444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Australia OOH and DOOH market represents a dynamic and rapidly evolving advertising landscape that encompasses traditional out-of-home advertising alongside cutting-edge digital out-of-home solutions. This comprehensive market includes billboards, transit advertising, street furniture, digital displays, and interactive advertising platforms across major Australian cities and regional areas. Market growth has been particularly robust, with the sector experiencing a compound annual growth rate of 8.2% over recent years, driven by technological advancement and changing consumer behavior patterns.

Digital transformation has fundamentally reshaped the Australian outdoor advertising industry, with digital out-of-home (DOOH) solutions gaining significant traction among advertisers seeking more flexible, targeted, and measurable campaign options. The integration of programmatic advertising capabilities has enhanced the appeal of DOOH platforms, enabling real-time bidding and dynamic content optimization. Urban development across major metropolitan areas including Sydney, Melbourne, Brisbane, and Perth has created numerous opportunities for strategic placement of both traditional and digital advertising assets.

Consumer engagement with out-of-home advertising remains exceptionally strong in Australia, with studies indicating that 78% of consumers notice outdoor advertising during their daily commutes and shopping activities. The market benefits from Australia’s urbanized population distribution, with approximately 86% of residents living in urban areas where OOH and DOOH advertising achieves maximum exposure and impact.

The Australia OOH and DOOH market refers to the comprehensive ecosystem of outdoor advertising solutions that reach consumers outside their homes through both traditional static displays and advanced digital platforms. Out-of-home advertising encompasses traditional formats including billboards, transit advertising, street furniture, and ambient media, while digital out-of-home advertising includes LED displays, digital billboards, interactive kiosks, and programmatically-enabled advertising networks.

Market definition extends beyond simple advertising placement to include sophisticated audience measurement systems, programmatic buying platforms, content management solutions, and data analytics capabilities that enable precise targeting and campaign optimization. The Australian market is characterized by its integration of location-based data, demographic insights, and real-time content delivery systems that enhance advertising effectiveness and return on investment for brands across diverse industry sectors.

Technological integration distinguishes modern OOH and DOOH solutions from traditional advertising approaches, incorporating features such as facial recognition for demographic analysis, mobile device connectivity, weather-triggered content changes, and social media integration capabilities that create immersive brand experiences for Australian consumers.

Australia’s OOH and DOOH market demonstrates exceptional resilience and growth potential, positioning itself as a critical component of the national advertising ecosystem. The market has successfully adapted to digital transformation while maintaining the fundamental strengths of outdoor advertising including broad reach, high visibility, and cost-effective audience delivery. Digital adoption has accelerated significantly, with DOOH solutions now representing 42% of total outdoor advertising investments across the country.

Key market drivers include urbanization trends, infrastructure development, technological advancement, and evolving consumer media consumption patterns that favor location-based advertising experiences. The integration of programmatic advertising capabilities has revolutionized campaign planning and execution, enabling advertisers to achieve greater precision and measurability in their outdoor advertising investments.

Competitive dynamics reflect a market dominated by established players who have successfully invested in digital infrastructure while maintaining extensive traditional advertising networks. Innovation in areas such as augmented reality integration, mobile connectivity, and data analytics continues to differentiate leading market participants and drive overall industry growth.

Future prospects remain highly positive, with continued urbanization, smart city initiatives, and advancing display technologies expected to sustain robust market expansion throughout the forecast period.

Strategic market insights reveal several critical trends shaping the Australia OOH and DOOH landscape:

Market maturity indicators suggest that Australia has achieved significant sophistication in outdoor advertising technology adoption while maintaining strong growth potential in emerging segments such as interactive displays and location-based targeting solutions.

Primary market drivers propelling Australia’s OOH and DOOH market expansion include several interconnected factors that create sustained demand for outdoor advertising solutions. Urbanization trends continue to concentrate population density in major metropolitan areas, creating ideal conditions for outdoor advertising effectiveness and advertiser investment.

Digital transformation across the advertising industry has elevated the appeal of DOOH solutions, which offer enhanced targeting capabilities, real-time content updates, and comprehensive performance measurement. The ability to deliver dynamic, contextually relevant advertising messages has attracted significant advertiser interest and investment, particularly among brands seeking to maximize campaign impact and return on investment.

