444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Mexico telecom tower market represents a critical infrastructure segment driving the nation’s digital transformation and telecommunications expansion. Mexico’s telecommunications landscape has experienced unprecedented growth, fueled by increasing mobile penetration, 5G network deployments, and rising demand for high-speed connectivity across urban and rural areas. The market encompasses various tower types including monopoles, lattice towers, guyed towers, and stealth towers, each serving specific deployment requirements and geographical constraints.

Market dynamics indicate robust expansion driven by major telecommunications operators investing heavily in network infrastructure modernization. The sector benefits from government initiatives promoting digital inclusion and connectivity improvements nationwide. Tower sharing arrangements have become increasingly prevalent, with multiple operators utilizing shared infrastructure to optimize costs and accelerate network deployment timelines. Recent analysis shows the market experiencing 8.2% annual growth in tower installations, reflecting strong demand for enhanced mobile coverage and capacity.

Technological evolution toward 5G networks has created substantial opportunities for tower infrastructure providers. The transition requires dense network architectures with increased tower density, particularly in metropolitan areas where data consumption continues rising exponentially. Rural connectivity initiatives supported by government programs have further expanded market opportunities, addressing coverage gaps in underserved regions and promoting economic development through improved telecommunications access.

The Mexico telecom tower market refers to the comprehensive ecosystem of telecommunications infrastructure comprising physical tower structures, supporting equipment, and related services that enable wireless communication networks throughout Mexico. This market encompasses the design, construction, installation, maintenance, and operation of various tower types that support cellular, microwave, and other wireless communication technologies across the country.

Tower infrastructure serves as the backbone for mobile network operators, enabling signal transmission and reception across diverse geographical terrains. The market includes multiple stakeholder categories: tower companies that own and operate infrastructure, telecommunications operators that lease tower space, equipment manufacturers providing specialized components, and service providers offering installation and maintenance solutions. Shared infrastructure models have become predominant, allowing multiple operators to utilize common tower assets while reducing individual capital expenditure requirements.

Market scope extends beyond traditional voice and data services to encompass emerging technologies including Internet of Things (IoT) applications, smart city initiatives, and industrial automation systems. The infrastructure supports various frequency bands and technologies, from legacy 2G and 3G networks to advanced 4G LTE and next-generation 5G deployments, ensuring comprehensive coverage and capacity for Mexico’s evolving telecommunications needs.

Mexico’s telecom tower market demonstrates exceptional growth momentum driven by accelerating digital transformation initiatives and expanding mobile connectivity requirements. The market has evolved from basic voice communication infrastructure to sophisticated multi-technology platforms supporting diverse applications including high-speed internet, video streaming, and emerging IoT services. Infrastructure sharing has emerged as a dominant business model, with approximately 72% of new tower deployments incorporating multi-tenant capabilities.

Key market drivers include government-backed rural connectivity programs, 5G network rollouts by major operators, and increasing smartphone adoption across demographic segments. The market benefits from favorable regulatory frameworks encouraging infrastructure investment and foreign participation. Tower densification in urban areas has accelerated to support growing data traffic, while rural expansion programs address coverage gaps in previously underserved regions.

Competitive landscape features both international tower companies and domestic infrastructure providers, creating a dynamic ecosystem with varied service offerings and technological capabilities. Market participants are increasingly focusing on energy-efficient solutions, renewable power integration, and advanced monitoring systems to optimize operational performance. Strategic partnerships between tower companies and telecommunications operators have become essential for successful market penetration and sustainable growth.

Market intelligence reveals several critical insights shaping Mexico’s telecom tower landscape. The sector demonstrates strong resilience and adaptability, successfully navigating economic challenges while maintaining steady infrastructure expansion. Technology convergence has created opportunities for tower infrastructure to support multiple services simultaneously, increasing asset utilization and revenue potential per site.

Emerging trends indicate growing demand for edge computing capabilities at tower sites, creating additional revenue streams and service differentiation opportunities. The integration of artificial intelligence and machine learning technologies for network optimization and predictive maintenance has gained significant traction among leading market participants.

