444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

The procure to pay software market represents a rapidly evolving segment within the enterprise software landscape, driven by organizations’ increasing need to streamline procurement processes and enhance financial visibility. This comprehensive market encompasses solutions that automate the entire procurement lifecycle, from requisition creation to invoice payment, delivering significant operational efficiencies and cost savings to businesses across various industries.

Market dynamics indicate robust growth momentum, with the sector experiencing a compound annual growth rate (CAGR) of 11.2% as organizations prioritize digital transformation initiatives. The increasing adoption of cloud-based solutions has fundamentally transformed how enterprises approach procurement management, enabling real-time visibility, improved compliance, and enhanced supplier relationships.

North American enterprises continue to lead market adoption, accounting for approximately 42% of global market share, followed by Europe and Asia-Pacific regions showing accelerated implementation rates. The market’s expansion is particularly pronounced in manufacturing, healthcare, and retail sectors, where procurement complexity and volume demands necessitate sophisticated automation solutions.

Technology integration has become a defining characteristic of modern procure to pay platforms, with artificial intelligence, machine learning, and robotic process automation driving next-generation capabilities. These advanced features enable predictive analytics, automated approval workflows, and intelligent spend analysis, positioning organizations to achieve operational efficiency improvements of up to 35% while reducing processing costs significantly.

The procure to pay software market refers to the comprehensive ecosystem of digital solutions designed to automate and optimize the complete procurement process, from initial purchase requisitions through final payment processing and vendor management. These integrated platforms eliminate manual processes, reduce errors, and provide end-to-end visibility across procurement operations.

Core functionality encompasses requisition management, purchase order creation, supplier catalog management, invoice processing, approval workflows, and payment execution. Modern procure to pay solutions integrate seamlessly with enterprise resource planning systems, financial management platforms, and supplier networks to create unified procurement ecosystems.

Strategic value extends beyond operational efficiency to include enhanced compliance management, improved supplier relationships, and data-driven decision making capabilities. Organizations implementing comprehensive procure to pay solutions typically achieve procurement cycle time reductions of 45-60% while maintaining strict adherence to regulatory requirements and internal policies.

Market leadership in the procure to pay software sector is characterized by intense competition among established enterprise software providers and innovative technology startups. Leading platforms differentiate themselves through advanced automation capabilities, extensive integration options, and industry-specific functionality that addresses unique procurement challenges across various sectors.

Adoption trends reveal accelerating implementation rates among mid-market organizations, with cloud-based deployment models accounting for 78% of new implementations. This shift reflects organizations’ preferences for scalable, cost-effective solutions that can be rapidly deployed without extensive IT infrastructure investments.

Innovation drivers include artificial intelligence-powered spend analysis, blockchain-enabled supplier verification, and mobile-first user experiences that enable procurement professionals to manage operations from anywhere. These technological advances are reshaping procurement practices and establishing new benchmarks for operational excellence.

Future trajectory points toward increased market consolidation, enhanced AI capabilities, and deeper integration with emerging technologies such as Internet of Things sensors for automated inventory management and predictive procurement planning.

Strategic insights from comprehensive market analysis reveal several critical trends shaping the procure to pay software landscape:

Market maturation is evident through increased standardization of core features while differentiation occurs through specialized capabilities, industry expertise, and innovative technology integration approaches.

Primary growth drivers propelling the procure to pay software market include organizations’ urgent need to reduce operational costs while improving procurement efficiency and transparency. The increasing complexity of global supply chains and regulatory environments necessitates sophisticated automation solutions that can handle diverse procurement scenarios.

Cost optimization pressures continue to drive adoption as organizations seek to eliminate manual processes that consume significant resources and introduce error risks. Companies implementing comprehensive procure to pay solutions typically achieve processing cost reductions of 25-40% while improving accuracy and compliance adherence.

Digital transformation initiatives across industries are accelerating procurement technology adoption, with organizations recognizing procurement as a strategic function requiring modern, integrated solutions. The shift toward remote work models has further emphasized the need for cloud-based, accessible procurement platforms.

Regulatory compliance requirements in various industries mandate detailed audit trails, approval documentation, and spend visibility that manual processes cannot adequately provide. Automated procure to pay solutions ensure consistent compliance while reducing administrative burden on procurement teams.

Supplier relationship management needs are driving demand for platforms that facilitate collaboration, performance monitoring, and strategic partnership development. Modern solutions enable organizations to optimize supplier portfolios and negotiate better terms through data-driven insights.

