444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Bangladesh container glass market represents a dynamic and rapidly evolving sector within the country’s manufacturing landscape, driven by increasing demand from beverage, pharmaceutical, and food packaging industries. Container glass manufacturing in Bangladesh has experienced substantial growth momentum, with the market expanding at a robust CAGR of 8.2% over recent years. The sector encompasses various glass packaging solutions including bottles, jars, vials, and specialty containers designed for diverse industrial applications.

Market dynamics indicate strong domestic consumption patterns alongside growing export opportunities, particularly in pharmaceutical and beverage packaging segments. The Bangladesh glass container industry benefits from abundant raw material availability, competitive labor costs, and strategic geographic positioning for regional trade. Manufacturing capabilities have expanded significantly, with modern production facilities incorporating advanced furnace technologies and automated forming processes.

Industry stakeholders include both domestic manufacturers and international companies establishing production bases in Bangladesh to serve regional markets. The market demonstrates 65% concentration in beverage packaging applications, while pharmaceutical containers represent the fastest-growing segment with 12% annual growth rate. Export potential remains substantial, with neighboring countries increasingly sourcing container glass products from Bangladeshi manufacturers due to competitive pricing and improving quality standards.

The Bangladesh container glass market refers to the comprehensive ecosystem of glass packaging manufacturing, distribution, and consumption within Bangladesh’s borders, encompassing all forms of hollow glass containers designed for product packaging and storage applications. This market includes production facilities, raw material suppliers, technology providers, and end-user industries that collectively drive demand for glass packaging solutions.

Container glass products manufactured in Bangladesh span multiple categories including beverage bottles for carbonated drinks, beer, and spirits; pharmaceutical vials and bottles for medicines and healthcare products; food jars for preserves, sauces, and condiments; and specialty containers for cosmetics and industrial applications. The market encompasses both primary packaging solutions that directly contact products and secondary packaging applications for product protection and branding purposes.

Manufacturing processes within this market involve traditional glass forming techniques alongside modern automated production lines, utilizing locally sourced silica sand, soda ash, and limestone as primary raw materials. The market definition extends to include supporting industries such as mold manufacturing, quality control services, and logistics networks that enable efficient distribution of finished glass containers to end-user industries throughout Bangladesh and regional export markets.

Bangladesh’s container glass market demonstrates exceptional growth potential driven by expanding domestic consumption, increasing industrial production, and growing export opportunities across South Asian markets. The sector has evolved from traditional manufacturing approaches to incorporate modern production technologies, resulting in improved product quality and manufacturing efficiency. Market expansion is particularly pronounced in pharmaceutical packaging, where stringent quality requirements drive demand for premium glass containers.

Key growth drivers include rising disposable incomes leading to increased beverage consumption, expanding pharmaceutical manufacturing sector, and government initiatives supporting industrial development. The market benefits from 75% local raw material availability, reducing dependency on imports and enhancing cost competitiveness. Manufacturing capacity has increased substantially, with several new production facilities commissioned to meet growing demand.

Competitive landscape features both established domestic players and international companies investing in Bangladesh’s glass manufacturing sector. Technology adoption has accelerated, with manufacturers implementing energy-efficient furnaces and automated quality control systems. The market shows strong potential for continued expansion, supported by favorable demographics, industrial growth, and increasing emphasis on sustainable packaging solutions that favor glass containers over plastic alternatives.

Strategic market insights reveal several critical factors shaping Bangladesh’s container glass industry development and future growth trajectory:

Primary market drivers propelling Bangladesh’s container glass industry growth encompass both domestic demand factors and external market opportunities that create favorable conditions for sector expansion.

Beverage industry expansion represents the most significant driver, with increasing consumption of carbonated drinks, bottled water, and alcoholic beverages creating substantial demand for glass containers. Urbanization trends contribute to changing consumption patterns, with urban populations showing preference for packaged beverages and processed foods requiring glass packaging solutions. The pharmaceutical sector growth at 15% annually drives demand for specialized glass containers meeting stringent quality and safety requirements.

Government industrial policies supporting manufacturing sector development provide favorable regulatory environment and investment incentives for glass container production. Export promotion initiatives encourage manufacturers to explore regional markets, particularly in neighboring countries where demand for quality glass packaging continues growing. Infrastructure development including improved transportation networks facilitates efficient distribution of glass containers to end-user industries.

Environmental consciousness among consumers and businesses increasingly favors glass packaging due to its recyclability and premium perception compared to plastic alternatives. Quality requirements in food and pharmaceutical industries necessitate glass containers that ensure product integrity and safety, driving demand for high-quality manufacturing capabilities.

