444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Netherlands data center processor market represents a dynamic and rapidly evolving sector within the European technology landscape. Data center processors serve as the computational backbone of modern digital infrastructure, powering everything from cloud computing services to artificial intelligence applications across the Netherlands’ robust technology ecosystem. The market has experienced substantial growth driven by increasing digitalization, cloud adoption, and the country’s strategic position as a European data hub.

Market dynamics indicate that the Netherlands has emerged as a preferred destination for hyperscale data centers, with major technology companies establishing significant operations throughout the country. The processor market benefits from advanced infrastructure, favorable regulatory environment, and strategic geographic location connecting European markets. Current trends show 12.5% annual growth in processor deployment across Dutch data centers, reflecting the increasing computational demands of modern applications.

Key market drivers include the proliferation of edge computing, artificial intelligence workloads, and high-performance computing applications. The Netherlands’ commitment to sustainable technology and renewable energy sources has also influenced processor selection, with energy-efficient architectures gaining significant market traction. Industry analysts project continued expansion as digital transformation initiatives accelerate across various sectors.

The Netherlands data center processor market refers to the comprehensive ecosystem of central processing units, graphics processing units, and specialized computing chips deployed within data center facilities across the Netherlands. Data center processors encompass various architectures including x86, ARM, and specialized accelerators designed to handle diverse computational workloads ranging from traditional enterprise applications to modern artificial intelligence and machine learning tasks.

Market scope includes processors manufactured by leading semiconductor companies and deployed across colocation facilities, hyperscale data centers, enterprise data centers, and edge computing installations. The market encompasses both general-purpose processors optimized for versatile workloads and specialized processors designed for specific applications such as graphics processing, artificial intelligence acceleration, and high-performance computing tasks.

Technological evolution within this market reflects broader trends toward increased core counts, improved energy efficiency, and specialized acceleration capabilities. The Netherlands market particularly emphasizes processors that balance performance with power efficiency, aligning with the country’s sustainability goals and stringent environmental regulations governing data center operations.

Strategic positioning of the Netherlands data center processor market reflects the country’s emergence as a critical European technology hub. The market demonstrates robust growth trajectory supported by favorable business climate, advanced telecommunications infrastructure, and proximity to major European population centers. Investment patterns indicate sustained confidence in the Dutch market’s long-term potential.

Technology trends shaping the market include the transition toward more efficient processor architectures, increased adoption of specialized AI accelerators, and growing emphasis on sustainable computing solutions. The market shows 35% adoption rate for next-generation processor technologies, indicating strong appetite for innovation among Dutch data center operators.

Competitive landscape features established semiconductor leaders alongside emerging specialized processor manufacturers. Market participants focus on delivering solutions that address specific requirements of Dutch data center operators, including energy efficiency, performance optimization, and regulatory compliance. Partnership strategies between processor manufacturers and local system integrators have proven particularly effective in capturing market opportunities.

Future outlook suggests continued expansion driven by increasing digitalization, edge computing deployment, and artificial intelligence adoption across various industries. The market benefits from supportive government policies, substantial infrastructure investments, and the Netherlands’ strategic role in European digital transformation initiatives.

Primary market insights reveal several critical factors driving growth in the Netherlands data center processor market:

Market maturity indicators suggest the Netherlands processor market has reached a sophisticated development stage, with operators demonstrating advanced understanding of workload-specific processor requirements and optimization strategies.

Digital transformation initiatives across Dutch enterprises serve as a primary catalyst for data center processor demand. Organizations migrating to cloud-based infrastructure require powerful processors capable of supporting diverse application portfolios. The acceleration of digital services adoption, particularly following recent global events, has intensified computational requirements across various sectors.

Artificial intelligence adoption represents another significant driver, with Dutch companies increasingly implementing AI-powered solutions for business optimization, customer service, and operational efficiency. These applications demand specialized processors with enhanced parallel processing capabilities and optimized architectures for machine learning workloads.

Government digitalization programs contribute substantially to market growth, as public sector organizations modernize their IT infrastructure and migrate services to digital platforms. These initiatives require robust processor solutions capable of handling citizen services, data analytics, and administrative applications while maintaining security and compliance standards.

Sustainability mandates drive demand for energy-efficient processors that reduce power consumption and environmental impact. Dutch data centers face increasing pressure to minimize their carbon footprint, leading to preference for next-generation processors that deliver superior performance per watt ratios.

Edge computing proliferation creates new processor requirements as organizations deploy distributed computing infrastructure closer to end users. This trend demands compact, efficient processors optimized for edge environments while maintaining connectivity to centralized data center resources.