Implementation complexity represents a significant barrier for many organizations considering procure to pay software adoption. The need to integrate with existing enterprise systems, migrate historical data, and train users can create substantial project timelines and resource requirements that may delay deployment decisions.

Change management challenges often impede successful adoption as procurement professionals may resist transitioning from familiar manual processes to automated workflows. Organizations must invest considerable effort in user training, process redesign, and cultural adaptation to realize full solution benefits.

Integration difficulties with legacy enterprise resource planning systems and financial management platforms can create technical obstacles that require specialized expertise and extended implementation periods. These challenges are particularly pronounced in organizations with complex, multi-system environments.

Security concerns regarding sensitive procurement data, supplier information, and financial transactions may cause organizations to hesitate before adopting cloud-based solutions. Addressing these concerns requires comprehensive security frameworks and compliance certifications from software providers.

Customization limitations in standardized software packages may not accommodate unique procurement processes or industry-specific requirements, necessitating expensive customization efforts or process modifications that organizations may be reluctant to undertake.

Emerging market segments present substantial growth opportunities, particularly in developing economies where organizations are rapidly modernizing procurement operations. The increasing adoption of digital technologies in these regions creates favorable conditions for procure to pay software expansion.

Small and medium enterprise adoption represents a significant untapped opportunity as cloud-based solutions become more accessible and affordable. These organizations often lack sophisticated procurement processes and can benefit substantially from automated solutions that provide enterprise-grade capabilities at reasonable costs.

Industry-specific solutions offer differentiation opportunities for software providers willing to develop specialized functionality for sectors such as healthcare, construction, and government procurement. These vertical markets have unique requirements that generic solutions may not adequately address.

Artificial intelligence integration creates opportunities for advanced features such as predictive analytics, automated contract analysis, and intelligent supplier recommendations. Organizations implementing AI-enhanced procure to pay solutions report decision-making speed improvements of up to 50% compared to traditional approaches.

Sustainability focus is driving demand for solutions that can track and report on environmental impact, supplier sustainability practices, and circular economy initiatives. This trend aligns with corporate social responsibility objectives and regulatory requirements in various jurisdictions.

Competitive dynamics in the procure to pay software market are characterized by rapid innovation cycles, strategic partnerships, and aggressive pricing strategies as providers compete for market share. Established enterprise software companies leverage their existing customer relationships while startup companies focus on innovative features and user experience advantages.

Technology evolution continues to reshape market dynamics through the introduction of artificial intelligence, machine learning, and blockchain capabilities that enhance automation and provide new value propositions. These technological advances enable providers to differentiate their offerings and command premium pricing for advanced features.

Customer expectations are evolving toward comprehensive, integrated solutions that can handle complex procurement scenarios while providing intuitive user experiences. Organizations increasingly demand platforms that can adapt to their specific processes rather than requiring significant process modifications.

Partnership ecosystems are becoming crucial for market success as software providers collaborate with system integrators, consulting firms, and technology partners to deliver complete solutions. These relationships enable faster implementations and broader market reach while providing customers with comprehensive support services.

Pricing models are shifting toward subscription-based approaches that provide predictable costs and scalability options. This trend benefits both providers and customers by aligning costs with usage and enabling gradual expansion of solution capabilities.

Comprehensive market analysis employed multiple research methodologies to ensure accurate and reliable insights into the procure to pay software market. Primary research included extensive interviews with procurement executives, software vendors, and industry experts across various sectors and geographic regions.

Data collection approaches encompassed surveys of procurement professionals, vendor briefings, and detailed analysis of solution capabilities and market positioning. Secondary research involved examination of financial reports, industry publications, and technology trend analyses to validate primary findings.

Market sizing methodologies utilized bottom-up and top-down approaches to assess market dynamics, growth rates, and competitive positioning. Analysis included evaluation of deployment models, pricing structures, and adoption patterns across different industry segments and geographic markets.

Validation processes ensured data accuracy through cross-referencing multiple sources, expert review panels, and statistical analysis techniques. The research framework incorporated both quantitative metrics and qualitative insights to provide comprehensive market understanding.

Analytical frameworks applied established market research principles while incorporating innovative approaches to capture emerging trends and technology impacts. The methodology emphasized forward-looking analysis to identify future market opportunities and challenges.