Market constraints affecting Bangladesh’s container glass industry include both structural challenges and operational limitations that may impact growth potential and competitive positioning.

High energy costs represent a significant constraint, as glass manufacturing requires substantial energy inputs for furnace operations, impacting production costs and pricing competitiveness. Initial capital requirements for establishing modern glass manufacturing facilities create barriers to entry for smaller players and limit industry expansion pace. Technical expertise shortage in specialized glass manufacturing processes constrains operational efficiency and quality improvement initiatives.

Raw material quality variations occasionally affect product consistency, requiring additional quality control measures and potentially impacting customer satisfaction. Transportation challenges for fragile glass products increase logistics costs and limit market reach, particularly for export opportunities. Competition from alternative packaging materials, especially plastic containers offering lower costs and reduced breakage risks, constrains market share growth in certain applications.

Regulatory compliance costs for meeting international quality standards, particularly in pharmaceutical applications, require significant investments in quality control systems and certification processes. Seasonal demand fluctuations in certain market segments create capacity utilization challenges and impact manufacturing efficiency. Limited research and development capabilities within the domestic industry constrain innovation and product differentiation opportunities.

Significant opportunities exist within Bangladesh’s container glass market, driven by evolving consumer preferences, industrial growth, and favorable market conditions for expansion and diversification.

Export market development presents substantial opportunities, with regional countries showing increasing demand for quality glass containers. MarkWide Research analysis indicates strong potential in pharmaceutical packaging exports, where Bangladesh manufacturers can leverage cost advantages while meeting international quality standards. Specialty glass applications including cosmetics packaging and premium beverage containers offer higher margin opportunities for manufacturers investing in advanced production capabilities.

Technology partnerships with international glass manufacturers can accelerate capability development and enable access to advanced production techniques. Sustainable packaging trends create opportunities for glass container manufacturers to capture market share from plastic packaging alternatives. Value-added services such as custom molding, decorative treatments, and integrated labeling solutions can enhance profitability and customer relationships.

Government infrastructure projects supporting industrial development create favorable conditions for facility expansion and modernization. Regional trade agreements facilitate market access and reduce export barriers, enabling Bangladeshi manufacturers to compete effectively in neighboring markets. Pharmaceutical sector growth offers opportunities for specialized container production meeting stringent regulatory requirements and commanding premium pricing.

Market dynamics within Bangladesh’s container glass industry reflect complex interactions between supply-side capabilities, demand patterns, and external factors influencing sector development and competitive positioning.

Supply chain evolution demonstrates increasing integration, with manufacturers establishing closer relationships with raw material suppliers and end-user industries to ensure consistent quality and delivery performance. Production capacity expansion continues across the industry, with manufacturers investing in modern furnace technologies that improve energy efficiency by 25% compared to traditional systems. Quality standardization efforts align domestic production capabilities with international requirements, particularly for pharmaceutical and food packaging applications.

Demand patterns show increasing sophistication, with customers requiring specialized container designs, enhanced durability, and consistent quality standards. Price competition intensifies as production capacity increases, driving manufacturers to focus on operational efficiency and value-added services. Technology adoption accelerates across the industry, with automated production systems and quality control technologies becoming standard in modern facilities.

Market consolidation trends favor larger manufacturers with economies of scale and advanced production capabilities. Environmental regulations increasingly influence production processes and product design, creating opportunities for manufacturers emphasizing sustainability and recyclability. Customer relationships evolve toward long-term partnerships, with manufacturers providing technical support and customized solutions to meet specific application requirements.

Comprehensive research methodology employed for analyzing Bangladesh’s container glass market incorporates multiple data collection approaches and analytical techniques to ensure accurate and reliable market insights.

Primary research activities include extensive interviews with industry stakeholders including manufacturers, suppliers, distributors, and end-user companies to gather firsthand insights on market conditions, growth drivers, and future prospects. Manufacturing facility visits provide detailed understanding of production processes, capacity utilization, and technology adoption patterns across different market segments. Customer surveys capture demand patterns, quality requirements, and purchasing decision factors influencing container glass selection.

Secondary research encompasses analysis of industry reports, government statistics, trade publications, and company financial statements to establish market size, growth trends, and competitive positioning. Trade data analysis reveals import-export patterns, regional market dynamics, and competitive positioning relative to international suppliers. Regulatory review examines quality standards, environmental regulations, and trade policies affecting market development.

Analytical frameworks include market sizing models, competitive analysis matrices, and growth projection methodologies incorporating both quantitative data and qualitative insights. Data validation processes ensure accuracy through cross-referencing multiple sources and expert review of findings and conclusions.

