444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Mexico data center processor market represents a rapidly evolving technological landscape driven by increasing digitalization, cloud computing adoption, and growing demand for high-performance computing solutions. Mexico’s strategic position as a gateway between North and South America has positioned the country as an attractive destination for data center investments, creating substantial opportunities for processor manufacturers and technology providers.

Digital transformation initiatives across various industries in Mexico have accelerated the demand for advanced data center infrastructure, with processors serving as the critical backbone of these operations. The market demonstrates robust growth potential, with adoption rates increasing by approximately 12.5% annually as organizations migrate to cloud-based solutions and implement artificial intelligence applications.

Key market drivers include the expansion of hyperscale data centers, increasing internet penetration reaching 78% of the population, and growing e-commerce activities. Major technology companies are establishing significant data center presence in Mexico, creating demand for cutting-edge processor technologies that can handle intensive computational workloads while maintaining energy efficiency standards.

The Mexico data center processor market refers to the comprehensive ecosystem encompassing the design, manufacturing, distribution, and implementation of central processing units specifically optimized for data center operations within Mexico’s technology infrastructure landscape. These processors serve as the computational engines powering everything from basic server operations to complex artificial intelligence workloads.

Data center processors in the Mexican market include various categories such as x86 processors, ARM-based processors, graphics processing units, and specialized accelerators designed for machine learning applications. The market encompasses both traditional server processors and emerging technologies like quantum processing units and neuromorphic chips that are beginning to find applications in advanced computing environments.

Market participants include global semiconductor manufacturers, local system integrators, cloud service providers, and end-user organizations across industries including telecommunications, financial services, manufacturing, and government sectors. The ecosystem also involves supporting infrastructure providers, cooling solution vendors, and power management specialists who work together to create comprehensive data center solutions.

Mexico’s data center processor market is experiencing unprecedented growth driven by digital transformation initiatives, increasing cloud adoption, and expanding internet infrastructure. The market benefits from Mexico’s favorable geographic location, competitive labor costs, and improving regulatory environment that attracts international technology investments.

Key growth catalysts include the proliferation of edge computing applications, increasing demand for real-time data processing, and the expansion of 5G networks requiring enhanced computational capabilities. Organizations are increasingly adopting hybrid cloud strategies, driving demand for versatile processor solutions that can handle diverse workloads efficiently.

Market dynamics indicate strong momentum in artificial intelligence and machine learning applications, with AI-optimized processors experiencing adoption growth of approximately 18.3% year-over-year. The gaming and entertainment sectors are also contributing significantly to processor demand as streaming services and online gaming platforms expand their Mexican operations.

Competitive landscape features established global players alongside emerging regional providers, creating a dynamic environment that fosters innovation and competitive pricing. Strategic partnerships between international technology companies and Mexican organizations are accelerating market development and technology transfer.

Strategic market insights reveal several critical trends shaping the Mexico data center processor landscape:

Digital transformation acceleration serves as the primary driver for Mexico’s data center processor market, with organizations across all sectors implementing comprehensive digitalization strategies. Government initiatives promoting digital economy development have created favorable conditions for technology infrastructure investments, resulting in increased demand for advanced processing capabilities.

Cloud computing adoption continues to expand rapidly, with cloud service utilization growing by approximately 15.7% annually among Mexican enterprises. This trend drives consistent demand for scalable processor solutions that can handle varying computational workloads while maintaining performance standards and cost efficiency.

E-commerce growth has accelerated significantly, particularly following global events that shifted consumer behavior toward online platforms. Mexican e-commerce platforms require robust data center infrastructure to handle transaction processing, inventory management, and customer analytics, creating substantial processor demand.

Artificial intelligence implementation across industries is driving demand for specialized processors optimized for machine learning workloads. Financial services, healthcare, manufacturing, and retail sectors are increasingly deploying AI solutions that require high-performance computing capabilities and specialized acceleration technologies.

Internet of Things expansion is creating new data processing requirements as connected devices generate massive amounts of data requiring real-time analysis and response. This trend drives demand for edge computing processors capable of handling distributed processing tasks efficiently.

High initial investment costs represent a significant barrier for many organizations considering data center processor upgrades or new implementations. The substantial capital requirements for advanced processor technologies, combined with supporting infrastructure costs, can limit adoption among smaller enterprises and organizations with constrained budgets.

