444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Japan data center processor market represents a critical component of the nation’s digital infrastructure ecosystem, experiencing unprecedented growth driven by cloud computing adoption, artificial intelligence deployment, and digital transformation initiatives across industries. Japan’s strategic position as a technology leader in Asia-Pacific has positioned its data center processor market at the forefront of innovation, with enterprises increasingly demanding high-performance computing solutions to support their evolving digital requirements.

Market dynamics indicate robust expansion with the sector growing at a significant CAGR of 8.2% as organizations prioritize computational efficiency and processing power. The integration of advanced semiconductor technologies, including next-generation CPU architectures and specialized AI processors, has transformed the landscape of data center operations across Japan. Enterprise adoption of hybrid cloud environments and edge computing solutions continues to drive demand for sophisticated processor technologies.

Regional concentration remains particularly strong in major metropolitan areas including Tokyo, Osaka, and Yokohama, where approximately 72% of data center infrastructure is concentrated. The market encompasses various processor categories including general-purpose CPUs, graphics processing units (GPUs), field-programmable gate arrays (FPGAs), and application-specific integrated circuits (ASICs), each serving distinct computational requirements within modern data center environments.

The Japan data center processor market refers to the comprehensive ecosystem of semiconductor processing units specifically designed and deployed within data center facilities across Japan to handle computational workloads, data processing tasks, and digital service delivery. This market encompasses the design, manufacturing, distribution, and implementation of various processor technologies that power cloud computing infrastructure, enterprise applications, and digital services throughout the Japanese technology landscape.

Data center processors serve as the computational backbone of modern digital infrastructure, enabling organizations to process vast amounts of data, support artificial intelligence workloads, and deliver cloud-based services with optimal performance and efficiency. These sophisticated semiconductor devices include traditional central processing units (CPUs), specialized graphics processing units (GPUs) for parallel computing, and emerging processor architectures designed for specific applications such as machine learning and edge computing scenarios.

Japan’s data center processor market demonstrates exceptional growth momentum, driven by the nation’s commitment to digital innovation and technological advancement. The market benefits from strong government support for digitalization initiatives, substantial corporate investments in cloud infrastructure, and increasing demand for artificial intelligence and machine learning capabilities across various industry sectors.

Key market drivers include the rapid adoption of cloud computing services, with approximately 68% of Japanese enterprises implementing hybrid cloud strategies, and the growing emphasis on data analytics and AI-driven business intelligence. The market landscape features intense competition among global semiconductor manufacturers, with companies focusing on developing energy-efficient, high-performance processor solutions tailored to Japanese market requirements.

Strategic partnerships between international processor manufacturers and local system integrators have facilitated market expansion, while government initiatives promoting digital transformation have created favorable conditions for sustained growth. The integration of 5G networks and Internet of Things (IoT) technologies continues to generate additional demand for advanced processing capabilities within data center environments.

Market analysis reveals several critical insights that define the current state and future trajectory of Japan’s data center processor market:

Digital transformation initiatives across Japanese enterprises serve as the primary catalyst for data center processor market expansion. Organizations are increasingly investing in advanced computing infrastructure to support their digital business strategies, with cloud-first approaches becoming standard practice among forward-thinking companies. The integration of artificial intelligence and machine learning technologies into business processes has created substantial demand for specialized processor architectures capable of handling complex computational workloads.

Government digitalization policies continue to provide strong market support through initiatives promoting smart city development, digital government services, and Industry 4.0 adoption. These policy frameworks encourage private sector investment in advanced computing infrastructure, creating favorable conditions for processor market growth. Regulatory compliance requirements related to data protection and cybersecurity have also driven demand for processors with enhanced security features.

5G network deployment across Japan has generated significant demand for edge computing capabilities, requiring distributed processor architectures to support low-latency applications and real-time data processing. The proliferation of Internet of Things (IoT) devices and smart technologies continues to increase data generation volumes, necessitating more powerful processing capabilities within data center environments.

Supply chain complexities represent a significant challenge for the Japan data center processor market, with global semiconductor shortages periodically impacting availability and pricing of critical processor components. Manufacturing constraints and geopolitical tensions affecting international trade relationships have created uncertainty regarding consistent processor supply, potentially limiting market growth in certain segments.

