444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Qatar OOH and DOOH market represents a dynamic and rapidly evolving advertising landscape that has experienced remarkable transformation over the past decade. Out-of-home (OOH) advertising and digital out-of-home (DOOH) advertising in Qatar have become integral components of the nation’s comprehensive marketing ecosystem, driven by significant infrastructure development, urbanization, and technological advancement. The market encompasses traditional billboards, transit advertising, street furniture, and increasingly sophisticated digital displays that leverage cutting-edge technology to deliver targeted messaging.

Qatar’s strategic positioning as a regional hub for business, tourism, and major international events has created unprecedented opportunities for outdoor advertising growth. The market demonstrates robust expansion with a compound annual growth rate (CAGR) of 8.2%, reflecting strong advertiser confidence and increasing consumer engagement with outdoor media formats. Digital transformation has emerged as a primary catalyst, with DOOH installations representing approximately 45% of total outdoor advertising inventory across major urban centers.

Infrastructure development projects associated with major sporting events and urban expansion have significantly enhanced the outdoor advertising landscape. The integration of smart city technologies, advanced display systems, and data-driven targeting capabilities has positioned Qatar as a leading market for innovative outdoor advertising solutions in the Middle East region.

The Qatar OOH and DOOH market refers to the comprehensive ecosystem of outdoor advertising solutions that utilize both traditional static media and advanced digital display technologies to reach consumers in public spaces throughout Qatar. Out-of-home advertising encompasses all advertising media that reaches consumers when they are outside their homes, including billboards, transit advertising, street furniture, and venue-based displays.

Digital out-of-home advertising represents the technologically advanced segment that utilizes LED screens, LCD displays, projection systems, and interactive digital installations to deliver dynamic, programmable content. This market segment includes roadside digital billboards, transit digital displays, retail digital signage, and venue-specific digital installations that can be updated remotely and targeted based on various demographic and contextual factors.

Market participants include media owners, advertising agencies, technology providers, content creators, and advertisers across various industry sectors. The ecosystem encompasses traditional outdoor advertising companies that have evolved to include digital capabilities, specialized DOOH technology providers, and integrated marketing agencies that leverage outdoor media as part of comprehensive campaign strategies.

Qatar’s OOH and DOOH market demonstrates exceptional growth potential driven by ongoing infrastructure development, increasing urbanization, and rising consumer spending power. The market has experienced significant transformation with digital adoption accelerating rapidly, creating new opportunities for targeted advertising and enhanced measurement capabilities. Technology integration has become a defining characteristic, with programmatic DOOH solutions gaining traction among sophisticated advertisers seeking data-driven campaign optimization.

Key market drivers include substantial government investment in infrastructure, growing tourism sector, expanding retail landscape, and increasing adoption of smart city technologies. The market benefits from 65% smartphone penetration among the population, enabling integration between outdoor advertising and mobile marketing strategies. Premium location availability in high-traffic areas has created competitive dynamics that favor innovative display technologies and creative content solutions.

Market challenges include regulatory considerations, weather-related durability requirements, and the need for continuous technology upgrades to maintain competitive positioning. However, strong economic fundamentals, government support for digital transformation, and increasing advertiser sophistication continue to drive market expansion and innovation adoption.

Strategic market insights reveal several critical trends shaping the Qatar OOH and DOOH landscape:

Market maturation is evident through increasing advertiser sophistication, technology standardization, and the emergence of specialized service providers focused on DOOH campaign management and optimization.

Infrastructure development initiatives serve as the primary catalyst for OOH and DOOH market expansion in Qatar. Massive construction projects, transportation network enhancements, and urban development programs have created numerous high-visibility advertising opportunities. Government investment in smart city technologies has facilitated the integration of digital advertising infrastructure into urban planning processes, creating synergies between public infrastructure and commercial advertising opportunities.

Tourism sector growth has generated increased demand for outdoor advertising as hospitality, retail, and entertainment businesses seek to capture visitor attention. The expanding airport infrastructure, hotel development, and attraction venues have created premium advertising inventory that commands significant advertiser interest. International event hosting has demonstrated the effectiveness of outdoor advertising for reaching diverse, global audiences.