Primary market drivers propelling Mexico’s telecom tower sector include accelerating mobile data consumption, government digital inclusion initiatives, and expanding 5G network deployments. Mobile traffic growth continues at unprecedented rates, necessitating network densification and capacity expansion across urban and suburban areas. The proliferation of smartphones, tablets, and connected devices has created sustained demand for enhanced coverage and improved network performance.

Government initiatives promoting digital connectivity have significantly impacted market dynamics. Federal programs targeting rural and underserved communities have created substantial infrastructure investment opportunities. Regulatory support for tower sharing and streamlined permitting processes has accelerated deployment timelines and reduced operational barriers for market participants.

5G technology adoption represents a transformational driver requiring extensive infrastructure upgrades and new tower installations. The technology demands higher site density, advanced equipment capabilities, and enhanced backhaul connectivity. Enterprise digitalization across industries including manufacturing, agriculture, and services has increased demand for reliable, high-capacity wireless connectivity solutions.

Economic development initiatives linking telecommunications infrastructure to regional growth have garnered strong government and private sector support. The recognition of connectivity as essential infrastructure has elevated the strategic importance of tower networks in national development planning and investment prioritization.

Market challenges facing Mexico’s telecom tower sector include regulatory complexities, environmental concerns, and significant capital investment requirements. Permitting processes for new tower construction can be lengthy and complex, involving multiple government levels and regulatory bodies. Zoning restrictions and community opposition occasionally delay or prevent tower installations, particularly in densely populated urban areas.

Environmental regulations require comprehensive impact assessments and mitigation measures, adding complexity and cost to tower development projects. Land acquisition challenges in prime locations can significantly impact deployment timelines and project economics. Competition for suitable sites has intensified as network densification requirements increase, driving up land lease costs and creating site availability constraints.

Technical challenges include power infrastructure limitations in remote areas, requiring expensive backup power solutions and grid connectivity investments. Security concerns related to tower infrastructure protection and equipment theft have necessitated additional security measures and monitoring systems, increasing operational costs.

Economic factors including currency fluctuations, interest rate variations, and financing availability can impact investment decisions and project viability. The capital-intensive nature of tower infrastructure requires substantial upfront investments with long payback periods, creating financial planning challenges for market participants.

Significant opportunities exist within Mexico’s telecom tower market, driven by technological advancement, infrastructure modernization needs, and expanding service applications. 5G network deployment creates substantial demand for new tower installations and existing infrastructure upgrades. The technology’s requirements for dense network architecture present opportunities for innovative tower solutions and strategic site development.

Rural connectivity expansion represents a major growth opportunity supported by government initiatives and operator investment programs. Underserved regions offer substantial market potential with limited existing infrastructure and growing connectivity demand. Public-private partnerships for rural development create favorable conditions for infrastructure investment and deployment.

Smart city initiatives across major metropolitan areas present opportunities for tower infrastructure to support multiple applications beyond traditional telecommunications. IoT deployments in agriculture, transportation, and industrial sectors require extensive wireless infrastructure, creating new revenue streams and service opportunities for tower operators.

Energy efficiency solutions including renewable power integration and advanced cooling systems offer opportunities for operational cost reduction and environmental sustainability improvements. Edge computing integration at tower sites creates potential for additional services and revenue diversification, positioning tower infrastructure as critical components in distributed computing architectures.

Market dynamics within Mexico’s telecom tower sector reflect complex interactions between technological evolution, regulatory frameworks, and competitive pressures. Infrastructure sharing has fundamentally altered market economics, enabling more efficient capital utilization and accelerated network deployment. The shift toward shared infrastructure models has created new business relationships and revenue-sharing arrangements among market participants.

Technological convergence has expanded the role of tower infrastructure beyond traditional telecommunications to encompass broadcasting, emergency services, and emerging applications. Network densification requirements driven by 5G deployment and increasing data consumption have intensified competition for prime tower locations and created opportunities for innovative site solutions.

