, regulatory harmonization efforts, and growing demand for high-quality packaging solutions that meet international standards.

Key growth drivers include expanding pharmaceutical manufacturing capabilities, with 65% of regional pharmaceutical companies upgrading their packaging infrastructure to comply with international quality standards. The market benefits from strategic government initiatives promoting local pharmaceutical production, reducing import dependencies, and establishing the region as an export hub for global markets.

Technological advancement represents a crucial market differentiator, with manufacturers increasingly adopting automated glass forming technologies, advanced coating systems, and smart packaging solutions. The integration of serialization and track-and-trace capabilities has become essential, with 78% of pharmaceutical glass packaging now incorporating anti-counterfeiting features to ensure product authenticity and patient safety.

Regional market dynamics vary significantly, with the Gulf Cooperation Council countries leading in terms of advanced packaging adoption, while African markets show strong growth potential driven by expanding healthcare access and pharmaceutical localization initiatives. The market’s future trajectory appears robust, supported by demographic trends, increasing disease prevalence, and continued healthcare infrastructure development across the region.

Strategic market positioning reveals several critical insights shaping the Middle East and Africa pharmaceutical glass packaging landscape. The following key insights demonstrate the market’s evolution and growth potential:

Market intelligence indicates that pharmaceutical glass packaging adoption rates vary significantly across the region, with developed markets showing higher penetration while emerging markets present substantial growth opportunities for packaging manufacturers and pharmaceutical companies alike.

Healthcare infrastructure expansion serves as the primary catalyst driving pharmaceutical glass packaging market growth across the Middle East and Africa. Government investments in healthcare systems, hospital construction, and pharmaceutical manufacturing facilities create substantial demand for high-quality packaging solutions that ensure drug safety and efficacy.

Pharmaceutical manufacturing growth represents another significant driver, with regional countries establishing local production capabilities to reduce import dependencies and serve domestic markets. This trend has resulted in increased demand for pharmaceutical glass packaging by 45% over recent years, as manufacturers require reliable, compliant packaging solutions for their products.

Regulatory harmonization efforts across the region drive adoption of international packaging standards, compelling pharmaceutical companies to upgrade their packaging infrastructure. The implementation of Good Manufacturing Practices (GMP) and alignment with international regulatory requirements necessitate high-quality glass packaging solutions that meet stringent safety and quality standards.

Population demographics and increasing disease prevalence create sustained demand for pharmaceutical products, directly translating to packaging requirements. The region’s growing elderly population and rising incidence of chronic diseases such as diabetes, cardiovascular conditions, and cancer drive demand for specialized drug delivery systems and corresponding glass packaging solutions.

Export market development encourages pharmaceutical manufacturers to adopt international-standard packaging solutions, enabling them to access global markets and compete effectively with established pharmaceutical companies worldwide.

High capital investment requirements for establishing pharmaceutical-grade glass packaging manufacturing facilities present significant barriers to market entry. The specialized equipment, quality control systems, and regulatory compliance infrastructure required for pharmaceutical glass packaging production demand substantial financial resources that may limit market participation.

Technical expertise shortage across the region constrains market development, as pharmaceutical glass packaging requires specialized knowledge in glass chemistry, forming technologies, and quality assurance protocols. The limited availability of skilled technicians and engineers familiar with pharmaceutical packaging requirements creates operational challenges for manufacturers.

Supply chain complexities affect market efficiency, particularly regarding raw material sourcing and specialized equipment procurement. Many regional manufacturers depend on imported glass-making materials and packaging machinery, creating potential supply disruptions and cost volatility that impact market stability.

Regulatory compliance costs represent ongoing challenges, as maintaining pharmaceutical-grade manufacturing standards requires continuous investment in quality systems, testing protocols, and regulatory submissions. These compliance requirements can strain smaller manufacturers and limit market competition.

Economic volatility in certain regional markets affects pharmaceutical investment decisions and packaging procurement strategies. Currency fluctuations, political instability, and economic uncertainty can impact long-term planning and capital allocation for packaging infrastructure development.

Biologics and biosimilars growth presents substantial opportunities for specialized glass packaging solutions. The increasing development and production of biological pharmaceuticals in the region requires advanced packaging technologies, including prefilled syringes, cartridges, and specialized vials designed for sensitive biological products.

Vaccine manufacturing expansion creates significant market opportunities, particularly following global health initiatives and regional vaccine production capabilities development. The demand for vaccine vials, ampoules, and cold-chain compatible glass packaging solutions represents a growing market segment with substantial revenue potential.

