444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

China’s out-of-home (OOH) and digital out-of-home (DOOH) market represents one of the world’s most dynamic and rapidly evolving advertising landscapes. The market encompasses traditional billboards, transit advertising, street furniture, and increasingly sophisticated digital displays across urban centers throughout the country. Digital transformation has fundamentally reshaped how brands connect with consumers in public spaces, with DOOH segments experiencing particularly robust growth at approximately 12.5% CAGR over recent years.

Urbanization trends continue to drive market expansion as China’s metropolitan areas accommodate growing populations seeking enhanced connectivity and engagement. The integration of smart city initiatives with advertising infrastructure has created unprecedented opportunities for targeted messaging and real-time content optimization. Technology adoption across major cities like Beijing, Shanghai, Guangzhou, and Shenzhen has established China as a global leader in digital advertising innovation.

Market dynamics reflect the country’s broader economic transformation, with increasing consumer spending power and sophisticated audience segmentation capabilities. The convergence of mobile technology, data analytics, and programmatic advertising has enabled more precise targeting and measurable campaign effectiveness. Retail integration and location-based advertising have become particularly influential, with shopping centers and transportation hubs serving as premium advertising real estate.

The China OOH and DOOH market refers to the comprehensive ecosystem of advertising displays, digital screens, and traditional outdoor media formats that reach consumers outside their homes across Chinese territories. This market encompasses static billboards, digital signage, transit advertising, street furniture displays, and interactive kiosks deployed in high-traffic locations throughout urban and suburban environments.

Out-of-home advertising traditionally includes static billboards, posters, and printed materials displayed in public spaces, while digital out-of-home (DOOH) represents the evolution toward electronic displays, LED screens, and interactive digital platforms. The distinction has become increasingly important as advertisers shift budgets toward more flexible, data-driven digital formats that offer real-time content updates and audience measurement capabilities.

Market scope extends beyond simple advertising placement to include comprehensive audience analytics, programmatic buying platforms, and integrated marketing solutions that connect outdoor advertising with mobile and online campaigns. The ecosystem includes media owners, technology providers, content creators, and data analytics companies working together to deliver measurable advertising outcomes across China’s diverse geographic and demographic landscape.

China’s OOH and DOOH market has emerged as a critical component of the country’s advertising ecosystem, driven by rapid urbanization, technological advancement, and evolving consumer behaviors. The market demonstrates strong growth momentum with digital formats capturing an increasing share of total outdoor advertising investments. DOOH adoption has accelerated significantly, representing approximately 68% of total OOH advertising spend in major metropolitan areas.

Key market drivers include the proliferation of smart city infrastructure, increased mobile device penetration, and sophisticated audience measurement technologies. Programmatic advertising capabilities have transformed how brands approach outdoor campaigns, enabling real-time optimization and cross-channel integration. Consumer engagement metrics indicate higher effectiveness for digital formats, with interactive displays generating 35% higher recall rates compared to traditional static media.

Competitive landscape features both established outdoor media companies and emerging technology-focused players. International brands increasingly recognize China’s market as essential for global expansion, while domestic companies leverage local market knowledge and government relationships to maintain competitive advantages. Innovation focus centers on artificial intelligence integration, augmented reality experiences, and seamless mobile connectivity that enhances consumer interaction with outdoor advertising content.

Market insights reveal several critical trends shaping China’s OOH and DOOH landscape:

Urbanization momentum continues to fuel market expansion as China’s urban population grows and concentrates in major metropolitan areas. The development of smart cities creates infrastructure that naturally accommodates digital advertising displays, while urban planning initiatives increasingly integrate advertising opportunities into public spaces. Population density in key markets provides advertisers with efficient reach and frequency opportunities unavailable in less concentrated markets.

Technology advancement has revolutionized outdoor advertising capabilities, with 5G networks enabling real-time content delivery and interactive experiences. Artificial intelligence and machine learning applications optimize content selection and audience targeting, while improved display technologies offer better visibility and energy efficiency. Cost reduction in digital display manufacturing has made DOOH deployment more economically viable across diverse location types.