Regulatory evolution continues shaping market dynamics through streamlined permitting processes, infrastructure sharing mandates, and environmental compliance requirements. Government policies promoting digital inclusion and rural connectivity have created new market segments and funding mechanisms for infrastructure development.

Competitive pressures have driven innovation in tower design, construction methods, and operational efficiency. Market participants increasingly focus on differentiation through service quality, technological capabilities, and customer relationship management. Consolidation trends among smaller operators have created opportunities for larger infrastructure providers while intensifying competition for major operator partnerships.

Comprehensive research methodology employed for analyzing Mexico’s telecom tower market incorporates multiple data sources, analytical frameworks, and validation techniques. Primary research includes extensive interviews with industry executives, government officials, and market participants across the telecommunications ecosystem. Direct engagement with tower companies, equipment manufacturers, and service providers provides firsthand insights into market trends and operational challenges.

Secondary research encompasses analysis of government publications, regulatory filings, industry reports, and financial statements from publicly traded companies. Data triangulation methods ensure accuracy and reliability by cross-referencing information from multiple independent sources. Statistical analysis techniques identify patterns, correlations, and trend projections based on historical performance data.

Market modeling utilizes advanced analytical tools to project future market scenarios and assess impact factors. Scenario analysis evaluates potential outcomes under different regulatory, economic, and technological conditions. Expert validation through industry advisory panels ensures research findings align with practical market realities and stakeholder perspectives.

Geographic analysis covers regional variations in market dynamics, regulatory environments, and infrastructure requirements across Mexico’s diverse geographical and economic landscape. Technology assessment evaluates current and emerging technologies impacting tower infrastructure requirements and market opportunities.

Regional market dynamics across Mexico demonstrate significant variation based on population density, economic development, and existing infrastructure availability. Mexico City metropolitan area represents the largest market segment, accounting for approximately 32% of total tower installations due to high population density and intensive business activity. The region’s advanced telecommunications infrastructure supports diverse applications including enterprise services, consumer broadband, and emerging 5G deployments.

Northern border states including Nuevo León, Chihuahua, and Baja California demonstrate strong market growth driven by manufacturing activity and cross-border trade. Industrial corridor development has created substantial demand for reliable telecommunications infrastructure supporting supply chain management and industrial automation applications. These regions benefit from proximity to United States markets and advanced manufacturing investments.

Central Mexico regions encompassing Jalisco, Puebla, and Estado de México show balanced growth across urban and rural areas. Government connectivity initiatives have accelerated rural tower deployment in these regions, while urban areas experience continued densification to support growing data consumption. Tourism-dependent areas require robust seasonal capacity management and infrastructure resilience.

Southern and southeastern states present significant growth opportunities despite infrastructure challenges. Rural connectivity programs have prioritized these regions for telecommunications expansion, creating substantial market potential. Geographic terrain and limited power infrastructure require specialized tower solutions and innovative deployment approaches.

Competitive environment within Mexico’s telecom tower market features diverse participants ranging from multinational infrastructure companies to specialized domestic providers. Market leadership is distributed among several key players, each bringing unique capabilities and strategic advantages to the sector.

Competitive strategies emphasize infrastructure sharing, technological innovation, and operational efficiency improvements. Market participants increasingly focus on value-added services including energy management, security solutions, and maintenance optimization. Strategic partnerships with telecommunications operators and equipment manufacturers have become essential for market success and sustainable growth.

Innovation initiatives include development of smart tower technologies, renewable energy integration, and advanced monitoring systems. Customer relationship management and service quality differentiation have emerged as key competitive factors in an increasingly mature market environment.

Market segmentation analysis reveals distinct categories based on tower type, technology support, ownership model, and geographical deployment. Tower type segmentation includes monopoles, lattice towers, guyed towers, and stealth installations, each serving specific deployment requirements and environmental constraints.

By Tower Type:

By Technology Support:

By Ownership Model:

Category analysis provides detailed insights into specific market segments and their unique characteristics. Urban tower deployments focus on capacity enhancement and network densification to support high user density and intensive data consumption. These installations typically feature advanced equipment configurations and multi-operator sharing arrangements to maximize site utilization and revenue potential.

