444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Canada data center processor market represents a critical component of the nation’s rapidly evolving digital infrastructure landscape. As Canadian enterprises accelerate their digital transformation initiatives, the demand for high-performance processors capable of handling intensive computational workloads continues to surge. Data center processors serve as the computational backbone for cloud services, artificial intelligence applications, and enterprise-level data processing operations across various industries.

Market dynamics indicate robust growth driven by increasing cloud adoption, edge computing deployment, and the proliferation of data-intensive applications. The Canadian market demonstrates strong demand for both traditional x86 processors and emerging ARM-based solutions, with organizations seeking optimal performance-per-watt ratios to manage operational costs effectively. Growth projections suggest the market will expand at a compound annual growth rate of 8.2% through the forecast period, reflecting sustained investment in digital infrastructure.

Regional distribution shows concentrated activity in major metropolitan areas including Toronto, Vancouver, and Montreal, where hyperscale data centers and colocation facilities drive significant processor demand. The market encompasses various processor architectures, from high-performance server CPUs to specialized accelerators designed for artificial intelligence and machine learning workloads. Technology adoption trends indicate growing interest in energy-efficient processors as sustainability becomes a key consideration for data center operators.

The Canada data center processor market refers to the comprehensive ecosystem of central processing units, graphics processing units, and specialized accelerators deployed within Canadian data center facilities to support computational workloads. This market encompasses processors used in various data center applications, including cloud computing, enterprise servers, high-performance computing clusters, and edge computing infrastructure.

Data center processors represent the fundamental computing engines that power modern digital services, from web applications and databases to artificial intelligence training and inference operations. The market includes traditional server processors based on x86 architecture, ARM-based processors gaining traction for specific workloads, and specialized accelerators such as GPUs and field-programmable gate arrays designed for parallel processing tasks.

Market scope extends beyond hardware procurement to include processor-related services, support, and optimization solutions that help organizations maximize their computational investments. The Canadian market reflects unique characteristics including regulatory compliance requirements, bilingual support needs, and specific industry verticals such as financial services, healthcare, and natural resources that drive distinct processor requirements.

Strategic analysis reveals the Canada data center processor market is experiencing unprecedented growth driven by digital transformation acceleration and cloud migration initiatives across multiple industry sectors. Organizations are increasingly investing in modern processor architectures to support emerging technologies including artificial intelligence, machine learning, and real-time analytics applications that demand substantial computational resources.

Key market drivers include the rapid expansion of cloud service providers establishing Canadian data centers, growing demand for edge computing solutions, and increasing adoption of hybrid cloud architectures. The market benefits from government initiatives supporting digital infrastructure development, with approximately 72% of Canadian enterprises planning to increase their data center processor investments over the next three years.

Competitive landscape features established processor manufacturers competing alongside emerging players offering specialized solutions for specific workloads. The market demonstrates strong preference for processors offering superior performance-per-watt ratios, advanced security features, and compatibility with containerized applications and microservices architectures that characterize modern data center deployments.

Future outlook indicates continued market expansion supported by 5G network rollout, Internet of Things proliferation, and increasing demand for real-time data processing capabilities. The market is expected to witness significant growth in specialized processor categories including AI accelerators and edge computing processors as organizations seek to optimize their computational infrastructure for emerging workloads.

Market intelligence reveals several critical insights shaping the Canada data center processor landscape. The following key insights demonstrate the market’s evolution and strategic importance:

Primary market drivers propelling the Canada data center processor market include the accelerating pace of digital transformation across Canadian enterprises and the expanding presence of global cloud service providers establishing local data center facilities. Organizations are investing heavily in modernizing their computational infrastructure to support data-intensive applications and emerging technologies requiring substantial processing power.

Cloud computing adoption represents a fundamental driver as Canadian businesses migrate from traditional on-premises infrastructure to cloud-based solutions. This transition necessitates processors capable of supporting virtualized environments, multi-tenancy, and dynamic resource scaling. Government initiatives promoting digital infrastructure development further stimulate market growth through favorable policies and investment incentives.

Artificial intelligence proliferation drives significant demand for specialized processors optimized for machine learning workloads. Canadian organizations across healthcare, financial services, and manufacturing sectors are implementing AI solutions requiring processors with parallel processing capabilities and high memory bandwidth. Edge computing deployment creates additional demand for processors designed for distributed computing environments with specific power and thermal constraints.

Data explosion resulting from Internet of Things devices, social media platforms, and digital business processes requires processors capable of handling massive data volumes and complex analytics workloads. The growing emphasis on real-time decision-making drives demand for processors offering low-latency performance and high-speed data processing capabilities essential for competitive advantage.