High capital investment requirements present significant barriers for smaller data center operators seeking to upgrade their processor infrastructure. The substantial costs associated with advanced processor technologies can limit adoption rates, particularly among organizations with constrained IT budgets or uncertain return on investment projections.

Supply chain complexities affecting the global semiconductor industry impact processor availability and pricing in the Netherlands market. Manufacturing constraints and geopolitical tensions can create procurement challenges, leading to extended delivery times and increased costs for data center operators.

Technical integration challenges arise when implementing new processor architectures within existing data center infrastructure. Legacy systems may require significant modifications or complete replacement to accommodate modern processor technologies, creating additional complexity and expense for operators.

Skilled workforce limitations constrain market growth as organizations struggle to find qualified personnel capable of managing and optimizing advanced processor technologies. The specialized knowledge required for processor selection, deployment, and maintenance creates human resource challenges for many data center operators.

Regulatory uncertainties surrounding data protection, energy consumption, and technology standards can create hesitation among potential investors and operators. Changing regulatory requirements may necessitate processor architecture modifications or additional compliance measures that increase operational complexity.

Emerging technologies present substantial opportunities for processor manufacturers and data center operators in the Netherlands market. The growing adoption of quantum computing, blockchain applications, and advanced AI models creates demand for specialized processor architectures designed to handle these computational challenges efficiently.

Sustainable computing initiatives offer opportunities for companies developing energy-efficient processor technologies. The Netherlands’ commitment to carbon neutrality and sustainable technology adoption creates a favorable environment for green processor solutions that minimize environmental impact while maintaining performance standards.

Industry 4.0 implementations across Dutch manufacturing and logistics sectors drive demand for edge computing processors capable of supporting real-time analytics, predictive maintenance, and automated systems. These applications require ruggedized processors optimized for industrial environments.

Financial services digitalization creates opportunities for high-performance processors capable of handling complex financial modeling, risk analysis, and real-time transaction processing. The Netherlands’ position as a European financial hub amplifies these opportunities for specialized processor solutions.

Research and development collaborations between processor manufacturers, academic institutions, and technology companies offer pathways for innovation and market expansion. These partnerships can accelerate development of next-generation processor technologies tailored to specific Dutch market requirements.

Competitive dynamics within the Netherlands data center processor market reflect broader global trends while incorporating specific regional characteristics. Market leaders maintain strong positions through continuous innovation, strategic partnerships, and comprehensive support services tailored to Dutch customer requirements.

Technology evolution cycles significantly influence market dynamics, with processor generations typically following 18-24 month development cycles. Dutch data center operators demonstrate strategic adoption patterns, often waiting for proven performance and reliability before implementing new processor technologies at scale.

Pricing pressures affect market dynamics as customers seek optimal price-performance ratios while managing total cost of ownership considerations. The market shows 28% preference for processors that deliver superior long-term value rather than lowest initial purchase prices.

Partnership ecosystems play crucial roles in market dynamics, with processor manufacturers collaborating closely with system integrators, software vendors, and service providers to deliver comprehensive solutions. These relationships enable optimized processor deployments that maximize performance for specific workload requirements.

Innovation cycles drive market dynamics as emerging technologies create new processor requirements and opportunities. The market demonstrates rapid adaptation to technological changes, with operators showing willingness to invest in processors that enable new capabilities and competitive advantages.

Comprehensive market analysis employed multiple research methodologies to ensure accurate and reliable insights into the Netherlands data center processor market. Primary research included extensive interviews with data center operators, processor manufacturers, system integrators, and industry experts to gather firsthand market intelligence and validate market trends.

Secondary research incorporated analysis of industry reports, financial statements, regulatory filings, and technical documentation to establish market baselines and identify growth patterns. Data triangulation methods ensured consistency and accuracy across multiple information sources.

Market modeling utilized statistical analysis and forecasting techniques to project market trends and identify growth opportunities. Quantitative analysis focused on deployment patterns, technology adoption rates, and competitive positioning metrics to provide measurable market insights.

Expert validation processes involved consultation with industry specialists, technology analysts, and market participants to verify research findings and ensure practical relevance. Peer review mechanisms maintained research quality and objectivity throughout the analysis process.

Continuous monitoring of market developments, technology announcements, and regulatory changes ensured research currency and relevance. Real-time data integration capabilities enabled incorporation of latest market developments into the analysis framework.