Smart packaging integration offers opportunities for technology-enhanced glass packaging solutions incorporating sensors, RFID tags, and digital tracking capabilities. These advanced packaging systems enable real-time monitoring of drug conditions, authentication verification, and supply chain transparency.

Sustainability initiatives create opportunities for eco-friendly glass packaging solutions, including recyclable materials, reduced environmental impact manufacturing processes, and circular economy approaches. Pharmaceutical companies increasingly prioritize sustainable packaging options, creating market demand for environmentally responsible solutions.

Regional pharmaceutical hubs development in countries like Saudi Arabia, UAE, and South Africa present opportunities for establishing localized glass packaging manufacturing and distribution centers. These strategic locations can serve broader regional markets while reducing logistics costs and supply chain dependencies.

Contract manufacturing growth creates opportunities for specialized glass packaging suppliers to serve multiple pharmaceutical clients through flexible manufacturing arrangements and customized packaging solutions.

Competitive landscape evolution shapes market dynamics through increasing consolidation among packaging manufacturers and strategic partnerships with pharmaceutical companies. The market demonstrates a trend toward vertical integration, with pharmaceutical manufacturers establishing in-house packaging capabilities or forming exclusive supplier relationships to ensure supply chain security.

Technology advancement cycles drive continuous market evolution, with manufacturers investing in automated production systems, quality control technologies, and innovative glass formulations. These technological improvements result in enhanced production efficiency by 35% while maintaining strict quality standards required for pharmaceutical applications.

Regulatory landscape changes significantly impact market dynamics, as evolving pharmaceutical regulations require packaging manufacturers to adapt their products and processes continuously. The harmonization of regional regulatory standards with international requirements creates both challenges and opportunities for market participants.

Supply chain optimization efforts influence market dynamics through the development of regional distribution networks, strategic inventory management, and supplier diversification strategies. These initiatives aim to reduce supply chain vulnerabilities while maintaining cost competitiveness in the pharmaceutical packaging market.

Customer relationship evolution reflects the pharmaceutical industry’s increasing focus on strategic partnerships rather than transactional supplier relationships. This trend drives packaging manufacturers to develop comprehensive service offerings, including technical support, regulatory assistance, and customized packaging solutions tailored to specific pharmaceutical applications.

Comprehensive market analysis employs multiple research methodologies to ensure accurate and reliable market insights for the Middle East and Africa pharmaceutical glass packaging sector. The research approach combines quantitative data analysis with qualitative industry expertise to provide a complete market perspective.

Primary research activities include extensive interviews with pharmaceutical manufacturers, glass packaging suppliers, regulatory officials, and industry experts across key regional markets. These interviews provide firsthand insights into market trends, challenges, and opportunities while validating secondary research findings through direct industry feedback.

Secondary research sources encompass industry reports, regulatory publications, trade association data, and company financial statements to establish market baselines and identify growth patterns. This research foundation ensures comprehensive coverage of market segments, competitive landscapes, and regulatory environments across the diverse MEA region.

Data validation processes involve cross-referencing multiple sources, conducting follow-up interviews, and applying statistical analysis techniques to ensure research accuracy and reliability. The methodology includes market sizing calculations, growth rate projections, and trend analysis based on verified industry data.

Regional market segmentation analysis covers individual country markets, sub-regional clusters, and cross-border trade patterns to provide detailed insights into market dynamics and opportunities across the Middle East and Africa pharmaceutical glass packaging landscape.

Gulf Cooperation Council markets lead regional pharmaceutical glass packaging adoption, with Saudi Arabia and UAE representing the largest market segments. These markets benefit from substantial healthcare investments, advanced pharmaceutical manufacturing capabilities, and strong regulatory frameworks that drive demand for high-quality glass packaging solutions. The GCC region accounts for approximately 42% of regional market share due to its developed pharmaceutical infrastructure and export-oriented manufacturing strategies.

North African markets demonstrate strong growth potential, particularly Egypt and Morocco, which are establishing pharmaceutical manufacturing hubs to serve both domestic and export markets. These countries benefit from strategic geographic positioning, growing healthcare access, and government initiatives promoting pharmaceutical sector development.

South African market represents the continent’s most developed pharmaceutical glass packaging segment, with established manufacturing infrastructure and strong regulatory compliance standards. The market serves as a regional hub for pharmaceutical distribution across sub-Saharan Africa, creating substantial demand for diverse packaging solutions.