Significant market restraints include the substantial capital investment requirements associated with data center processor upgrades and the complexity of migrating existing workloads to new processor architectures. Organizations face challenges in justifying processor investments, particularly when existing infrastructure continues to meet current operational requirements adequately.

Technical complexity associated with processor selection and optimization presents barriers for organizations lacking specialized expertise. The diverse range of processor options, each optimized for specific workloads, creates decision-making challenges for IT departments evaluating performance, compatibility, and cost considerations. Integration challenges with existing infrastructure and software applications can delay processor adoption and increase implementation costs.

Supply chain constraints affecting semiconductor manufacturing impact processor availability and pricing, particularly for specialized accelerators and high-performance processors. Global supply chain disruptions can create procurement delays and budget uncertainties that influence purchasing decisions. Skilled workforce shortage in areas such as processor optimization and performance tuning limits organizations’ ability to maximize their processor investments effectively.

Regulatory compliance requirements specific to Canadian data sovereignty and privacy regulations may restrict processor options or require additional security features that increase costs. Organizations must balance performance requirements with compliance obligations, potentially limiting processor choices or necessitating additional security implementations that impact total cost of ownership.

Emerging opportunities in the Canada data center processor market include the growing demand for specialized processors designed for artificial intelligence and machine learning workloads. As Canadian organizations increasingly adopt AI technologies across various applications, the need for processors optimized for neural network training and inference operations presents significant growth potential for specialized accelerator manufacturers.

Edge computing expansion creates substantial opportunities for processors designed for distributed computing environments. The rollout of 5G networks and increasing deployment of Internet of Things devices drive demand for edge processors capable of handling real-time processing requirements with minimal latency. Quantum computing research initiatives in Canadian universities and research institutions may create future opportunities for quantum processor technologies.

Sustainability initiatives present opportunities for energy-efficient processor technologies that help data center operators reduce power consumption and carbon footprint. Processors incorporating advanced power management features and optimized performance-per-watt ratios align with corporate sustainability goals and regulatory requirements. Government digitization programs create opportunities for processor suppliers serving public sector data center modernization initiatives.

Industry-specific solutions offer opportunities for processors tailored to unique Canadian market requirements, including financial services compliance, healthcare data processing, and natural resources analytics. The development of processors optimized for specific industry workloads can command premium pricing and establish competitive differentiation in the Canadian market.

Market dynamics in the Canada data center processor sector reflect the interplay between technological innovation, economic factors, and evolving customer requirements. The market demonstrates cyclical patterns influenced by technology refresh cycles, with organizations typically upgrading processor infrastructure every three to five years to maintain competitive performance levels.

Competitive dynamics feature intense rivalry between established processor manufacturers and emerging players offering specialized solutions. Traditional x86 processor vendors face increasing competition from ARM-based alternatives and specialized accelerator manufacturers targeting specific workloads. Price competition intensifies as organizations seek to optimize their total cost of ownership while maintaining performance requirements.

Technology evolution drives market dynamics as processor manufacturers continuously introduce new architectures, manufacturing processes, and specialized features. The transition to smaller manufacturing nodes, integration of AI acceleration capabilities, and development of energy-efficient designs influence customer purchasing decisions and market positioning strategies. Performance benchmarking becomes increasingly important as organizations evaluate processors based on specific workload requirements rather than generic performance metrics.

Customer behavior patterns show increasing sophistication in processor evaluation and selection processes. Organizations are developing more detailed requirements specifications, conducting proof-of-concept testing, and implementing comprehensive total cost of ownership analyses. Vendor relationships evolve toward strategic partnerships that include ongoing optimization support and performance monitoring services beyond initial hardware procurement.

Comprehensive research methodology employed for analyzing the Canada data center processor market incorporates multiple data collection and analysis techniques to ensure accuracy and reliability of market insights. The methodology combines primary research through industry interviews and surveys with secondary research utilizing published reports, industry publications, and regulatory filings.

Primary research activities include structured interviews with data center operators, IT decision-makers, and processor vendors active in the Canadian market. Survey methodologies capture quantitative data regarding processor adoption patterns, purchasing criteria, and future investment plans across various industry sectors. Expert consultations with technology analysts and industry specialists provide qualitative insights into market trends and competitive dynamics.

Secondary research sources encompass industry reports, vendor financial statements, government publications, and academic research papers relevant to data center processor technologies and market trends. Data validation processes ensure consistency and accuracy across multiple sources, with particular attention to Canadian-specific market characteristics and regulatory requirements.

