444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Nigeria telecom tower market represents one of Africa’s most dynamic telecommunications infrastructure sectors, driven by rapid digital transformation and increasing mobile penetration across the country. Nigeria’s telecommunications landscape has experienced unprecedented growth, with mobile subscriber numbers reaching impressive levels and data consumption patterns evolving significantly. The market encompasses various tower types including ground-based towers, rooftop installations, and innovative small cell deployments that support the expanding 4G networks and emerging 5G infrastructure.

Market dynamics indicate substantial growth potential, with the sector experiencing a compound annual growth rate (CAGR) of 8.2% driven by urbanization trends and rural connectivity initiatives. The Nigerian government’s commitment to digital infrastructure development has created favorable conditions for tower deployment, while mobile network operators continue expanding coverage to underserved areas. Tower sharing arrangements have become increasingly prevalent, with approximately 75% of new tower deployments following shared infrastructure models to optimize costs and accelerate network expansion.

Infrastructure development across Nigeria’s six geopolitical zones presents diverse opportunities, from dense urban deployments in Lagos and Abuja to rural connectivity projects in northern and southern regions. The market benefits from strong regulatory support, with the Nigerian Communications Commission implementing policies that encourage infrastructure sharing and foreign investment in telecommunications infrastructure.

The Nigeria telecom tower market refers to the comprehensive ecosystem of telecommunications infrastructure comprising physical towers, supporting equipment, and related services that enable mobile network connectivity across Nigeria. This market encompasses the design, construction, deployment, maintenance, and operation of various tower structures that support cellular base stations, antennas, and transmission equipment for mobile network operators.

Telecom towers in Nigeria serve as critical infrastructure backbone, facilitating voice communications, data transmission, and emerging digital services across urban and rural areas. The market includes multiple stakeholder categories: tower companies that own and operate infrastructure, mobile network operators that lease tower space, equipment manufacturers providing technical solutions, and service providers offering maintenance and optimization services.

Infrastructure sharing models have become fundamental to the market’s evolution, enabling multiple operators to utilize single tower structures, thereby reducing deployment costs and environmental impact while accelerating network coverage expansion. The market also encompasses emerging technologies including small cells, distributed antenna systems, and fiber backhaul solutions that complement traditional macro tower deployments.

Nigeria’s telecom tower market demonstrates robust growth trajectory supported by increasing mobile data consumption, government digitalization initiatives, and expanding telecommunications infrastructure requirements. The market has evolved from basic voice-centric deployments to sophisticated multi-technology platforms supporting 4G services and preparing for 5G implementation across major urban centers.

Key market drivers include rising smartphone adoption rates of approximately 65% among mobile subscribers, growing demand for high-speed internet services, and government policies promoting digital inclusion. The sector benefits from significant foreign investment, with international tower companies establishing strong presence alongside domestic operators to capitalize on Nigeria’s large population and expanding digital economy.

Competitive dynamics feature both local and international players, with tower sharing becoming the dominant business model. Infrastructure companies are increasingly focusing on energy-efficient solutions, renewable power integration, and advanced monitoring systems to optimize operational efficiency. The market faces challenges including security concerns in certain regions, power supply reliability issues, and regulatory compliance requirements, yet maintains strong growth momentum driven by fundamental telecommunications expansion needs.

Strategic market insights reveal several critical trends shaping Nigeria’s telecom tower landscape. The following key insights demonstrate the market’s evolution and future direction:

Primary market drivers propelling Nigeria’s telecom tower sector encompass demographic, technological, and economic factors that create sustained demand for telecommunications infrastructure. The country’s large population base of over 200 million people represents a substantial market opportunity, with mobile penetration continuing to expand across urban and rural areas.

Digital transformation initiatives across various sectors including banking, education, healthcare, and government services drive increased data consumption and network capacity requirements. Mobile data usage has grown exponentially, necessitating network densification and infrastructure upgrades to maintain service quality. The emergence of digital payment systems, e-commerce platforms, and online services creates continuous demand for reliable telecommunications infrastructure.

Government policy support through the National Broadband Plan and digital economy initiatives provides regulatory framework encouraging infrastructure investment. Policies promoting infrastructure sharing, foreign investment, and rural connectivity create favorable market conditions. The Nigerian Communications Commission’s regulatory approach balances market competition with infrastructure development needs, supporting sustainable sector growth.

Economic diversification efforts beyond oil dependency emphasize telecommunications and technology sectors as growth engines. This strategic focus attracts investment, encourages innovation, and supports infrastructure development. Rising disposable income levels and urbanization trends further drive mobile service adoption and data consumption patterns.