Amsterdam metropolitan area dominates the Netherlands data center processor market, accounting for approximately 45% market concentration due to its strategic location, excellent connectivity, and established technology ecosystem. The region benefits from proximity to major European internet exchanges and submarine cable landing points.

North Holland province represents the largest regional market segment, hosting numerous hyperscale data centers and colocation facilities that drive substantial processor demand. The area’s advanced infrastructure and favorable business climate attract international data center operators seeking European market presence.

South Holland region, including Rotterdam and The Hague, demonstrates growing importance in the processor market as organizations establish data centers to support port logistics, government services, and financial sector applications. The region shows 22% market share with strong growth potential.

Eastern Netherlands emerges as an attractive alternative location for data center development, offering competitive land costs, renewable energy access, and strategic positioning for serving German and Central European markets. Processor deployment in this region focuses on cost-effective solutions optimized for specific workload requirements.

Southern provinces including North Brabant and Limburg demonstrate increasing data center activity driven by cross-border connectivity with Belgium and Germany. These regions show 18% combined market presence with emphasis on edge computing and regional service delivery applications.

Market leadership in the Netherlands data center processor market reflects global semiconductor industry dynamics while incorporating regional competitive factors. Leading companies maintain strong positions through comprehensive product portfolios, local support capabilities, and strategic partnerships with Dutch system integrators.

Competitive strategies emphasize differentiation through performance optimization, energy efficiency, and specialized capabilities for emerging workloads. Market participants invest heavily in research and development to maintain technological leadership and address evolving customer requirements.

Partnership dynamics play crucial roles in competitive positioning, with processor manufacturers collaborating closely with original equipment manufacturers, system integrators, and software vendors to deliver optimized solutions for Dutch market requirements.

Technology segmentation reveals diverse processor architectures serving different market segments within the Netherlands data center ecosystem:

By Processor Type:

By Application Segment:

By End-User Industry:

Enterprise processors represent the largest category within the Netherlands market, serving traditional business applications, database management, and enterprise resource planning systems. These processors emphasize reliability, security, and consistent performance to support mission-critical business operations across various industries.

High-performance computing processors demonstrate strong growth driven by research institutions, financial modeling applications, and scientific computing requirements. This category shows 31% annual growth as organizations implement more sophisticated computational models and simulation capabilities.

AI acceleration processors emerge as the fastest-growing category, reflecting increasing adoption of artificial intelligence and machine learning applications across Dutch enterprises. Specialized AI chips offer superior performance for training and inference workloads compared to traditional processor architectures.

Edge computing processors gain importance as organizations deploy distributed computing infrastructure to reduce latency and improve application performance. These processors prioritize power efficiency and compact form factors while maintaining sufficient computational capability for edge applications.

Networking processors support the growing requirements for data center interconnectivity, software-defined networking, and network function virtualization. This category benefits from increasing network complexity and bandwidth requirements within modern data center environments.

Data center operators benefit from advanced processor technologies through improved computational efficiency, reduced power consumption, and enhanced capability to support diverse workload requirements. Modern processors enable operators to maximize facility utilization while minimizing operational costs and environmental impact.

Enterprise customers gain access to superior application performance, faster data processing capabilities, and improved user experiences through deployment of advanced processor technologies. Business benefits include reduced time-to-insight for analytics applications and enhanced competitiveness through technology-enabled innovation.

Technology vendors benefit from growing market demand for specialized processor solutions, creating opportunities for product differentiation and premium pricing strategies. Market expansion enables vendors to establish stronger relationships with Dutch customers and expand their European market presence.

System integrators capitalize on increasing complexity of processor deployments by providing specialized expertise in architecture design, implementation, and optimization services. Professional services opportunities expand as customers require assistance with processor selection and deployment strategies.

Government stakeholders benefit from enhanced digital service delivery capabilities, improved citizen experiences, and more efficient public sector operations through advanced processor technologies. Economic benefits include job creation, technology sector development, and improved international competitiveness.

Strengths:

Weaknesses:

Opportunities:

Threats:

Artificial intelligence integration represents the most significant trend shaping the Netherlands data center processor market. Organizations increasingly deploy AI-optimized processors to support machine learning applications, natural language processing, and computer vision systems across various industry sectors.

Energy efficiency optimization drives processor selection decisions as data center operators seek to minimize power consumption and environmental impact. Next-generation processors demonstrate substantial improvements in performance-per-watt ratios, enabling more sustainable data center operations.