Regional market distribution within Bangladesh’s container glass industry demonstrates distinct patterns based on industrial concentration, infrastructure availability, and market accessibility factors.

Dhaka Division dominates the market with approximately 45% market share, driven by high industrial concentration, large consumer population, and excellent transportation connectivity. The region hosts major beverage manufacturers, pharmaceutical companies, and food processing facilities that constitute primary demand sources for glass containers. Manufacturing facilities in Dhaka Division benefit from proximity to key customers and access to skilled workforce, though face higher operational costs due to urban location factors.

Chittagong Division represents 30% of market activity, leveraging port access for raw material imports and finished product exports. The region’s industrial base includes significant pharmaceutical manufacturing and beverage production facilities requiring glass packaging solutions. Export-oriented manufacturers particularly favor Chittagong locations due to logistics advantages and government export promotion incentives.

Sylhet and Rajshahi Divisions collectively account for 20% market share, with growing industrial development creating new opportunities for glass container suppliers. Emerging markets in other divisions show potential for future growth as industrial development spreads beyond traditional manufacturing centers. Rural market penetration remains limited but offers long-term expansion opportunities as economic development reaches smaller urban centers.

Competitive environment within Bangladesh’s container glass market features diverse players ranging from established domestic manufacturers to international companies establishing local production capabilities.

Market competition intensifies as production capacity increases and manufacturers seek to differentiate through quality, service, and specialized applications. Technology investments become critical competitive factors, with advanced manufacturers gaining advantages through improved efficiency and product quality. Customer relationships and technical support capabilities increasingly influence competitive positioning, particularly in pharmaceutical and specialty applications.

Pricing strategies vary across market segments, with commodity applications experiencing intense price competition while specialized containers command premium pricing. Export capabilities provide competitive advantages for manufacturers able to meet international quality standards and serve regional markets effectively.

Market segmentation within Bangladesh’s container glass industry reflects diverse applications, manufacturing processes, and customer requirements across multiple industry sectors.

By Product Type:

By Manufacturing Process:

By End-User Industry:

Beverage containers dominate market volume with consistent demand growth driven by urbanization and changing consumption patterns. Carbonated drink bottles represent the largest single category, requiring high-volume production capabilities and standardized quality specifications. Premium beverage packaging shows growing demand as consumers increasingly value product presentation and brand differentiation through distinctive container designs.

Pharmaceutical containers demonstrate the highest growth potential with 18% annual expansion driven by healthcare sector development and increasing quality requirements. Injection vials and medicine bottles require specialized production capabilities and stringent quality control systems meeting international pharmaceutical standards. Export opportunities in pharmaceutical packaging offer significant potential as regional healthcare markets expand.

Food packaging applications show steady growth with increasing demand for preserved foods, sauces, and specialty products requiring glass containers. Premium food packaging benefits from consumer preference for glass containers perceived as higher quality and safer than plastic alternatives. Specialty containers for ethnic foods and traditional products create niche market opportunities for customized solutions.

Cosmetic containers represent emerging high-value segment with growing demand for premium packaging solutions. Decorative treatments and custom designs command premium pricing while requiring advanced manufacturing capabilities and design expertise.

Industry participants in Bangladesh’s container glass market realize multiple strategic advantages from market participation and continued investment in sector development.

Manufacturers benefit from growing domestic demand, export opportunities, and favorable raw material availability that supports competitive cost structures. Production efficiency improvements through modern technology adoption enable better margins and market competitiveness. Diversification opportunities across multiple end-user industries reduce market risk and provide growth options in various segments.

Suppliers and vendors gain from expanding market size and increasing sophistication of manufacturing operations requiring advanced equipment, raw materials, and technical services. Technology providers find growing demand for modern furnace systems, automation equipment, and quality control technologies as manufacturers upgrade facilities.

End-user industries benefit from improved local supply availability, competitive pricing, and enhanced quality standards that meet international requirements. Pharmaceutical companies particularly gain from local suppliers capable of meeting stringent quality standards while offering cost advantages over imported containers. Beverage manufacturers benefit from reliable supply chains and customization capabilities supporting brand differentiation strategies.

Economic stakeholders including government and financial institutions benefit from industrial development, employment creation, and export revenue generation contributing to economic growth and development objectives.