Significant market restraints challenge the Nigeria telecom tower sector’s growth potential, requiring strategic approaches to overcome operational and structural barriers. Security concerns in certain regions create deployment challenges, with infrastructure vandalism and theft affecting operational continuity and increasing security costs for tower operators.

Power supply reliability remains a critical constraint, with inconsistent electricity availability necessitating expensive backup power systems and increasing operational costs. Diesel generator dependency for power backup creates ongoing fuel expenses and environmental concerns, while grid power instability affects service quality and equipment longevity.

Regulatory complexity across federal, state, and local government levels creates administrative challenges for tower deployment. Multiple approval processes, varying local regulations, and bureaucratic delays can extend project timelines and increase development costs. Land acquisition difficulties and community relations challenges further complicate site development processes.

Economic volatility including currency fluctuation affects equipment importation costs and foreign investment decisions. Infrastructure financing challenges, particularly for smaller operators, limit expansion capabilities. High initial capital requirements for tower construction and equipment installation create barriers for market entry and expansion.

Substantial market opportunities emerge from Nigeria’s evolving telecommunications landscape, presenting multiple avenues for growth and innovation. The impending 5G network deployment across major cities creates significant infrastructure upgrade opportunities, requiring tower modifications, new installations, and advanced equipment integration.

Rural connectivity expansion represents a major growth opportunity, with government initiatives and international development programs supporting telecommunications infrastructure in underserved areas. These projects often involve innovative deployment models, satellite integration, and community-based approaches that create new business opportunities for tower companies and service providers.

Smart city initiatives in major urban centers including Lagos, Abuja, and Port Harcourt drive demand for advanced telecommunications infrastructure supporting IoT applications, smart traffic systems, and digital governance platforms. These projects require dense network deployments, small cell installations, and integrated fiber connectivity solutions.

Energy sector integration opportunities include renewable energy projects, energy storage solutions, and grid stabilization services. Tower sites can serve as platforms for solar installations, battery storage systems, and distributed energy resources, creating additional revenue streams while addressing power reliability challenges.

Complex market dynamics shape Nigeria’s telecom tower sector through interconnected technological, economic, and regulatory factors. The competitive landscape features both consolidation trends and new market entrants, with international tower companies acquiring local assets while domestic players expand operations through strategic partnerships and infrastructure sharing agreements.

Technology evolution drives continuous infrastructure adaptation, with operators upgrading existing towers to support multiple technologies simultaneously. Network densification requirements in urban areas create demand for small cell deployments, distributed antenna systems, and innovative coverage solutions. The transition from 3G to 4G networks, with 5G preparation underway, necessitates ongoing infrastructure investment and modernization.

Operational efficiency improvements through automation, remote monitoring, and predictive maintenance systems reduce costs while enhancing service reliability. Tower companies are implementing advanced management systems, energy optimization solutions, and security technologies to improve operational performance. These efficiency gains enable competitive pricing while maintaining service quality standards.

Market consolidation trends create opportunities for scale economies and operational optimization. Larger tower companies can leverage economies of scale for equipment procurement, maintenance services, and technology deployment. This consolidation also facilitates infrastructure sharing arrangements and standardization of operational practices across the industry.

Comprehensive research methodology employed for analyzing Nigeria’s telecom tower market combines primary and secondary research approaches to ensure accurate and reliable market insights. The methodology encompasses multiple data collection techniques, analytical frameworks, and validation processes to provide thorough market understanding.

Primary research activities include structured interviews with key industry stakeholders including tower company executives, mobile network operators, equipment manufacturers, and regulatory officials. Field surveys and site visits provide firsthand insights into operational challenges, technology deployment patterns, and market dynamics. Industry expert consultations and focus group discussions with telecommunications professionals contribute valuable qualitative insights.

Secondary research sources encompass industry reports, regulatory publications, financial statements, and academic studies related to Nigeria’s telecommunications sector. Government statistics, international development organization reports, and technology vendor publications provide additional data points. Market intelligence databases and industry association publications contribute comprehensive market information.

Analytical frameworks include market sizing methodologies, competitive analysis models, and trend identification techniques. Statistical analysis, correlation studies, and predictive modeling support quantitative insights. Cross-validation processes ensure data accuracy and reliability across multiple sources and analytical approaches.

Regional market analysis reveals distinct patterns across Nigeria’s six geopolitical zones, each presenting unique opportunities and challenges for telecom tower deployment. The Southwest region, anchored by Lagos State, represents the most mature market with high tower density and advanced infrastructure supporting the country’s commercial capital.