Edge computing proliferation creates demand for distributed processor architectures capable of supporting real-time applications with minimal latency. Edge-optimized processors balance computational capability with power efficiency and compact form factors suitable for diverse deployment environments.

Hybrid cloud architectures influence processor requirements as organizations implement flexible computing strategies spanning on-premises and cloud environments. Processor compatibility across different deployment models becomes increasingly important for seamless workload migration and management.

Security enhancement trends drive adoption of processors with built-in security features including hardware-based encryption, secure boot capabilities, and trusted execution environments. Security-focused processors address growing concerns about data protection and cyber threats.

Specialized workload optimization leads to increased deployment of purpose-built processors designed for specific applications such as database processing, analytics, and scientific computing. According to MarkWide Research analysis, specialized processors show 42% higher efficiency for targeted workloads compared to general-purpose alternatives.

Major processor manufacturers continue investing in research and development facilities within the Netherlands, strengthening local innovation capabilities and customer support infrastructure. These investments demonstrate long-term commitment to the Dutch market and European technology ecosystem.

Strategic partnerships between international processor companies and Dutch system integrators create comprehensive solution offerings tailored to local market requirements. Collaboration initiatives focus on developing optimized architectures for specific industry applications and use cases.

Government initiatives supporting digital transformation and sustainable technology adoption create favorable conditions for advanced processor deployment. Policy frameworks encourage investment in energy-efficient computing infrastructure and innovative processor technologies.

Academic research programs at Dutch universities contribute to processor technology advancement through collaborative research projects with industry partners. Innovation partnerships accelerate development of next-generation processor architectures and optimization techniques.

Infrastructure investments by major cloud service providers expand the addressable market for high-performance processors in the Netherlands. Hyperscale deployments drive substantial processor volume requirements and influence technology roadmap development.

Sustainability certifications and environmental standards increasingly influence processor selection criteria, with operators prioritizing technologies that support carbon reduction goals and regulatory compliance requirements.

Strategic positioning recommendations emphasize the importance of aligning processor selection with long-term business objectives and workload requirements. MWR analysis suggests organizations should prioritize processors that offer scalability, energy efficiency, and compatibility with emerging technologies.

Investment timing considerations indicate that organizations should carefully evaluate processor upgrade cycles to maximize return on investment while avoiding technology obsolescence risks. Phased deployment strategies enable gradual migration to advanced processor technologies while maintaining operational continuity.

Vendor relationship management becomes increasingly critical as processor technologies become more specialized and complex. Organizations should develop strategic partnerships with processor manufacturers and system integrators to ensure optimal technology selection and implementation support.

Workload optimization strategies should guide processor selection decisions, with organizations matching specific processor capabilities to application requirements. Performance benchmarking and pilot deployments help validate processor performance for specific use cases before large-scale implementation.

Sustainability planning should incorporate processor energy efficiency considerations into data center design and operations strategies. Organizations should evaluate total cost of ownership including power consumption, cooling requirements, and environmental impact when selecting processor technologies.

Skills development initiatives should address the growing need for expertise in advanced processor technologies, optimization techniques, and emerging computing paradigms. Training programs and certification initiatives help organizations build internal capabilities for processor management and optimization.

Market evolution projections indicate continued growth in the Netherlands data center processor market driven by digital transformation, artificial intelligence adoption, and edge computing expansion. Technology advancement cycles suggest regular introduction of more powerful and efficient processor architectures.

Artificial intelligence applications will likely drive the most significant growth in specialized processor demand, with organizations implementing AI-powered solutions across various business functions. AI processor adoption is expected to reach 67% penetration among Dutch enterprises within the next five years.

Edge computing deployment will create new market segments for processors optimized for distributed computing environments. Edge processor requirements emphasize power efficiency, compact form factors, and real-time processing capabilities to support latency-sensitive applications.

Sustainability initiatives will increasingly influence processor selection criteria as organizations work toward carbon neutrality goals. Energy-efficient processors that minimize environmental impact while maintaining performance standards will gain competitive advantages in the Dutch market.

Quantum computing integration may create new processor categories as quantum technologies mature and become commercially viable. Hybrid computing architectures combining traditional and quantum processors could emerge as significant market opportunities.

Regulatory developments surrounding data protection, artificial intelligence governance, and environmental standards will shape processor requirements and market dynamics. Organizations must prepare for evolving compliance requirements that may influence technology selection decisions.

The Netherlands data center processor market demonstrates robust growth potential driven by digital transformation, artificial intelligence adoption, and the country’s strategic position as a European technology hub. Market dynamics reflect strong demand for advanced processor technologies that balance performance, energy efficiency, and specialized capabilities for emerging workloads.