Technical complexity associated with modern data center processor implementations requires specialized expertise that may be limited in the Mexican market. Organizations often face challenges in finding qualified personnel capable of designing, implementing, and maintaining advanced processor-based systems effectively.

Power infrastructure limitations in certain regions of Mexico can constrain data center development and processor deployment. Reliable power supply and adequate cooling infrastructure are essential for high-performance processor operations, and limitations in these areas can restrict market growth in specific geographic locations.

Regulatory compliance requirements can create additional complexity and costs for data center processor implementations. Organizations must navigate various regulations related to data protection, cross-border data transfer, and industry-specific compliance requirements that can impact processor selection and deployment strategies.

Supply chain vulnerabilities have become increasingly apparent, with global semiconductor shortages affecting processor availability and pricing. These challenges can delay implementation projects and increase costs, particularly for organizations requiring specific processor configurations or large-scale deployments.

Government digitalization initiatives present substantial opportunities for data center processor providers, as public sector organizations modernize their IT infrastructure and implement citizen-facing digital services. These initiatives often involve large-scale processor deployments and long-term technology partnerships.

Nearshoring trends are creating opportunities as international companies establish operations in Mexico to serve North American markets. This trend drives demand for data center infrastructure and associated processor technologies to support manufacturing, logistics, and customer service operations.

Financial services modernization offers significant growth potential as banks and financial institutions upgrade their core systems and implement advanced analytics capabilities. The sector’s focus on real-time transaction processing and fraud detection creates demand for high-performance processor solutions.

Smart city development across major Mexican metropolitan areas creates opportunities for edge computing processors and distributed processing solutions. These initiatives require processors capable of handling diverse applications including traffic management, environmental monitoring, and public safety systems.

Manufacturing industry 4.0 adoption is driving demand for industrial-grade processors capable of handling real-time production monitoring, predictive maintenance, and quality control applications. Mexico’s strong manufacturing sector presents substantial opportunities for specialized processor solutions.

Market dynamics in Mexico’s data center processor sector reflect the complex interplay between technological advancement, economic factors, and evolving user requirements. The market demonstrates strong momentum driven by increasing computational demands and expanding digital infrastructure requirements across multiple industry sectors.

Competitive intensity is increasing as global processor manufacturers compete for market share in Mexico’s growing technology sector. This competition is driving innovation in processor design, performance optimization, and cost reduction, ultimately benefiting end-users through improved price-performance ratios.

Technology evolution continues at a rapid pace, with new processor architectures and specialized computing solutions entering the market regularly. Organizations must balance the benefits of cutting-edge technology with practical considerations such as compatibility, support availability, and total cost of ownership.

Partnership strategies are becoming increasingly important as processor manufacturers collaborate with local system integrators, cloud service providers, and technology consultants to deliver comprehensive solutions. These partnerships enable better market penetration and customer support capabilities.

Economic factors including currency fluctuations, trade policies, and regional economic conditions influence processor pricing and availability. Organizations must consider these factors when planning long-term technology investments and processor deployment strategies.

Comprehensive market analysis for the Mexico data center processor market employs a multi-faceted research approach combining primary and secondary research methodologies. The research framework incorporates quantitative data analysis, qualitative insights from industry experts, and detailed examination of market trends and competitive dynamics.

Primary research activities include structured interviews with key market participants including processor manufacturers, system integrators, data center operators, and end-user organizations. These interviews provide valuable insights into market challenges, opportunities, and future development directions from multiple stakeholder perspectives.

Secondary research encompasses analysis of industry reports, government publications, technology vendor documentation, and academic research related to data center processor technologies and market developments. This research provides comprehensive background information and validates primary research findings.

Market sizing methodology utilizes bottom-up and top-down approaches to estimate market dimensions and growth projections. The analysis considers factors such as data center capacity expansion, processor replacement cycles, and new technology adoption rates to develop accurate market assessments.

Data validation processes ensure research accuracy through cross-referencing multiple sources, expert review, and statistical analysis. The methodology incorporates feedback from industry participants to refine findings and ensure practical relevance of research conclusions.