Rural tower category emphasizes coverage extension and connectivity provision to underserved communities. Government support programs have significantly impacted this segment, creating favorable economics for infrastructure investment in previously unviable locations. Rural towers often require specialized power solutions and enhanced security measures due to remote locations and limited infrastructure availability.

Industrial tower applications serve specialized requirements including manufacturing facilities, logistics centers, and agricultural operations. Private network deployments for enterprise customers have created new market opportunities with specific performance and security requirements. These installations often feature dedicated infrastructure and customized service level agreements.

Smart city tower integration represents an emerging category supporting multiple municipal applications beyond traditional telecommunications. Multi-purpose infrastructure incorporates environmental monitoring, traffic management, and public safety applications, creating additional revenue streams and enhanced community value propositions.

Industry participants derive substantial benefits from Mexico’s expanding telecom tower market through diverse revenue opportunities and strategic positioning advantages. Tower companies benefit from long-term lease agreements, multiple tenant arrangements, and expanding service portfolios that create stable, recurring revenue streams with attractive margins and growth potential.

Telecommunications operators gain significant advantages through infrastructure sharing arrangements that reduce capital expenditure requirements while accelerating network deployment timelines. Operational efficiency improvements through shared infrastructure enable operators to focus resources on core service delivery and customer experience enhancement rather than infrastructure management.

Equipment manufacturers benefit from sustained demand for advanced tower equipment, including antennas, power systems, and monitoring technologies. Technology evolution toward 5G and emerging applications creates ongoing upgrade opportunities and new product development requirements, supporting continued revenue growth and market expansion.

Government stakeholders achieve policy objectives including digital inclusion, economic development, and improved public services through enhanced telecommunications infrastructure. Rural connectivity improvements support education, healthcare, and economic opportunities in underserved communities, contributing to broader social and economic development goals.

Local communities benefit from improved connectivity, enhanced emergency services communication, and economic development opportunities associated with telecommunications infrastructure investment. Employment creation through construction, maintenance, and support services provides additional community benefits and economic stimulus effects.

Strengths:

Weaknesses:

Opportunities:

Threats:

Emerging trends shaping Mexico’s telecom tower market include accelerating infrastructure sharing adoption, renewable energy integration, and smart tower technology deployment. Tower sharing arrangements have become the predominant deployment model, with new installations increasingly designed for multi-tenant operations from initial construction phases.

Sustainability initiatives are driving widespread adoption of solar power systems and energy-efficient equipment configurations. Environmental consciousness among operators and regulatory requirements have accelerated the transition toward renewable energy sources, reducing operational costs while improving environmental performance metrics.

Digital transformation of tower operations through IoT sensors, artificial intelligence, and predictive analytics has gained significant momentum. Smart monitoring systems enable proactive maintenance, optimize energy consumption, and enhance security through real-time surveillance and automated alert systems.

Edge computing integration at tower sites represents an emerging trend creating new service opportunities and revenue streams. Distributed computing architectures require infrastructure capable of supporting processing capabilities at network edges, positioning tower sites as critical components in next-generation computing networks.

Modular construction techniques and prefabricated tower components are improving deployment efficiency and reducing installation timelines. Construction innovation enables faster project completion while maintaining quality standards and reducing labor requirements in challenging deployment environments.

Recent industry developments demonstrate the dynamic nature of Mexico’s telecom tower market and ongoing evolution toward more sophisticated infrastructure solutions. Major operator partnerships have been established between international tower companies and Mexican telecommunications providers, creating long-term strategic relationships and substantial infrastructure investment commitments.

Regulatory improvements including streamlined permitting processes and infrastructure sharing mandates have accelerated market development and reduced deployment barriers. Government initiatives promoting rural connectivity have resulted in significant public-private partnerships and funding mechanisms supporting infrastructure expansion in underserved regions.