Economic diversification efforts have resulted in increased business activity across multiple sectors, driving advertising demand from financial services, real estate, automotive, and consumer goods companies. Retail sector expansion has created particular demand for location-based advertising solutions that can drive foot traffic to shopping centers, restaurants, and entertainment venues.

Technology advancement has made DOOH solutions more accessible and cost-effective, enabling smaller advertisers to participate in digital outdoor campaigns. Improved display quality, reduced operational costs, and enhanced targeting capabilities have expanded the addressable market significantly.

Regulatory compliance requirements present ongoing challenges for market participants, particularly regarding content approval processes, location restrictions, and technical specifications. Municipal regulations governing outdoor advertising placement, size limitations, and operational parameters require careful navigation and can impact campaign deployment timelines and costs.

Environmental considerations pose significant challenges for outdoor advertising infrastructure. Extreme weather conditions, including high temperatures, sandstorms, and humidity, require specialized equipment and increased maintenance costs. Durability requirements for displays and supporting infrastructure add complexity and expense to DOOH installations.

Technology obsolescence risks create ongoing investment pressures as display technologies, software platforms, and connectivity solutions evolve rapidly. Capital intensity of DOOH installations requires substantial upfront investment and ongoing technology refresh cycles that can strain smaller market participants.

Measurement standardization challenges limit advertiser confidence in campaign effectiveness assessment. The lack of unified audience measurement standards across different media owners and technology platforms creates complexity for advertisers seeking to optimize campaign performance and demonstrate return on investment.

Smart city integration presents substantial opportunities for innovative outdoor advertising solutions that complement urban infrastructure development. Internet of Things (IoT) connectivity enables advanced audience detection, environmental responsiveness, and integration with other smart city systems. These capabilities create opportunities for context-aware advertising that responds to traffic patterns, weather conditions, and local events.

Programmatic advertising expansion offers significant growth potential as advertisers seek automated buying solutions that provide efficiency, targeting precision, and real-time optimization capabilities. The development of standardized APIs and data integration platforms creates opportunities for technology providers and media owners to capture increased advertiser spending through programmatic channels.

Retail integration opportunities are expanding as shopping centers, malls, and standalone retail locations seek to monetize their customer traffic through targeted advertising solutions. Location-based marketing capabilities enable retailers to offer advertising inventory to complementary businesses while enhancing the overall customer experience.

Event-driven advertising opportunities continue to expand as Qatar hosts international conferences, sporting events, and cultural festivals. These occasions create temporary but high-value advertising opportunities that can command premium pricing and demonstrate the effectiveness of outdoor advertising for reaching specific audience segments.

Competitive dynamics in the Qatar OOH and DOOH market are characterized by ongoing consolidation among traditional media owners and the emergence of specialized technology providers. Market leaders are investing heavily in digital infrastructure upgrades and data analytics capabilities to maintain competitive positioning. The integration of artificial intelligence and machine learning technologies is creating new competitive advantages for companies that can effectively leverage audience data and campaign optimization algorithms.

Advertiser behavior evolution reflects increasing sophistication in campaign planning, measurement requirements, and integration with digital marketing strategies. Cross-channel campaign integration has become a standard requirement, with outdoor advertising serving as a key component of omnichannel marketing approaches that span digital, social, and traditional media channels.

Technology adoption cycles are accelerating as display costs decrease and functionality improves. LED display technology has achieved 78% market penetration among new DOOH installations, reflecting improved reliability, energy efficiency, and content quality capabilities. Interactive features are being incorporated into approximately 35% of new digital installations, indicating growing interest in engagement-driven advertising formats.

Pricing dynamics reflect the premium value of digital inventory, with DOOH advertising commanding higher rates than traditional static displays while offering enhanced targeting and measurement capabilities. Inventory utilization rates have improved to 82% average occupancy across prime locations, indicating strong advertiser demand and effective sales processes.

Comprehensive market analysis for the Qatar OOH and DOOH market incorporates multiple research methodologies to ensure accuracy and reliability of findings. Primary research activities include structured interviews with key market participants, including media owners, advertising agencies, technology providers, and major advertisers across various industry sectors.