Mexico City metropolitan area dominates the data center processor market, accounting for approximately 42% of total market activity. The region benefits from concentrated business activity, excellent connectivity infrastructure, and proximity to major international markets, making it the preferred location for hyperscale data center deployments.

Guadalajara region represents the second-largest market segment with approximately 23% market share, driven by its established technology sector and growing reputation as Mexico’s “Silicon Valley.” The region attracts significant technology investments and serves as a hub for software development and IT services companies requiring advanced data center infrastructure.

Monterrey industrial corridor captures approximately 18% of market activity, primarily driven by manufacturing sector digitalization and cross-border trade facilitation requirements. The region’s strong industrial base creates demand for specialized processor solutions supporting manufacturing execution systems and supply chain management applications.

Border regions including Tijuana, Ciudad Juárez, and Nuevo Laredo collectively represent 12% of market share, benefiting from nearshoring trends and cross-border data processing requirements. These regions require processors optimized for low-latency applications and cross-border connectivity.

Emerging markets in cities such as Puebla, Querétaro, and Mérida are showing increasing processor demand as regional economic development drives technology infrastructure investments. These markets present growth opportunities for cost-effective processor solutions tailored to regional requirements.

Market leadership in Mexico’s data center processor sector is characterized by intense competition among global technology giants and emerging regional players. The competitive environment fosters innovation and drives continuous improvement in processor performance, efficiency, and cost-effectiveness.

Key market participants include:

Competitive strategies focus on technological differentiation, strategic partnerships, and localized support capabilities. Companies are investing in research and development to create processors optimized for specific Mexican market requirements and use cases.

Market consolidation trends are emerging as companies seek to strengthen their competitive positions through acquisitions and strategic alliances. These activities aim to combine complementary technologies and expand market reach across different processor segments.

By Processor Type:

By Application:

By End-User Industry:

Enterprise Processors represent the largest market segment, driven by organizations upgrading legacy systems and implementing digital transformation initiatives. These processors must balance performance requirements with cost considerations while providing reliable operation for business-critical applications.

Cloud-Optimized Processors are experiencing rapid growth as cloud service providers expand their Mexican operations. These processors feature enhanced virtualization capabilities, improved resource utilization, and optimized performance for multi-tenant environments.

AI-Specialized Processors show the highest growth rates, with adoption increasing by approximately 22.4% annually as organizations implement machine learning and artificial intelligence solutions across various applications including customer analytics, predictive maintenance, and automated decision-making systems.

Edge Computing Processors are gaining traction as organizations deploy distributed computing architectures to reduce latency and improve application responsiveness. These processors must operate efficiently in diverse environmental conditions while maintaining reliable connectivity to central data centers.

High-Performance Computing Processors serve specialized applications in research institutions, financial services, and engineering organizations requiring massive computational capabilities for complex modeling and simulation tasks.

Technology Vendors benefit from Mexico’s growing data center market through expanded revenue opportunities, strategic partnership development, and access to emerging market segments. The market provides opportunities for both established players and innovative startups to establish strong competitive positions.

System Integrators gain value through comprehensive solution delivery capabilities, combining processor technologies with supporting infrastructure to create complete data center solutions. These organizations can develop specialized expertise in specific industry verticals or technology domains.

End-User Organizations benefit from improved computational capabilities, enhanced application performance, and reduced total cost of ownership through advanced processor technologies. Organizations can achieve better business outcomes through faster data processing, improved analytics capabilities, and enhanced customer experiences.

Cloud Service Providers can offer enhanced services and improved performance to their customers through deployment of advanced processor technologies. This enables competitive differentiation and supports expansion into new market segments and geographic regions.

Government Entities benefit from improved digital service delivery capabilities, enhanced cybersecurity, and more efficient public sector operations through modern processor-based infrastructure implementations.

Strengths:

Weaknesses:

Opportunities:

Threats:

Artificial Intelligence Integration is transforming data center processor requirements, with organizations increasingly deploying AI-optimized processors for machine learning workloads. This trend is driving demand for specialized acceleration technologies and hybrid computing architectures that combine traditional processors with AI accelerators.

Edge Computing Expansion is creating new processor deployment patterns as organizations implement distributed computing architectures. Edge processors must operate efficiently in diverse environments while maintaining connectivity to central data centers and cloud platforms.