East African markets show emerging opportunities driven by expanding healthcare access, growing pharmaceutical imports, and increasing local manufacturing initiatives. Countries like Kenya and Ethiopia are developing pharmaceutical sectors that require reliable glass packaging solutions to meet quality and safety standards.

West African markets present long-term growth opportunities as healthcare infrastructure develops and pharmaceutical access expands. Nigeria’s large population and growing healthcare investments create substantial potential for pharmaceutical glass packaging market development.

Market leadership in the Middle East and Africa pharmaceutical glass packaging sector involves both international manufacturers and emerging regional players. The competitive landscape reflects a mix of established global companies and local manufacturers developing specialized capabilities for regional market requirements.

Competitive strategies focus on technological innovation, regional manufacturing establishment, and strategic partnerships with pharmaceutical companies. Market leaders invest in advanced production technologies, quality assurance systems, and regulatory compliance capabilities to maintain competitive advantages in the growing regional market.

Market consolidation trends indicate increasing merger and acquisition activity as companies seek to expand regional presence and enhance technological capabilities. These strategic moves aim to create comprehensive service offerings and strengthen supply chain positions across the diverse Middle East and Africa markets.

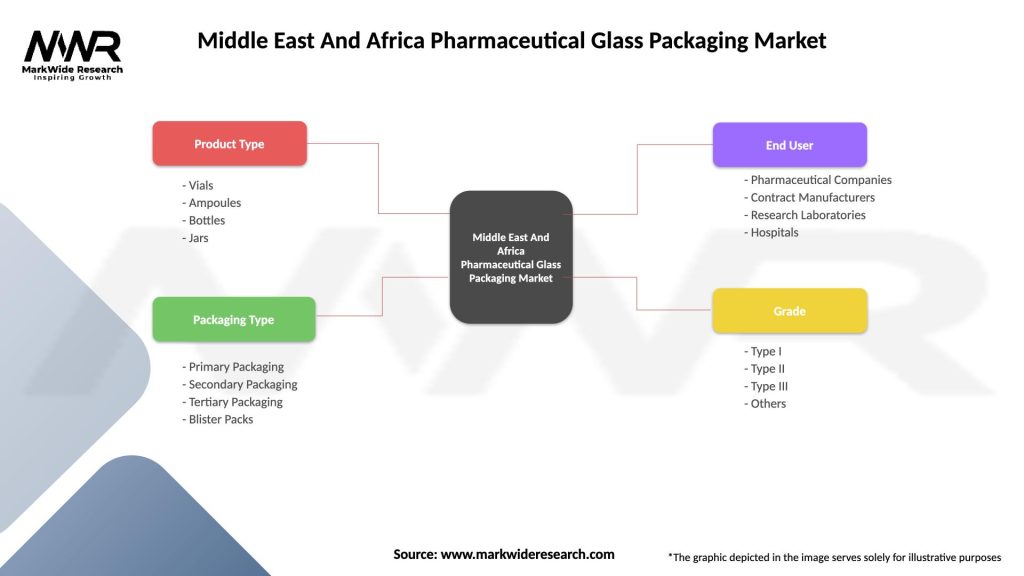

Product type segmentation reveals diverse market categories serving different pharmaceutical applications and requirements. The market encompasses various glass packaging formats designed for specific drug types and delivery methods.

By Product Type:

By Application:

By End User:

Injectable packaging category dominates the pharmaceutical glass packaging market, representing the largest revenue segment due to stringent sterility requirements and growing biologics production. This category benefits from increasing vaccine manufacturing and biosimilar development across the region, with injectable packaging accounting for 58% of market demand.

Oral medication packaging maintains steady growth driven by expanding pharmaceutical production and increasing healthcare access. This category includes bottles for tablets and capsules, with growing demand for child-resistant and senior-friendly packaging designs that enhance patient safety and medication compliance.

Specialty packaging category shows the highest growth rates, driven by advanced drug delivery systems and personalized medicine trends. This segment includes prefilled syringes, auto-injector cartridges, and smart packaging solutions that integrate digital technologies for enhanced patient monitoring and medication management.

Biologics packaging category represents the fastest-growing segment, reflecting the region’s increasing focus on biotechnology and biosimilar production. These products require specialized glass formulations and packaging designs that maintain product stability while enabling precise dosing and administration.

Vaccine packaging category has gained significant importance, particularly following global health initiatives and regional vaccine manufacturing development. This category requires specialized cold-chain compatible packaging solutions that maintain vaccine efficacy throughout distribution and storage processes.