Secondary research components encompass analysis of industry reports, government publications, regulatory documents, and company financial statements. Market data validation is conducted through cross-referencing multiple sources and verification with industry experts to ensure consistency and accuracy of market insights and projections.

Quantitative analysis includes examination of advertising spending patterns, audience measurement data, technology adoption rates, and competitive market share information. Qualitative research focuses on understanding market trends, technology evolution, regulatory impacts, and strategic decision-making processes among key market participants.

Geographic analysis considers regional variations within Qatar, including urban versus suburban advertising dynamics, transportation corridor opportunities, and venue-specific advertising performance. Temporal analysis examines seasonal patterns, event-driven advertising cycles, and long-term market evolution trends to provide comprehensive market understanding.

Doha metropolitan area represents the dominant regional market, accounting for approximately 72% of total OOH and DOOH advertising inventory and generating the majority of advertising revenue. The capital city’s concentration of business districts, shopping centers, transportation hubs, and entertainment venues creates premium advertising opportunities that attract both local and international advertisers.

Northern regions including Al Rayyan and Umm Salal have experienced significant growth in outdoor advertising infrastructure, driven by residential development and commercial expansion. These areas represent emerging opportunities for advertisers seeking to reach growing suburban populations with targeted messaging relevant to local consumer preferences and shopping patterns.

Southern coastal areas including Al Wakrah and Mesaieed have developed specialized advertising opportunities related to industrial, logistics, and port activities. Transportation corridor advertising along major highways connecting these regions has become increasingly valuable for reaching commuter audiences and logistics industry participants.

Western regions including Dukhan and surrounding areas present unique opportunities for outdoor advertising related to energy sector activities, tourism, and recreational facilities. The development of entertainment and tourism infrastructure in these areas has created new advertising inventory that serves both local residents and visitors.

Infrastructure connectivity between regions has created opportunities for coordinated advertising campaigns that reach audiences across multiple geographic areas through strategic placement along transportation routes and at key interchange points.

Market leadership in Qatar’s OOH and DOOH sector is characterized by a mix of established regional players and international companies that have adapted their offerings to local market requirements. The competitive environment reflects ongoing consolidation trends and increasing specialization in digital advertising technologies.

Competitive differentiation increasingly focuses on technology capabilities, data analytics offerings, and integrated campaign management services. Strategic partnerships between media owners and technology providers are becoming common as companies seek to offer comprehensive solutions that address evolving advertiser requirements for measurement, targeting, and campaign optimization.

Technology-based segmentation reveals distinct market dynamics between traditional and digital outdoor advertising formats:

By Technology:

By Location Type:

By Advertiser Category:

Automotive advertising represents the largest category by spending, accounting for approximately 28% of total OOH advertising revenue. This segment demonstrates strong preference for premium roadside locations and digital displays that can showcase vehicle features through high-quality imagery and video content. Luxury automotive brands particularly favor DOOH solutions for their ability to deliver sophisticated creative content that aligns with brand positioning.

Real estate advertising has experienced substantial growth, driven by ongoing development projects and investment opportunities. This category shows 22% year-over-year growth and increasingly utilizes location-based targeting to reach potential buyers and investors in relevant geographic areas. Digital displays enable real estate advertisers to update content frequently with new property listings and pricing information.

Retail and consumer goods advertising demonstrates seasonal patterns with peak activity during shopping festivals and holiday periods. This category has embraced interactive DOOH solutions that can integrate with mobile applications and social media platforms to create engaging consumer experiences. Fashion and lifestyle brands particularly value the visual impact capabilities of high-resolution digital displays.

Financial services advertising focuses on building brand awareness and promoting specific products or services. This category shows increasing interest in data-driven targeting capabilities that can deliver relevant messaging based on location demographics and economic indicators. Islamic banking and investment services represent growing subcategories within this segment.

Media owners benefit from increased revenue opportunities through premium pricing for digital inventory and enhanced operational efficiency through programmatic selling platforms. Technology integration enables better inventory utilization, reduced operational costs, and improved advertiser satisfaction through enhanced campaign performance measurement and optimization capabilities.