Sustainability Focus is influencing processor selection criteria, with organizations prioritizing energy-efficient solutions that reduce operational costs and environmental impact. Green data center initiatives are driving adoption of processors with improved performance-per-watt ratios.

Hybrid Cloud Architectures are becoming standard, requiring processors capable of seamlessly operating across on-premises, private cloud, and public cloud environments. This trend demands versatile processor solutions with consistent performance characteristics across different deployment models.

Security Enhancement is driving demand for processors with built-in security features including hardware-level encryption, secure boot capabilities, and trusted execution environments. Organizations are prioritizing security-focused processor solutions to protect sensitive data and applications.

Major cloud service providers have announced significant data center investments in Mexico, creating substantial demand for high-performance processors and supporting infrastructure. These developments are attracting additional technology investments and accelerating market growth across multiple regions.

Government digitalization programs are driving large-scale processor deployments as public sector organizations modernize their IT infrastructure. These initiatives involve comprehensive technology upgrades and create long-term demand for advanced processor solutions.

Manufacturing sector automation is accelerating with Industry 4.0 implementations requiring specialized processors for real-time production monitoring, quality control, and predictive maintenance applications. This trend is creating demand for industrial-grade processor solutions with enhanced reliability and environmental tolerance.

Telecommunications infrastructure upgrades supporting 5G network deployment are creating demand for processors optimized for network function virtualization and edge computing applications. These developments require processors capable of handling increased data throughput and real-time processing requirements.

Financial services modernization initiatives are driving processor upgrades as banks and financial institutions implement advanced analytics, real-time fraud detection, and digital banking platforms requiring high-performance computing capabilities.

MarkWide Research recommends that processor manufacturers focus on developing solutions optimized for Mexico’s specific market requirements, including support for Spanish-language interfaces, local compliance requirements, and regional connectivity standards. This localization approach can provide competitive advantages and improve customer adoption rates.

Strategic partnerships with local system integrators and technology consultants are essential for successful market penetration. These partnerships enable better customer support, faster deployment capabilities, and deeper understanding of local market requirements and preferences.

Investment in training programs and technical education initiatives can help address the skills gap limiting market growth. Processor manufacturers should collaborate with educational institutions and training organizations to develop specialized curricula and certification programs.

Flexible financing options and leasing programs can help overcome cost barriers limiting adoption among smaller organizations. These programs should be tailored to Mexican market conditions and customer preferences to maximize effectiveness.

Sustainability initiatives should be prioritized as environmental concerns become increasingly important to Mexican organizations. Processor manufacturers should emphasize energy efficiency, recyclability, and environmental impact reduction in their product development and marketing strategies.

Market growth prospects remain strong with projected expansion driven by continued digital transformation, cloud computing adoption, and emerging technology implementations. The market is expected to maintain robust growth rates of approximately 14.2% annually over the next five years as organizations continue modernizing their IT infrastructure.

Technology evolution will continue driving market development with advances in artificial intelligence, quantum computing, and neuromorphic processing creating new opportunities for specialized processor solutions. Organizations will increasingly require processors capable of handling diverse workloads efficiently.

Geographic expansion beyond traditional technology centers will create new market opportunities as digital infrastructure development spreads to secondary cities and rural regions. This expansion will require processors optimized for diverse operating conditions and connectivity scenarios.

Industry convergence trends will create new application areas for data center processors as traditional boundaries between computing, telecommunications, and industrial automation continue to blur. This convergence will drive demand for versatile processor solutions capable of handling multiple application types.

Regulatory developments will influence market evolution as government policies promote digital economy development while addressing data protection and cybersecurity concerns. Processor manufacturers must stay aligned with evolving regulatory requirements to maintain market access and customer trust.

Mexico’s data center processor market presents substantial opportunities driven by accelerating digital transformation, expanding cloud computing adoption, and growing demand for advanced computational capabilities across multiple industry sectors. The market benefits from favorable geographic positioning, government support for technology development, and increasing international investment in Mexican data center infrastructure.

Key success factors for market participants include technological innovation, strategic partnerships with local organizations, and development of solutions tailored to Mexican market requirements. Organizations must balance performance requirements with cost considerations while addressing evolving security and sustainability concerns.