Pharmaceutical manufacturers benefit from reliable, high-quality glass packaging solutions that ensure product integrity, regulatory compliance, and market access. The availability of diverse packaging options enables companies to optimize their product portfolios while meeting specific therapeutic and market requirements across the region.

Healthcare providers gain advantages through improved medication safety, reduced contamination risks, and enhanced patient outcomes. Glass packaging solutions provide clear visibility of medication contents, tamper-evident features, and precise dosing capabilities that support clinical effectiveness and patient safety protocols.

Patients and consumers benefit from enhanced medication safety, improved dosing accuracy, and better product preservation. Glass packaging maintains drug stability, prevents contamination, and provides clear visual confirmation of medication integrity, contributing to improved therapeutic outcomes and patient confidence.

Regulatory authorities benefit from standardized packaging solutions that facilitate quality control, product tracking, and safety monitoring. Glass packaging enables effective implementation of serialization requirements, anti-counterfeiting measures, and supply chain transparency initiatives.

Investment stakeholders gain access to a growing market with strong fundamentals, technological advancement opportunities, and expanding regional demand. The pharmaceutical glass packaging sector offers attractive returns through market growth, technological innovation, and strategic positioning in the developing healthcare ecosystem.

Supply chain partners benefit from reliable packaging solutions that enable efficient distribution, reduce product losses, and maintain cold-chain integrity. Glass packaging compatibility with existing logistics infrastructure facilitates smooth supply chain operations and cost-effective distribution strategies.

Strengths:

Weaknesses:

Opportunities:

Threats:

Sustainable packaging initiatives represent a major trend driving innovation in pharmaceutical glass packaging. Manufacturers are developing eco-friendly production processes, implementing recycling programs, and creating packaging designs that minimize environmental impact while maintaining pharmaceutical quality standards. This trend reflects growing corporate sustainability commitments and regulatory pressure for environmental responsibility.

Smart packaging integration emerges as a transformative trend, with glass packaging incorporating digital technologies such as RFID tags, temperature sensors, and blockchain tracking systems. These innovations enable real-time monitoring of medication conditions, supply chain transparency, and patient adherence tracking, creating new value propositions for pharmaceutical companies and healthcare providers.

Personalized medicine packaging gains momentum as pharmaceutical companies develop targeted therapies requiring specialized packaging solutions. This trend drives demand for smaller batch sizes, customized labeling, and flexible packaging formats that accommodate personalized dosing regimens and patient-specific requirements.

Cold-chain optimization becomes increasingly important as the region expands vaccine production and biologics manufacturing. Glass packaging manufacturers are developing specialized solutions that maintain product integrity throughout temperature-controlled distribution networks, ensuring vaccine efficacy and biological product stability.

Automation and digitalization transform packaging manufacturing processes, with companies investing in automated production lines, quality control systems, and digital manufacturing technologies. These advancements improve production efficiency, reduce human error, and enhance quality consistency across pharmaceutical glass packaging operations.

Regulatory harmonization continues as regional authorities align packaging standards with international requirements, creating opportunities for manufacturers to develop standardized solutions that serve multiple markets while reducing compliance complexity and costs.

Manufacturing capacity expansion represents significant industry development, with several international glass packaging manufacturers establishing production facilities in the Middle East and Africa. These investments aim to serve growing regional demand while reducing supply chain dependencies and logistics costs for pharmaceutical companies.

Technology partnerships between glass packaging manufacturers and pharmaceutical companies drive innovation in specialized packaging solutions. These collaborations focus on developing advanced packaging formats for biologics, vaccines, and personalized medicines that require unique storage and delivery characteristics.

Regulatory compliance initiatives include implementation of serialization requirements, track-and-trace systems, and anti-counterfeiting measures across regional pharmaceutical markets. These developments require packaging manufacturers to integrate digital technologies and quality assurance systems into their production processes.

Sustainability programs launched by major packaging manufacturers include glass recycling initiatives, carbon footprint reduction projects, and circular economy approaches. These programs respond to growing environmental awareness and corporate sustainability requirements in the pharmaceutical industry.

Research and development investments focus on advanced glass formulations, coating technologies, and specialized packaging designs for emerging pharmaceutical applications. These R&D efforts aim to address specific challenges in biologics packaging, vaccine storage, and temperature-sensitive drug delivery systems.