High implementation costs associated with advanced processor technologies can deter smaller organizations from upgrading their data center infrastructure. The substantial capital investment required for next-generation processor deployment, combined with associated infrastructure modifications, creates financial barriers for some market participants. Technical complexity in integrating new processor architectures with existing systems also presents implementation challenges.

Energy consumption concerns and environmental regulations increasingly influence processor selection decisions, with organizations seeking to balance performance requirements with sustainability objectives. The need for specialized cooling infrastructure to support high-performance processors adds additional operational complexity and cost considerations for data center operators.

Artificial intelligence acceleration presents substantial growth opportunities for specialized processor manufacturers, as Japanese organizations increasingly adopt AI-driven business processes and analytics capabilities. The development of domain-specific processor architectures optimized for machine learning workloads offers significant market potential, particularly in sectors such as automotive, manufacturing, and financial services.

Edge computing expansion creates opportunities for distributed processor deployment strategies, with organizations requiring processing capabilities closer to data sources and end users. This trend supports demand for compact, energy-efficient processor solutions capable of operating in diverse environmental conditions while maintaining high performance standards.

Quantum computing research and development initiatives in Japan present long-term opportunities for revolutionary processor technologies. Government and private sector investments in quantum computing research create potential for breakthrough processor architectures that could transform data center computing capabilities. Sustainability initiatives also drive opportunities for energy-efficient processor designs that reduce environmental impact while maintaining computational performance.

Competitive dynamics within Japan’s data center processor market reflect intense innovation pressure and rapid technological evolution. Leading semiconductor manufacturers continuously invest in research and development to deliver next-generation processor architectures that meet evolving customer requirements for performance, efficiency, and specialized capabilities. Market consolidation trends have resulted in strategic partnerships and acquisitions aimed at strengthening technological capabilities and market positioning.

Customer preferences increasingly favor processor solutions that offer flexibility, scalability, and energy efficiency while supporting diverse workload requirements. Organizations prioritize total cost of ownership considerations, including initial procurement costs, operational expenses, and lifecycle management requirements. Technology refresh cycles have accelerated as organizations seek to maintain competitive advantages through advanced computing capabilities.

Innovation cycles in processor technology continue shortening, with manufacturers introducing new architectures and performance improvements at increasingly rapid intervals. This dynamic creates both opportunities and challenges for market participants, requiring continuous investment in technology development while managing inventory and product lifecycle considerations.

Comprehensive market analysis for the Japan data center processor market employs multiple research methodologies to ensure accuracy and reliability of findings. Primary research activities include structured interviews with industry executives, technology leaders, and key stakeholders across the data center ecosystem, providing direct insights into market trends, challenges, and opportunities.

Secondary research components encompass analysis of industry reports, government publications, corporate financial statements, and technology documentation from leading processor manufacturers. Market data validation occurs through triangulation of multiple information sources, ensuring consistency and accuracy of quantitative findings. Expert consultations with technology specialists and industry analysts provide additional validation of market trends and projections.

Data collection processes incorporate both quantitative metrics and qualitative insights, enabling comprehensive understanding of market dynamics and competitive landscapes. Research activities include analysis of patent filings, technology roadmaps, and investment patterns to identify emerging trends and future market directions.

Tokyo metropolitan area dominates Japan’s data center processor market, accounting for approximately 58% of total market activity due to its concentration of technology companies, financial institutions, and government organizations. The region benefits from advanced telecommunications infrastructure, skilled workforce availability, and proximity to major technology suppliers, creating favorable conditions for data center processor deployment and innovation.

Osaka region represents the second-largest market segment, with significant manufacturing and logistics industries driving demand for advanced computing capabilities. The area’s strategic location and established industrial base support approximately 22% of national processor market activity, with particular strength in automotive and electronics manufacturing applications requiring specialized processing capabilities.

Regional distribution patterns reflect Japan’s industrial geography, with processor deployment concentrated in major urban centers while expanding into secondary markets as digital transformation initiatives reach smaller cities and rural areas. Government initiatives promoting regional digitalization continue creating new market opportunities outside traditional technology hubs, supporting more distributed processor market growth patterns.

Market leadership in Japan’s data center processor sector reflects global semiconductor industry dynamics, with established international manufacturers maintaining strong positions through continuous innovation and strategic partnerships with local system integrators and technology providers.