North American markets continue to demonstrate the highest adoption rates and solution sophistication, with the United States leading in both vendor concentration and customer implementation maturity. The region accounts for approximately 42% of global market activity, driven by large enterprises’ digital transformation initiatives and regulatory compliance requirements.

European adoption is characterized by strong growth in the United Kingdom, Germany, and France, where organizations prioritize procurement automation to address complex regulatory environments and multi-currency operations. European markets show particular interest in sustainability tracking and supplier diversity management capabilities.

Asia-Pacific regions exhibit the fastest growth rates, with China, India, and Southeast Asian countries rapidly implementing procure to pay solutions to support economic expansion and manufacturing sector development. This region is expected to achieve growth rates exceeding 15% annually over the next five years.

Latin American markets are emerging as significant opportunities, particularly in Brazil and Mexico, where organizations are modernizing procurement operations to improve efficiency and transparency. Government initiatives promoting digital transformation are accelerating adoption in these markets.

Middle East and Africa show increasing interest in procure to pay solutions, particularly in the United Arab Emirates and South Africa, where organizations seek to improve procurement governance and reduce operational costs through automation.

Market leadership is distributed among several categories of providers, each offering distinct value propositions and targeting different market segments. The competitive landscape includes established enterprise software companies, specialized procurement solution providers, and innovative technology startups.

Leading providers in the procure to pay software market include:

Competitive differentiation occurs through specialized industry expertise, advanced technology integration, user experience design, and comprehensive service offerings that support implementation and ongoing optimization.

Market segmentation reveals distinct categories based on deployment models, organization size, industry verticals, and functional capabilities. Understanding these segments is crucial for vendors developing targeted solutions and customers evaluating appropriate platforms.

By Deployment Model:

By Organization Size:

By Industry Vertical:

Requisition Management represents the foundational component of procure to pay solutions, enabling organizations to standardize purchase requests, implement approval workflows, and maintain spending controls. Modern requisition systems incorporate catalog management, budget checking, and automated routing capabilities that streamline the procurement initiation process.

Purchase Order Processing automation eliminates manual document creation while ensuring accuracy and compliance with organizational policies. Advanced systems provide real-time status tracking, exception handling, and supplier communication features that improve order fulfillment efficiency.

Invoice Management capabilities focus on automated data capture, three-way matching, and exception resolution to reduce processing time and improve accuracy. Organizations implementing automated invoice processing typically achieve processing time reductions of 60-75% compared to manual methods.

Supplier Management functionality encompasses vendor onboarding, performance monitoring, and relationship optimization features that enable strategic supplier partnerships. These capabilities include supplier scorecards, risk assessment tools, and collaboration platforms that enhance supply chain resilience.

Analytics and Reporting components provide spend visibility, compliance monitoring, and performance measurement capabilities that support strategic decision-making. Advanced analytics platforms incorporate predictive modeling and artificial intelligence to identify optimization opportunities and risk factors.

Procurement Organizations benefit from comprehensive automation that reduces manual workload, improves process consistency, and enhances strategic focus. Teams can redirect efforts from transactional activities to value-added initiatives such as supplier relationship management and strategic sourcing.

Finance Departments gain improved visibility into spending patterns, enhanced budget control, and streamlined accounts payable processes. Automated three-way matching and approval workflows reduce errors while providing detailed audit trails for compliance purposes.

Suppliers and Vendors experience improved collaboration through self-service portals, electronic document exchange, and real-time order status visibility. These capabilities reduce administrative overhead while enabling faster payment processing and stronger customer relationships.

Executive Leadership receives comprehensive spend analytics, compliance reporting, and performance metrics that support strategic decision-making. Real-time dashboards provide visibility into procurement operations and identify opportunities for cost optimization and process improvement.

IT Departments benefit from reduced system maintenance overhead through cloud-based deployments while gaining improved integration capabilities with existing enterprise systems. Modern platforms provide robust security features and compliance certifications that address data protection requirements.

Strengths:

Weaknesses:

Opportunities:

Threats:

Artificial Intelligence Integration is transforming procure to pay solutions through intelligent automation, predictive analytics, and natural language processing capabilities. AI-powered platforms can automatically categorize expenses, identify anomalies, and recommend optimal procurement strategies based on historical data and market conditions.

Mobile-First Design approaches are becoming standard as procurement professionals require access to systems from various locations and devices. Modern platforms prioritize responsive design and mobile applications that enable approval workflows, supplier communication, and spend analysis from smartphones and tablets.