Strategic acquisitions and partnerships reshape the competitive landscape as companies seek to expand regional presence, enhance technological capabilities, and develop comprehensive service offerings for pharmaceutical clients across the diverse Middle East and Africa markets.

MarkWide Research recommends that pharmaceutical glass packaging manufacturers prioritize regional manufacturing establishment to capitalize on growing market opportunities while reducing supply chain vulnerabilities. Local production facilities enable companies to serve regional pharmaceutical markets more effectively while meeting increasing demand for reliable, high-quality packaging solutions.

Investment in advanced technologies should focus on automation, quality control systems, and smart packaging capabilities that differentiate manufacturers in the competitive landscape. Companies that integrate digital technologies and sustainable manufacturing processes will be better positioned to serve evolving pharmaceutical industry requirements and regulatory expectations.

Strategic partnerships with regional pharmaceutical manufacturers, contract manufacturing organizations, and healthcare providers can create competitive advantages through collaborative product development, supply chain optimization, and market access enhancement. These partnerships enable packaging manufacturers to develop specialized solutions tailored to regional market needs.

Regulatory compliance preparation requires ongoing investment in quality systems, documentation processes, and certification maintenance to meet evolving pharmaceutical packaging standards. Companies should establish comprehensive compliance frameworks that facilitate market access across diverse regional regulatory environments.

Sustainability integration should become a core business strategy, incorporating environmental considerations into product design, manufacturing processes, and supply chain operations. This approach addresses growing market demand for sustainable packaging solutions while supporting corporate responsibility objectives.

Market diversification strategies should consider the varying development stages and requirements across Middle East and Africa markets, enabling companies to optimize their approaches for different regional segments while maintaining operational efficiency and cost competitiveness.

Market growth trajectory indicates sustained expansion driven by increasing pharmaceutical manufacturing, healthcare infrastructure development, and growing demand for high-quality packaging solutions. The market is projected to maintain robust growth rates, with biologics packaging expected to grow at 12.5% CAGR reflecting the region’s increasing focus on biotechnology and advanced therapeutics.

Technology evolution will continue transforming the pharmaceutical glass packaging landscape through smart packaging integration, advanced manufacturing processes, and innovative glass formulations. These technological advancements will enable new applications, improve product performance, and create additional value propositions for pharmaceutical companies and healthcare providers.

Regional market development will vary across different countries and sub-regions, with established markets like the GCC continuing to lead in advanced packaging adoption while emerging markets in Africa present substantial long-term growth opportunities. This diversity will require flexible market approaches and localized strategies.

Regulatory landscape evolution will drive continued alignment with international standards, creating opportunities for manufacturers that invest in compliance capabilities and quality assurance systems. The harmonization of regional regulations will facilitate market access and enable standardized packaging solutions across multiple countries.

Sustainability imperatives will increasingly influence packaging decisions, with pharmaceutical companies prioritizing environmentally responsible solutions that maintain product quality and safety standards. This trend will drive innovation in sustainable glass packaging technologies and circular economy approaches.

Supply chain optimization will remain critical as the market develops, with companies investing in regional distribution networks, strategic inventory management, and supplier diversification to ensure reliable packaging material availability and cost competitiveness in the growing pharmaceutical market.

The Middle East and Africa pharmaceutical glass packaging market represents a dynamic and rapidly evolving sector with substantial growth potential driven by expanding healthcare infrastructure, increasing pharmaceutical manufacturing capabilities, and growing demand for high-quality packaging solutions. The market’s development reflects the region’s transformation into a significant pharmaceutical hub serving both domestic and international markets.

Key success factors for market participants include strategic regional positioning, technological innovation, regulatory compliance excellence, and sustainable manufacturing practices. Companies that establish local manufacturing capabilities, develop specialized packaging solutions, and build strong partnerships with pharmaceutical manufacturers will be best positioned to capitalize on market opportunities.

Market dynamics indicate continued growth across diverse segments, with particular strength in biologics packaging, vaccine storage solutions, and smart packaging technologies. The integration of digital technologies, sustainability initiatives, and advanced manufacturing processes will drive market evolution and create new competitive advantages for forward-thinking companies.

The future outlook for the Middle East and Africa pharmaceutical glass packaging market remains positive, supported by demographic trends, healthcare access expansion, and continued pharmaceutical sector development. Success in this market will require adaptability, innovation, and commitment to quality excellence that meets the stringent requirements of the pharmaceutical industry while serving the diverse needs of the region’s growing healthcare ecosystem.

What is Pharmaceutical Glass Packaging?