Consumer behavior evolution reflects increased mobile device usage and expectation for personalized, relevant advertising content. Younger demographics particularly respond to interactive and socially shareable outdoor advertising experiences. Brand recognition of outdoor advertising effectiveness has grown as measurement technologies provide clearer ROI demonstration and campaign attribution capabilities.

Government support for digital infrastructure development and smart city initiatives creates favorable conditions for DOOH expansion. Regulatory frameworks increasingly accommodate innovative advertising formats while maintaining appropriate content standards. Economic growth in consumer spending and business investment provides the financial foundation for sustained advertising market expansion.

Regulatory complexity presents ongoing challenges as local governments maintain varying standards for outdoor advertising content, placement, and operational requirements. Compliance costs and approval processes can delay campaign launches and limit creative flexibility. Content restrictions require careful navigation to ensure advertising materials meet evolving regulatory standards across different jurisdictions.

High capital requirements for DOOH infrastructure development create barriers for smaller market participants and limit rapid expansion in secondary markets. Installation, maintenance, and technology upgrade costs require substantial ongoing investment. Location acquisition challenges in premium areas result in intense competition and elevated pricing for desirable advertising positions.

Measurement standardization remains inconsistent across different media owners and technology platforms, complicating campaign comparison and optimization efforts. Audience measurement methodologies vary significantly, making it difficult for advertisers to establish consistent performance benchmarks. Data privacy concerns and regulations increasingly impact audience tracking and personalization capabilities.

Economic sensitivity affects advertising budgets during economic uncertainty, with outdoor advertising often experiencing reduced investment during challenging economic periods. Competition intensity from digital and mobile advertising channels requires continuous innovation and value demonstration to maintain advertiser interest and budget allocation.

Smart city integration presents significant expansion opportunities as municipal governments invest in connected infrastructure that can accommodate advanced advertising technologies. The convergence of public services and advertising platforms creates new revenue streams and enhanced citizen engagement possibilities. IoT connectivity enables sophisticated audience analytics and real-time content optimization that dramatically improves advertising effectiveness.

Retail media expansion offers substantial growth potential as shopping centers, malls, and retail chains recognize the value of their customer traffic for advertising revenue generation. Point-of-sale integration and purchase attribution capabilities make retail locations increasingly attractive for brand advertisers. E-commerce integration creates seamless pathways from outdoor advertising exposure to online purchase completion.

Transportation advertising continues expanding as China’s infrastructure development includes new airports, high-speed rail stations, and urban transit systems. These environments provide captive audiences with extended exposure times and favorable demographics. Travel recovery following global disruptions has renewed focus on transportation hub advertising opportunities.

Technology innovation in augmented reality, artificial intelligence, and interactive displays creates differentiated advertising experiences that command premium pricing. Programmatic expansion into smaller markets and diverse inventory types offers efficiency gains and broader market access for advertisers seeking comprehensive outdoor advertising solutions.

Supply and demand dynamics in China’s OOH and DOOH market reflect the tension between limited premium locations and growing advertiser interest in outdoor advertising effectiveness. Inventory scarcity in tier-one cities drives pricing premiums while encouraging expansion into secondary markets with more favorable cost structures. The balance between traditional and digital inventory continues shifting toward digital formats as advertisers prioritize flexibility and measurement capabilities.

Competitive dynamics feature established outdoor media companies adapting to digital transformation while technology-focused entrants challenge traditional business models. Consolidation trends have emerged as companies seek scale advantages and comprehensive market coverage. Strategic partnerships between media owners and technology providers create integrated solutions that enhance advertiser value propositions.

Pricing dynamics reflect the premium value of digital formats and data-rich advertising opportunities. Programmatic pricing models introduce greater transparency and efficiency while enabling real-time price optimization based on audience and performance metrics. Seasonal fluctuations and economic cycles continue influencing pricing strategies across different market segments.

Innovation dynamics drive continuous technology advancement as companies compete to offer superior audience targeting, content delivery, and campaign measurement capabilities. According to MarkWide Research analysis, companies investing in advanced analytics and AI-powered optimization report 23% higher client retention rates compared to traditional service providers.