Future market development will be shaped by emerging technologies including artificial intelligence, edge computing, and 5G networks creating new processor requirements and application opportunities. The market’s continued evolution will require adaptive strategies and ongoing investment in research and development to maintain competitive positioning in this dynamic technology landscape.

What is Data Center Processor?

Data Center Processors are specialized computing units designed to manage and process data in data centers. They are optimized for high performance, energy efficiency, and reliability, supporting various applications such as cloud computing, big data analytics, and enterprise resource management.

What are the key players in the Mexico Data Center Processor Market?

Key players in the Mexico Data Center Processor Market include Intel Corporation, AMD, and NVIDIA, which provide a range of processors tailored for data center applications. These companies focus on enhancing processing power and energy efficiency to meet the growing demands of data centers, among others.

What are the main drivers of growth in the Mexico Data Center Processor Market?

The main drivers of growth in the Mexico Data Center Processor Market include the increasing demand for cloud services, the rise of big data analytics, and the need for enhanced data security. Additionally, the expansion of digital transformation initiatives across various industries is fueling the market’s growth.

What challenges does the Mexico Data Center Processor Market face?

The Mexico Data Center Processor Market faces challenges such as high energy consumption and the need for continuous technological advancements. Additionally, supply chain disruptions and the increasing complexity of data center management can hinder market growth.

What opportunities exist in the Mexico Data Center Processor Market?

Opportunities in the Mexico Data Center Processor Market include the growing adoption of artificial intelligence and machine learning applications, which require advanced processing capabilities. Furthermore, the shift towards edge computing presents new avenues for processor development and deployment.

What trends are shaping the Mexico Data Center Processor Market?

Trends shaping the Mexico Data Center Processor Market include the increasing integration of AI capabilities in processors, the rise of energy-efficient designs, and the growing importance of sustainability in data center operations. These trends are driving innovation and competition among manufacturers.

Mexico Data Center Processor Market

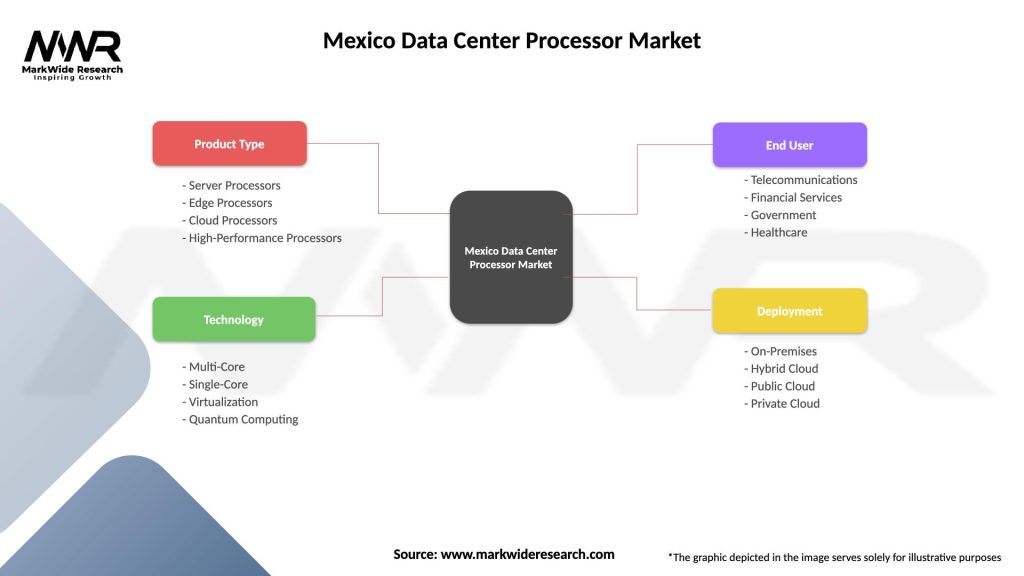

| Segmentation Details | Description |

|---|---|

| Product Type | Server Processors, Edge Processors, Cloud Processors, High-Performance Processors |

| Technology | Multi-Core, Single-Core, Virtualization, Quantum Computing |

| End User | Telecommunications, Financial Services, Government, Healthcare |

| Deployment | On-Premises, Hybrid Cloud, Public Cloud, Private Cloud |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Mexico Data Center Processor Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at