Pharmaceutical Glass Packaging refers to the use of glass containers and packaging solutions specifically designed for the storage and transportation of pharmaceutical products, including medicines, vaccines, and other healthcare items. This type of packaging is essential for maintaining the integrity and stability of sensitive products.

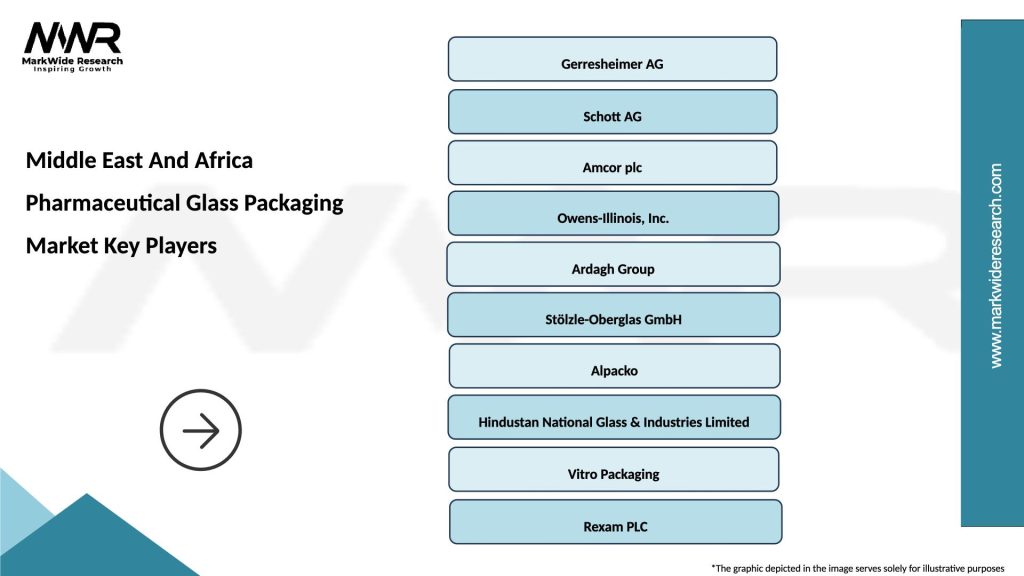

What are the key players in the Middle East And Africa Pharmaceutical Glass Packaging Market?

Key players in the Middle East And Africa Pharmaceutical Glass Packaging Market include Schott AG, Gerresheimer AG, and Nipro Corporation, among others. These companies are known for their innovative glass packaging solutions tailored for the pharmaceutical industry.

What are the growth factors driving the Middle East And Africa Pharmaceutical Glass Packaging Market?

The growth of the Middle East And Africa Pharmaceutical Glass Packaging Market is driven by increasing demand for biologics and vaccines, rising healthcare expenditures, and a growing focus on sustainable packaging solutions. Additionally, the expansion of the pharmaceutical industry in emerging markets contributes to this growth.

What challenges does the Middle East And Africa Pharmaceutical Glass Packaging Market face?

The Middle East And Africa Pharmaceutical Glass Packaging Market faces challenges such as the high cost of glass production and competition from alternative packaging materials like plastics. Additionally, regulatory compliance and quality assurance in packaging standards can pose significant hurdles for manufacturers.

What opportunities exist in the Middle East And Africa Pharmaceutical Glass Packaging Market?

Opportunities in the Middle East And Africa Pharmaceutical Glass Packaging Market include the increasing adoption of smart packaging technologies and the growing trend towards eco-friendly packaging solutions. Furthermore, the rise in personalized medicine and advanced drug delivery systems presents new avenues for growth.

What trends are shaping the Middle East And Africa Pharmaceutical Glass Packaging Market?

Trends shaping the Middle East And Africa Pharmaceutical Glass Packaging Market include the shift towards sustainable and recyclable packaging materials, advancements in glass manufacturing technologies, and the integration of digital solutions for tracking and authentication. These trends are influencing how pharmaceutical products are packaged and delivered.

Middle East And Africa Pharmaceutical Glass Packaging Market

| Segmentation Details | Description |

|---|---|

| Product Type | Vials, Ampoules, Bottles, Jars |

| Packaging Type | Primary Packaging, Secondary Packaging, Tertiary Packaging, Blister Packs |

| End User | Pharmaceutical Companies, Contract Manufacturers, Research Laboratories, Hospitals |

| Grade | Type I, Type II, Type III, Others |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Middle East And Africa Pharmaceutical Glass Packaging Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at