Primary research methodology encompasses comprehensive interviews with industry stakeholders including media owners, advertisers, technology providers, and regulatory officials across major Chinese markets. Survey data collection from advertising agencies and brand managers provides insights into decision-making processes, budget allocation trends, and performance expectations. Field observations in key metropolitan areas document advertising deployment patterns and audience engagement behaviors.

Secondary research incorporates analysis of industry reports, government publications, financial statements, and regulatory filings to establish market context and validate primary research findings. Data triangulation ensures accuracy and reliability by comparing multiple information sources and methodologies. Historical trend analysis provides foundation for future market projections and scenario development.

Quantitative analysis utilizes statistical modeling to identify market drivers, correlations, and growth patterns across different segments and geographic regions. Qualitative assessment captures nuanced market dynamics, competitive strategies, and emerging trends that quantitative methods might overlook. Expert interviews provide professional perspectives on market evolution and strategic implications.

Market sizing methodology employs bottom-up and top-down approaches to ensure comprehensive coverage and accuracy. Validation processes include cross-referencing with industry associations, government statistics, and company disclosures to maintain research integrity and reliability throughout the analysis process.

Tier-one cities including Beijing, Shanghai, Guangzhou, and Shenzhen dominate market activity with approximately 55% of total advertising investment concentrated in these metropolitan areas. These markets feature the highest DOOH penetration rates, most advanced technology deployments, and premium pricing structures. Infrastructure sophistication in tier-one cities enables cutting-edge advertising formats and comprehensive audience measurement capabilities.

Tier-two cities represent significant growth opportunities as economic development and urbanization create expanding consumer markets with increasing advertising demand. Cities like Chengdu, Hangzhou, Nanjing, and Wuhan demonstrate strong market potential with growing advertising investment at 16% annually. Cost advantages in tier-two markets attract advertisers seeking efficient reach and frequency opportunities.

Eastern coastal regions maintain market leadership due to economic concentration, international business presence, and advanced infrastructure development. The Yangtze River Delta and Pearl River Delta economic zones generate disproportionate advertising demand. Western region development initiatives create emerging opportunities as government investment improves infrastructure and economic conditions.

Transportation corridors connecting major cities offer unique advertising opportunities with high-value audiences traveling between economic centers. High-speed rail networks and major highway systems provide premium advertising environments with extended exposure times and affluent demographic profiles that justify premium pricing strategies.

Market leadership is distributed among several key players with distinct competitive advantages:

Competitive strategies increasingly focus on technology integration, data analytics capabilities, and programmatic advertising platform development. Companies are investing heavily in audience measurement technologies and cross-channel attribution capabilities to demonstrate advertising effectiveness. Partnership strategies with technology providers and data companies create competitive advantages in service delivery and client value proposition.

By Format:

By Technology:

By Application:

Digital billboard category represents the highest growth segment with advertisers increasingly preferring flexible, updatable content delivery. These installations command premium pricing due to high visibility and audience impact. Technology advancement in LED display efficiency and brightness has improved outdoor visibility while reducing operational costs.

Transit advertising maintains strong performance due to captive audience characteristics and extended exposure times. Subway systems in major cities provide particularly valuable advertising environments with affluent, educated demographics. Integration opportunities with mobile apps and QR codes enhance engagement and campaign measurement capabilities.

Retail media category demonstrates exceptional growth potential as shopping centers recognize advertising revenue opportunities from their customer traffic. Point-of-sale integration and purchase attribution make retail locations increasingly attractive for brand advertisers. E-commerce integration creates seamless pathways from advertising exposure to online purchase completion.

Building advertising networks offer unique advantages in reaching professional audiences in office environments and residential communities. Elevator screens provide guaranteed exposure with minimal distraction competition. Audience segmentation by building type and location enables precise demographic targeting for relevant advertising content.