Competitive strategies focus on technological differentiation, energy efficiency improvements, and specialized capabilities for emerging applications such as artificial intelligence and edge computing. Companies invest heavily in research and development while forming strategic partnerships to strengthen their market positions and expand customer reach.

Technology-based segmentation reveals distinct market categories with varying growth trajectories and application requirements:

By Processor Type:

By Application:

By End-User Industry:

CPU processors continue representing the largest market segment, though growth rates have moderated as organizations increasingly adopt specialized processor architectures for specific workloads. Traditional CPU applications remain essential for general computing tasks, database operations, and enterprise application hosting, with demand driven by server refresh cycles and capacity expansion requirements.

GPU processors demonstrate the highest growth rates, with adoption increasing by approximately 35% annually as organizations implement artificial intelligence and machine learning capabilities. These processors excel in parallel computing scenarios and have become essential for data analytics, scientific computing, and AI model training applications within Japanese data centers.

FPGA processors serve specialized market niches requiring configurable computing capabilities, particularly in telecommunications, financial trading, and research applications. While representing a smaller market segment, FPGAs offer unique advantages for applications requiring low latency and customizable processing logic. ASIC processors address highly specialized requirements where standard processors cannot deliver optimal performance or efficiency.

Technology providers benefit from Japan’s advanced digital infrastructure and strong demand for innovative processor solutions. The market offers opportunities for revenue growth through premium processor technologies while supporting long-term customer relationships through comprehensive support services and continuous innovation. Strategic partnerships with local system integrators provide market access and customer relationship advantages.

Data center operators gain competitive advantages through deployment of advanced processor technologies that improve operational efficiency, reduce energy consumption, and enable new service offerings. Performance improvements from next-generation processors support higher customer satisfaction and market differentiation opportunities while optimizing total cost of ownership.

End-user organizations benefit from enhanced computing capabilities that support digital transformation initiatives, improve business process efficiency, and enable innovative applications. Advanced processor technologies provide competitive advantages through faster data processing, improved analytics capabilities, and support for emerging technologies such as artificial intelligence and machine learning.

Strengths:

Weaknesses:

Opportunities:

Threats:

Artificial intelligence integration represents the most significant trend reshaping Japan’s data center processor market, with organizations increasingly deploying AI-optimized processors to support machine learning workloads and intelligent automation initiatives. Processor manufacturers are responding by developing specialized architectures that accelerate AI computations while maintaining energy efficiency standards.

Edge computing adoption continues expanding as organizations seek to process data closer to sources and end users, driving demand for distributed processor architectures capable of operating in diverse environmental conditions. This trend supports the development of compact, energy-efficient processors that maintain high performance while operating outside traditional data center environments.

Sustainability initiatives increasingly influence processor selection decisions, with organizations prioritizing energy-efficient designs that reduce environmental impact and operational costs. Green computing trends drive innovation in processor architecture, cooling technologies, and power management systems, creating opportunities for environmentally conscious technology providers.

Hybrid cloud strategies require flexible processor architectures that support both on-premises and cloud-based workloads, with approximately 73% of Japanese enterprises implementing multi-cloud approaches. This trend creates demand for processors that optimize performance across diverse computing environments while maintaining consistent management and security capabilities.

Recent technological breakthroughs in processor architecture have introduced new capabilities for artificial intelligence acceleration, quantum computing integration, and energy efficiency optimization. Major manufacturers continue investing in advanced semiconductor fabrication processes that enable higher performance and lower power consumption, supporting next-generation data center requirements.

Strategic partnerships between international processor manufacturers and Japanese technology companies have accelerated market development and localization efforts. These collaborations focus on developing processor solutions tailored to Japanese market requirements while leveraging global technology expertise and manufacturing capabilities.

Government initiatives supporting semiconductor industry development have created favorable conditions for domestic processor innovation and manufacturing capabilities. Investment programs and research grants encourage collaboration between academic institutions, technology companies, and government agencies to advance processor technology development.

Market consolidation activities have reshaped competitive dynamics, with strategic acquisitions and partnerships enabling companies to strengthen their technology portfolios and market positions. These developments create opportunities for enhanced innovation and more comprehensive processor solutions addressing diverse customer requirements.