Key success factors for market participants include understanding specific customer requirements, developing strategic partnerships, and maintaining technological leadership in rapidly evolving processor architectures. The market rewards companies that can deliver comprehensive solutions addressing both current needs and future technology trends.

Future growth prospects remain positive as organizations continue investing in digital infrastructure, artificial intelligence capabilities, and edge computing solutions. Market opportunities will likely expand as new technologies create demand for specialized processor architectures and optimization strategies.

Strategic recommendations emphasize the importance of long-term planning, sustainable technology adoption, and collaborative partnerships to capitalize on market opportunities while managing technological and business risks. Success in this dynamic market requires continuous adaptation to evolving customer needs and technology capabilities.

What is Data Center Processor?

Data Center Processor refers to specialized computing units designed to handle the high-performance demands of data centers, including tasks such as data processing, storage management, and network operations.

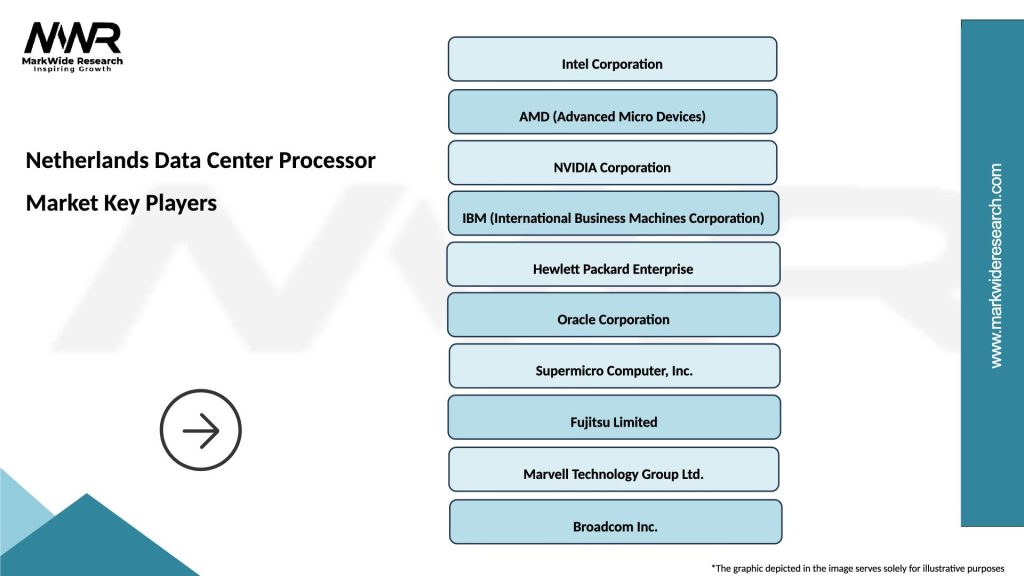

What are the key players in the Netherlands Data Center Processor Market?

Key players in the Netherlands Data Center Processor Market include Intel Corporation, AMD, and NVIDIA, which provide advanced processors tailored for data center applications, among others.

What are the main drivers of growth in the Netherlands Data Center Processor Market?

The growth of the Netherlands Data Center Processor Market is driven by the increasing demand for cloud computing services, the rise of big data analytics, and the need for enhanced processing power to support AI applications.

What challenges does the Netherlands Data Center Processor Market face?

Challenges in the Netherlands Data Center Processor Market include the high costs of advanced processors, the rapid pace of technological change, and the need for energy-efficient solutions to meet sustainability goals.

What opportunities exist in the Netherlands Data Center Processor Market?

Opportunities in the Netherlands Data Center Processor Market include the expansion of edge computing, the growing adoption of hybrid cloud solutions, and advancements in processor technology that enhance performance and efficiency.

What trends are shaping the Netherlands Data Center Processor Market?

Trends in the Netherlands Data Center Processor Market include the shift towards ARM-based processors, increased focus on AI and machine learning capabilities, and the integration of advanced cooling technologies to improve energy efficiency.

Netherlands Data Center Processor Market

| Segmentation Details | Description |

|---|---|

| Product Type | Server Processors, Edge Processors, Cloud Processors, High-Performance Processors |

| Technology | ARM, x86, RISC-V, SPARC |

| End User | Telecommunications, Financial Services, Healthcare, Government |

| Deployment | On-Premises, Hybrid Cloud, Public Cloud, Private Cloud |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Netherlands Data Center Processor Market

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at