Lagos State dominance accounts for approximately 25% of total tower installations nationwide, driven by high population density, commercial activity, and advanced telecommunications requirements. The region benefits from reliable power infrastructure, established fiber networks, and strong regulatory support. Urban areas in Lagos, Ibadan, and Abeokuta demonstrate sophisticated network deployments with multiple technology layers.

North Central region including the Federal Capital Territory shows strong growth potential, with Abuja serving as a major telecommunications hub. Government presence, international organizations, and growing commercial activities drive infrastructure demand. The region accounts for 18% of national tower deployments with continued expansion planned to support administrative and commercial growth.

Northern regions present significant rural connectivity opportunities, with government initiatives targeting improved telecommunications access. These areas face unique challenges including security concerns, power supply limitations, and geographic constraints, yet represent substantial untapped market potential. Infrastructure sharing models prove particularly effective in these regions for cost optimization.

Southern regions including the South-South and Southeast zones show balanced urban and rural development patterns. Oil industry presence in the South-South creates specific telecommunications requirements, while the Southeast’s commercial activities drive network expansion needs.

Nigeria’s telecom tower market features a diverse competitive landscape with both international and domestic players competing across various market segments. The competitive environment has evolved significantly with the entry of specialized tower companies and the adoption of infrastructure sharing models.

Competitive strategies focus on infrastructure sharing, operational efficiency, and technology innovation. Companies are investing in renewable energy solutions, advanced monitoring systems, and automated maintenance processes to differentiate their offerings and reduce operational costs.

Market segmentation analysis reveals distinct categories based on tower type, ownership model, technology support, and geographic deployment patterns. Understanding these segments enables targeted strategies and optimized resource allocation across different market opportunities.

By Tower Type:

By Ownership Model:

By Technology Support:

Ground-based macro towers continue dominating Nigeria’s telecommunications infrastructure, providing wide-area coverage essential for mobile network operators. These installations typically support multiple operators through infrastructure sharing arrangements, optimizing capital utilization and operational efficiency. Macro tower deployments focus on strategic locations providing optimal coverage while minimizing environmental impact and community concerns.

Rooftop installations have gained prominence in dense urban areas where ground-based towers face space constraints or regulatory restrictions. These solutions offer cost advantages, faster deployment timelines, and reduced visual impact while providing effective coverage for high-density areas. Urban rooftop strategies enable network operators to achieve coverage objectives without significant land acquisition costs.

Small cell deployments represent the fastest-growing segment, driven by network densification requirements and capacity enhancement needs. These installations support high-traffic areas, indoor coverage solutions, and emerging 5G applications. Small cell integration with existing macro networks creates comprehensive coverage solutions addressing diverse connectivity requirements.

Infrastructure sharing models have transformed the competitive landscape, with shared tower arrangements becoming standard practice. This approach reduces deployment costs, accelerates network expansion, and optimizes resource utilization across multiple operators. Sharing agreements typically cover tower space, power systems, and maintenance services while maintaining operational independence for each tenant.

Tower companies benefit from diversified revenue streams through multi-tenant arrangements, reduced operational risks through geographic diversification, and economies of scale in equipment procurement and maintenance services. Infrastructure sharing models enable higher asset utilization rates and improved return on investment while supporting sustainable business growth.

Mobile network operators gain significant advantages through reduced capital expenditure requirements, faster network deployment timelines, and improved operational efficiency. Shared infrastructure arrangements enable operators to focus resources on core telecommunications services while accessing high-quality infrastructure without substantial upfront investment.

Government stakeholders benefit from accelerated telecommunications infrastructure development, improved digital connectivity across urban and rural areas, and enhanced economic development opportunities. Infrastructure sharing reduces environmental impact through optimized land use and supports national digitalization objectives.

Local communities experience improved telecommunications services, enhanced economic opportunities through improved connectivity, and reduced environmental impact through shared infrastructure approaches. Tower deployments often include community development programs and local employment opportunities.

Equipment manufacturers and service providers benefit from sustained demand for telecommunications infrastructure, opportunities for technology innovation, and long-term service contracts supporting predictable revenue streams. The evolving technology landscape creates continuous upgrade and modernization opportunities.

Strengths:

Weaknesses:

Opportunities:

Threats:

Infrastructure sharing evolution continues transforming Nigeria’s telecom tower landscape, with operators increasingly adopting comprehensive sharing arrangements covering towers, power systems, and maintenance services. This trend reduces individual operator costs while accelerating network expansion and improving service quality across the country.