Analytical frameworks applied include market sizing methodologies, competitive positioning analysis, and trend identification techniques. Statistical analysis methods validate quantitative findings and support projection development. Quality assurance processes include peer review, data triangulation, and sensitivity analysis to ensure research findings meet professional standards and provide actionable market intelligence.

Regional distribution within the Canada data center processor market shows significant concentration in major metropolitan areas where data center infrastructure development is most active. Ontario province leads the market with approximately 45% market share, driven by the Greater Toronto Area’s position as Canada’s primary financial and business center, attracting major cloud service providers and enterprise data center investments.

British Columbia represents the second-largest regional market, accounting for roughly 25% of processor demand, with Vancouver serving as a key hub for technology companies and international connectivity. The province benefits from abundant hydroelectric power and favorable climate conditions that attract energy-intensive data center operations requiring high-performance processors.

Quebec province demonstrates growing market presence with approximately 18% market share, leveraging competitive electricity rates and government incentives to attract data center investments. Montreal’s emergence as a technology hub and the province’s focus on artificial intelligence research create specific demand for AI-optimized processors and high-performance computing solutions.

Alberta and other provinces collectively represent the remaining market share, with Alberta showing particular strength in energy sector applications requiring specialized processing capabilities for seismic data analysis and resource modeling. Regional preferences vary based on local industry concentrations, with financial services driving processor demand in Toronto, technology companies influencing Vancouver requirements, and research institutions shaping Montreal market characteristics.

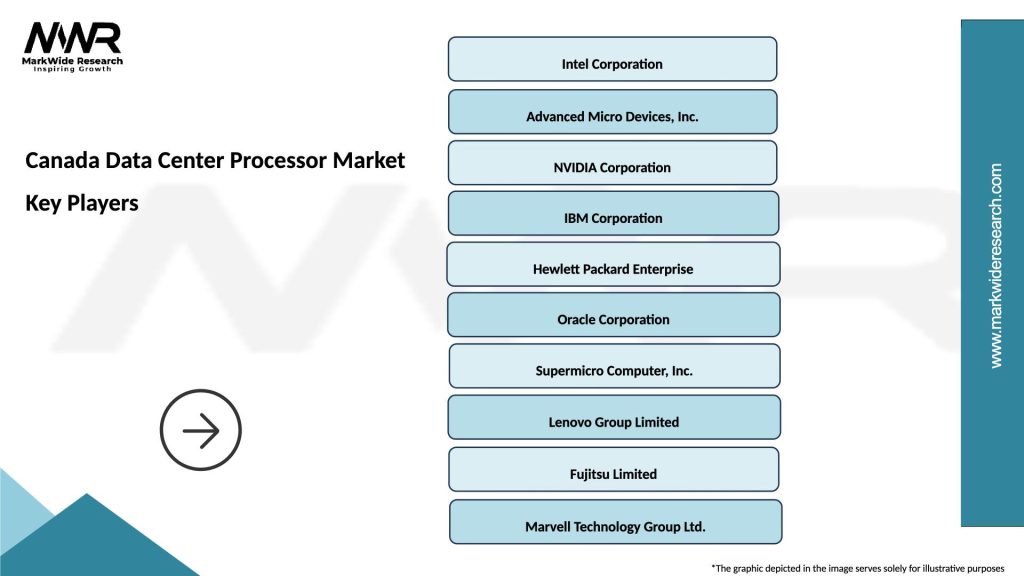

Competitive landscape in the Canada data center processor market features a diverse ecosystem of established semiconductor manufacturers, emerging technology companies, and specialized solution providers. The market demonstrates healthy competition across multiple processor categories, from traditional server CPUs to specialized accelerators designed for artificial intelligence and machine learning workloads.

Leading market participants include:

Competitive strategies emphasize performance optimization, energy efficiency, and total cost of ownership advantages. Vendors increasingly offer comprehensive solutions including software optimization tools, support services, and ecosystem partnerships to differentiate their processor offerings in the competitive Canadian market.

Market segmentation analysis reveals distinct categories within the Canada data center processor market, each characterized by specific performance requirements, application focus, and customer preferences. Segmentation approaches include processor type, application area, deployment model, and end-user industry to provide comprehensive market understanding.

By Processor Type:

By Application Area:

Central Processing Unit category maintains the largest market share within the Canada data center processor market, driven by continued demand for general-purpose server processors supporting traditional enterprise applications, databases, and web services. CPU adoption remains strong across all industry sectors, with organizations prioritizing processors offering balanced performance, reliability, and ecosystem compatibility.