Advertisers gain access to sophisticated targeting capabilities, real-time campaign optimization, and comprehensive measurement solutions that demonstrate clear return on investment. Digital formats provide creative flexibility, rapid content updates, and integration with broader digital marketing strategies that enhance overall campaign effectiveness.

Technology providers experience growing demand for innovative display solutions, software platforms, and data analytics tools. Market expansion creates opportunities for specialized service providers focused on content management, audience measurement, and campaign optimization services.

Government stakeholders benefit from improved urban aesthetics, enhanced communication capabilities for public messaging, and economic development through increased business activity and employment opportunities in the advertising and technology sectors.

Consumers experience more relevant and engaging advertising content, improved urban environments through attractive digital displays, and enhanced access to information about local businesses, events, and services through interactive advertising formats.

Strengths:

Weaknesses:

Opportunities:

Threats:

Programmatic advertising adoption is accelerating rapidly, with automated buying platforms gaining acceptance among major advertisers seeking efficiency and precision targeting. Real-time bidding systems are being implemented across premium DOOH inventory, enabling advertisers to optimize campaigns based on audience data, weather conditions, and contextual factors.

Interactive technology integration is transforming traditional outdoor advertising into engaging consumer experiences. Touchscreen displays, augmented reality features, and mobile app integration are becoming standard features in new DOOH installations, particularly in retail and entertainment environments.

Sustainability initiatives are driving adoption of energy-efficient LED technology and solar-powered installations. Environmental responsibility has become a key consideration for both advertisers and media owners, with green technology solutions increasingly preferred for new installations and upgrades.

Data analytics sophistication is improving campaign measurement and optimization capabilities. Audience measurement systems utilizing computer vision, mobile data integration, and IoT sensors are providing detailed insights into campaign performance and audience engagement patterns.

Content personalization is becoming more sophisticated through integration of weather data, traffic patterns, and demographic information. Dynamic content delivery systems can automatically adjust messaging based on environmental conditions and audience characteristics, improving campaign relevance and effectiveness.

Major infrastructure projects have created significant new advertising inventory opportunities, particularly along transportation corridors and in developing urban areas. Metro system expansion has generated substantial demand for transit advertising solutions, with digital displays becoming standard installations in new stations and train cars.

Technology partnerships between media owners and international technology providers have accelerated the deployment of advanced DOOH solutions. Strategic alliances with companies specializing in audience measurement, content management, and programmatic advertising have enhanced service capabilities across the market.

Regulatory framework updates have provided greater clarity for digital advertising installations while maintaining content quality standards. Streamlined approval processes for certain categories of digital displays have reduced deployment timelines and encouraged investment in new technology.

International event preparations have driven substantial investment in temporary and permanent outdoor advertising infrastructure. These projects have demonstrated the effectiveness of outdoor advertising for reaching global audiences and have created lasting infrastructure benefits for the market.

Cross-industry collaboration between outdoor advertising companies and retail, hospitality, and entertainment sectors has created innovative advertising solutions that benefit multiple stakeholders while enhancing consumer experiences.

MarkWide Research analysis indicates that market participants should prioritize digital transformation initiatives to maintain competitive positioning in the evolving outdoor advertising landscape. Investment in programmatic capabilities and data analytics platforms will be essential for capturing increased advertiser spending and improving campaign performance measurement.

Strategic recommendations include developing comprehensive audience measurement systems that provide advertisers with detailed campaign performance insights. Integration with mobile and social media platforms should be prioritized to create seamless omnichannel advertising experiences that maximize campaign effectiveness and advertiser satisfaction.

Technology infrastructure investments should focus on flexible, upgradeable systems that can adapt to evolving advertiser requirements and technological advances. Standardization of APIs and data formats will facilitate programmatic advertising adoption and improve operational efficiency across the market.

Market expansion strategies should consider opportunities in emerging geographic areas and specialized venue categories. Partnership development with retail, hospitality, and entertainment sectors can create mutually beneficial advertising solutions that enhance revenue opportunities for all participants.

Sustainability initiatives should be integrated into technology selection and operational practices to align with government environmental objectives and advertiser corporate responsibility requirements.