Strengths:

Weaknesses:

Opportunities:

Threats:

Technological advancement represents the most significant trend shaping Bangladesh’s container glass industry, with manufacturers increasingly adopting automated production systems and energy-efficient furnace technologies. Digital integration in manufacturing processes enables better quality control, production monitoring, and efficiency optimization. Advanced forming techniques allow production of lighter containers while maintaining strength and durability requirements.

Sustainability focus drives industry evolution toward environmentally responsible manufacturing practices and recyclable packaging solutions. Energy efficiency improvements become critical as manufacturers seek to reduce operational costs and environmental impact. Circular economy principles influence product design and manufacturing processes, emphasizing recyclability and resource conservation.

Customization demand increases as customers seek distinctive packaging solutions supporting brand differentiation and market positioning. Premium packaging trends create opportunities for value-added services including decorative treatments, custom molding, and integrated labeling solutions. Quality standardization accelerates as manufacturers align with international standards to access export markets and serve multinational customers.

Market consolidation continues as industry structure evolves toward larger, more efficient operations with greater economies of scale. Vertical integration strategies enable manufacturers to control supply chains and improve cost competitiveness while ensuring quality consistency.

Recent industry developments demonstrate significant progress in Bangladesh’s container glass manufacturing capabilities and market expansion initiatives.

Capacity expansion projects include several new manufacturing facilities commissioned with modern furnace technologies and automated production systems. Technology upgrades at existing facilities improve production efficiency and enable manufacture of higher-quality containers meeting international standards. Quality certification achievements by leading manufacturers facilitate access to pharmaceutical and export markets requiring stringent quality compliance.

Strategic partnerships between domestic manufacturers and international technology providers accelerate capability development and knowledge transfer. Export initiatives supported by government trade promotion programs help manufacturers access regional markets and establish international customer relationships. Investment announcements by both domestic and foreign companies indicate continued confidence in market growth potential.

Research and development investments focus on product innovation, energy efficiency improvements, and sustainable manufacturing practices. Workforce development programs enhance technical skills and operational capabilities supporting industry modernization efforts. Infrastructure improvements including transportation and energy supply enhance manufacturing competitiveness and market access capabilities.

Strategic recommendations for Bangladesh’s container glass industry stakeholders focus on sustainable growth, competitive positioning, and market development opportunities.

Technology investment should prioritize energy-efficient production systems and automated quality control capabilities that improve competitiveness and enable access to premium market segments. MWR analysis suggests manufacturers focus on pharmaceutical and specialty applications where quality requirements create barriers to entry and support premium pricing. Export market development requires systematic approach to quality certification, customer relationship building, and logistics optimization.

Capacity planning should consider market growth projections while avoiding overcapacity situations that intensify price competition. Product diversification across multiple end-user industries reduces market risk and provides growth opportunities in various segments. Sustainability initiatives including energy efficiency improvements and recyclable packaging solutions align with market trends and regulatory requirements.

Partnership strategies with international technology providers and customers can accelerate capability development and market access. Workforce development investments in technical training and operational excellence support quality improvements and productivity gains. Supply chain optimization including raw material sourcing and logistics efficiency enhances cost competitiveness and customer service capabilities.

Future prospects for Bangladesh’s container glass market remain highly positive, supported by strong domestic demand growth, expanding export opportunities, and continued industrial development initiatives.

Market expansion is projected to continue at robust growth rates exceeding 8% annually driven by beverage industry growth, pharmaceutical sector development, and increasing preference for glass packaging solutions. Production capacity will likely expand significantly as manufacturers invest in modern facilities and technology upgrades to meet growing demand. Export potential offers substantial opportunities as regional markets recognize quality improvements and cost competitiveness of Bangladeshi manufacturers.

Technology adoption will accelerate across the industry, with advanced manufacturing systems becoming standard for competitive operations. Quality standards will continue improving as manufacturers align with international requirements and pursue premium market segments. Sustainability initiatives will gain importance as environmental regulations strengthen and customer preferences favor eco-friendly packaging solutions.

Market structure may evolve toward greater consolidation as economies of scale become increasingly important for competitive success. Specialization trends will likely emerge as manufacturers focus on specific applications or customer segments where they can achieve competitive advantages. Regional integration through trade agreements and economic cooperation will facilitate market access and growth opportunities beyond domestic boundaries.

Bangladesh’s container glass market demonstrates exceptional growth potential driven by expanding domestic demand, favorable manufacturing conditions, and increasing export opportunities across regional markets. The industry has evolved significantly from traditional manufacturing approaches to incorporate modern production technologies, resulting in improved quality standards and competitive positioning.