Infrastructure development initiatives across Australian cities have created numerous opportunities for strategic advertising placement, including new transit systems, commercial developments, and public spaces that accommodate both traditional and digital advertising formats. Government investment in smart city technologies has further enhanced the integration potential for advanced DOOH solutions.

Consumer behavior evolution reflects increasing acceptance and engagement with outdoor advertising, particularly digital formats that offer interactive and personalized experiences. The growing time spent outside homes for work, shopping, and entertainment activities sustains high exposure levels for outdoor advertising campaigns.

Technological advancement in display technologies, content management systems, and data analytics has significantly improved the cost-effectiveness and performance measurability of outdoor advertising investments, encouraging continued market expansion and innovation.

Market restraints affecting Australia’s OOH and DOOH sector include regulatory challenges, infrastructure limitations, and economic factors that may impact growth trajectories. Regulatory compliance requirements vary significantly across different states and local government areas, creating complexity for national advertising campaigns and potentially limiting placement opportunities in certain locations.

Infrastructure constraints in some regional areas limit the deployment of advanced DOOH solutions, particularly in locations where reliable power supply and internet connectivity may be insufficient to support sophisticated digital advertising systems. These limitations can restrict market expansion beyond major metropolitan areas.

Capital investment requirements for digital infrastructure development represent significant financial commitments for market participants, particularly smaller operators seeking to compete with established players who have already invested heavily in DOOH capabilities. The ongoing costs associated with technology upgrades and maintenance can impact profitability margins.

Economic sensitivity affects advertiser spending patterns during economic downturns, with outdoor advertising budgets often subject to reduction when companies implement cost-cutting measures. This cyclical sensitivity can create revenue volatility for OOH and DOOH operators.

Competition from digital media platforms continues to challenge traditional advertising approaches, requiring outdoor advertising providers to demonstrate clear value propositions and measurable results to maintain advertiser loyalty and investment levels.

Significant market opportunities exist across multiple dimensions of Australia’s OOH and DOOH landscape, driven by technological innovation, changing consumer preferences, and evolving advertiser requirements. Smart city development initiatives across major Australian cities present substantial opportunities for integrated advertising solutions that combine public information services with commercial messaging capabilities.

Programmatic advertising expansion offers considerable growth potential as more advertisers seek automated, data-driven campaign management solutions that enhance targeting precision and operational efficiency. The development of sophisticated audience measurement and attribution systems creates opportunities for premium pricing and enhanced advertiser value propositions.

Interactive technology integration presents opportunities to develop immersive advertising experiences that engage consumers through augmented reality, mobile connectivity, and personalized content delivery. These advanced capabilities can command premium advertising rates while delivering superior campaign performance for brand partners.

Regional market expansion opportunities exist in secondary cities and regional centers where digital infrastructure development could unlock new advertising inventory and revenue streams. The growing economic importance of regional areas creates demand for sophisticated advertising solutions beyond traditional metropolitan markets.

Cross-platform integration opportunities enable OOH and DOOH providers to develop comprehensive advertising solutions that coordinate with digital marketing campaigns, social media initiatives, and mobile advertising programs, creating enhanced value propositions for advertisers seeking integrated marketing approaches.

Market dynamics within Australia’s OOH and DOOH sector reflect complex interactions between technological advancement, consumer behavior changes, regulatory evolution, and competitive pressures that shape industry development. Digital adoption acceleration has fundamentally altered competitive dynamics, with companies investing heavily in DOOH capabilities to maintain market relevance and growth prospects.

Audience measurement sophistication has enhanced the credibility and appeal of outdoor advertising among advertisers who increasingly demand detailed performance metrics and attribution data. The implementation of advanced analytics systems has improved campaign optimization capabilities and enabled more precise targeting approaches that deliver superior return on investment.

Programmatic advertising integration has streamlined campaign planning and execution processes while enabling real-time optimization and automated buying decisions. This technological advancement has attracted new advertiser segments and increased campaign frequency among existing clients who appreciate the enhanced efficiency and control.

Content personalization capabilities have elevated the effectiveness of outdoor advertising campaigns, with dynamic content delivery systems enabling message optimization based on time of day, weather conditions, audience demographics, and other contextual factors. These capabilities have resulted in campaign performance improvements of up to 35% compared to static advertising approaches.

Competitive intensity continues to drive innovation and service enhancement across the market, with leading players investing in technology upgrades, network expansion, and value-added services to maintain competitive advantages and market share positions.