Technology partnerships between tower companies and equipment manufacturers have facilitated rapid 5G infrastructure deployment and advanced monitoring system integration. Innovation collaborations focus on developing Mexico-specific solutions addressing local market requirements and operational challenges.

Sustainability commitments from major market participants have driven substantial investments in renewable energy systems and environmental compliance improvements. Corporate responsibility initiatives demonstrate industry commitment to sustainable development and community benefit creation through telecommunications infrastructure investment.

Market consolidation activities including acquisitions and strategic partnerships have reshaped competitive dynamics while creating opportunities for operational efficiency improvements and service enhancement. MarkWide Research analysis indicates these developments have strengthened market stability and improved service quality across the sector.

Strategic recommendations for market participants emphasize the importance of infrastructure sharing optimization, technology innovation, and sustainable operational practices. Tower companies should prioritize multi-tenant site development and value-added service offerings to maximize revenue potential and competitive differentiation in an increasingly mature market environment.

Investment focus should target 5G-ready infrastructure and rural expansion opportunities supported by government initiatives and operator demand. Technology integration including edge computing capabilities and smart monitoring systems will become essential for maintaining competitive advantages and meeting evolving customer requirements.

Partnership strategies with telecommunications operators, government agencies, and technology providers are crucial for successful market penetration and sustainable growth. Collaborative approaches enable risk sharing, resource optimization, and accelerated deployment timelines while improving overall market efficiency and service quality.

Sustainability initiatives including renewable energy adoption and environmental compliance improvements should be prioritized to meet regulatory requirements and stakeholder expectations. Operational efficiency through advanced monitoring and predictive maintenance systems will become increasingly important for cost management and service reliability.

Market expansion strategies should consider regional variations in demand, regulatory environments, and infrastructure requirements. Customized solutions addressing specific market segments and applications will create differentiation opportunities and enhanced customer value propositions in competitive market conditions.

Future market prospects for Mexico’s telecom tower sector remain highly positive, driven by sustained demand for enhanced connectivity, 5G network deployment, and expanding digital services across economic sectors. Market evolution toward more sophisticated infrastructure supporting diverse applications beyond traditional telecommunications creates substantial growth opportunities and revenue diversification potential.

5G deployment acceleration will drive significant infrastructure investment and upgrade requirements over the coming years. Network densification needs in urban areas and coverage extension in rural regions will sustain demand for new tower installations and existing infrastructure enhancements. MarkWide Research projections indicate continued robust growth with annual expansion rates exceeding 7% through the forecast period.

Technology convergence including IoT, smart city applications, and edge computing will expand the role of tower infrastructure beyond traditional telecommunications services. Multi-purpose platforms supporting diverse applications will become increasingly common, creating new revenue streams and enhanced asset utilization opportunities for infrastructure providers.

Regulatory evolution toward more streamlined processes and infrastructure sharing requirements will continue supporting market development and operational efficiency improvements. Government connectivity initiatives will maintain focus on rural and underserved areas, creating sustained demand for infrastructure investment and deployment services.

Sustainability requirements will drive continued adoption of renewable energy systems and environmentally responsible operational practices. Innovation focus on energy efficiency, environmental compliance, and community integration will become essential for long-term market success and stakeholder acceptance.

Mexico’s telecom tower market represents a dynamic and rapidly evolving sector positioned for sustained growth driven by technological advancement, regulatory support, and expanding connectivity requirements. The market has successfully transitioned from basic infrastructure provision to sophisticated multi-service platforms supporting diverse applications and emerging technologies. Infrastructure sharing models have fundamentally improved market economics while accelerating deployment capabilities and service innovation.

Strategic opportunities abound across multiple market segments, from urban 5G deployments to rural connectivity expansion and smart city integration. The sector’s resilience and adaptability have been demonstrated through successful navigation of economic challenges while maintaining steady growth and infrastructure expansion. Government support through policy initiatives and funding programs continues creating favorable conditions for sustained market development and investment attraction.