Key success factors include abundant raw material availability, competitive labor costs, growing end-user industries, and strategic geographic location facilitating regional trade. Market dynamics favor continued expansion with pharmaceutical packaging representing the highest growth segment and beverage containers maintaining dominant market share. Technology adoption and quality improvements position Bangladeshi manufacturers to compete effectively in both domestic and international markets.

Future development will likely focus on capacity expansion, technology modernization, and export market development as manufacturers seek to capitalize on favorable market conditions and growing demand. Sustainability considerations and environmental consciousness will increasingly influence market development, creating opportunities for manufacturers emphasizing recyclable packaging solutions. The Bangladesh container glass market is well-positioned for sustained growth and continued contribution to the country’s industrial development and economic progress.

What is Container Glass?

Container glass refers to glass products designed for packaging and storing various goods, including beverages, food, and pharmaceuticals. It is known for its durability, recyclability, and ability to preserve the quality of its contents.

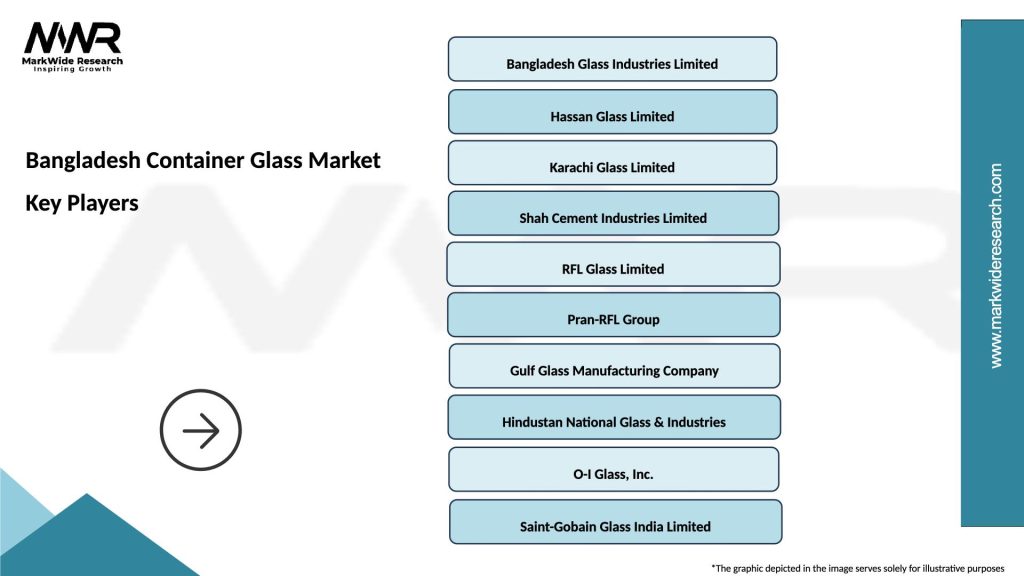

What are the key players in the Bangladesh Container Glass Market?

Key players in the Bangladesh Container Glass Market include Bangladesh Glass Limited, Beximco Glass, and ACI Glass, among others. These companies are involved in the production and distribution of various glass containers for different industries.

What are the growth factors driving the Bangladesh Container Glass Market?

The growth of the Bangladesh Container Glass Market is driven by increasing demand for packaged food and beverages, rising consumer awareness about sustainability, and the expansion of the pharmaceutical industry. Additionally, the trend towards eco-friendly packaging solutions is boosting market growth.

What challenges does the Bangladesh Container Glass Market face?

The Bangladesh Container Glass Market faces challenges such as high production costs, competition from alternative packaging materials like plastics, and fluctuations in raw material prices. These factors can impact profitability and market stability.

What opportunities exist in the Bangladesh Container Glass Market?

Opportunities in the Bangladesh Container Glass Market include the growing trend of sustainable packaging, innovations in glass manufacturing technology, and the potential for export to neighboring countries. These factors can enhance market growth and diversification.

What trends are shaping the Bangladesh Container Glass Market?

Trends shaping the Bangladesh Container Glass Market include the increasing use of lightweight glass containers, advancements in glass recycling technologies, and a shift towards more aesthetically pleasing designs. These trends reflect changing consumer preferences and environmental considerations.

Bangladesh Container Glass Market

| Segmentation Details | Description |

|---|---|

| Product Type | Flint Glass, Amber Glass, Green Glass, Specialty Glass |

| End User | Food & Beverage, Pharmaceuticals, Cosmetics, Household |

| Packaging Type | Bottles, Jars, Containers, Jugs |

| Grade | Food Grade, Pharmaceutical Grade, Industrial Grade, Recycled Grade |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Bangladesh Container Glass Market

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at