Comprehensive research methodology employed for analyzing Australia’s OOH and DOOH market incorporates multiple data collection and analysis approaches to ensure accuracy, reliability, and depth of market insights. Primary research activities include extensive interviews with industry executives, advertising agency professionals, technology providers, and regulatory officials to gather firsthand perspectives on market trends, challenges, and opportunities.

Secondary research components encompass analysis of industry reports, financial statements, regulatory filings, trade publications, and academic studies to establish comprehensive market context and validate primary research findings. Data triangulation methods ensure consistency and reliability across different information sources.

Market modeling techniques utilize statistical analysis, trend extrapolation, and scenario planning to develop accurate market projections and identify key growth drivers and potential risks. Quantitative analysis incorporates advertising spending data, audience measurement statistics, and technology adoption rates to establish market sizing and growth trajectories.

Competitive analysis methodology includes detailed examination of market participant strategies, financial performance, technology capabilities, and market positioning to understand competitive dynamics and identify success factors within the industry.

Quality assurance processes include peer review, expert validation, and cross-referencing with multiple data sources to ensure research accuracy and reliability. Regular methodology updates incorporate emerging research techniques and data sources to maintain analytical sophistication and relevance.

Regional market analysis reveals significant variations in OOH and DOOH market development across different Australian states and territories, reflecting differences in population density, economic activity, infrastructure development, and regulatory environments. New South Wales dominates the national market with approximately 38% market share, driven by Sydney’s status as the country’s largest metropolitan area and primary commercial center.

Victoria represents the second-largest regional market with 28% market share, benefiting from Melbourne’s substantial population base, extensive public transportation network, and strong commercial activity that supports diverse outdoor advertising opportunities. The state’s progressive approach to digital infrastructure development has facilitated rapid DOOH adoption and innovation.

Queensland accounts for 18% of national market activity, with Brisbane serving as the primary market center while Gold Coast and other regional centers contribute to overall market development. The state’s tourism industry creates unique opportunities for outdoor advertising targeting both domestic and international visitors.

Western Australia represents 12% of market share, with Perth as the dominant metropolitan area. The state’s mining industry and economic growth have supported continued investment in outdoor advertising infrastructure, particularly digital solutions that serve the business community and consumer markets.

South Australia, Tasmania, and Northern Territory collectively account for the remaining 4% of market activity, with Adelaide representing the largest market within this group. These markets present growth opportunities as digital infrastructure development continues and regional economic activity expands.

Competitive landscape analysis reveals a market structure dominated by several major players who have established extensive networks of traditional and digital advertising assets across Australia’s key metropolitan and regional markets. Market leadership is characterized by companies that have successfully invested in digital transformation while maintaining comprehensive traditional advertising capabilities.

Competitive differentiation strategies include technology innovation, premium location acquisition, comprehensive service offerings, and data analytics capabilities that enhance advertiser value propositions. Market leaders continue to invest in programmatic advertising platforms, audience measurement systems, and interactive technology integration to maintain competitive advantages.

Market consolidation trends reflect ongoing industry maturation, with larger players acquiring smaller operators to expand geographic coverage and enhance technology capabilities. Strategic partnerships between outdoor advertising companies and technology providers are becoming increasingly common to accelerate innovation and service enhancement.