Energy efficiency focus drives adoption of renewable energy solutions, with solar power installations and battery storage systems becoming standard features in tower deployments. Operators are implementing energy management systems and efficient equipment to reduce operational costs and environmental impact while improving service reliability.

Network densification strategies emphasize small cell deployments and distributed antenna systems to enhance coverage quality and capacity in high-demand areas. This approach supports growing data consumption patterns and prepares networks for 5G technology implementation across major urban centers.

Digital transformation integration includes IoT sensors, remote monitoring systems, and predictive maintenance technologies improving operational efficiency and reducing service disruptions. These digital solutions enable proactive maintenance, optimize energy consumption, and enhance security monitoring capabilities.

Rural connectivity initiatives leverage innovative deployment models including satellite integration, community-based approaches, and government partnership programs. These initiatives address digital divide challenges while creating sustainable business models for telecommunications infrastructure in underserved areas.

Recent industry developments demonstrate the dynamic nature of Nigeria’s telecom tower market, with significant investments, technological upgrades, and strategic partnerships shaping the sector’s evolution. MarkWide Research analysis indicates accelerating infrastructure modernization across major urban centers and expanding rural connectivity programs.

5G preparation activities have intensified, with major operators conducting network trials and infrastructure assessments in Lagos, Abuja, and other key cities. These preparations involve tower upgrades, fiber backhaul enhancement, and equipment modernization to support future 5G service deployment.

International investment flows continue supporting market expansion, with global tower companies establishing stronger Nigerian presence through acquisitions, partnerships, and greenfield developments. These investments bring advanced technologies, operational expertise, and capital resources supporting sector growth.

Regulatory framework evolution includes updated infrastructure sharing guidelines, streamlined approval processes, and enhanced security requirements. The Nigerian Communications Commission has implemented policies encouraging foreign investment while ensuring national security and operational standards.

Technology partnerships between tower companies, equipment manufacturers, and service providers create integrated solutions addressing operational challenges and market opportunities. These collaborations focus on energy efficiency, security enhancement, and advanced monitoring capabilities.

Strategic recommendations for Nigeria’s telecom tower market emphasize sustainable growth approaches, operational efficiency optimization, and technology innovation integration. Market participants should prioritize infrastructure sharing arrangements to maximize asset utilization and reduce deployment costs while maintaining service quality standards.

Investment priorities should focus on renewable energy integration, advanced monitoring systems, and security enhancement measures addressing operational challenges and improving long-term sustainability. Companies should develop comprehensive energy strategies reducing dependence on diesel generators while ensuring reliable power supply for critical telecommunications infrastructure.

Geographic expansion strategies should balance urban densification requirements with rural connectivity opportunities, leveraging government initiatives and development programs supporting underserved area access. Market participants should develop flexible deployment models accommodating diverse geographic and economic conditions across Nigeria’s regions.

Technology roadmap planning must incorporate 5G preparation requirements, IoT integration capabilities, and emerging telecommunications standards. Companies should invest in future-ready infrastructure supporting multiple technology generations while maintaining operational flexibility for evolving market requirements.

Partnership development with local stakeholders, government agencies, and international organizations can facilitate market access, reduce operational risks, and enhance community relations. Strategic alliances should focus on complementary capabilities, shared resources, and mutual growth objectives supporting sustainable market development.

Nigeria’s telecom tower market demonstrates strong future growth potential driven by continuing digital transformation, government infrastructure initiatives, and evolving telecommunications technology requirements. MWR projections indicate sustained expansion across urban and rural markets, with infrastructure sharing models becoming increasingly sophisticated and comprehensive.

5G network deployment will create substantial infrastructure upgrade opportunities over the next five years, requiring tower modifications, new installations, and advanced equipment integration. Urban markets will lead 5G adoption, with gradual expansion to secondary cities and eventually rural areas as technology costs decrease and coverage requirements expand.

Rural connectivity expansion represents a major growth driver, supported by government digitalization objectives and international development programs. These initiatives will require innovative deployment approaches, cost-effective technologies, and sustainable business models addressing unique challenges in underserved areas.

Technology convergence trends will integrate telecommunications infrastructure with smart city applications, IoT platforms, and digital service delivery systems. Tower sites will evolve into multi-purpose platforms supporting diverse connectivity requirements and emerging technology applications.

Sustainability focus will drive continued adoption of renewable energy solutions, energy-efficient equipment, and environmentally responsible operational practices. Market participants will increasingly prioritize environmental, social, and governance considerations in strategic planning and operational decision-making processes.