Advertisers benefit from enhanced targeting capabilities, real-time campaign optimization, and comprehensive performance measurement that traditional outdoor advertising could not provide. Cost efficiency improvements through programmatic buying and automated campaign management reduce operational overhead while improving campaign effectiveness. Cross-channel integration enables cohesive marketing strategies that amplify overall campaign impact.

Media owners experience increased revenue potential through premium pricing for digital formats and enhanced inventory utilization through programmatic platforms. Operational efficiency gains from centralized content management and remote monitoring reduce maintenance costs and improve service reliability. Technology integration creates new revenue streams through data services and audience analytics offerings.

Technology providers find expanding market opportunities as media owners invest in digital transformation and advanced advertising capabilities. Innovation demand drives continuous product development and service enhancement opportunities. Partnership opportunities with media owners and advertisers create integrated solution offerings that command premium pricing.

Consumers benefit from more relevant, engaging advertising content that provides useful information and entertainment value. Interactive capabilities enable consumer participation and engagement with brands in meaningful ways. Improved content quality and relevance reduce advertising intrusion while increasing information value.

Strengths:

Weaknesses:

Opportunities:

Threats:

Programmatic advertising adoption continues accelerating as advertisers seek efficiency and optimization capabilities in outdoor advertising campaigns. Automated buying platforms enable real-time bidding, audience targeting, and performance optimization that traditional booking methods cannot match. Integration capabilities with existing digital marketing platforms create seamless campaign management across multiple channels.

Artificial intelligence integration transforms content selection, audience targeting, and campaign optimization through machine learning algorithms that continuously improve performance. Predictive analytics enable proactive campaign adjustments based on weather, traffic patterns, and audience behavior predictions. Computer vision technology provides sophisticated audience measurement and demographic analysis capabilities.

Interactive experience development incorporates augmented reality, touch interfaces, and mobile connectivity to create engaging consumer interactions with outdoor advertising content. Social media integration enables content sharing and viral marketing amplification beyond initial advertising exposure. Gamification elements increase engagement time and brand interaction quality.

Sustainability focus drives adoption of energy-efficient display technologies and environmentally responsible operational practices. Solar power integration and LED efficiency improvements reduce environmental impact while lowering operational costs. Sustainable practices increasingly influence advertiser selection of media partners and campaign strategies.

Technology partnerships between traditional media owners and digital technology companies create integrated solutions that combine location assets with advanced advertising capabilities. These collaborations accelerate digital transformation while leveraging existing market relationships and infrastructure investments. Strategic alliances enable rapid market expansion and service enhancement without requiring complete internal technology development.

Regulatory framework evolution reflects government efforts to balance advertising industry growth with urban planning and content standards. New guidelines for digital display deployment and content approval processes provide greater clarity for market participants. Standardization initiatives aim to create consistent measurement methodologies and operational standards across different regions and media types.

Investment activity includes both domestic and international capital flowing into Chinese OOH and DOOH companies seeking to capitalize on market growth opportunities. MWR data indicates that private equity and strategic investor interest has increased significantly, with technology-focused companies receiving 31% more investment compared to traditional outdoor media operators.

International expansion by Chinese OOH companies demonstrates growing confidence and capability in global markets. These companies leverage domestic market experience and technology capabilities to compete internationally. Knowledge transfer from international markets also influences domestic innovation and best practice adoption.

Technology investment should prioritize audience measurement, programmatic capabilities, and content management systems that enable competitive differentiation and operational efficiency. Companies that delay digital transformation risk losing market share to more technologically advanced competitors. Partnership strategies with technology providers can accelerate capability development while managing investment requirements.

Geographic expansion into tier-two and tier-three cities offers growth opportunities as these markets develop economically and infrastructure improves. Early market entry can establish competitive advantages before markets become saturated. Local partnership strategies may be essential for understanding regional market dynamics and regulatory requirements.

Data monetization represents significant revenue opportunity as audience analytics and consumer insights become increasingly valuable to advertisers and retailers. Companies should invest in data collection, analysis, and privacy-compliant sharing capabilities. Service diversification beyond traditional advertising placement can create additional revenue streams and client value.