Future success will depend on market participants’ ability to embrace technological innovation, optimize operational efficiency, and develop sustainable business models addressing evolving customer requirements. The integration of advanced technologies including artificial intelligence, edge computing, and renewable energy systems will be essential for maintaining competitive advantages in an increasingly sophisticated market environment. Mexico’s telecom tower market is well-positioned to support the nation’s digital transformation objectives while creating substantial value for industry participants and stakeholders across the telecommunications ecosystem.

What is Telecom Tower?

Telecom towers are structures that support antennas and other equipment for telecommunications, enabling wireless communication for mobile networks, broadcasting, and data transmission.

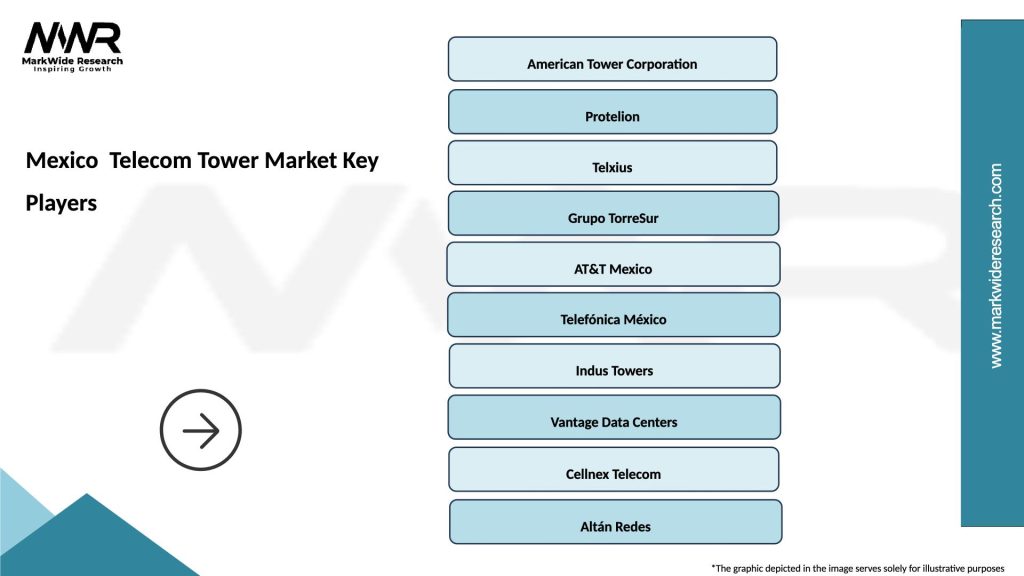

What are the key players in the Mexico Telecom Tower Market?

Key players in the Mexico Telecom Tower Market include American Tower Corporation, Crown Castle, and Grupo Torrecom, among others.

What are the main drivers of growth in the Mexico Telecom Tower Market?

The main drivers of growth in the Mexico Telecom Tower Market include the increasing demand for mobile data services, the expansion of 5G networks, and the rise in internet penetration across urban and rural areas.

What challenges does the Mexico Telecom Tower Market face?

Challenges in the Mexico Telecom Tower Market include regulatory hurdles, high infrastructure costs, and competition from alternative communication technologies such as satellite and fiber optics.

What opportunities exist in the Mexico Telecom Tower Market?

Opportunities in the Mexico Telecom Tower Market include the potential for partnerships with local governments for infrastructure development, the growth of smart city initiatives, and the increasing adoption of IoT devices.

What trends are shaping the Mexico Telecom Tower Market?

Trends shaping the Mexico Telecom Tower Market include the shift towards small cell technology, the integration of renewable energy sources in tower operations, and the focus on enhancing network security.

Mexico Telecom Tower Market

| Segmentation Details | Description |

|---|---|

| Product Type | Macro Towers, Small Cells, Distributed Antenna Systems, Micro Towers |

| Technology | 4G LTE, 5G NR, Wi-Fi, Fiber Optics |

| End User | Telecom Operators, Government Agencies, Enterprises, ISPs |

| Installation | Urban, Suburban, Rural, Remote |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Mexico Telecom Tower Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at