MarkWide Research recommends that processor manufacturers focus on developing energy-efficient architectures that address Japan’s sustainability concerns while maintaining high performance standards. Investment priorities should emphasize AI acceleration capabilities, edge computing optimization, and security feature integration to align with evolving market demands and regulatory requirements.

Strategic recommendations include strengthening partnerships with local system integrators and technology providers to improve market access and customer relationship development. Companies should consider establishing regional research and development facilities to better understand Japanese market requirements and accelerate product localization efforts.

Technology development should prioritize modular processor architectures that support flexible deployment models and diverse workload requirements. Market participants should invest in comprehensive support services and training programs to address the technical complexity associated with advanced processor integration and management.

Long-term success requires continuous innovation in processor technology while maintaining cost competitiveness and reliability standards that meet Japanese market expectations. Companies should develop comprehensive sustainability strategies that address environmental concerns while supporting business growth objectives.

Market projections indicate continued strong growth for Japan’s data center processor market, with expansion expected to accelerate as digital transformation initiatives mature and new technologies emerge. Artificial intelligence adoption will continue driving demand for specialized processor architectures, while edge computing requirements support distributed deployment strategies.

Technology evolution will focus on quantum computing integration, advanced AI acceleration, and ultra-low power consumption designs that address sustainability concerns. MWR analysis suggests that processor manufacturers investing in these emerging technologies will gain competitive advantages in the evolving market landscape.

Market expansion beyond traditional urban centers will create new opportunities as regional digitalization initiatives progress and 5G networks enable advanced computing applications in secondary markets. The integration of Internet of Things technologies and smart city initiatives will generate additional demand for diverse processor capabilities.

Growth projections indicate the market will maintain a robust CAGR of 8.5% over the next five years, driven by continued enterprise digitalization, government policy support, and technological innovation. Investment opportunities will emerge in specialized processor categories serving artificial intelligence, edge computing, and quantum computing applications.

Japan’s data center processor market represents a dynamic and rapidly evolving sector characterized by strong growth fundamentals, technological innovation, and increasing strategic importance within the nation’s digital infrastructure ecosystem. The market benefits from robust enterprise demand for advanced computing capabilities, supportive government policies promoting digitalization, and Japan’s position as a global technology leader driving continuous innovation in processor architectures.

Key success factors for market participants include continuous investment in research and development, strategic partnerships with local technology providers, and focus on energy-efficient processor designs that address sustainability concerns while maintaining high performance standards. The integration of artificial intelligence capabilities, edge computing optimization, and security feature enhancement will continue driving market evolution and creating new opportunities for innovative processor solutions.

Future market development will be shaped by emerging technologies including quantum computing, advanced AI acceleration, and ultra-low power processor architectures that support diverse deployment scenarios. Organizations that successfully navigate the evolving technological landscape while addressing Japanese market requirements for reliability, performance, and sustainability will be well-positioned to capture the substantial growth opportunities ahead in this critical technology sector.

What is Data Center Processor?

Data Center Processors are specialized computing units designed to handle the high-performance demands of data centers, enabling efficient processing, storage, and management of large volumes of data. They are essential for cloud computing, big data analytics, and enterprise applications.