Blockchain Technology adoption is emerging for supplier verification, contract management, and payment processing applications. Blockchain capabilities provide immutable audit trails, enhanced security, and improved transparency that address compliance requirements and fraud prevention needs.

Sustainability Tracking features are increasingly important as organizations focus on environmental impact measurement and supplier sustainability practices. Modern platforms incorporate carbon footprint tracking, sustainable sourcing metrics, and supplier diversity reporting capabilities.

API-First Architecture enables seamless integration with existing enterprise systems and third-party services. This approach allows organizations to create customized procurement ecosystems that leverage best-of-breed solutions while maintaining data consistency and workflow continuity.

Strategic acquisitions continue to reshape the competitive landscape as established software companies acquire specialized procurement solution providers to enhance their platform capabilities. These consolidation activities create more comprehensive solutions while potentially reducing vendor choice for customers.

Partnership expansions between software providers and system integrators are accelerating implementation capabilities and market reach. MarkWide Research analysis indicates that organizations working with certified implementation partners achieve deployment success rates of 85% compared to 65% for self-implemented projects.

Technology investments in artificial intelligence, machine learning, and robotic process automation are driving next-generation platform capabilities. Leading providers are allocating significant resources to develop intelligent features that provide competitive advantages and customer value.

Regulatory developments in various jurisdictions are influencing solution requirements, particularly regarding data privacy, audit trail maintenance, and supplier verification processes. Software providers must continuously adapt their platforms to address evolving compliance requirements.

Industry standardization efforts are promoting interoperability and data exchange capabilities between different procurement platforms and enterprise systems. These initiatives facilitate vendor switching and multi-platform environments while reducing integration complexity.

Implementation strategy recommendations emphasize the importance of comprehensive change management programs that address user training, process redesign, and organizational culture adaptation. Successful deployments require executive sponsorship and dedicated project management resources to ensure adoption and value realization.

Vendor selection should prioritize platforms that offer extensive integration capabilities, scalable architecture, and industry-specific functionality relevant to organizational requirements. Evaluation criteria should include total cost of ownership, implementation timeline, and ongoing support quality rather than focusing solely on initial licensing costs.

Phased deployment approaches are recommended for large organizations to minimize risk and enable gradual user adoption. Starting with pilot programs in specific departments or regions allows organizations to refine processes and demonstrate value before enterprise-wide rollouts.

Data migration planning requires careful attention to ensure historical procurement data accuracy and completeness during system transitions. Organizations should invest in data cleansing and validation processes to maximize the value of analytics and reporting capabilities in new platforms.

Performance measurement frameworks should establish clear metrics for success evaluation, including processing time reduction, cost savings achievement, and user satisfaction scores. Regular assessment enables continuous optimization and demonstrates return on investment to stakeholders.

Market evolution will continue toward more intelligent, automated platforms that require minimal human intervention for routine procurement activities. Advanced artificial intelligence capabilities will enable predictive procurement planning, automated supplier selection, and dynamic pricing optimization based on market conditions and organizational requirements.

Integration sophistication will expand beyond traditional enterprise resource planning systems to include Internet of Things sensors, supply chain visibility platforms, and external market data sources. This comprehensive connectivity will create procurement ecosystems that provide unprecedented visibility and control over organizational spending.

User experience innovation will focus on conversational interfaces, voice-activated commands, and augmented reality applications that make procurement processes more intuitive and accessible. These advances will reduce training requirements and improve user adoption rates across diverse organizational roles.

Sustainability emphasis will drive development of comprehensive environmental impact tracking, circular economy support, and supplier sustainability assessment capabilities. Organizations will increasingly demand platforms that help achieve corporate social responsibility objectives while maintaining operational efficiency.

Market consolidation trends suggest continued acquisition activity as larger software companies seek to expand their procurement solution portfolios. According to MWR projections, the market will experience sustained growth rates of 10-12% annually over the next five years, driven by digital transformation initiatives and emerging market adoption.

The procure to pay software market represents a dynamic and rapidly evolving sector that continues to transform organizational procurement practices through advanced automation, artificial intelligence, and comprehensive integration capabilities. Market growth momentum remains strong, driven by organizations’ urgent need to reduce costs, improve efficiency, and enhance compliance while managing increasingly complex supply chain requirements.

Technological innovation will continue to reshape the competitive landscape as providers integrate artificial intelligence, blockchain, and mobile technologies to deliver next-generation capabilities. Organizations that embrace these advanced platforms will achieve significant competitive advantages through improved operational efficiency, enhanced supplier relationships, and data-driven decision-making capabilities.