Graphics Processing Unit segment demonstrates the highest growth rate, reflecting increasing adoption of artificial intelligence and machine learning applications across Canadian enterprises. GPU demand shows particular strength in sectors including healthcare, financial services, and research institutions implementing AI-driven solutions for data analysis, pattern recognition, and predictive modeling applications.

Application-Specific Integrated Circuit category represents a specialized but growing market segment, with demand driven by organizations requiring optimized performance for specific workloads. ASIC adoption shows concentration in cryptocurrency mining operations, telecommunications infrastructure, and specialized research applications where custom processor designs provide significant performance advantages.

Field-Programmable Gate Array segment appeals to organizations requiring flexible processor solutions that can be reconfigured for evolving workload requirements. FPGA deployment shows strength in telecommunications, aerospace, and research applications where adaptability and customization capabilities justify the higher complexity and cost compared to fixed-function processors.

Industry participants in the Canada data center processor market realize substantial benefits through strategic positioning in this growing sector. Processor manufacturers benefit from sustained demand growth driven by digital transformation initiatives and emerging technology adoption across multiple industry verticals, creating opportunities for revenue expansion and market share growth.

Data center operators gain competitive advantages through deployment of advanced processor technologies that enable superior performance, energy efficiency, and operational cost optimization. Modern processors provide capabilities for workload consolidation, improved resource utilization, and support for emerging applications that drive customer value and differentiation in competitive markets.

Enterprise customers benefit from enhanced computational capabilities that support digital transformation initiatives, artificial intelligence implementations, and real-time analytics applications. Advanced processors enable organizations to process larger data volumes, implement sophisticated algorithms, and deliver improved user experiences while maintaining cost-effective operations.

Technology partners including system integrators, software vendors, and service providers benefit from expanded business opportunities created by processor technology evolution. New processor capabilities enable development of innovative solutions, specialized services, and value-added offerings that address specific customer requirements and market opportunities in the Canadian technology ecosystem.

Strengths:

Weaknesses:

Opportunities:

Threats:

Artificial intelligence integration represents the most significant trend shaping the Canada data center processor market, with organizations increasingly deploying AI-optimized processors to support machine learning, natural language processing, and computer vision applications. AI processor adoption shows acceleration across healthcare, financial services, and manufacturing sectors implementing intelligent automation solutions.

Edge computing proliferation drives demand for processors designed for distributed computing environments with specific power, thermal, and latency requirements. Edge processor deployment increases as organizations implement Internet of Things solutions, autonomous systems, and real-time analytics applications requiring local processing capabilities.

Energy efficiency focus becomes increasingly important as data center operators seek to reduce operational costs and meet sustainability commitments. Green processor technologies incorporating advanced power management, optimized manufacturing processes, and improved performance-per-watt ratios gain market preference and regulatory support.

Hybrid architecture adoption shows organizations combining traditional CPUs with specialized accelerators to optimize performance for diverse workloads. Heterogeneous computing approaches enable workload-specific optimization while maintaining compatibility with existing software applications and development frameworks, creating demand for integrated processor solutions.

Recent industry developments demonstrate the dynamic nature of the Canada data center processor market, with significant investments in research and development, strategic partnerships, and technology advancement initiatives. Major processor manufacturers continue expanding their Canadian presence through local partnerships, support centers, and customer engagement programs designed to address specific market requirements.

Technology advancement initiatives include development of next-generation processor architectures incorporating artificial intelligence acceleration, advanced security features, and improved energy efficiency. Manufacturing process improvements enable smaller transistor geometries, higher performance, and reduced power consumption that benefit Canadian data center operators seeking competitive advantages.

Strategic partnerships between processor manufacturers and Canadian system integrators, cloud service providers, and enterprise customers create collaborative development opportunities for market-specific solutions. Ecosystem development includes software optimization tools, development frameworks, and support services that enhance processor value propositions and accelerate customer adoption.

Regulatory developments including data sovereignty requirements, cybersecurity standards, and environmental regulations influence processor selection criteria and market dynamics. Compliance initiatives drive demand for processors incorporating hardware-level security features and energy-efficient designs that align with Canadian regulatory requirements and corporate sustainability goals.

Strategic recommendations for market participants include focusing on specialized processor solutions that address specific Canadian market requirements and industry vertical needs. MarkWide Research analysis suggests organizations should prioritize processors offering superior total cost of ownership through combination of performance, energy efficiency, and operational simplicity.

Investment priorities should emphasize artificial intelligence and machine learning capabilities as these technologies become increasingly important across Canadian enterprises. Organizations should evaluate processors based on their ability to support current workloads while providing flexibility for future technology adoption and workload evolution.