Market growth projections indicate continued expansion driven by ongoing digital transformation and increasing advertiser sophistication. DOOH segment growth is expected to accelerate with a projected compound annual growth rate of 11.8% over the next five years, reflecting strong demand for digital advertising solutions and technology advancement.

Technology evolution will continue to drive market innovation, with artificial intelligence, machine learning, and advanced data analytics becoming standard features in DOOH platforms. 5G connectivity deployment will enable more sophisticated interactive features and real-time content optimization capabilities.

Programmatic advertising is projected to represent 40% of total DOOH spending within three years, reflecting advertiser preference for automated buying solutions and data-driven campaign optimization. Cross-channel integration will become increasingly important as advertisers seek unified measurement and optimization across all media channels.

Regulatory environment is expected to evolve to accommodate new technologies while maintaining content quality and safety standards. Government support for smart city initiatives will continue to create opportunities for innovative outdoor advertising solutions that complement urban infrastructure development.

Market consolidation may accelerate as companies seek to achieve scale advantages and technology capabilities necessary to compete effectively in the evolving landscape. MWR projections suggest that successful market participants will be those that effectively combine premium location portfolios with advanced technology platforms and comprehensive service capabilities.

Qatar’s OOH and DOOH market represents a dynamic and rapidly evolving advertising landscape characterized by strong growth potential, technological innovation, and increasing advertiser sophistication. The market benefits from robust economic fundamentals, government support for infrastructure development, and growing demand for targeted advertising solutions that can demonstrate clear return on investment.

Digital transformation continues to drive market evolution, with DOOH solutions gaining market share through superior targeting capabilities, measurement accuracy, and creative flexibility. Technology integration with mobile platforms, data analytics systems, and programmatic buying platforms is creating new opportunities for advertisers to reach audiences with relevant, timely messaging.

Future success in the Qatar OOH and DOOH market will depend on the ability to adapt to evolving technology requirements, meet increasing advertiser demands for measurement and accountability, and capitalize on opportunities created by ongoing infrastructure development and economic diversification initiatives. Companies that effectively combine premium location portfolios with advanced technology capabilities and comprehensive service offerings will be best positioned to capture the significant growth opportunities that lie ahead in this dynamic market.

What is OOH and DOOH?

OOH stands for Out-Of-Home advertising, which includes any advertising that reaches the consumer while they are outside their home. DOOH, or Digital Out-Of-Home, refers to digital screens used for advertising in public spaces, such as billboards and transit displays.

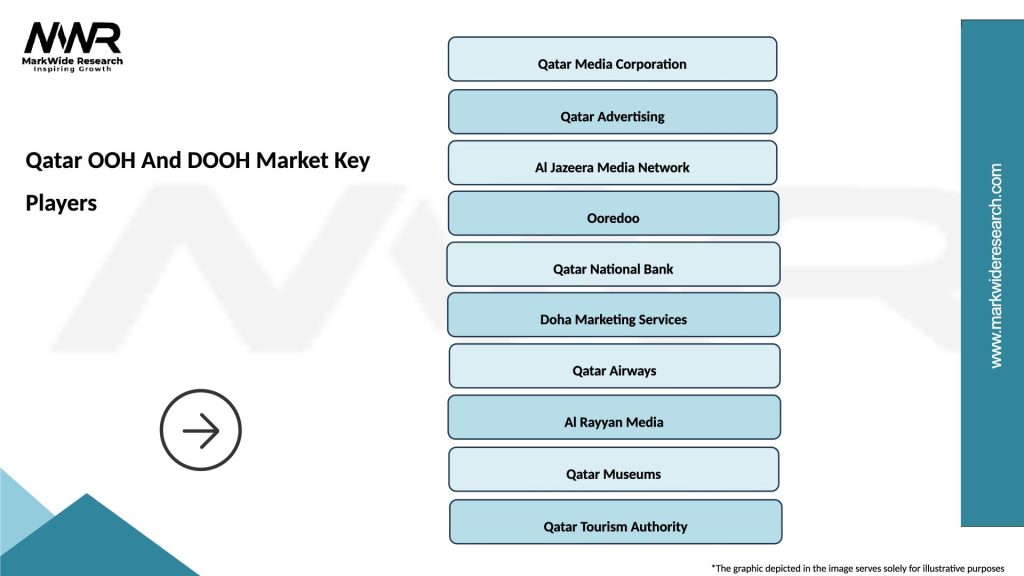

What are the key players in the Qatar OOH And DOOH Market?