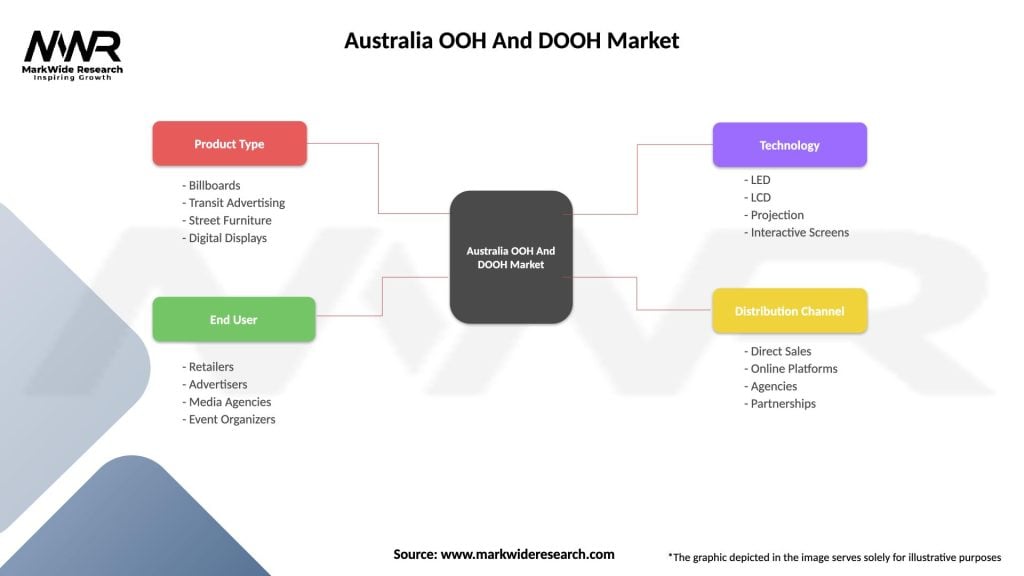

Market segmentation analysis reveals distinct categories within Australia’s OOH and DOOH market, each characterized by unique growth patterns, technology requirements, and advertiser preferences. Format-based segmentation distinguishes between traditional static displays and advanced digital solutions that offer enhanced targeting and measurement capabilities.

By Format Type:

By Technology Integration:

Category-wise market insights demonstrate varying growth patterns and development opportunities across different segments of Australia’s OOH and DOOH market. Digital billboard segments show the strongest growth trajectory, with adoption rates increasing by 15% annually as advertisers recognize the enhanced flexibility and targeting capabilities offered by these advanced display systems.

Transit advertising categories benefit from Australia’s extensive public transportation networks and growing urban population density. The integration of digital displays within transit environments has enhanced advertiser appeal while providing valuable public information services that create positive consumer associations with advertising messages.

Retail environment advertising demonstrates strong performance driven by the integration of digital displays with point-of-sale systems and customer journey optimization. Shopping center advertising solutions have evolved to incorporate mobile connectivity and personalized messaging capabilities that enhance consumer engagement and purchase influence.

Street furniture advertising continues to provide reliable revenue streams while evolving to incorporate digital capabilities and smart city integration. The development of multifunctional displays that combine advertising with public services creates enhanced value propositions for both advertisers and municipal authorities.

Interactive advertising solutions represent the fastest-growing category segment, with implementation rates increasing by 22% annually as brands seek to create memorable consumer experiences that differentiate their marketing campaigns from traditional advertising approaches.

Industry participants and stakeholders across Australia’s OOH and DOOH market realize substantial benefits from continued market development and technological advancement. Advertising agencies benefit from enhanced campaign planning tools, comprehensive audience measurement systems, and flexible content delivery options that improve client service capabilities and campaign effectiveness.

Brand advertisers gain access to sophisticated targeting capabilities, real-time campaign optimization, and comprehensive performance analytics that enhance return on advertising investment. The integration of programmatic buying platforms streamlines campaign management while providing greater control over budget allocation and message delivery timing.

Technology providers benefit from growing demand for advanced display systems, content management platforms, and data analytics solutions that support the evolution of outdoor advertising capabilities. Continued innovation in areas such as artificial intelligence, machine learning, and IoT integration creates ongoing revenue opportunities.

Media owners realize enhanced revenue potential through premium pricing for advanced advertising solutions, improved inventory utilization through programmatic selling, and expanded advertiser base attraction through superior service offerings and performance measurement capabilities.

Consumers benefit from more relevant and engaging advertising experiences, integration of public information services with commercial messaging, and enhanced urban environment aesthetics through advanced display technologies and creative content delivery.

Government stakeholders benefit from smart city integration opportunities, enhanced public information delivery capabilities, and economic development support through continued industry investment and innovation activities.

Strengths:

Weaknesses:

Opportunities:

Threats:

Key market trends shaping Australia’s OOH and DOOH landscape reflect broader technological, social, and economic developments that influence industry evolution and growth prospects. Programmatic advertising adoption continues accelerating, with automated buying platforms now accounting for 31% of digital outdoor advertising transactions, streamlining campaign management and enhancing targeting precision.

Audience measurement sophistication has advanced significantly through implementation of computer vision technology, mobile device tracking, and advanced analytics systems that provide detailed demographic and behavioral insights. These capabilities enable more precise campaign targeting and comprehensive performance measurement that appeals to data-driven advertisers.