Nigeria’s telecom tower market represents a dynamic and rapidly evolving sector with substantial growth potential driven by demographic advantages, government support, and technological advancement. The market has successfully transitioned from basic infrastructure deployment to sophisticated sharing models and technology integration, positioning itself for continued expansion and innovation.

Key success factors include infrastructure sharing optimization, operational efficiency improvement, and strategic technology adoption supporting evolving telecommunications requirements. Market participants who effectively balance urban densification needs with rural connectivity opportunities while maintaining cost-effective operations will achieve sustainable competitive advantages.

Future market development will be characterized by 5G network deployment, smart city integration, and continued rural expansion supported by government initiatives and international partnerships. The sector’s evolution toward comprehensive digital infrastructure platforms will create new opportunities for innovation, investment, and sustainable growth across Nigeria’s diverse geographic and economic landscape.

What is Telecom Tower?

Telecom towers are structures that support antennas and other equipment for telecommunications, enabling wireless communication services such as mobile phone networks and internet connectivity.

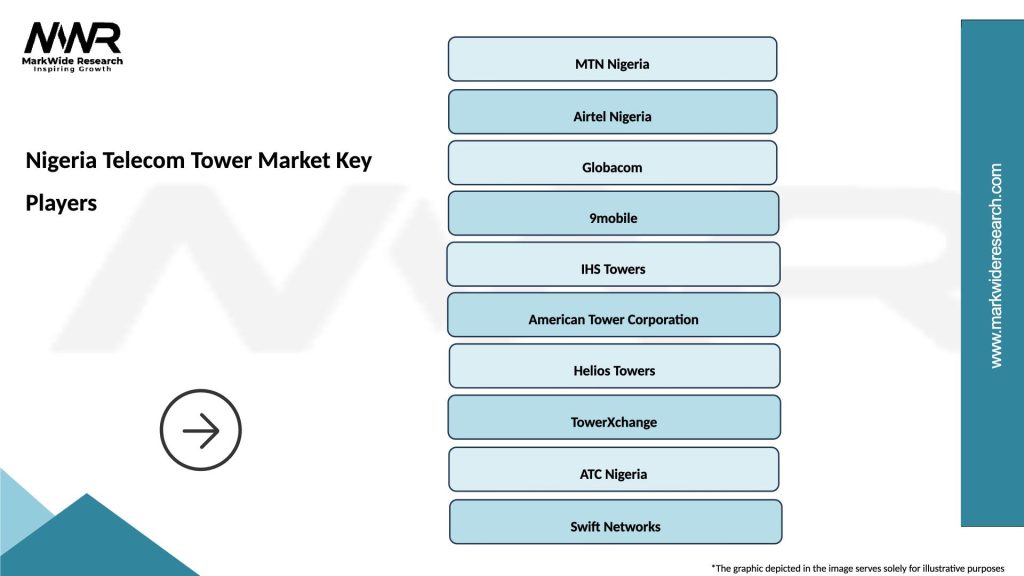

What are the key players in the Nigeria Telecom Tower Market?

Key players in the Nigeria Telecom Tower Market include MTN Nigeria, Airtel Nigeria, and IHS Towers, which are involved in the development and management of telecom infrastructure, among others.

What are the growth factors driving the Nigeria Telecom Tower Market?

The growth of the Nigeria Telecom Tower Market is driven by increasing mobile phone penetration, rising demand for high-speed internet, and the expansion of digital services across urban and rural areas.

What challenges does the Nigeria Telecom Tower Market face?

Challenges in the Nigeria Telecom Tower Market include regulatory hurdles, high operational costs, and issues related to land acquisition for new tower installations.

What opportunities exist in the Nigeria Telecom Tower Market?

Opportunities in the Nigeria Telecom Tower Market include the potential for expanding 5G networks, increasing investments in infrastructure, and the growing trend of shared tower services among telecom operators.

What trends are shaping the Nigeria Telecom Tower Market?

Trends in the Nigeria Telecom Tower Market include the adoption of green technologies for energy efficiency, the rise of small cell networks to enhance coverage, and the increasing collaboration between telecom companies and tower management firms.

Nigeria Telecom Tower Market

| Segmentation Details | Description |

|---|---|

| Product Type | Macro Towers, Micro Towers, Small Cells, Distributed Antenna Systems |

| Technology | 4G LTE, 5G, Fiber Optics, Microwave |

| End User | Telecom Operators, Internet Service Providers, Government, Enterprises |

| Installation | Urban, Suburban, Rural, Industrial |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Nigeria Telecom Tower Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at