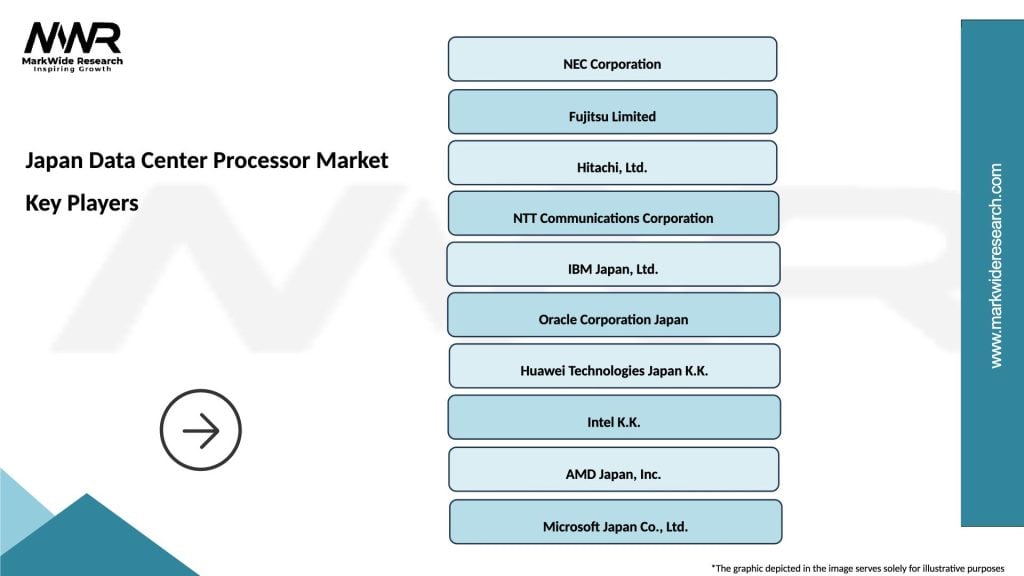

What are the key players in the Japan Data Center Processor Market?

Key players in the Japan Data Center Processor Market include Intel Corporation, AMD, and Fujitsu, which are known for their advanced processor technologies and solutions tailored for data center applications, among others.

What are the growth factors driving the Japan Data Center Processor Market?

The growth of the Japan Data Center Processor Market is driven by the increasing demand for cloud services, the rise of big data analytics, and the need for enhanced processing power to support AI and machine learning applications.

What challenges does the Japan Data Center Processor Market face?

Challenges in the Japan Data Center Processor Market include the high costs associated with advanced processor technologies, the rapid pace of technological change, and the need for energy-efficient solutions to meet sustainability goals.

What opportunities exist in the Japan Data Center Processor Market?

Opportunities in the Japan Data Center Processor Market include the growing adoption of edge computing, advancements in processor architecture, and the increasing focus on hybrid cloud solutions that require robust processing capabilities.

What trends are shaping the Japan Data Center Processor Market?

Trends in the Japan Data Center Processor Market include the shift towards ARM-based processors for energy efficiency, the integration of AI capabilities into processors, and the increasing use of virtualization technologies to optimize resource utilization.

Japan Data Center Processor Market

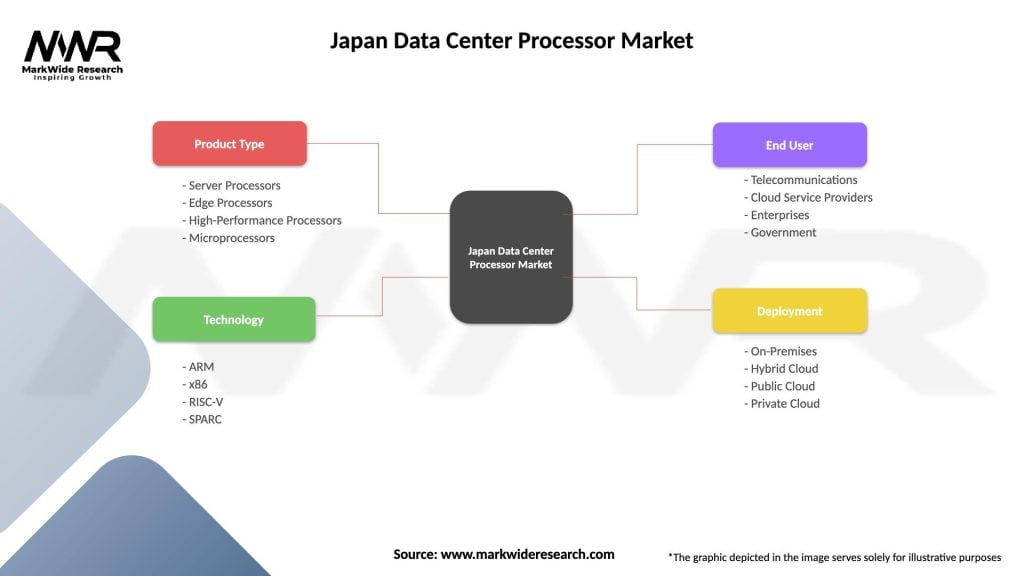

| Segmentation Details | Description |

|---|---|

| Product Type | Server Processors, Edge Processors, High-Performance Processors, Microprocessors |

| Technology | ARM, x86, RISC-V, SPARC |

| End User | Telecommunications, Cloud Service Providers, Enterprises, Government |

| Deployment | On-Premises, Hybrid Cloud, Public Cloud, Private Cloud |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Japan Data Center Processor Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at