Sustainability initiatives should be integrated into operational strategies as environmental considerations increasingly influence advertiser and government decision-making. Energy efficiency improvements and renewable power adoption can reduce costs while enhancing corporate reputation and regulatory compliance.

Market evolution will continue favoring digital formats as technology costs decline and advertiser demand for flexibility and measurement increases. Traditional static outdoor advertising will likely maintain niche applications but represent a declining share of total market activity. Innovation acceleration in display technology, artificial intelligence, and interactive capabilities will create new advertising formats and engagement opportunities.

Consolidation trends may intensify as companies seek scale advantages and comprehensive market coverage to compete effectively with large integrated players. Technology integration will become increasingly important for competitive positioning, with companies investing heavily in programmatic platforms, audience analytics, and cross-channel attribution capabilities.

Regulatory environment will likely become more sophisticated as governments develop comprehensive frameworks for digital advertising deployment and content standards. Industry standardization efforts may create more consistent measurement methodologies and operational practices across different regions and market participants.

Growth projections indicate continued market expansion driven by urbanization, technology adoption, and increasing advertiser recognition of outdoor advertising effectiveness. MarkWide Research projects that digital formats will represent approximately 78% of total outdoor advertising investment within the next five years, reflecting the ongoing transformation toward more flexible, measurable advertising solutions.

China’s OOH and DOOH market represents a dynamic and rapidly evolving advertising landscape characterized by technological innovation, urbanization-driven growth, and increasing advertiser sophistication. The market’s transformation from traditional static displays to advanced digital platforms reflects broader trends in consumer behavior, technology adoption, and advertising effectiveness measurement. Digital formats have established clear competitive advantages through flexibility, targeting capabilities, and comprehensive performance analytics that traditional outdoor advertising cannot match.

Future success in this market will depend on companies’ ability to integrate advanced technologies, develop comprehensive audience measurement capabilities, and create seamless programmatic advertising experiences. The convergence of outdoor advertising with mobile technology, artificial intelligence, and data analytics creates unprecedented opportunities for targeted, effective advertising campaigns. Market participants that invest in technology infrastructure, data capabilities, and strategic partnerships will be best positioned to capitalize on continued market growth and evolution in China’s dynamic advertising ecosystem.

What is OOH and DOOH?

OOH stands for Out-Of-Home advertising, which includes any advertising that reaches the consumer while they are outside their home. DOOH, or Digital Out-Of-Home, refers specifically to digital advertising displays in public spaces, such as digital billboards and screens in transit areas.

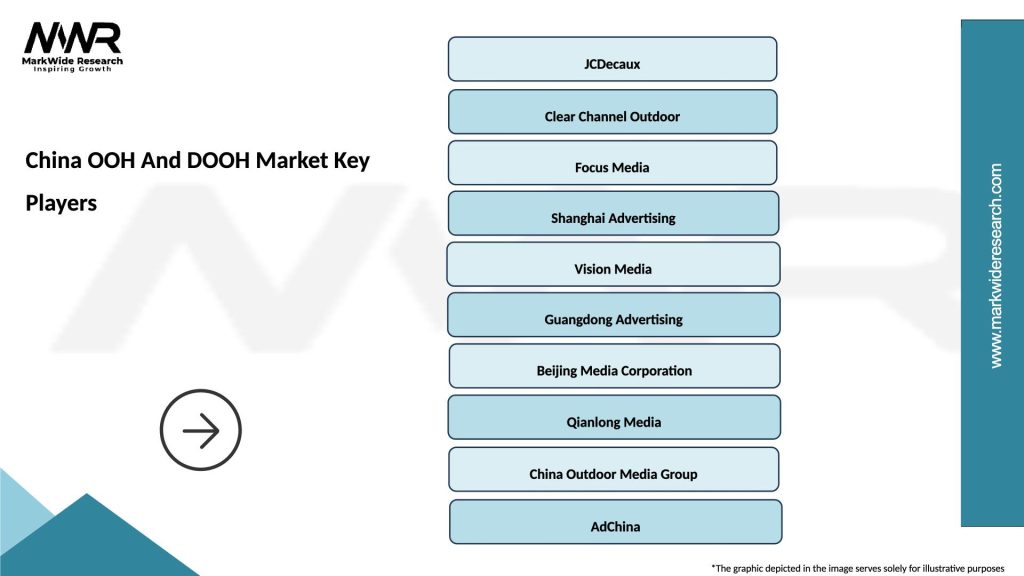

What are the key players in the China OOH And DOOH Market?