Content personalization trends reflect growing advertiser demand for dynamic messaging capabilities that respond to environmental factors, audience characteristics, and real-time events. Weather-triggered content changes, time-based messaging optimization, and location-specific customization have become standard features of advanced DOOH systems.

Sustainability integration has emerged as a significant trend, with industry participants investing in energy-efficient display technologies, renewable power sources, and environmentally responsible materials. These initiatives respond to growing corporate social responsibility requirements and consumer environmental consciousness.

Mobile connectivity enhancement enables interactive advertising experiences that bridge outdoor displays with personal devices, creating opportunities for extended engagement, social media integration, and e-commerce conversion that extends campaign impact beyond initial exposure.

Cross-platform campaign integration has become increasingly sophisticated, with OOH and DOOH campaigns coordinated with digital marketing initiatives, social media programs, and mobile advertising to create comprehensive brand experiences that maximize reach and frequency optimization.

Recent industry developments demonstrate continued innovation and investment across Australia’s OOH and DOOH market, reflecting strong growth prospects and evolving advertiser requirements. Technology infrastructure expansion has accelerated significantly, with major market participants investing heavily in 5G connectivity, edge computing capabilities, and advanced display systems that enhance content delivery and audience engagement.

Programmatic platform development has advanced through partnerships between outdoor advertising companies and technology providers, creating sophisticated automated buying systems that integrate with existing digital advertising ecosystems. These developments have attracted new advertiser segments and increased campaign frequency among existing clients.

Audience measurement innovation includes implementation of privacy-compliant tracking systems that provide detailed demographic and behavioral insights without compromising individual privacy. Advanced analytics capabilities enable real-time campaign optimization and comprehensive performance attribution that enhances advertiser confidence and investment levels.

Smart city integration projects across major Australian cities have created opportunities for multifunctional displays that combine advertising with public information services, emergency communications, and urban management systems. These integrated solutions provide enhanced value propositions for both advertisers and municipal authorities.

Sustainability initiatives include deployment of solar-powered displays, energy-efficient LED systems, and recyclable materials that reduce environmental impact while maintaining advertising effectiveness. According to MarkWide Research analysis, these initiatives have improved operational efficiency by 25% while enhancing corporate social responsibility positioning.

Interactive technology deployment has expanded rapidly, with touch-screen displays, augmented reality integration, and mobile connectivity becoming standard features of premium advertising locations. These capabilities enable immersive brand experiences that differentiate outdoor advertising from traditional media channels.

Strategic recommendations for Australia’s OOH and DOOH market participants focus on technology advancement, market expansion, and service enhancement initiatives that capitalize on emerging opportunities while addressing competitive challenges. Digital infrastructure investment remains critical for maintaining market relevance and growth prospects, with continued deployment of advanced display systems and programmatic advertising capabilities essential for competitive positioning.

Programmatic advertising development should prioritize integration with existing digital advertising ecosystems, enabling seamless campaign planning and execution across multiple media channels. Investment in data analytics capabilities and audience measurement systems will enhance advertiser value propositions and support premium pricing strategies.

Geographic expansion strategies should focus on secondary cities and regional centers where digital infrastructure development could unlock new revenue opportunities. Partnership approaches with local operators and government authorities can facilitate market entry while minimizing capital investment requirements.

Technology partnership development with software providers, hardware manufacturers, and data analytics companies can accelerate innovation while sharing development costs and risks. Strategic alliances enable access to cutting-edge capabilities without requiring internal development resources.

Sustainability integration should become a core component of operational strategies, addressing growing environmental consciousness among advertisers and consumers while potentially reducing operational costs through energy efficiency improvements.

Service diversification opportunities include development of comprehensive marketing solutions that integrate outdoor advertising with digital marketing, social media management, and content creation services, creating enhanced value propositions for brand clients seeking integrated marketing approaches.

Future market outlook for Australia’s OOH and DOOH sector remains highly positive, with continued growth expected across multiple market segments driven by technological advancement, urbanization trends, and evolving advertiser requirements. Digital transformation acceleration will continue reshaping the industry landscape, with DOOH solutions projected to achieve 58% market share within the next five years as advertisers increasingly prioritize flexibility and measurability.

Programmatic advertising expansion is expected to reach 45% of total digital outdoor advertising spending as automated buying platforms become more sophisticated and integrated with broader digital advertising ecosystems. This growth will be supported by continued investment in data analytics capabilities and audience measurement systems that enhance targeting precision and campaign effectiveness.