Key players in the Qatar OOH And DOOH Market include companies like Q Media, Al Jazeera Media Network, and Clear Channel Outdoor, among others. These companies provide various advertising solutions across different platforms and locations.

What are the growth factors driving the Qatar OOH And DOOH Market?

The Qatar OOH And DOOH Market is driven by factors such as increasing urbanization, the rise of digital technology, and the growing demand for targeted advertising. Additionally, major events and tourism contribute to the expansion of advertising opportunities.

What challenges does the Qatar OOH And DOOH Market face?

Challenges in the Qatar OOH And DOOH Market include regulatory restrictions, competition from digital media, and the need for continuous innovation to engage consumers effectively. These factors can impact the effectiveness and reach of advertising campaigns.

What opportunities exist in the Qatar OOH And DOOH Market?

The Qatar OOH And DOOH Market presents opportunities such as the integration of advanced technologies like augmented reality and programmatic advertising. Additionally, the growing focus on sustainability in advertising practices can attract environmentally conscious brands.

What trends are shaping the Qatar OOH And DOOH Market?

Trends in the Qatar OOH And DOOH Market include the increasing use of data analytics for targeted advertising, the rise of interactive and immersive advertising experiences, and the expansion of digital signage in high-traffic areas. These trends are enhancing consumer engagement and measurement capabilities.

Qatar OOH And DOOH Market

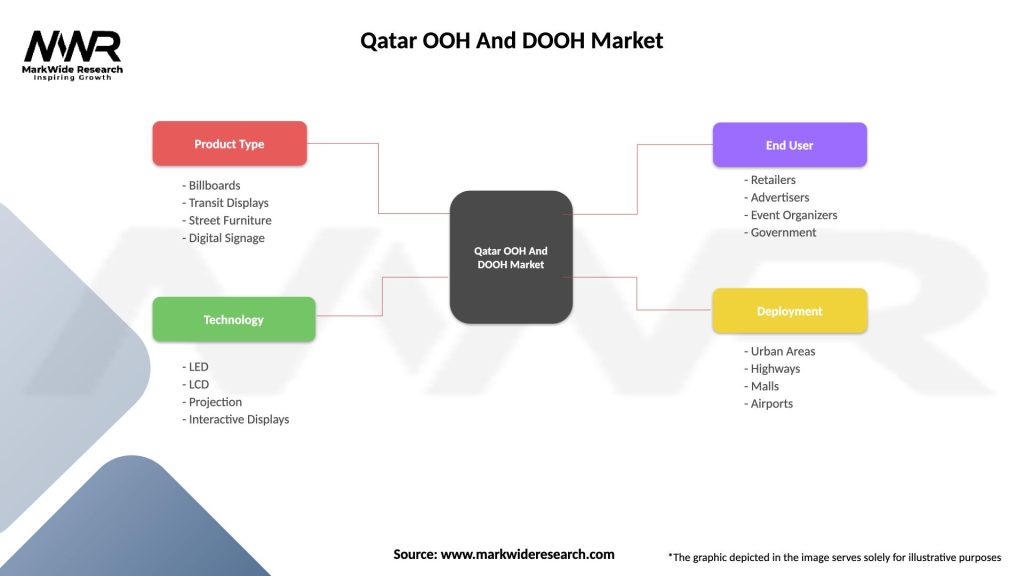

| Segmentation Details | Description |

|---|---|

| Product Type | Billboards, Transit Displays, Street Furniture, Digital Signage |

| Technology | LED, LCD, Projection, Interactive Displays |

| End User | Retailers, Advertisers, Event Organizers, Government |

| Deployment | Urban Areas, Highways, Malls, Airports |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Qatar OOH And DOOH Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at