Key players in the China OOH And DOOH Market include companies like JCDecaux, Focus Media, and Clear Channel Outdoor, which are known for their extensive advertising networks and innovative digital solutions, among others.

What are the growth factors driving the China OOH And DOOH Market?

The growth of the China OOH And DOOH Market is driven by increasing urbanization, the rise of digital technology, and the growing demand for targeted advertising. Additionally, the expansion of public transport systems and shopping centers enhances the visibility of OOH and DOOH advertising.

What challenges does the China OOH And DOOH Market face?

The China OOH And DOOH Market faces challenges such as regulatory restrictions on outdoor advertising, competition from digital media, and the need for continuous technological upgrades. These factors can impact the effectiveness and reach of advertising campaigns.

What opportunities exist in the China OOH And DOOH Market?

Opportunities in the China OOH And DOOH Market include the integration of advanced technologies like AI and data analytics for better audience targeting, as well as the potential for interactive advertising experiences. The growing trend of smart cities also presents new avenues for innovative advertising solutions.

What trends are shaping the China OOH And DOOH Market?

Trends shaping the China OOH And DOOH Market include the increasing use of programmatic advertising, the rise of mobile integration, and the focus on sustainability in advertising practices. Additionally, the shift towards more engaging and immersive advertising formats is becoming prominent.

China OOH And DOOH Market

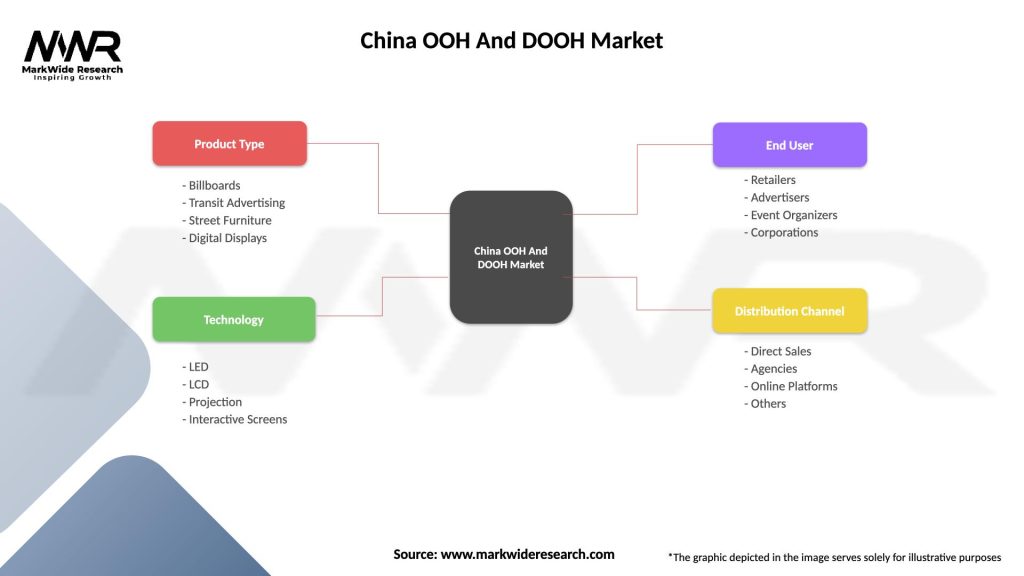

| Segmentation Details | Description |

|---|---|

| Product Type | Billboards, Transit Advertising, Street Furniture, Digital Displays |

| Technology | LED, LCD, Projection, Interactive Screens |

| End User | Retailers, Advertisers, Event Organizers, Corporations |

| Distribution Channel | Direct Sales, Agencies, Online Platforms, Others |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the China OOH And DOOH Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at