Smart city integration will create substantial new opportunities for multifunctional advertising solutions that combine commercial messaging with public services, emergency communications, and urban management systems. Government investment in smart city technologies will facilitate market expansion while creating enhanced value propositions for advertisers and municipal authorities.

Interactive technology adoption will accelerate as brands seek to create memorable consumer experiences that differentiate their marketing campaigns from traditional advertising approaches. Augmented reality integration, mobile connectivity, and personalized content delivery will become standard features of premium advertising locations.

Regional market development will expand opportunities beyond major metropolitan areas as digital infrastructure deployment continues and regional economic activity grows. MWR projections indicate that regional markets could achieve growth rates of 12% annually as digital capabilities become more widely available.

Sustainability focus will intensify as environmental consciousness grows among advertisers and consumers, driving continued investment in energy-efficient technologies and environmentally responsible operational practices that reduce environmental impact while maintaining advertising effectiveness.

Australia’s OOH and DOOH market represents a dynamic and rapidly evolving sector that has successfully adapted to digital transformation while maintaining the fundamental strengths of outdoor advertising including broad reach, high visibility, and cost-effective audience delivery. The market demonstrates exceptional resilience and growth potential, supported by continued urbanization, infrastructure development, and technological advancement that enhance advertiser value propositions and consumer engagement.

Digital adoption acceleration has fundamentally transformed the competitive landscape, with DOOH solutions gaining significant market share through enhanced targeting capabilities, real-time content optimization, and comprehensive performance measurement. The integration of programmatic advertising platforms has streamlined campaign management while enabling greater precision and efficiency in advertising investment allocation.

Future growth prospects remain highly favorable, driven by smart city integration opportunities, interactive technology development, and continued expansion into regional markets where digital infrastructure deployment creates new revenue opportunities. The market’s ability to evolve with changing advertiser requirements and consumer preferences positions it well for sustained expansion throughout the forecast period.

Strategic success factors for market participants include continued investment in digital infrastructure, programmatic advertising capabilities, and data analytics systems that enhance advertiser value propositions. The integration of sustainability initiatives, interactive technologies, and cross-platform campaign coordination will be essential for maintaining competitive advantages in an increasingly sophisticated marketplace that demands innovation, measurability, and environmental responsibility.

What is OOH and DOOH?

OOH stands for Out-Of-Home advertising, which includes any advertising that reaches the consumer while they are outside their home. DOOH, or Digital Out-Of-Home, refers specifically to digital displays used in public spaces to convey advertising messages.

What are the key players in the Australia OOH And DOOH Market?

Key players in the Australia OOH And DOOH Market include companies like oOh!media, JCDecaux, and APN Outdoor, which provide various advertising solutions across different platforms, including billboards and digital screens, among others.

What are the growth factors driving the Australia OOH And DOOH Market?

The Australia OOH And DOOH Market is driven by factors such as increasing urbanization, the rise of digital technology, and the growing demand for targeted advertising. These elements enhance the effectiveness of advertising campaigns in high-traffic areas.

What challenges does the Australia OOH And DOOH Market face?

Challenges in the Australia OOH And DOOH Market include regulatory restrictions on outdoor advertising, competition from digital media, and the need for continuous innovation to capture consumer attention. These factors can impact the growth and effectiveness of OOH campaigns.

What opportunities exist in the Australia OOH And DOOH Market?

Opportunities in the Australia OOH And DOOH Market include the integration of advanced technologies like augmented reality and data analytics to enhance audience engagement. Additionally, the expansion of smart cities presents new avenues for innovative advertising solutions.

What trends are shaping the Australia OOH And DOOH Market?

Trends in the Australia OOH And DOOH Market include the increasing use of programmatic advertising, the rise of interactive digital displays, and a focus on sustainability in advertising practices. These trends are transforming how brands connect with consumers in public spaces.

Australia OOH And DOOH Market

| Segmentation Details | Description |

|---|---|

| Product Type | Billboards, Transit Advertising, Street Furniture, Digital Displays |

| End User | Retailers, Advertisers, Media Agencies, Event Organizers |

| Technology | LED, LCD, Projection, Interactive Screens |

| Distribution Channel | Direct Sales, Online Platforms, Agencies, Partnerships |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Australia OOH And DOOH Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at