Partnership strategies should focus on developing relationships with local system integrators, software vendors, and service providers who understand Canadian market characteristics and regulatory requirements. Ecosystem development through collaboration with educational institutions and research organizations can create competitive advantages and market differentiation opportunities.

Technology adoption strategies should balance performance requirements with practical considerations including integration complexity, staff training requirements, and ongoing support needs. Organizations should implement comprehensive evaluation processes that consider long-term strategic objectives alongside immediate performance and cost requirements.

Future market projections indicate continued robust growth for the Canada data center processor market, driven by sustained digital transformation initiatives and emerging technology adoption across multiple industry sectors. Growth expectations suggest the market will maintain strong momentum with projected compound annual growth rate exceeding 8% through the next five years.

Technology evolution will continue driving market dynamics as processor manufacturers introduce advanced architectures optimized for artificial intelligence, edge computing, and quantum computing applications. Innovation cycles are expected to accelerate, with new processor generations offering significant performance improvements and specialized capabilities for emerging workloads.

Market maturation will likely result in increased specialization, with processors designed for specific applications and industry verticals gaining market share from general-purpose solutions. Customization trends suggest growing demand for processors tailored to unique Canadian requirements including regulatory compliance, bilingual support, and industry-specific optimization.

Competitive landscape evolution will feature continued innovation from established players alongside emergence of new companies offering specialized processor solutions. Market consolidation may occur as smaller players seek partnerships or acquisition opportunities to compete effectively against larger, well-resourced competitors in the dynamic Canadian market.

Comprehensive analysis of the Canada data center processor market reveals a dynamic and rapidly evolving sector characterized by strong growth fundamentals, technological innovation, and increasing strategic importance to Canadian digital infrastructure. The market demonstrates resilience and adaptability in response to changing customer requirements, emerging technologies, and evolving competitive dynamics.

Key success factors for market participants include focus on specialized solutions, strategic partnerships, and comprehensive understanding of Canadian market characteristics and regulatory requirements. Organizations that effectively balance performance, efficiency, and total cost of ownership considerations will be best positioned to capitalize on market opportunities and achieve sustainable competitive advantages.

Future prospects remain highly positive, with sustained growth expected across multiple processor categories and application areas. The continued evolution of artificial intelligence, edge computing, and emerging technologies will create new market opportunities while driving demand for increasingly sophisticated processor solutions. Strategic positioning in this growing market requires commitment to innovation, customer focus, and adaptability to rapidly changing technology landscapes that define the modern data center processor ecosystem in Canada.

What is Data Center Processor?

Data Center Processors are specialized computing units designed to handle the high-performance demands of data centers. They are optimized for tasks such as data processing, storage management, and virtualization, making them essential for efficient data center operations.

What are the key players in the Canada Data Center Processor Market?

Key players in the Canada Data Center Processor Market include Intel Corporation, AMD, and NVIDIA, which are known for their advanced processor technologies. These companies focus on delivering high-performance solutions tailored for data center applications, among others.

What are the main drivers of growth in the Canada Data Center Processor Market?

The growth of the Canada Data Center Processor Market is driven by the increasing demand for cloud computing services, the rise of big data analytics, and the need for enhanced processing power in enterprise applications. Additionally, the shift towards AI and machine learning is further fueling this demand.

What challenges does the Canada Data Center Processor Market face?

The Canada Data Center Processor Market faces challenges such as the high cost of advanced processors and the rapid pace of technological change. Additionally, issues related to energy consumption and cooling requirements in data centers pose significant hurdles.

What opportunities exist in the Canada Data Center Processor Market?

Opportunities in the Canada Data Center Processor Market include the growing adoption of edge computing and the expansion of 5G networks. These trends are expected to create demand for more efficient and powerful processors to support new applications and services.

What trends are shaping the Canada Data Center Processor Market?

Trends shaping the Canada Data Center Processor Market include the increasing integration of AI capabilities into processors and the development of energy-efficient designs. Additionally, the rise of hybrid cloud environments is influencing processor architecture and performance requirements.

Canada Data Center Processor Market

| Segmentation Details | Description |

|---|---|

| Product Type | CPUs, GPUs, FPGAs, ASICs |

| End User | Telecommunications, Cloud Providers, Enterprises, Government |

| Technology | Virtualization, Edge Computing, High-Performance Computing, AI Processing |

| Deployment | On-Premises, Colocation, Hybrid Cloud, Public Cloud |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Canada Data Center Processor Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at