Future success in this market will depend on vendors’ ability to deliver comprehensive, user-friendly solutions that address diverse industry requirements while providing seamless integration with existing enterprise systems. As the market matures, differentiation will increasingly focus on specialized functionality, implementation expertise, and ongoing innovation rather than basic feature parity.

Strategic implementation of procure to pay solutions requires careful planning, comprehensive change management, and ongoing optimization to realize full value potential. Organizations that approach these deployments strategically will achieve substantial returns on investment while positioning themselves for continued growth and operational excellence in an increasingly competitive business environment.

What is Procure To Pay Software?

Procure To Pay Software refers to a suite of applications that manage the procurement process from requisition to payment. It streamlines purchasing, invoicing, and payment processes, enhancing efficiency and accuracy in financial transactions.

What are the key players in the Procure To Pay Software Market?

Key players in the Procure To Pay Software Market include SAP, Oracle, Coupa Software, and Ariba, among others. These companies offer various solutions that cater to different business sizes and industries, focusing on automation and integration.

What are the main drivers of growth in the Procure To Pay Software Market?

The main drivers of growth in the Procure To Pay Software Market include the increasing need for operational efficiency, the rise of digital transformation in procurement processes, and the demand for better compliance and risk management solutions.

What challenges does the Procure To Pay Software Market face?

Challenges in the Procure To Pay Software Market include integration issues with existing systems, resistance to change from employees, and the complexity of managing supplier relationships effectively.

What opportunities exist in the Procure To Pay Software Market?

Opportunities in the Procure To Pay Software Market include the growing adoption of cloud-based solutions, advancements in artificial intelligence for procurement analytics, and the increasing focus on sustainability in supply chain management.

What trends are shaping the Procure To Pay Software Market?

Trends shaping the Procure To Pay Software Market include the rise of mobile procurement solutions, the integration of machine learning for predictive analytics, and the emphasis on user-friendly interfaces to enhance user adoption.

Procure To Pay Software Market

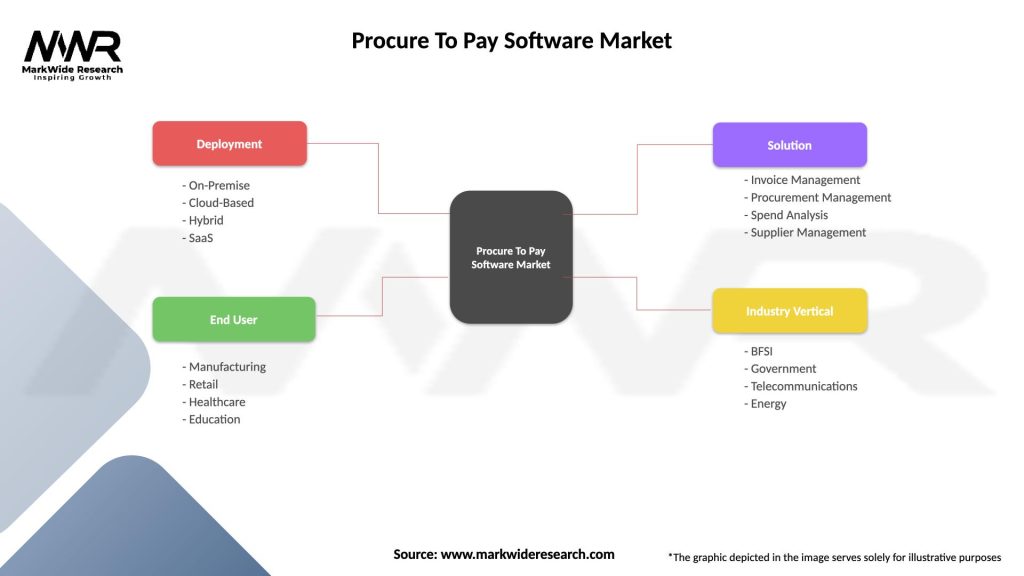

| Segmentation Details | Description |

|---|---|

| Deployment | On-Premise, Cloud-Based, Hybrid, SaaS |

| End User | Manufacturing, Retail, Healthcare, Education |

| Solution | Invoice Management, Procurement Management, Spend Analysis, Supplier Management |

| Industry Vertical | BFSI, Government, Telecommunications, Energy |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Procure To Pay Software Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at